Best Pomona, California Auto Insurance in 2026 (Compare the Top 10 Companies)

The best Pomona, California auto insurance providers include State Farm, Geico, and Allstate, offering coverage with rates starting as low as $110/month. Drivers in Pomona can choose from comprehensive, liability, and collision coverage options, ensuring protection on the road at affordable rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated March 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Pomona CA

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Pomona CA

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Pomona CA

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsWhen searching for the best Pomona, California auto insurance, State Farm, Geico, and Allstate offer competitive rates starting at $110 per month.

State Farm emerges as the top choice, thanks to its comprehensive coverage options and exceptional customer service.

Geico and Allstate also provide strong alternatives with attractive pricing and extensive benefits. Compare these leading providers to find the ideal insurance plan for your needs.

Our Top 10 Company Picks: Best Pomona, California Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Broad Availability | State Farm | |

| #2 | 15% | A++ | Affordable Rates | Geico | |

| #3 | 25% | A+ | Local Agents | Allstate | |

| #4 | 20% | A+ | Usage-Based Program | Progressive | |

| #5 | 20% | A | Customizable Coverage | Liberty Mutual |

| #6 | 22% | A+ | Vanishing Deductible | Nationwide |

| #7 | 10% | A++ | Military Discounts | USAA | |

| #8 | 13% | A++ | Hybrid Discounts | Travelers | |

| #9 | 18% | A | Personalized Service | Farmers | |

| #10 | 15% | A+ | Superior Claims | Amica |

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- State Farm offers the best Pomona, California auto insurance with $110/mo rates

- Geico and Allstate provide strong alternatives with competitive pricing

- Compare top providers for the best coverage and customer service options

#1 – State Farm: Top Overall Pick

Pros

- Coverage Options: Provides insurance products that cater to a broad spectrum of needs. Whether you’re looking for basic coverage or more comprehensive policies in Pomona, California.

- Safe Driving: Offers discounts and programs for safe drivers, which can lead to substantial savings for Pomona, California, residents who consistently demonstrate responsible driving behavior.

- Mobile App: Pomona, CA, drivers can manage their insurance policies from their smartphones, simplifying insurance management, as noted in our State Farm auto insurance review.

Cons

- Flexibility for High-Mileage: If you’re a Pomona, CA resident who drives a significant amount, you might find that coverage options for high-mileage drivers aren’t as competitive.

- Higher Premium: State Farm may not always have the lowest rates despite providing excellent benefits. Pomona drivers looking for lower insurance rates may have better choices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cost-Effective

Pros

- Cost-Effective: Geico is widely recognized for its competitive pricing, which can be particularly advantageous for drivers in Pomona, California, who are looking to save on their insurance premiums.

- Discount Options: As mentioned in our Geico auto insurance review, it provides discounts in Pomona, California, such as those for safe driving and multiple vehicles.

- Claims Processing: Geico has a reputation for handling claims quickly and efficiently, a major plus for Pomona, California, drivers who must resolve issues promptly.

Cons

- Higher Rates: For Pomona, CA, drivers with a history of accidents or other risk factors, Geico’s rates may not be as competitive, and drivers might find better pricing with other insurers.

- Limited Coverage: While Geico offers insurance options, its coverage selection might not be as extensive as another insurer in Pomona, California.

#3 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: One of Allstate’s standout features is its accident forgiveness program, which helps Pomona, California drivers avoid rate increases after their first at-fault accident.

- Drivewise Program: This program uses telematics to monitor driving habits and reward safe driving with discounts for drivers in Pomona, California.

- Claims Satisfaction: Offers a satisfaction guarantee for its claims process, ensuring that Pomona, CA, drivers are satisfied with their claims experience or receive a refund.

Cons

- Discounts Availability: As noted in our Allstate auto insurance review, some discounts require meeting specific conditions or criteria, which may be challenging for all Pomona, CA drivers to qualify for.

- Claims Processing: Although many drivers report positive experiences in Pomona, CA, there are occasional concerns about delays or issues in the claims process.

#4 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Offers discounts for safe driving. Pomona, California, drivers with responsible driving habits can benefit from reduced premiums, as our Progressive auto insurance review shows.

- Coverage Options: Provides a range of policy add-ons and endorsements, allowing Pomona, California, residents to tailor their coverage according to their particular requirements and inclinations.

- Online Quoting: Progressive’s website’s online quoting system makes it easy for Pomona, California, drivers to quickly get insurance quotes and compare options.

Cons

- Snapshot Program Risks: While the Snapshot program can provide discounts for safe driving, it may also result in higher costs for Pomona, CA, residents whose driving habits are deemed risky.

- Local Agents: Focusing on digital services means fewer agents are available in Pomona, CA, and drivers with personal interactions and personalized service might find this less convenient.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Roadside Assistance

Pros

- Roadside Assistance: This coverage includes services, such as towing and emergency fuel delivery, to assist Pomona, California drivers, as mentioned in our Liberty Mutual auto insurance review.

- Coverage Options: Offers a selection of insurance policies, providing Pomona, CA drivers with various choices to meet their needs. Whether you require standard coverage or specialized protection.

- Accident Forgiveness: This program assists drivers in protecting themselves from rate increases in Pomona, California, after their first liable collision.

Cons

- Higher Premiums: Insurance premiums can be higher for some drivers in Pomona, CA, particularly those with less favorable risk profiles, who may discover more affordable rates from other providers.

- Discounts Availability: Some discounts may have specific eligibility criteria or require certain actions to qualify. This can make it challenging for all Pomona, CA drivers to use available savings.

#6 – Nationwide: Best for On Your Side® Service

Pros

- On Your Side® Sevice: The On Your Side® claims service is tailored to assist Pomona, CA, drivers through every stage of the claims process. It offers expert support and personalized guidance.

- Digital Tools: Nationwide equips Pomona, CA drivers with cutting-edge tools like online account management and a user-friendly mobile app.

- Roadside Assistance: Policies frequently include roadside assistance, offering extra support to Pomona, CA drivers in emergencies. This coverage ensures that drivers receive prompt help if needed.

Cons

- Discount Availability: According to Nationwide auto insurance review, discounts may have eligibility conditions that must be met, which may restrict the number of drivers who can take advantage of them.

- Claims Processing: Despite Nationwide’s excellent claims assistance, drivers in Pomona, California, may see variations in effectiveness and efficiency in how claims are handled.

