Does auto insurance pay over the limit of bodily injury to settle lawsuits?

Does car insurance cover lawsuits? Yes, if the amount demanded doesn't exceed the policy's limits, your insurance company will provide you with help through a trial. Read on to learn what your liability insurance covers and what you can do if you lose your case.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Editor-in-Chief

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney.

Mathew B. Sims

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated December 2024

Being in an auto accident is awful, but getting sued for a car accident is even worse. It’s scary to think of someone suing you after a car accident, and what happens if someone sues you for more than your insurance covers might be at the forefront of your mind.

You worry you might lose your home or have your wages garnished if you lose the car crash lawsuit, and you might end up asking does car insurance cover if someone sues you? The good news is that car insurance does cover lawsuits in many situations.

If you lose a lawsuit, your bodily injury liability insurance pays up to a certain amount, though not over the limit of bodily injury on your policy. Your insurance company also typically pays for the costs related to car accident court cases, including hiring an attorney. The company will also try to go through an arbitrator first to settle the case quickly.

The process can be stressful, but your insurance company works on your side. Understanding how insurance claims work can help you understand what your insurance company will do for you when you make car accident claims.

You might wonder can you be sued for more than your insurance covers? Well, if the person suing you wants more than what’s covered by your insurance policy, here are some tips on what to do.

- If someone sues you after an accident, the insurance company only pays up to your policy’s bodily injury limit

- Work with your appointed attorney and send off subpoenas and other documentation immediately

- If the person who sues you wins more than the insurance limit, the court typically doesn’t take your home or garnish your wages

How does car insurance cover lawsuits after an accident?

After an accident, the other party in an accident may sue you for their injuries. This is especially true if the officer on the scene decides it’s your fault.

Your insurance company will try to limit the damages. The company wants to avoid a trial and settle the case out of court, if possible.

Your Insurance Company Provides You With an Attorney

Your insurance company usually has a lawyer on retainer. This attorney represents you at all court appearances. It’s in your best interest to cooperate with this professional as much as possible.

Make copies of all the legal documents you’ve received and forward those documents to your attorney right away. Attach your auto insurance policy number to the documents along with your name and phone number. The attorney may need to contact you.

If you’re served with a subpoena or other legal document, contact your attorney right away. Your attorney has to respond to these documents within a certain amount of time. Missing a deadline could hurt your case.

If anyone from the opposing party contacts you, refer them to your attorney and don’t speak to them. Do nothing on your own. Your attorney has experience in these matters, so let your handle all matters.

If You Don’t Like Your Attorney

You might feel your attorney isn’t qualified to handle your case. You can hire a different attorney, but you’ll have to pay the legal costs yourself. You may want to look for a specialized accident insurance lawyer or an attorney who has experience in lawsuit insurance cases.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does car insurance cover lawsuits if you’re sued for more than the limit?

What happens when a car accident claim exceeds insurance limits? You might want to know, can I recover more than the insurance policy limits? Your insurance company will only pay up to the bodily injury limit specified in your policy. So if the property damage exceeds insurance coverage and the person suing you demands more than that amount, that person can sue you personally for it.

That’s why it’s important to make sure you have the right auto insurance against a lawsuit before you’re involved in an accident.

The Burden of Proof Is on the Complainant

When someone sues you for more than the insurance company is willing to pay, they have to provide evidence that they’re entitled to that money. Unfortunately, there’s no limit on the amount of money a complainant can demand.

Fortunately, a jury hears the case, and proving a need for more money is easier said than done. That’s why having insurance for a lawsuit is so important to have.

What do you do if you believe you’re not responsible?

If you believe you’re not responsible for the accident, it will be up to you to prove your innocence:

- Contact the reporting officer and ask for a meeting.

- Request a copy of the accident report.

- Gather all the evidence.

- Get photos from the scene of the accident as well as statements from other witnesses.

Be careful to document everything. It will be up to you to prove your innocence to the court. And depending on the situation, you might end up wondering can I sue my insurance company if I was not at-fault? Keep reading for more information.

What happens if you lose?

Sitting through a trial when you’re the defendant can be devastating. It’s worse when you lose and you’re responsible for whatever your insurance company doesn’t pay with your liability insurance coverage.

