Phoenix, AZ Auto Insurance (2024)

Arizona requires 15/30/10 for bodily injury and property coverage. The average cost of auto insurance in Phoenix is $452.83/mo. Save now and compare quotes below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Phoenix Statistics | Details |

|---|---|

| City Population | 1,615,041 |

| City Density | 3,401 people per square mile |

| Average Cost of Car Insurance in Phoenix | $5,433.92 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor Share: 23% Mediocre Share: 29% Fair Share: 20% Good Share: 27% VOC: $550 |

Choosing the right car insurance company in the Valley of the Sun can be quite a challenge. It is one of the most important investments you will ever make, though.

As a wise investor, you will want to collect as much information about the companies you will be choosing from and the type of coverage and coverage amounts that you might need.

You will also want to find out just which factors can impact your rates as you begin to make your decision about which provider best suits your needs. That is where we come in.

Keep reading to find out how we can help you get the most for your money when purchasing your car insurance policy in the Phoenix area.

Need insurance? Enter your ZIP code in our FREE tool above.

The Cost of Car Insurance in Phoenix

Money is tight for a lot of us nowadays which is why it is so important to get every penny out of your car insurance policy.

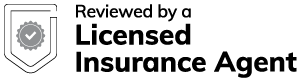

Which city you live in will have a major effect on car insurance. That’s why it’s vital to compare Phoenix, AZ against other top US metro areas’ auto insurance rates.

It is also why most people start by looking for the cheapest rates, but there is more to getting the best price for your car insurance policy than finding the cheapest provider in your area.

Making a sound investment in your car insurance policy also means understanding just which factors impact your rates the most.

Things such as the zip code you choose to call home, your driving record, the amount of coverage you purchase, and your age or gender can all play a part in determining your rates.

We have collected the data for you and are here to help you make sense of it all before you spend your hard-earned cash on car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Male vs. Female vs. Age

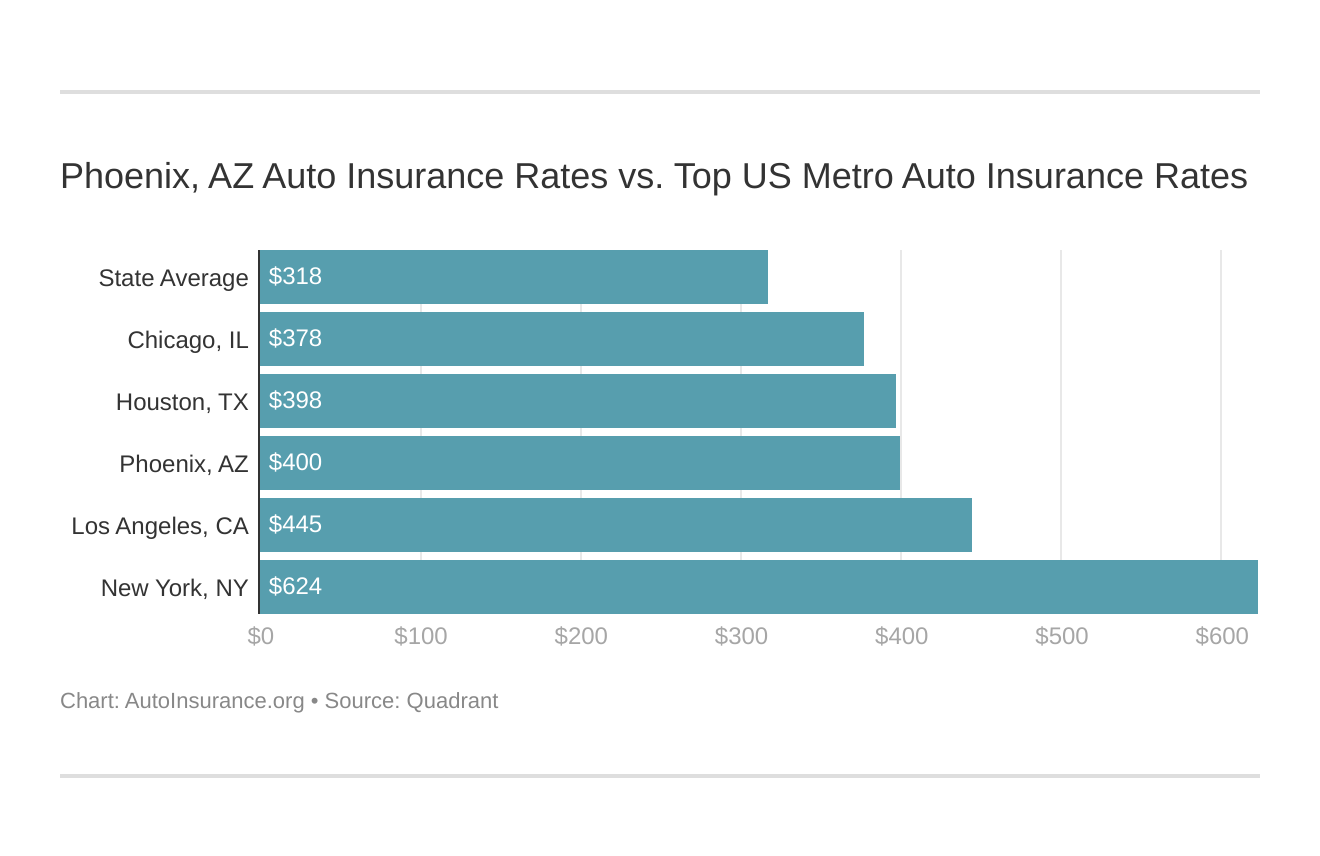

Most people assume that car insurance rates for males than females. Another common assumption is that the older you get the cheaper your car insurance rate gets as well.

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Phoenix. Phoenix, AZ does use gender, so check out the average rates by age and gender in Phoenix, AZ.

That is not always the case though. Sometimes age and gender combine to upend these commonly held beliefs as a 2017 study from Consumer Federation of America (CFA) reveals.