#7 – USAA: Best for Membership Benefits

Pros

- Membership Benefits: These insurance benefits are tailored to Pomona, CA, military members and their families. These exclusive perks are to address the needs of veterans and active-duty personnel.

- Competitive Rates: USAA offers some of Pomona, California’s most competitive auto insurance rates, particularly for military families. Pricing is often more affordable than that of other providers.

- Mobile App: This app stands out for its user-friendly design. As noted in our USAA auto insurance review, it offers policyholders in Pomona, CA, a convenient platform to manage their insurance needs.

Cons

- Limited Benefits: The biggest drawback of USAA is its exclusivity. Only military personnel, veterans, and their families in Pomona, CA, can access its products, limiting availability to the general public.

- Military Rates: Although USAA is known for low rates, non-military family members in Pomona, CA, may not always see the same savings that military members enjoy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Affordable Rates

Pros

- Affordable Rates: Its competitive pricing structure in Pomona, CA, makes it an attractive option for those maintaining clean driving records and ensuring safe drivers benefit from lower rates.

- Coverage Options: Travelers offers a broad selection of coverage choices for drivers in Pomona, California, including essential options like comprehensive and collision coverage.

- Telematics Program: According to Travelers auto insurance review, the intelliDrive program is designed to incentivize safe driving through its telematics-based system in Pomona, CA.

Cons

- Local Agents: Travelers have fewer local agents in Pomona, CA, which could disadvantage individuals who would rather meet in person.

- Limited Discounts: Travelers may not always be able to take advantage of discounts because not all Pomona, California drivers can take advantage of all promos and savings choices.

#9 – Farmers: Best for Policy Options

Pros

- Policy Options: This company offers a range of policy options, allowing drivers in Pomona, California, to customize their coverage from basic to comprehensive insurance to suit their needs.

- Accident Forgiveness: Farmers’ notable feature is its accident forgiveness program, which helps protect Pomona drivers from significant increases in their premiums following their first at-fault accident.

- Rideshare: Provides coverage for Pomona, CA drivers for ridesharing services like Uber and Lyft. This customized coverage ensures that drivers who participate in ridesharing are sufficiently safeguarded.

Cons

- Higher Premiums: Farmers For certain drivers in Pomona, California, particularly those who are younger and have a history of infractions, insurance might not be the most economical option.

- Online Tools: Farmers’ online tools lag behind tech-savvier competitors, which may feel outdated for Pomona drivers seeking modern, user-friendly options, as noted in our Farmers auto insurance review.

#10 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: As noted in our Amica auto insurance review, Amica’s dividend plans give Pomona drivers significant long-term savings by returning premiums on an annual basis.

- Claims Processing: Amica is known for excellent claims handling, which guarantees Pomona, CA, policyholders experience the fewest possible delays and annoyances during the claims filing.

- Flexible Payment: Amica provides flexible payment options to Pomona, CA, individuals on a limited budget. By distributing their premium costs over the year, these choices help drivers avoid penalties.

Cons

- Higher Premiums: Despite a strong reputation, some drivers in Pomona, CA, may face higher premiums compared to other insurance. Due to increased risk, inexperienced drivers may pay higher premiums.

- Limited Dividend: Eligibility for this benefit may be limited by specific criteria for drivers in Pomona, CA, potentially restricting savings for some policyholders and affecting their overall satisfaction with Amica.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

