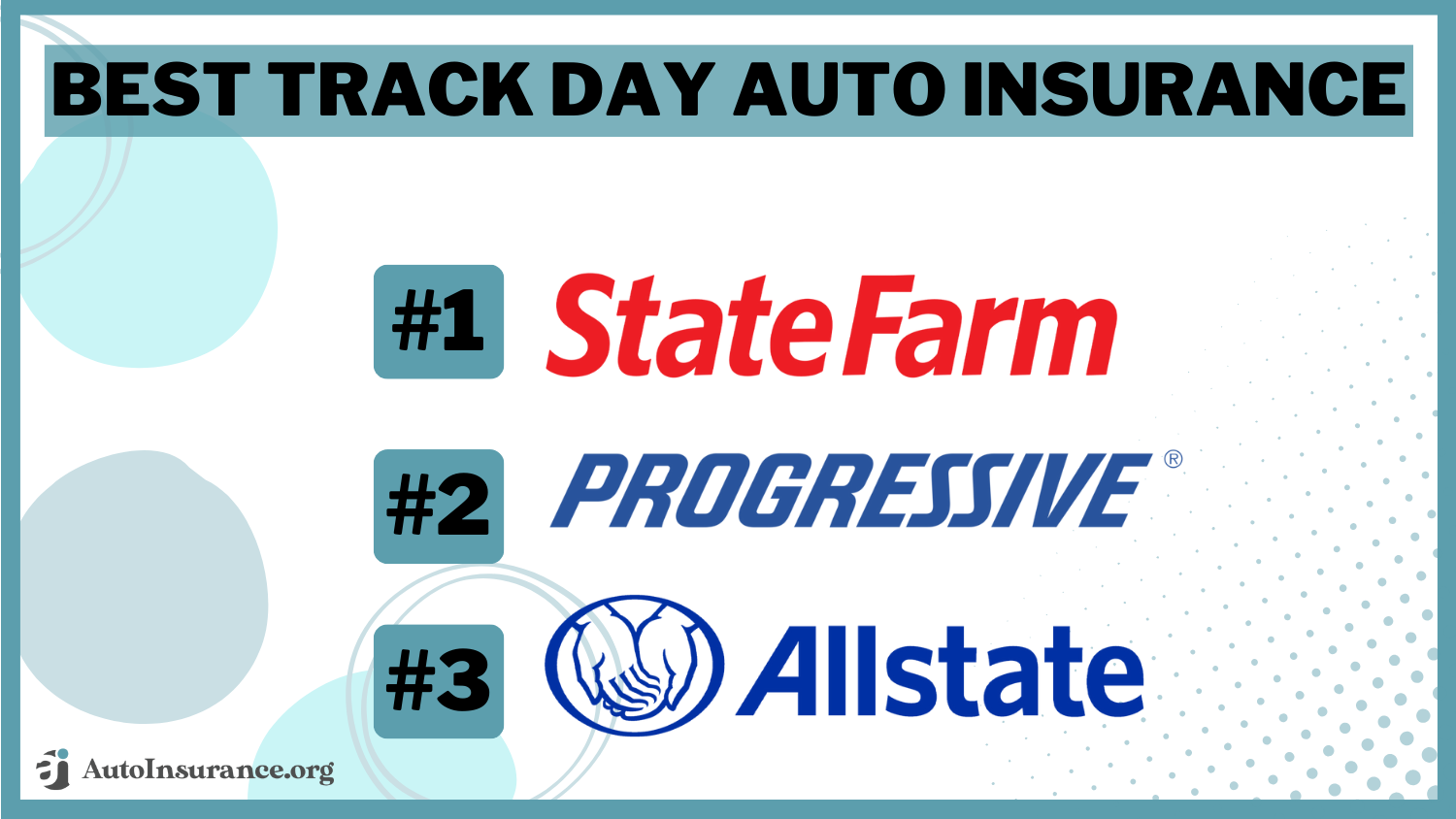

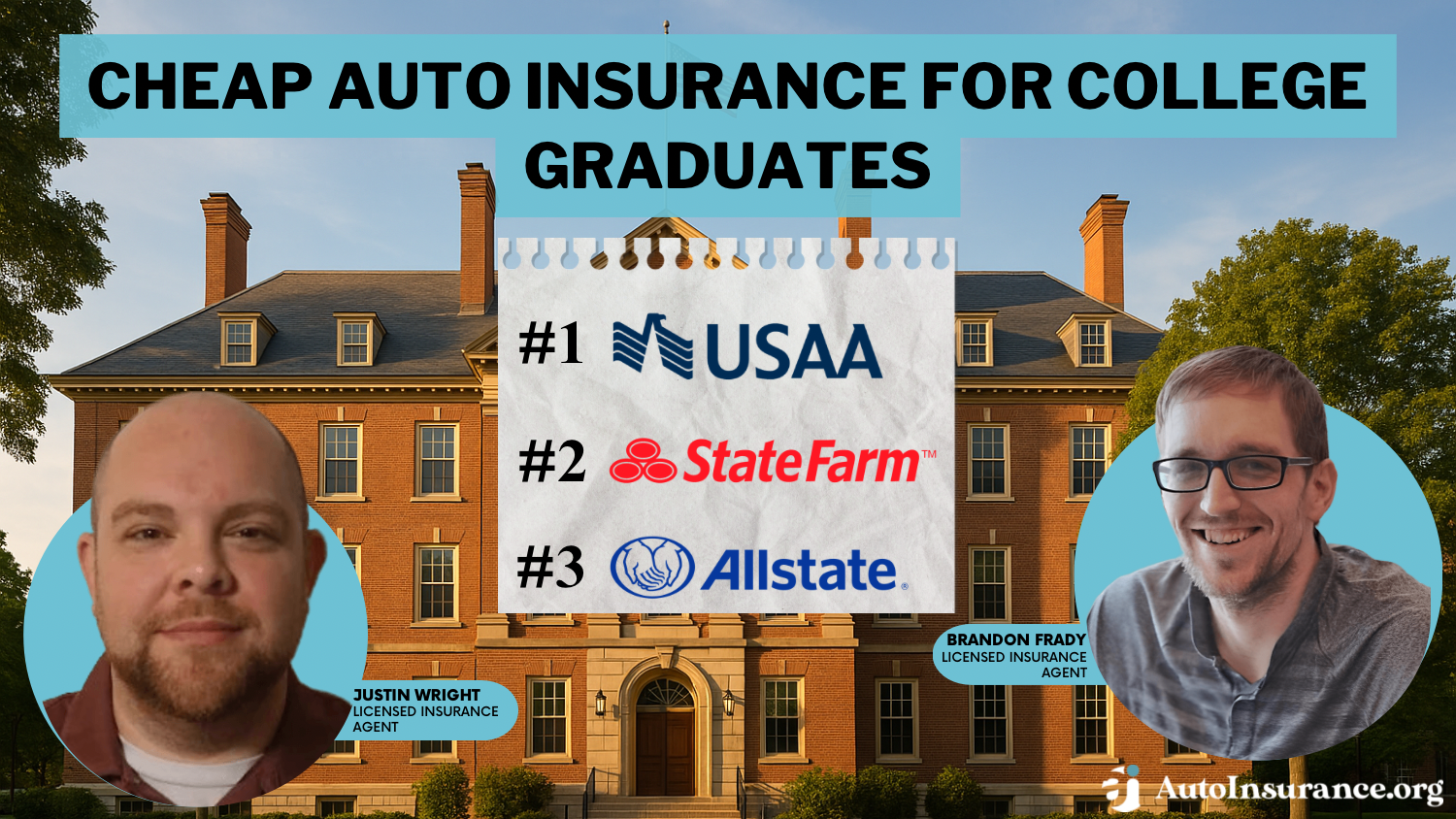

Best Track Day Auto Insurance in 2026 (Find the Top 10 Companies Here!)

