Best Escondido, California Auto Insurance in 2026

The cheapest Escondido, CA auto insurance on average is from GEICO, but rates will vary by driver. However, some low-income drivers may qualify for the CLCA program if they meet certain criteria. Auto insurance in Escondido must meet the California minimum requirements of 15/60/5 in liability coverage. Shop around and compare online Escondido, CA auto insurance quotes to find your best deal.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

- Geico offers the cheapest Escondido, CA auto insurance on average

- Escondido auto insurance is more expensive than the national average

- Drivers in Escondido who meet certain requirements may qualify for the California Low-Cost Auto program

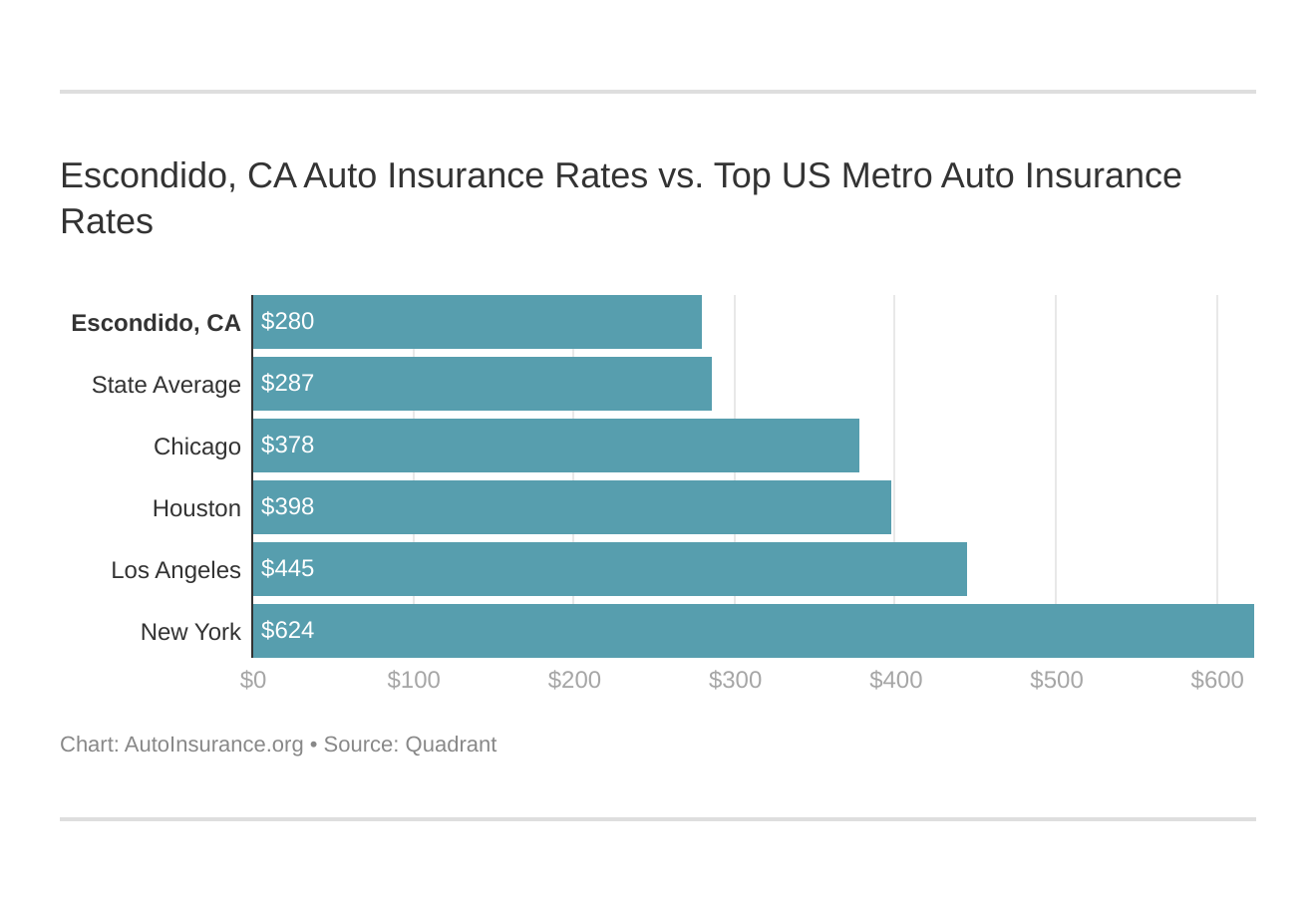

Escondido auto insurance is cheaper than the average California auto insurance rates but more expensive than the national average.

The good news is that you can still find affordable Escondido, CA auto insurance if you shop around. Compare rates from different companies to see who can offer you the cheapest coverage.

