Allstate vs. Progressive Auto Insurance in 2026 (Who’s Best for Coverage & Savings?!)

Get started comparing Allstate vs. Progressive auto insurance with rates from $39/month for Progressive and $61/month for Allstate. Progressive’s Snapshot program helps you save based on how you drive, while Allstate’s Drivewise rewards safe drivers with big discounts. Tailor your choice to your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2025

11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsChoosing between Allstate vs. Progressive auto insurance depends on your driving habits and budget. Allstate is known for its many discounts if you drive safely or have a newer car.

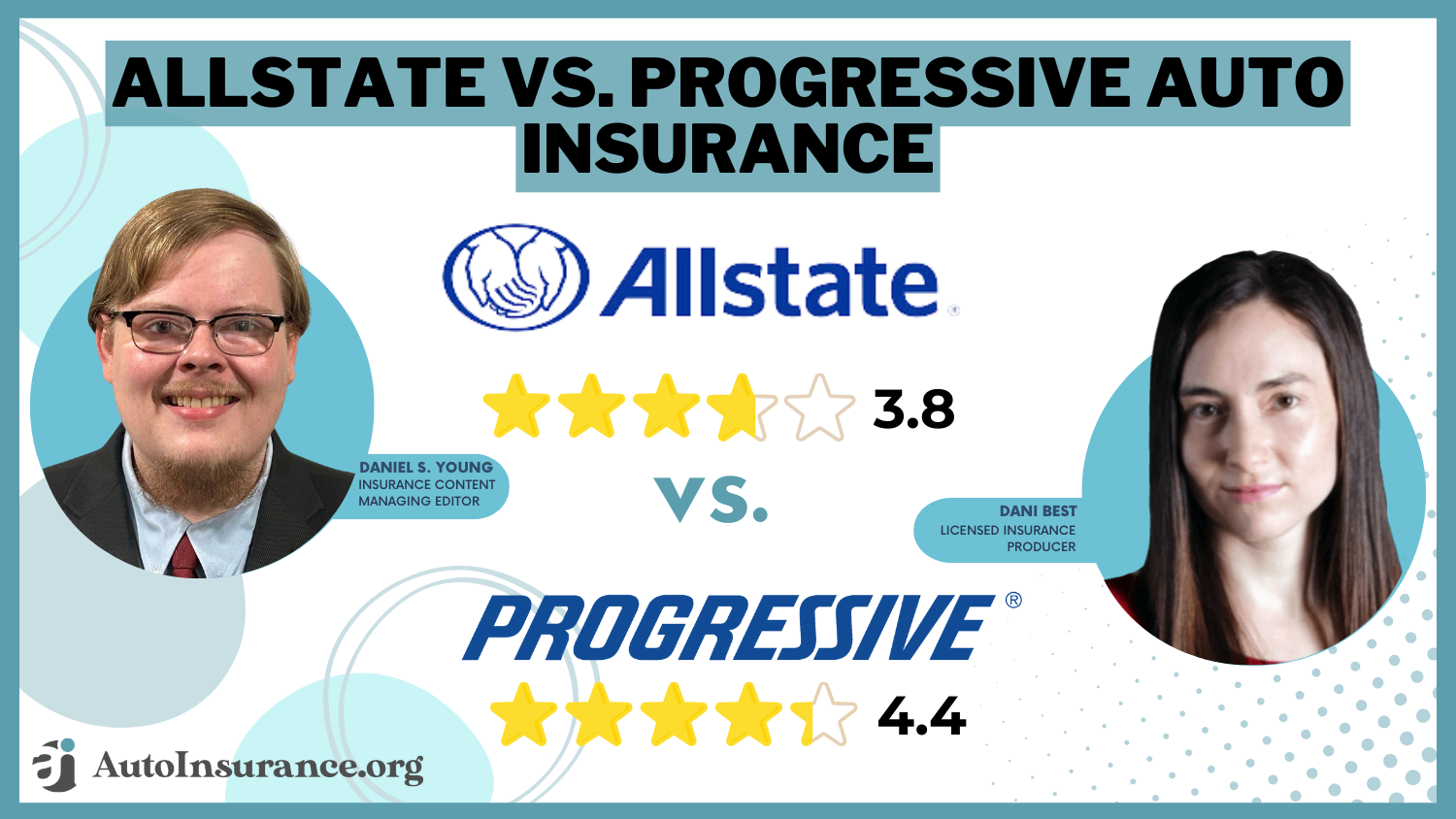

Allstate vs. Progressive Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.4 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.4 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.2 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 3.8 | 4.5 |

| Allstate Review | Progressive Review |

On the other hand, Progressive is famous because its rates cost less, and it also helps those with not-so-good credit scores by offering flexible options. When Allstate gives many discounts, Progressive is usually cheaper for most drivers. But Progressive rates go up a lot more when accidents happen than Allstate.

- Allstate and Progressive have top ratings from financial and consumer agencies

- Allstate offers numerous discounts with savings up to 45%

- Progressive is a good choice if you have bad credit or a DUI on your record

A comparison of Allstate and Progressive auto insurance shows that both are among the most reputable auto insurance companies. How do they compare rates, discounts, consumer satisfaction, complaints, mobile apps, and financial strength?

Keep reading to compare affordable Allstate vs. Progressive auto insurance quotes, or enter your ZIP code to compare multiple companies in your area.

Allstate vs. Progressive: Auto Insurance Costs for Different Age Groups

For 16-year-old drivers, Progressive tends to charge significantly higher rates, with females paying $801 and males $814, compared to Allstate’s $608 and $638, respectively. As drivers age, the gap between Allstate and Progressive narrows.

Allstate vs. Progressive Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $608 | $801 |

| Age: 16 Male | $638 | $814 |

| Age: 30 Female | $168 | $131 |

| Age: 30 Male | $176 | $136 |