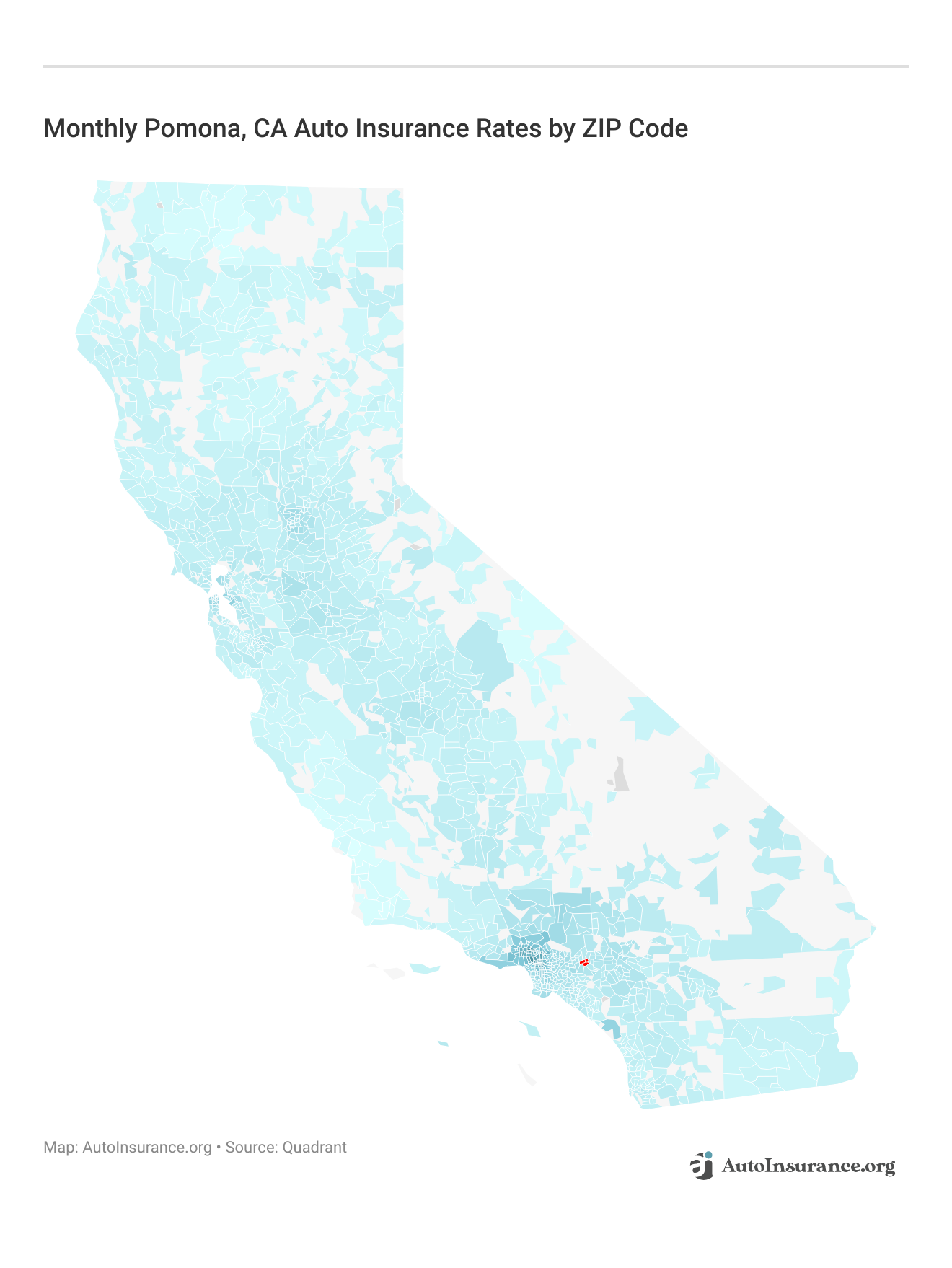

Pomona, CA Car Insurance Rates by ZIP Code – Monthly Overview

Exploring car insurance rates in Pomona, CA, can be a challenge, especially when trying to find the best coverage at the most affordable price. Explore our detailed analysis on “What is the average auto insurance cost per month?” for additional information.

Pomona, California Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $130 | $215 | |

| $140 | $230 | |

| $130 | $220 | |

| $115 | $190 | |

| $135 | $225 |

| $125 | $205 |

| $125 | $210 | |

| $120 | $200 | |

| $120 | $195 | |

| $110 | $180 |

This monthly overview provides a detailed look at insurance rates by ZIP code across Pomona, helping you understand how different areas within the city can impact your premium. By examining these rates, you can make more informed decisions about your auto insurance policy and find the coverage that best fits your needs and budget.

Auto Insurance Discounts From the Top Providers in Pomona, California

Insurance Company Available Discounts

Multi-Policy, Safe Driving, Early Signing, New Car, Defensive Driving, Pay-in-Full

Multi-Policy, Safe Driver, Loyalty, Good Student, Homeowners, Dividend, Online Quote

Multi-Policy, Safe Driver, Accident Forgiveness, Good Student, Vehicle Safety Features, Telematics

Multi-Car, Good Driver, Military, Federal Employee, Anti-Theft, Emergency Deployment

Multi-Policy, Safe Driver, New Car, Vehicle Safety Features, Early Signing, Hybrid/Electric Vehicle

Accident Forgiveness, Vanishing Deductible, Safe Driver, Multi-Policy, New Car, Good Student

Snapshot, Multi-Policy, Safe Driver, Homeowners, Continuous Insurance, Paperless Billing

![]()

Multi-Policy, Safe Driver, Good Student, Defensive Driving, Vehicle Safety Features

Hybrid/Electric Vehicle, Multi-Policy, Safe Driver, Homeowners, Early Signing, Continuous Coverage

Military, Safe Driver, Vehicle Safety Features, Multi-Policy, Good Student, Defensive Driving

Understanding the variations in car insurance rates by ZIP code in Pomona, CA, is essential for navigating your insurance options effectively. With this monthly overview, you can see how rates differ across the city and use this information to find the best deal for your specific location.

Find more info about the monthly Pomona, CA car insurance rates by ZIP Code below:

Whether you’re looking to adjust your current policy or shop for new coverage, knowing these details can help you secure the most cost-effective and suitable insurance for your vehicle.

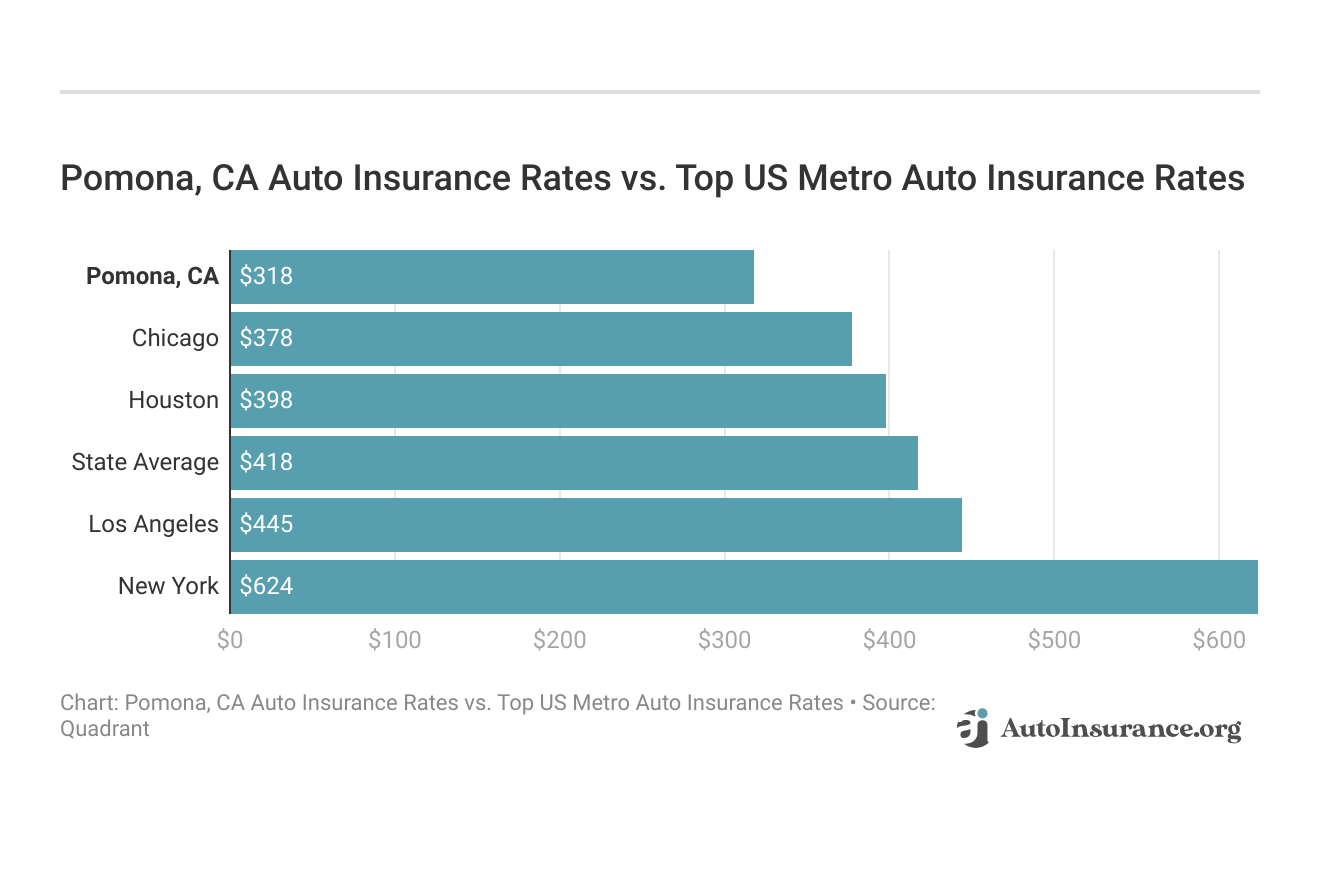

Pomona, CA vs. Major US Cities: A Comparison of Car Insurance Rates

When comparing car insurance rates, Pomona, CA presents a unique case in the broader landscape of major U.S. cities. This analysis delves into how Pomona’s insurance premiums stack up against those in leading metropolitan areas across the country.