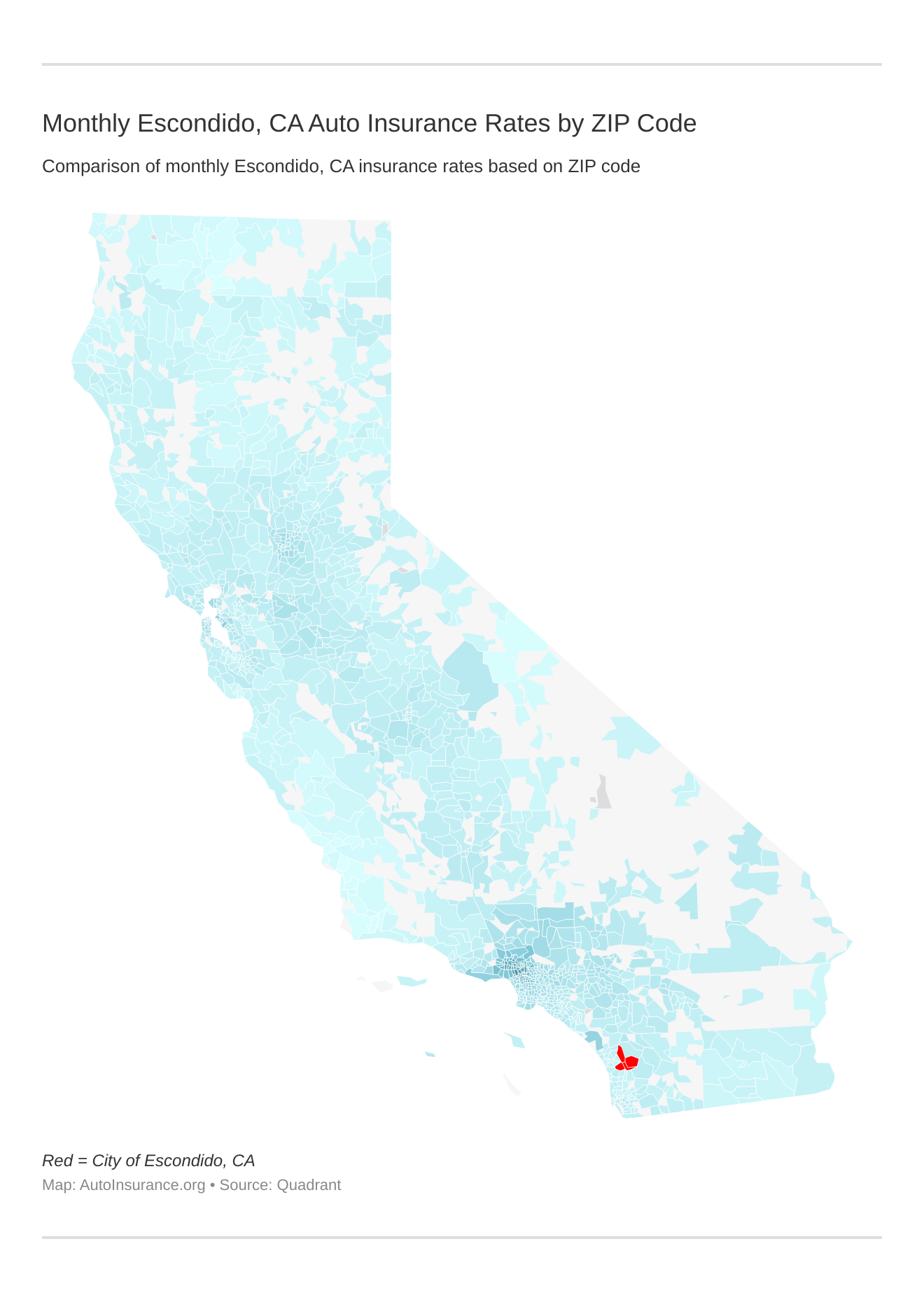

Monthly Escondido, CA Car Insurance Rates by ZIP Code

Check out the monthly Escondido, CA auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Escondido, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Escondido, CA stack up against other top metro auto insurance rates? We’ve got your answer below.

Enter your ZIP code now to compare Escondido, CA auto insurance quotes from multiple companies near you for free.

What is the cheapest auto insurance company in Escondido, CA?

The cheapest Escondido, CA auto insurance company is Geico, but rates will be different for each driver.

