Best Subaru Forester Auto Insurance in 2026 (Find the Top 10 Companies Here!)

The top picks for the best Subaru Forester auto insurance are State Farm, Geico, and Progressive, with rates starting at $68/month. These companies are top picks due to their affordable premiums, flexible coverage options, and strong local agent networks, ensuring comprehensive protection for your Subaru Forester.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2025

Company Facts

Full Coverage for Subaru Forester

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Forester

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru Forester

A.M. Best

Complaint Level

Pros & Cons

The top picks for the best Subaru Forester auto insurance are State Farm, Geico, and Progressive, with rates starting as low as $68 per month.

These companies stand out for their affordable premiums, flexible coverage options, and strong local agent support.

Our Top 10 Company Picks: Best Subaru Forester Auto Insurance

Company Rank Safe-Driving Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% B Local Agent State Farm

![]()

#2 22% A++ Affordable Premiums Geico

#3 12% A+ Flexible Coverage Progressive

![]()

#4 10% A+ Drivewise Rewards Allstate

#5 15% A Accident Forgiveness Liberty Mutual

#6 30% A++ Competitive Rates USAA

#7 10% A+ Vanishing Deductible Nationwide

#8 8% A++ Reliable Coverage Travelers

#9 10% A+ Customizable Policies Farmers

#10 12% A+ Customer Satisfaction Amica

Choosing one of these providers ensures you get comprehensive auto insurance tailored to your Subaru Forester. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- State Farm provides top affordability and flexible coverage for Subaru Forester

- Top Subaru Forester insurance rates start at $68/month for comprehensive coverage

- Compare quotes from top providers to find the best rates for your Subaru Forester

