Best Los Angeles, California Auto Insurance in 2026

This is a complete guide to everything you need to know about auto insurance in Los Angeles, California. California requires 15/30/5 for bodily injury and property damage coverage. The average rate for insurance in Los Angeles is about $605 / month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

Summary Overview of Los Angeles, CA

| Summary Overview of Los Angeles, CA | |

|---|---|

| Population | 3,976,324 |

| Density | 8,477 people per square mile |

| Average Cost of Insurance in Los Angeles | $7,260.97 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor: 57% Mediocre: 22% Fair: 11% Good: 10% |

The City of Angels is home to some acclaimed museums, vibrant multicultural neighbourhoods, a plethora of cuisines and, of course, Hollywood. Los Angeles, home to the second-largest urban population in the country, also boasts of 75 miles of sunny coastline.

With so many things to do and places to go, naturally, you would have a lot of drivers on the road. Since you have to share the road with so many drivers, you must get the best auto insurance coverage for complete peace of mind.

However, we understand that insurance can be confusing. In this complete guide which covers atis auto insurance in Los Angeles, we will give you all the knowledge on coverage type, coverage rates, factors impacting your premium and much more.

We hope that by the end of this guide, you will be able to navigate the car insurance market and choose the right coverage for your needs.

Before we begin, you should get your quotes so that you can compare as we move along in the guide.

What is the average car insurance cost in Los Angeles, California?

You might be wondering how car insurance companies in Los Angeles calculate your car insurance rate? What factors impact your premium rate?

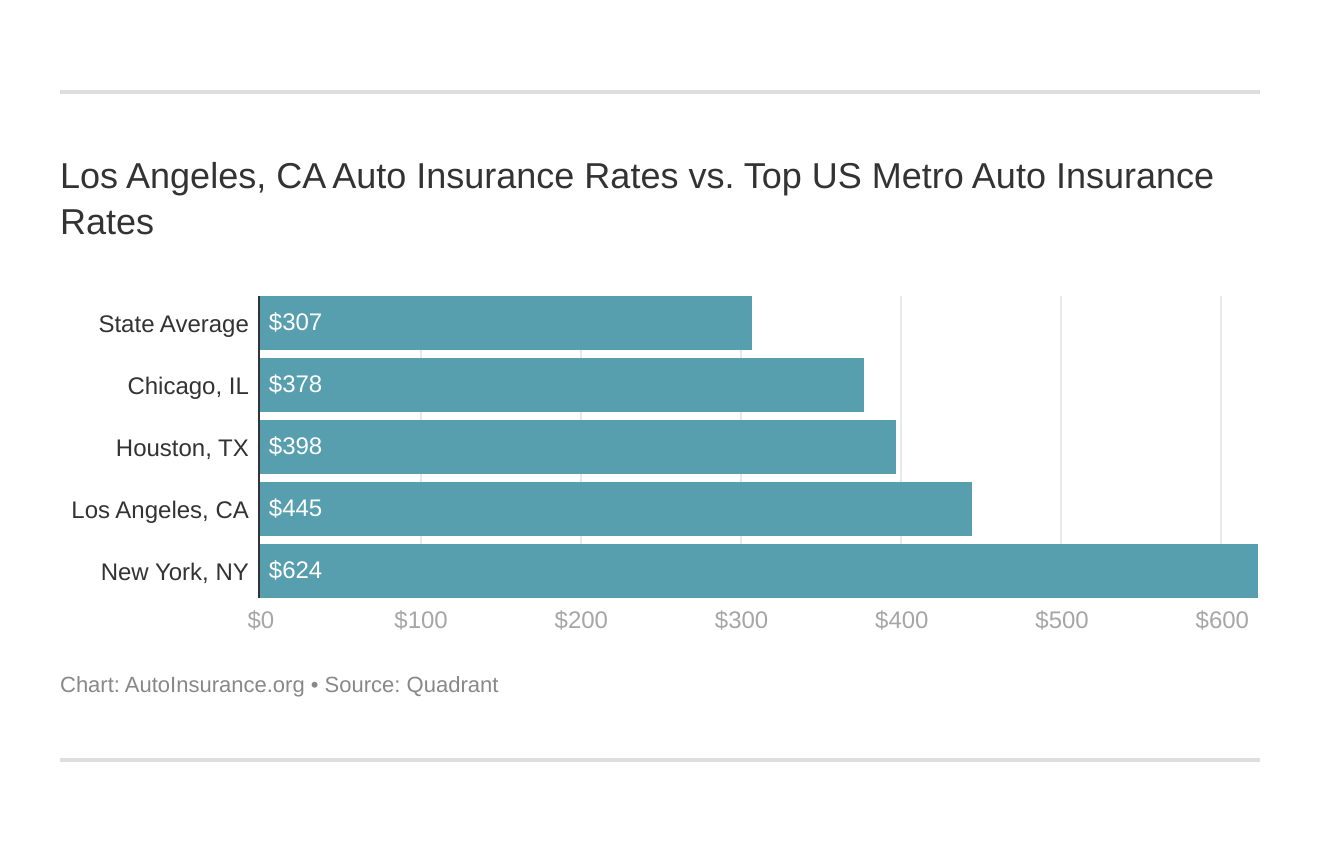

You might find yourself asking how does my Los Angeles, California stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Car insurance companies consider several factors that determine your auto insurance rates, including your driving history, marital status, credit score, etc.

In this section, we will look at the factors considered while calculating premium rates in Los Angeles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

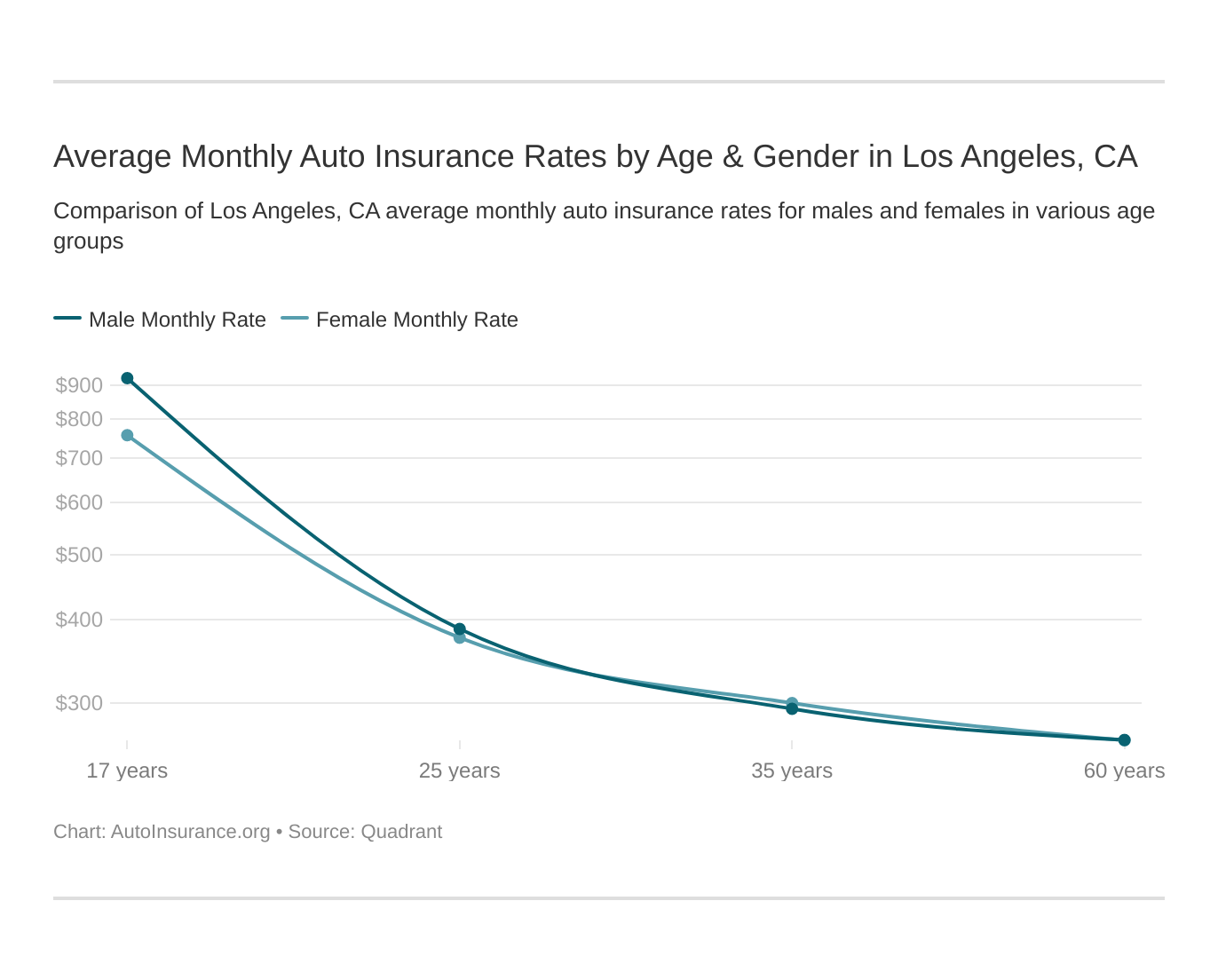

Demographics: Male vs. Female vs. Age

Age is an important factor considered by insurers while calculating the cost of car insurance in Los Angeles. Younger drivers, especially teens, are usually considered by insurers to be riskier as they tend to engage in reckless driving, get tickets, etc. With age, insurance companies believe that you would start maturing as a driver and make fewer mistakes or take fewer risks.

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Los Angeles, CA does use gender, so check out the average monthly car insurance rates by age and gender in Los Angeles, CA.

As per DataUSA, in the case of Los Angeles, the median age is 36.6 years.

With a median age at 36.6 years, the residents of L.A. can see their premium taper down at this age.

