Best New Jersey Auto Insurance in 2026 (Top 10 Companies Ranked)

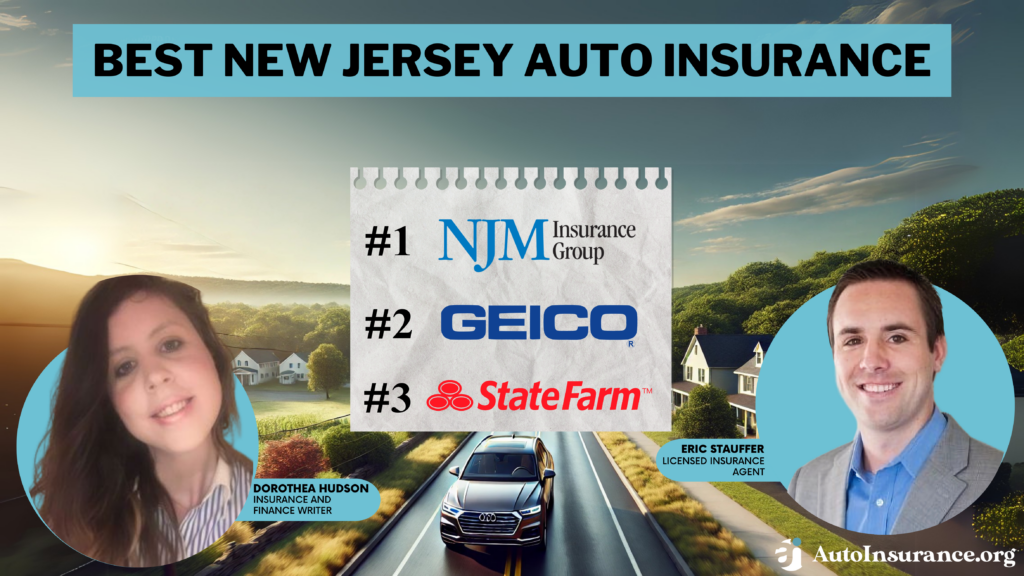

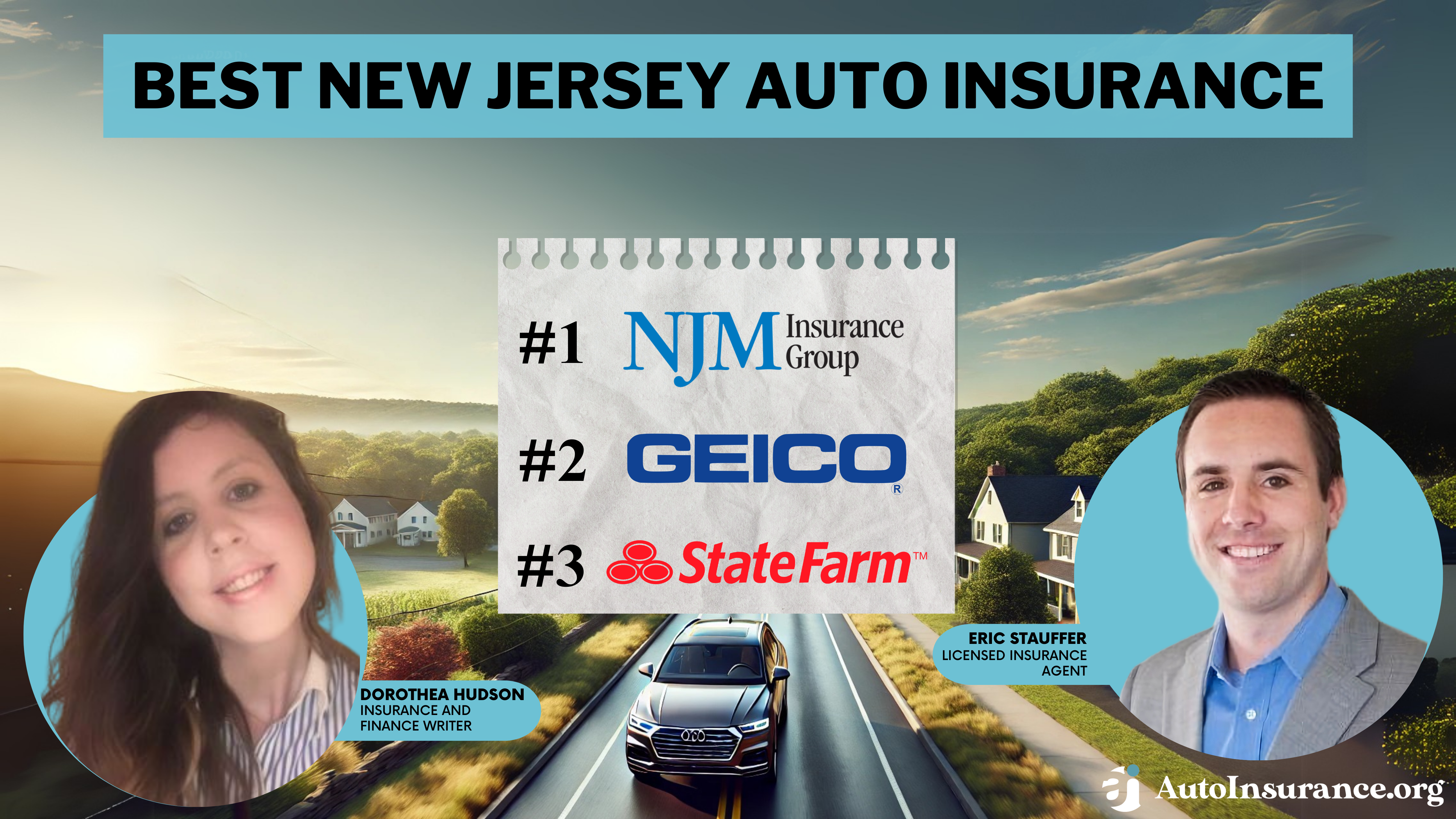

Get the best New Jersey auto insurance includes top providers NJM, Geico, and State Farm, offering up to 25% discounts. These companies excel in affordability, extensive coverage options, and customer satisfaction. With competitive rates and strong financial stability, they stand out as the best choices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated November 2025

372 reviews

372 reviewsCompany Facts

Full Coverage for New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

372 reviews

372 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for New Jersey

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for New Jersey

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsDiscover the best New Jersey auto insurance with NJM, Geico, and State Farm, they stand out for their competitive rates offering up to 17% discount. NJM is the top choice, with savings and great customer satisfaction. Learn why these companies are preferred by NJ drivers for their affordable rates and quality service.

New Jersey auto insurance is more expensive than many other states. Liability-only rates are higher than average. However, cheap car insurance in New Jersey is possible when you know how much coverage you need.

Our Top 10 Company Picks: Best New Jersey Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 25% A+ Customer Service NJM

![]()

#2 25% A++ Many Discounts Geico

![]()

#3 20% A++ Competitive Rates State Farm

#4 12% A+ Snapshot Discounts Progressive

