Pennsylvania Minimum Auto Insurance Requirements in 2026 (Coverage You Need in PA)

Pennsylvania minimum auto insurance requirements are 15/30/5, meaning drivers must have $15,000 for bodily injury per person, $30,000 for all persons injured, and $5,000 for property damage. Minimum auto insurance coverage in PA starts at $19/month. Comparing rates can help you save money.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated November 2025

Pennsylvania minimum auto insurance requirements are 15/30/5, meaning you need $15,000 for injuries to one person, $30,000 for all injuries, and $5,000 for property damage.

These basic coverage amounts help protect you after an accident, but they might not be enough in more serious situations. If you want better protection, consider getting additional coverage such as collision or comprehensive insurance.

Pennsylvania Minimum Auto Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

For affordable rates that meet Pennsylvania’s minimum auto insurance laws, companies like USAA, Geico, and Travelers are great options.

Although the prices differ according to where you live, these providers will offer good coverage and the lowest rates in the state, thus helping you save while being covered under Pennsylvania’s requirements. Always compare quotes to get the best deal for your needs.

Make sure to compare rates with our free quote tool above today!

- Pennsylvania minimum auto insurance is 15/30/5 for BIL and PDL

- Failing to meet minimum coverage in PA can lead to fines and license suspension

- USAA, Geico, and Travelers offer affordable options meeting state requirements

Pennsylvania Minimum Coverage Requirements & What They Cover

Pennsylvania strictly enforces its minimum auto insurance requirements, so all drivers should be aware of and actively comply with these requirements.

- Bodily Injury Liability: Bodily injury liability auto insurance is one of Pennsylvania’s required auto insurance types. It offers no benefits for your own medical expenses, and it only pays others for their medical bills associated with an injury accident.

- Property Damage Liability: Property damage liability auto insurance coverage is also required in Pennsylvania. This type of auto insurance pays other parties for any property damage repairs needed for an accident you cause. This includes vehicle repairs, home repairs, fencing repairs, and more as needed. Find the best property damage liability auto insurance companies.

- Personal Injury Protection (PIP)/Medical Payments: Medical payment coverage is also required in Pennsylvania. Unlike bodily injury liability, which pays for other people’s medical bills, personal injury protection auto insurance pays for your own medical bills if you are injured on Pennsylvania roads.

The minimum amount of car insurance that Pennsylvania drivers need to buy includes:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident.

- Property Damage Liability: $5,000 per accident.

Personal Injury Protection (PIP): $5,000 to cover medical expenses, lost wages, etc.

There are instances when these insurance requirements may not apply to your vehicle. For example, if you drive your car for business purposes, you may need to comply with special insurance requirements for business-use vehicles.

Additionally, drivers in Pennsylvania must follow Pennsylvania auto insurance requirements to stay covered and avoid trouble. Pennsylvania car insurance laws require every driver to have basic insurance, including bodily injury and property damage coverage.

Understanding Pennsylvania's 15/30/5 auto insurance coverage ensures you're meeting the state's minimum requirements while keeping costs low.Schimri Yoyo Licensed Agent & Financial Advisor

Meeting PA state minimum car insurance rules protects you financially if there’s an accident. Failure to meet the PA minimum auto insurance requirements may result in fines, license suspension, or even car impoundment.

Maintaining the required coverage is not just about keeping up with the law- it’s about keeping safe and prepared for any unexpected event on the road.

Read more: What is needed for adequate auto insurance coverage?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Pennsylvania

If you’re searching for cheap state minimum car insurance in Pennsylvania, there are affordable options available. USAA offers the cheapest rates, followed by Geico and Travelers. These companies provide good coverage while meeting PA auto insurance laws.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