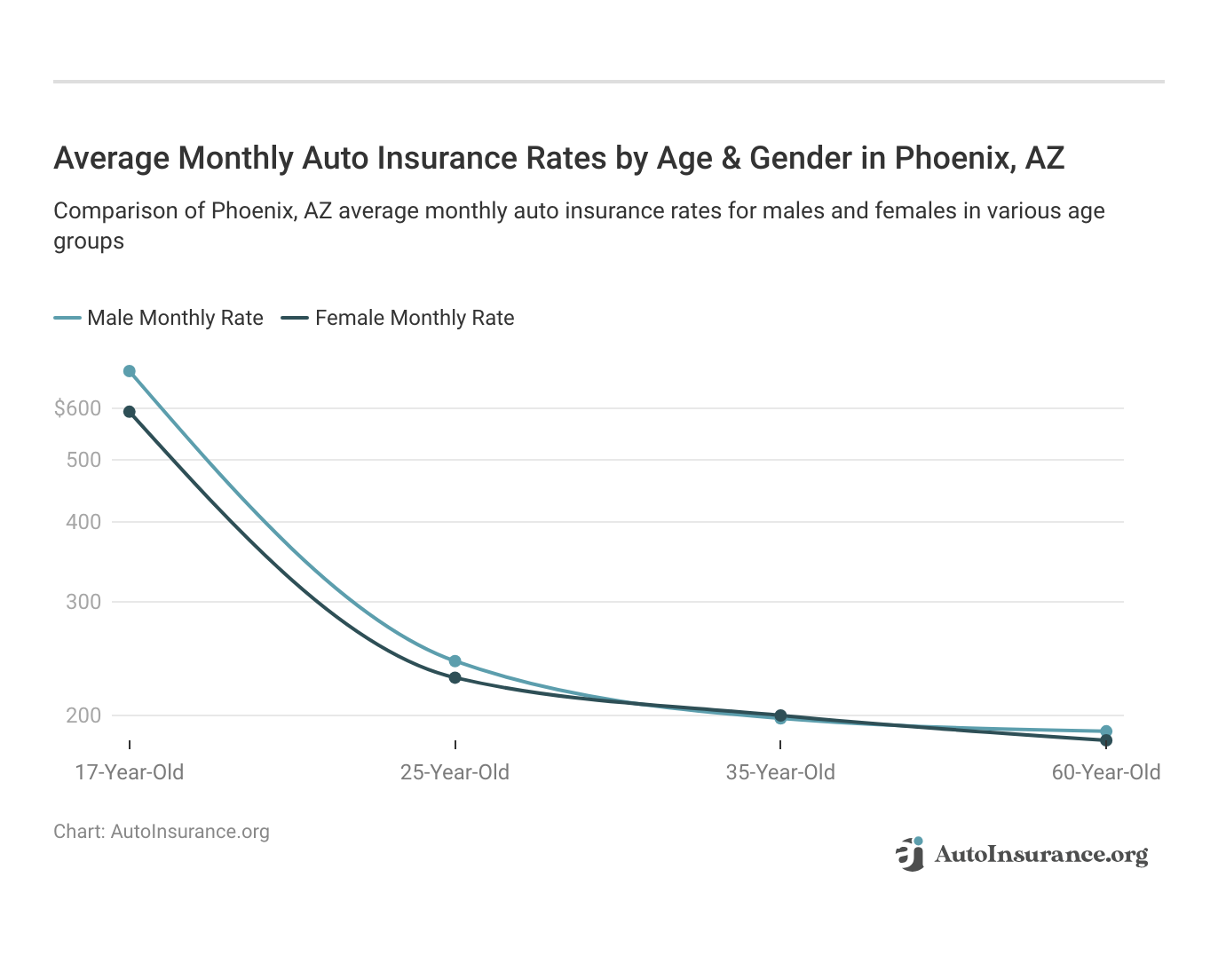

Phoenix, Arizona car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

According to CFA, on the national level for car insurance:

Most large auto insurers charge 40 and 60-year-old women higher rates than men.

This isn’t all there is to it when it comes to your age and your car insurance rates in Phoenix though.

Data USA asserts that the median age of residents in the Valley of the Sun is 33.8. What this means for most Phoenix residents is that their rates will be pretty middle of the road. Phoenix is pretty middle of the road for both males and females in the 40-to-60-year-old range as well.

Take a look at the table below to see what we mean.

| Age | 17 | 25 | 35 | 60 |

|---|---|---|---|---|

| Average Annual Rate | $10,105.79 | $3,384.84 | $2,966.21 | $2,747.78 |

As you can see, a 60-year-old driver in Phoenix actually enjoys the cheapest rates of any of the age groups in the Valley of the Sun which is contrary to the CFA findings.

Married females in this age group also enjoy a savings of around $100 compared to their male counterparts.

| Demographic | Average Annual Rates |

|---|---|

| Single 17-year-old female | $9,240.33 |

| Single 17-year-old male | $10,971.25 |

| Single 25-year-old female | $3,235.53 |

| Single 25-year-old male | $3,534.14 |

| Married 35-year-old female | $2,961.25 |

| Married 35-year-old male | $2,971.16 |

| Married 60-year-old female | $2,697.88 |

| Married 60-year-old male | $2,797.67 |

Age, gender, and marital status are not the only factors that influence the price you will pay for car insurance, though. Sometimes just living on the right block can make a huge difference in the price of your premiums.

Cheapest Zip Codes in Phoenix

There is a lot to see and do in the Valley of the Sun so it’s no wonder that almost 1.7 million people call Phoenix their home. Forbes even lists Phoenix as the 34th best place in the United States for Business and Careers.