#5 25% A+ Comprehensive Coverage Allstate

#6 25% A Customizable Policies Liberty Mutual

#7 20% A+ Multi-Policy Discounts Nationwide

#8 8% A++ Extensive Coverage Travelers

#9 25% A+ Potential Dividends Amica

#10 20% A Local Agents Farmers

Discover essential coverage details and top insurers for all types to find the best rates for cheap auto insurance in New Jersey. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Jersey Auto Insurance Costs

New Jersey auto insurance requirements include additional coverage to pay for personal injuries with no-fault auto insurance. As a result, monthly minimum liability costs more than in other states. Full coverage averages $160 monthly, 7% higher than the national average.

High traffic and accident rates are to blame for New Jersey’s expensive auto insurance costs. New Jersey has some of the worst urban traffic congestion in the nation. More traffic means drivers are more likely to get into an accident and file a claim.

Unsurprisingly, auto accidents in New Jersey increased by nearly 25% over the past two years, putting every N.J. driver at risk of filing a claim. In turn, insurance companies charge higher rates in case of payout.

Read more: Most Fatal Intersections in America

New Jersey Full and Minimum Coverage Auto Insurance Rates

Full coverage includes all required state minimums plus collision and comprehensive insurance, whereas minimum coverage only meets the basic legal requirements. While the additional coverage costs more per month compared to minimum coverage, you can still find very cheap rates when you shop around with more than one company.

