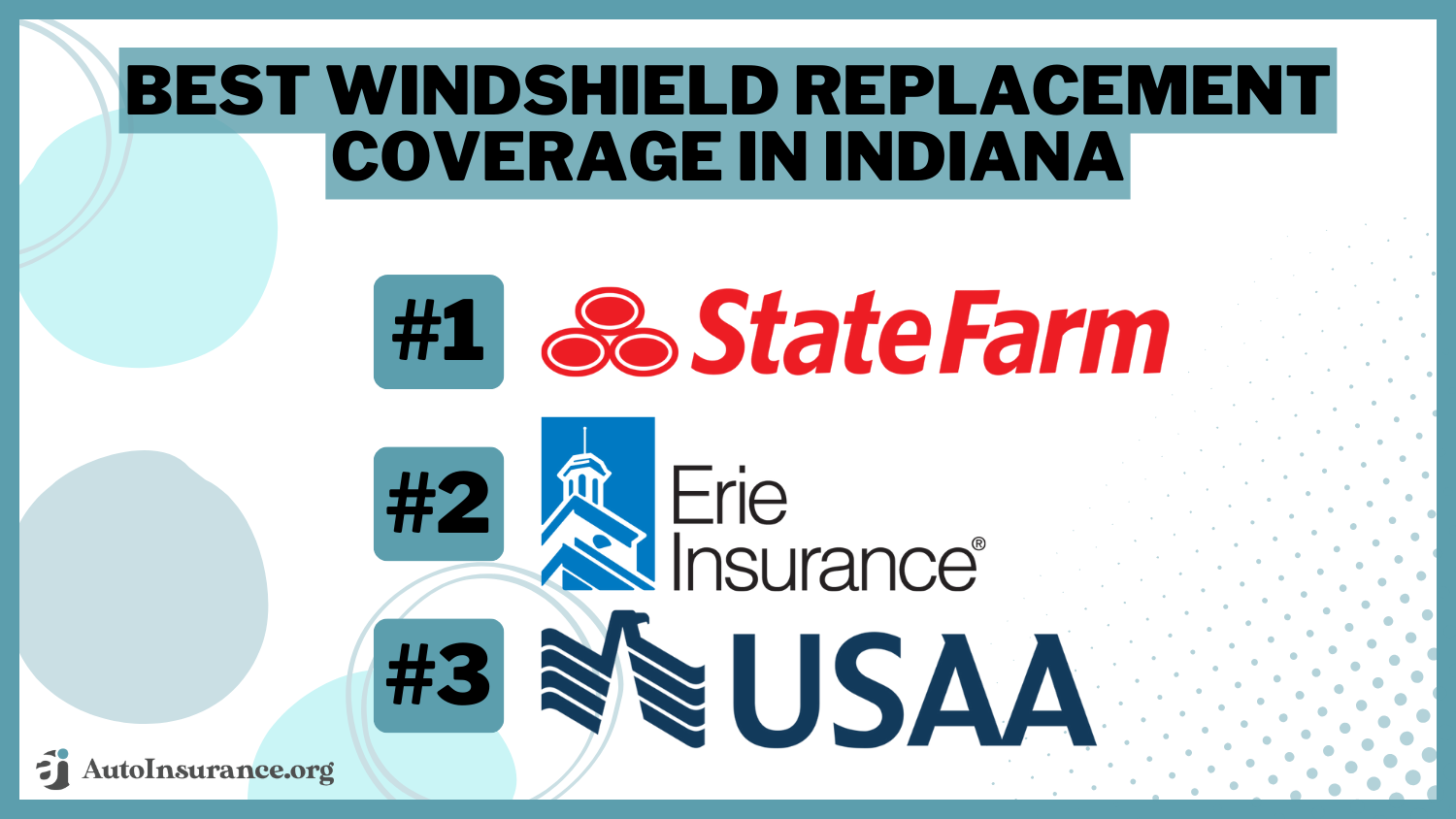

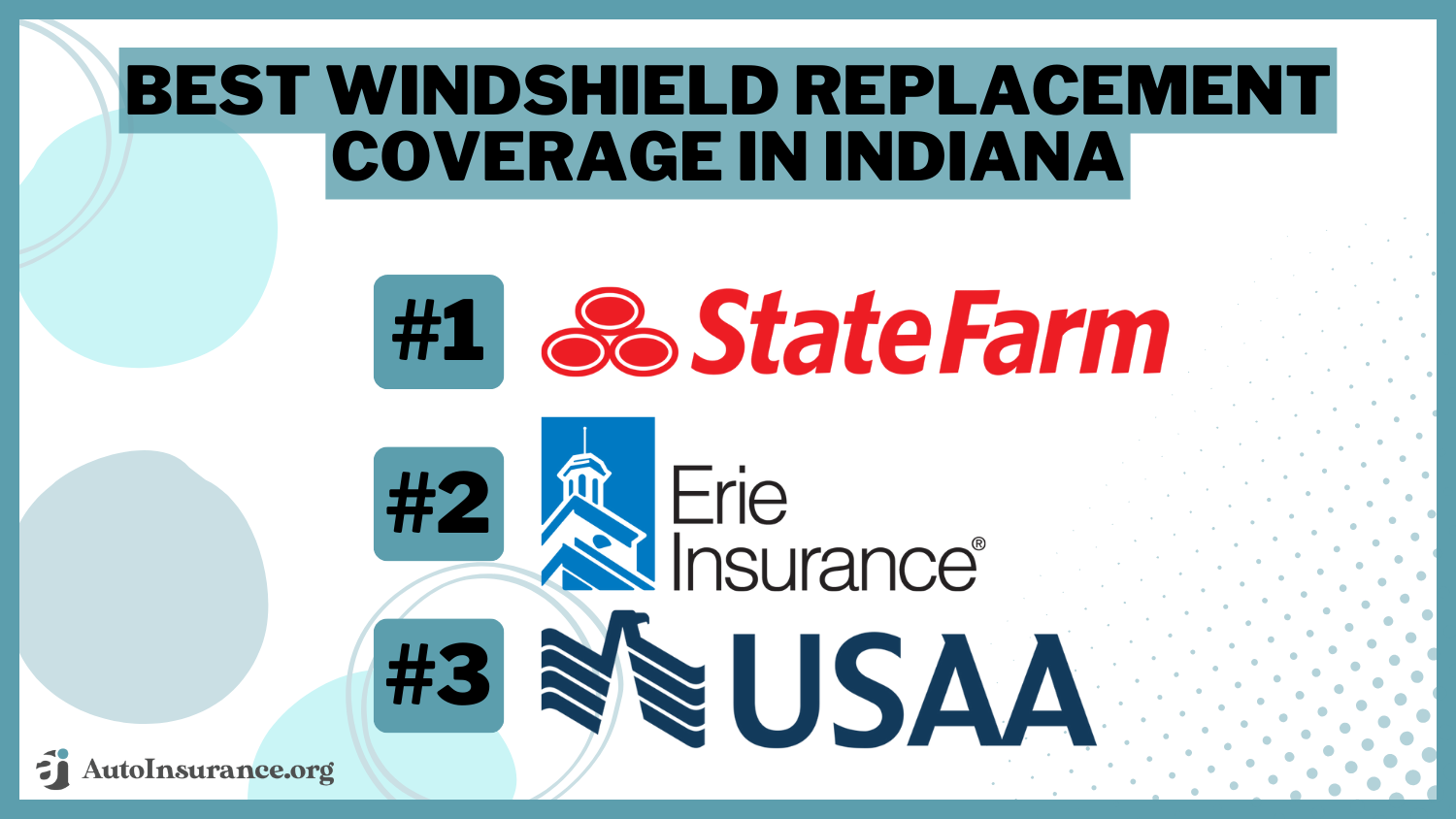

Best Windshield Replacement Coverage in Indiana (Top 10 Companies in 2026)

State Farm, Erie, and USAA provide the best windshield replacement coverage in Indiana, beginning at just $61 per month. Our goal is to help you compare quotes from these reputable insurers, ensuring you find the perfect coverage and take advantage of customized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Indiana

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage Windshield Replacement in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage Windshield Replacement in Indiana

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews- State Farm provides competitive rates starting at $61 per month

- Leading insurance providers offer options for windshield replacements

- Many discounts available for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Customer Service: State Farm has excellent reviews from customers, who say the claims handling process was smooth.

- Extensive Network: State Farm has a vast network of agents and service centers, making it convenient for customers to access support and assistance. Find out more in our State Farm auto insurance review.