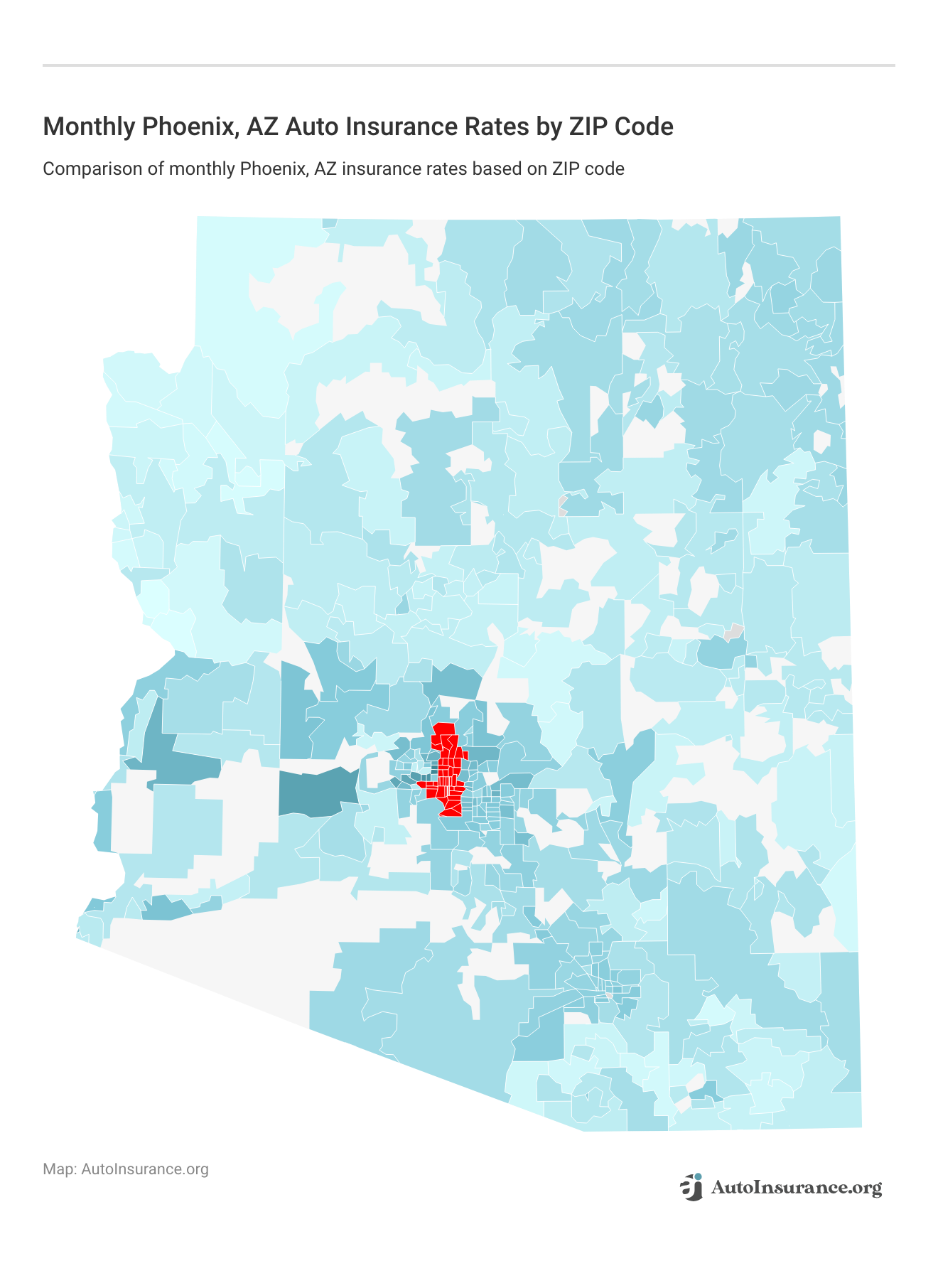

Find more info about the monthly Phoenix, AZ auto insurance rates by ZIP Code below:

More people and businesses mean more zip codes, though, and the one that you call home could end up costing you more for car insurance. Take a look at the table below to see what we mean.

| Zip Code | Average Annual Rate |

|---|---|

| 85086 | $4,053.68 |

| 85087 | $4,090.25 |

| 85085 | $4,129.51 |

| 85048 | $4,138.67 |

| 85044 | $4,181.43 |

| 85045 | $4,204.17 |

| 85083 | $4,285.29 |

| 85050 | $4,345.58 |

| 85027 | $4,406.90 |

| 85054 | $4,407.98 |

| 85097 | $4,460.05 |

| 85028 | $4,477.01 |

| 85024 | $4,489.60 |

| 85039 | $4,500.91 |

| 85022 | $4,550.49 |

| 85032 | $4,556.05 |

| 85018 | $4,615.79 |

| 85065 | $4,676.64 |

| 85053 | $4,686.83 |

| 85016 | $4,710.99 |

| 85026 | $4,738.00 |

| 85023 | $4,749.20 |

| 85037 | $4,750.51 |

| 85008 | $4,785.75 |

| 85073 | $4,788.65 |

| 85014 | $4,811.87 |

| 85020 | $4,825.63 |

| 85042 | $4,847.26 |

| 85029 | $4,957.12 |

| 85025 | $4,961.06 |

| 85003 | $4,961.45 |

| 85007 | $4,983.98 |

| 85004 | $4,987.28 |

| 85012 | $4,990.24 |

| 85043 | $4,999.24 |

| 85013 | $5,013.46 |

| 85034 | $5,035.29 |

| 85006 | $5,049.71 |

| 85041 | $5,069.50 |

| 85021 | $5,073.14 |

| 85040 | $5,084.77 |

| 85051 | $5,106.96 |

| 85015 | $5,153.56 |

| 85033 | $5,179.81 |

| 85035 | $5,185.54 |

| 85031 | $5,297.78 |

| 85019 | $5,327.55 |

| 85017 | $5,394.22 |

| 85009 | $5,433.92 |

The data reveals that you could save almost $300 just by living north of Pointe Golf Club on Lookout Mountain in zip code 85022 versus the residents who choose to make their home south of North Mountain Preserve in zip code 85020.

The New River community also enjoys some of the cheapest rates in the Phoenix area whereas folks in the city center pay some of the highest.

What is the Best Car Insurance Company in Phoenix?

Now that you have a good idea about what your neighbors are paying for their car insurance policies, it’s time to start thinking about which companies are available to you in the Valley of the Sun.