State Farm, Progressive, and Allstate provide the best track day auto insurance, with premiums starting at only $47 per month. Our objective is to help you compare quotes from these reliable companies, ensuring you get the best coverage for your assurance, and customized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated April 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Track Day

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Track Day

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Track Day

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews- State Farm presents competitive pricing from $47 per month

- Top insurance companies offer potential savings for track day coverage

- Various discount opportunities exist for auto insurance tailored to track day events

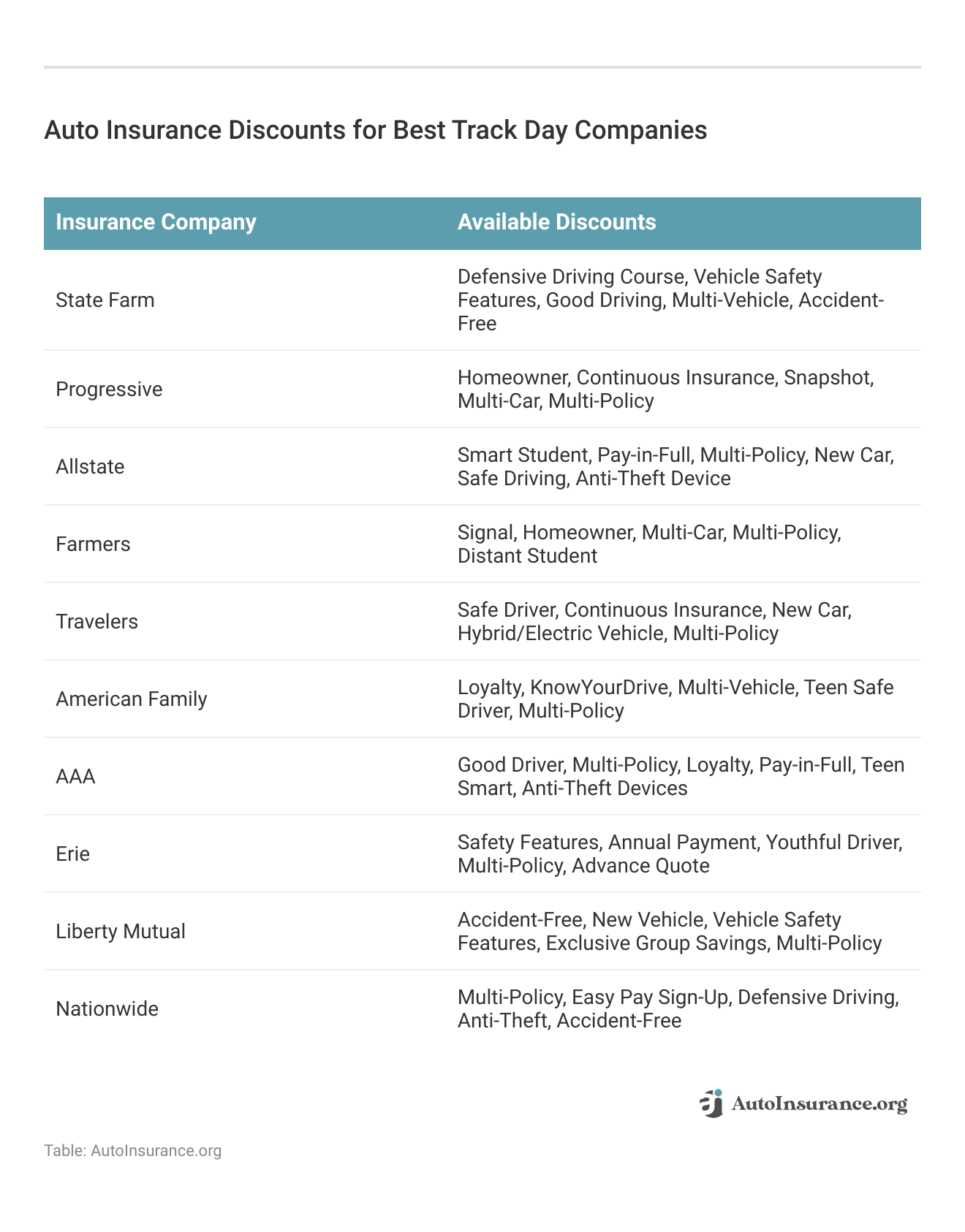

#1 – State Farm: Top Overall Pick

Pros

- Excellent Customer Service: Strong reputation for personalized attention to policyholders. Find out more in our State Farm auto insurance review.