By examining these differences, drivers can better understand where Pomona fits into the national picture of car insurance costs. Get more insights by reading our expert “How do I compare auto insurance quotes?” advice.

Understanding how Pomona’s car insurance rates compare to those in major U.S. cities provides valuable insight for local drivers. Whether you’re evaluating options or seeking the best coverage for your budget, this comparison highlights the key factors influencing premiums in Pomona versus top metropolitan areas. Enter your ZIP code now to compare Pomona, CA auto insurance rates for free today.

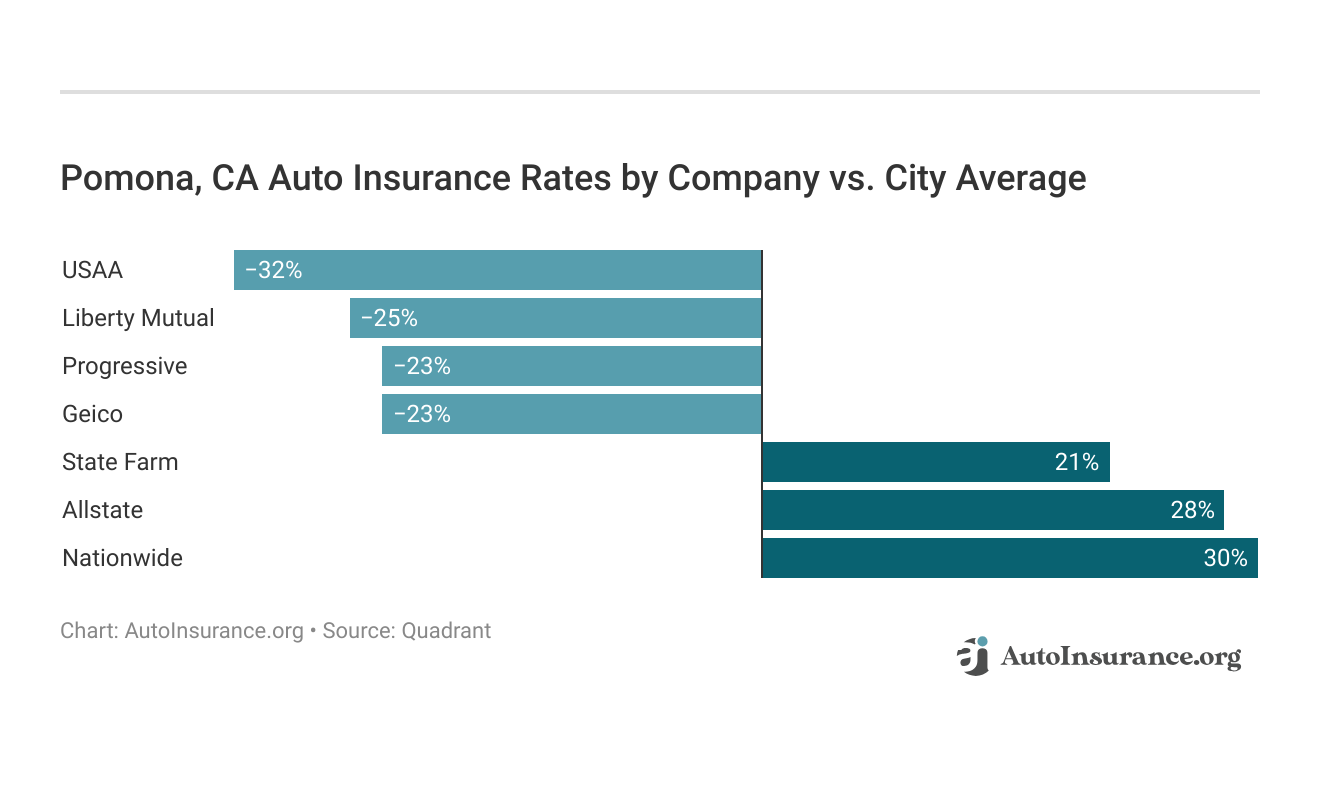

Finding the Most Affordable Auto Insurance Company in Pomona, CA

While USAA provides the lowest rates for auto insurance in Pomona, CA, its coverage is limited to military personnel, veterans, and their families. For all other drivers, Liberty Mutual stands out as the most affordable option in the city.

You can find details on the most cost-effective auto insurance providers in Pomona, CA below. Additionally, we will compare these rates with the average insurance costs across California. Continue reading our full “Compare Cheap Online Auto Insurance Quotes” guide for extra tips.

Your location also plays a significant role in determining your insurance costs. Larger cities with higher crime rates and more traffic, such as Los Angeles, typically see higher insurance premiums compared to smaller areas like Pomona, despite their proximity.

Also, California does offer low-cost auto insurance for low-income drivers. The California Low-Cost Auto (CLCA) program offers very low coverage for drivers who meet certain requirements.