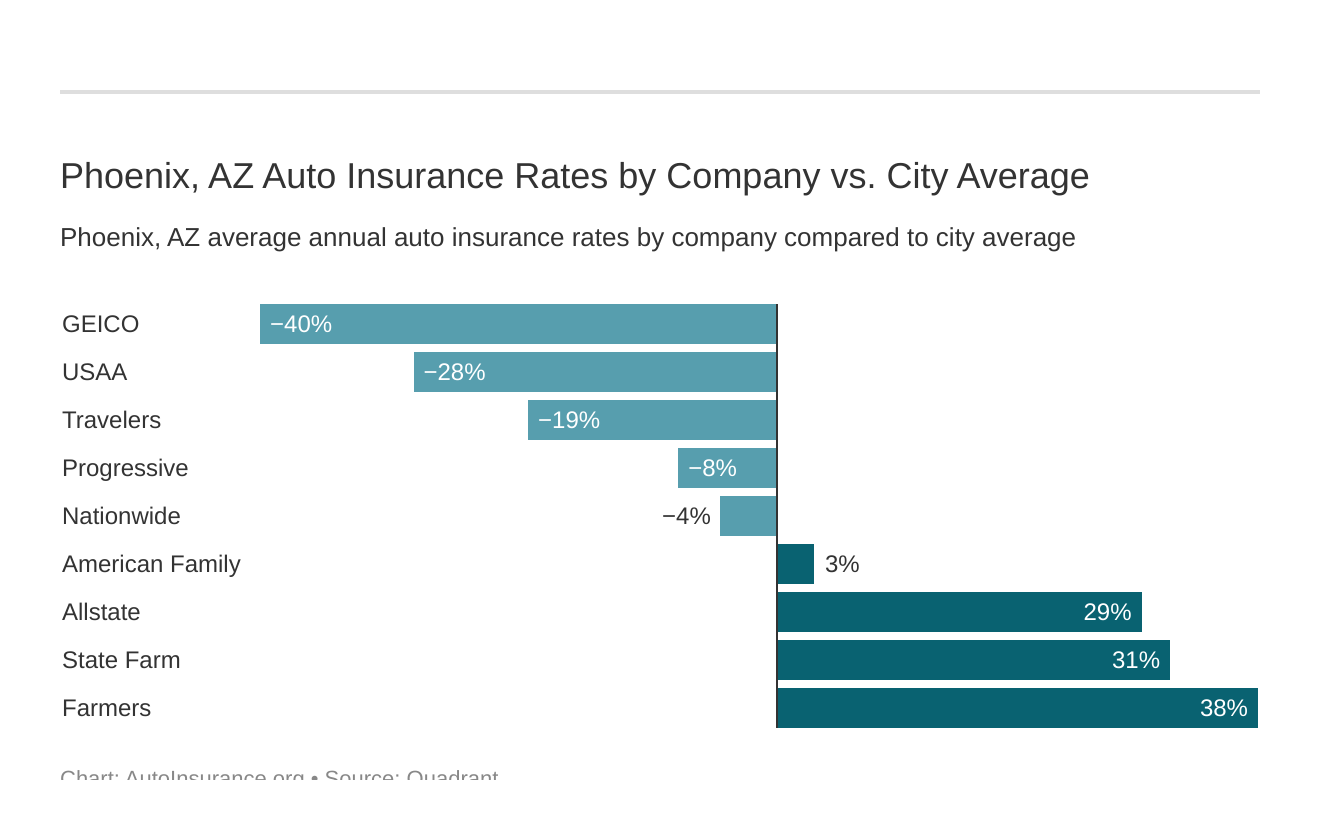

The cheapest Phoenix, AZ car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average rates in Phoenix?” We cover that as well.

When you are looking at car insurance companies in your area you will want to think about the types of drivers who will be covered under your policy. You will also want to consider the coverage types and amounts that you will need according to the type of car you drive and what is required by law.

Things like your credit history and driving record can also play a key role in determining your rates. Keep scrolling to find out how we can help you make sense of it all.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance Rates by Company

We’ve talked a little about how age and marital status can impact the price you will pay for car insurance. Now it’s time to see how those statistics translate into prices.

Take a look at the table below to see what we mean.

| Group | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $4,419.60 | $4,419.60 | $4,306.76 | $4,306.76 | $9,466.11 | $12,191.84 | $4,925.16 | $5,341.70 | $6,172.19 |

| American Family | $3,264.65 | $3,264.65 | $2,998.24 | $2,998.24 | $8,649.73 | $11,311.59 | $3,264.65 | $3,820.35 | $4,946.51 |

| Farmers | $3,488.67 | $3,491.25 | $3,092.54 | $3,300.20 | $15,434.42 | $16,048.47 | $3,945.24 | $4,071.95 | $6,609.09 |

| Geico | $1,944.75 | $2,172.44 | $1,658.73 | $2,135.01 | $5,622.93 | $5,896.33 | $1,765.35 | $1,721.86 | $2,864.68 |

| Nationwide | $3,055.09 | $3,109.12 | $2,723.37 | $2,888.14 | $7,705.85 | $9,890.36 | $3,542.35 | $3,835.44 | $4,593.72 |

| Progressive | $2,452.83 | $2,128.39 | $2,197.51 | $2,087.34 | $10,127.71 | $11,275.34 | $2,621.26 | $2,581.25 | $4,433.95 |

| State Farm | $3,770.00 | $3,770.00 | $3,337.79 | $3,337.79 | $11,885.08 | $14,939.62 | $4,058.40 | $5,133.79 | $6,279.06 |

| Travelers | $2,399.40 | $2,526.29 | $2,233.39 | $2,376.04 | $7,161.63 | $9,051.98 | $2,542.13 | $2,673.68 | $3,870.57 |

| USAA | $1,856.29 | $1,858.69 | $1,732.63 | $1,749.52 | $7,109.49 | $8,135.68 | $2,455.27 | $2,627.25 | $3,440.60 |

It comes as no surprise that all of the auto insurance prices for teenage drivers are much higher than any of the other age groups. What may be surprising though is the big differences in prices among companies when looking at some of the other groups.

For instance, a married 35-year-old woman who is covered by Allstate pays nearly $2,600 more than one who is covered by USAA. Things are not as simple as they appear, though.

Just because USAA looks like the cheapest company for a 35-year-old married woman doesn’t necessarily mean that it is. If this woman has marks on her credit report or driving record she could actually be charged more than the average car insurance rate shown here.

A 35-year-old woman with a clean credit history and driving record who is forced to make a long commute to work every day could also pay more.

Best Car Insurance for Commute Rates

Data collected from the Federal Highway Administration reveals that licensed Arizona residents racked up an average of 12,829 miles on the road in 2014 alone. Even with this number, drivers in the Valley of the Sun actually spend less time in traffic than some of the other major cities across the United States.

Car insurance providers know that more time spent behind the wheel means an increased chance for a traffic incident. This is why what our commute rate has an impact on what you will pay for car insurance. Take a look at the table below to see how your commute in Phoenix might be impacting the price you are paying for car insurance.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $6,172.19 | $6,172.19 | $6,172.19 |

| American Family | $4,899.30 | $4,993.72 | $4,946.51 |

| Farmers | $6,609.09 | $6,609.09 | $6,609.09 |

| Geico | $2,815.81 | $2,913.54 | $2,864.68 |

| Nationwide | $4,593.71 | $4,593.71 | $4,593.71 |

| Progressive | $4,433.95 | $4,433.95 | $4,433.95 |

| State Farm | $6,117.42 | $6,440.69 | $6,279.06 |

| Travelers | $3,870.57 | $3,870.57 | $3,870.57 |

| USAA | $3,403.62 | $3,477.59 | $3,440.61 |

The differences in prices between commute rates may not seem like much in the Valley of the Sun, but stretching your dollar certainly does no matter where you live. This is why it is so important to know which companies can save you money based on which factors they are using to set your rates.

