Best The Hartford Auto Insurance Discounts in 2026 (Save 25% With These Deals!)

Best The Hartford auto insurance discounts offer up to 25% savings by bundling policies, making them a top choice for affordable coverage. You can also save with a clean driving record. The Hartford’s mix of bundling, driver rewards, and flexible plans makes them one of the best providers for lowering your premium.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated November 2024

Best The Hartford auto insurance discounts deliver impressive savings, especially for policyholders eager to minimize their premiums and enhance coverage.

By taking advantage of these tailored options, drivers can significantly reduce costs while enjoying peace of mind with comprehensive protection.

Get started on comparing Hartford car insurance coverage rates by entering your ZIP code above.

Our Top 10 Picks: Best The Hartford Auto Insurance Discounts

| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Multi-Policy | #1 | 25% | Bundle auto with home, renters, or umbrella policies |

| Safe Driver | #2 | 10% | Must have a clean driving record for 5 years |

| Good Student | #3 | 15% | Requires a GPA of 3.0 or higher |

| Loyalty | #4 | 10% | Must be a customer for 3+ years |

| Homeowners | #5 | 5% | For homeowners insured with The Hartford |

| Driver Training | #6 | 10% | Save by completing an approved training course |

| Low Mileage | #7 | 15% | For drivers logging fewer miles |

| Senior Driver | #8 | 10% | Must be age 60 or older |

| Military | #9 | 10% | Available for active military personnel |

| Payment Plan | #10 | 5% | Save for enrolling in automatic payments |

Choosing the right auto insurance premium helps drivers stay prepared for the unexpected without paying extra for features they don’t need.

- Discounts include incentives for good students and anti-theft devices

- Customers can save up to 25% through bundling policies with The Hartford

- The Hartford provides various discounts to meet driver needs

Driving Cost-Efficient Solutions in the Auto Insurance Industry

Looking for ways to save on full coverage auto insurance? The Hartford could help you save up to 25% with their discounts. If you’re a safe driver, Geico has rates as low as $100, and State Farm offers rates starting at $120 when you bundle multiple policies. These deals make it easier to keep your premium low, so it’s worth checking them out

The Hartford Min. Coverage Insurance Monthly Cost With Top Discounts

| Discount Name |  |

|---|---|

| Multi-Policy | $75 |

| Safe Driver | $90 |

| Good Student | $85 |

| Loyalty | $90 |

| Homeowners | $95 |

| Driver Training | $90 |

| Low Mileage | $85 |

| Senior Driver | $90 |

| Military | $90 |

| Payment Plan | $95 |

You can significantly reduce your Hartford auto insurance costs with discounts like a 25% savings for good drivers or bundling policies. Compare rates from top providers like Geico, State Farm, and Progressive to find the best full coverage options at affordable monthly rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford Multi-Policy Discount

The Multi-Policy discount provides substantial savings by bundling auto insurance with additional policies, such as homeowners or renters insurance, offering up to 25% off.

Which cars have the lowest auto insurance premiums? Many drivers look for affordability and comprehensive coverage. This approach simplifies policy management and reduces overall premiums. Policy bundling, driving history, and individual risk determine your premium.

- Savings Potential: Up to 25% off premiums with bundling.

- Convenience: Streamlines management of multiple policies.

- Long-Term Benefit: Increases savings over time.

This discount is an excellent way to secure affordable and reliable insurance with The Hartford. By bundling, you can enjoy convenience and significant savings, ensuring you get the most out of your coverage.

The Hartford Safe Driver Discount

The Safe Driver discount offers a 10% premium reduction for drivers with a clean driving record. This incentive rewards responsible behavior, encouraging individuals to avoid accidents and traffic violations, which can lead to significant savings on auto insurance.

When it comes to the best auto insurance discounts for good drivers, the first thing that should be taken into account is that a clean driving record can not only be the main factor in strengthening the long-term relationship with a provider but also may serve as a springboard for other discounts and better insurance options.

The Hartford Good Student Discount

Want to spend less money? The Good Student discount is an excellent option, As long as your student average is B or higher, you can get 15% off your insurance premiums.