- Customizable Coverage: State Farm offers a wide range of coverage options and discounts, allowing customers to tailor their policies to their specific needs.

Cons

- Higher Premiums: While State Farm provides excellent coverage, its premiums may be higher compared to some other insurers.

- Limited Availability: State Farm’s coverage may not be available in all areas, limiting options for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- Excellent Customer Service: Erie is well-regarded for its exceptional customer service, with representatives known for their responsiveness and helpfulness.

- Competitive Rates: Erie often offers competitive rates, making it an attractive option for budget-conscious customers.

- Add-On Coverages: Erie provides a variety of additional coverages and discounts, allowing customers to enhance their policies as needed.

Cons

- Limited Availability: Erie’s coverage is only available in select states, which may restrict options for some customers. Find out more using our Erie auto insurance review.

- Coverage Options: While Erie offers solid coverage options, it may not have as many add-ons or customization options as some larger insurers.

#3 – USAA: Best for Military Savings

Pros

- Military-Focused: USAA caters specifically to military members and their families, offering unique benefits and support tailored to their needs.

- Strong Financial Ratings: USAA consistently receives high financial strength ratings, providing reassurance to customers about its stability. Find out more through our USAA auto insurance review.

- Member Discounts: USAA offers various discounts and benefits exclusively for its members, helping them save on premiums and other services.

Cons

- Membership Restrictions: USAA membership is limited to military members, veterans, and their families, excluding others from accessing its services.

- Limited Physical Locations: USAA primarily operates online and through phone services, which may be a drawback for customers who prefer in-person interactions.

#4 – Progressive: Best for Online Convenience

Pros

- User-Friendly Technology: In our Progressive auto insurance review, Progressive offers innovative online tools and mobile apps that make it easy for customers to manage their policies and file claims.

- Bundling Discounts: Progressive provides significant discounts for customers who bundle multiple insurance policies such as auto and home insurance.

- Name Your Price Tool: Progressive’s Name Your Price tool allows customers to customize their coverage based on their budget, providing flexibility and transparency.

Cons

- Average Customer Service: While Progressive offers convenient online services, some customers have reported mixed experiences with its customer service representatives.

- Limited Agent Availability: Progressive primarily operates online, which may be a disadvantage for customers who prefer face-to-face interactions with agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Nationwide Network: Nationwide has a vast network of agents and service centers across the country, making it convenient for customers to access support and assistance.

- Multi-Policy Discounts: Nationwide offers discounts for customers who bundle multiple insurance policies, such as auto, home, and life insurance.

- Variety of Coverage Options: Nationwide provides a wide range of coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

Cons

- Mixed Customer Reviews: Nationwide has received mixed reviews regarding its customer service and claims handling, with some customers reporting dissatisfaction.

- Premiums May Be Higher: While Nationwide offers comprehensive coverage options, its premiums may be higher compared to some other insurers. Read more through our Nationwide auto insurance review.

#6 – Farmers: Best for Local Agents

Pros

- Personalized Service: Farmers has a network of local agents who provide personalized service and guidance to customers, helping them find the right coverage options.

- Range of Discounts: Farmers offers various discounts for factors such as safe driving, bundling policies, and loyalty, helping customers save on premiums.

- Strong Financial Stability: Farmers has a strong financial stability rating, providing reassurance to customers about its ability to cover claims.

Cons

- Limited Online Tools: Farmers’ online tools and mobile apps may not be as advanced or user-friendly as those offered by some other insurers. Seek for more guide through our Farmers auto insurance review.

- Coverage Options: While Farmers offers solid coverage options, it may not have as many add-ons or customization options as some larger insurers.

#7 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico is known for offering competitive rates, making it an attractive option for budget-conscious customers.

- Convenient Online Services: Geico provides user-friendly online tools and mobile apps that make it easy for customers to manage their policies, file claims, and access support.

- Wide Range of Discounts: Geico offers various discounts for factors such as safe driving, vehicle safety features, and bundling policies, helping customers save on premiums.

Cons

- Limited Agent Interaction: Geico primarily operates online and through phone services, which may be a drawback for customers who prefer in-person interactions with agents. Use our Geico auto insurance review as your guide.

