Best Manitowoc, Wisconsin Auto Insurance in 2026 (Find the Top 10 Companies Here)

The best Manitowoc, Wisconsin auto insurance options are State Farm, American Family, and Farmers, with rates from $85 per month. State Farm offers the top overall value, American Family excels in customer service, and Farmers provides customizable coverage options for your car insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2024

Company Facts

Full Coverage in Manitowoc Wisconsin

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Manitowoc Wisconsin

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Manitowoc Wisconsin

A.M. Best

Complaint Level

Pros & Cons

State Farm leads with the most cost-effective and reliable coverage, while American Family and Farmers offer excellent customer service and flexibility.

Our Top 10 Company Picks: Best Manitowoc, Wisconsin Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Local Agents State Farm

#2 15% A Customizable Policies American Family

#3 12% A Comprehensive Coverage Farmers

#4 17% A+ Affordable Rates Progressive

#5 12% A Multiple Discounts Liberty Mutual

#6 14% A+ Strong Reputation Nationwide

#7 11% A++ Flexible Options Travelers

#8 20% A+ Excellent Service The Hartford

#9 12% A+ Robust Discounts Allstate

#10 13% A++ Personalized Service Auto-Owners

Choosing among these top providers ensures you get the best car insurance for your budget and requirements.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code above to begin.

- State Farm provides top coverage for Manitowoc, Wisconsin auto insurance.

- State Farm offers top-rated, reliable, and affordable car insurance options.

- State Farm offers Manitowoc auto insurance starting at $85 per month.

#1 – State Farm: Top Overall Pick

Pros

- Local Agent Support: With an extensive network of local agents, State Farm ensures personalized and accessible service in Manitowoc, Wisconsin, as highlighted in our State Farm review.

- Tailored Coverage: State Farm’s local agents provide personalized advice, ensuring coverage options meet specific needs in Manitowoc, Wisconsin.

- Customer Service: State Farm excels in customer satisfaction with accessible local agents offering personalized assistance.

Cons

- Higher Premiums: State Farm’s personalized service may come with slightly higher premiums compared to other providers in Manitowoc, Wisconsin.

- Limited Online Services: State Farm relies heavily on local agents, which may limit the convenience of managing policies online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best For Customizable Policies

Pros

- Local Presence: American Family provides excellent auto insurance with robust local support and active community involvement in Manitowoc, Wisconsin..

- Customizable Coverage: American Family presents highly customizable coverage options for the best Manitowoc, Wisconsin auto insurance, allowing drivers to tailor protection to meet unique needs, as detailed in our American Family review.

- Discounts Available: American Family offers a variety of discounts, making it easier to find affordable coverage in Manitowoc, Wisconsin.

Cons

- Higher Premiums: American Family’s focus on personalized service may result in higher premiums for Manitowoc, Wisconsin auto insurance.

- Limited Digital Tools: American Family’s online tools may not be as comprehensive as other providers, which could affect convenience for Manitowoc, Wisconsin customers.

#3 – Farmers: Best For Comprehensive Coverage

Pros

- Customizable Policies: Farmers offers the best Manitowoc, Wisconsin auto insurance with highly customizable coverage options to suit individual needs.

- Strong Claims Service: Farmers provides excellent claims handling, ensuring Manitowoc drivers receive prompt and efficient service.

- Comprehensive Coverage: Farmers exhibits comprehensive coverage plans, providing robust protection for diverse driving needs in the best Manitowoc, Wisconsin auto insurance, as showcased in our Farmers review.

Cons

- Higher Premiums: Farmers’ comprehensive coverage options may come with higher premiums for best Manitowoc, Wisconsin auto insurance.

- Limited Local Agents: Farmers may have fewer local agents in Manitowoc, which could impact personalized service for some customers.

#4 – Progressive: Best For Affordable Rates

Pros

- Affordable Rates: Progressive demonstrates competitive pricing for the best Manitowoc, Wisconsin auto insurance, making it a cost-effective choice with great value, as discussed in our Progressive review.

- Flexible Coverage: Progressive offers a range of customizable options, allowing Manitowoc drivers to tailor their policies to their needs.

- Numerous Discounts: Progressive features various discounts, helping reduce overall costs for Manitowoc, Wisconsin drivers.

Cons

- Higher Costs for Add-Ons: Progressive’s optional add-ons might increase the total cost of the best Manitowoc, Wisconsin auto insurance.

- Limited Local Agents: Progressive may have fewer local agents in Manitowoc, impacting face-to-face service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best For Multiple Discounts

Pros

- Extensive Coverage Options: Liberty Mutual offers a variety of coverage plans for drivers in Manitowoc, Wisconsin.