| Age: 45 Female | $162 | $112 |

| Age: 45 Male | $160 | $105 |

| Age: 60 Female | $150 | $92 |

| Age: 60 Male | $154 | $95 |

By age 30, Progressive offers slightly lower rates for both females and males, with females paying $131 and males $136, compared to Allstate’s $168 and $176. This trend continues into middle age, where Progressive remains cheaper, especially for drivers in their 60s, with rates as low as $92 for females and $95 for males, while Allstate charges $150 and $154.

Read More:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Allstate and Progressive Auto Insurance Rates for Different Driving Records

No matter which auto insurance company you select, Allstate vs. Progressive auto insurance rates will increase if you get a speeding ticket, cause an accident, or get a DUI.

If your driving record makes you look like a liability to an auto insurance company, you will pay more. Allstate and Progressive are no exception. Find out how auto insurance companies check driving records.

Allstate vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $160 | $105 |

| Not-At-Fault Accident | $225 | $186 |

| Speeding Ticket | $188 | $140 |

| DUI/DWI | $270 | $140 |

The costs for auto insurance from Allstate and Progressive vary significantly based on individual driving histories. While rates go up for infractions with both companies, Progressive usually has the best deals, particularly for customers with perfect records or those facing DUI charges.

While Progressive typically has cheaper rates, Allstate stands out with its extensive discounts and customer loyalty programs.Michelle Robbins Licensed Insurance Agent

In general, Progressive has cheaper auto insurance rates than Allstate for drivers with any type of driving record. However, Progressive is more punitive with customers who get a speeding ticket or cause an accident.

Progressive is historically more forgiving than Allstate regarding certain infractions, like DUIs. However, drivers should exercise caution because both companies raise premiums following accidents and speeding tickets.

Impact of Credit Score on Allstate vs. Progressive Insurance Costs

Your credit score reflects your ability to manage your finances, make good choices, and pay your bills on time. Car insurance companies assume that the more financially responsible you are, the safer you are behind the wheel. Let’s compare Allstate and Progressive’s rates based on credit score.