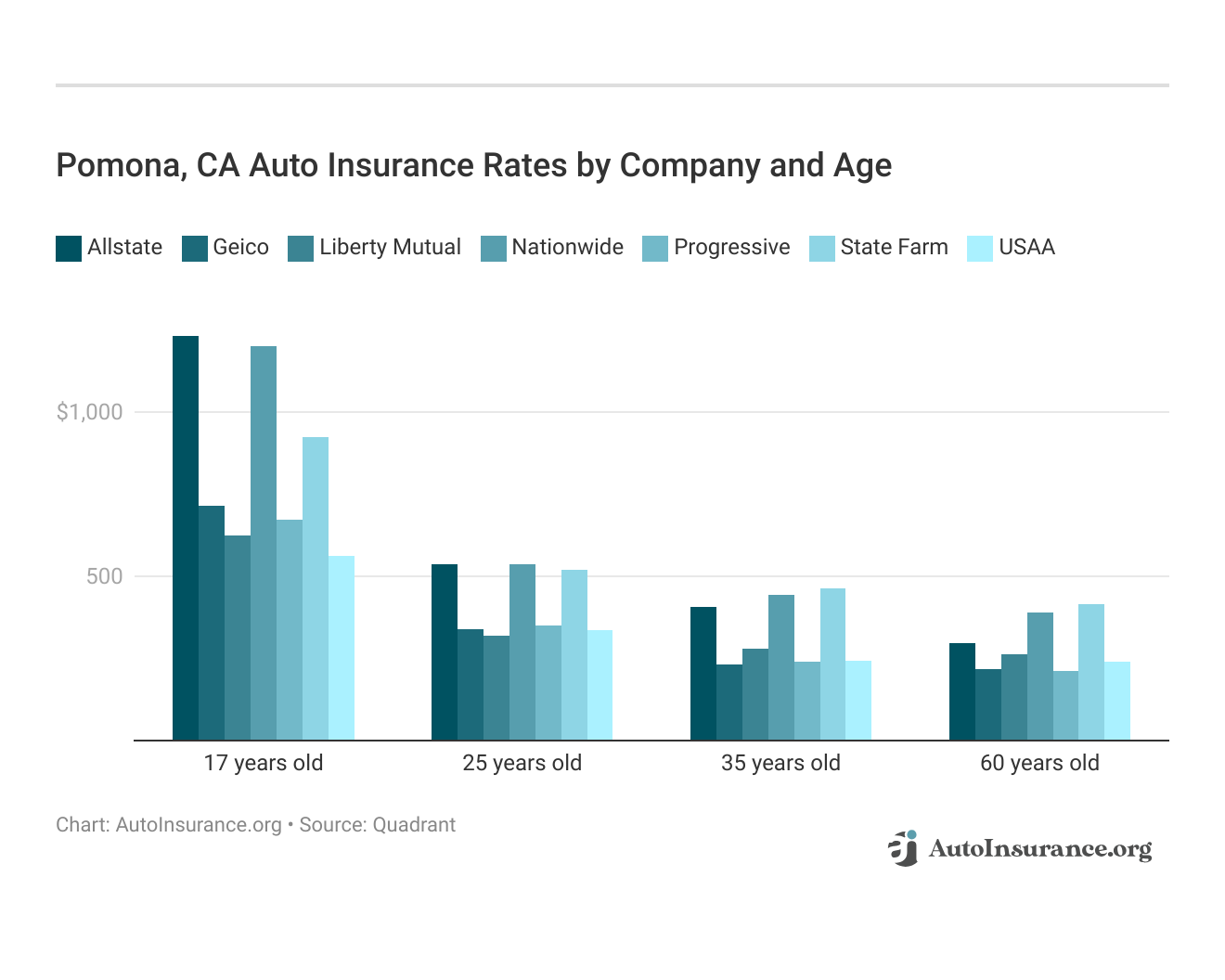

Pomona, CA auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

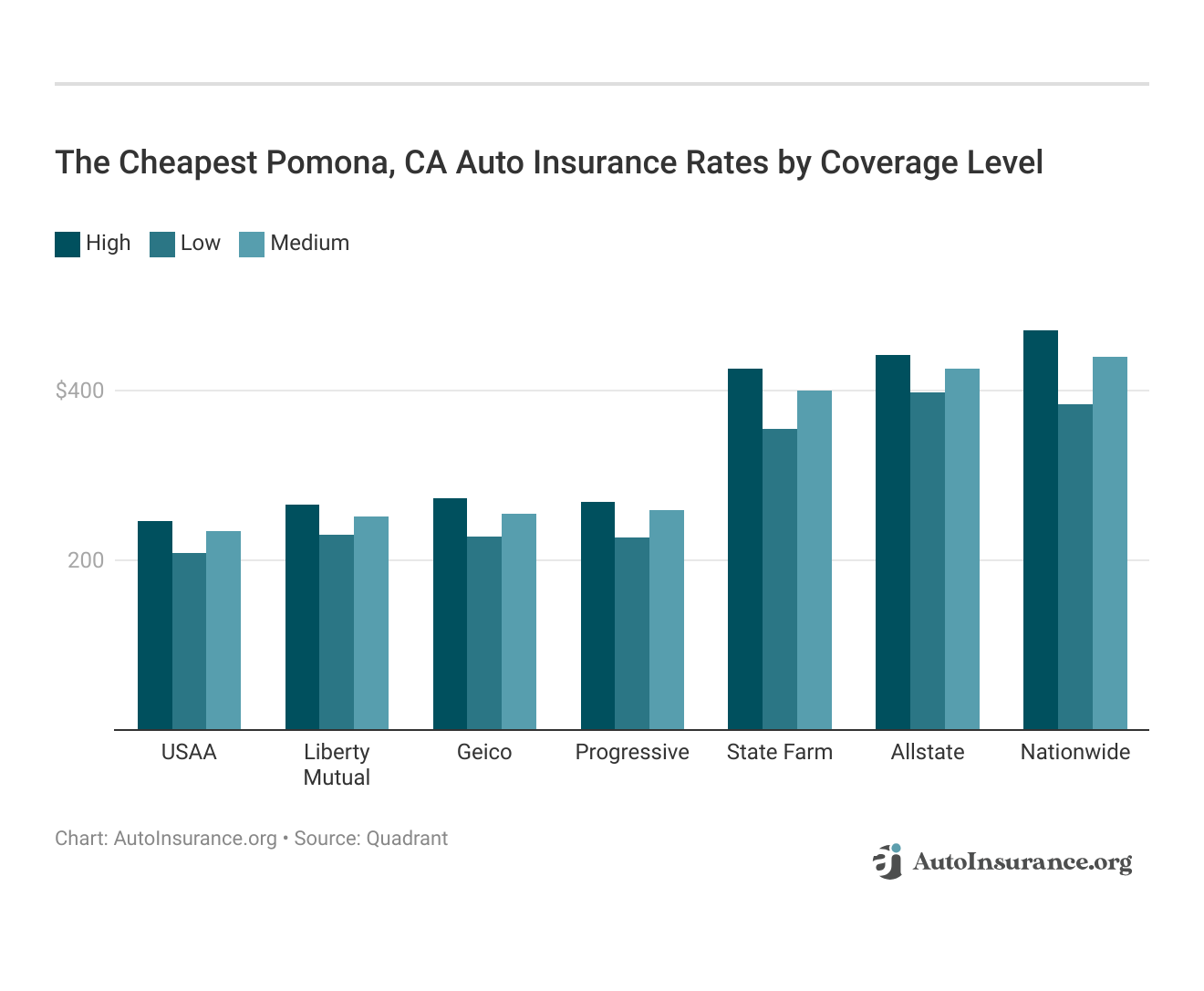

Your coverage level will play a significant role in your Pomona, CA auto insurance rates. Find the cheapest Pomona, California auto insurance rates by coverage level below:

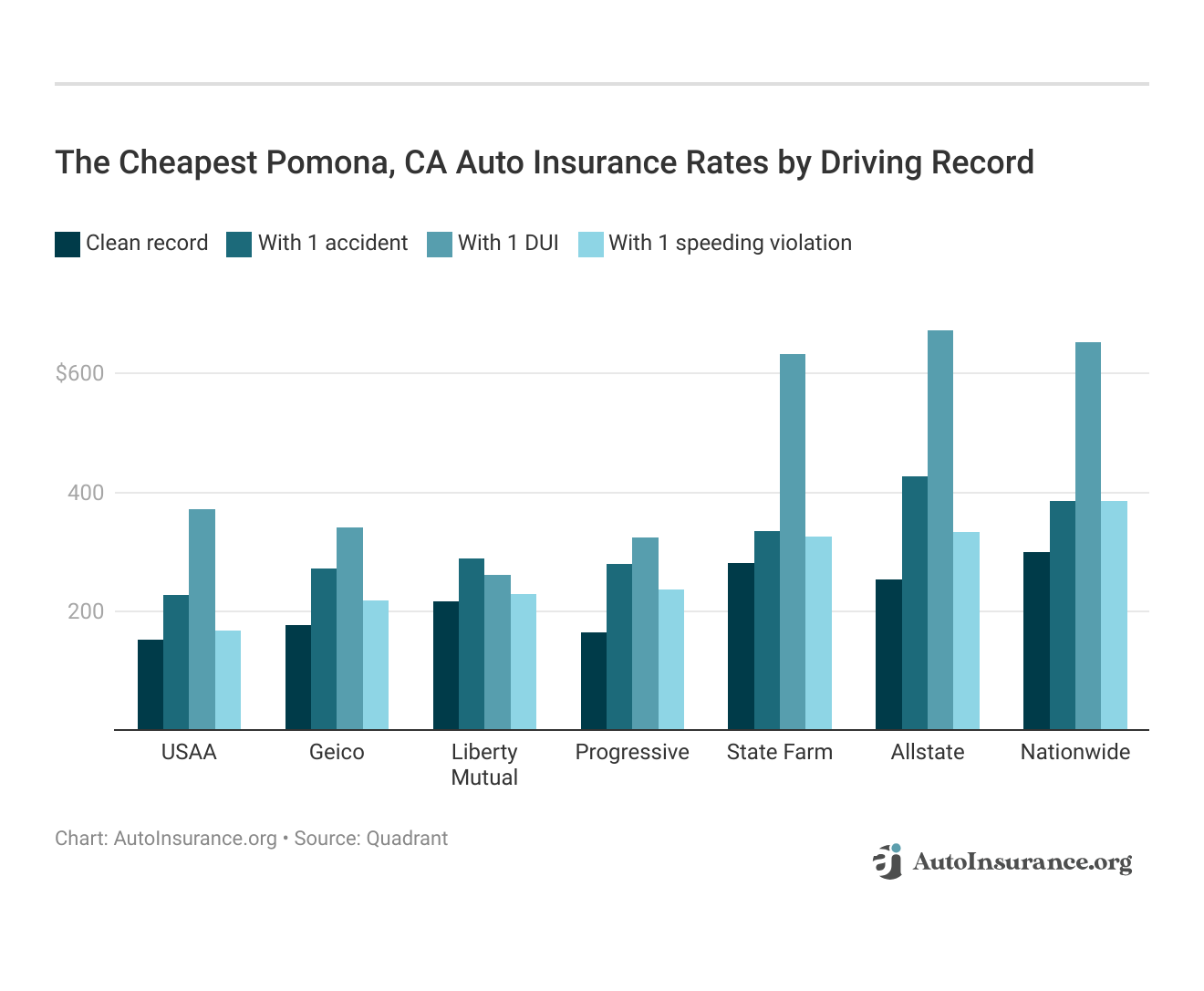

Your driving record will affect your Pomona auto insurance rates. For example, a Pomona, California DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Pomona, California auto insurance rates by driving record.