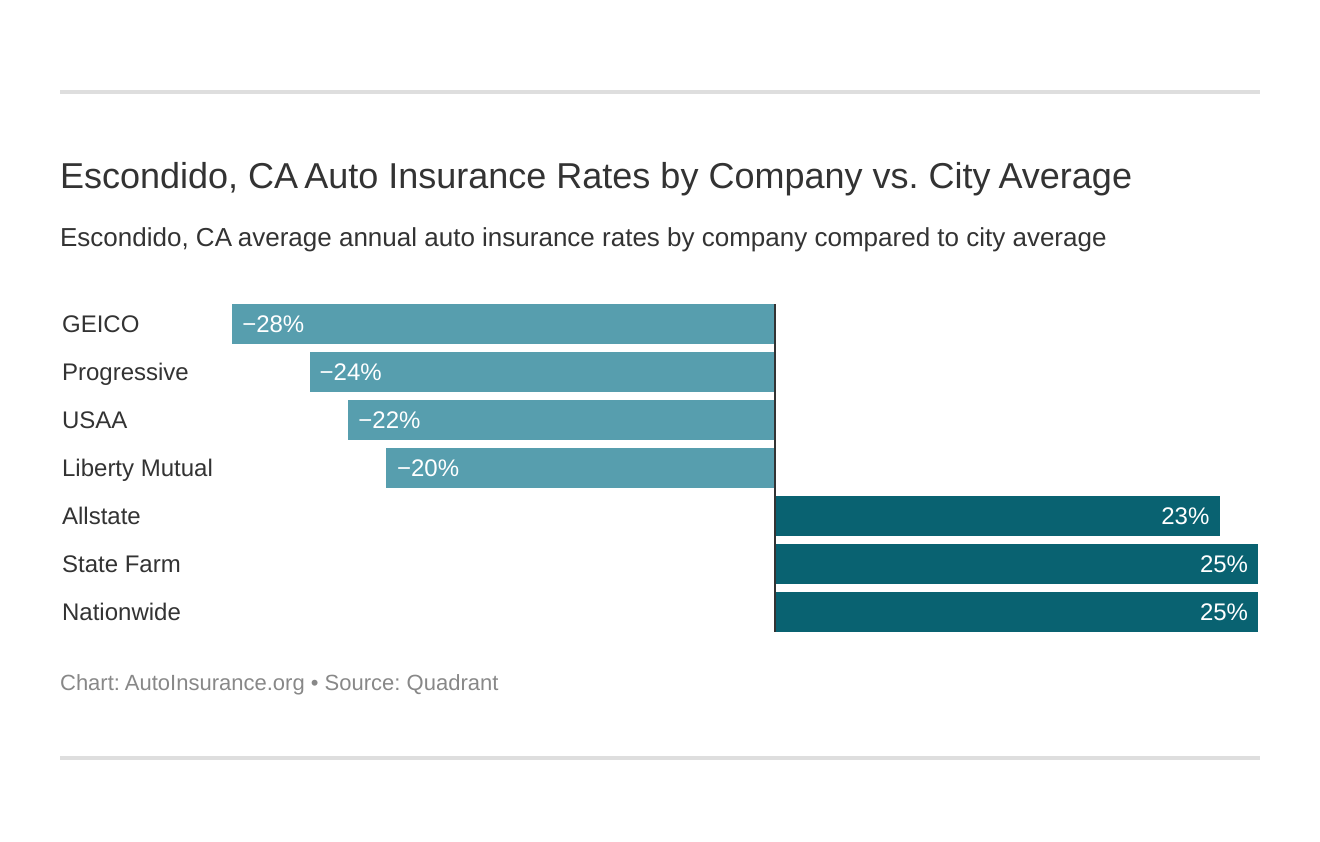

Which Escondido, CA auto insurance company has the cheapest rates? And how do those rates compare against the average California auto insurance company rates? We’ve got the answers below.

The top-rated Escondido, CA auto insurance companies listed from least to most expensive are:

- Geico – $2,542.72

- Progressive – $2,640.79

- USAA – $2,701.64

- Liberty Mutual – $2,758.00

- Travelers – $3,165.33

- Allstate – $4,252.81

- Farmers – $4,295.02

- Nationwide – $4,297.33

- State Farm – $4,321.01

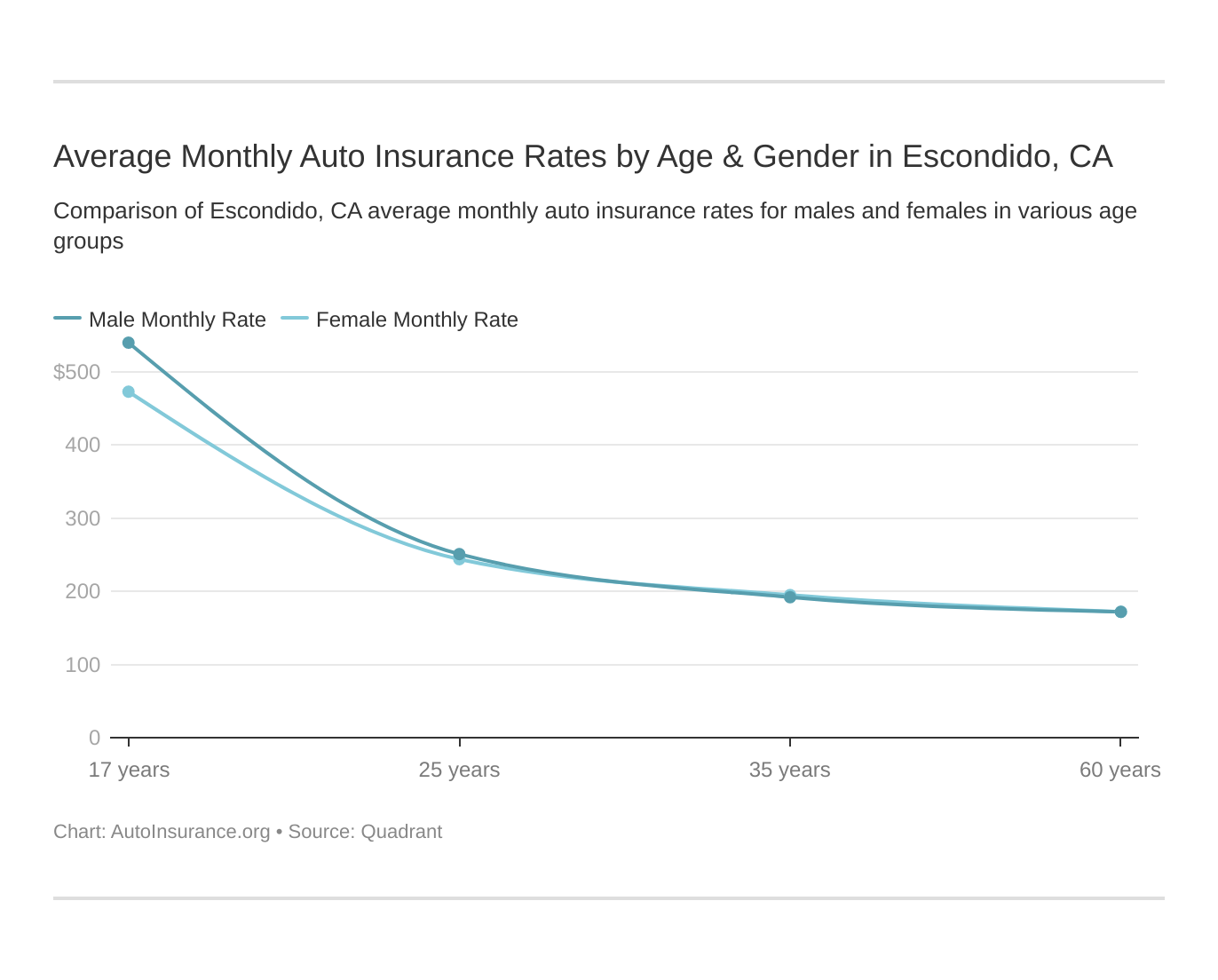

Many factors, including your age and driving record, influence your car insurance rates. While most car insurance companies consider your gender when determining your rates, California is one of the few states that has made this practice illegal.

Your rates are influenced by where you live and the size of your city. Car insurance would cost more in larger cities with higher crime and traffic. Auto insurance in San Diego, CA, for example, is much more expensive than Escondido coverage.

It’s also worth noting that California provides low-cost car insurance to low-income drivers. For low-income drivers who meet certain criteria, the California Low-Cost Auto (CLCA) program provides very low coverage.

