How Tariffs Impact Auto Insurance Rates in 2026 (Stats Here!)

Tariffs impact auto insurance rates by driving up the cost of vehicle repairs, car parts, and replacements. Insurers raise premiums to cover higher claim payouts and offset inflation. Tariffs could raise car insurance rates by about 9%, especially for newer or imported vehicles.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated June 2025

Wondering how tariffs impact auto insurance rates? Auto tariffs drive up the cost of imported cars and vehicle parts, which in turn increases the cost of repairs and payouts for totaled cars.

With higher claim costs, auto insurance rates may go up for cars affected by tariffs, even if you’re with one of the cheapest auto insurance companies.

- Tariffs raise repair costs, which may hike insurance rates by 9%

- SUVs will likely have the highest tariff cost increase

- Tesla is the brand least likely to be affected by tariff increases

Read on to learn more about your auto insurance cost after tariffs and how to mitigate cost increases. Need to find cheaper insurance for your vehicle today? Compare rates with our free quote tool.

Why Tariffs Could Drive Car Insurance Rates Up

Tariffs are taxes placed on foreign goods by the government, driving up the prices of imported products. In 2025, President Donald Trump enacted new tariffs that increased costs for automakers importing cars and parts.

With repair and replacement costs going up, insurers may pass those expenses on to drivers through higher auto insurance premiums. Take a look at the table below to see the rising policy costs by state due to tariffs.

Full Coverage Auto Insurance Monthly Rates Before and After Tariffs

| State | Before Tariffs | After Tariffs | % Increase |

|---|---|---|---|

| Alabama | $194 | $215 | 11% |

| Alaska | $197 | $225 | 14% |

| Arizona | $214 | $226 | 6% |

| Arkansas | $217 | $227 | 5% |

| California | $217 | $227 | 5% |

| Colorado | $159 | $173 | 9% |

| Connecticut | $233 | $248 | 6% |

| Delaware | $171 | $187 | 9% |

| Florida | $186 | $204 | 10% |

| Georgia | $237 | $264 | 11% |

| Hawaii | $220 | $245 | 11% |

| Idaho | $238 | $252 | 6% |

| Illinois | $238 | $257 | 8% |

| Indiana | $162 | $182 | 12% |

| Iowa | $208 | $219 | 5% |

| Kansas | $215 | $226 | 5% |

| Kentucky | $189 | $206 | 9% |

| Louisiana | $237 | $256 | 8% |

| Maine | $196 | $209 | 7% |

| Maryland | $238 | $254 | 7% |

| Massachusetts | $231 | $252 | 9% |

| Michigan | $187 | $211 | 13% |

| Minnesota | $175 | $203 | 16% |

| Mississippi | $227 | $237 | 4% |

| Missouri | $222 | $246 | 11% |

| Montana | $159 | $172 | 8% |

| Nebraska | $170 | $192 | 13% |

| Nevada | $168 | $182 | 9% |

| New Hampshire | $184 | $204 | 10% |

| New Jersey | $204 | $220 | 8% |

| New Mexico | $210 | $229 | 9% |

| New York | $210 | $225 | 7% |

| North Carolina | $194 | $209 | 8% |

| North Dakota | $179 | $191 | 7% |

| Ohio | $160 | $170 | 6% |

| Oklahoma | $199 | $213 | 7% |

| Oregon | $179 | $197 | 10% |

| Pennsylvania | $169 | $193 | 14% |

| Rhode Island | $169 | $194 | 15% |

| South Carolina | $164 | $177 | 8% |

| South Dakota | $189 | $214 | 13% |

| Tennessee | $182 | $205 | 13% |

| Texas | $215 | $241 | 12% |

| Utah | $159 | $186 | 17% |

| Vermont | $207 | $222 | 7% |

| Virginia | $182 | $201 | 10% |

| Washington | $181 | $194 | 7% |

| Washington, D.C. | $198 | $213 | 8% |

| West Virginia | $224 | $234 | 4% |

| Wisconsin | $173 | $188 | 9% |

| Wyoming | $185 | $195 | 5% |

| U.S. Average | $202 | $220 | 9% |

In addition to the state you live in, the amount that insurance will increase also depends on the type of vehicle you drive.