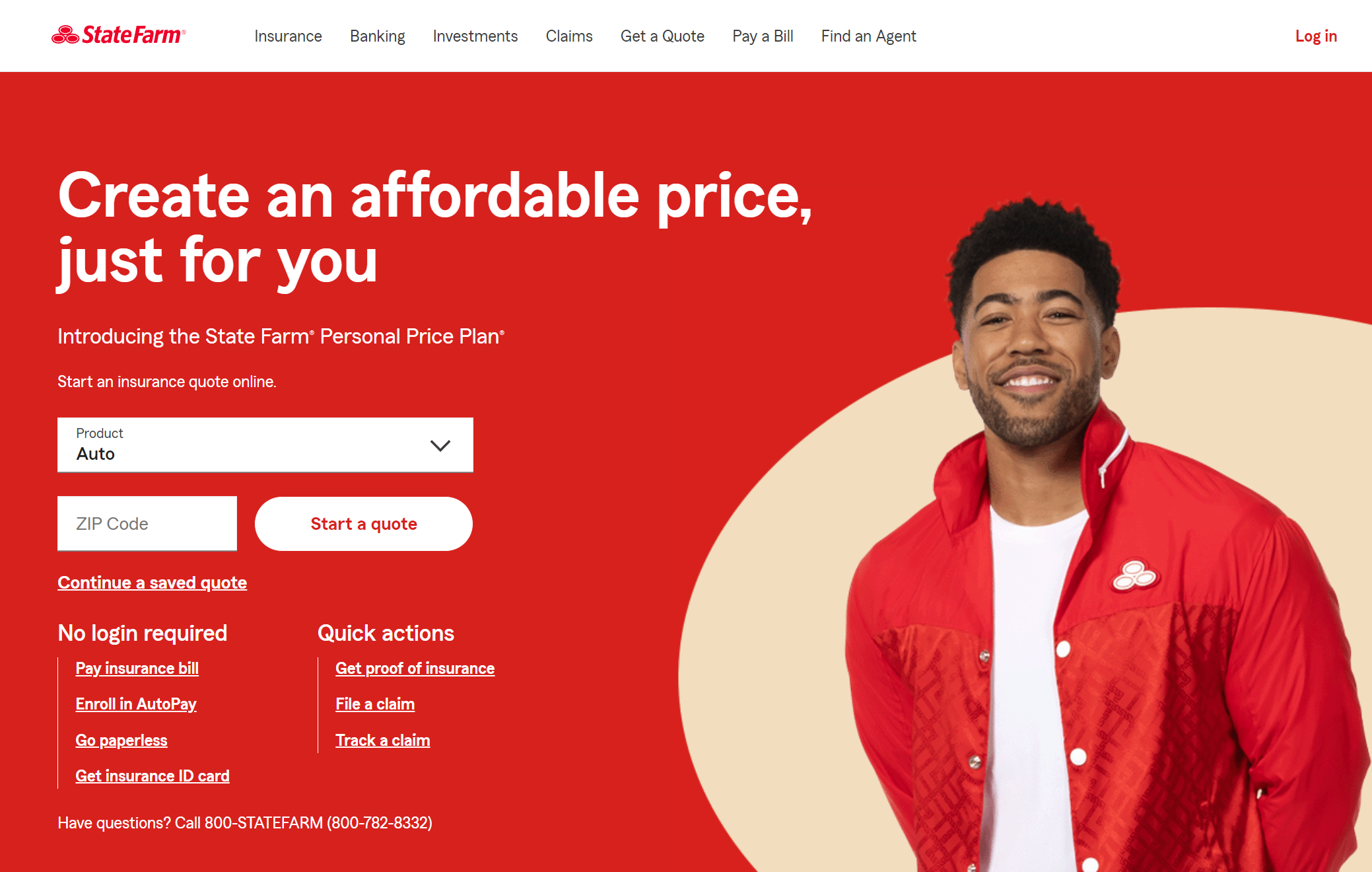

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm’s local agents provide tailored guidance specific to your Subaru Forester, ensuring you get the coverage you need. Learn more in our State Farm review.

- Easy Claims Process: With local agents, filing a claim for your Subaru Forester auto insurance is more straightforward and hassle-free.

- Community Presence: Having a local agent means better support and quicker resolution of issues related to your Subaru Forester auto insurance.

Cons

- Potential for Higher Costs: Local agent services for Subaru Forester auto insurance might come with higher premiums compared to online-only providers.

- Variable Service Quality: The quality of service for Subaru Forester auto insurance can vary significantly between different local agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Premiums

Pros

- Cost Savings: Geico offers some of the most affordable premiums, making it budget-friendly for Subaru Forester owners.

- Discount Opportunities: Numerous discounts can lower your Subaru Forester auto insurance costs even further. Read our Geico review for a full list.

- Consistently Low Rates: Geico’s competitive pricing ensures that Subaru Forester auto insurance remains economical over time.

Cons

- Limited Personal Interaction: Geico’s affordable premiums often come at the cost of minimal personal interaction for your Subaru Forester auto insurance needs.

- Basic Coverage Options: While affordable, Geico’s Subaru Forester auto insurance may lack some of the comprehensive options available through other insurers.

#3 – Progressive: Best for Flexible Coverage

Pros

- Customizable Plans: Progressive offers flexible coverage options, allowing you to tailor your policy to your Subaru Forester’s needs.

- Snapshot Program: This usage-based insurance option can help lower your Subaru Forester auto insurance rates based on your driving habits.

- Bundling Options: Progressive’s ability to bundle various policies can lead to significant savings on your Subaru Forester auto insurance. Find out more in our Progressive review.

Cons

- Potential Complexity: The numerous options for customizing Subaru Forester auto insurance might be overwhelming for some customers.

- Mixed Customer Service Reviews: Progressive’s customer service experience for Subaru Forester auto insurance can be inconsistent.

#4 – Allstate: Best for Drivewise Rewards

Pros

- Rewards for Safe Driving: Allstate’s Drivewise program can significantly reduce your Subaru Forester auto insurance costs with safe driving rewards.

- Usage-Based Discounts: The more you drive safely, the more you save on your Subaru Forester auto insurance, which you can learn about in our Allstate review.

- Real-Time Feedback: Drivewise provides real-time driving feedback, helping you become a safer driver and reduce Subaru Forester auto insurance premiums.

Cons

- Privacy Concerns: The tracking technology used in Drivewise might raise privacy issues for some Subaru Forester auto insurance customers.

- Variable Discounts: The savings on your Subaru Forester auto insurance through Drivewise can vary and may not always be substantial.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- No Rate Increase: Liberty Mutual’s accident forgiveness ensures that your Subaru Forester auto insurance rate won’t increase after your first accident.

- Peace of Mind: Knowing that one accident won’t affect your Subaru Forester auto insurance premium provides added peace of mind. Read more in our review of Liberty Mutual.

- Competitive Premiums: Despite offering accident forgiveness, Liberty Mutual maintains competitive Subaru Forester auto insurance rates.