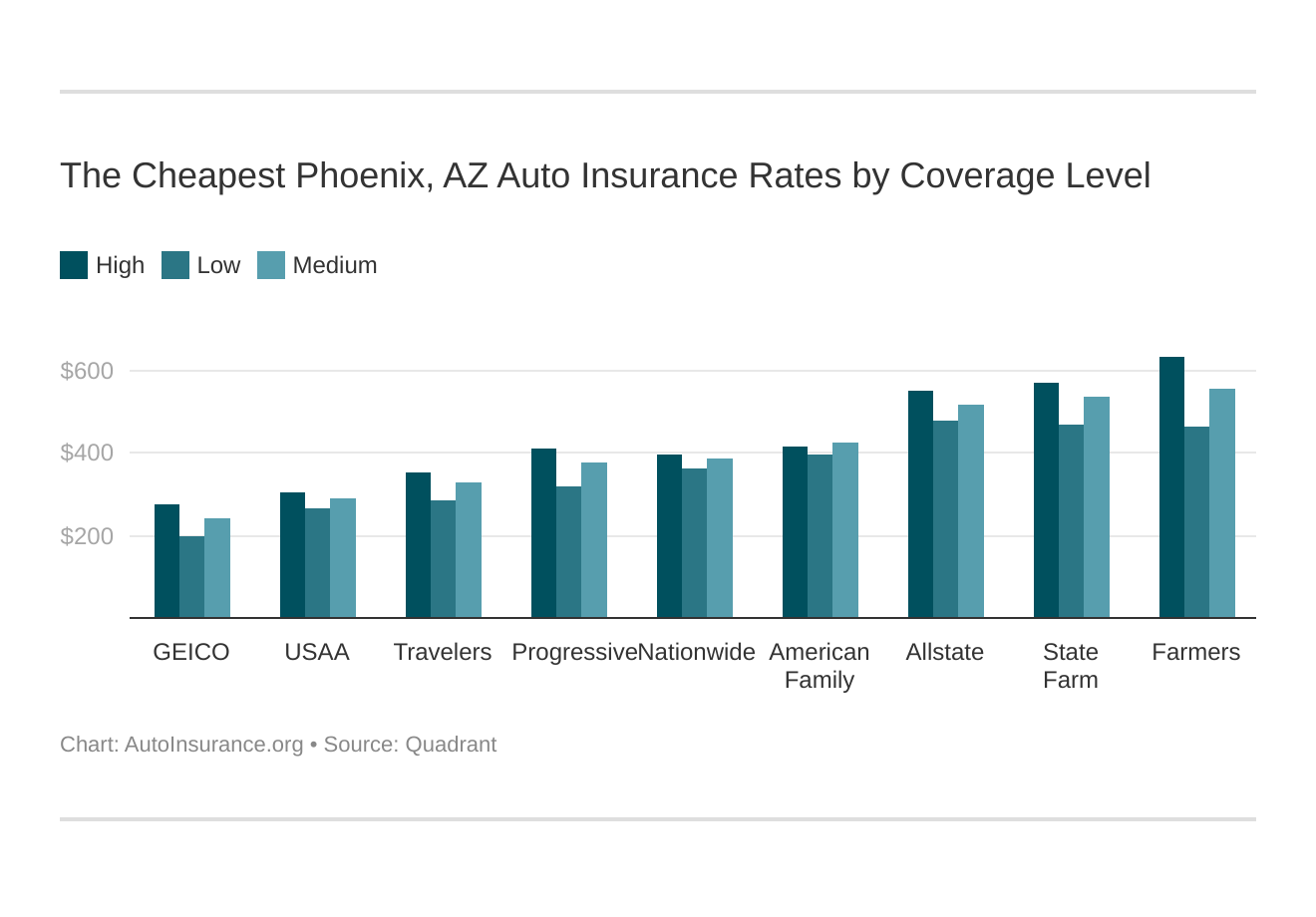

Best Car Insurance for Coverage Level Rates

One of the most recognizable factors that impact your auto insurance premiums is the amount of coverage that you purchase.

Your coverage level will play a major role in your Phoenix, AZ car insurance rates. Find the cheapest Phoenix, Arizona car insurance rates by coverage level below:

Coverage amounts can vary depending on the type of driver you are and the type of car that you drive. For instance, if you have a brand new car, then the lending agent may require that you carry higher coverage amounts.

Take a look at the table below to see how changing your coverage amount can raise or lower the price that you will pay for your car insurance policy.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $6,593.61 | $5,711.69 | $6,211.28 | $6,172.19 |

| American Family | $4,975.42 | $4,760.14 | $5,103.98 | $4,946.51 |

| Farmers | $7,602.03 | $5,542.42 | $6,682.83 | $6,609.09 |

| Geico | $3,322.45 | $2,360.09 | $2,911.48 | $2,864.67 |

| Nationwide | $4,773.24 | $4,360.28 | $4,647.62 | $4,593.71 |

| Progressive | $4,940.49 | $3,837.15 | $4,524.22 | $4,433.95 |

| State Farm | $6,816.24 | $5,615.20 | $6,405.74 | $6,279.06 |

| Travelers | $4,249.42 | $3,425.94 | $3,936.34 | $3,870.57 |

| USAA | $3,670.71 | $3,160.54 | $3,490.56 | $3,440.60 |

Looking at the data it seems as if Geico is the cheapest provider in the Phoenix area. The raw data doesn’t tell the whole story, though.

These coverage prices assume that you are a perfect driver, and none of us is perfect no matter how much we strive to be.

If you have a few dings on driving record or you don’t have enough years of driving experience on your side these prices can change.

The best way to ensure that you are getting the best price for your policy then is to shop around and educate yourself about just what information car insurance providers are using to determine your rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