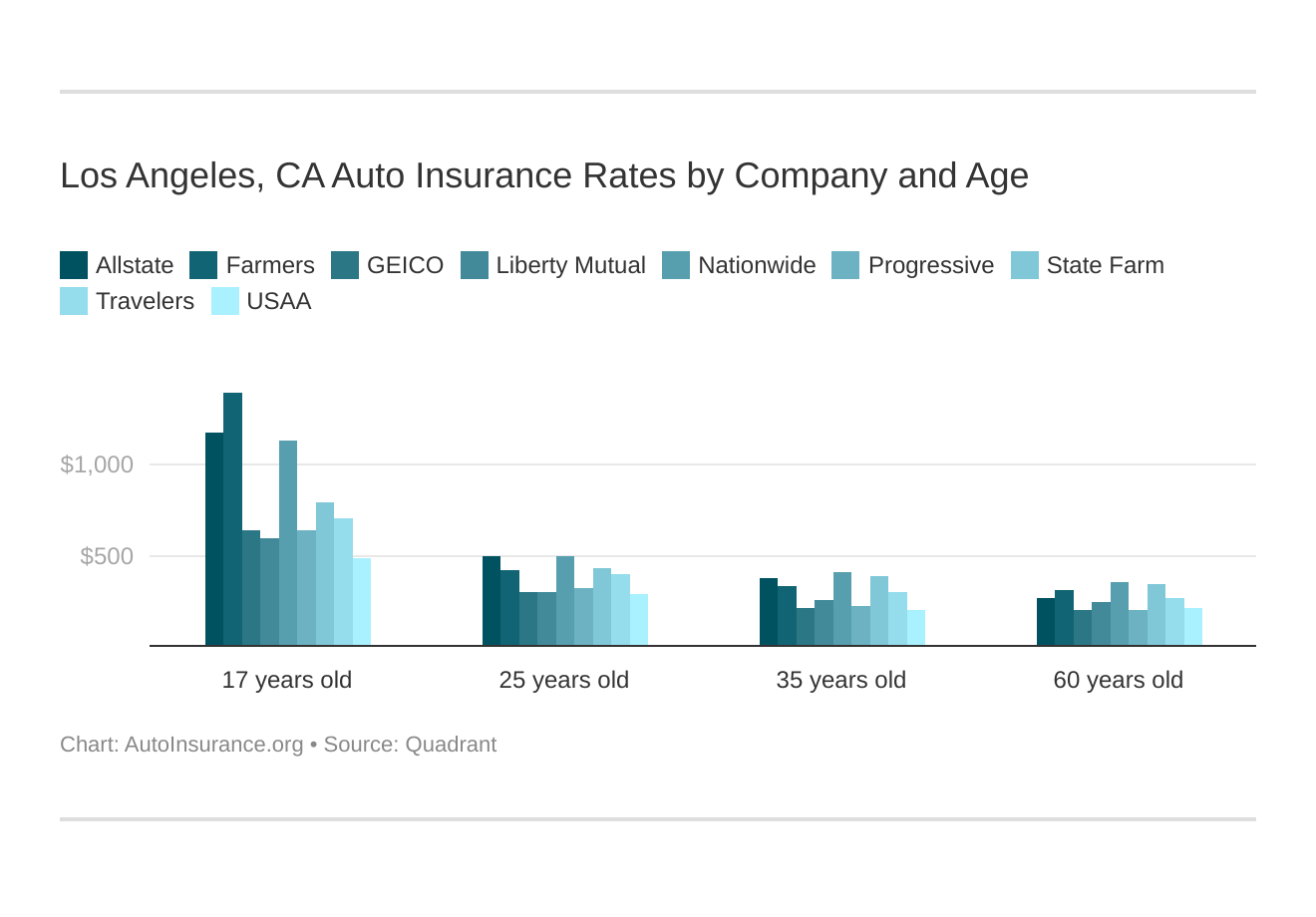

Los Angeles, CA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

Let us review the average insurance rates available for different age groups in Los Angeles.

Los Angeles Average Annual Rate by Age

| Age | 17 | 25 | 35 | 60 | Cheapest Age |

|---|---|---|---|---|---|

| Average Annual Rate | $10,073.54 | $4,578.97 | $3,562.33 | $3,164.93 | 60 |

Remember, these are average annual rates and may be different from your insurance rates due to factors such as your driving record or credit score.

As you see from the table above, insurance rates decline progressively with age. The insurance rates drop drastically between the age of 17 and 25 and stabilize around age 35, which is roughly the median age for residents of Los Angeles.

But, what about gender? Does gender play a role in calculating your premium in the City of Los Angeles?

The average annual premium for car insurance for males in Los Angeles is $5,344, whereas for females it is $5,088. Males have to pay more for insurance than females in Los Angeles, which is in line with the trend we have observed from around the country.

Your marital status also plays a part in determining your insurance premium.

Los Angeles average insurance rate by age and gender

| Demographic | Rate (Cheapest) |

|---|---|

| Married 60-year old female | $1,160 |

| Married 60-year old male | $1,185 |

| Married 35-year old male | $1,410 |

| Married 35-year old female | $1,450 |

| Single 25-year old female | $1,890 |

| Single 25-year old male | $2,050 |

| Average | $1,750 |

| Single 17-year old female | $4,850 |

| Single 17-year old male | $5,110 |

A single 17-year male driver pays a whopping $7,536 extra compared to a married 35-year-old male. Factors such as age and marital status contribute to the difference in premium rates.

The difference is also partly because married people are assumed to be less risky than unmarried teenagers.

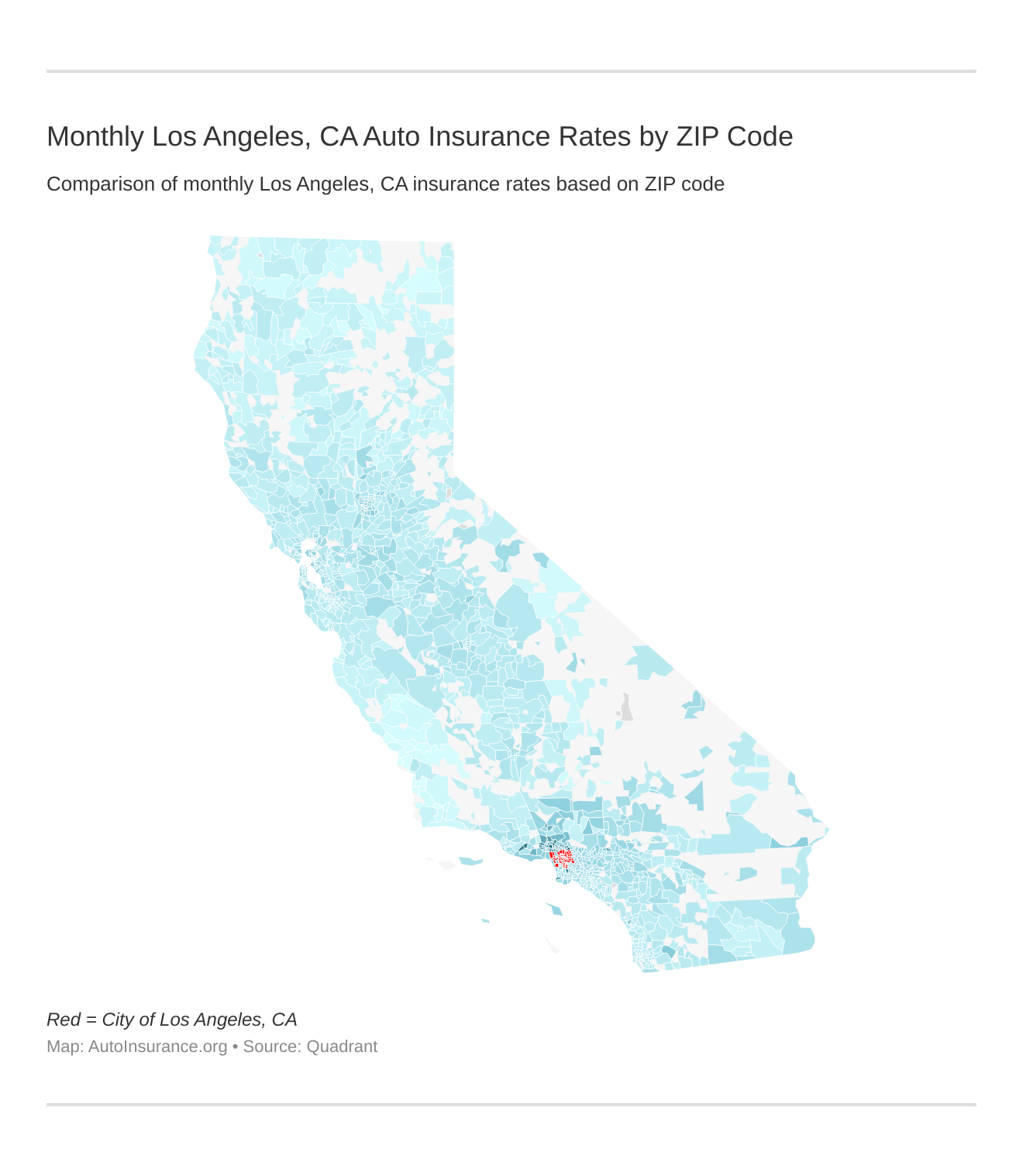

What are the cheapest ZIP codes in Los Angeles?

Your ZIP code is also a factor in determining your insurance rate. The insurance companies know how many claims were filed from a ZIP code, giving them an idea about accidents, theft, vandalism, and other risks.

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Los Angeles, California auto insurance rates by ZIP Code below:

You can use the following table to find the average annual premium in your ZIP code.

Cheapest Zip Codes in Los Angeles

| Zipcode | Annual average rate |

|---|---|

| 90732 | $5,443.97 |

| 90248 | $5,547.61 |

| 90022 | $5,659.38 |

| 90731 | $5,785.84 |

| 90045 | $5,866.67 |

| 90023 | $5,961.50 |

| 90063 | $6,112.29 |

| 90032 | $6,257.72 |

| 90066 | $6,263.93 |

| 90042 | $6,342.79 |

| 90041 | $6,408.45 |

| 90073 | $6,442.82 |

| 90031 | $6,574.62 |

| 90065 | $6,606.33 |

| 90059 | $6,638.38 |

| 90292 | $6,639.76 |

| 90033 | $6,641.77 |

| 90039 | $6,666.43 |

| 90001 | $6,668.83 |

| 91342 | $6,669.47 |

| 90061 | $6,680.53 |

| 91345 | $6,711.32 |

| 90064 | $6,790.13 |

| 91311 | $6,856.34 |

| 90002 | $6,880.20 |

| 91307 | $6,911.28 |

| 90034 | $6,938.01 |

| 90047 | $6,990.32 |

| 90011 | $7,015.39 |

| 90025 | $7,018.22 |

| 90058 | $7,034.66 |

| 90043 | $7,151.68 |

| 90044 | $7,199.59 |

| 91304 | $7,210.43 |

| 90003 | $7,216.78 |

| 90071 | $7,263.26 |

| 90089 | $7,299.04 |

| 90021 | $7,317.97 |

| 90049 | $7,318.65 |

| 90008 | $7,324.43 |

| 90079 | $7,356.48 |

| 90026 | $7,407.32 |

| 90037 | $7,442.40 |

| 91330 | $7,471.96 |

| 90013 | $7,484.92 |

| 90062 | $7,554.63 |

| 90012 | $7,585.79 |

| 90016 | $7,666.96 |

| 90018 | $7,691.95 |

| 90035 | $7,723.27 |

| 90007 | $7,804.44 |

| 90036 | $7,859.43 |

| 90024 | $7,859.78 |

| 90019 | $7,892.49 |

| 90068 | $7,907.31 |

| 90067 | $7,924.85 |

| 90015 | $7,984.60 |

| 90014 | $7,996.90 |

| 90006 | $8,008.26 |

| 90048 | $8,094.05 |

| 90077 | $8,095.60 |

| 90057 | $8,100.73 |

| 90027 | $8,112.12 |

| 90017 | $8,115.53 |

| 90004 | $8,152.00 |

| 90029 | $8,166.29 |

| 90005 | $8,303.29 |

| 90046 | $8,322.74 |

| 90038 | $8,323.32 |

| 90028 | $8,339.09 |

| 90020 | $8,434.59 |

| 90010 | $8,529.77 |

What’s the best car insurance company in Los Angeles?