Cons

- Eligibility Restrictions: Not all Subaru Forester auto insurance customers qualify for accident forgiveness.

- Higher Base Premiums: Liberty Mutual may have higher base premiums for Subaru Forester auto insurance to offset the cost of accident forgiveness.

#6 – USAA: Best for Competitive Rates

Pros

- Low Rates for Military Members: USAA offers some of the most competitive rates for Subaru Forester auto insurance, especially for military personnel.

- Excellent Customer Service: USAA is renowned for its high customer satisfaction in Subaru Forester auto insurance services.

- Comprehensive Coverage Options: Despite low rates, USAA provides extensive coverage options for Subaru Forester auto insurance. For a complete list, read our USAA review.

Cons

- Membership Restrictions: Only military members and their families can access USAA’s Subaru Forester auto insurance.

- Limited Local Agents: USAA’s focus on online services may limit personal interaction for Subaru Forester auto insurance customers.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Reduced Deductibles Over Time: Nationwide’s vanishing deductible program rewards you with lower Subaru Forester auto insurance deductibles for safe driving.

- Incentives for Safe Driving: The program encourages better driving habits, ultimately lowering your Subaru Forester auto insurance costs.

- Comprehensive Support: Nationwide provides extensive support and resources for managing your Subaru Forester auto insurance policy. Read our Nationwide review to learn what else is offered.

Cons

- Higher Initial Premiums: Nationwide may start with higher premiums for Subaru Forester auto insurance to account for the vanishing deductible benefits.

- Complex Terms and Conditions: Understanding the vanishing deductible program for your Subaru Forester auto insurance might require careful review of terms and conditions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Reliable Coverage

Pros

- Reliable Coverage: Travelers offers reliable and consistent Subaru Forester auto insurance coverage, ensuring peace of mind. Learn more in our Travelers review.

- Strong Financial Stability: Travelers’ financial strength means they can reliably pay out claims for Subaru Forester auto insurance.

- Extensive Coverage Options: A wide range of Subaru Forester auto insurance coverage options are available to suit different needs.

Cons

- Premium Rates: Travelers may have higher premium rates for Subaru Forester auto insurance compared to some competitors.

- Limited Discounts: There may be fewer discount opportunities available for Subaru Forester auto insurance with Travelers.

#9 – Farmers: Best for Customizable Policies

Pros

- Flexible Policy Customization: Farmers allows you to create a Subaru Forester auto insurance policy that fits your specific needs.

- Extensive Coverage Options: A wide range of options ensures comprehensive protection for your Subaru Forester.

- Unique Discounts: Farmers offers unique discounts that can be applied to your Subaru Forester auto insurance. Find out more in our Farmers review.

Cons

- Higher Customization Costs: Customizable policies might result in higher Subaru Forester auto insurance premiums.

- Policy Complexity: Managing and understanding a highly customizable Subaru Forester auto insurance policy can be more complex.

#10 – Amica: Best for Customer Satisfaction

Pros

- Top Customer Ratings: Amica consistently receives high marks for customer satisfaction in Subaru Forester auto insurance.

- Responsive Customer Service: Quick and efficient customer service enhances the Subaru Forester auto insurance experience.

- Tailored Coverage: Amica offers personalized coverage options specifically for Subaru Forester auto insurance. Read our Amica review for a full list.

Cons

- Higher Cost: The premium service may come with higher costs for Subaru Forester auto insurance.

- Limited Online Tools: Amica may offer fewer online tools for managing your Subaru Forester auto insurance compared to other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Monthly Rates and Discounts for Subaru Forester Auto Insurance

Finding the best insurance for your Subaru Forester means comparing rates and discounts from top providers. This guide covers monthly rates for minimum and full coverage auto insurance from companies like Allstate, Geico, and more, along with key discounts to help you save. Explore your options to find the best fit for your needs and budget.

Subaru Forester Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $78 $150

Amica $71 $142

Farmers $77 $152

Geico $70 $135

Liberty Mutual $80 $155

Nationwide $76 $148

Progressive $72 $145

State Farm $75 $140

Travelers $74 $140

USAA $68 $130

Compare Subaru Forester insurance rates across various providers. For minimum coverage, prices range from $68 with USAA to $80 with Liberty Mutual. For full coverage, rates vary from $130 with USAA to $155 with Liberty Mutual. Explore these options to find the best coverage for your needs.