- Multiple Discounts: Liberty Mutual features a range of discounts for the best Manitowoc, Wisconsin auto insurance, helping to lower premiums and provide substantial savings, as elaborated in our Liberty Mutual review.

- Strong Customer Support: Liberty Mutual is known for good customer service, enhancing the insurance experience in Manitowoc, Wisconsin.

Cons

- Higher Premiums: Liberty Mutual’s extensive coverage options can lead to higher premiums for the best Manitowoc, Wisconsin auto insurance.

- Limited Local Offices: Fewer local offices in Manitowoc might affect accessibility for some customers.

#6 – Nationwide: Best For Strong Reputation

Pros

- Affordable Premiums: Nationwide delivers competitive rates for the best Manitowoc, Wisconsin auto insurance.

- Diverse Discounts: Nationwide offers a range of discounts, making it easier for Manitowoc drivers to save on their car insurance.

- Strong Reputation: Nationwide highlights a strong reputation for reliable auto insurance, offering trusted coverage and peace of mind for the best Manitowoc, Wisconsin auto insurance, as noted in our Nationwide review.

Cons

- Fewer Local Agents: Nationwide may have fewer local agents in Manitowoc, which could limit personalized service.

- Claims Processing: Some drivers may experience slower claims processing compared to other providers.

#7 – Travelers: Best For Flexible Options

Pros

- Competitive Pricing: Travelers offers competitive rates and discounts, helping Manitowoc drivers find affordable insurance.

- Flexible Options: Travelers presents flexible coverage options, adapting to various needs and preferences for Manitowoc, Wisconsin auto insurance, as covered in our Travelers review.

- Comprehensive Coverage: Travelers features extensive coverage options for enhanced protection in Manitowoc.

Cons

- Higher Rates for Young Drivers: Travelers may have higher premiums for younger drivers in Manitowoc, Wisconsin.

- Limited Local Presence: Fewer local agents in Manitowoc may impact personal service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best For Excellent Service

Pros

- Excellent Service: The Hartford demonstrates exceptional service, ensuring effective and responsive support for Manitowoc drivers with every claim, as featured in our The Hartford review.

- Strong Customer Support: The Hartford offers robust customer service for the best Manitowoc, Wisconsin auto insurance.

- Discounts for Safe Drivers: The Hartford provides discounts for safe driving, benefiting Manitowoc drivers.

Cons

- Higher Premiums: The Hartford’s comprehensive policies might come with higher premiums.

- Limited Coverage Options: The Hartford may have fewer coverage options compared to some competitors.

#9 – Allstate: Best For Robust Discounts

Pros

- Extensive Coverage Choices: Allstate provides a wide range of coverage options for the best Manitowoc, Wisconsin auto insurance.

- Robust Discounts: Allstate flaunts robust discounts, helping Manitowoc drivers save significantly on their premiums, as mentioned in our Allstate review.

- Local Agent Network: Allstate has a broad network of local agents in Manitowoc, enhancing personalized service.

Cons

- Higher Premiums: Allstate’s extensive coverage options can lead to higher premiums.

- Inconsistent Service: Customer service experiences may vary across local agents in Manitowoc.

#10 – Auto-Owners: Best For Personalized Service

Pros

- Personalized Service: Auto-Owners exhibits highly personalized service, focusing on individual needs and customer care for the best Manitowoc, Wisconsin auto insurance, as shown in our Auto-Owners review.

- Competitive Rates: Auto-Owners offers affordable premiums, making it a cost-effective choice for Manitowoc drivers.

- Excellent Claims Support: Auto-Owners is known for effective claims handling and customer support.

Cons

- Fewer Discounts: Auto-Owners may offer fewer discount opportunities compared to other providers.

- Limited Local Agents: Auto-Owners might have fewer local agents in Manitowoc, affecting personalized service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Manitowoc, Wisconsin

In Manitowoc, Wisconsin, drivers must meet specific minimum auto insurance requirements to comply with state laws. This includes liability coverage for bodily injury and property damage.

State Farm offers unmatched local expertise and reliable coverage, making it the top choice for Manitowoc, Wisconsin auto insurance.Kristen Gryglik Licensed Insurance Agent

The minimum coverage ensures financial protection in case of accidents. It’s essential to understand these requirements to avoid legal issues and ensure adequate protection on the road.

Best Manitowoc, Wisconsin Auto Insurance by Age, Gender, and Marital Status

The best Manitowoc, Wisconsin auto insurance rates by age, gender, and marital status analyzes how different demographic factors impact auto insurance rates. It identifies optimal coverage options and rates tailored to specific age groups, genders, and marital statuses.