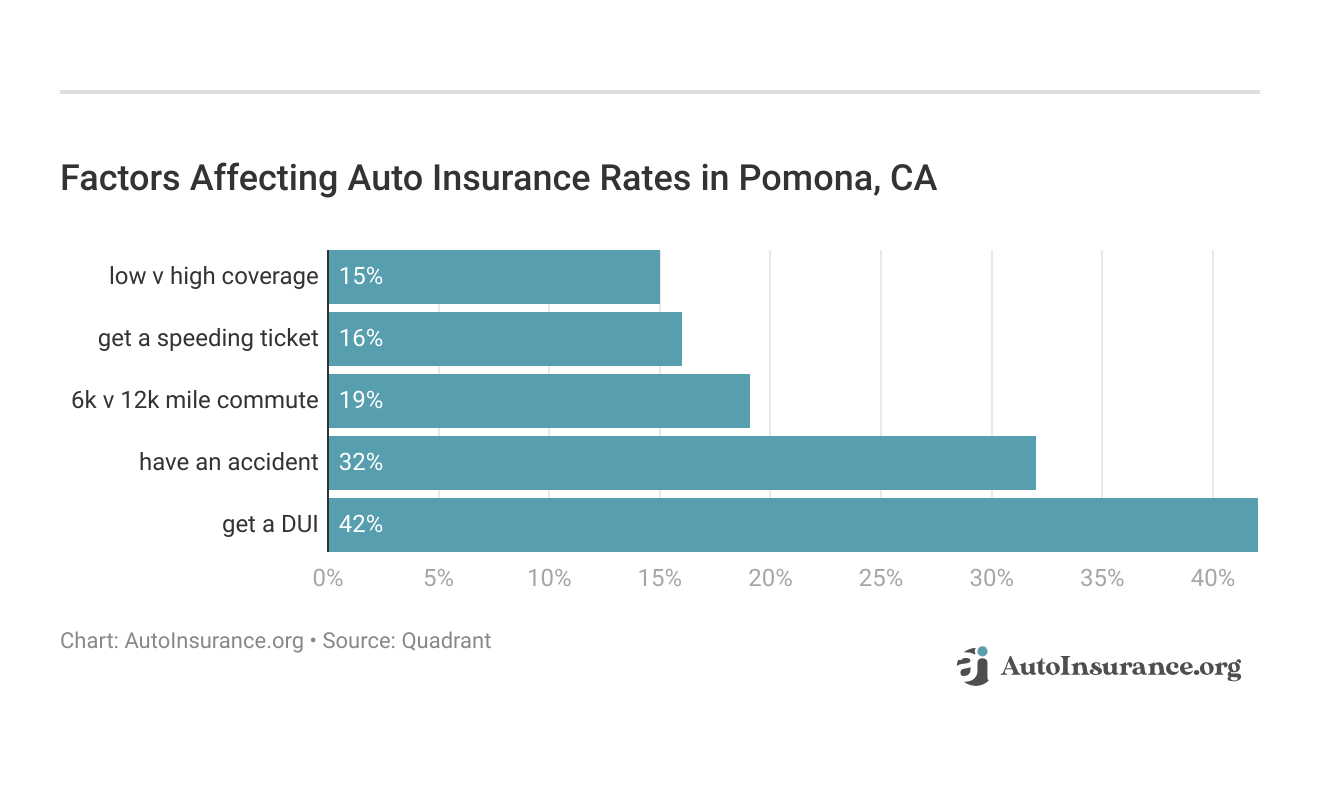

Factors affecting auto insurance rates in Pomona, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Pomona, California auto insurance.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania.

Monthly Cost of Pomona, CA Auto Insurance by Age & Gender

Age Male Monthly Rate Female Monthly Rate

Age: 17 $616 $539

Age: 25 $284 $277

Age: 35 $217 $221

Age: 60 $195 $194

But age is still a big factor because young drivers are considered high-risk drivers in Pomona. California does use gender, so check out the average monthly auto insurance rates by age and gender in Pomona, CA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements for Pomona, CA

Nearly all states mandate a minimum level of auto insurance for drivers to operate their vehicles legally, and California is no different. This requirement ensures that all drivers have a basic level of financial protection in case of accidents or damages. In California, adhering to these insurance standards is crucial for maintaining legal driving status and safeguarding yourself and others on the road.

The minimum auto insurance requirements in California for Pomona drivers are:

- $15,000 per person and $30,000 per incident for bodily injury liability.

- $5,000 per incident for property damage.

The state-mandated minimum coverage limits are quite basic, and it’s advisable for drivers to opt for higher limits and additional coverage options. In the event of a severe accident, these minimal coverage levels may fall short, potentially leaving you responsible for any expenses beyond what is covered.

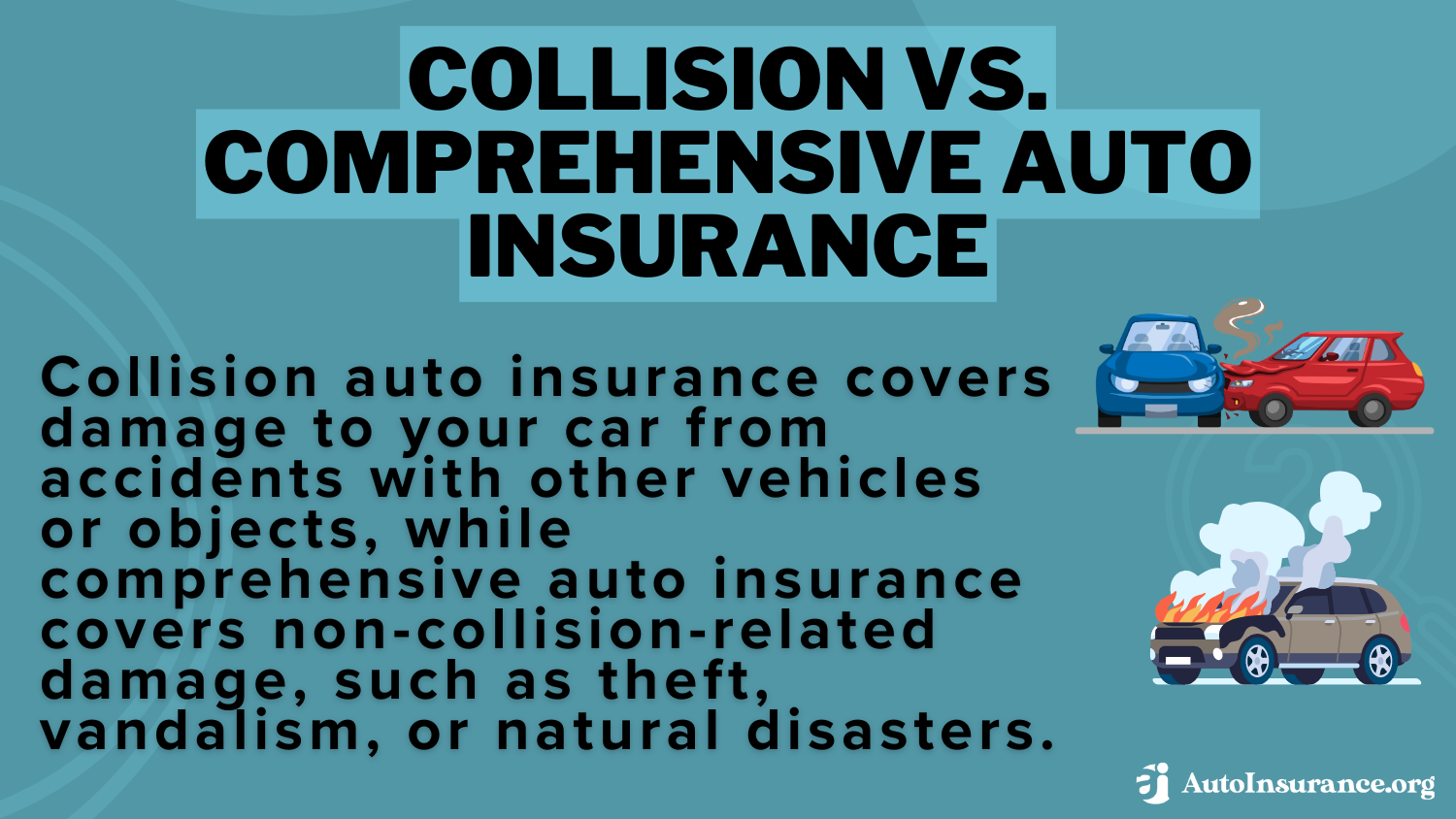

Think about including collision and comprehensive coverage in your policy. Collision insurance can help cover repair costs from accidents, while comprehensive insurance protects against non-collision-related damages, such as those caused by severe weather in Pomona, CA. For more information, explore our informative “Types of Auto Insurance” page.