We know it’s tough figuring out what would be thebest car insurance company for you. Given the fact that there so many choices in the market, it can become difficult.

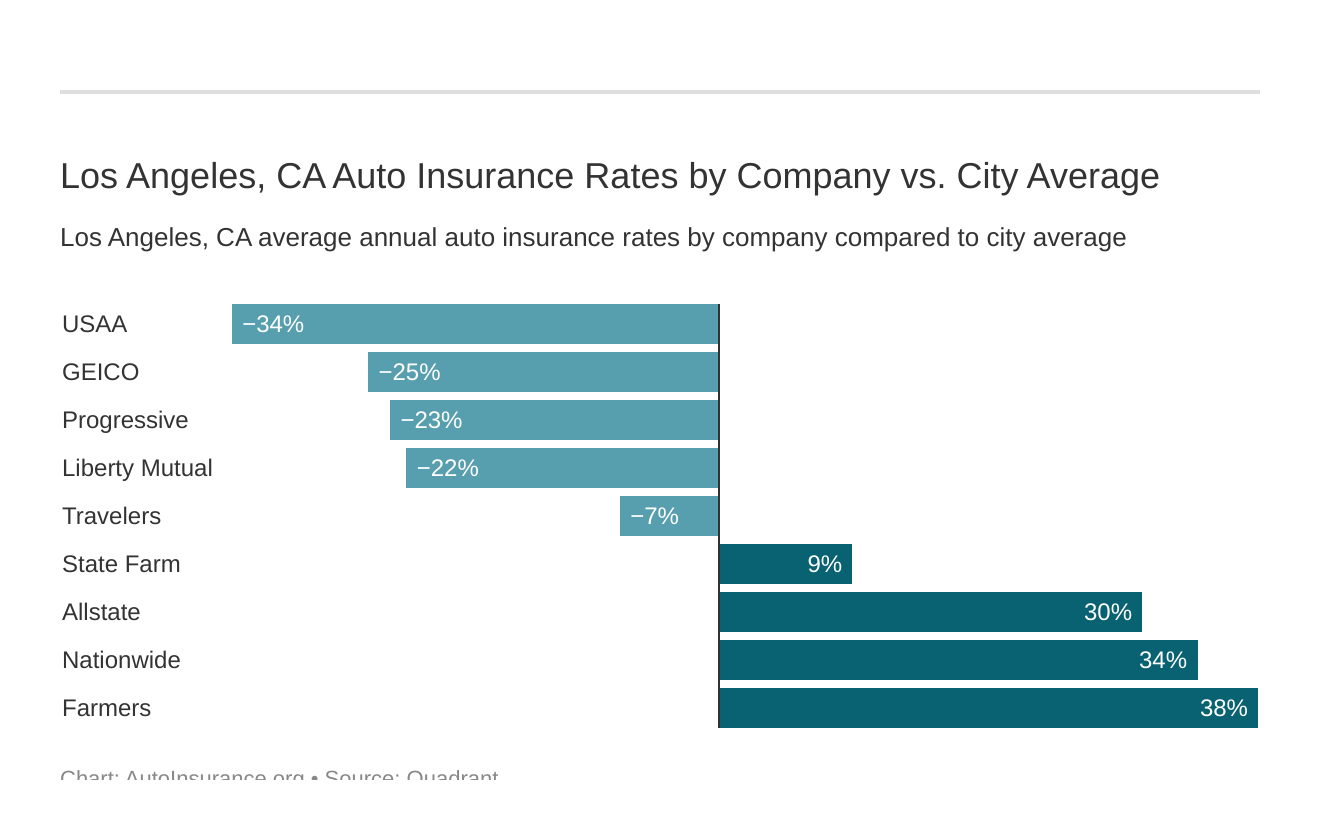

Which Los Angeles, CA car insurance company has the best rates? And how do those rates compare against the average California car insurance company rates? We’ve got the answers below.

In this section, we will help you figure out the best insurance company based on your requirements. Are you looking for cheapest rates, or best policy for commuters, or best for drivers with a bad credit score?

Read on to know the best car insurance for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest car insurance rates by company in Los Angeles?

Los Angeles has a lot of options for car insurance. All of the big national providers, including Geico, USAA, State Farm, and Allstate, are present in the city.

However, the insurers weigh factors differently, and therefore, they all have different rates. Here is the table of rates, organized by company and broken down by age, gender, and marital status.

Car Insurance Rates by Company in Los Angeles

| Insurer | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| $2,504.85 | $2,368.01 | $2,441.10 | $2,446.92 | $5,806.10 | $5,835.43 | $3,475.77 | $3,280.14 | $3,519.79 |

| $2,491.48 | $2,490.71 | $2,340.16 | $2,340.16 | $7,615.45 | $7,734.42 | $3,584.13 | $3,653.83 | $4,031.29 |

| $2,542.54 | $2,618.94 | $2,173.29 | $2,582.03 | $6,935.09 | $8,359.95 | $3,706.13 | $3,990.25 | $4,113.53 |

| $3,172.36 | $2,975.30 | $2,974.72 | $2,869.00 | $6,853.08 | $7,392.56 | $3,547.93 | $3,615.08 | $4,175.00 |

| $3,644.32 | $3,512.51 | $3,208.00 | $3,173.32 | $7,851.28 | $8,932.09 | $4,804.82 | $4,680.00 | $4,975.79 | |

| $4,591.64 | $4,591.64 | $4,106.31 | $4,106.31 | $8,499.31 | $10,546.13 | $5,085.40 | $5,243.41 | $5,846.27 |

| $4,440.80 | $4,431.31 | $3,211.59 | $3,235.18 | $12,526.09 | $15,746.23 | $5,675.19 | $6,203.58 | $6,933.75 | |

| $4,984.81 | $4,748.21 | $4,371.12 | $4,108.92 | $12,865.63 | $14,217.34 | $5,955.49 | $5,869.86 | $7,140.17 |

| $4,006.28 | $4,006.28 | $3,640.26 | $3,640.26 | $12,797.29 | $20,810.33 | $4,751.88 | $5,298.50 | $7,368.89 |

The rates vary by age and marital status.

Farmers Insurance is the most expensive insurer, with a whopping $20,810 annual rate for a single 17-year-old male driver. Farmers Insurance drops its average yearly rate by $15,511 for a 25-year-old single male driver.

However, for a 17-year-old teen male driver, USAA and Geico are the cheapest insurers. On average, USAA and Geico are approximately $14,000 cheaper than Farmers Insurance for a teen driver. You may want to keep this in mind when you are ready to add a young driver to your policy.

In 2019, California prohibited insurance companies from using gender information in determining rates.

However, you must not only consider the rate when finalizing your insurer. Many other factors impact an insurance policy.

In the next section, we will look at how your annual commute impacts your insurance rate.

What is the best rate for auto insurance in Los Angeles by commute?

According to the Federal Highway Administration, the total annual miles driven per licensed driver in California is 13,414 miles. This is slightly less than the national average of 14,132 miles per driver.

You can expect the difference in commute because the commuters in the big Californian cities might be leveraging public transportation.

Insurers might consider this data when they calculate your insurance rate. We partnered with Quadrant Data Solutions to analyze the impact of your annual commute on the insurance rate. Here are the insurance rates of major insurers in Los Angeles organized by annual commute.

Insurance rates by annual commute in Los Angeles

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| $3,240.71 | $3,798.88 | $3,519.80 |

| $3,661.25 | $4,401.33 | $4,031.29 |

| $3,729.65 | $4,497.40 | $4,113.53 |

| $3,826.67 | $4,523.34 | $4,175.01 |

| $4,459.95 | $5,491.64 | $4,975.80 | |

| $5,633.47 | $6,059.06 | $5,846.27 |

| $6,239.26 | $7,628.23 | $6,933.75 | |

| $6,289.10 | $7,991.24 | $7,140.17 |

| $6,682.86 | $8,054.91 | $7,368.89 |

Almost all insurers in Los Angeles will increase your insurance rate if you drive a lot. Allstate, Nationwide, and Farmers Insurance tend to increase the insurance rate by more than $1,300 on average if you commute around 12,000 miles annually.

If you commute for work, you should consider USAA, Geico, or Progressive for a better rate.

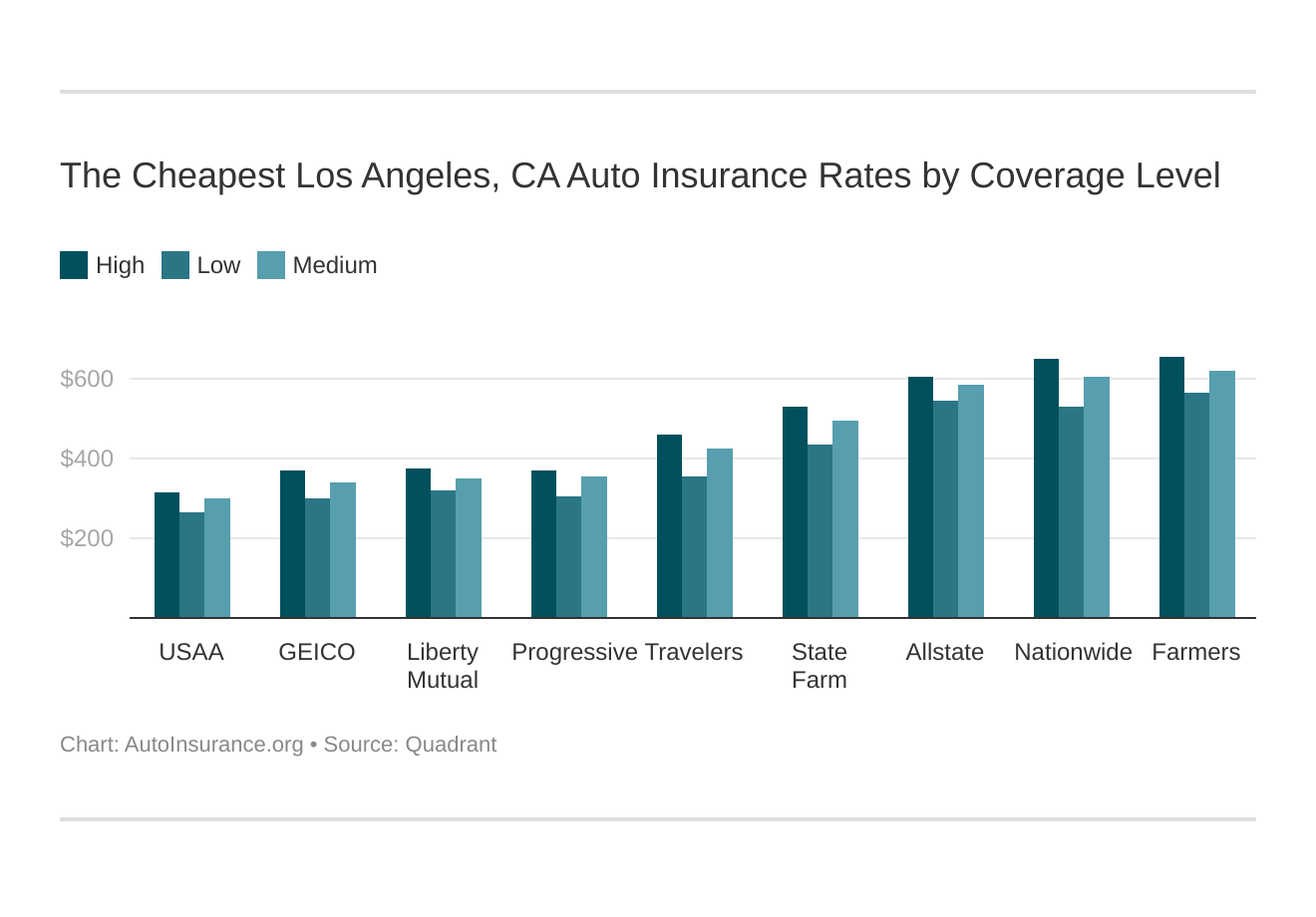

What is the best car insurance based on coverage levels?