New Jersey Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$144 $225

$46 $151

$211 $330

![]()

$68 $106

$254 $397

$108 $169

![]()

$33 $101

$85 $133

$104 $162

$124 $194

The cheapest minimum coverage auto insurance in N.J. is NJM at $33 per month. Amica Insurance also has competitive rates — around $46 per month. Read more about them in our NJM auto insurance review.

New Jersey Auto Insurance Laws

Knowing how much coverage you need is key to getting cheap insurance quotes in New Jersey. You must carry 15/30/5 in minimum liability by law, but your auto loan or lease may require full coverage.

Driving without insurance in New Jersey can put you in jail for two weeks. The state will also fine you up to $5,000, and you’ll lose your license for at least one full year.

The minimum auto insurance requirements by state vary. Not having the minimum requirements also makes it difficult to buy auto insurance later — you’ll see rates nearly three times higher after a coverage lapse. To get the cheapest auto insurance in New Jersey, carry the state minimum liability.

New Jersey Auto Insurance Requirements

New Jersey is a no-fault state, so drivers must buy personal injury protection auto insurance, bodily injury liability, and property damage liability. To lower insurance costs, drivers can choose between two types of minimum policies: standard and basic.

Standard vs. Basic Liability Auto Insurance Requirements in New Jersey

| Requirement | Standard Policy | Basic Policy |

|---|---|---|

| Personal Injury Liability | $15,000 per person/$30,000 per accident | Optional coverage of $10,000/accident |

| Property Damage Liability | $5,000 per accident | $5,000 per accident |

| Personal Injury Protection (PIP) | $15,000 per accident Up to $250,000 for specific injuries | $15,000 per person/$30,000 per accident Up to $250,000 for specific injuries |

Basic liability meets N.J. auto insurance minimums and tends to cost less than a standard policy. Drivers can also add a minimum of $10,000 in bodily injury. Opting out will put you at financial risk if a driver decides to sue for medical costs after an accident.

New Jersey’s no-fault auto insurance laws give injured drivers the right to reject the state’s threshold and sue at-fault parties. Carrying a standard policy comes with higher rates but provides the necessary coverage if you’re liable for legal fees and medical costs.

Special Automobile Insurance Policies (SAIP) are also available to drivers who qualify for Federal Medicaid with hospitalization. SAIP, or dollar-a-day auto insurance in N.J., only costs $365 annually or $360 if you pay in full. However, this policy only offers medical coverage and death benefits, not liability.

New Jersey Optional Auto Insurance

Since drivers are responsible for their own medical costs and property damage after a collision, N.J. insurance companies offer unique additional coverages to mitigate some of the financial burdens.

- Extended Medical Benefits: Pays for injuries or death while driving an insured vehicle that the policyholder doesn’t own. Drivers must carry at least $1,000 in coverage if they want to add it to their policy and can increase coverage up to $10,000.

- Funeral Expense Coverage: Pays for funeral costs up to the policy limit should you die in an accident or collision.

- Death Benefit Coverage: Pays an amount to your listed beneficiary up to the policy’s limit if you die in an auto accident.

PIP includes some funeral expenses and death benefits coverage, but these options can enhance the benefit amount your family receives. You can also increase your PIP minimums up to $75,000 for more financial relief, but your monthly rates will go up.

NJ drivers should consider extended medical and funeral coverages for added financial protection.Tim Bain LICENSED INSURANCE AGENT

New Jersey drivers can also buy rental car reimbursement coverage and roadside assistance coverage to supplement their full coverage policies. Availability will vary based on which company you shop with, and some companies will offer better rates on optional coverage than others.

If you’re interested in buying these or other coverages in New Jersey, we recommend shopping around and comparing auto insurance quotes online. Getting quotes from at least three companies allows you to compare various policy options, rates, and more.

Top Auto Insurance Companies in New Jersey

We found that the cheapest auto insurance companies in New Jersey are Geico, NJM Insurance, and State Farm. Geico and NJM offer the lowest rates to good drivers, while State Farm is the most competitive for those with accidents or DUIs.

