Government Auto Insurance for Low Income Drivers (2024)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Sep 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Government auto insurance is a more affordable option for low-income families

- California, New Jersey, and Hawaii are the only states currently offering government auto insurance plans

- If you don’t qualify for government auto insurance, there are other options available to help with the cost of car insurance

Many low-income families struggle to afford the rising costs of car insurance. However, state-sponsored insurance options can provide a more affordable option for those in need.

And if government car insurance for low-income is unavailable in your state, there are still ways to save on car insurance as a low-income driver.

Read on to learn more about government auto insurance for low-income individuals and how to save on car insurance overall.

State-Sponsored Insurance Options for Low-Income Families

There are currently only three states that offer a government auto insurance program:

- California

- New Jersey

- Hawaii

These programs cater to low-income individuals and families who cannot afford traditional auto insurance.

California – California Low-Cost Automobile (CLCA)

If you reside in California, you may be eligible for this policy. To benefit from California’s program, you must meet the following requirements:

- Be a California resident

- Own a car with a value of $25,000 or less

- Have maintained continuous liability coverage for the past six months

- Have a household income that falls within the program’s income guidelines

- Clean driving record

- Possess a valid California driver’s license

The CLCA program only offers basic liability coverage, so it may not be the best option for drivers who want more comprehensive coverage.

New Jersey – Special Automobile Insurance Policy (SAIP)

The SAIP program can provide affordable auto insurance coverage if you’re a New Jersey resident. According to New Jersey’s Department of Banking and Insurance, you must meet the following requirements to qualify:

- Be a New Jersey resident

- Be enrolled in Medicaid with hospitalization coverage

- Have a valid New Jersey driver’s license or permit

The SAIP program pays for medical expenses and accidents involving uninsured motorists. However, it does not cover damage to your vehicle or injuries to passengers in your car. The policy costs $365 per year.

Hawaii – Assistance to the Aged, Blind, and Disabled program (AABD)

As a low-income driver in Hawaii, you may qualify for the AABD program, which offers discounted auto insurance. According to Hawaii’s Deparmtent of Human Services, to qualify, you must:

- Be a Hawaii resident

- Have a valid Hawaii driver’s license

- Be enrolled in Medicaid

- Be 65 years of age or older, blind, or disabled

- Income below 34% of the federal poverty level

Note that the AABD program only offers basic liability coverage. However, it sometimes provides coverage for damage to your vehicle.

How To Find Low-Income Car Insurance

Finding cheap auto insurance rates can be challenging, but there are some steps you can take to lower your premiums.

One way is to look for auto insurance discounts. Many insurance companies offer discounts like a good student discount or for things like installing safety features in your car or being a member of certain organizations.