- Diverse Coverage Options: Offers a wide range of coverage options, including track day insurance, for various driving needs.

- Financial Stability: Demonstrates strong financial stability and reliability, providing peace of mind to customers.

Cons

- Higher Premiums: May not offer the most competitive rates compared to some other providers.

- Limited Discounts: Offers fewer discounts compared to competitors, potentially resulting in higher premiums for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Safe-Driving Discounts

Pros

- Innovative Tools and Technology: Offers innovative tools and technology for policy management and claims processing.

- Extensive Discount Options: Provides an extensive range of discounts, making it easier for customers to save on premiums.

- Flexible Policy Options: Offers flexible policy options, including track day insurance, catering to diverse driving needs.

Cons

- Inconsistent Customer Service: In our Progressive auto insurance review, customer service quality can be inconsistent, with some users reporting dissatisfaction.

- Rate Increases After Incidents: Rates may increase significantly after accidents or violations, potentially leading to higher long-term costs.

#3 – Allstate: Best for Infrequent Drivers

Pros

- Efficient Claims Handling: Strong reputation for handling claims efficiently and effectively.

- Discount and Rewards Programs: Offers a variety of discounts and rewards programs for safe driving habits.

- Customizable Coverage Options: Provides customizable coverage options to tailor policies to individual needs.

Cons

- Higher Premiums: Premiums may be higher compared to some other providers, potentially limiting affordability for some customers. Use our Allstate auto insurance review as your guide.

- Limited Agent Availability: Limited availability of local agents in some areas may affect personalized service for customers.

#4 – Farmers: Best for Safe-Driving Discounts

Pros

- Comprehensive Coverage Options: Offers comprehensive coverage options, including track day insurance, for various vehicle types.

- Local Agent Network: Farmers, as mentioned in our Farmers auto insurance review, has a strong network of local agents providing personalized service and support.

- Variety of Discounts: Provides a variety of discounts to help customers save on premiums.

Cons

- Lower Customer Satisfaction Ratings: Customer satisfaction ratings may be lower compared to some competitors, potentially indicating issues with service quality.

- Limited Availability: Limited availability in certain regions may restrict options for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Bundling Policies

Pros

- Competitive Rates and Discounts: Offers competitive rates and a variety of discounts, helping customers save on premiums.

- Wide Coverage Options: Provides a wide range of coverage options, including track day insurance, for diverse driving needs.

- Strong Financial Stability: Demonstrates strong financial stability and a reputation for efficient claims handling.

Cons

- Limited Local Agents: Our Travelers auto insurance review reveals limited availability of local agents may affect personalized service for some customers.

- User-Friendly Interface: Some customers may find the online and mobile interface less intuitive compared to other providers, potentially leading to usability issues.

#6 – American Family: Best for Loyalty Rewards

Pros

- Personalized Service: Our examination of American Family insurance review reveals offers personalized service and support through a network of local agents.

- Discount and Rewards Programs: Provides a variety of discounts and rewards programs to help customers save on premiums.

- Flexible Policy Options: Offers flexible policy options, including coverage for high-performance vehicles and track day insurance.

Cons

- Higher Premiums: Premiums may be higher compared to some other providers, potentially limiting affordability for some customers.

- Limited Availability: Limited availability in certain regions may restrict options for some customers.

#7 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance Services: Strong reputation for roadside assistance services, providing added value to policyholders.

- Membership Benefits: Offers a variety of discounts and benefits to AAA members, including savings on insurance premiums.

- Coverage Options: Provides a wide range of coverage options, including specialized policies for high-performance vehicles. Your affordability guide starts with our AAA auto insurance review.

Cons

- Higher Premiums: Premiums may be higher compared to some other providers, potentially limiting affordability for some customers.

- Limited Coverage Options: Limited availability of coverage options in certain states or regions may restrict choices for customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Personalized Policies

Pros

- Excellent Customer Service: High satisfaction ratings among policyholders, indicating excellent customer service.

- Competitive Rates and Discounts: Offers competitive rates and discounts, making it easier for customers to save on premiums.