Fortunately, there should be a fair and impartial judge presiding over your case. The judge will review your financial status and situation at home before making any decisions on how to recover that extra money.

Beware of Scare Tactics

The lawyers representing the other side may try to scare you, hoping you’ll give them the money you owe. They may threaten to seize your home or garnish your wages.

Keep in mind that it’s rare for a court to pass an order to garnish your wages. Usually, it is only done if the government is trying to recover taxes or if you’re behind on child support payments.

That isn’t the case with a lawsuit over a car accident. A judge will usually be more lenient in such cases. This is especially true if you’re a single parent or guardian making a low income and supporting children at home.

If down the road, you get a pay increase of a certain amount, the court may reconsider the issue, and you’ll then have to make payments.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What should you do if you’re sued for more than your auto insurance payout limit?

Some drivers might ask, can you sue for more than insurance limits? Or what happens if someone sues you for more than your insurance covers? If you are sued after a car accident for more than your insurance policy covers, contact both your insurance company and your appointed attorney as soon as possible. They’ll give you the information you need for the best way to proceed and what you may be liable for.

For more information, you can contact an independent car insurance lawyer, but you’ll have to pay for that out of pocket.

Being involved in a lawsuit is stressful and expensive, whether it’s a hit and run lawsuit or a civil lawsuit for a car accident. Protect yourself by contacting your insurance company as soon as you learn of a lawsuit. Getting legal representation as soon as you can protect you from further loss.

Get proactive now, before you get sued. You can buy auto insurance online, but make sure to talk to your agent and find out what car insurance lawsuit coverage is included.

Frequently Asked Questions

Does auto insurance pay over the limit of bodily injury to settle lawsuits?

Can an insurance company pay more than policy limits? No, auto insurance will only pay up to the bodily injury limit specified in your policy to settle lawsuits. So make sure you have insurance against lawsuits to avoid a bad situation.

Does car insurance cover lawsuits?

Does car insurance cover civil lawsuits? Yes, you can get insurance for lawsuits in many situations. If you are sued for injuries resulting from an accident, your insurance company will provide you with help through a trial if the amount demanded doesn’t exceed the policy’s limits.

But who pays the damages that exceed the policy limits? You will be personally responsible for costs over your policy limit.

How does car insurance cover lawsuits after an accident?

After an accident, your insurance company will try to limit the damages and settle the case out of court if possible. Whose insurance pays for car accident? That depends on who is at-fault. Your insurance company may provide you with an attorney who will represent you in court and handle all legal matters.

Your insurance company typically pays for all court costs, although there may be some instances where an at-fault driver wants to pay out of pocket.

What happens if the person suing me demands more than my insurance policy’s bodily injury limit?