Coverage level is another factor that impacts your insurance rates. If you opt for higher coverage, your insurance rate might also increase.

Your coverage level will play a major role in your Los Angeles car insurance rates. Find the cheapest Los Angeles, CA car insurance rates by coverage level below:

However, each insurer might have different car insurance prices in Los Angeles, therefore, may change your premium rate. Check out the recommended auto insurance coverage levels.

Car insurance rate by coverage in Los Angeles

| Insurer | High | Low | Medium | Average |

|---|---|---|---|---|

| $3,791.79 | $3,176.34 | $3,591.24 | $3,519.79 |

| $4,433.77 | $3,579.19 | $4,080.91 | $4,031.29 |

| $4,448.14 | $3,648.91 | $4,243.53 | $4,113.53 |

| $4,474.55 | $3,835.18 | $4,215.28 | $4,175.00 |

| $5,536.42 | $4,268.80 | $5,122.16 | $4,975.79 | |

| $6,344.14 | $5,242.92 | $5,951.74 | $5,846.27 |

| $7,283.19 | $6,518.17 | $6,999.88 | $6,933.75 | |

| $7,785.36 | $6,366.35 | $7,268.81 | $7,140.17 |

| $7,869.87 | $6,802.49 | $7,434.30 | $7,368.89 |

Travelers, State Farm, Nationwide, and Farmers Insurance may increase your premium rate by more than $1,000 if you opt for high coverage, whereas other large insurers might increase the premium rate by $500-$600.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is high coverage and low coverage?

Any car insurance policy can consist of two parts:

- the policy legally required to drive

- the options that you may want for additional coverage

In Los Angeles, you must have the following minimum car insurance:

- $15,000 for bodily injury or death per person

- $30,000 for total bodily injury or death per accident

- $5,000 for damage to property per accident

The minimum car insurance is the lowest coverage that you can use.

However, this may not be sufficient for your needs, and you may want to opt for any of the following:

- Collision

- Comprehensive

- Med Pay

- Uninsured/Underinsured Motorist

- Personal Injury Protection

If you choose these, you may be purchasing a high coverage insurance policy.

However, you may not need all of the coverages depending on your situation. For example, if you have an older car, you may not need comprehensive coverage, which would protect you against vandalism or hitting a deer.

After something like that happens to an older car, your insurer may not want to pay for repairs. You’ll want to double check with them, but it’s best to tailor your auto policy to what you’ll actually need.

Will your credit history affect what you pay for car insurance?

Your credit history is usually an important factor in determining your car insurance premium rate. However, California insurance law prohibits insurers from using your credit history to determine insurance rates.

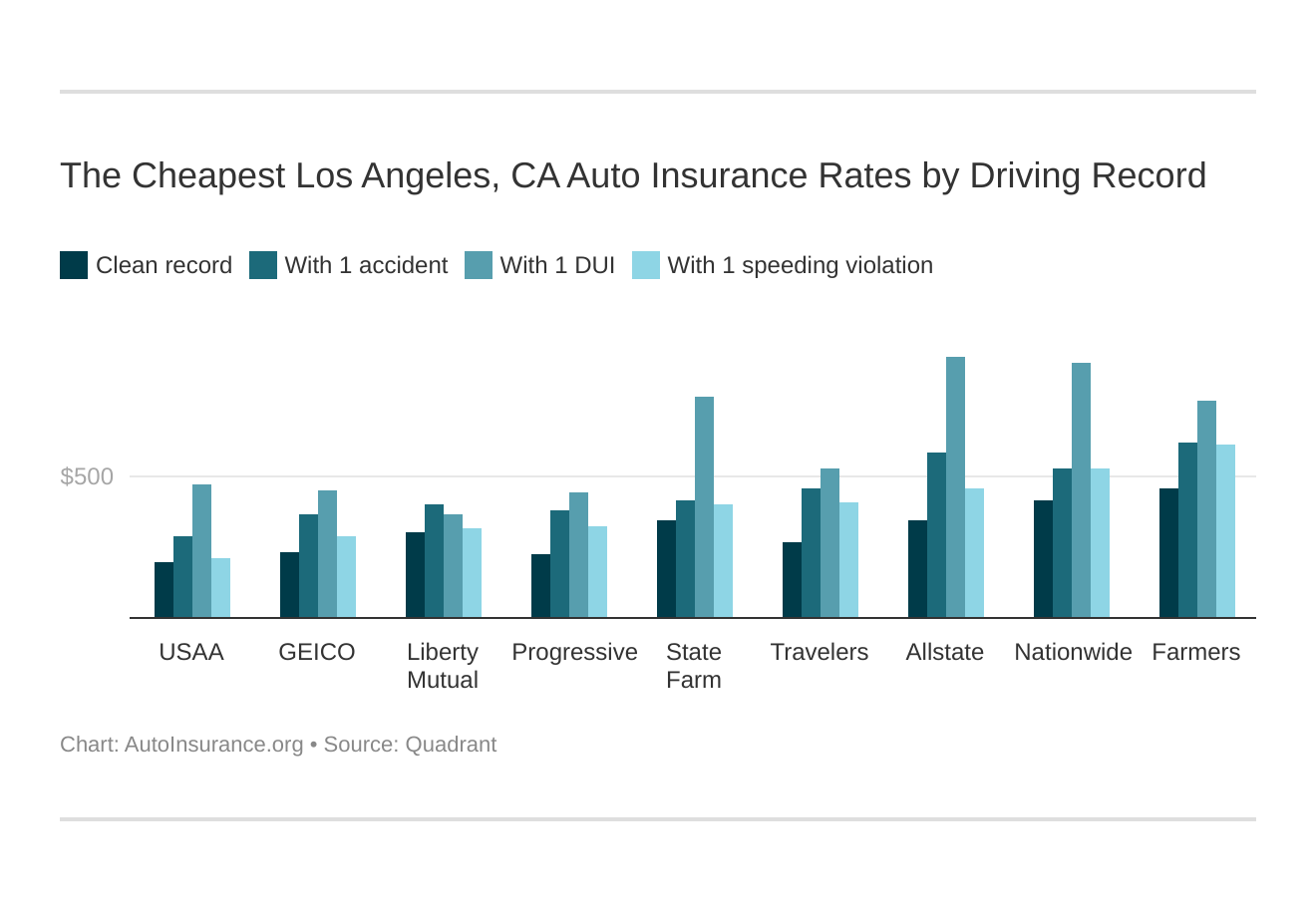

What would be the best company according to your driving record?

Auto insurance companies check your driving record as another important factor that helps them determine your insurance rate.

Your driving record will play a major role in your Los Angeles car insurance rates. For example, other factors aside, a Los Angeles, CA DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Los Angeles, CA car insurance rates by driving record.

Best Car Insurance for Driving Record in Los Angeles

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| $2,330.45 | $3,485.00 | $5,708.26 | $2,555.44 | $3,841.24 |

| $2,674.38 | $4,583.08 | $5,332.27 | $3,864.37 | $4,196.58 |

| $2,811.80 | $4,369.58 | $5,454.45 | $3,489.34 | $4,211.94 |

| $3,624.85 | $4,850.21 | $4,383.60 | $3,841.35 | $4,286.22 |

| $3,235.94 | $5,455.96 | $6,320.04 | $4,891.24 | $5,003.98 | |

| $4,174.95 | $4,977.11 | $9,389.60 | $4,843.42 | $6,180.55 |

| $5,457.32 | $7,424.13 | $9,228.04 | $7,366.05 | $7,369.83 | |

| $4,967.15 | $6,379.89 | $10,833.75 | $6,379.89 | $7,393.60 |

| $4,149.84 | $7,025.57 | $11,093.95 | $5,465.62 | $7,423.12 |

All insurance companies increase your insurance rate if you are caught speeding or cause an accident. If you are caught driving under the influence (DUI), your insurance rate will increase on average by $3,800. Allstate and Nationwide may increase your premium rate by as much as $6,000.

Insurance companies will pull your full motor vehicle report (MVR) that gives them a record summary of your driving activity, including:

- Traffic tickets

- Convictions

- Accidents

- Even little things like parking tickets

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

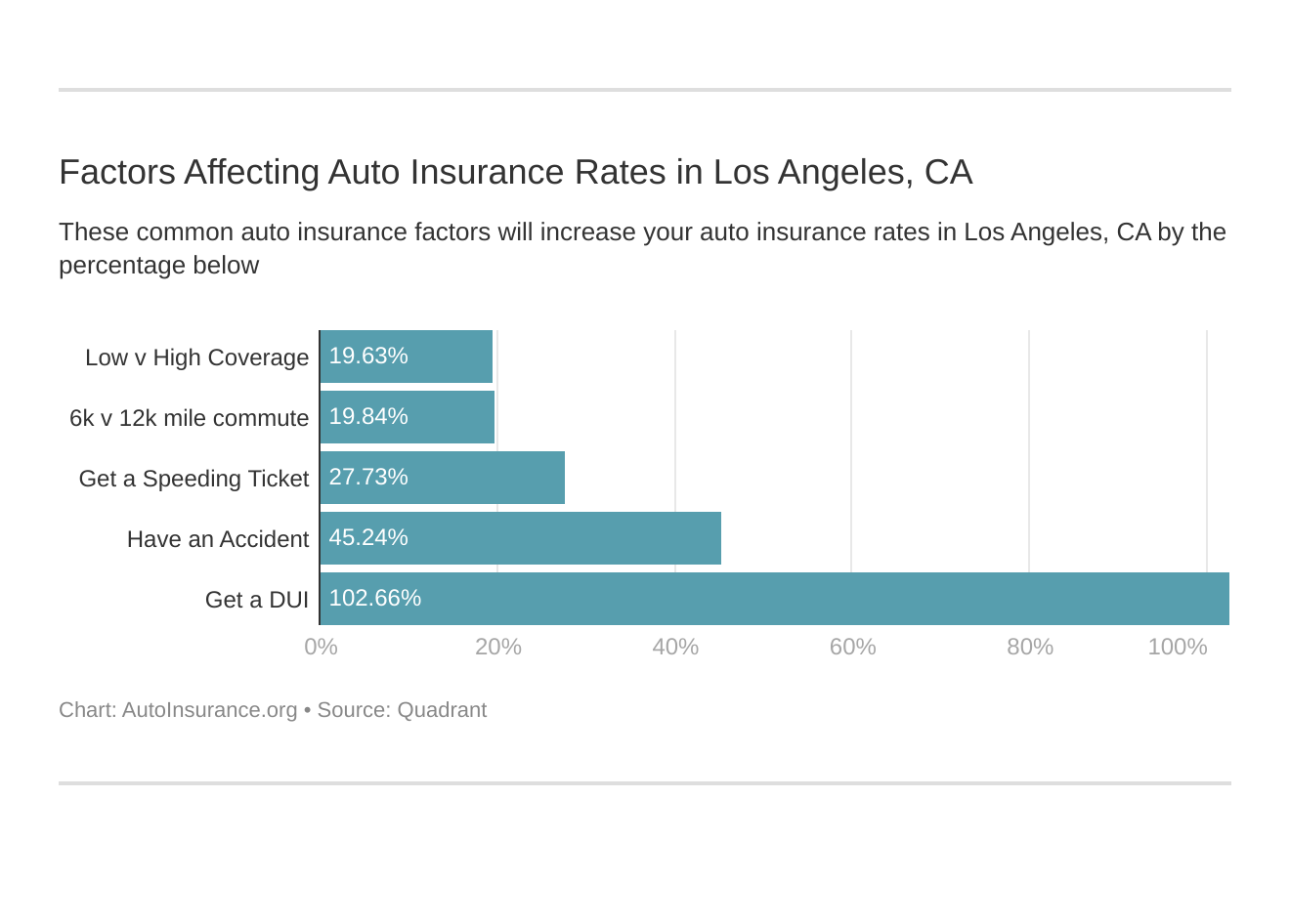

What are the factors that affect what you’ll pay for coverage in Los Angeles?

Aside from driving record, annual mileage, and your coverage level, other external factors might influence your car insurance rates.

Factors affecting car insurance rates in Los Angeles, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Los Angeles auto insurance.

With an estimated population of 4 million, Los Angeles is the second-most populous city in the country after New York City.

The large population can impact the city’s prosperity, economy, homeownership, and income. These factors can influence your car insurance in Los Angeles.

Let us analyze factors the factors influencing your insurance rate in Los Angeles.

What do growth and prosperity have to do with what you pay?

According to the Bureau of Economic Analysis (BEA), the Los Angeles metropolitan area has a GDP of $1.043 trillion, making it the third-largest economic metropolitan area in the world after Tokyo and New York. The Los Angeles metro area would have been the 17th biggest economy if it was an independent country.

International trade, health care, education, technology, manufacturing, retail, and entertainment drive the economy of Los Angeles.

There are several firsts to the city:

- The largest manufacturers in the country

- The largest and busiest port in the United States

- The largest retail market in the country

- Home to the entertainment industry including Hollywood

- Los Angeles has 23 Fortune 500 companies

Los Angeles is witnessing an economic boom in recent times evident by the growth of personal income, gross domestic product per capita, jobs, home prices, global trade and transportation, and corporate equity.

This economic boom would mean that Los Angeles is still an attractive opportunity for a lot of people. The rising population and resulting growth can also mean that your insurance rate may increase.

To understand the change in insurance rate, let us first look at Los Angeles’ national prosperity and growth ranks from 2005 to 2015.

Prosperity (11th)

Productivity: +10.9 percent (10th of 100)

Standard of living: +9.2 percent (9th of 100)

Average annual wage: +8.9 percent (34th of 100)

According to the Metro Monitor Report by the Brookings Institution, in the last two decades, productivity and standard of living in Los Angeles increased at a faster rate than the national average. However, the same cannot be said about the average annual wage. In fact, between 2012-2014, the growth in yearly salary lagged the national average.

Growth (49th)

Jobs: +3.2 percent (62nd of 100)

Gross metropolitan product (GMP): +14.5 percent (31st of 100)

Jobs at young firms: -16.3 percent (51st of 100)

Job growth in Los Angeles has been lagging behind the national average in the last decade.

What is the median household income in Los Angeles?

According to DataUSA, the median household income in Los Angeles County is $65,006. This is $3,668 more than the national median household income of $61,338. The Long Island-Long Beach-Anaheim metropolitan area has a median household income of $69,992.

However, this is less than the median household income in California ($71,805) which is propelled by the likes of Orange and Ventura counties with median household incomes of $86,217 and $82,857 respectively.

The average annual car insurance premium for residents of L.A. is $7,260, whereas the average for California is $5,048.

Premium as a percentage of income in Los Angeles

| MEDIAN INCOME LEVEL | AVERAGE CAR INSURANCE PREMIUM | PREMIUM AS A PERCENTAGE OF INCOME | |

|---|---|---|---|

| Los Angeles | $65,006 | $7,260.97 | 11.17% |

| California | $71,805 | $5,048.88 | 7.03% |

The residents of L.A. are paying 11.17 percent of their income for car insurance premiums. Compare this to the rest of the Californians who pay only 7.03 percent of their income towards car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does homeownership look like in Los Angeles?

Whether you are a homeowner or not impacts your car insurance rate. Homeownership signifies financial stability to the insurer and may indicate that you will be able to pay the insurance premiums on time.

According to DataUSA, the median property value in Los Angeles was $588,700 in 2017, which is more than twice the national median property value.

If you consider the Los Angeles-Long Beach-Anaheim metropolitan area, the median property value is 2.83 times the national median property value.

The median property value in Los Angeles County increased by 9.4 percent during 2016-17. Given the high property values, L.A. has a considerably low ownership rate compared to the rest of the country.

The homeownership rate in Los Angeles County is only 45 percent, which is far lower than the national average of 63.9 percent.

Homeownership is difficult in Los Angeles County. Although homeowners may get some discounts from insurers, renting is also a sign of financial stability in the City of Angels.

What does the education situation look like in Los Angeles?

What is the highest level of education you’ve completed?

Remember answering this question on the car insurance application? Ever wondered why your education level is vital for your insurer?

According to insurance companies, educated people tend to be more responsible drivers. Of course, there would be exceptions to the rule, but generally speaking, educated people tend to avoid risky driving behavior.

Education is significant in Los Angeles. The University of California, Los Angeles, is one of the top employers in the city.

The City of Los Angeles is home to three campuses of the University of California system, seven from the California State University system, and other private universities. The University of California, Los Angeles, and the University of Southern California are two national research universities based in Los Angeles.

The top three universities in Los Angeles according to the number of degrees awarded:

- The University of Southern California (15,664 degrees awarded)

- The University of California-Los Angeles (12,961 degrees awarded)

- California State University-Northridge (9,890 degrees awarded)

The total number of degrees awarded in 2016 by universities in Los Angeles was 169,429. The following graph provides a break up of the various degrees awarded:

Multiple organizations are calling for insurers not to consider education level while calculating insurance premiums. However, education does impact insurance rates at least for the time being.

Does race and ethnicity factor into what a person earns in Los Angeles?

In 2017, Asians were the highest-paid ethnicity in Los Angeles followed by Caucasian and people from two or more races.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does gender affect what a person earns in Los Angeles?

While gender equality is a hot topic in America and for a good reason, insurance companies tend to charge different rates for men and women.

The percentage of income that you have to shell out for car insurance may also change based on your gender. Why?

Because wages differ for gender.

According to DataUSA, the average male salary in California is $75,050, whereas the average female wage is $59,658.

Based on the previously discussed wages, we can calculate the percentage of income that a person has to shell out for car insurance.

Premium as a % of income in Los Angeles by gender

| Occupation | Premium as a % of income (male) | Premium as a % of income (female) |

|---|---|---|

| Miscellaneous managers | 4.25 | 5.37 |

| Elementary & middle school teachers | 7.77 | 7.99 |

| Retail salespersons | 11.15 | 14.22 |

We can see that for every occupation, females are spending a larger percentage of their income on car insurance.

Do age and gender have anything to do with poverty?

Los Angeles has some of the most sought after ZIP codes in the country. But the city also has places like Skid Row that was part of the report by United Nations Special Rapporteur for extreme poverty.

According to DataUSA, 17 percent of the city’s population is living below the national poverty line. This is worse than the national average of 13.4 percent.

The surprising fact is that the top three demographics living in poverty are females.

The largest demographic living in poverty are females between the ages 25-34, followed by females 35-44 and again, females 18-24.

The federal poverty level for a family of four is determined to be $25,750. In the case of Los Angeles, even an income of $52,200 is considered a very low-income level for a family of four.

Poverty level in Los Angeles

| Family Size (Persons in Family/Household) | HUD Low Income Level 1 | Premium as a % of income for HUD 1 | HUD Very Low Income Level 2 | Premium as a % of income for HUD 2 | HUD Extremely Low Income Level 3 | Premium as a % of income for HUD 3 | Federal Poverty Level | Premium as a % of income for federal poverty level |

|---|---|---|---|---|---|---|---|---|

| 1 | $58,450 | 9.1 | $36,550 | 14.6 | $21,950 | 24.3 | $12,490 | 42.8 |

| 2 | $66,800 | 8 | $41,800 | 12.8 | $25,050 | 21.3 | $16,910 | 31.6 |

| 3 | $75,150 | 7.1 | $47,000 | 11.4 | $28,200 | 19 | $21,330 | 25.1 |

| 4 | $83,500 | 6.4 | $52,200 | 10.2 | $31,300 | 17.1 | $25,750 | 20.8 |

However, many of the households below the poverty line cannot own a car and therefore rely on modes of public transportation. Additionally, the insurance premium used for the calculation is the average of Los Angeles County. For people generating low incomes, the premium might also be higher than the average. Making it even more expensive to own and maintain a vehicle.

How do race and ethnicity factor into poverty?

Hispanics are the most common ethnic group living below the poverty line in Los Angeles County, followed by Whites and Others with the most poverty.

The top three ethnicity makes about 84.3 percent of the total people in poverty in L.A.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does employment by occupation look like in Los Angeles?

Total people employed in Los Angeles County increased from 4.97 million in 2016 to 4.89 million in 2017.

What does the driving scene look like in Los Angeles?

Whether you are going west on Santa Monica Boulevard or you are going to Beverly Hills using Sunset Boulevard, there are several places you can explore in L.A.

Navigating L.A. is tough primarily due to the traffic. We understand that despite the plentiful roads, it can be frustrating navigating your way through traffic.

We understand the headache! And that is why we have put together this guide to help you safely navigate around L.A.