NJM Insurance – Cheapest Local Company

New Jersey Manufacturers Insurance (NJM) isn’t featured in many top ten lists because it only offers coverage in five states. New Jersey residents are among the lucky few with access to the company’s excellent rates, which often rival Geico for young drivers. It’s the cheapest auto insurance in N.J. for students and offers cheap auto insurance for teens.

NJM is the cheapest company for long-term coverage, offering full 12-month policies instead of the traditional six months. On average, NJM monthly insurance costs are $60 for liability-only and $33 for minimum coverage.

A.M. Best gives NJM an A+ financial rating, and the company receives fewer complaints than average, according to the NAIC. J.D. Power ranks NJM in the top five for customer satisfaction in the Mid-Atlantic region, higher than Geico and Allstate.

Geico – Cheapest Overall

According to our Geico auto insurance review, this company continues to offer the best auto insurance rates in New Jersey for good drivers. While it raises rates more than other companies after an accident or speeding ticket, costs remain lower than the state average.

Geico is also the most affordable option for short-term coverage. While you can’t buy a policy for one day, you can get low rates on a monthly policy that you can cancel at any time. Geico doesn’t charge cancellation fees and will refund any unused amount during your coverage period.

The company earned a superior A++ financial rating from A.M. Best and a 1.33 from the National Association of Insurance Commissioners (NAIC). Geico receives the average amount of complaints for a company its size, and most are directed at the claims department.

State Farm – Cheapest for High-Risk Drivers

If you’re shopping for auto insurance with DUIs or accidents on your driving record, start with quotes from State Farm. On average, State Farm only raises monthly rates by about $25 after an accident and $35 after your first DUI. Compare that to Geico charging an extra $50 per month after your first accident.

J.D. Power rated State Farm in the top three for customer satisfaction in the Mid-Atlantic region. Its customer service also earned an A+ with the Better Business Bureau (BBB) and an average 1.44 with the NAIC. A.M. Best ranks its financial strength as superior (A++).

Find out more about State Farm auto insurance in our State Farm auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Jersey Auto Insurance Rates by Coverage

What is the cheapest auto insurance in New Jersey? Basic liability auto insurance gives you the lowest rates but the least amount of protection.

For a few extra dollars a month, standard liability offers more coverage in an at-fault accident and still costs less than full coverage. However, don’t sacrifice coverage to save money on auto insurance.

Find out how much coverage you need and compare quotes from multiple companies to get a great price. Below we compare liability vs. full coverage insurance costs in New Jersey to help you find the best company and policy.

New Jersey Liability Auto Insurance Rates

The table below compares liability insurance rates from the most popular N.J. insurance companies.

New Jersey Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $32 |

| $144 | |

| $105 | |

| $211 | |

| $68 | |

| $254 |

| $108 |

| $85 | |

| $104 | |

| $43 |

| $124 | |

| U.S. Average | $126 |

Geico offers the lowest rates for liability coverage in New Jersey, followed by State Farm. Remember, your rates will increase if you carry a standard policy or opt for higher limits than what’s required.

New Jersey Auto Insurance Rates by age

Age is one of the biggest influencers in New Jersey auto insurance rates. Auto insurance for young adults can be hard to come by in New Jersey. Teens, especially drivers under 18, pay the most, followed by young adults in their 20s and early 30s.

We compared New Jersey auto insurance companies by age and found that Geico offers the lowest average rates. State Farm and NJM Insurance rates are also nominally priced, but you might get lower quotes with another company depending on your driving and claims history.

Use the tables below to compare auto insurance quotes from multiple N.J. insurance companies.

New Jersey Auto Insurance for Teens and New Drivers

How much is auto insurance for a 16-year-old? On average, 16-year-old drivers pay around $577 per month for coverage.