Monthly Auto Insurance Rates for Allstate vs. Progressive by Credit Score

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $322 | $302 |

| Fair Credit (580-669) | $382 | $330 |

| Poor Credit (300-579) | $541 | $395 |

Progressive comes in cheaper than Allstate if you need better credit. If your credit score tanks with Allstate, expect to pay 68% more than drivers with good credit. With Progressive, your rates will increase by only 28% if your credit score drops significantly.

If you notice a rate increase when it’s time to renew your six-month policy, it could be because your credit score dropped. It’s good to look at your credit report every six months. If needed, use your Allstate or Progressive login to temporarily adjust your deductible and coverage levels. This can lower your rates while you work to improve your credit score.

It might be a good time to check Allstate or Progressive quotes, too, and compare with other car insurance companies if you don’t want to change your deductible or coverage. Learn more about how your credit score impacts auto insurance rates.

Auto Insurance Discounts: Allstate vs. Progressive Breakdown

Each company has its selling point, and sometimes, it comes down to who offers the best auto insurance discounts for your specific situation. This is why it pays to shop around. Let’s examine Allstate and Progressive auto insurance discounts.

Allstate vs. Progressive Auto Insurance Discounts

| Discount Name | ||

|---|---|---|

| Anti-Lock Brakes | 10% | X |

| Anti-Theft | 10% | X |

| Claim Free | 35% | X |

| Daytime Running Lights | 2% | X |

| Defensive Driver | 10% | 10% |

| Distant Student | 35% | X |

| Driver's Ed | 10% | 10% |

| Driving Device/App | 20% | 20% |

| Early Signing | 10% | X |

| Electronic Stability Control | 2% | X |

| Farm Vehicle | 10% | X |

| Full Payment | 10% | X |

| Good Student | 20% | X |

| Green Vehicle | 10% | X |

| Multiple Policies | 10% | 12% |

| Multiple Vehicles | X | 10% |

| Newer Vehicle | 30% | X |

| On Time Payments | 5% | X |

| Online Shopper | X | 7% |

| Paperless Documents | 10% | 50% |

| Paperless/Auto Billing | 5% | X |

| Passive Restraint | 30% | X |

| Safe Driver | 45% | 31% |

| Senior Driver | 10% | X |

| Utility Vehicle | 15% | X |

| Vehicle Recovery | 10% | X |

When comparing all the discounts that either company offers, Allstate offers 24 auto insurance discounts, while Progressive offers only eight.

Even though Progressive has cheaper rates, Allstate has some competitive discounts. With Allstate, you can save between 30% and 45% for being a safe driver, claim-free, having a newer vehicle, having airbags, or being a distant student.

Progressive’s most significant discount is 50% for using paperless documents. Progressive also offers a 31% discount for being a safe driver.

Both Allstate and Progressive offer a 20% discount for using their driving apps or devices. Learn more about Allstate’s driving app in our Allstate Drivewise review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Pros & Cons

Allstate may have higher rates than Progressive and other competitors, but it offers many different ways to lower premiums.

- Generous Discounts: Anyone who values safety and owns a new vehicle would love Allstate’s up to 45% discount for good drivers and new vehicle owners.

- Strong Financial Stability: According to their high A.M. Best rating, Allstate is financially stable, which means they can reliably handle claims and provide long-term coverage support.

- Comprehensive App Functionality: In the Allstate Milewise review, we saw how the app simplifies policy management for tech-savvy clients by letting them pay bills and track claims with simplicity.

However, budget is important, and on top of already high rates, Allstate does raise rates higher than other providers after claims. Watch this video to learn more about the pros and cons of Allstate car insurance.

- Higher Base Rates: Allstate premiums are often more costly than rival companies, and that’s before you factor in discounts.

- Less Forgiving for Minor Claims: People needing to use their insurance regularly may not be the best candidates because even a small claim can lead to significant rate spikes.