We will cover speed traps, road conditions, vehicle thefts, and much more.

What do the roads look like in LA?

Want to know the major highways in Los Angeles? In this section, we will cover the major roads, speed traps, road conditions, etc.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

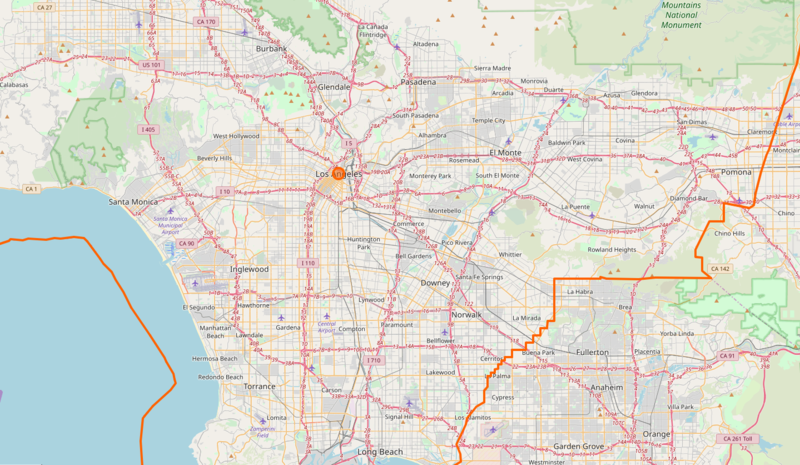

What major highways run through Los Angeles?

The City of Los Angeles is spread over 472 square miles. A sprawling network of freeways and roads connect the vast metropolis.

Here is the map of the interstates and other highways in Los Angeles.

I-5, I-10, I-15, I-110, I-405, I-105, I-710, and I-10 are the major freeways linking the Los Angeles metropolitan area. US 101 is the major highway that originates from the Greater Los Angeles area and goes all the way to Washington in the north.

Los Angeles has 515 miles of freeways and expressways. Here is a list of major highways along with the total miles.

Los Angeles Highways

| Highway | Interstate | Miles |

|---|---|---|

| Golden State Freeway/Santa Ana Freeway/San Diego Freeway/Montgomery Freeway | Interstate 5 | 796 |

| Santa Monica Freeway/Rosa Parks Freeway/Golden State Freeway | Interstate 10 | 243 |

| Veteran's Memorial Highway | Interstate 15 | 295 |

| Glenn Anderson Freeway/Century Freeway | Interstate 105 | 19 |

| Harbor Freeway | Interstate 110 | 32 |

| Foothill Freeway | Interstate 210 | 85 |

| San Diego Freeway | Interstate 405 | 72 |

| San Gabriel River Freeway | Interstate 605 | 27 |

| Long Beach Freeway | Interstate 710 | 23 |

| Santa Ana Freeway | part of U.S. Route 101 and I-5 | |

| Hollywood Freeway | part of U.S. Route 101 | 17 |

Some of the major interstates and highways that end within the Los Angeles metropolitan area are:

- I-105 (19 miles)

- I-710 (23 miles)

- I-110 (32 miles) – one of the busiest interstates

- I-210 (85 miles) – Foothill Freeway

- I-405 (72 miles)

- I-605 (27 miles) – San Gabriel River Freeway

What are some popular road trip destinations in LA?

There are many sights and scenic drivers in L.A. to keep you busy. Here are the top five cool things you can do in L.A.

Mulholland Drive – with the valley on one side and Hollywood on the other, Mulholland drive is sure to give you the very best scenery in L.A.

Pacific Coast Highway – the drive between Santa Monica to Zuma Beach will give the flavor of arguably the most beautiful road in continental America.

Catalina Island – just a short drive down to this beach will give you the feel of the Mediterranean in California!

Universal Studio – Take the studio tour of the famous Universal Studio to get a feel of Hollywood

Sunset Strip – drive down the Sunset Strip and see the iconic images of L.A. come to life.

What are the road conditions like in Los Angeles?

According to TRIP, a national transportation research group, 57 percent of roads in the Los Angeles metropolitan area are in poor condition.

Road Condition in Los Angeles

| Road Condition | Poor Share | Mediocre Share | Fair Share | Good Share |

|---|---|---|---|---|

| Los Angeles‐‐Long Beach‐‐Anaheim | 57% | 22% | 11% | 10% |

Los Angeles seems to have a never-ending problem with potholes. An average driver in L.A. spends an additional $900 per year to fix wear and tear in the car.

However, the city, along with companies like Google, are looking to address the problem of potholes. Google is using machine learning to identify potholes through images that will reduce the manual workload in identifying dangerous potholes.

The city’s Department of Public Works has a yearly budget of $150 million to repair roads in the city. However, the department spends 80 percent of the amount in repairing 1,545 lane miles of roads in good condition. The rest 20 percent is used to repair the remaining 855 lane miles that are in poor condition.

The state government is also investing in improving major highways across Southern California. A major improvement project includes the I-405 improvement plan. The $1.9 billion I-405 improvement plan was the most significant in 2018. The construction is expected to end in 2023 and will involve 18 bridge replacements and new and widened bridges.

Other projects that will improve the road conditions in Los Angeles include:

Road Improvement Projects in Los Angeles

| Project location | Description | Construction period | Total Project Cost ($ million) |

|---|---|---|---|

| I-710 – Port of Long Beach | Gerald Desmond Bridge Replacement | 2012-2021 | 1,200 |

| I-5 (SR-14 Connector to Parker Road) | Construct HOV and Truck Lanes | 2019-2021 | 440 |

| I-5 (Olive Avenue in Burbank to Sheldon St./Laurel Canyon Blvd. in LA) | Widen and realign highway for HOV lanes, realign Metrolink railroad tracks | 2012-2022 | 402 |

| I-5 (Orange County line to Olive Avenue in Burbank) | Widen and realign highway for HOV, general purpose lanes, rehab pavement | 2016-2022 | 3200 |

| 101 (Liberty Canyon Road, Agoura Hills) | Wildlife Habitat Connectivity | TBD | TBD |

| I-10 Puente Avenue to SR-57 | HOV Lanes | 2014-2021 | 343 |

| 71 (SR-60 interchange to I-10) | Upgrade route from 4 lane expressway to 8 lane highway | 2020-2023 | 243 |

| LA-057 (SR-57 connector to Golden Springs Drive) | Reconstruct SR-57 connector to SR-60; construct eastbound SR-60 bypass off-ramp to Grand Avenue; construct southbound Grand Avenue to eastbound SRr-60 loop on-ramp. | 2020-2024 | 263 |

| LA-605-Carson Boulevard to Telegraph Road | Road rehabilitation | 2022-2025 | 81.5 |

| LA-060-I-710 to I-605 | Pavement rehabilitation | 2018-2020 | 75 |

| LA-405-Western Avenue to Crenshaw Boulevard | Construct auxiliary lane, road widening, ramp improvements | 2020-2023 | 68 |

| LA-047-Port of LA | Schulyer Heim Bridge Replacement | 2011-2020 | 247 |

| LA 60 (I-710 to County Line) | Bridge freight corridor improvement | 2021-2024 | 38.6 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Los Angeles use speeding or red light cameras?

The good news is that the City of Los Angeles does not have speeding cameras.

According to the Los Angeles Police Department, the city discontinued its red-light camera program in 2011.

What sort of vehicles can be found in Los Angeles?

Los Angeles boasts of the most cars per capita. The city residents navigate the massive sprawl, not through an efficient transport system but their cars.

In this section, we will look at the most popular car in the city and the most stolen car in the city.

What are the most popular vehicles?

Los Angeles is one of the most car-dependent major metropolitan areas in the country.

Unusually, Mitsubishi Montero used to be the most popular car in the city. Mitsubishi has discontinued the sale of Montero in the North American market.

However, driving long distances requires a fuel-efficient car, which is why the residents of L.A. prefer driving a Honda Civic. It is not only fuel-efficient but also cheaper to maintain.

Honda Civic is among the safest vehicles available in the market. The Insurance Institute of Highway Safety rates it “good” for almost all parameters.

In terms of safety features, Honda Civic provides Driver Air Bag, Passenger Air Bag, Front Head Air Bag, Rear Head Air Bag, Front Side Air Bag, 4-Wheel ABS, 4-Wheel Disc Brakes, Brake Assist, Electronic Stability Control, Daytime Running Lights, Child Safety Locks, Traction Control, Lane Departure Warning, and Lane Keeping Assist.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How many cars are averaged per household?

Most households in Los Angeles County owns two cars. Having three cars is the next most common car count for an average household in Los Angeles. This is understandable because of the amount of driving you need to do in L.A.

Are there any speed traps in Los Angeles?

You should be careful to not over speed in Los Angeles. Not only it can be risky, but there might be speed traps that can cause you to pay fine and the hassle of being stopped by a cop.

As per speedtrap.org, many neighborhoods in the Los Angeles metropolitan area, including Hacienda Heights and Brea are the worst when it comes to speed traps.

What is the vehicle theft situation in LA?

Experiencing vehicle theft can be painfully agonizing. According to the FBI, in 2016, there were 18,591 cases of vehicle theft in Los Angeles.

According to neighborhoodscout.com, Los Angeles has a high crime index, so much so that L.A. is safer than only 14 percent of U.S. cities.

In Los Angeles, you have one in 130 chances of becoming a victim of a violent crime, which is very high compared to the California average of one in 223.

Crime rate in Los Angeles

| MURDER | RAPE | ROBBERY | ASSAULT | |

|---|---|---|---|---|

| LOS ANGELES VIOLENT CRIMES RATES per 1,000 | 0.07 | 0.62 | 2.73 | 4.28 |

| UNITED STATES VIOLENT CRIMES RATES per 1,000 | 0.05 | 0.42 | 0.98 | 2.49 |

However, there are safer neighborhoods in the city that reduces the chances that you will be a victim of a crime.

- Victory Blvd / Balboa Blvd

- Topanga Canyon Blvd / S Topanga Canyon Blvd

- Mulholland Dr / Sepulveda Blvd

- Reseda Blvd / Rosita St

- De Soto Ave / Chatsworth St

- Palisades Dr / Ave De Santa Ynez

- W Sunset Blvd / N Kenter Ave

- Riviera

- Sesnon Blvd / Reseda Blvd

- Balboa Blvd / Westbury Dr

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is traffic like in Los Angeles?

Nobody likes sitting in traffic. You may lose time, miss meetings, and get stressed.

But you have to face traffic if you have to go to work.

However, with the correct information, you can better prepare for the congestion.

Traffic Congestion

Los Angeles is notorious for traffic congestion. In fact, according to a survey, L.A. ranks as the most stressful drive in the country.

According to a 2018 traffic study done by INRIX (a team of traffic experts), Los Angeles was the fifth most congested city in the country and 47th most congested city in the world.

In 2018, an average driver in Los Angeles spent 128 hours in congestion. The cost of congestion for an average driver is $1,788.