New Jersey Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Male | Age: 16 Female | Age: 18 Male | Age: 18 Female |

|---|---|---|---|---|

| $465 | $445 | $378 | $328 |

| $645 | $920 | $748 | $609 | |

| $502 | $716 | $582 | $429 | |

| $1,207 | $1,722 | $1,400 | $1,211 | |

| $182 | $260 | $211 | $209 | |

| $937 | $1,337 | $1,087 | $958 |

| $492 | $702 | $571 | $447 |

| $868 | $1,238 | $1,007 | $903 | |

| $585 | $835 | $679 | $531 | |

| $577 | $552 | $469 | $407 |

| $399 | $570 | $463 | $411 | |

| U.S. Average | $646 | $922 | $705 | $598 |

Overall, the best auto insurance for new drivers in N.J. is Geico. Still, teens should compare quotes from State Farm, NJM Insurance, and at least one other local company to get the lowest possible auto insurance rates for teens.

New Jersey Auto Insurance for Young Adults

New Jersey auto insurance rates start to decrease after you turn 25. NJM offers very low rates for 20-year-olds — around $180 per month. Compare that to quotes from the N.J. insurance companies listed below.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 | |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

Again, Geico offers the cheapest rates, but insurance costs are still higher than the national average.

Auto insurance in New Jersey remains expensive for young adults because long work commutes increase their risk of filing a claim. They’re also the second-most likely age group to die in a fatal accident on New Jersey roads.

Young drivers can combat these statistics by maintaining a good driving record and asking for age-specific discounts like discounts for good students.

Learn more: How to Get a Good Student Auto Insurance Discount

For example, most insurance companies offer discounts to college students away at school or members of a sorority or fraternity. Occupation-based discounts can also cut 2-5% off your rates.

New Jersey Auto Insurance for Adults and Seniors

Once drivers turn 40, auto insurance rates start to drop. In New Jersey, monthly rates can go as low as $45 for minimum coverage and $100 for full. However, rates will increase again after 60. See how rates vary for older drivers and seniors in the table below.

Senior Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 55 Male | Age: 55 Female | Age: 60 Male | Age: 60 Female | Age: 65 Male | Age: 65 Female |

|---|---|---|---|---|---|---|

| $213 | $214 | $220 | $220 | $220 | $221 | |

| $131 | $131 | $126 | $122 | $135 | $136 | |

| $313 | $311 | $292 | $305 | $323 | $321 | |

| $100 | $103 | $111 | $111 | $103 | $106 | |

| $377 | $377 | $438 | $438 | $389 | $389 |

| $160 | $158 | $154 | $146 | $166 | $163 |

| $126 | $137 | $129 | $125 | $130 | $141 | |

| $154 | $154 | $145 | $145 | $158 | $158 | |

| $152 | $156 | $147 | $144 | $156 | $159 |

| $184 | $188 | $171 | $170 | $190 | $194 |

Drivers between 50 and 65 are most at-risk for a fatal accident in New Jersey, leading to a spike in insurance costs. The good news is seniors can often lower rates with low-mileage discounts and reduced coverage if they’re retired and not driving as often.

Read more: How To Get a Low Mileage Auto Insurance Discount

New Jersey Auto Insurance Rates by Driving Record

Along with age and gender, your driving record has a significant impact on New Jersey auto insurance quotes. Good drivers get lower rates, while one car accident can cost you 50% more yearly.

New Jersey Auto Insurance With Bad Credit

How does your credit score impact auto insurance rates? New Jersey insurance laws also allow companies to consider your credit record when determining rates. Higher scores lead to lower rates, but drivers with bad credit can pay as much as high-risk drivers.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $52 | $53 | $58 | |

| $47 | $48 | $52 | |

| $32 | $33 | $35 |

| $64 | $65 | $71 | |

| $42 | $43 | $47 | |

| $77 | $79 | $86 |

| $45 | $46 | $50 | |

| $53 | $54 | $59 | |

| $52 | $53 | $58 | |

| $37 | $38 | $41 |

Most companies offer a discount to drivers who pay their annual premium once instead of monthly or bi-monthly. On-time payments like this improve your credit score and earn you a auto insurance discount.

Learn more: Best Auto Insurance Companies That Use Credit Scores

New Jersey auto Insurance With a Speeding Ticket

Having one or more speeding tickets shows insurance companies you’re a risky driver. As a result, you’ll pay higher rates in New Jersey for five years until the New Jersey Motor Vehicle Commission (MVC) clears the ticket from your record.