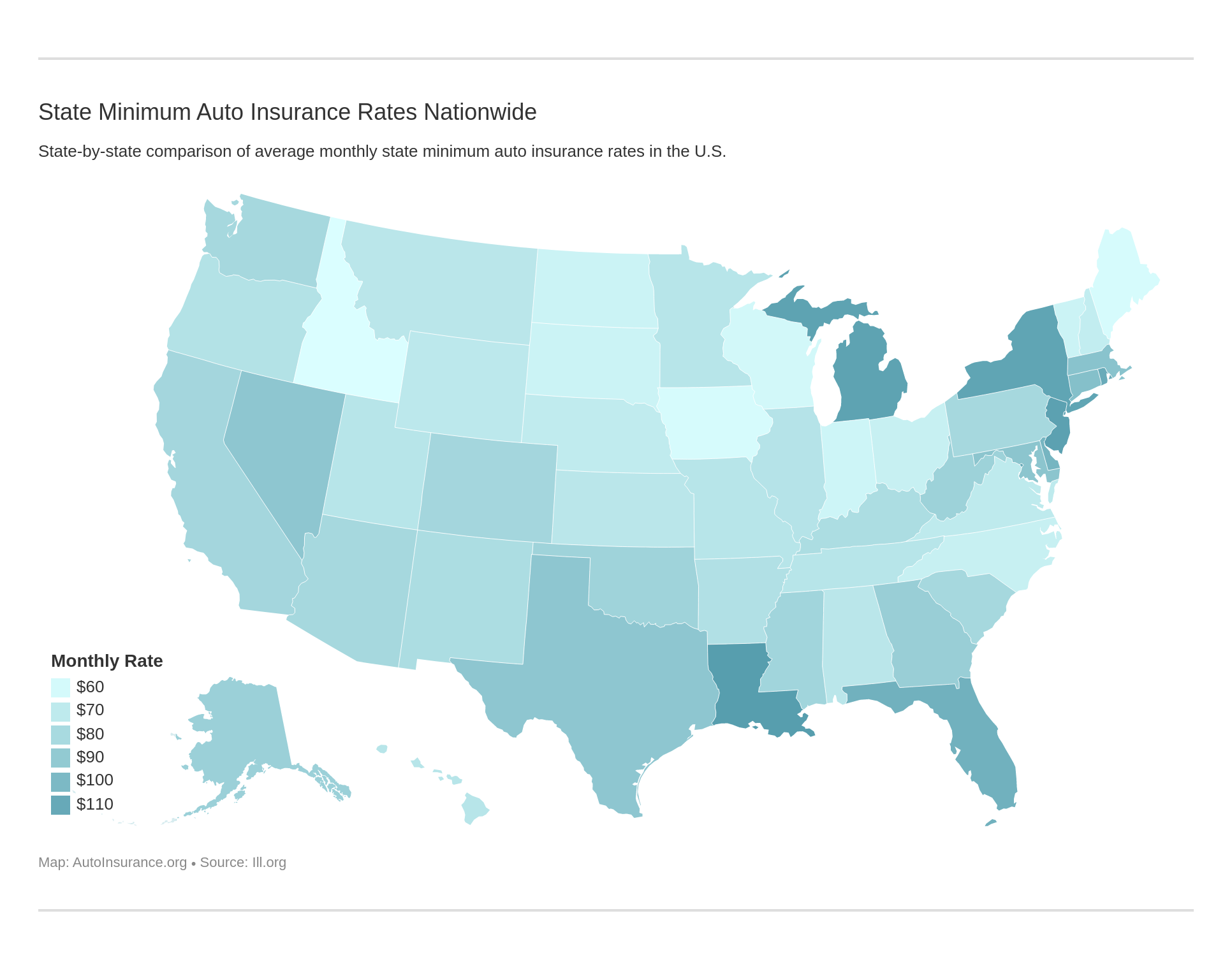

1,733 reviewsThe rates depend on where you live. For example, in Erie, you might pay as little as $45 a month, while in Philadelphia, the cost is higher at $107. These rates meet the PA liability insurance minimum, making sure you have the basic protection required by law. Affordable insurance doesn’t mean less protection.

Pennsylvania Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Allentown | $58 |

| Altoona | $46 |

| Bethlehem | $56 |

| Erie | $45 |

| Harrisburg | $63 |

| Lancaster | $53 |

| Philadelphia | $107 |

| Pittsburgh | $56 |

| Reading | $65 |

| Scranton | $52 |

| State College | $42 |

| Wilkes-Barre | $49 |

| York | $61 |

| Wilmington | $79 |

| Winston-Salem | $81 |

Companies like USAA, Geico, and Travelers offer plans that follow PA auto insurance requirements while keeping costs low. Policies must meet PA minimum auto insurance limits, which include coverage for injuries and property damage.

It’s smart to compare rates from these companies to find a plan that fits your budget and keeps you covered under Pennsylvania law.

Other Coverage Options to Consider in Pennsylvania

Pennsylvania’s minimum auto insurance requirements include liability and personal injury protection benefits, but there are other types of insurance available to drivers in this state as optional add-ons to your coverage. It is important that you understand what is covered by each insurance type before you make a final decision about how to set up your auto coverage.

- Collision Coverage: Collision auto insurance is not a state requirement, but it may be a lender requirement that applies to some drivers who have a car loan in place. In the event of a collision only, this coverage pays benefits to repair or replace your vehicle.

- Comprehensive Coverage: This is another type of insurance that may be a lender requirement, but it is not legally required by the state of Pennsylvania. Comprehensive auto insurance covers your own vehicle repair bills related to damage from a wide range of events, including criminal activities, accidents, and more.

- Uninsured and Underinsured Motorist Coverage: Pennsylvania drivers may also prefer to buy uninsured and underinsured motorist coverage, which is not required by the state. With this type of insurance included in your policy, you may receive financial benefits if you are involved in a collision with someone else who is not properly insured or who flees the scene.

When you request quotes for car insurance in Pennsylvania, you will need to specify the types of insurance that you want from the items listed above as well as a limit for each type.

Penalties for Driving Without Auto Insurance in Pennsylvania

In Pennsylvania, this kind of insurance is required by law, and drivers must always carry proof of active coverage with them.