Pre & Post Tariff Auto Insurance Monthly Rates by Vehicle

| Vehicle Type | Before Tariffs | After Tariffs | % Increase |

|---|---|---|---|

| SUV | $160 | $188 | 19% |

| Electric Car | $245 | $284 | 16% |

| Hybrid Car | $221 | $243 | 10% |

| Pickup Truck | $220 | $242 | 10% |

| Midsize Sedan | $158 | $170 | 8% |

| Luxury Car | $223 | $237 | 6% |

| Economy Car | $257 | $269 | 5% |

When you look at the auto insurance cost after tariffs by vehicle, SUVs have the largest increase in insurance costs, while economy cars will be affected the least by rising tariffs.

Let’s take a deeper look at how tariffs can impact your auto insurance costs, from higher repair costs to supply chain disruptions.

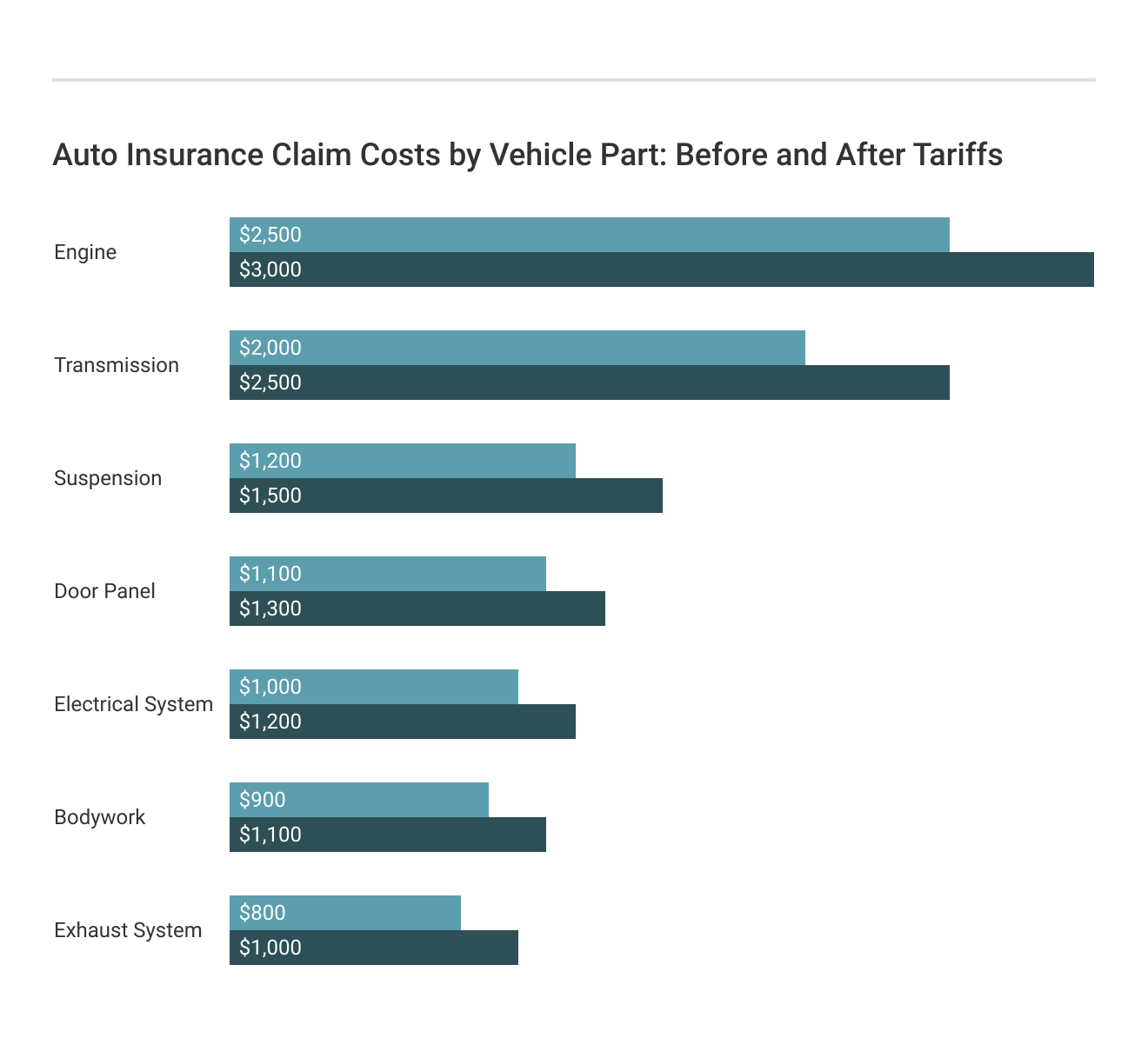

Higher Repair Costs as Part Prices Rise

Tariffs will drive up manufacturing costs, with manufacturers having to pay more to import auto parts. While you will always see some price increases over the years for auto parts due to inflation, increased manufacturer costs from tariffs will likely drive up the cost noticeably.

Take a look at how tariffs can affect claim costs for different vehicle parts below.

How does this affect insurance rates? Increased auto part costs will result in higher repair costs at shops, especially if you are choosing original equipment manufacturer parts for your vehicle repairs (Learn More: Best Auto Insurance Companies That Offer OEM Parts Coverage).

With the cost of parts increasing, insurance companies will have to pay more for vehicle repairs.

Since your insurance company is the one paying for repairs in a covered claim, increasing repair costs could cause insurance companies to increase rates to offset any future financial losses from more expensive claims.

More Vehicles Could Be Declared Total Losses

If repair costs become too high due to tariffs increasing the cost of repair parts and vehicles in general, insurance companies may start changing their total loss thresholds and declaring more damaged cars total losses.

This is because it is more cost-effective for a company to declare a totaled car a total loss than pay to fix it, but it forces customers to buy a new vehicle sooner than expected.

In these cases, insurance companies will pay you the actual cash value (ACV) of your vehicle, which is the depreciated value of your vehicle.

If you have a new car and want to receive more than the AVC if you total your car, then you will need to buy new car replacement coverage or gap insurance. And with the expected increased cost of repairs, you may have higher rates on these coverages.