Full Coverage Auto Insurance Monthly Rates & Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $220 | $180 |

| $270 | $225 | |

| $191 | $164 | |

| $367 | $330 | |

| $106 | $106 | |

| $397 | $397 |

| $202 | $169 |

| $174 | $133 | |

| $231 | $162 | |

| $215 | $175 |

| $263 | $194 | |

| U.S. Average | $240 | $203 |

It’s important to find the best auto insurance companies that don’t penalize for a speeding ticket. Geico offers the lowest N.J. auto insurance rates after a speeding ticket. However, it raises rates hundreds of dollars more than other companies. State Farm offers the next most affordable rates and won’t punish you as harshly for your first ticket.

New Jersey Auto Insurance With an Accident

State Farm is more easygoing with accidents in New Jersey, too. Geico offers the lowest rates, but State Farm only increases its rates by a small amount per month after an at-fault accident.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $228 | $321 | |

| $166 | $251 | |

| $138 | $196 | |

| $198 | $282 | |

| $114 | $189 | |

| $249 | $335 |

| $164 | $230 |

| $150 | $265 | |

| $123 | $146 | |

| $161 | $235 |

| $141 | $199 | |

U.S. Average | $161 | $244 |

Each company treats collisions differently — some are more forgiving to high-risk drivers than others. Another company on this list or in your neighborhood could offer you better rates based on your record and the kind of accident you caused.

Always shop around and compare multiple quotes to get the best rates on high-risk auto insurance in New Jersey.

New Jersey Auto Insurance With a DUI

A DUI will raise your New Jersey auto insurance rates higher than other traffic violations. State Farm doesn’t raise rates as much, but you’ll still pay much more than the state average for auto insurance for drivers with a DUI.

If you have more than one DUI on your record, some of the above companies won’t insure you. Cheap auto insurance for drivers with a DUI can be tough to find. However, Geico and State Farm remain among the best auto insurance companies for high-risk drivers.

New Jersey DUI Penalties

A DUI costs more than just a $1,000 surcharge to your annual auto insurance. New Jersey law charges additional fines and court fees, costing drivers $525 or more. You’ll also lose your driving privileges and must pay another processing fee to file SR-22 insurance and reinstate your license.

Here is a closer look at New Jersey DUI penalties by the offense.

DUI Penalties in New Jersey

| Offense | Penalties |

|---|---|

| First Offense | $250-$450, Up to 30 days, 3-months |

| Second Offense | $500-$1,000, Up to 90 days, 2-years |

| Third Offense | 1000, 180 days, 10-years |

DUIs get more costly after your first offense, and standard insurance companies are less likely to cover you. State Farm may offer the best rates after a first offense, but subsequent offenses could cause your auto insurance to skyrocket.

Insights into Cost of Auto Insurance in Your City

Discover the localized nuances of auto insurance costs with our detailed breakdown for Bridgeton, Fairview, and Woodstown, NJ. This table offers insights into the unique pricing dynamics in these cities, helping you make informed decisions tailored to your location.

New Jersey Auto Insurance Cost by City

Explore how factors such as population density and traffic patterns influence insurance rates in your area.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