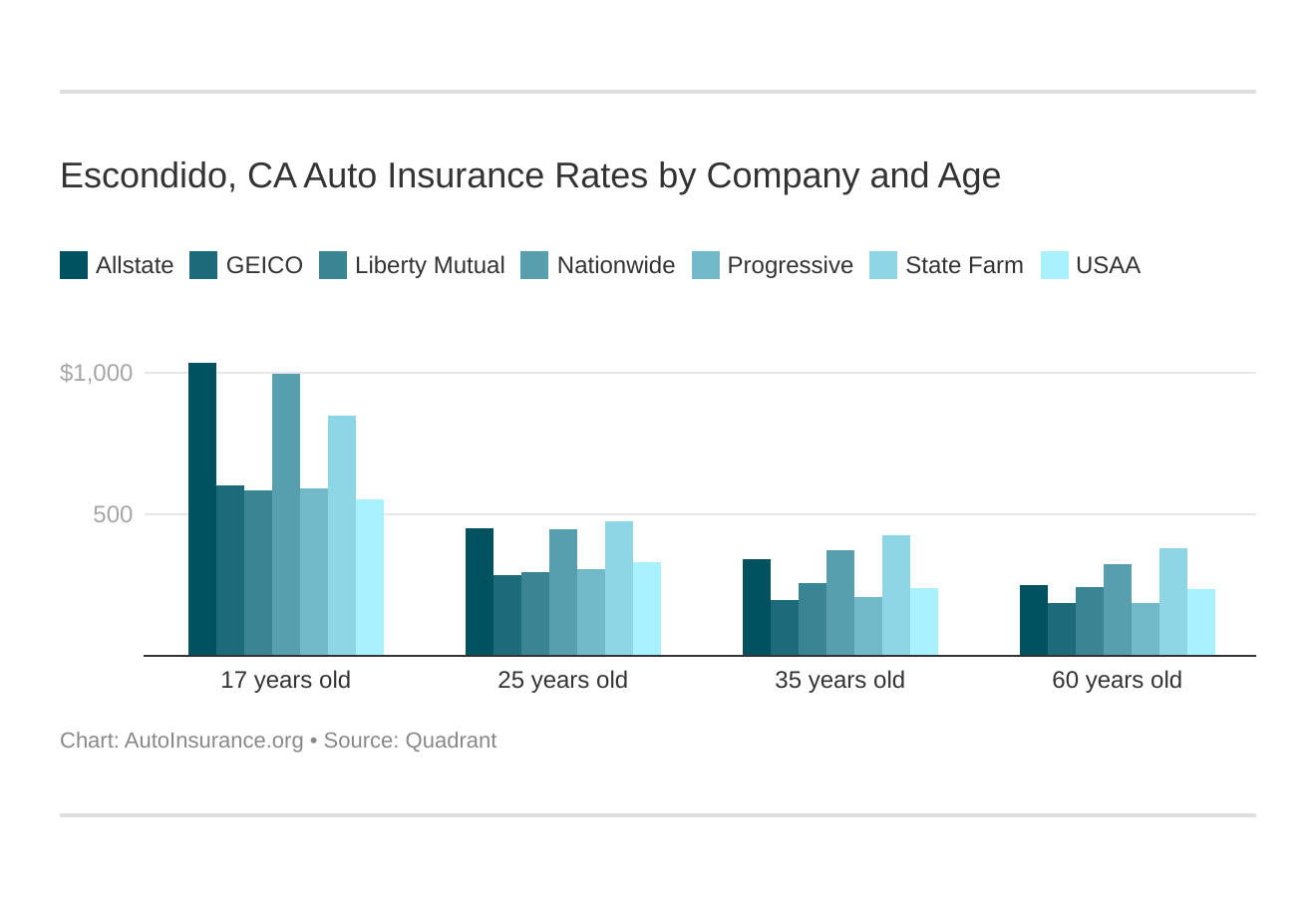

Escondido, CA auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

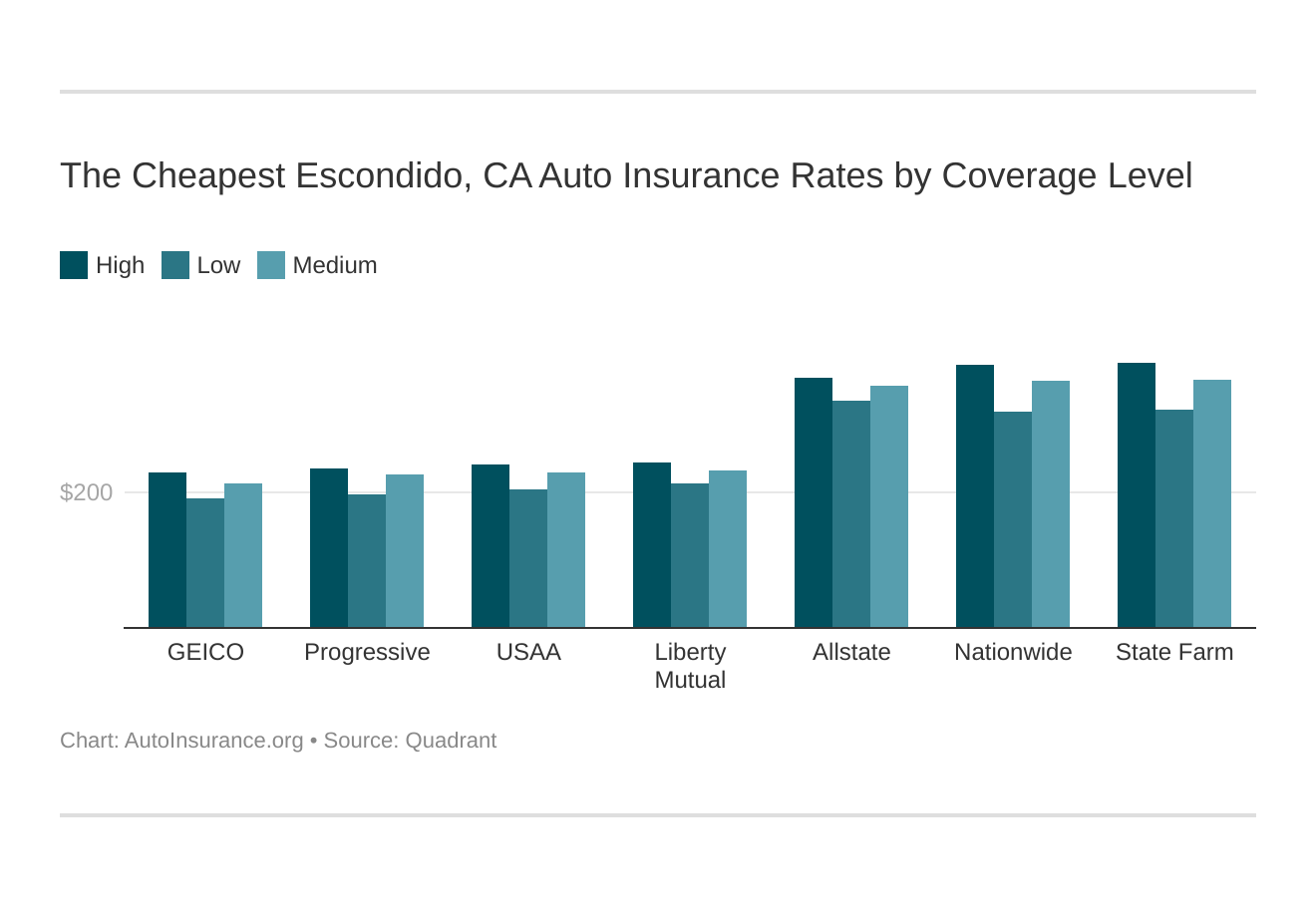

Your coverage level will play a major role in your Escondido auto insurance rates. Find the cheapest Escondido, CA auto insurance rates by coverage level below:

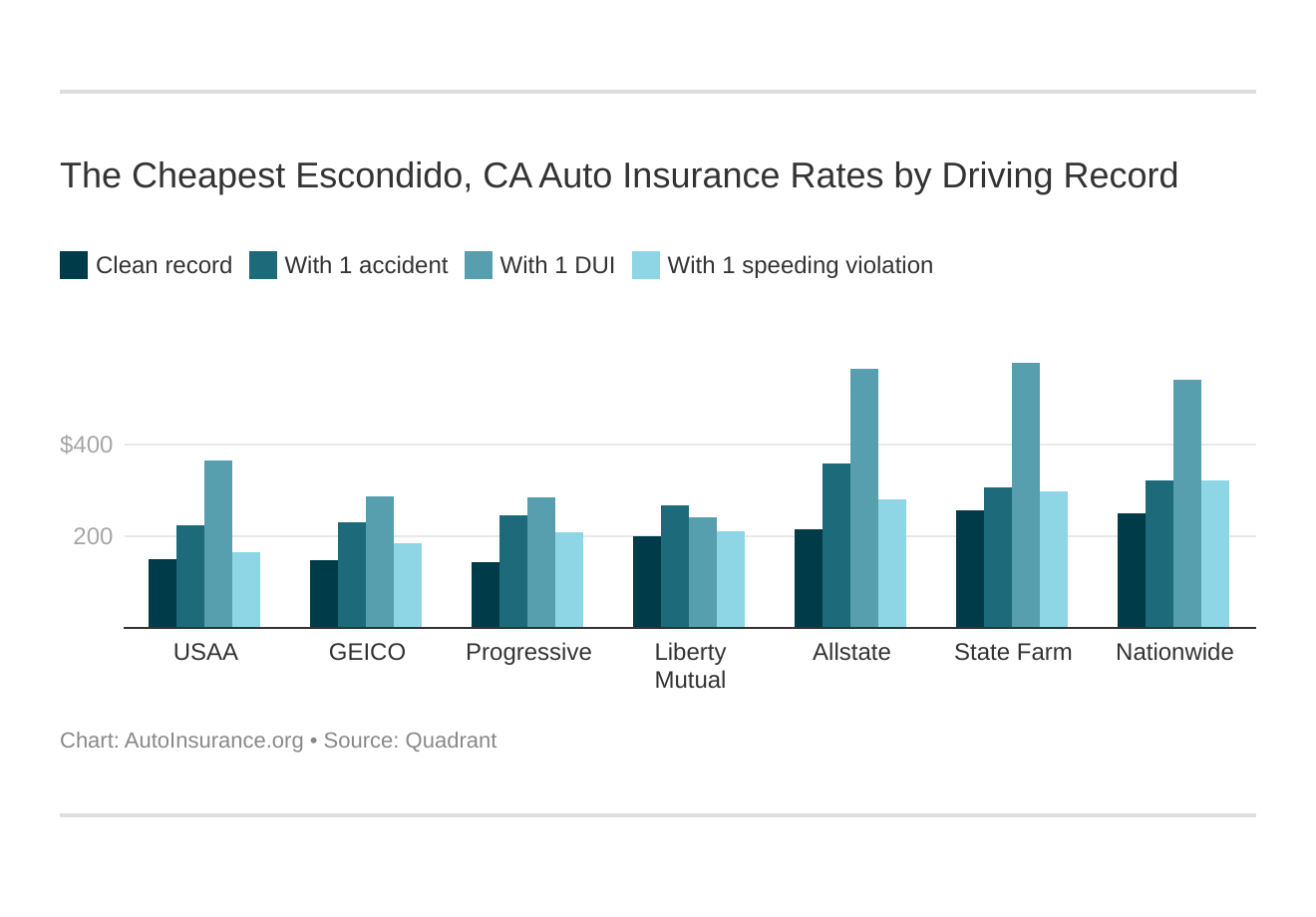

Your driving record will play a major role in your Escondido auto insurance rates. For example, other factors aside, a Escondido, CA DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Escondido, CA