Learn More: What happens if you total your car with no insurance?

Higher Car Prices Could Mean Larger Insurance Payouts

If you are wondering, “will Trump tariffs affect car prices?” The answer is yes. Higher tariffs equal higher sticker prices on vehicles.

Manufacturers who have to pay more to import cars or parts to the U.S. will have to raise the MSRP to avoid losses.Dani Best Licensed Insurance Producer

Increased manufacturer’s suggested retail price (MSRP) means that insurance companies may therefore raise the cost of auto insurance premiums because they will have to pay out larger insurance payouts in claims, even after taking into account depreciation over time.

Supply Chain Disruptions Could Delay Repairs

Another way insurance costs may increase due to tariffs is due to supply chain disruptions, as manufacturers scramble to find cost-effective ways to still produce their vehicles and procure parts. Users on Reddit are already worrying that this could lead to more totaled vehicles, rather than companies waiting for repair parts.

Some manufacturers may be trying to move manufacturing locally or find somewhere else to import parts from. However, insurance companies may be stuck paying out more for replacement vehicles to customers with rental car insurance while cars sit in the shop waiting for back-ordered parts.

Repair delays from parts shortages from tariffs could therefore raise your insurance costs if you add on extra types of auto insurance like rental car replacement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Soon Insurance Rates Could Rise After Tariffs Take Effect

Wondering when will my insurance go up? With tariffs going into effect in early 2025, you will likely see insurance rate hikes in 2025 at your next insurance renewal.

While you won't see an increase in insurance tariff rates immediately on your bill, you will likely be quoted a higher rate at your next renewal.Daniel Walker Licensed Insurance Agent

Car tariff insurance costs will affect every driver differently, depending on several car insurance factors affecting price.

For example, drivers in some states will have lower insurance costs, even with tariffs increasing the prices, as car insurance is cheaper in their state (Learn More: Auto Insurance Rates by State).

Drivers Most Likely to See Higher Insurance Costs

Drivers who own imported cars could see higher insurance rates on their luxury car insurance, as tariffs raise the cost of repair parts (Read More: Best Auto Insurance for Luxury Cars). Owners of car brands who depend on their production in Mexico and Canada will also likely see higher insurance costs.