It is a great way to recognize your academic successes while allowing families to save on their insurance costs. This is a win-win situation that is changing the world. For more insights, check out our comprehensive guide titled Best Good Student Auto Insurance Discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford Loyalty Discounts

Hartford’s Loyalty discount is a significant kickback for 10% savings, simply a discounted auto insurance premium for long-term customers. Through this discount, Hartford effectively communicates its commitment to customer retention, and policyholders are encouraged to stay with the company for a long time.

Borrowing loyalty earns clients savings and gives them the reassurance and confidence of a long-term relationship.

The Hartford offers competitive monthly rates and loyalty discounts, making it a top choice for long-term auto insurance savings.Dani Best Licensed Insurance Producer

Hartford customers can receive the best customer loyalty auto insurance discounts, which are indicative of the company’s customer care policy and form a partnership between the company and the customer. For additional details, explore our resource on commercial auto insurance titled Best Customer Loyalty Auto Insurance Discounts.

The Hartford Loyalty discount is a testament to the company’s dedication to its customers, celebrating their continued support through tangible savings.

The Hartford Homeowners Discount

If you have a homeowners insurance policy with The Hartford, you’re in luck, and You can get a nice 5% discount on your auto insurance premiums. It’s a great way to save money while keeping things simple.

You might be wondering, what are the recommended auto insurance coverage levels? Bundling your home and car insurance makes it easier to manage everything and helps you keep some extra cash in your pocket. It’s a win-win.

The Hartford: Savings for Every Type of Driver

Saving on auto insurance is easy, with various discounts for driving habits and lifestyles. If you’ve completed an approved driver training course, you can earn a 10% discount for promoting safe driving. The Low Mileage discount offers 15% off for those who drive less, while mature drivers can benefit from a 10% Senior Driver discount.

If you’re in the military, you’ll appreciate the 10% Military discount as a thank-you for your service. It’s one of the best auto insurance options for military families and veterans. You can snag an extra 5% off through the Payment Plan discount if you set up automatic payments. It’s a great way to save while managing your insurance efficiently.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Save Smartly: The Hartford’s Variety of Discounts for Drivers

When it comes down to it, The Hartford car insurance gets that every driver has their own story. That’s why they offer a range of discounts to fit different needs, along with various types of auto insurance to choose from.

Whether you’re in the military, a safe driver, or someone who loves to save by bundling, you’ll find plenty of ways to lower your premiums while enjoying the peace of mind that comes with great coverage. It’s all about finding the right fit for you.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

What AARP car insurance discounts can I get with The Hartford?

AARP members with The Hartford can get discounts for bundling policies, safe driving, completing a defensive driving course, having vehicle safety features, paying in full, and good student performance.

How do I get a quote from The Hartford for car insurance?

You can do it online in just a few minutes, over the phone, or by chatting with a local agent. It’s all about finding the coverage that fits your needs.

Enter your ZIP code below in our free quote comparison tool to find affordable auto insurance, no matter your driving record.

Why is The Hartford a good choice for seniors looking for car insurance?

The Hartford shines for seniors by offering customized coverage options and special discounts. They understand what older drivers need, making them a solid choice for affordable car insurance. For a deeper dive, refer to our extensive handbook titled What is needed for adequate auto insurance coverage?

What’s the best and cheapest auto insurance option for seniors with The Hartford?

If you’re a senior, Hartford offers affordable options and various discounts. It’s all about getting the right coverage without breaking the bank.

What makes The Hartford automobile insurance company stand out?

The Hartford is special because it genuinely cares about its customers. It focuses on providing personalized service and solutions, especially for seniors and AARP members.

How much can I expect to pay for car insurance in Hartford, Connecticut?

The cost of auto insurance in Hartford can vary widely depending on your driving history and the type of coverage you want. However, The Hartford is known for its competitive rates, so it’s worth checking out. If you want a broader overview, explore our resource on business insurance titled How Auto Insurance Companies Check Driving Records.

Is there another name for The Hartford insurance?

You might hear The Hartford referred to as The Hartford Financial Services Group. It’s just a long way to mention the same trusted company that offers various insurance products.