If you fail to do so or are caught driving without the proper amount of auto insurance, you may face numerous penalties. These penalties for non-compliance of the state’s auto insurance requirements in Pennsylvania include:

- Impoundment of your car

- Suspension of your driver’s license and vehicle registration for up to three months

- A fine of at least $300

Keep in mind that a suspension of your vehicle’s registration means that nobody is permitted to drive the car until the registration is reinstated. Always ensure you meet the auto insurance requirements in Pennsylvania to avoid these serious penalties and stay legally protected.

Read more: When to Buy More Than Minimum Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Requirement vs. Recommended Coverage

Some drivers in Pennsylvania think their auto insurance will cover all expenses after an accident, but that’s not the case. The minimum car insurance requirements in Pennsylvania only cover basic liability, which means they help pay for damages or injuries you cause to others.

USAA returning an additional $280M to members, bringing total to $800M. Members will automatically receive a credit to their auto and property insurance account. There is no need to call and no additional action is required. Learn more at https://t.co/bsVE9jEOAw pic.twitter.com/15nLJW0TuO

— USAA (@USAA) May 1, 2020

The minimum auto insurance coverage in PA won’t cover your own car repairs or other costs if the accident is your fault. If your expenses go over the limits of your policy, you’ll have to pay the rest out of pocket. This is why relying on just PA state minimum auto insurance can leave you with big bills after an accident.

To protect yourself financially, it’s smart to consider more coverage than what the Pennsylvania car insurance requirements demand. Adding collision and comprehensive insurance, for example, can help pay for your car repairs, no matter who’s at fault.

Checking your policy and understanding what it does and doesn’t cover can save you from surprises later.

Read more: How much car insurance do I need?

How to Buy Cheap Auto Insurance in Pennsylvania

If you want to buy cheap auto insurance in Pennsylvania, the first thing is to understand the minimum car insurance in Pennsylvania and make sure you follow the state’s coverage laws.

One simple way to find good rates is by getting car insurance quotes online. Choose a few trustworthy insurance companies and check their financial stability and customer reviews. Picking a reliable company is important for when you need help down the road.

After that, decide how much coverage you want. Remember, the Pennsylvania auto insurance minimums are just the bare minimum the state requires. You might want more coverage to protect yourself if an accident happens.

If you use your vehicle for work, make sure you know about the Pennsylvania commercial auto insurance requirements to make sure you’re covered for business use. Comparing different companies’ quotes will help you find the best deal and keep you protected.

Read more: Do all vehicles have set auto insurance requirements?

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Frequently Asked Questions

What are the minimum auto insurance requirements in Pennsylvania?

In Pennsylvania, the minimum auto insurance requirements are as follows:

- $15,000 for bodily injury liability per person

- $30,000 for bodily injury liability per accident

- $5,000 for property damage liability per accident

What is bodily injury liability coverage?

Bodily injury liability coverage is insurance that helps cover the costs if you cause an accident and injure someone else. It provides financial protection for the other party’s medical expenses, lost wages, and other related damages up to the limits of your policy. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

What is property damage liability coverage?

Property damage liability coverage is insurance that pays for damages you cause to someone else’s property in an accident. This coverage helps cover the cost of repairing or replacing the damaged property, such as another vehicle, a fence, or a building.

Read more: Full Coverage Auto Insurance

Are the minimum requirements sufficient for all drivers?

While the minimum requirements meet the legal obligations in Pennsylvania, they may not provide adequate coverage for all drivers. It’s essential to evaluate your personal circumstances and consider additional coverage beyond the minimum to protect yourself financially in the event of an accident.

What are some additional types of coverage I should consider?

While not required by law, there are additional types of coverage you may want to consider for greater protection:

- Uninsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance.

- Underinsured Motorist Coverage: Provides coverage when you’re involved in an accident with a driver whose insurance limits are insufficient to cover your damages.

- Collision Coverage: Pays for the repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

What happens if I don’t meet the minimum insurance requirements?

Failing to meet the minimum insurance requirements in Pennsylvania can result in penalties and legal consequences. You may face fines, license suspension, and registration suspension. Additionally, if you cause an accident and don’t have sufficient insurance coverage, you may be personally liable for the damages you caused.

Read more: Can you get auto insurance with a suspended license?

Can I choose higher coverage limits than the minimum requirements?

Yes, you can choose to purchase higher coverage limits than the minimum requirements in Pennsylvania. Many drivers opt for higher limits to have better financial protection and peace of mind in case of an accident.

Where can I purchase auto insurance in Pennsylvania?

Auto insurance in Pennsylvania can be purchased from various insurance companies. You can contact insurance agents and brokers or directly reach out to insurance companies to obtain quotes and purchase a policy that suits your needs.

Do you need car insurance in PA?

Yes, car insurance is required in Pennsylvania. Drivers must maintain minimum auto insurance coverage to operate a vehicle legally. It is essential to carry the necessary insurance to avoid fines and legal issues.

Read more: Does a suspended license affect auto insurance rates?

What are the Pennsylvania auto insurance laws?

Pennsylvania auto insurance laws require drivers to have a minimum coverage of 15/30/5 for bodily injury and property damage liability, plus personal injury protection (PIP) for medical expenses.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.