Elements Impacting Car Insurance Rates in Pomona, CA

Traffic conditions can significantly influence your auto insurance premiums, as increased vehicle density heightens the risk of accidents. Expand your understanding with our thorough “Factors That Affect Auto Insurance Rates” overview.

Pomona, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | C | Higher-than-average rate of uninsured drivers, common in urban California |

| Average Claim Size | B | Claims are generally average compared to other cities in California |

| Traffic Density | B | Medium traffic density, with more congestion during peak hours |

| Vehicle Theft Rate | C | Moderate vehicle theft rate, slightly above the national average |

| Weather-Related Risks | A | Low risk due to favorable weather, minimal impact from extreme weather events |

While specific data for Pomona may be limited, nearby Los Angeles is known for its severe congestion, ranking as the fifth most congested city in the U.S. and 37th globally, according to INRIX.

Pomona, California Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,300 |

| Claims per Year | 950 |

| Average Claim Cost | $6,200 |

| Percentage of Uninsured Drivers | 17% |

| Vehicle Theft Rate | 320 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

Additionally, City-Data notes that many Pomona residents face lengthy commutes, with the average drive time being around 35 minutes and a considerable number commuting over an hour. Moreover, theft rates also contribute to higher insurance costs. The FBI reports that Pomona experienced 1,250 motor vehicle thefts within a single year, further impacting insurance rates in the area.

The Essentials of Auto Insurance in Pomona, CA

Navigating the landscape of auto insurance in Pomona, CA, requires understanding a range of key factors that influence coverage options and costs. Read our extensive guide on “Where to Compare Auto Insurance Rates” for more knowledge.

From state-mandated requirements to regional influences like traffic congestion and crime rates, the essentials of auto insurance encompass various elements that can impact your policy. This overview will provide you with the fundamental insights needed to make informed decisions about your auto insurance in Pomona.

State Farm’s extensive network and personalized service set it apart as the best option for auto insurance in Pomona, California.Jeff Root Licensed Insurance Agent

By grasping the core aspects of auto insurance in Pomona, CA, you are better equipped to choose a policy that aligns with your needs and budget. Understanding the local factors and coverage requirements ensures you can secure a plan that offers comprehensive protection while potentially saving you money.

For the most accurate and personalized advice, always consider consulting with insurance experts familiar with the Pomona area. Enter your ZIP code now to compare Pomona, CA auto insurance quotes from multiple companies near you today.

Frequently Asked Questions

What is the cheapest full coverage car insurance in Pomona, California?

To uncover the most budget-friendly full coverage car insurance in Pomona, California, you’ll need to embark on a thorough comparison journey. This means gathering and comparing quotes from different insurers, focusing not only on the initial premium but also on coverage options, discounts, and overall value, including customer service and policy details.

How can I find the cheapest and best car insurance in Pomona, California?

To identify the cheapest and best car insurance in Pomona, California, it’s essential to compare quotes from various insurance providers. Evaluate each option based on coverage details, rates, and available discounts. This approach will help you find a policy that offers both affordability and comprehensive coverage tailored to your needs.

How do car insurance rates in Pomona, California compare to other cities?

Car insurance rates in Pomona, California can vary significantly based on factors such as driving history and local conditions. Generally, rates in Pomona tend to be lower compared to those in larger metropolitan areas like Los Angeles, due to differences in traffic density and risk levels.

Explore our detailed analysis on “How to Evaluate Auto Insurance Quotes” for additional information.

In Pomona, California, state minimum liability requirements include specific coverage limits for bodily injury and property damage. Ensuring that your policy meets these legal requirements is crucial to avoid penalties and ensure compliance with state laws.

Do I need full coverage in Pomona, California?

The necessity of full coverage in Pomona, California depends on your individual circumstances, such as the value of your vehicle and your financial situation. Full coverage provides more extensive protection against a range of risks, making it a viable option for those who want comprehensive insurance.

Get more insights by reading our expert “Full Coverage Auto Insurance Defined” advice.

What is the cheapest car insurance in Pomona, California after a driving offense?

After a driving offense, the cheapest car insurance in Pomona, California can be found by seeking out insurers that specialize in high-risk policies or offer discounts for improvements in driving behavior. Comparing quotes and exploring these options will help you find the most affordable coverage despite a driving record issue.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What is the cheapest car insurance in Pomona, California for teens?

For teens in Pomona, California, finding the cheapest car insurance involves comparing rates from various insurers that offer policies tailored for young drivers. Look for insurers that provide safety discounts and coverage options designed specifically for teens to secure the most affordable rates.

What is the cheapest car insurance in Pomona, California for military drivers?

Military drivers in Pomona, California often benefit from special discounts and benefits offered by insurers. To find the cheapest car insurance for military personnel, compare quotes from providers that offer military-specific discounts and coverage options.

For more information, explore our informative “How to Find Auto Insurance Quotes Fast” page.

How can I compare cheap Pomona, California car insurance quotes online?

Comparing cheap Pomona, California car insurance quotes online involves using comparison websites where you can input your details to receive quotes from multiple insurers. Review the quotes, coverage options, and discounts offered to find the most cost-effective policy for your needs.

What does a car insurance calculator in Pomona, California do?

A car insurance calculator in Pomona, California helps estimate your insurance premiums by taking into account various factors such as your driving record, vehicle type, and coverage needs. Using this tool allows you to get a better understanding of potential costs and make informed decisions about your insurance.

Why is there difficulty getting auto insurance in Pomona, California?

The challenge of securing auto insurance in Pomona, California can be attributed to several factors, including high traffic volume, elevated crime rates, and the overall risk profile of the area. These factors contribute to higher perceived risks, which can complicate the insurance process.

Expand your understanding with our thorough “How to Get Fast and Free Auto Insurance Quotes” overview.

What insurance company is leaving Pomona, California?

Why did Geico leave Pomona, California?

Is Geico leaving Pomona, California?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.