Continue comparing Allstate vs. Progressive below with a closer look at the pros and cons of Progressive auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Progressive Pros & Cons

Progressive is well-known for its cheap quotes and discounts for drivers who shop online and get quotes in advance. Here are more reasons customers choose Progressive:

- Affordable Rates for Younger Drivers: Younger drivers on a budget often choose Progressive because of their consistently reduced monthly costs compared to other insurance providers.

- Leniency for Low Credit Scores: Progressive’s more forgiving policy offers rates 27% lower than those provided by Allstate to drivers with compromised credit.

- Usage-Based Discounts: Drivers can save up to 31% through the Snapshot program, which rewards safe driving, as highlighted in the Progressive Snapshot review.

One of the biggest drawbacks to Progressive Insurance is its rate hikes at policy renewal. Even safe drivers without claims can see their rates go up after just six months.

- Rates Increase After Accidents: If you have an accident, premiums with Progressive can rise by up to 41%. This significant increase might be too expensive for some drivers.

- Fewer Discount Options: While solo drivers might find ways to save cash with Progressive, the company offers fewer discounts overall than other companies like Allstate.

You should always compare your top insurance choices against other local companies online before you buy. Enter your ZIP code now to see rates from insurers near you.

Exploring Auto Insurance Coverage with Allstate and Progressive

Since Allstate and Progressive are both big contenders for market share in the auto insurance industry, they both likely offer the standard six coverages listed below, in addition to many more.

- Liability Auto Insurance

- Collision Auto Insurance

- Uninsured/Underinsured Auto Insurance Coverage

- Medical Payments (MedPay) Auto Insurance

- Personal Injury Protection (PIP) Auto Insurance

Look closely at any specialty coverages you might need, such as rental car reimbursement, roadside assistance auto insurance, guaranteed auto protection (Gap), mechanical breakdown auto insurance, and insurance for recreational vehicles such as ATVs or boats.

Also, if you are a food delivery driver, you will need Allstate or Progressive commercial auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mobile App Usability for Allstate and Progressive Customers

Most of the top auto insurance companies have mobile apps that allow you to make payments, adjust coverage levels, or show electronic verification of auto insurance coverage.

Most auto insurance companies also have a separate app for their usage-based auto insurance programs.

Your Allstate insurance login or Progressive insurance login will usually work with both the general Allstate and Progressive apps and the driving apps.

Consumer Satisfaction and Financial Strength of Allstate and Progressive

If auto insurance companies can judge their customers based on gender, marital status, and credit score, then it’s only fair for customers to judge them. Below, we list ratings for Allstate and Progressive from the top agencies that judge the credibility of all auto insurance companies. And if you’re considering investing in Allstate vs. Progressive stock, these ratings will guide you.

A.M. Best scores companies based on their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid. The highest score A.M. Best awards is Superior A++.

Consumer Reports collects annual data from its subscribers regarding customer satisfaction with the Allstate and Progressive claims processes, step by step. In its 2017 survey, 27 insurance companies were rated, and scores ranged from 86 to 96.

The National Association of Insurance Commissioners (NAIC) compares the total number of clients to the total number of complaints to determine the ratio. The average complaint ratio nationwide was one in 2017. A lower ratio is better.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Progressive

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.45 More Complaints Than Avg. | Score: 1.11 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A+ Superior Financial Strength |

Allstate and Progressive are on top of things when it comes to external ratings by government, financial, and consumer agencies. You will have a good experience with Allstate and Progressive customer service, and you can expect financial sustainability with either company.