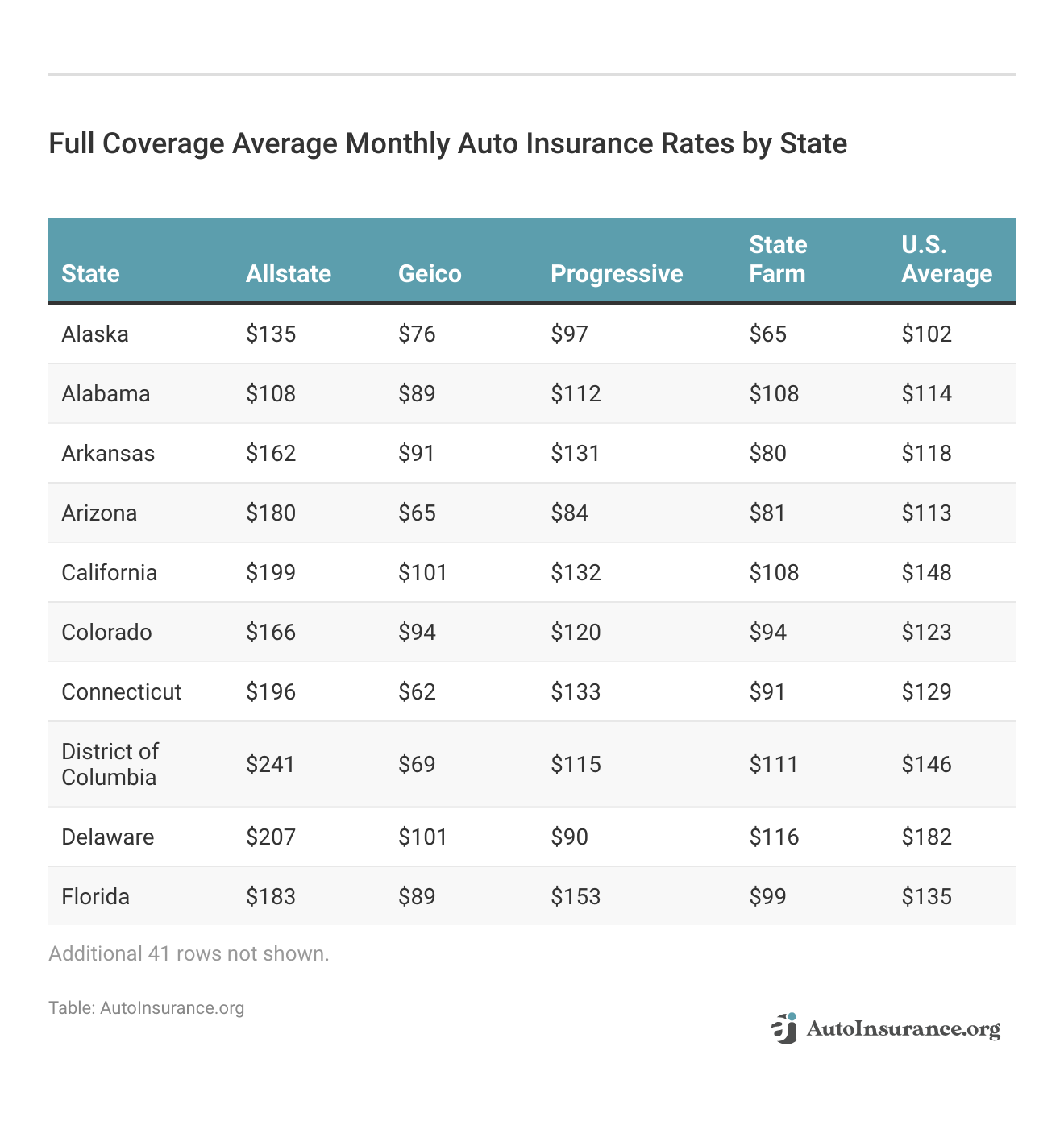

Another way is to shop around and get multiple auto insurance quotes from different insurance companies. Always compare rates to ensure you’re getting the best deal possible. The table below shows the cheapest rates for low-income drivers in each state.

How much does regular car insurance cost for low-income drivers?

The cost of car insurance varies greatly depending on specific factors. The factors that affect car insurance rates include:

- Driving background

- Manufacturer and model of the car

- Driver’s age

- Location

It’s important to note that these averages are just estimates, and your rates may vary.

Other Opportunities for Low-Income Drivers To Save on Car Insurance

If you don’t qualify for government programs or can’t find an affordable policy, there are still some options for saving on auto insurance as a low-income driver.

Here are some potential options for saving on car insurance:

Shop Around

As anyone who has ever shopped for auto insurance knows, there can be a wide range of prices from the best auto insurance companies.

However, remember that the lowest price is not always the best deal. Several factors go into setting rates, so getting quotes from several companies is imperative. For example, one company may offer a lower rate for a particular driver, while another may offer a better overall value. Always read the fine print and ensure the policy covers what you need.

Consider Buying Pay-per-Mile Car Insurance

Pay-per-mile car insurance is a usage-based insurance that charges drivers based on the number of miles driven. This type of car insurance can be a good option for infrequent or occasional drivers, who may find that traditional auto insurance policies are too expensive. For example, a driver who only drives a few hundred miles per year may find that pay-per-mile insurance is cheaper than a standard policy.