Transportation

According to DataUSA, commuters in Los Angeles (on average) have a longer commute time (30 minutes) compared to an average US commuter (25.5 minutes). The average commute time in Los Angeles is higher than the California average of 28 minutes.

Unfortunately, the average commute time for more than 25 percent of commuters in L.A. is more than 45 minutes.

This high commute time is probably because 74.6 percent of people preferred to drive alone to work.

Busiest Highways

According to the Federal Highway Administration, Los Angeles has some of the busiest highways in the country. The Los Angeles metropolitan area has four routes with more than 12 lanes.

Highways in Los Angeles

| Urban Area | Route | Lanes |

|---|---|---|

| Los Angeles-Long Beach-Santa Ana | I-405 | 14 |

| Los Angeles-Long Beach-Santa Ana | I-5 | 12 |

| Los Angeles-Long Beach-Santa Ana | 91 | 12 |

| Los Angeles-Long Beach-Santa Ana | I-110 | 12 |

How safe are Los Angeles’s streets and roads?

The City of Los Angeles is the seat of Los Angeles County.

Traffic Fatalities in Los Angeles

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Fatalities (All Crashes) | 625 | 639 | 651 | 837 | 658 |

| Fatalities in Crashes Involving an Alcohol-Impaired Driver | 187 | 172 | 149 | 240 | 192 |

| Single Vehicle Crash Fatalities | 379 | 359 | 389 | 472 | 368 |

| Fatalities in Crashes Involving a Large Truck by County for 2017 | 51 | 59 | 44 | 63 | 45 |

| Fatalities in Crashes Involving Speeding | 245 | 240 | 231 | 308 | 214 |

| Fatalities in Crashes Involving an Intersection | 218 | 234 | 242 | 307 | 234 |

| Passenger Car Occupant Fatalities | 200 | 200 | 202 | 263 | 183 |

| Pedestrian Fatalities | 209 | 209 | 209 | 278 | 235 |

| Pedalcyclist Fatalities | 30 | 24 | 33 | 37 | 29 |

Los Angeles County has been witnessing around 650 traffic fatalities every year since 2013. In 2016, there were 837 traffic-related fatalities in L.A. County.

Single-vehicle crashes were the biggest reason for traffic fatalities in Los Angeles County. The second biggest reason was pedestrian fatalities in L.A.

California counties ranked by traffic fatalities

| California Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| 1 | Los Angeles County | 625 | 639 | 651 | 837 | 658 |

| 2 | Riverside County | 228 | 246 | 242 | 297 | 294 |

| 3 | San Bernardino County | 262 | 285 | 260 | 273 | 271 |

| 4 | San Diego County | 198 | 233 | 246 | 243 | 231 |

| 5 | Kern County | 131 | 111 | 138 | 149 | 182 |

| 6 | Orange County | 186 | 173 | 183 | 204 | 178 |

| 7 | Sacramento County | 123 | 114 | 139 | 169 | 172 |

| 8 | Fresno County | 119 | 117 | 102 | 150 | 156 |

| 9 | San Joaquin County | 93 | 83 | 98 | 119 | 116 |

| 10 | Santa Clara County | 95 | 106 | 133 | 114 | 105 |

| Sub Total 1. | Top Ten Counties | 2,060 | 2,107 | 2,192 | 2,555 | 2,363 |

| Sub Total 2. | All Other Counties | 1,047 | 995 | 1,195 | 1,282 | 1,239 |

| Total | All Counties | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

The Los Angeles County accounted for the highest number of traffic-related fatalities among counties in California.

Another critical question is, what is the most dangerous type of roadway in Los Angeles?

According to the National Highway Traffic Safety Administration, other principal arterial roads in L.A. County are the most fatal roads.

Highways with most fatal crashes in Los Angeles

| RURAL INTERSTATE | URBAN INTERSTATE | FREEWAY/EXPRESSWAY | OTHER | MINOR ARTERIAL | COLLECTOR ARTERIAL | LOCAL | UNKNOWN | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 3 | 77 | 47 | 257 | 148 | 56 | 33 | 1 | 622 |

To understand the basic definitions of the different types of roads. You can learn more at the NHTSA website here.

According to the Department of Transportation, L.A. County also saw many railway accidents.

US DOT Railroad Crossing Incident in Los Angeles

| YEAR | COUNTY | RAIL EQUIPMENT | HIGHWAY | HIGHWAY USER TYPE | HIGHWAY USER SPEED | NONSUICIDE FATALITIES | NONSUICIDE INJURIES |

|---|---|---|---|---|---|---|---|

| 2012 | LOS ANGELES | Yard/Switch | DISTRICT BLVD | Truck-trailer | 20 | 0 | 0 |

| 2012 | LOS ANGELES | Yard/Switch | 26TH STREET | Truck-trailer | 20 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | 103 RD STREET | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Yard/Switch | UP PRI YARD XING | Truck-trailer | 18 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | ELM | Pedestrian | 35 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | 92 ND STREET | Pedestrian | 45 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | IMPERIAL | Pedestrian | 0 | 0 | |

| 2012 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | B | FRONT STREET | Pick-up truck | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Light Loco(s) | UP PRI YARD XING | Truck-trailer | 5 | 0 | 2 |

| 2012 | LOS ANGELES | Psgr Train | STOCKWELL | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | B | TURNBULL CANYON ROAD | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | Freight Train | PALMDALE BLVD/SR 138 | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | Psgr Train | BELLAIRE AVE | Pedestrian | 0 | 0 | 1 |

| 2012 | LOS ANGELES | Commuter | GLENDORA AVENUE | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Truck-trailer | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Light Loco(s) | ROLLING JCT | Automobile | 0 | 0 | 0 |

| 2012 | LOS ANGELES | C | RAMONA BLVD | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Freight Train | NORWALK BLVD | Automobile | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Commuter | CALEX | Truck-trailer | 0 | 0 | 10 |

| 2012 | LOS ANGELES | C | SAN ANTONIO AVENUE | Automobile | 0 | 0 | 1 |

| 2012 | LOS ANGELES | Freight Train | SOUTH VAIL AVENUE | Truck-trailer | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Freight Train | WESTMONT DR | Truck-trailer | 0 | 1 | |

| 2013 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Automobile | 10 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Truck-trailer | 0 | 0 | 2 |

| 2013 | LOS ANGELES | Freight Train | SO. GREENWOOD AVE. | Pedestrian | 0 | 1 | |

| 2013 | LOS ANGELES | C | WOLFSKILL STREET | Pedestrian | 0 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | UP PRIVATE YARD CROS | Automobile | 2 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 0 | 1 | 0 |

| 2013 | LOS ANGELES | Freight Train | FRIES AVE | Truck-trailer | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | ARVILLA AVENUE | Pedestrian | 0 | 0 | |

| 2013 | LOS ANGELES | Light Loco(s) | PARK AVE | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | E HARCOURT ST. | Automobile | 25 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | VINELAND AVE | Automobile | 5 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Automobile | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | BRAND BLVD. | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | PRIVATE | Truck-trailer | 5 | 0 | 1 |

| 2013 | LOS ANGELES | C | INDIAN HILL BLVD. | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | C | VINELAND AVE. | Pedestrian | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | PALOMARES ST | Van | 0 | 0 | 0 |

| 2013 | LOS ANGELES | C | SUNLAND BOULEVARD | Automobile | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Truck-trailer | 0 | 3 | |

| 2013 | LOS ANGELES | Yard/Switch | SLAUSON AVE | Automobile | 30 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Automobile | 0 | 2 | |

| 2013 | LOS ANGELES | B | HAMILTON BLVD | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Freight Train | MONTEBELLO BLVD | Automobile | 0 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | TROJAN WAY | Van | 10 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | SAN FERNANDO RD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Commuter | PALMDALE BLVD | Pedestrian | 1 | 0 | |

| 2014 | LOS ANGELES | C | DORAN AVENUE | Automobile | 0 | 0 | |

| 2014 | LOS ANGELES | Freight Train | VAN NUYS BLVD. | Pedestrian | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Truck-trailer | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Light Loco(s) | YARD | Truck-trailer | 5 | 0 | 1 |

| 2014 | LOS ANGELES | Commuter | AVENUE K | Pedestrian | 1 | 0 | |

| 2014 | LOS ANGELES | C | GRAND AVE | Automobile | 5 | 0 | 0 |

| 2014 | LOS ANGELES | Freight Train | UP PRI YARD XING | Truck-trailer | 15 | 0 | 0 |

| 2014 | LOS ANGELES | Yard/Switch | DOWNEY ROAD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | WALNUT AVENUE | Truck-trailer | 0 | 0 | 1 |

| 2014 | LOS ANGELES | C | BUENA VISTA STREET | Automobile | 5 | 1 | 1 |

| 2014 | LOS ANGELES | C | SIERRA HIGHWAY | Automobile | 5 | 0 | 1 |

| 2014 | LOS ANGELES | Freight Train | RAINBOW GLEN DR | Pedestrian | 0 | 0 | |

| 2014 | LOS ANGELES | B | NORTH MAIN STREET | Automobile | 25 | 0 | 0 |

| 2014 | LOS ANGELES | C | LOS NIETOS ROAD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | GLENDORA AVENUE | Pedestrian | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | LOS ANGELES AVE | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | N. GAREY AVENUE | Automobile | 0 | 0 | |

| 2014 | LOS ANGELES | Freight Train | WATSON PRIVATE | Truck-trailer | 5 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | GAFFEY STREET | Pick-up truck | 15 | 0 | 1 |

| 2015 | LOS ANGELES | Freight Train | FAIRWAY DR | Truck-trailer | 0 | 0 | 0 |

| 2015 | LOS ANGELES | Light Loco(s) | PRIVATE | Truck-trailer | 0 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | FAIRWAY AVENUE | Truck-trailer | 0 | 4 | |

| 2015 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 1 | 0 | |

| 2015 | LOS ANGELES | Commuter | SONORA AVENUE | Pedestrian | 0 | 0 | 0 |

| 2015 | LOS ANGELES | C | COGSWELL ROAD | Pedestrian | 0 | 0 | |

| 2015 | LOS ANGELES | Yard/Switch | ALONDRA ST. | Automobile | 8 | 0 | 1 |

| 2015 | LOS ANGELES | Yard/Switch | ALCOA AVENUE | Automobile | 15 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | N. HENRY FORD AVE. | Automobile | 20 | 0 | 0 |

| 2016 | LOS ANGELES | Psgr Train | DE SOTO ST | Automobile | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Yard/Switch | 26TH ST | Pick-up truck | 6 | 0 | 0 |

| 2016 | LOS ANGELES | C | SUN FLOWER AVENUE | Pedestrian | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Commuter | SYCAMORE DRIVE | Pedestrian | 0 | 1 | 0 |

| 2016 | LOS ANGELES | Yard/Switch | 37TH & ALAMEDA ST | Truck-trailer | 30 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | 48TH PLACE | Pedestrian | 1 | 0 | |

| 2016 | LOS ANGELES | Light Loco(s) | LOMITA BLVD. | Truck-trailer | 2 | 0 | 0 |

| 2016 | LOS ANGELES | Commuter | RUETHER ROAD | Pedestrian | 1 | 0 | |

| 2016 | LOS ANGELES | Psgr Train | TAMPA AVE | Pedestrian | 0 | 1 | |

| 2016 | LOS ANGELES | Commuter | CAMBIDGE AVENUE | Pedestrian | 0 | 0 | 0 |

| 2016 | LOS ANGELES | C | JURUPA ROAD | Van | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | LOMITA BLVD | Truck-trailer | 15 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | NADEAU | Automobile | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | TEMPLE AVENUE | Automobile | 1 | 0 | 0 |

What does Allstate America’s Best Drivers Report look like for Los Angeles?

