Best California Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Progressive, State Farm, and Nationwide offer the best California auto insurance, with rates starting at $55 per month for minimum coverage. These companies excel in affordability, comprehensive coverage, and customer service, making them top choices for reliable and cost-effective California auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated September 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe top picks overall for the best California auto insurance are Progressive, State Farm, and Nationwide, offering rates starting at $55 per month. These companies excel in affordability, comprehensive coverage, and customer service, making them ideal for California drivers.

With higher traffic and repair costs in the state, comparing quotes from these top providers ensures the best rates and protection. Explore the various options and find the best coverage for your needs today.

Our Top 10 Company Picks: Best California Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

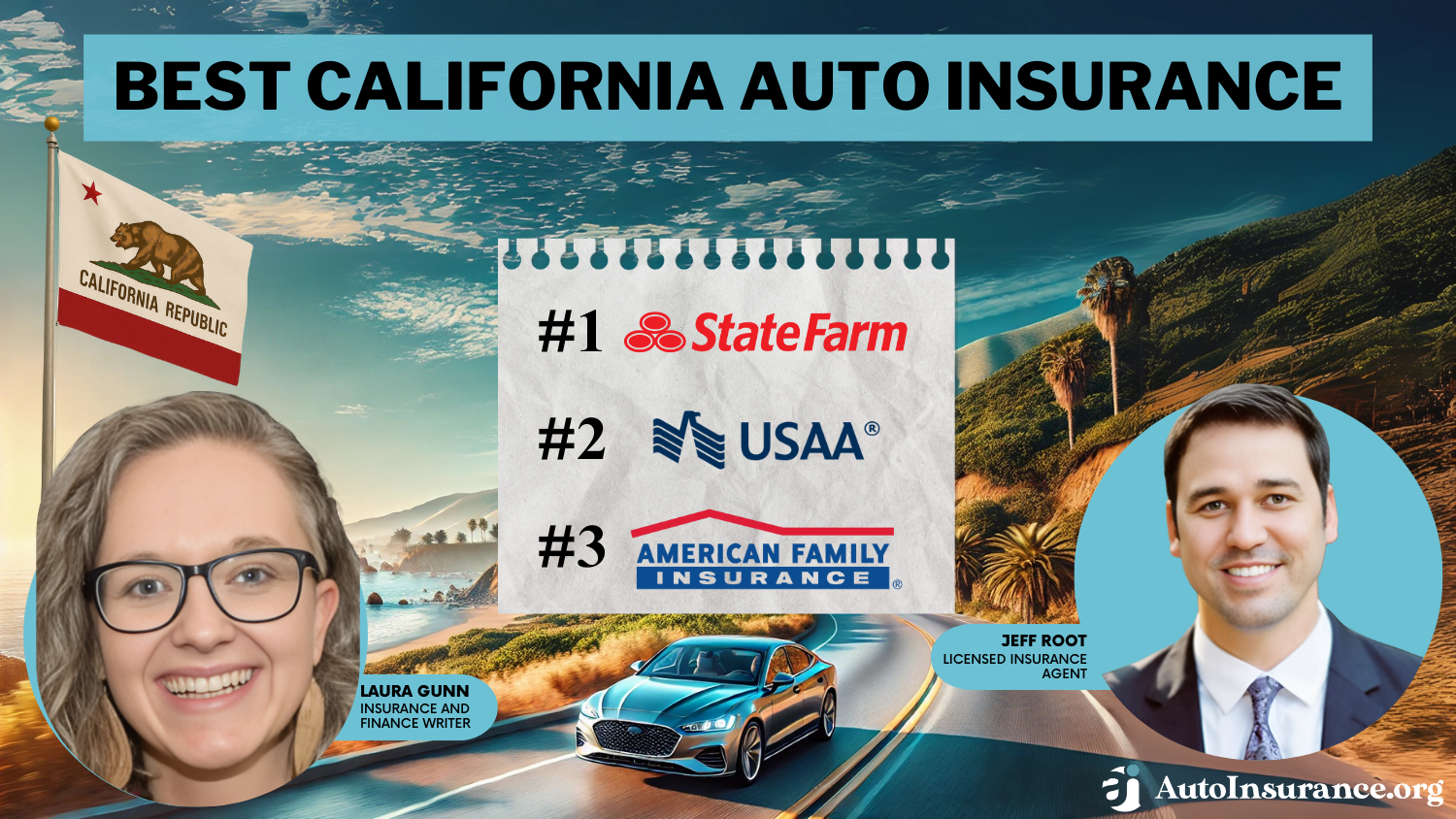

| #1 | 15% | A++ | Many Discounts | State Farm | |

| #2 | 15% | A++ | Military Savings | USAA | |

| #3 | 15% | A | Student Savings | American Family |

| #4 | 13% | A+ | Add-on Coverages | Allstate | |

| #5 | 10% | A+ | Online Convenience | Progressive | |

| #6 | 10% | A++ | Cheap Rates | Geico | |

| #7 | 10% | A++ | Accident Forgiveness | Travelers | |

| #8 | 10% | A | Local Agents | Farmers | |

| #9 | 10% | A | Customizable Polices | Liberty Mutual |

| #10 | 8% | A+ | Usage Discount | Nationwide |

Drivers in the Golden State can find the cheapest car insurance in California by comparing rates from the best auto insurance companies. There are many factors that affect auto insurance rates, but these companies generally offer the best car insurance in California.

- California Auto Insurance

- Cheap Gap Insurance in California (10 Most Affordable Companies for 2026)

- Cheap Auto Insurance for High-Risk Drivers in California (Find Savings With These 10 Companies in 2026)

- Cheapest Teen Driver Auto Insurance in California for 2026 (Save With These 10 Companies)

- Auto Insurance Companies Denying Coverage in California (2026 Update)

- California SR-22 Auto Insurance (2026)

- Best Los Angeles, California Auto Insurance in 2026

- Best Santa Cruz, California Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Sacramento, California Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Rowland Heights, California Auto Insurance in 2026

- Best Roseville, California Auto Insurance in 2026

- Best Riverside, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Redding, California Auto Insurance in 2026

- Best Palo Alto, California Auto Insurance in 2026

- Best Palm Springs, California Auto Insurance in 2026

- Best Orland, California Auto Insurance in 2026

- Best Moreno Valley, California Auto Insurance in 2026

- Best Milpitas, California Auto Insurance in 2026

- Best Madera, California Auto Insurance in 2026

- Best Ivanhoe, California Auto Insurance in 2026

- Best Hemet, California Auto Insurance in 2026

- Best El Cajon, California Auto Insurance in 2026

- Best Eastvale, California Auto Insurance in 2026