The type of vehicle you purchase matters to your insurance provider.🤯 Save money and compare rates today on our site🤑: https://t.co/27f1xf131D. Find vehicles that are cheaper to insure than others🤩: https://t.co/heKtRZ8iKT. pic.twitter.com/7tY0RV4zDl

— AutoInsurance.org (@AutoInsurance) March 15, 2023

Some brands that are most likely to be affected by the Mexico tariffs, as about half of their manufacturing for popular models is done in Mexico, include:

- Audi

- BMW

- Chevrolet

- Ford

Brands that will be affected the most by Canada tariffs include Honda and Toyota. If you own a car brand that will be affected heavily by tariff increases, you can expect an increase in insurance costs as repair costs shoot up.

Ways to Limit Car Insurance Rate Increases From Tariffs

Now that you know the answer to “how soon will I pay more?” you probably want to know what you can do to reduce the effect tariffs will have on your car insurance costs. While you can’t control some of the non-driving factors that affect auto insurance rates, like tariffs, there are some ways to save on car insurance.

- Compare Quotes: Get quotes from different companies in your area to see which one offers the best deal (Read More: How to Get Multiple Auto Insurance Quotes).

- Discounts: See which of the best auto insurance discounts your insurance provider offers, such as a bundling discount.

- Drive Safely: The better you drive, the lower your auto insurance costs will be due to good driver discounts (Learn More: Best Auto Insurance for Good Drivers).

- Cut Coverages: Check to see if there are any cost-cutting coverage options, such as dropping types of auto insurance like rental car reimbursement.

- Raise Deductible: Raising your auto insurance deductibles will lower rates; just make sure it’s an amount you can still pay out of pocket.

One of the best tips we have for lowering your auto insurance, however, is to shop around for quotes frequently. Insurance companies are always competing with each other to score customers, which means that they frequently offer deals for potential customers.

Enter your ZIP code in our free quote tool to find out which insurance company in your area offers the cheapest car insurance.

Frequently Asked Questions

How much will tariffs increase car insurance rates?

Tariffs will increase car insurance rates by an average of 9% across the U.S.

Why do tariffs impact car insurance rates?

Because tariffs will increase the cost of vehicles and parts, insurance companies will have to pay more for repairs or totaled cars. Insurance companies will have to raise rates to offset the financial losses of these claims. Shop for affordable car insurance today with our free quote tool.

When could tariffs start impacting my auto insurance rates?

With tariffs going into effect in April 2025 and beyond, customers can expect to see rate increases at their next renewal in 2025 (Read More: Why do my auto insurance rates go up every year?).

How do auto parts affect car insurance rates?

More expensive auto parts mean more expensive repair bills. Insurance companies will have to pay out more in covered claims for repairs, which could result in a rate hike.

Are some states more likely to see higher insurance rate increases from tariffs?

Yes, some states are more likely to see a higher insurance rate increase from tariffs, with Minnesota having a 16% increase in insurance rates from tariffs. Rhode Island has the second-largest increase of 15%.

Which vehicles could see the most impact from tariffs?

SUVs will see the most impact from tariffs, with rates rising an estimated 19% (Learn More: Auto Insurance Rates by Vehicle Make and Model).

How much will car prices go up with tariffs?

It depends on what type of car it is and the affordability of the vehicle, but tariffs could increase vehicle costs by thousands.

What car brands are not affected by tariffs?

Almost all car brands will be affected by tariffs unless every single part of the vehicle is made in the U.S. However, some brand models, like the Honda Passport, Tesla Model 3, or Ford Mustang GT, have most of their parts made predominantly in the U.S., so they will likely see the lowest price increases from tariffs.

Does Tesla benefit from tariffs?

Yes, Tesla will likely benefit from tariffs, as most of its cars are already procured domestically. While other car brands deal with higher import and manufacturing costs, driving up the cost of their product, Tesla will likely be able to keep its vehicle and insurance prices the same (Read More: Tesla Auto Insurance Review).

Which automakers will be affected by tariffs?

Audi, BMW, Chevrolet, Ford, Honda, and Toyota are automakers that produce several of their popular cars in Mexico or Canada and will be affected by tariffs.

Should I buy a new car now before tariffs take effect?

Do imported cars have higher insurance rates?

Does inflation affect car insurance rates?

How are tariffs going to affect car prices?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.