- Mixed Customer Service Reviews: While Geico offers convenient online services, some customers have reported mixed experiences with its customer service representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Name Recognition: Allstate is a well-known and reputable insurance provider with a long history in the industry, providing customers with a sense of trust and reliability.

- Wide Range of Coverage Options: Allstate offers a comprehensive selection of coverage options and add-ons, allowing customers to customize their policies to suit their individual needs.

- Innovative Technology: Allstate provides innovative online tools and mobile apps that make it easy for customers to manage their policies, file claims, and access support.

Cons

- Higher Premiums: While Allstate offers comprehensive coverage options, its premiums may be higher compared to some other insurers. Use our Allstate auto insurance review as your guide.

- Mixed Customer Reviews: Allstate has received mixed reviews regarding its customer service and claims handling, with some customers reporting dissatisfaction.

#9 – American Family: Best for Student Savings

Pros

- Personalized Service: American Family has a network of local agents who provide personalized service and guidance to customers, helping them find the right coverage options.

- Variety of Discounts: American Family offers a wide range of discounts for factors such as safe driving, bundling policies, and loyalty, helping customers save on premiums.

- Community Involvement: American Family is known for its community involvement and philanthropic efforts, giving customers a sense of supporting a socially responsible company.

Cons

- Limited Availability: American Family’s coverage may not be available in all areas, limiting options for some customers. Find out more through our American Family auto insurance review.

- Mixed Customer Reviews: American Family has received mixed reviews regarding its customer service and claims handling, with some customers reporting dissatisfaction.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Strong Financial Stability: Our Travelers auto insurance review reveals that Travelers has a strong financial stability rating, providing reassurance to customers about its ability to cover claims.

- Range of Discounts: Travelers offers various discounts for factors such as safe driving, vehicle safety features, and bundling policies, helping customers save on premiums.

- Comprehensive Coverage Options: Travelers provides a wide range of coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

Cons

- Limited Availability: Travelers’ coverage may not be available in all areas, limiting options for some customers.

- Mixed Customer Reviews: Travelers has received mixed reviews regarding its customer service and claims handling, with some customers reporting dissatisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Glass Insurance Coverage and Replacement

Filing a Glass Replacement Claim

Damaged Windshield

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Affordable Way to Replace or Repair a Damaged Windshield

Indiana’s Full Glass Coverage Laws: Bottom Line

Frequently Asked Questions

Does auto insurance in Indiana cover windshield replacement?

Yes, most comprehensive auto insurance policies in Indiana cover windshield replacement as part of their coverage.

What is comprehensive auto insurance?

Comprehensive auto insurance is an optional coverage that protects your vehicle from damage caused by non-collision incidents, such as theft, vandalism, fire, and falling objects. It typically includes coverage for windshield damage. Enter your ZIP code now to start.

Is windshield replacement covered under liability insurance?

No, windshield replacement is not typically covered under liability auto insurance. Liability insurance covers the damage you cause to other vehicles and property in an accident.

Are there any specific requirements for windshield replacement coverage in Indiana?

While there are no specific requirements for windshield replacement coverage in Indiana, it is recommended to review your policy or contact your insurance provider to understand the details of your coverage.

Will I have to pay a deductible for windshield replacement claims?

The deductible for windshield replacement claims may vary depending on your insurance policy. Some policies have a separate deductible for glass-related claims, while others may require you to pay the standard comprehensive deductible. Enter your ZIP code now to start.

Which insurance provider offer the best windshield replacement coverage in Indiana?

What are some key factors to consider when comparing windshield replacement coverage options in Indiana?

Some key factors to consider when comparing windshield replacement coverage options in Indiana include the cost of premiums, the extent of coverage provided, the insurer’s financial stability, and any available discounts or add-on coverages.

Does Indiana mandate free windshield replacement in comprehensive coverage policies?

No, Indiana does not mandate free windshield replacement in comprehensive coverage policies. While some policies may include windshield coverage, there are no statewide mandates for free replacement when the windshield is damaged. Enter your ZIP code now to begin.

What types of damages are typically covered by comprehensive auto insurance policies?

How do insurers like State Farm, Erie, and USAA stand out in terms of windshield replacement coverage options in Indiana?

State Farm, Erie, and USAA stand out for their competitive rates, extensive coverage options, and customizable discounts tailored to individual driving needs, according to the article.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.