Find the best auto insurance discounts for your Subaru Forester with top providers. Savings include multi-car, safe driving, and homeowner discounts. Providers like Allstate, Amica, Farmers, Geico, and others offer various incentives to help you save. Explore these options to secure the best deal.

Finding the right insurance for your Subaru Forester is easier than you think. Compare monthly rates and available discounts from top providers to find coverage that fits your needs and budget. Maximize your savings with discounts like multi-car and safe driving. Start comparing now to get the best deal and drive with confidence.

Cost Analysis of Insuring a Subaru Forester

The chart below provides a comprehensive comparison of Subaru Forester insurance rates against those of other popular SUVs, including the GMC Yukon, Dodge Journey, and BMW X3. By examining these rates side by side, you can gain a clearer understanding of how the insurance costs for the Subaru Forester stack up against its competitors in terms of affordability and coverage.

Subaru Forester Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Subaru Forester | $30 | $44 | $26 | $112 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Dodge Journey | $27 | $44 | $31 | $115 |

| BMW X3 | $31 | $55 | $31 | $130 |

| Toyota 4Runner | $28 | $43 | $28 | $109 |

| Audi Q3 | $29 | $57 | $33 | $132 |

| Acura MDX | $31 | $47 | $31 | $122 |

Factors Influencing Subaru Forester Insurance Costs

Several factors affect Subaru Forester insurance rates, including your age, location, driving record, and the model year of your vehicle. For a thorough analysis, see our guide titled “Types of Auto Insurance.”

State Farm stands out as the top choice for Subaru Forester insurance due to its exceptional coverage and reliable local agent support.Michelle Robbins Licensed Insurance Agent

Younger drivers and those with less favorable driving records often face higher premiums, while location and the age of your Forester also play a significant role in determining your insurance costs.

Age of the Vehicle

When considering auto insurance for your Subaru Forester, it’s important to understand how rates can vary by model year and coverage type. This guide provides a comprehensive look at the monthly insurance rates for Subaru Forester models, covering comprehensive, collision auto insurance, minimum, and full coverage options.

Subaru Forester Auto Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Subaru Forester | $32 | $45 | $27 | $113 |

| 2023 Subaru Forester | $31 | $45 | $27 | $113 |

| 2022 Subaru Forester | $31 | $44 | $26 | $113 |

| 2021 Subaru Forester | $30 | $44 | $26 | $112 |

| 2020 Subaru Forester | $30 | $44 | $26 | $112 |

| 2019 Subaru Forester | $29 | $43 | $28 | $111 |

| 2018 Subaru Forester | $28 | $42 | $28 | $109 |

| 2017 Subaru Forester | $27 | $41 | $30 | $109 |

| 2016 Subaru Forester | $26 | $40 | $30 | $107 |

| 2015 Subaru Forester | $24 | $38 | $31 | $105 |

| 2014 Subaru Forester | $24 | $35 | $32 | $102 |

| 2013 Subaru Forester | $23 | $33 | $32 | $100 |

| 2012 Subaru Forester | $22 | $30 | $33 | $95 |

| 2011 Subaru Forester | $20 | $28 | $33 | $92 |

| 2010 Subaru Forester | $20 | $26 | $33 | $90 |

By examining the insurance rates for various Subaru Forester models, you can see how costs decrease with older vehicles. Whether you need comprehensive, collision, minimum, or full coverage, this breakdown helps you understand the financial impact and aids in selecting the best insurance plan for your Subaru Forester.

Driver Age

Understanding these variations can help you better manage your budget and make more informed decisions. In this guide, we’ll break down the monthly auto insurance rates for a Subaru Forester across different age groups, from new drivers to seasoned motorists.

Whether you’re a teenager just starting out or a more experienced driver, knowing these rates can give you a clearer picture of what to expect. See our full report titled “Auto Insurance Rates by Age.”

Subaru Forester Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $410 |

| Age: 20 | $251 |

| Age: 30 | $117 |

| Age: 40 | $112 |

| Age: 45 | $110 |

| Age: 50 | $102 |

| Age: 60 | $100 |

The cost of insuring a Subaru Forester varies significantly with age. Younger drivers, particularly those in their teens and early twenties, face higher premiums, while those in their thirties and beyond see a more gradual decrease in rates.