- Best Camarillo, California Auto Insurance in 2026

- Best Burbank, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Bellflower, California Auto Insurance in 2026 (Find the Top 10 Companies Here)

- Best Anaheim, California Auto Insurance in 2026 (Top 10 Companies Ranked)

- Best Alameda, California Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Pomona, California Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Salinas, California Auto Insurance in 2026

- Best Palmdale, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Escondido, California Auto Insurance in 2026

- Best Elk Grove, California Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Modesto, California Auto Insurance in 2026

- Best Fremont, California Auto Insurance in 2026

- Best Glendale, California Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Oceanside, California Auto Insurance in 2026

- Best Garden Grove, California Auto Insurance in 2026 (Cash Savings With These 10 Companies)

- Best San Bernardino, California Auto Insurance in 2026

- Best San Francisco, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best San Diego, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- Progressive stands out as the best California auto insurance

- California drivers face higher insurance rates due to traffic, theft, and repair costs

- Compare quotes to get the most affordable and comprehensive coverage

#1 – Progressive: Top Overall Pick

Pros

- User-Friendly Online Platform: Progressive offers a highly convenient and intuitive online platform for policy management and claims.

- Snapshot Program: Their Snapshot program rewards safe driving with potential discounts.

- Customizable Policies: Progressive auto insurance review allows for extensive customization of policies to fit individual needs.

Cons

- Customer Service: Some customers report less satisfactory experiences with customer service compared to other providers.

- High Rates for High-Risk Drivers: Progressive’s rates can be higher for those with poor driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Many Discounts

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm auto insurance review highlights that it provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Premiums might still be relatively higher for certain coverage levels despite discounts.

#3 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: Nationwide auto insurance review showcases a significant discounts based on safe driving habits through the SmartRide program.

- Vanishing Deductible: Deductible decreases over time with a good driving record.

- Comprehensive Coverage Options: Provides a wide array of coverage options, including unique add-ons.

Cons

- Lower Multi-Vehicle Discount: Offers a lower discount for insuring multiple vehicles compared to other companies.

- Price: Can be more expensive for some drivers, particularly those with less than perfect records.

#4 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico is known for offering some of the lowest rates in the industry.

- Easy Online Quotes: Geico auto insurance review provides a quick and easy online quote process.

- Wide Range of Discounts: Offers a variety of discounts, including for good drivers, students, and federal employees.