auto insurance rates by driving record.

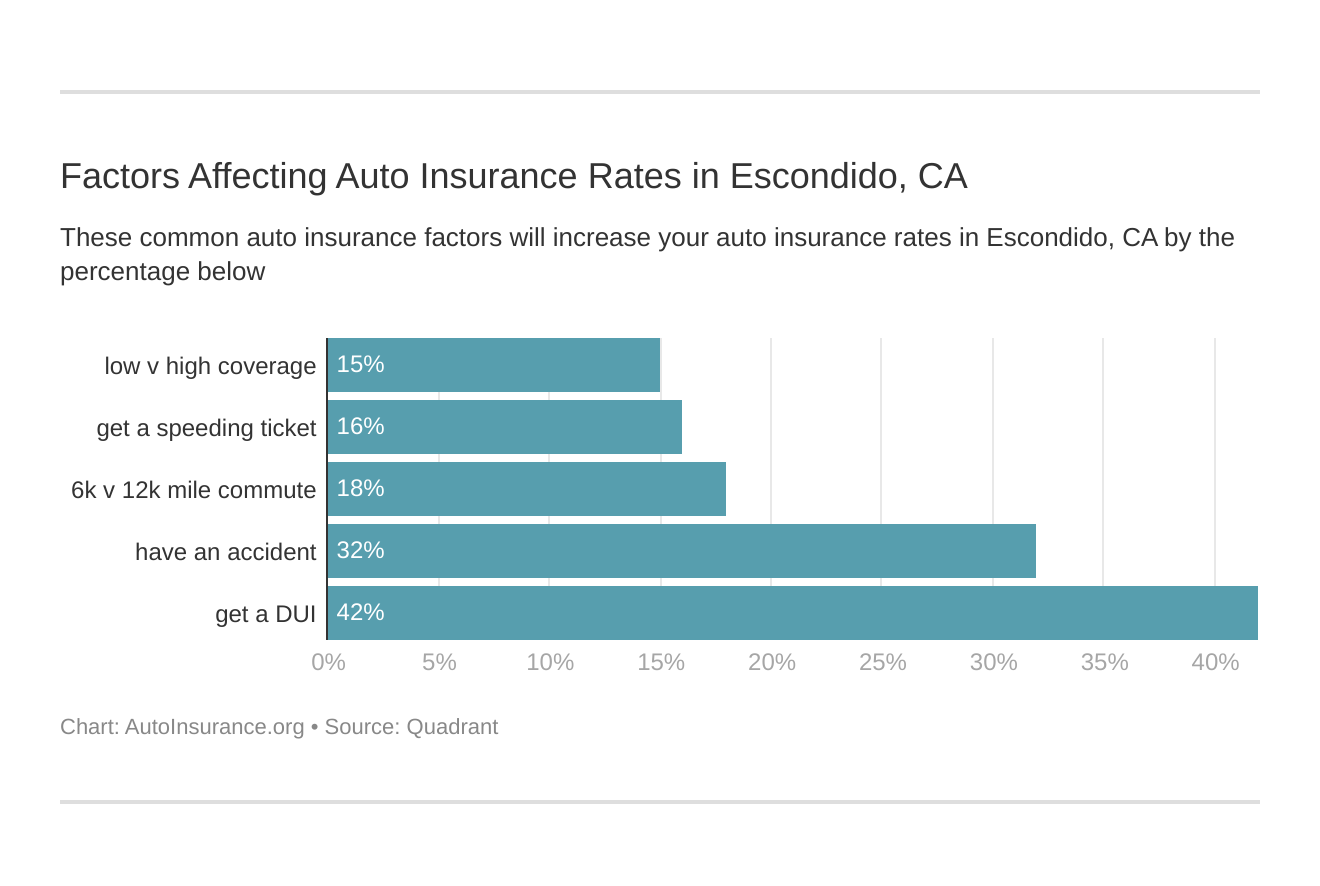

Factors affecting auto insurance rates in Escondido, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Escondido, California auto insurance.