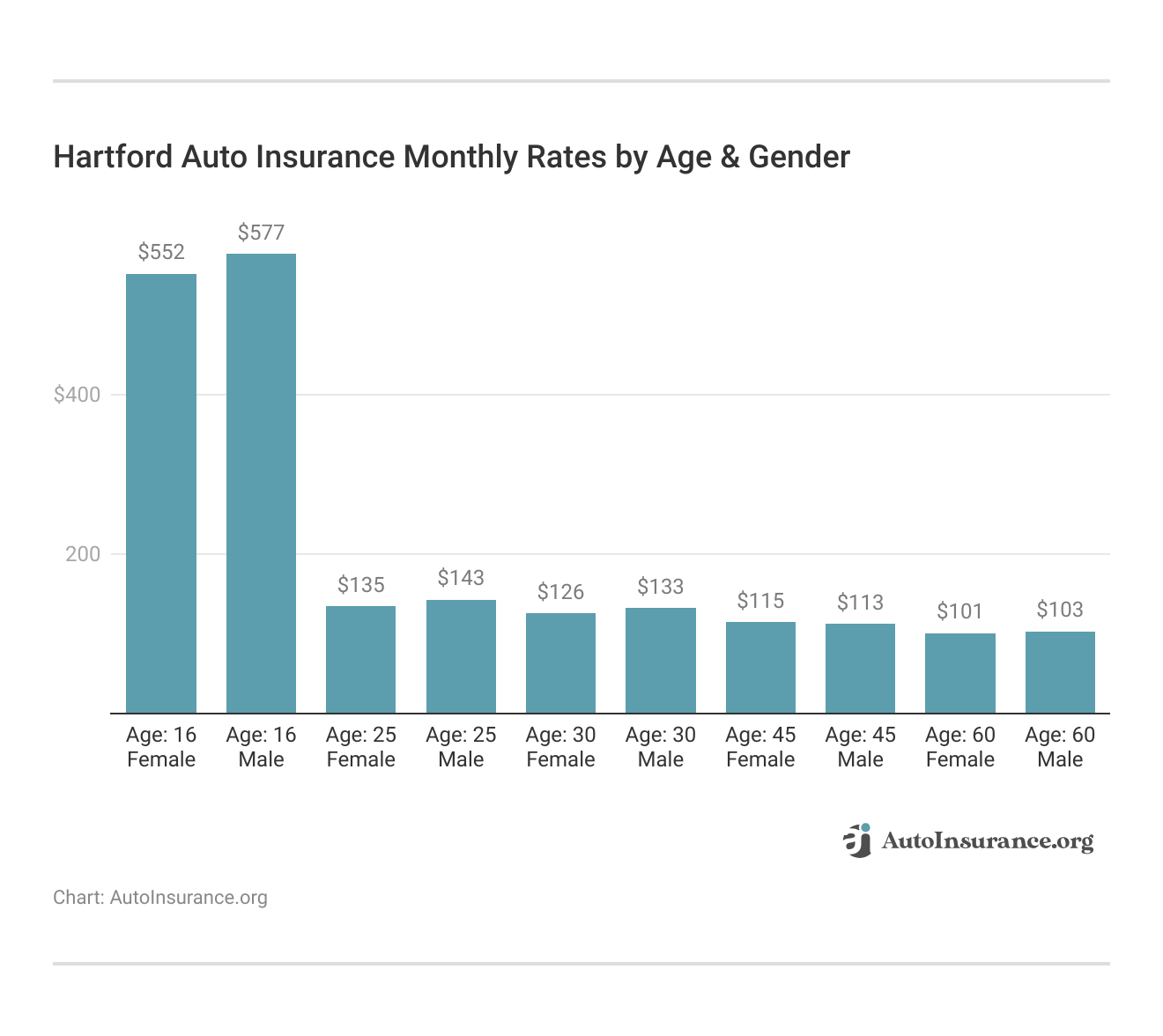

At what age is car insurance usually the cheapest with The Hartford?

Car insurance rates are typically lower for drivers in their 30s and 40s. But don’t worry, The Hartford also offers competitive rates for seniors so that you can find good coverage at any age.

What day of the week is best to snag a car insurance quote from The Hartford?

If you’re looking for the best deals, try getting a quote on a Tuesday or Wednesday. Those mid-week days are usually less hectic, and you might find better offers. For a complete breakdown, consult our detailed guide, How to Get Fast and Free Auto Insurance Quotes.

When’s the best month to buy car insurance?

Fall is often considered the best time to buy car insurance. Many companies, including The Hartford, reassess their rates during this time so that you might discover some great options.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.