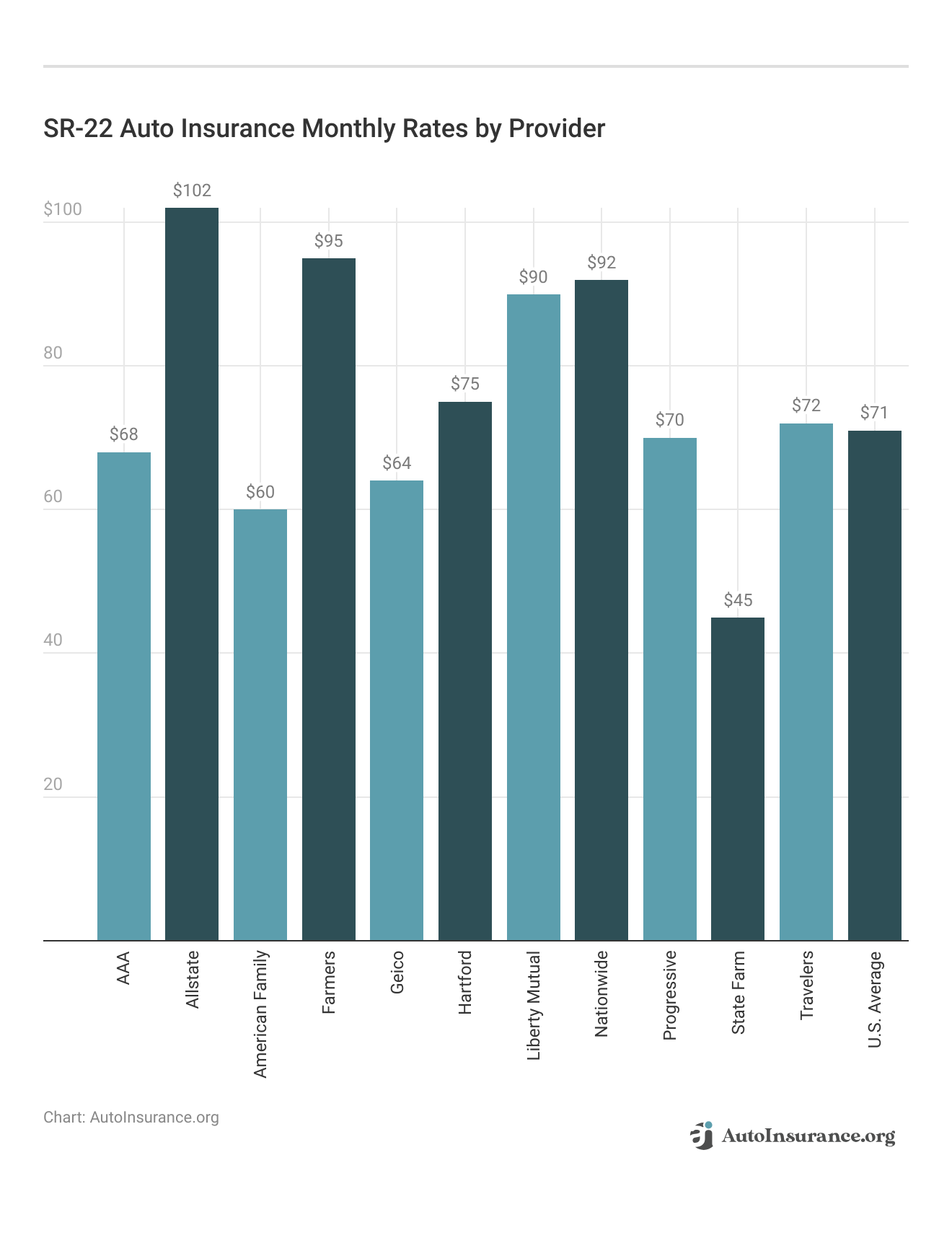

New Jersey SR-22 Insurance

An SR-22 filing isn’t insurance — it’s a legal document from your insurance company proving you carry the New Jersey state liability minimums.

The MVC requires SR-22 insurance filings for drivers with DUI charges, multiple speeding tickets, multiple points on their licenses, and at-fault accidents. You’ll also have to file SR-22 if you got caught driving without insurance.

Follow these steps to get SR-22 auto insurance in New Jersey:

- If You Have Auto Insurance: Contact your current company and ask them to file it on your behalf. You may need to find new coverage if it doesn’t file SR-22 or insure high-risk drivers.

- If You’re Uninsured: Shop online for auto insurance quotes and choose “yes” when asked if you need SR-22 insurance.

- If You Don’t Own a Car: Ask for non-owner SR-22 insurance, which may be unavailable with standard N.J. insurance companies.

It can cost anywhere between $40 and $102 to file SR-22 in New Jersey. Filing automatically moves you into the high-risk category and raises your insurance rates. You must carry SR-22 in New Jersey for a minimum of three years, and your rates will remain high during that time or longer.

If you need SR-22 insurance, use our comparison tool below to shop around with local companies. High-risk auto insurance in NJ is expensive, so compare quotes every few months to ensure you aren’t overpaying for coverage.

How to Get Cheap Auto Insurance in New Jersey

Geico and NJM Insurance have cheap auto insurance in New Jersey, but State Farm has better rates for high-risk car insurance in NJ drivers with accidents or DUIs. You might find even cheaper rates with another company, so always shop around for coverage.