Apply for Common Car Insurance Discounts

As a low-income driver, inquire about any potential auto insurance discounts that may be available. Common car insurance discounts include:

- Safe driver discount. This discount is available for drivers with a clean driving record.

- Bundling discount. This discount applies if you purchase an additional insurance policy from the same company.

- Vehicle safety discount. If your car has safety features installed, you’re likely to get a discount.

Other common auto insurance discounts include:

- Good student

- Anti-theft

- New car

- Defensive driver

- Paperless

- Senior driver

- Occupational

Own a Car That’s Inexpensive to Insure

The most impactful way to save on auto insurance as a low-income driver is to drive an inexpensive car. Examples include:

- Older cars. A car’s value depreciates over time, meaning that older cars are generally less expensive to insure.

- Smaller cars. Smaller cars typically have a lower replacement value and, therefore, a lower insurance cost.

- Cars with a good safety record. Cars with a history of fewer accidents or theft claims are less expensive to insure.

- Cars with a low theft rate. Cars that have fewer thefts have lower insurance rates.

Reduce the Number of Cars You Own

The number of cars and drivers on a policy often dictates the auto insurance rates. Owning and insuring multiple cars can significantly increase the cost.

One option for reducing insurance costs may be to sell or get rid of a second car and become a single-car household. Moreover, this can help reduce transportation expenses, like gas and maintenance. Learn how to save on auto insurance with three vehicles.

Reduce Your Coverage

Another potential option for reducing auto insurance costs is to reduce your coverage. However, carefully consider the risks and ensure that you are not compromising your financial security.

For instance, while dropping collision coverage on an older car with a low value may save on insurance costs, it may not be worth it if you are at risk of being unable to cover the cost of repairs in the event of an accident.

Avoid Letting Your Insurance Lapse

Maintaining continuous auto insurance coverage is vital for several reasons. For one, it’s the law in most states. But beyond that, letting your insurance lapse can lead to much higher rates when you restart your policy.

Insurance companies view lapsed coverage as a risk since you were willing to drive without insurance at one point. As a result, you’ll likely pay a significantly higher rate than someone who has maintained continuous coverage.

If you’ve let your previous insurance policy lapse, you may have difficulty obtaining proof of prior insurance when you reapply. So if you don’t want to see your rates skyrocket, it’s best to avoid letting your car insurance lapse.

Final Thoughts on Government Auto Insurance

Government-assisted car insurance may be the best and most affordable option if you are a low-income earner and need help paying car insurance. State-sponsored programs offer cheap auto insurance to those who qualify based on their income.

You can also find other ways to get low-income car insurance by shopping around, considering pay-per-mile policies, applying for discounts, and reducing your coverage. Also, avoid letting your insurance lapse, as this will result in much higher rates when you reinstate your policy.

If you don’t qualify for government auto insurance, there are still options for finding affordable coverage, like shopping around and looking for discounts. The key is to research and find the best option for you.

Frequently Asked Questions

How do I apply for government auto insurance?

The application process will vary depending on where you live and the specific program in your state. Generally, you will need to provide proof of income and a valid driver’s license. You may also need to provide the make and model of your vehicle.

Is government auto insurance available in all states?

Not all states offer a government-sponsored auto insurance program for low-income individuals. This program is only available in California, New Jersey, and Hawaii.

How do you get government car insurance if you are low-income?

If you live in California, New Jersey, or Hawaii, you can apply for government-sponsored auto insurance through your state’s program.

In other states, you can explore options for low-income auto insurance through insurance companies and potential discounts for which you may be eligible.

Is there low-income car insurance in Georgia?

Georgia does not offer a publicly financed auto insurance program. However, Georgia residents may still qualify for low-income discounts through their auto insurance provider.

Companies, such as the Government Employees Insurance Company (GEICO), offer low-income discounts to those who meet specific requirements.

Another option for Georgia’s low-income earners is joining a group auto insurance program offering lower rates. Some examples include groups for teachers, nurses, military members, and government employees.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.