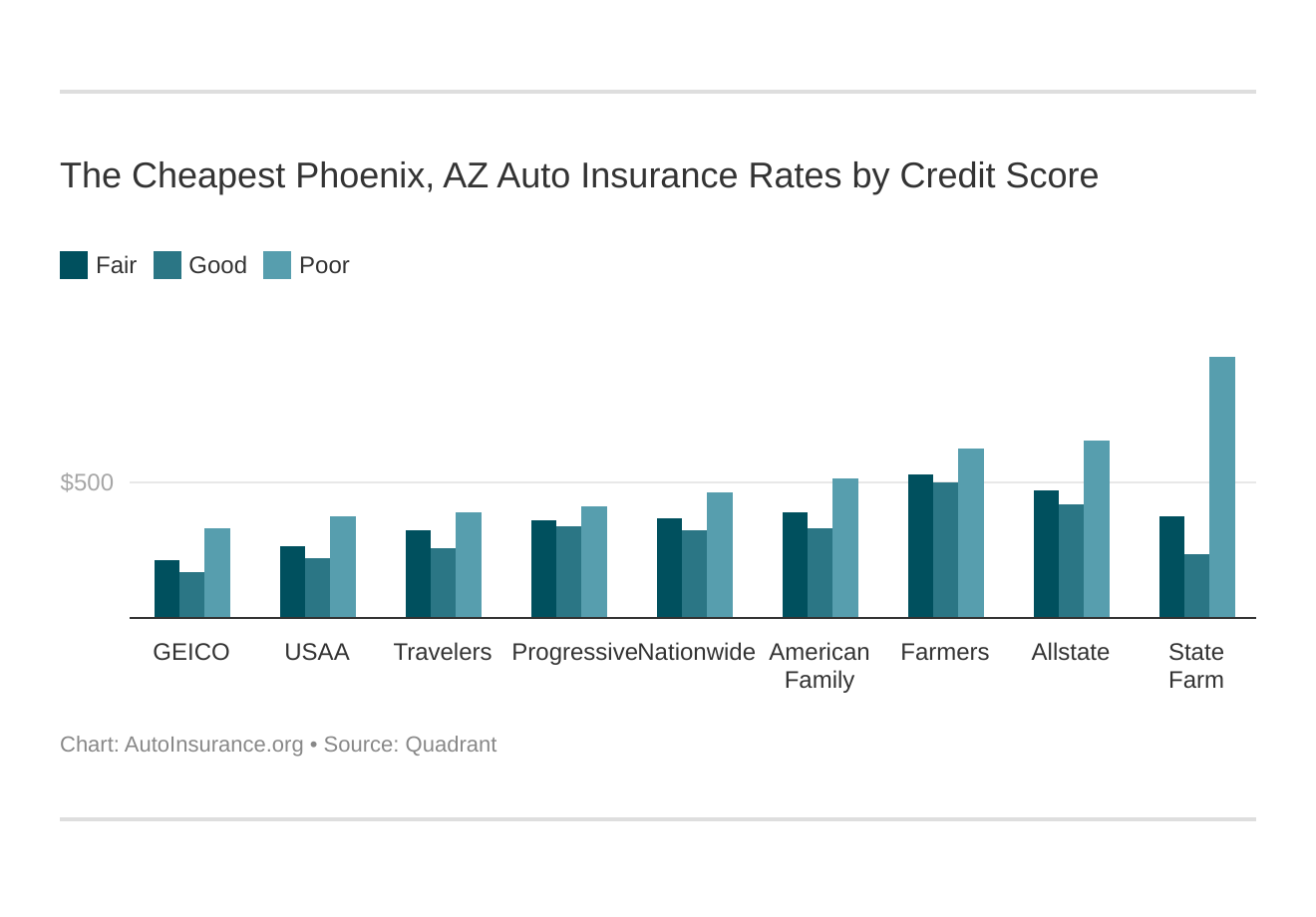

Best Car Insurance for Credit History Rates

While most of us assume that car insurance companies will be looking at our age or our driving record, not too many people realize that your credit history can seriously impact the amount of money that you shell out for your car insurance policy.

Your credit score will play a major role in your Phoenix, AZ car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Phoenix, Arizona car insurance rates by credit score below.

There are a few places where using your credit score to determine your car insurance rates is not allowed. Unfortunately, Phoenix is not one of them. In fact, the price you pay for car insurance in the Valley of the Sun could vary greatly all because of a few credit points which have shifted your credit score in the wrong direction.

| Group | Good Credit | Fair Credit | Poor Credit | Average |

|---|---|---|---|---|

| Allstate | $5,025.29 | $5,618.05 | $7,873.23 | $6,172.19 |

| American Family | $3,993.23 | $4,632.34 | $6,213.97 | $4,946.51 |

| Farmers | $6,000.67 | $6,309.77 | $7,516.84 | $6,609.09 |

| Geico | $2,067.82 | $2,579.19 | $3,947.01 | $2,864.67 |

| Nationwide | $3,839.02 | $4,397.66 | $5,544.47 | $4,593.72 |

| Progressive | $4,032.59 | $4,318.99 | $4,950.28 | $4,433.95 |

| State Farm | $2,796.19 | $4,471.16 | $11,569.83 | $6,279.06 |

| Travelers | $3,056.90 | $3,839.59 | $4,715.22 | $3,870.57 |

| USAA | $2,635.49 | $3,164.45 | $4,521.87 | $3,440.60 |

According to Consumer Reports:

Your credit score could have more of an impact on your premium price than any other factor.

This is because part of the reason that car insurance companies use your credit score as a determinant when setting your rates is that they assume that someone with a lower credit score is more likely to file a claim after an accident.

This assumption could cost you hundreds of dollars if you go with a company like Travelers or thousands of dollars if you purchase blindly from one of their competitors. It doesn’t have to though.

Cleaning up your credit report by just a few points could go a long way towards saving you money on car insurance. One of the easiest ways to do this according to NOLO is to check for errors on your credit report and have things that are no longer applicable removed.

Be aware that you are entitled to one free copy of your credit report from Equifax, TransUnion, and Experian every 12 months. Just go to AnnualCreditReport.com and follow a few simple directions.