By knowing these rates, you can better anticipate and manage your insurance expenses as you age. For more personalized advice and to find the best coverage for your needs, consider reaching out to an insurance advisor.

Driver Location

Discover how auto insurance rates for the Subaru Forester vary across major cities. From bustling Los Angeles to quieter Columbus, find out how your location impacts your monthly premium. Explore our resource titled “Do auto insurance companies check where you live?” for more insights on insurance.

Subaru Forester Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $192 |

| New York, NY | $177 |

| Houston, TX | $176 |

| Jacksonville, FL | $163 |

| Philadelphia, PA | $150 |

| Chicago, IL | $148 |

| Phoenix, AZ | $130 |

| Seattle, WA | $109 |

| Indianapolis, IN | $95 |

| Columbus, OH | $93 |

Your Driving Record

Your driving record can have an impact on the cost of Subaru Forester auto insurance. Teens and drivers in their 20’s see the highest jump in their Subaru Forester auto insurance rates with violations on their driving record. For a comprehensive overview, explore our detailed resource titled “How Auto Insurance Companies Check Driving Records.”

Subaru Forester Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $930 | $1,240 | $775 |

| Age: 18 | $410 | $615 | $820 | $513 |

| Age: 20 | $251 | $376 | $501 | $314 |

| Age: 30 | $117 | $175 | $233 | $146 |

| Age: 40 | $112 | $168 | $224 | $140 |

| Age: 45 | $110 | $165 | $220 | $137 |

| Age: 50 | $102 | $153 | $204 | $127 |

| Age: 60 | $100 | $150 | $200 | $125 |

Your driving record is a crucial factor in determining your Subaru Forester insurance costs. Drivers with violations, especially teens and those in their 20s, often face higher rates. Maintaining a clean driving record can help keep your insurance premiums lower and ensure you get the best rates possible.

Subaru Forester Safety Ratings

The safety ratings of your Subaru Forester can lower your insurance premiums. High marks in tests like small overlap front and side from the Insurance Institute for Highway Safety show your Forester’s strong protection, potentially reducing your auto insurance costs. See the table below:

Subaru Forester Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Understanding your Subaru Forester’s safety ratings is essential for managing your insurance costs. With high marks in key safety tests, your Forester not only offers excellent protection but may also help you secure better insurance rates. To gain profound insights, consult our extensive guide titled “What is the average auto insurance cost per month?“

Subaru Forester Crash Test Ratings

Subaru Forester’s impressive crash test ratings can significantly lower your insurance costs, highlighting its top-notch protection across various model years. Check out our ranking of the top providers: Cheap Auto Insurance After an Accident

Subaru Forester Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Subaru Forester SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Subaru Forester SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Subaru Forester SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Subaru Forester SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

By understanding your Subaru Forester’s crash test ratings, you can better manage your insurance expenses. High safety scores, such as those consistently achieved by recent Forester models, often translate to lower premiums and greater peace of mind. Use these ratings to your advantage when choosing your insurance provider and to ensure you’re getting the best coverage at the best price.

Subaru Forester Safety Features

Advanced safety features in your Subaru Forester can lower your insurance costs. With technologies like airbags, ABS, and electronic stability control, the Forester enhances safety and may qualify you for discounts.

Understanding these features helps you save on insurance while keeping your vehicle secure by reducing the risk of accidents and damage. Enhanced safety measures can lead to lower insurance premiums, while providing greater protection for you and your passengers.

With advanced systems like lane departure warning, traction control, and auto-leveling headlights, you not only ensure greater safety but may also benefit from reduced auto insurance premiums. Consider these features when evaluating your insurance options to maximize both your vehicle’s security and your financial savings.

Subaru Forester Insurance Loss Probability

Loss probability for different insurance coverage types can impact your Subaru Forester’s insurance costs. Lower loss rates in areas like collision and bodily injury insurance often lead to reduced premiums. According to the Insurance Institute for Highway Safety, understanding these rates can help you manage and potentially lower your insurance expenses.

Subaru Forester Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | -9% |

| Property Damage | -15% |

| Comprehensive | -10% |

| Personal Injury | 22% |

| Medical Payment | 17% |

| Bodily Injury | -6% |

Considering the loss probability for different types of coverage can help you make more informed decisions about your Subaru Forester’s insurance. Lower loss rates generally lead to lower premiums, reflecting a decreased risk of claims.