Cons

- Customer Support: Limited in-person support since most services are online.

- Claims Process: Some customers report a less-than-satisfactory experience with the claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness to help prevent premium increases after the first accident.

- Good Payer Discount: Discounts for paying on time and in full.

- Extensive Coverage Options: Provides a wide range of customizable coverage options.

Cons

- Higher Premiums: Generally higher premiums compared to other insurers.

- Customer Service: Mixed reviews on customer service responsiveness and effectiveness.

#6 – American Family: Best for Student Savings

Pros

- Generous Student Discounts: Offers substantial discounts for students with good grades.

- Teen Safe Driver Program: Program designed to help teen drivers stay safe and earn discounts.

- Wide Variety of Coverage Options: American Family auto insurance review has extensive range of policy options and add-ons.

Cons

- Availability: Limited availability in certain states.

- Higher Rates for Some: Higher premiums for non-student drivers or those without discounts.

#7 – Farmers: Best for Local Agents

Pros

- Personalized Service: Offers a network of local agents providing personalized service.

- Extensive Coverage Options: In examining a Farmers auto insurance review, it has a wide variety of coverage options, including unique policies like Farmers’ Rideshare Insurance.

- Accident Forgiveness: Provides accident forgiveness options.

Cons

- Higher Premiums: Can be more expensive than some other insurers.

- Discounts: Some discounts are not as generous compared to other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: Offers exclusive discounts for military members and their families.

- Exceptional Customer Service: Highly rated for customer service and satisfaction.

- Comprehensive Coverage: USAA auto insurance review provides a wide range of coverage options, tailored to the needs of military personnel.

Cons

- Eligibility: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer physical branch locations compared to other insurers.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Coverage Options: Allows extensive customization of policies to meet individual needs.

- Accident Forgiveness: Includes accident forgiveness as a standard feature.

- New Car Replacement: Offers new car replacement if your car is totaled within the first year.

Cons

- Higher Premiums: Tends to have higher premiums, especially for full coverage.

- Mixed Reviews: Mixed customer reviews regarding claims handling and customer service.

#10 – Allstate: Best for Add-On Coverages

Pros

- Comprehensive Add-Ons: In an Allstate auto insurance review, a variety of add-on coverages like rental reimbursement and roadside assistance.

- Drivewise Program: Rewards safe driving with discounts through the Drivewise program.

- Multiple Discount Options: Provides several discount options, including multi-policy and new car discounts.

Cons

- Premium Costs: Can be on the higher end compared to competitors.

- Claims Process: Some customers report a slower claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest California Auto Insurance Companies

As the third-largest state in the country, there are many CA auto insurance companies offering coverage to the state’s nearly 40 million residents. However, not all companies offer affordable insurance rates in the Golden State.

The cheapest insurance companies in California tend to be Wawanesa, Progressive, Geico, State Farm, and Mercury auto insurance. However, insurance companies base your rates on many factors, so it’s possible to find lower rates elsewhere.

You can explore the average cost of California car insurance below, but remember that your rates might be different. Factors like age, your driving record, and ZIP code make your rates higher or lower. You can find out more about the best auto insurance by age before buying a policy.

Read More: Auto Insurance Companies Pulling Out of California

California Auto Insurance Costs

Unfortunately for Californians, cheap car insurance is more difficult to find than in other states. The average California driver can pay up to 24% more for car insurance than the national average.

How much is car insurance in California? Californians can expect to pay about $56 a month for minimum insurance and $207 for full coverage.

California Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $102 | $312 | |

| $71 | $216 |

| $85 | $261 | |

| $51 | $157 | |

| $110 | $338 |

| $73 | $223 | |

| $68 | $207 | |

| $55 | $169 | |

| $63 | $192 | |

| $38 | $116 |

Why do Californians pay more for car insurance? There are several reasons for increased rates, including the following:

- Population density and heavy traffic

- Natural disasters, including wildfires and earthquakes

- Rising healthcare costs

- Expensive car repairs

- Uninsured drivers

- High rates of theft and vandalism

Your location plays an integral role in your insurance rates. For example, residents of Mount Shasta have some of the cheapest rates in the state, while Los Angeles and San Francisco residents see higher prices. It’s still possible to find cheap auto insurance in San Francisco, though.

California Auto Insurance Rates by Company

Before you delve into the individual factors that affect your car insurance, you can get an idea of which companies offer the lowest rates by looking at their average prices. You can compare the average rates for California’s biggest insurance companies below.