Age, gender, and marital status play in determining auto insurance rates in Manitowoc, Wisconsin.

By comparing these variables, drivers can find the most cost-effective and suitable insurance plans for their unique profiles. This approach helps ensure that Manitowoc residents receive the best value based on their personal circumstances.

Best Manitowoc, Wisconsin Auto Insurance by Driving Record

When evaluating auto insurance options in Manitowoc, Wisconsin, your driving record plays a significant role in determining rates. The best Manitowoc, Wisconsin auto insurance for individuals with a clean driving record often features lower premiums and better coverage.

Best Manitowoc, Wisconsin Auto Insurance Rates After a DUI

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Manitowoc, Wisconsin Auto Insurance by Credit History

Evaluating how credit history affects auto insurance rates is key to finding the best Manitowoc, Wisconsin auto insurance. Insurers factor in credit scores when setting premiums, which can influence your costs.

Best Manitowoc, Wisconsin Auto Insurance Rates by ZIP Code

Best Manitowoc, Wisconsin Auto Insurance Rates by Commute

When comparing best Manitowoc, Wisconsin auto insurance rates by commute, it’s essential to consider how your daily travel impacts your premium.

Longer commutes often result in higher rates due to increased exposure to road risks. Choosing a policy tailored to your specific driving habits can help you secure the most cost-effective coverage.

To expand your knowledge, refer to our comprehensive handbook titled “How Much Insurance Do I Need?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