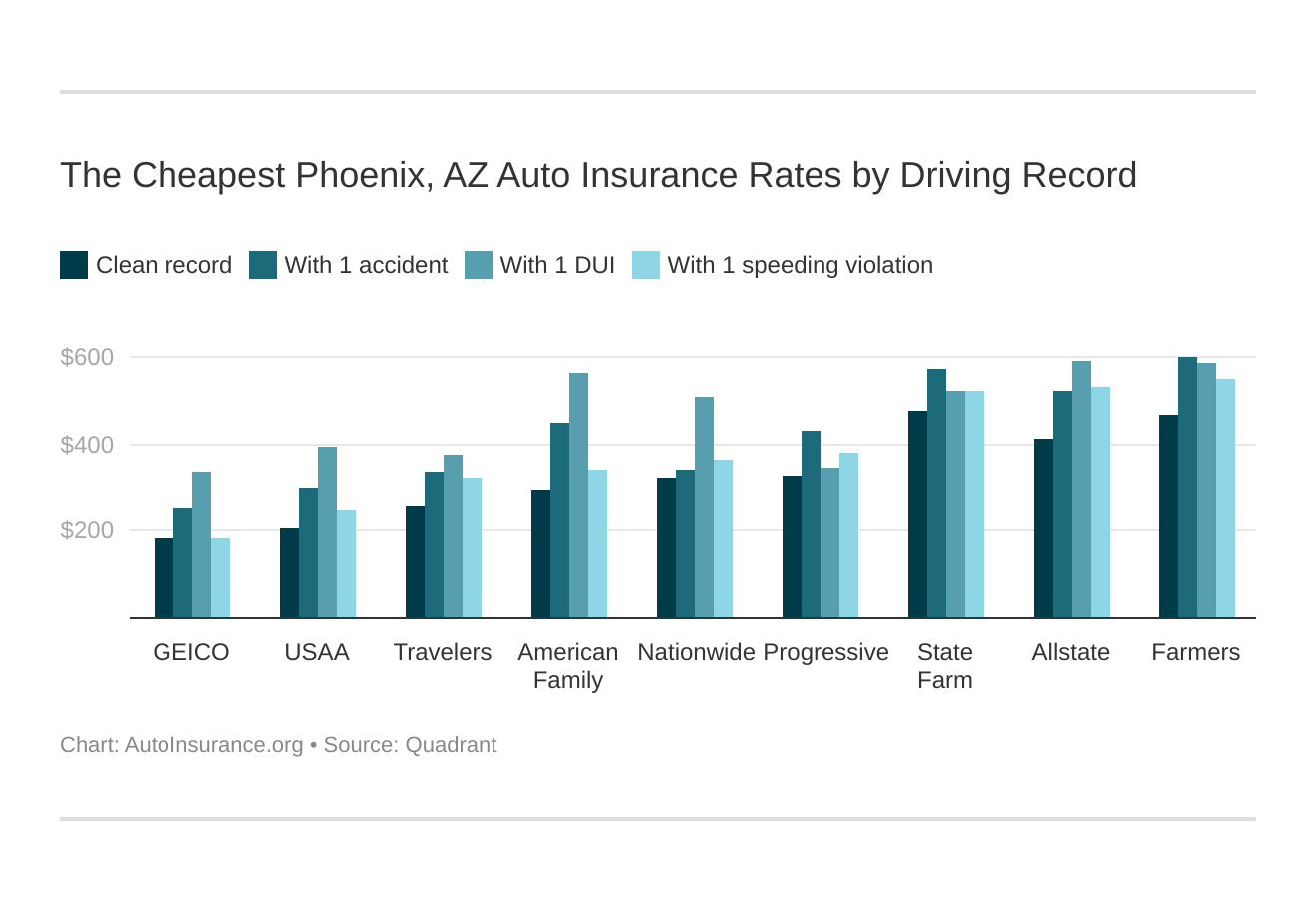

Best Car Insurance for Driving Record Rates

Maintaining a healthy credit report that is free from errors is not the only way that you can save money as a Phoenix driver. Keeping your driving record clean can also put a few bucks back in your pocket.

Your driving record will affect your Phoenix car insurance rates. For example, a Phoenix, Arizona DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Phoenix, AZ car insurance rates by driving record.

Avoiding things like tickets or accidents is not always easy but before you put the pedal to the metal because you are late for work, take a look at the table below to see what it could cost you.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $4,944.22 | $6,260.76 | $7,084.42 | $6,399.37 | $6,096.47 |

| American Family | $3,525.12 | $5,384.00 | $6,785.55 | $4,091.37 | $5,231.56 |

| Farmers | $5,583.15 | $7,211.81 | $7,037.94 | $6,603.47 | $6,610.97 |

| Geico | $2,207.41 | $3,003.89 | $4,039.99 | $2,207.41 | $3,083.76 |

| Nationwide | $3,872.83 | $4,077.56 | $6,081.05 | $4,343.42 | $4,677.15 |

| Progressive | $3,903.29 | $5,165.24 | $4,121.89 | $4,545.39 | $4,396.81 |

| State Farm | $5,700.86 | $6,857.25 | $6,279.06 | $6,279.06 | $6,279.06 |

| Travelers | $3,086.93 | $4,032.98 | $4,509.47 | $3,852.89 | $3,876.46 |

| USAA | $2,497.98 | $3,589.97 | $4,732.04 | $2,942.41 | $3,606.66 |

Looking at the table reveals that just one speeding ticket can cost you almost $2,000 more for your premiums on average than if you just slow down or leave the house a bit earlier. If you fail to drink responsibly the costs could be even higher so always designate a driver.

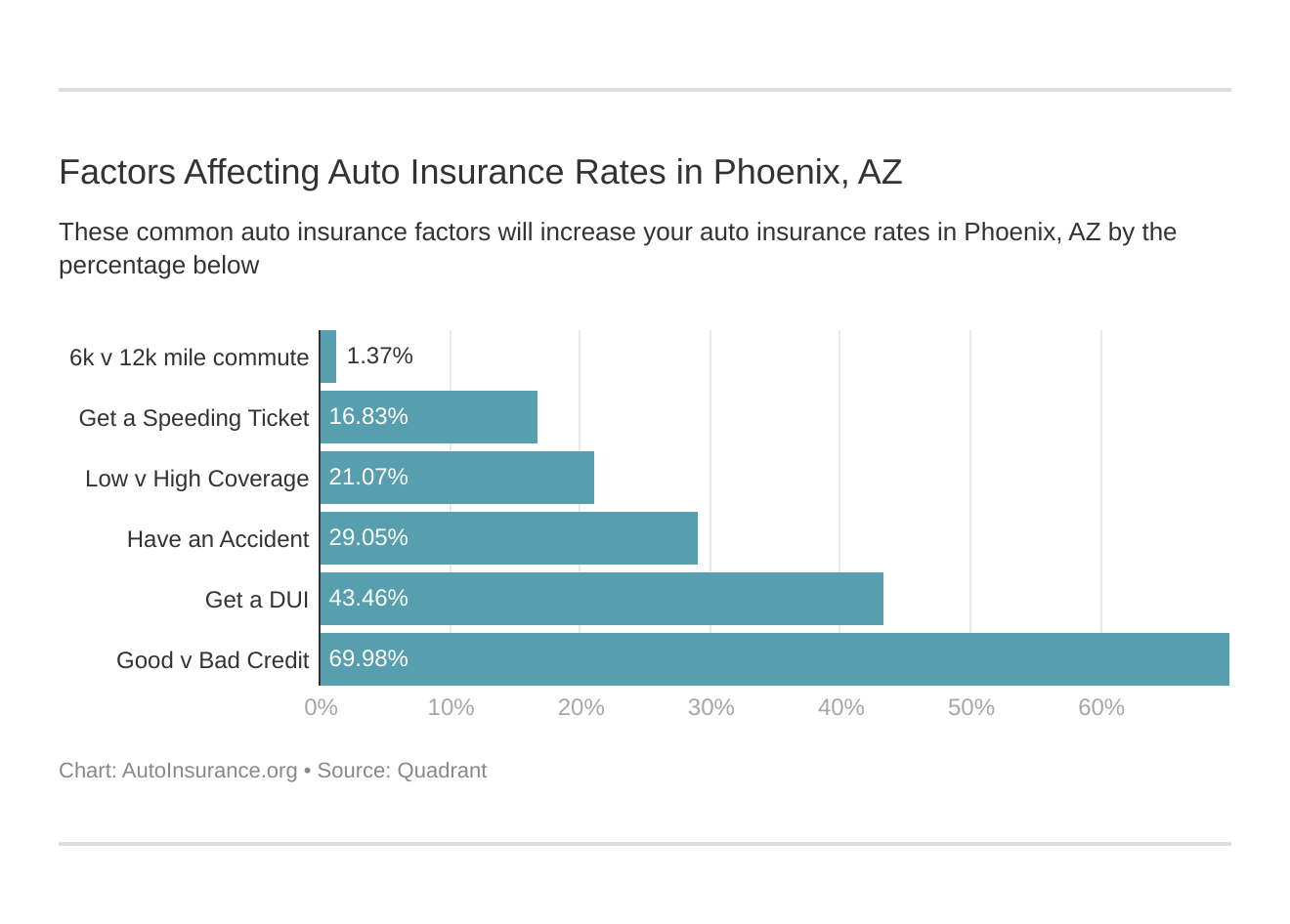

Car Insurance Factors in Phoenix

While things like your age, gender, and credit report may not be city-specific, when it comes to determining your car insurance rates, there are a few things that Phoenix drivers should keep their eye on.