While Wawanesa is often the cheapest insurance in California, it’s the only state with Wawanesa coverage. If you prefer to shop with a national company, Geico and USAA are excellent options, and you can find more about USAA in our USAA auto insurance review.

Minimum Auto Insurance Rates in California

When you need cheap insurance in California, minimum insurance is the most affordable option. California auto insurance requirements for minimum coverage include the following:

- Bodily Injury Liability: $15,000 per person

- Bodily Injury Liability: $30,000 per accident

- Property Damage Liability: $5,000 per accident

Although you don’t need it, California requires car insurance companies to offer uninsured motorist (UM) coverage. You can decline the offer, but your insurance company will need your decision in writing.

Although minimum insurance is your cheapest option for California car insurance quotes, rates vary by company. You can get an idea of how much you’ll pay for minimum insurance below.

California Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $102 | |

| $71 |

| $85 | |

| $51 | |

| $110 |

| $73 | |

| $68 | |

| $55 | |

| $63 | |

| $38 | |

| U.S. Average | $65 |

USAA is often a cheap option for car insurance, regardless of where you live. However, only military members and their families are eligible for coverage. If that doesn’t apply to you, Geico and Progressive are solid options.

If minimum coverage is not enough for you, consider adding optional coverages like:

- Comprehensive

- Collision

- Loan/lease payoff

- Medical and funeral services

- Rental car reimbursement

- Roadside assistance

Adding these coverages will raise your insurance rates, but you’ll be protecting yourself and your vehicle from just about every possible scenario.

Full Coverage Auto Insurance Rates in California

California does not require drivers to get full coverage auto insurance, but you might need it if you have a car loan or lease. It’s also a good idea to have full coverage if you can’t afford to replace your car or have a new, expensive vehicle.

Full coverage includes liability, comprehensive, collision, uninsured/underinsured motorist, and medical payments. It offers better protection for your vehicle, but it costs much more than minimum insurance.

California Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $312 | |

| $216 |

| $261 | |

| $157 | |

| $338 |

| $223 | |

| $207 | |

| $169 | |

| $192 | |

| $116 | |

| U.S. Average | $161 |

Your cheapest option for full coverage in California might be Mercury, Geico, or Progressive, each with an average monthly rate of about $150.

While full coverage protects your car from most of what the road can throw at it, insurance companies often offer add-ons to increase your coverage. Here are some popular add-ons in California:

- Rental car reimbursement

- Emergency roadside assistance

- Custom parts and equipment

- Gap coverage

Different types of auto insurance add-ons offer valuable protection, but you should only buy what you need. Add-ons can dramatically increase your monthly rates.

Learn More: Cheapest Teen Driver Auto Insurance in California

California Auto Insurance Rates After a DUI

Depending on the severity, a traffic violation can significantly increase your insurance rates. Of all types of violations, DUIs come with some of the stiffest rate increases. A DUI can increase your rates by more than 70%, and Californians pay more than double the national average.

Some insurance companies will drop you after even a single DUI, but most will continue to work with you. Even if you don’t need high-risk auto insurance, your rates will still be significantly higher after a DUI.

California Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | One Accident | One DUI | One Ticket | Clean Record |

|---|---|---|---|---|

| $321 | $385 | $268 | $228 | |

| $251 | $276 | $194 | $166 |

| $282 | $275 | $247 | $198 | |

| $189 | $309 | $151 | $114 | |

| $335 | $447 | $302 | $248 |

| $230 | $338 | $196 | $164 | |

| $265 | $200 | $200 | $150 | |

| $146 | $160 | $137 | $123 | |

| $199 | $294 | $192 | $141 | |

| $111 | $154 | $133 | $84 | |

| U.S. Average | $244 | $295 | $203 | $161 |

Wawanesa might be your best option if you have a DUI since it has significantly lower average rates. Competitors like Geico and Progressive also have lower rates, but they are not nearly as affordable as Wawanesa.

While increased car insurance rates can be expensive, it’s not the only thing you’ll have to worry about after a DUI. California imposes the following penalties after a DUI:

- First Offense: Up to six months in jail, $1,000 fine, license suspension for four months, six months with an ignition interlock device (IID) in your car, and nine months in DUI school

- Second Offense: Up to one year in jail, $1,000 fine, license suspension for two years, one year with an IID, and 30 months in DUI school

- Third Offense: Up to one year in jail, $1,000 fine, license suspension for three years, two years with an IID, and 30 months in DUI school

- DUI With an Injury: Up to one year in jail, $5,000 fine plus restitution, license suspension for three years, and 30 days in DUI school

- Felony DUI: Up to three years in prison, $1,000 fine, license suspension for five years, and 30 months of DUI school

Although DUI charges have serious consequences, your rates won’t be high forever. If you keep your record clean of future incidents, your rates will return to normal after about seven years. You can also shop for the best auto insurance for drivers with a DUI if you’re struggling to find coverage.