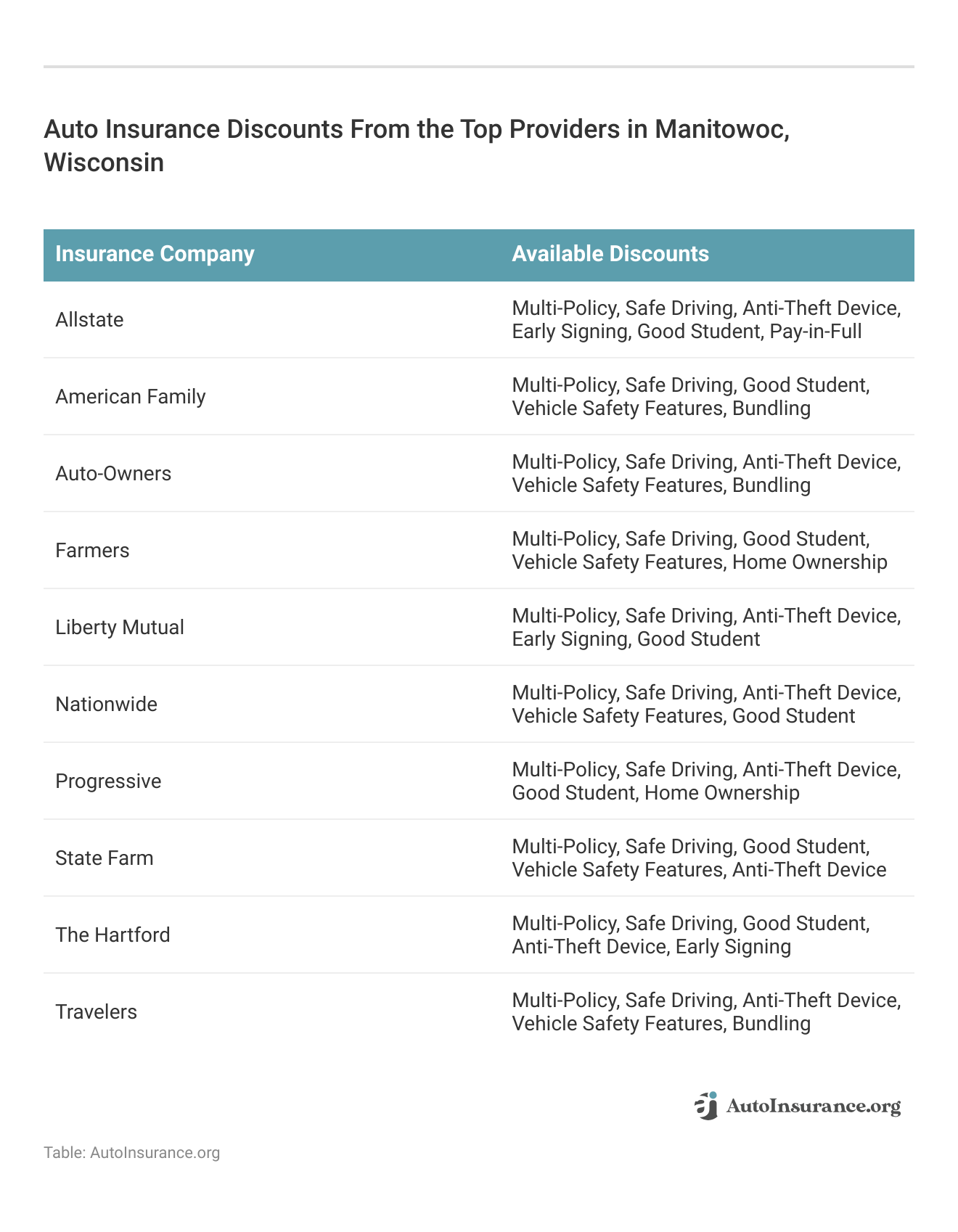

Best Manitowoc, Wisconsin Auto Insurance Rates by Coverage Level

When looking for the best Manitowoc, Wisconsin auto insurance rates by coverage level, it’s important to compare options that suit your specific needs.

Glendale, Arizona Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $89 $193

Auto-Owners $87 $195

Farmers $95 $210

Liberty Mutual $93 $205

Nationwide $88 $185

Progressive $90 $200

State Farm $85 $190

The Hartford $92 $205

Travelers $85 $203

USAA $80 $180

Best by Category: Best Auto Insurance in Manitowoc, Wisconsin

When seeking the best auto insurance in Manitowoc, Wisconsin, it’s important to compare providers by category to find coverage that meets your specific needs.

The top companies offer specialized plans tailored for different drivers, ensuring you get the most suitable protection. By evaluating policies by category, you can secure comprehensive and affordable auto insurance in Manitowoc.

To learn more, explore our comprehensive resource on commercial auto insurance titled “Where to compare auto insurance rates”

The Best Manitowoc, Wisconsin Auto Insurance Companies

Finding the best Manitowoc, Wisconsin auto insurance involves comparing top companies that offer reliable full coverage auto insurance, competitive rates, and excellent customer service. State Farm, American Family, and Progressive are top choices, each providing tailored options to meet various needs.

These providers stand out for their commitment to quality and affordability, ensuring drivers in Manitowoc, Wisconsin get the protection they need.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Frequently Asked Questions

Who has the best insurance rates in Wisconsin?

For competitive pricing on the best Manitowoc, Wisconsin auto insurance, companies like State Farm, American Family, and Progressive offer some of the best rates in the state.

Get the car insurance at the best price — enter your ZIP code below to shop for right coverage from the top insurers.

What is the penalty for not having car insurance in Wisconsin?

Driving without insurance in Wisconsin can result in fines, license suspension, and vehicle impoundment. Ensure you have the best Manitowoc, Wisconsin auto insurance to avoid these penalties.

When did Wisconsin require car insurance?

Wisconsin mandated car insurance for all drivers in 1982, and it’s crucial to have the best Manitowoc, Wisconsin auto insurance to comply with the auto insurance laws.

What is the most popular car insurance?

The best Manitowoc, Wisconsin auto insurance providers include State Farm, Progressive, and American Family, known for their extensive coverage and competitive rates.

How much is the average car insurance in Wisconsin?

The average cost of car insurance in Wisconsin is around $130 per month. To find the best Manitowoc, Wisconsin auto insurance rates, compare quotes from different providers.

How does Wisconsin car insurance work?

Wisconsin requires drivers to carry liability insurance to cover damages and injuries. Finding the best Manitowoc, Wisconsin auto insurance helps ensure compliance with minimum auto insurance requirements.

Is proof of insurance required in Wisconsin?

Yes, proof of insurance is required to drive legally in Wisconsin. To get the best Manitowoc, Wisconsin auto insurance, make sure you have valid proof when needed.

What is the minimum car insurance required in Wisconsin?

Wisconsin’s minimum car insurance includes liability coverage with limits of $25,000 per person and $50,000 per accident for bodily injury, and $10,000 for property damage. Look for the best Manitowoc, Wisconsin auto insurance to meet these requirements.

What happens if someone hits you and they don’t have insurance in Wisconsin?

If an uninsured driver hits you in Wisconsin, you may need to file a claim with your own insurance or seek compensation through legal action. Having the best Manitowoc, Wisconsin auto insurance with comprehensive coverage can help protect you in such situations.

Can you get car insurance without a license in Wisconsin?

You can obtain car insurance in Wisconsin without a license, but you’ll need to provide other documentation. For the best Manitowoc, Wisconsin auto insurance, ensure you meet all requirements.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.