Every year Allstate conducts a study on driver behavior in various American cities.

Here’s the latest data for Los Angeles:

Allstate Best Driver's in America Report for Los Angeles

| 2018 Best Drivers Report Ranking | City | Average Years Between Claims | Relative Claim Likelihood (Compared to National Average) | 2018 Ranking After Controlling for Population Density | 2018 Ranking After Controlling for Average Annual Precipitation |

|---|---|---|---|---|---|

| 194 | Los Angeles | 5.5 | 81.40% | 188 | 194 |

Among the 200 cities ranked by Allstate, Los Angeles was ranked 194th in 2018. The claim likelihood for drivers in Los Angeles relative to the national peers is 81.4 percent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there ridesharing options in Los Angeles?

The traffic congestion in Los Angeles may deter people from driving themselves around the city. In such a case ridesharing companies are a great alternative to public transportation.

Here’s the list of ridesharing companies available in Los Angeles:

- Blacklane

- Carmel

- Curb

- Flywheel

- HopSkipDrive

- Jayride

- Kango

- Limos.com

- Lyft

- RideYellow

- SuperShuttle

- Talixo

- Taxi

- Uber

Does Los Angeles have any E-star repair shops?

If your car breaks down or gets damaged in an accident, how do you find the best repair shop near you?

E-star repair shop network is created by Esurance to give you a list of reputable and top-quality repair shop near your location.

Here’s the list of top 10 repair shops near sunset strip in Los Angeles:

- AUTOBAHN COLLISION STUDIO CITY

- HARRY’S AUTO COLLISION CENTER

- WESTERN COLLISION

- ALL CITY AUTO BODY

- SANTA MONICA COLLISION CTR

- VICTORY AUTO BODY

- AGC COLLISION CENTER

- GOLDEN AUTO BODY & PAINT

- ALL CITY COLLISION BURBANK

- AUTO-TECH COLLISION CENTER_CF

What is Los Angeles weather like?

L.A. is known for its all year round fantastic weather. The average temperature in the city is between 72F to 55F. Thanks to this fantastic weather all year round, Los Angeles has a lot of restaurants offering alfresco style dining.

Here is the quick overview of the L.A. weather:

Weather in Los Angeles

| WEATHER FACTS | DETAILS |

|---|---|

| Annual High Temperature | 71.7°F |

| Annual Low Temperature | 55.9°F |

| Average Temperature | 63.8°F |

| Average Annual Rainfall | 18.67 inches |

The weather in L.A. is a dry Mediterranean type climate that usually means dry summer and rainy winter.

On average, L.A. is at a much higher risk of natural disasters than the rest of the country. Los Angeles County has seen 52 natural disasters compared to 13 for the rest of the country on average.

The most common types of natural disasters are fire, flood, storm, landslides, and winter storms.

You should consider adding a suitable comprehensive policy to protect yourself against financial injury. However, you need to make sure that your insurance policy has adequate coverage for the common types of natural disasters.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there public transit options?

Metro handles most public transportation in L.A.

To ride Metro operated buses and trains, you can buy TAP cards that offer two hours of unlimited transfers to metro trains and buses.

Metro runs different categories of buses, including:

- Metro Local (painted orange) – stops along major thoroughfares

- Metro Rapid (painted red) – stop less frequently and have sensors that keep traffic lights green when a bus approaches

- Commuter-oriented Metro Express (painted blue) – connect communities with Downtown LA

The metro service also includes a rail network that provides for two subway lines, four light-rail lines, and two express bus lines.

The fares for public transportation in L.A.

Public transportation fares in L.A.

| TAP validity | Fare |

|---|---|

| 1-Way | $1.75 |

| 1-Day Pass | $7 |

| 7-Day Pass | $25 |

| 30-Day Pass | $100 |

However, senior citizens (62+), people with disabilities, students, and low-income riders qualify for a discounted fare.

What about alternate transportation?

Los Angeles has always been at the vanguard of change. Los Angeles has many new options of getting around, such as scooters, bikes, electric bikes, dockless bikes, or smart bikes.

Some of the options available in L.A. include:

- Metro bike share

- Lime bikes

- Bird

- Spin (bought by Ford)

- Razor

- Social bicycles

- Jump (an Uber initiative)

- Lyft

Is there parking available in metro areas?

Parking in Los Angeles can be a hassle. Fortunately, there are many options available for drivers to book a parking spot ahead of time:

- Public parking – the city of Los Angeles has a public parking locator

- SpotHero

- LA Express Park

- ParkMe

- L.A. metered street parking

- WhereiPark

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the air quality in Los Angeles?

Vehicles contribute to air pollution leading to smog and poor air quality. According to the Environmental Protection Agency, all vehicles emitting pollutants such as particulate matter (PM), nitrogen oxides (NOx), and volatile organic compounds (VOCs) contribute to poor air quality.

It is astonishing to note that over 55 percent of NOx emissions is due to the transportation sector.

To control vehicle emissions, EPA regulates passenger vehicle emissions under the light-duty vehicle program. EPA also has specific standards to reduce emissions from heavy-duty diesel vehicles.

Here are the pollution statistics for Los Angeles County:

Pollution statistics in Los Angeles

| County | # Days with AQI | Good | Moderate | Unhealthy for Sensitive Groups | Unhealthy | Very Unhealthy | AQI Maximum | AQI 90th Percentile | AQI Median | # Days CO | # Days NO2 | # Days O3 | # Days SO2 | # Days PM2.5 | # Days PM10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Los Angeles County, CA | 365 | 35 | 222 | 89 | 18 | 1 | 201 | 130 | 76 | . | 30 | 173 | . | 161 | 1 |

Los Angeles County witnessed 18 days of unhealthy air quality.

What options are there for military members and veterans in Los Angeles?

We sincerely appreciate and thank the military personnel and veterans for the services rendered for our country. You may have lived a life of uncertainty, not knowing when and where you will have to relocate. But we hope to make one thing a tad easier for you: finding your car insurance.

In this section, we will talk about the car insurance options available to military personnel and veterans.

Let us start by analyzing the demographics of military personnel and veterans in Los Angeles.

The majority of military personnel and veterans in Los Angeles served in Vietnam and the First Gulf War.

Los Angeles hosts the Air Force Base located close to the Los Angeles International Airport and a mile west of the San Diego Freeway.

Other nearby military bases include:

- Naval Base in Ventura

- Marine Corps Base Camp Pendleton

- March Air Reserve Base

Following insurers provide insurance discounts for military personnel and veterans:

- Allstate

- Esurance

- Farmers Insurance

- Geico

- Liberty Mutual

- Metlife

- StateFarm

- The General

- USAA

USAA provides the maximum discount (below 26 percent of the state average) to military personnel, followed by Geico (22 percent below state average).

Insurance companies for military in Los Angeles

| Average Annual Premium ($3,688.93) | Higher/Lower (%) | |

|---|---|---|

| $4,532.96 | 22.88 | |

| $4,998.78 | 35.51 | |

| $2,885.65 | -21.78 | |

| $3,034.42 | -17.74 |

| $4,202.28 | 13.92 | |

| $2,693.87 | -26.97 |

Are there any unique city laws?

Los Angeles, like many other large cities, has some unique city driving laws.

Handheld Device Laws

Drivers are expected to use hands-free devices to talk while driving. However, it is illegal to text while driving in Los Angeles.

Food Trucks

Los Angeles has a thriving food truck scene.

Here is a list of 25 best food trucks in L.A.: The 25 Best Food Trucks in Los Angeles

However, there are specific rules that you would need to adhere to operate a food truck business in the city.

Applicable Laws – Essential laws for you to know include the 2009 California Retail Food Code, the Los Angeles Municipal Code 80.73, and the Los Angeles County Department of Public Health Informational Packet. The salient provisions that you should know include:

- You must have all pieces of equipment in your food truck certified by an American National Standard Institute (ANSI) accredited certification program

- You must obey all posted parking restrictions, including restrictions on stopping, loading, and parking

- If you want to operate in one location for more than an hour, you must have access to a bathroom within 200 ft travel distance of your truck

- You are only allowed to serve customers on the sidewalk side of your vehicle

- You must have a marked trash can outside your food truck

- You must rent space from a food commissary to park your vehicle when not in use – you may not park your vehicle in your driveway

Tiny Homes

It is legal in Los Angeles to build and live in tiny houses as long as you are adhering to the local zoning and building code requirements. There is no strict definition of a tiny house, but ideally, the tiny home should be under 500 square feet.

The tiny house is required to have at least 70 square feet of first-floor interior living space and should be licensed and registered with the Department of Motor Vehicles.

Parking Laws

In L.A., vehicles parked in violation of parking regulations are ticketed or towed very quickly.

For street parking, remember the following signs:

- Red curb = no parking

- Green curb = parking for a limited time only

- A white or yellow curb = passenger loading and unloading, no parking

Frequently Asked Questions

What is the average car insurance cost in Los Angeles, California?

The average rate for insurance in Los Angeles is about $605 per month. However, it’s important to note that this is just an average, and individual rates may vary based on various factors.

How do car insurance companies calculate rates in Los Angeles?

Car insurance companies in Los Angeles consider several factors when calculating your premium rates. These factors include your driving history, marital status, credit score, and more. Each insurer may weigh these factors differently, so it’s advisable to compare quotes from multiple companies to find the best rate.

How does age and gender affect car insurance rates in Los Angeles?

Age and gender can impact car insurance rates in Los Angeles. Younger drivers, especially teens, are often considered higher risk and may have higher premiums. Insurance rates generally decline with age, and gender can also play a role, with males typically paying higher premiums than females in Los Angeles.

How does marital status affect car insurance rates in Los Angeles?

Marital status can also influence car insurance rates in Los Angeles. Generally, married individuals are perceived as less risky compared to unmarried teenagers, leading to potentially lower premiums for married drivers. For example, a single 17-year-old male driver may pay significantly more for insurance compared to a married 35-year-old male.

How does ZIP code affect car insurance rates in Los Angeles?

Your ZIP code can impact car insurance rates in Los Angeles. Insurance companies consider factors like the number of claims filed, accidents, theft, and vandalism risks associated with specific ZIP codes. Rates may vary based on these factors, so it’s essential to consider your ZIP code when obtaining insurance quotes and comparing rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.