Comparing Auto Insurance Costs Across California Cities

This table compares auto insurance rates across California cities, from major urban centers like Los Angeles and San Francisco to smaller towns.

California Auto Insurance Cost by City

It serves as a guide for understanding the impact of location on insurance prices. Simply click on your city to see how much you could pay for California car insurance near you.

Cheapest California Auto Insurance by City

Finding cheap car insurance in California, particularly cities such as Los Angeles and San Francisco, can be difficult when you live in a big city.

Car insurance in Los Angeles is more expensive than in smaller cities due to heavy traffic and expensive cars. Nearby, car insurance quotes in Orange County are often pricier because of car thefts and congested streets. Meanwhile, auto insurance in San Francisco is more expensive because of the large number of uninsured drivers in the city.

Read More:

Car insurance companies in California charge higher rates to larger cities due to heavy traffic and population density. Still, you can always compare rates to buy cheap car insurance online in California, regardless of your location. Read more about how auto insurance rates by ZIP code vary.

Auto Insurance Discounts in California

Car insurance companies offer a variety of car insurance discounts to help drivers save money. Since California is so expensive, read more about taking advantage of the following auto insurance discounts as possible:

- How to Get a Good Student Auto Insurance Discount

- How to Get a Good Driver Auto Insurance Discount

- How to Save Money by Bundling Insurance Policies

- How to Get a Low Mileage Auto Insurance Discount

- How to Get an Anti-Theft Auto Insurance Discount

- How to Get a Driver’s Ed Auto Insurance Discount

- How to Get a Pay-in-Full Auto Insurance Discount

California also offers the California Low Cost Automobile (CLCA) insurance program to help low-income drivers get affordable coverage. Read more about government auto insurance for low-income drivers.

Most states require the same level of car🚘 insurance regardless of your income. Low-income drivers might need help affording coverage. Thankfully, https://t.co/27f1xf1ARb has researched and found the best ways to save💰. Check it out here👉: https://t.co/NLue1Ka4x0 pic.twitter.com/D07hMMPyfU

— AutoInsurance.org (@AutoInsurance) August 24, 2023

To be eligible, you must be at least 16 years old, have a driver’s license, and drive a car valued at less than $25,000. You also must meet income eligibility, which depends on your household size.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

SR-22 Auto Insurance in California

California requires SR-22 auto insurance after getting several traffic violations. It’s not actually a type of insurance but a form you must submit to prove you meet California’s minimum insurance requirements. The state of California might require you to submit SR-22 insurance after the following violations:

- Getting too many points on your license

- After an at-fault accident

- Driving with a suspended license

- Driving without insurance

- After a DUI conviction

You’ll be responsible for submitting SR-22 insurance for about three years. However, you won’t have to do it all by yourself — your insurance company will file it for you.

How to Get SR-22 Auto Insurance in California

SR-22 car insurance in California is more expensive than a standard policy because companies consider it a red flag.

However, you’ll still be able to find the right coverage with a little searching. The process is easier if you already have insurance. Your company might drop you as a customer if you need SR-22 insurance, but most companies will work with you.

Top Auto Insurance Discounts for California Drivers

| Company | Savings | Discount | Eligibility |

|---|---|---|---|

| 13% | Early Signing | Sign up before policy start date | |

| 15% | Loyalty | Existing customers with multiple years |

| 10% | Homeowner | Must own a home at insured address | |

| 10% | Defensive Driving | Complete approved driving course | |

| 10% | Multi-policy | Bundle auto with home/renters insurance |

| 8% | Multi-policy | Bundle two or more policies | |

| 10% | Snapshot Program | Use telematics device to track driving habits | |

| 15% | Safe Driving | Maintain clean driving record | |

| 10% | Safe Driver | Low accident/violation history | |

| 15% | Military Affiliation | Active/retired military members or family |

To add SR-22 filing to your policy, simply contact an insurance representative and let them know what you need. If you don’t have a policy, getting quotes works the same as if you need a standard policy. When you request a quote, make sure to let the company know you need SR-22 insurance.