By leveraging this information, you can select the best coverage options and potentially save on your insurance costs while ensuring adequate protection for your vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5 Ways to Save on Subaru Forester Insurance

Reducing your Subaru Forester insurance costs is possible with a few strategic approaches. By leveraging discounts and optimizing your insurance strategy, you can enjoy significant savings. Consider exploring loyalty discounts, mature driver benefits, usage-based insurance options, timely payments, and organization-based discounts.

- Ask About Loyalty Discounts

- Ask About Mature Driver Discounts for Drivers Over 50

- Ask About Usage-Based Insurance for Your Subaru Forester

- Pay Your Bills On Time — Especially Subaru Forester Payments and Insurance

- Check for Organization-Based Discounts, like Alumni or Employer Discounts

Implementing these five strategies can lead to considerable savings on your Subaru Forester insurance. From taking advantage of discounts for loyal customers and mature drivers to exploring usage-based insurance and timely payments, each step helps lower your premiums. To learn more, explore our comprehensive resource “How Vehicle Year Affects Auto Insurance Rates.”

Don’t forget to check for organization-based discounts that might apply to you. Start applying these tips today to maximize your savings and get the best value on your auto insurance.

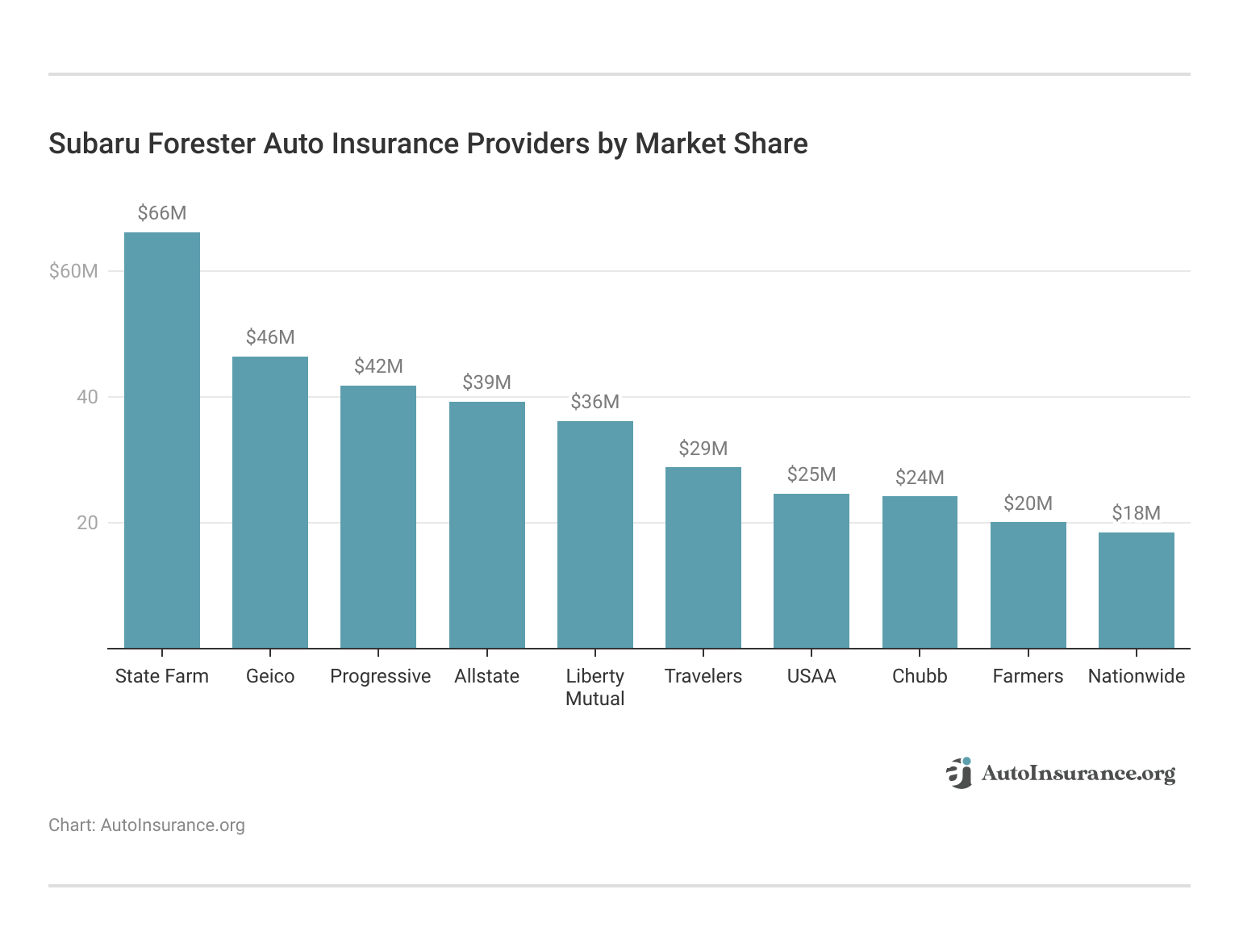

Top Subaru Forester Insurance Companies

The best auto insurance companies for Subaru Forester auto insurance rates will offer competitive rates, discounts, and account for the Subaru Forester’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Top Subaru Forester Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 7% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Choosing the right insurance company for your Subaru Forester can make a big difference in your coverage and costs. The leading insurers, including State Farm, Geico, and Progressive, offer a range of options and discounts tailored to meet your needs.

By exploring these top providers, you can secure competitive rates and comprehensive coverage for your Forester. Evaluate your options and select the insurer that best aligns with your requirements to ensure optimal protection and value.

Compare Free Subaru Forester Insurance Quotes Online

This article reviews the top auto insurance options for Subaru Forester owners, highlighting key providers like State Farm, Geico, and Progressive for their affordable rates and flexible coverage. Factors affecting insurance costs include vehicle age, driver age, location, driving record, and safety ratings.

Advanced safety features in the Forester can help reduce premiums. To find the best rates, access multiple quotes, compare rates, identify discounts, and choose the best coverage. This approach ensures comprehensive protection at competitive prices.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Frequently Asked Questions

How much does it cost to insure a Subaru Forester?