- Financial Stability: Demonstrates strong financial stability and reliability, providing peace of mind to customers.

Cons

- Limited Availability: Limited availability in select states may restrict options for some customers.

- Coverage Options: May not offer as many coverage options or add-on coverages compared to larger insurers, potentially limiting customization for some customers. Read our Erie auto insurance review for guidance.

#9 – Liberty Mutual: Best for Add-on Coverages

Pros

- Discount and Rewards Programs: Offers a variety of discounts and rewards programs to help customers save on premiums.

- Coverage Options: Provides a wide range of coverage options, including specialized policies for high-performance vehicles.

- Financial Stability: Demonstrates strong financial stability and a reputation for efficient claims processing.

Cons

- Higher Premiums: Premiums may be higher compared to some other providers, potentially limiting affordability for some customers.

- Inconsistent Customer Service: Customer service quality can be inconsistent, with some users reporting difficulties in claims handling. For further insights, refer to our Liberty Mutual auto insurance review.

#10 – Nationwide: Best for Usage-Based Coverage

Pros

- Discount and Incentive Programs: Provides diverse discount and rewards programs to help customers save on premiums and enhance value.

- Wide-Ranging Coverage: Offers a broad spectrum of coverage options, including specialized policies catering to high-performance vehicles.

- Financial Stability and Claims Efficiency: Demonstrates robust financial stability and a track record of efficient claims processing, ensuring timely resolution for policyholders.

Cons

- Premium Pricing: Premiums, as mentioned in our Nationwide insurance review, may be higher compared to some competitors, potentially limiting affordability for certain customers.

- Service Consistency: Customer service quality can vary, with some users reporting occasional difficulties in claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying Track Day Auto Insurance

Track Day Auto Insurance Coverage

Limitations of Track Day Auto Insurance Coverage

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Cost of Track Day Auto Insurance

The Final Word on Track Day Auto Insurance

If you want to jump in and compare auto insurance rates today, use our free quote comparison tool to find your area’s best rates by entering your ZIP code.

Frequently Asked Questions

Is my regular auto insurance policy sufficient for participating in track days?

No, your regular auto insurance policy is unlikely to cover you while participating in track days. Standard auto insurance policies typically exclude coverage for high-performance driving events, such as track days. It’s important to check with your insurance provider to understand the specific limitations of your policy.

What insurance options are available for track day participants?

For track day participants, there are specialized insurance options available, commonly known as track day insurance or motorsport insurance. These policies are specifically designed to provide coverage during track events and may include coverage for vehicle damage, liability, and even personal injury. Enter your ZIP code now.

What does track day insurance typically cover?

Do I need track day insurance if the event organizer provides insurance coverage?

While some track day event organizers may provide insurance coverage as part of the registration fee, it’s crucial to carefully review the details and limitations of that coverage. The organizer’s insurance may have restrictions or exclusions, and it may not provide the level of coverage you desire. Having your own dedicated track day insurance can offer additional peace of mind.

How do I purchase track day insurance?

Track day insurance can typically be purchased from specialty insurance providers that offer motorsport or track day coverage. It’s recommended to research and contact different providers to obtain quotes and compare coverage options. Some providers may offer online purchasing options, while others may require speaking with an agent to finalize the policy. Enter your ZIP code now to start comparing.

What factors affect the cost of track day insurance?

Can I get track day insurance for a rented or borrowed vehicle?

Track day insurance for rented or borrowed vehicles is typically more challenging to obtain. Most track day insurance policies require the vehicle to be owned by the policyholder or the policyholder to have an insurable interest in the vehicle. It’s advisable to consult with the insurance provider to determine if they offer coverage options for rented or borrowed vehicles.

Are there any restrictions or requirements for track day insurance coverage?

Track day insurance policies may have certain restrictions or requirements. These can include driver experience requirements, vehicle modifications limitations, adherence to safety regulations, and compliance with track event rules. It’s important to thoroughly review the policy terms and conditions to ensure compliance with any requirements set by the insurance provider. Enter your ZIP code now.

Where can I buy track day auto insurance?

What does track day auto insurance cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.