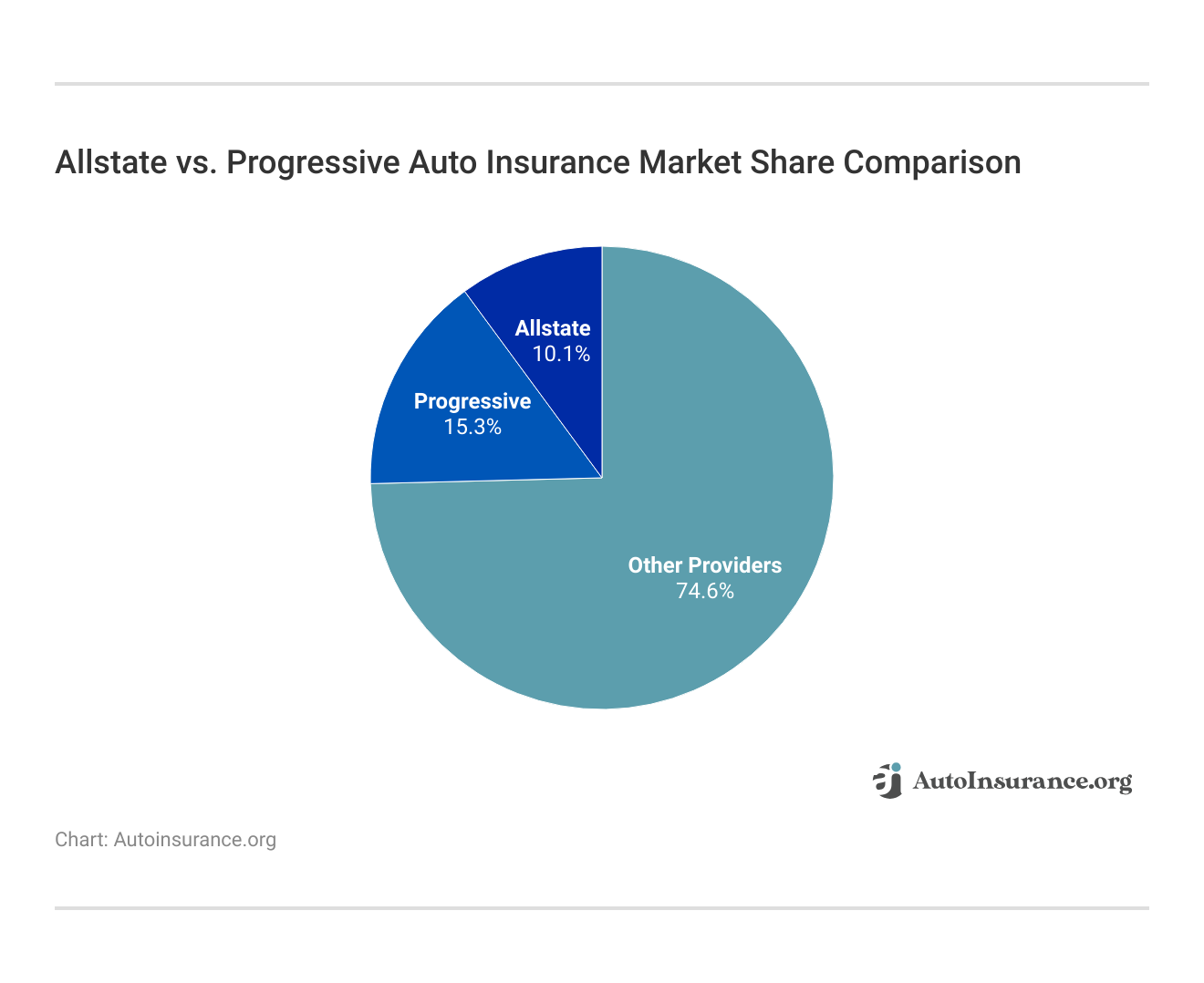

There is still fierce competition between Allstate and Progressive for substantial shares of the auto insurance industry. Although 74.6% of the market comprises other providers, these two titans remain fierce competitors, constantly fighting for supremacy.

Allstate and Progressive have significant sway over the auto insurance market, influencing policyholder rates and trends. Drivers gain from innovation spurred by their competition as they weigh their alternatives for coverage and cost.

A few users shared positive experiences with Allstate and Progressive in a Reddit discussion. Some praised Allstate’s customer service and flexible ride-sharing app, which offers savings.