The cost to insure a Subaru Forester varies based on factors such as your location, driving record, and the model year of the vehicle. On average, insurance for a Subaru Forester ranges from $130 to $155 per month for full coverage.

Are Subaru Foresters expensive to insure compared to other vehicles?

Subaru Foresters generally have moderate insurance costs compared to other vehicles. Their insurance rates can be higher than some sedans but lower than high-end luxury vehicles and sports cars.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

What factors influence the insurance cost for a Subaru Forester?

Key factors influencing Subaru Forester insurance costs include the driver’s age, location, driving record, the model year of the vehicle, and its safety features.

To gain further insights, consult our comprehensive guide titled “Factors That Affect Auto Insurance Rates.”

How does the insurance cost for a Subaru Forester compare to an Acura MDX?

Generally, insurance for an Acura MDX tends to be higher than for a Subaru Forester due to the Acura’s higher base price and potentially higher repair costs. The exact difference will depend on individual circumstances and coverage levels.

Are Subarus expensive to insure in general?

Subarus are typically not among the most expensive vehicles to insure. However, insurance costs can vary based on the specific model, age of the vehicle, and the driver’s profile.

What is the average insurance cost for a Subaru Forester?

The average insurance cost for a Subaru Forester is about $130 to $155 per month for full coverage. Minimum coverage options may be less expensive but provide less protection.

For additional details, explore our comprehensive resource titled “Minimum Auto Insurance Requirements by State.“

How can I find the best insurance rates for my Subaru Forester?

To find the best insurance rates for your Subaru Forester, compare quotes from multiple insurance providers, consider available discounts, and adjust your coverage levels to fit your needs and budget.

What is the Subaru Forester insurance group, and how does it affect my premiums?

The Subaru Forester is classified in various insurance groups depending on the model year and trim level. The insurance group affects premiums, with higher groups generally resulting in higher insurance costs.

Is insurance for a Subaru Forester different from insurance for a Subaru WRX?

Yes, insurance for a Subaru WRX is typically higher than for a Subaru Forester. The WRX is considered a sports car, which generally leads to higher premiums due to increased risk of accidents and higher repair costs.

Take a look at our list of the best providers: Best Auto Insurance for Regular Maintenance

How does the insurance cost for a 22-year-old compare to other age groups?

For a 22-year-old, insurance costs for a Subaru Forester or any vehicle are usually higher compared to more experienced drivers. Young drivers often face higher premiums due to their higher risk profile.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.