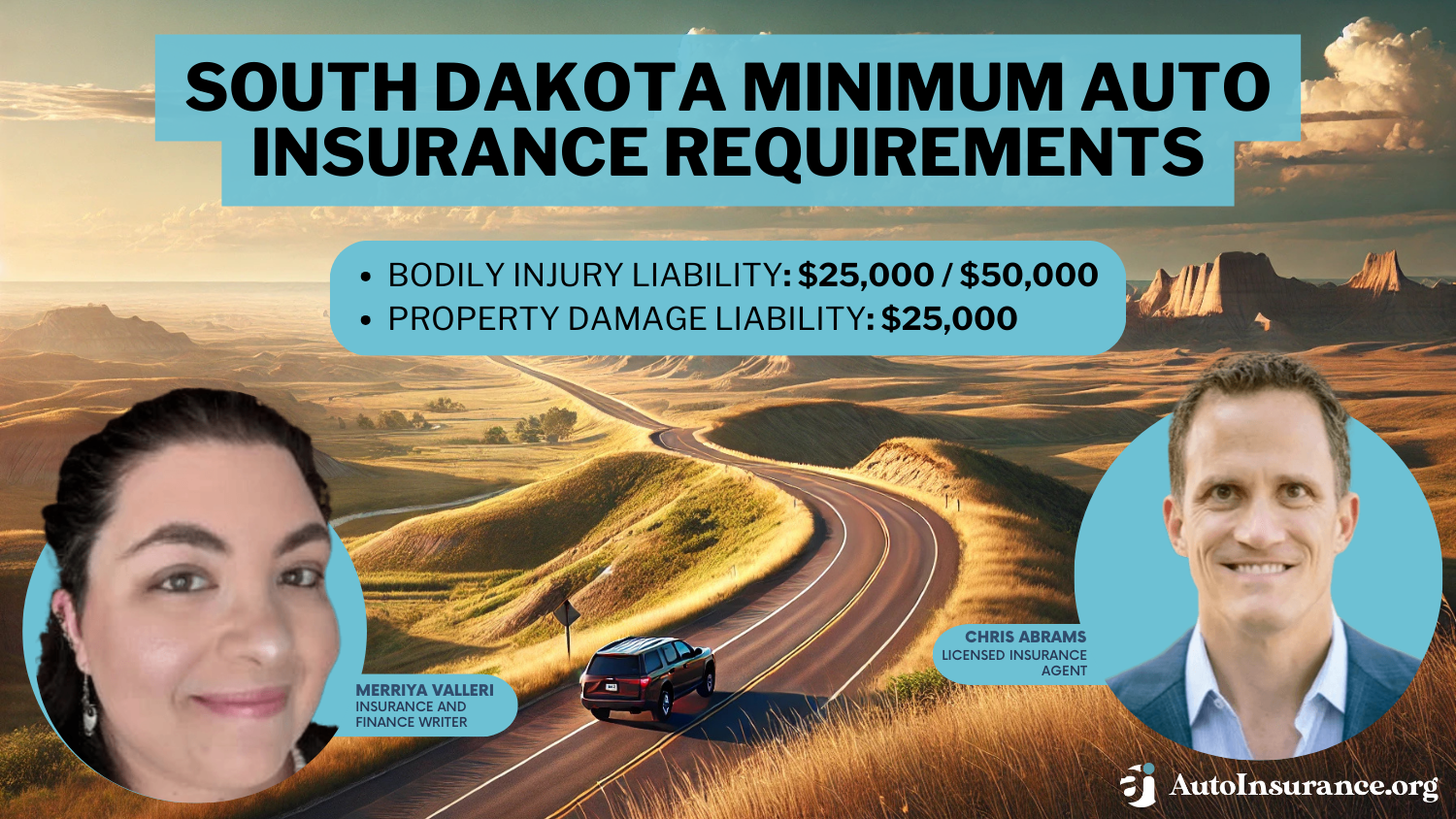

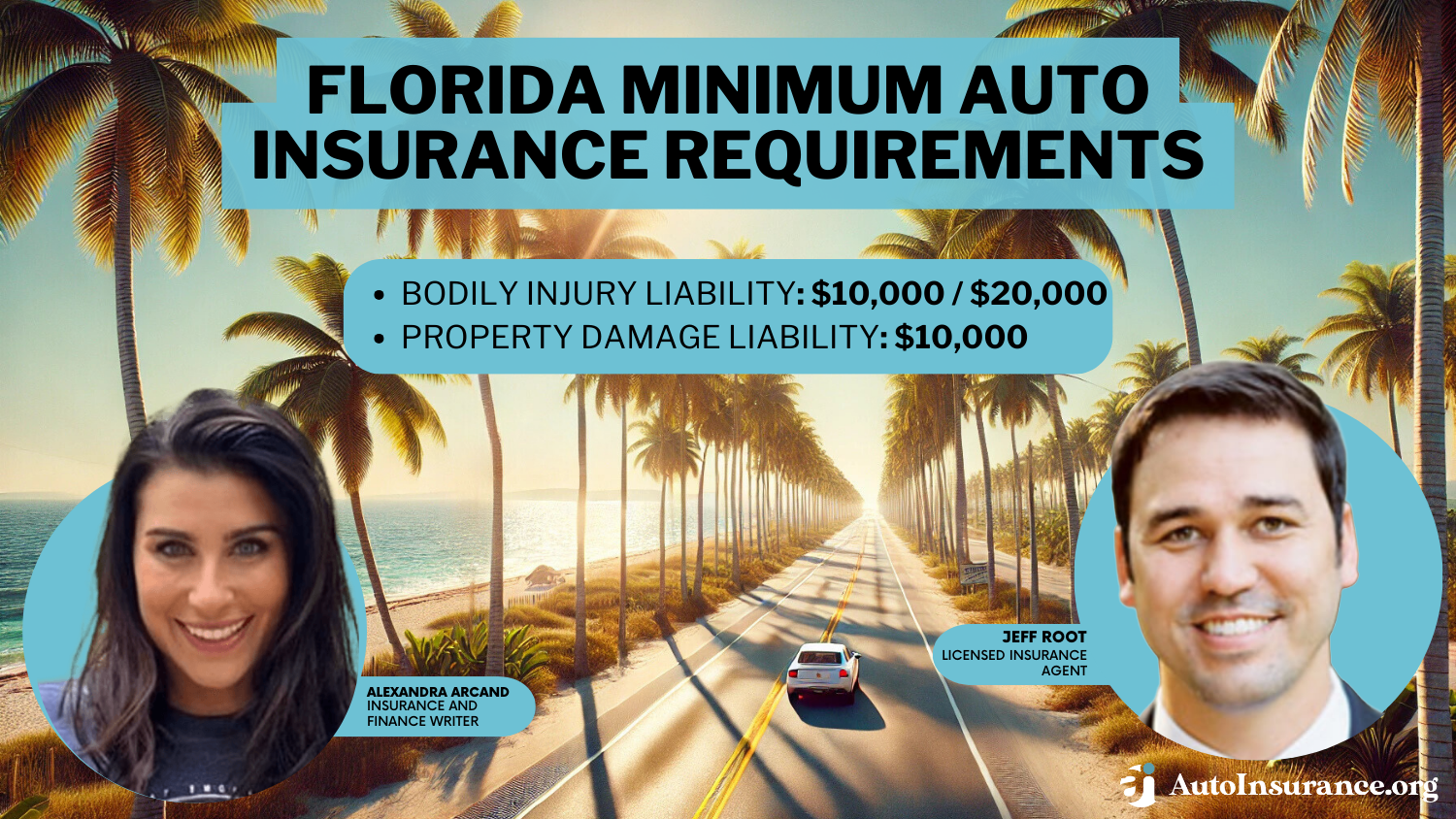

If the person suing you demands more than your insurance’s bodily injury claim in a car accident, they can sue you personally for the additional amount. It’s important to have adequate auto insurance coverage to protect yourself in such situations. The recommended bodily injury coverage will vary according to several different factors.

What should I do if I believe I’m not responsible for the accident?

If you believe you’re not responsible for the accident, it will be up to you to prove your innocence. Document everything related to the accident and be prepared to present evidence in court.

What happens if someone sues you for more than your insurance covers in your state?

People who live in different states may ask the same question. What happens if someone sues you for more than your insurance covers in Florida? What happens if someone sues you for more than your insurance covers in Georgia? Or what happens if someone sues you for more than your insurance covers in California?

The specifics may vary but the general process is much the same regardless of where you live. Ultimately, if someone sues you for more than your policy limits, you will be personally responsible for the costs.

Can I recover more than the insurance policy limits?

No, you usually will not be able to get more money from your insurance company that what your policy limits allow. There are a few unique situations where this is not the case, such as if you have uninsured motorist coverage or umbrella insurance. Talk to your insurance provider to find out more specific details.

Do I need uninsured motorist coverage if I have collision and comprehensive?

You may want to have uninsured motorist coverage as well as collision and comprehensive, but you should talk to your insurance company to determine the best coverage for your individual needs.

Can someone sue you for a car accident if you have insurance?

Yes, someone can sue you after an accident even if you have insurance. If you find yourself in the middle of a car accident lawsuit, make sure to contact your car insurance provider regardless of where you live. What to do if someone sues you for a car accident in Virginia or what to do if someone sues you for a car accident in Texas involve many of the same steps.

Can someone sue you after insurance pays?

Suing after car accidents, even after insurance has paid out, does sometimes happen. If you are being personally sued after your insurance company pays out, contact an attorney to help you manage the lawsuit.

Will insurance cover a hit and run?

Does car insurance pay for personal injury?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.