To get the cheapest car insurance quotes in New Jersey possible, check the following in your policy:

- Choosing Your Deductibles: Choosing higher auto insurance deductibles can reduce your monthly rates, but you’ll pay more out of pocket.

- Vehicle Make and Model: N.J. insurance companies charge more for certain vehicles, and you can earn lower rates by driving an older model. Compare auto insurance rates by vehicle make and model with your insurance agent to learn more about how different cars cost different prices to insure.

- Safety Features: Vehicles with advanced safety features can earn additional discounts on auto insurance.

- Multiple Vehicles: Having multiple vehicles on one policy is more affordable than taking out insurance for each, and you can earn additional multi-vehicle discounts with most companies.

- Teen Driver: Adding a teen or new driver to a parent’s or roommate’s policy earns them lower rates than buying new coverage.

- Bundling Home or Renters Insurance: Bundling home and auto policies with the same company can earn you a discount on auto insurance.

Read more: Auto Insurance Discounts

New Jersey drivers can also take advantage of the state’s no-fault insurance laws to lower costs. For example, you can get very cheap New Jersey auto insurance rates if you decide to withhold your right to sue at-fault parties in an accident and choose a basic liability policy.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

Who has the cheapest car insurance in New Jersey?

Geico and NJM Insurance offer the cheapest rates to New Jersey drivers. However, depending on your claims and accident history, you may find better New Jersey auto insurance rates with another company.

Read more: NJM Car Insurance Review

How much is car insurance in New Jersey?

Full coverage insurance costs around $160 per month in New Jersey, while liability-only New Jersey car insurance averages at $75. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Is car insurance more expensive in New Jersey?

Yes, car insurance in New Jersey is more expensive than average. Poor highways, heavy traffic, and an increase in accidents over the past few years have led to overall higher annual auto insurance costs.

Can I purchase auto insurance from any insurance company in New Jersey?

Yes, you have the freedom to choose a car insurance in NJ that suits your needs. New Jersey has a competitive insurance market, and there are numerous companies offering auto insurance coverage. It’s important to compare quotes, coverage options, and customer reviews to find a reputable insurer.

What should I do if I’m involved in an auto accident in New Jersey?

If you find yourself in an auto accident in New Jersey, your first priority should be ensuring your safety and that of others involved. Immediately contact the authorities to report the accident and ensure proper documentation. Exchange insurance information with the other party and gather any available evidence such as photographs or witness statements.

It is crucial to notify your New Jersey insurance company promptly about the incident to initiate the claims process smoothly. Taking these steps promptly can help ensure that necessary procedures are followed and that you receive appropriate support following the accident.

Are there any discounts available for auto insurance in New Jersey?

Yes, insurance companies in New Jersey often offer various discounts to help reduce your auto insurance premium. Common discounts include:

- Multi-policy discounts

- Good driver discounts

- Discounts for completing a defensive driving course

- Discounts for safety features installed in your vehicle

Exploring these discount opportunities can potentially reduce your overall insurance costs while maintaining adequate coverage for your needs.

Are there any other types of auto insurance coverage available in New Jersey?

Yes, besides liability and Personal Injury Protection (PIP) coverage, there are additional coverage options available in New Jersey. These include:

- Collision coverage (pays for damages to your vehicle in case of a collision)

- Comprehensive coverage (covers non-collision-related damages like theft or vandalism)

- Uninsured/underinsured motorist coverage (protection against drivers without adequate insurance)

Understanding and choosing the right coverage options can help safeguard you against various risks on the road.

Can I choose higher coverage limits for my auto insurance in New Jersey?

Absolutely. While the state sets the minimum coverage limits, you have the option to purchase higher coverage limits for both liability and Personal Injury Protection (PIP) coverage. It is recommended to consider higher auto insurance limits in New Jersey to ensure adequate protection.

Is New Jersey a no-fault state?

Yes, New Jersey is a no-fault auto insurance state. For more information read our article titled “Cheap No-Fault Auto Insurance“.

Can drivers get dollar-a-day car insurance in New Jersey?

Yes, New Jersey offers dollar-a-day car insurance to eligible drivers.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.