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. California does use gender, so check out the average monthly auto insurance rates by age and gender in Escondido, CA.

What auto insurance coverage is required in Escondido, CA?

Almost every state, including California, requires at least a minimum amount of auto insurance for drivers to drive legally.

Escondido drivers must carry at least these minimum auto insurance requirements in California:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These are very low minimums, and drivers should consider raising them and adding additional coverages. These low minimums will not fully cover you in the event of a serious accident, and you will be responsible for any expenses not covered.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Escondido, CA?

Traffic can affect your auto insurance rates because more cars on the road mean a higher chance of being in an accident.

INRIX lists Escondido, CA as the 24th most congested city in the U.S. Since the city is close to San Diego, it shares a higher volume of traffic with the bigger city.

City-Data reports that most drivers in Escondido commute around 35 minutes, which is higher than the national average commute time.

Theft can also raise your rates. According to the FBI, there were 398 motor vehicle thefts in Escondido in one year. Nearby San Diego had 5,135 in the same time period.

Escondido, CA Auto Insurance: The Bottom Line

Although Escondido car insurance is more expensive than average, some drivers may qualify for low coverage through the CLCA program.

Drivers can still find cheap coverage even if they don’t qualify for CLCA. Before you buy Escondido, CA auto insurance, shop around to see which company can offer you the best deal.

Enter your ZIP code to compare Escondido, CA auto insurance rates for free from companies near you.

Frequently Asked Questions

What is Escondido, CA auto insurance?

Escondido, CA auto insurance refers to insurance coverage specifically designed for vehicles registered and operated in the city of Escondido, California. It provides financial protection in the event of accidents, theft, property damage, or bodily injury resulting from vehicle-related incidents.

What types of auto insurance coverage are available in Escondido, CA?

Escondido, CA offers various types of auto insurance coverage, including:

- Liability Coverage: This is the most common type of auto insurance required by law in California. It covers bodily injury and property damage liability to other parties if you are at fault in an accident.

- Collision Coverage: This coverage pays for damage to your vehicle in the event of a collision, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-collision incidents such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you are involved in an accident with a driver who lacks insurance or has insufficient coverage to fully compensate you.

- Personal Injury Protection (PIP): PIP coverage provides medical expense coverage and other related benefits for injuries sustained in a car accident, regardless of fault.

Is auto insurance mandatory in Escondido, CA?

Yes, auto insurance is mandatory in Escondido, CA, as well as throughout the state of California. Drivers are required to carry minimum liability coverage to legally operate a vehicle. The current minimum liability coverage limits in California are $15,000 for injury/death to one person, $30,000 for injury/death to multiple people, and $5,000 for property damage.

Can I customize my auto insurance coverage in Escondido, CA?

Yes, you can customize your auto insurance coverage in Escondido, CA to suit your specific needs. Insurance providers offer options to adjust coverage limits, add additional coverage types, or choose optional endorsements to enhance your policy.

How can I find affordable auto insurance in Escondido, CA?

To find affordable auto insurance in Escondido, CA, it’s recommended to:

- Shop around and compare quotes from multiple insurance companies to ensure you’re getting the best rate.

- Consider raising your deductibles, but only if you can comfortably afford the higher out-of-pocket expenses in the event of a claim.

- Inquire about available discounts such as safe driver discounts, multi-policy discounts, or good student discounts.

- Maintain a clean driving record and be mindful of any traffic violations that could increase your premium.

- Seek advice from an insurance agent who can guide you through the process and help you find the most cost-effective options.

Are there any local insurance requirements specific to Escondido, CA?

While there are no specific insurance requirements unique to Escondido, CA, drivers must adhere to the state-mandated minimum liability coverage limits. It’s important to comply with these requirements to legally operate a vehicle within the city.

How can I contact Escondido, CA auto insurance providers?

To contact auto insurance providers in Escondido, CA, you can:

- Visit the websites of insurance companies that operate in the area and request a quote online.

- Call the customer service phone numbers provided by insurance companies to speak with a representative.

- Visit local insurance offices in Escondido, CA to discuss your insurance needs in person.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.