Others noted that if you understand your coverage and have the right policy, Allstate can handle claims smoothly. These reviews highlight how understanding your insurance can lead to more favorable experiences with major providers. See our explanation of how to get fast and free auto insurance quotes here.

Allstate Car Insurance vs. Progressive: Find Your Best Deal Now

Depending on your driving history, the kind of car you drive, and how points affect auto insurance rates, you can choose between Allstate’s generous discounts for safe drivers and newer vehicles and Progressive’s more reasonable rates for younger drivers and those with poorer credit.

State Farm, Progressive, Allstate, Geico…These and more made our list of the top 10 🏆auto insurance companies. Check out 👀our review to see which might be a good fit for you👉: https://t.co/RS6zOyxEnY pic.twitter.com/XUC6Loksx1

— AutoInsurance.org (@AutoInsurance) September 25, 2024

Allstate stands out due to its financial stability and flexible coverage options, while Progressive is known for its reduced prices across different demographics. Your driving record, the kind of car you drive, and your budget will determine which one is best for you. By comparing these companies, vehicle owners can discover the policy that works best for them in the long run.

Before you decide whether to buy Allstate vs. Progressive auto insurance, enter your ZIP code to compare multiple auto insurance companies in your area.

Frequently Asked Questions

What is the difference between Allstate and Progressive in terms of auto insurance?

Allstate and Progressive differ in pricing, discounts, and coverage options. Allstate excels in customizable options like new car replacements, while Progressive features affordability and programs like Snapshot for safe driving discounts.

How do Progressive and Allstate compare in terms of affordability?

Progressive generally provides cheaper rates, while Allstate offers more discounts for safe drivers and bundling.

How do Geico, Allstate, and Progressive auto insurance compare for savings?

Geico typically has the lowest rates, followed by Progressive, while Allstate offers more discounts but higher starting auto insurance premiums.

How do Geico, Allstate, and Progressive differ in coverage options?

Geico focuses on low rates, Allstate offers safe driving rewards, and Progressive excels in flexible programs and affordability.

How does Allstate and Safeco compare for auto insurance?

Allstate provides more discounts and rewards for safe driving, while Safeco excels with bundling options and flexible policies.

Start comparing total coverage auto insurance rates by entering your ZIP code.

How does Allstate and Progressive home insurance compare?

Allstate underwrites its home insurance with options like Claim RateGuard, making it one of the best companies for bundling home and auto insurance. Progressive acts as a broker, offering flexibility through third-party insurers and bundling discounts. Allstate provides consistent coverage, while Progressive’s options vary by provider.

How do Allstate and Mercury differ for drivers?

Allstate offers nationwide availability with safe driver discounts, while Mercury is often more affordable but available in fewer states.

What are the benefits of Progressive and Allstate home insurance?

Progressive offers budget-friendly rates through bundling, while Allstate excels in tailored coverage and safe homeowner discounts.

How does Allstate and Progressive car insurance differ?

Allstate provides vanishing deductibles and safe driver rewards, while Progressive offers lower starting rates and usage-based programs.

Is Allstate cheaper than Progressive for car insurance?

Progressive typically offers lower car insurance rates than Allstate, with an average monthly full coverage premium of $39 compared to Allstate’s $61. However, Allstate may be cheaper for teen drivers.

How do Progressive insurance and Allstate differ in terms of discounts?

How do Progressive and The General compare for high-risk drivers?

Is Allstate better than Progressive for auto insurance?

How does Progressive and Allstate car insurance differ in terms of savings?

How do Allstate and Erie compare in terms of car insurance?

How do Allstate and Safe Auto compare for budget drivers?

What is the difference between Progressive and Safe Auto in terms of affordability?

How do Allstate and Infinity compare for high-risk drivers?

What’s the difference between Root and Progressive in auto insurance?

How do Progressive and State Farm auto insurance differ?

How do Liberty Mutual and Allstate compare for car insurance?

What is the difference between Root and Allstate for usage-based insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.