California usually suspends your license until you submit proof of SR-22 insurance. Meeting the minimum insurance requirement can be more difficult if you don’t have a car. If you find yourself in this situation, consider a non-owner policy. Non-owner auto insurance allows you to prove financial responsibility to the state and covers you in any car you drive.

As a bonus, non-owner insurance is typically 15% cheaper than a standard policy.

Case Studies: Finding the Best California Auto Insurance

Selecting the best California auto insurance involves considering various factors such as affordability, coverage options, and customer service.

- Case Study #1 – Affordable Rates for Young Drivers: John, a young driver from Los Angeles, needed affordable insurance for his first car. Progressive offered him rates starting at $24 per month, providing him with comprehensive coverage and excellent customer service. This allowed John to drive confidently, knowing he was well-protected without breaking the bank.

- Case Study #2 – Comprehensive Coverage: The Martinez family from San Francisco required comprehensive coverage for their family vehicles. State Farm provided them with a policy that covered all their needs, including liability, collision, and uninsured motorist protection. The family appreciated the multiple discounts and the peace of mind that came with their extensive coverage.

- Case Study #3 – Usage-Based Discounts: Sarah, a part-time driver from San Diego, wanted an insurance policy that matched her low mileage. Nationwide’s usage-based insurance program offered her significant savings by charging based on the actual miles driven. This flexible option allowed Sarah to save money while maintaining robust coverage.

These case studies demonstrate how the best California auto insurance providers like Progressive, State Farm, and Nationwide can cater to various driver needs. Check out our guide titled “Comprehensive Auto Insurance Explained.”

Progressive offers the best rates and customer service for California drivers, starting at just $24 per month.Justin Wright Licensed Insurance Agent

By comparing quotes and understanding the benefits of each provider, you can find the ideal policy to suit your unique situation.

Find the Best Auto Insurance in California Today

While the average car insurance cost in California is higher than the national average, there are ways to save. Shopping at companies with the lowest average California auto insurance rates — like Wawanesa, USAA, and State Farm — will help you find the cheapest insurance in the Golden State. Read our Wawanesa auto insurance review for more information on the California auto insurance company.

One of the most critical aspects of finding cheap car insurance in California is comparing quotes. Enter your ZIP code into our free quote comparison tool below to get started on finding the best CA auto insurance.

Frequently Asked Questions

How much is car insurance in California?

California drivers should be prepared for higher rates. The average minimum insurance cost in California is $56, while full coverage costs around $182.

Why is California car insurance so expensive?

California’s high urban population, health care prices, and weather risks contribute to expensive rates. However, finding the best auto insurance in CA is still possible. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Which insurance company is the cheapest in California?

The cheapest car insurance company in California depends on your unique circumstances. However, companies like Geico, Progressive, State Farm, and Wawanesa offer the lowest average rates in California.

Does your credit score affect your rates in California?

Californians with low credit scores will be happy to know that state law does not allow insurance companies to use your score to determine your rates.

Does California have a low-income program for car insurance?

You must meet eligibility requirements, including having a driver’s license, being at least 16 years old, and having a car valued at less than $25,000.

Can you self-insure your car in California?

Most drivers buy minimum insurance, but you can self-insure in California. You have a few options — make a $35,000 deposit with the DMV or buy a $35,000 surety bond.

What should I do if I’m involved in an accident in California?

If you’re involved in an accident in California, first ensure your safety and the safety of others involved. Contact the authorities to report the accident, and if necessary, seek medical attention for any injuries.

Exchange information with the other party involved, including names, contact details, and insurance information. Notify your insurance company about the accident as soon as possible to initiate the claims process.

How can I find affordable auto insurance in California?

To find affordable auto insurance in California, it’s important to shop around and compare quotes from multiple insurance providers. Rates can vary significantly, so obtaining quotes from different companies allows you to find the most competitive prices.

Additionally, maintaining a clean driving record, opting for higher deductibles, and exploring available discounts can help lower your premiums.

Are there any discounts available for auto insurance in California?

Yes, there are various discounts available for auto insurance in California. Insurance companies may offer discounts for safe driving records, completing driver education courses, bundling multiple policies, having certain safety features in your vehicle, and more. We recommend asking about available discounts when obtaining quotes from insurance providers.

Are there any specific considerations for insuring a vehicle in California?

Insuring a vehicle in California may require additional considerations. California is known for having a higher population density, which can lead to increased traffic and a higher risk of accidents. It’s important to ensure that your coverage limits are adequate to protect your assets and consider optional coverages such as comprehensive and uninsured/underinsured motorist coverage.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.