Factors affecting car insurance rates in Phoenix, AZ may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Phoenix, Arizona car insurance.

One of these is the rates by zip code which we have discussed in a previous section. Another thing that drivers in the Valley of the Sun should consider is the overall health of their city’s economy and how that can drive costs up or down when it comes time to purchase a car insurance policy.

Growth and Prosperity

According to the Brookings Institute, Phoenix ranks 39th in growth and 82nd in prosperity nationally. This means that the economy in the Phoenix-Mesa-Scottsdale area is healthy and thriving and healthy economies encourage more business and bring in higher-paying jobs.

The expected job growth was 10 percent for the Phoenix area and The Valley of the Sun actually outpaced that at 13.2 percent. This growth is being fueled by government and service industry jobs. Job growth along with raises in income and overall productivity of the Phoenix workforce have all fed into Phoenix’s continued prosperity.

What does a healthy economy mean to you as a car insurance consumer? It means that competition for your business is fierce among car insurance companies which translates to better rates for you when you set out to purchase your policy.

Median Household Income

According to Data USA, the median household income in Phoenix in 2017 was $56,696. This number demonstrates an 8.9 percent annual growth rate over the previous year which places the median household income for residents of the Valley of the Sun just slightly below the national average. No matter how much money you make each year though, no one wants to spend too much on car insurance.

If the median household income for Phoenix residents is $56,696, and the average annual cost for insurance in the area is $5,433.92, this means that residents of the Valley of the Sun spend around $453 out of their monthly budget of $4,700 just for car insurance. This is roughly 9.58 percent of their yearly income.

You can use the calculator below to see just how much your annual income is being reduced by your car insurance premium.

Considering your findings, shouldn’t you get the most for your money?

Home Ownership in Phoenix

Homeownership is another good way to determine the overall health of a city’s economy, and according to Data USA, Phoenix is performing well in this area too.

In 2017, around 56 percent of homes in the Valley of the Sun were occupied by the people who own them. This was up 53 percent from the previous year.

While these percentages are lower than the national average their upward momentum demonstrates how great of a city Phoenix really is. According to Money Magazine and Consumer Federation of America (CFA), owning a home can also save you money on car insurance.

In fact, according to CFA:

Major auto insurance companies charge good drivers as much as 47 percent more for basic liability auto insurance if they don’t own their home.

You may not be able to buy a home in order to lower your car insurance rates, but you can drive defensively, drink responsibly, and keep an eye on your credit report and driving record. All of these things can really help you save money in the long run.

If you are thinking of buying a home in the Valley of the Sun it is good to know that median property value in Phoenix stands at around $231,000.

Bundling homeowners insurance and car insurance into one policy could also help you save money so be sure to ask your agent if there are discounts for doing this.

Education in Phoenix

Owning a home is not the only thing that can help lower your rates. Sometimes the value of a good education goes beyond just expanding your mind or enhancing your career prospects.

It can also impact your car insurance rates. Nasdaq even asserts that:

As controversial as it may be, the education level of drivers can be taken into account by auto insurance companies.

With this in mind, it is a good thing that Phoenix boasts a plethora of institutes for higher education. In fact, according to Study.com, there are about 90 colleges and universities within 25 miles of the Valley of the Sun.

The largest of these are:

- University of Phoenix (Arizona) with a student body of 195,059

- Grand Canyon University with a student body of 62,304

- Arizona State University with a student body of 50,320

- Mesa Community College with a student body of 22,711

- Glendale Community College with a student body of 20,506

About 38.7 percent of the students who attend some of these institutes choose to pursue a degree in nursing according to Data USA which translates to approximately 6.000 nursing degrees being awarded in 2015 alone.

This may not seem surprising when you consider that women outnumber men in the student body populations of these institutes by almost double.

The Arizona Commerce Authority also notes that:

Arizona is home to one of the fastest-growing bioscience industries in the U.S.

This could explain why so many students choose to go into the medical field.

No matter which gender you are, which major you choose, or where you choose to go to school one thing is clear: higher education has a lot of benefits beyond the classroom.

Wage by Race & Ethnicity in Common Jobs

Getting a good job that pays well is why most people go to college. Not everyone can afford to enroll at institutes for higher learning though.

Looking at the percentage of annual income spent on car insurance by college degree-holding individuals and non-degree-holding individuals reveals why it is necessary to really do your homework before you purchase your car insurance policy.

| Ethnicity | Micellaneous Managers | Premiums as Percentage of Income | Firstline Supervisonrs of Retail Sales Workers | Premiums as Percentage of Income | Customer Service Representative | Premiums as Percentage of Income | Elementary and Middle School Teachers | Premiums as Percentage of Income | Cashiers | Premiums as Percentage of Income |

|---|---|---|---|---|---|---|---|---|---|---|

| Asian | $99,831 | 5.44% | $59,912 | 9.07% | $47,099 | 11.54% | $37,726 | 14.40% | $12,483 | 43.53% |

| White | $90,658 | 5.99% | $52,561 | 10.34% | $30,822 | 17.63% | $39,182 | 13.87% | $18,801 | 28.90% |

| American Indian | $82,090 | 10.27% | $30,992 | 8.82% | $30,306 | 29.22% | $42,089 | 14.68% | $16,590 | 45.06% |

| Other | $64,916 | 8.37% | $32,209 | 16.87% | $22,543 | 24.10% | $36,303 | 14.97% | $8,933 | 60.83% |

| Two or More Races | $52,890 | 10.27% | $61,580 | 8.82% | $18,594 | 29.22% | $37,011 | 14.68% | $12,058 | 45.06% |

| Black | $50,455 | 10.77% | $57,701 | 9.42% | $26,218 | 20.73% | $41,118 | 13.22% | $9,260 | 58.68% |

It should come as no surprise that the lower your income is, the more of your annual budget will be eaten up by car insurance. What might come as a shock is that your occupation along with your gender could be impacting your rates.

Wage by Gender in Common Jobs

A monthly budget that is already stretched thin can be stressed even more when occupation and gender combine as factors for purchasing car insurance. Take a look at the table below to see how.

As you can see, the Phoenix area is not that different than the national picture where men earn more for the same types of jobs occupied by their female counterparts. What the table below reveals though is how this translates into a higher percentage of annual income being spent on car insurance premiums by females, though.

| Gender | Micellaneous Managers | Premiums as Percentage of Income | Firstline Supervisonrs of Retail Sales Workers | Premiums as Percentage of Income | Elementary and Middle School Teachers | Premiums as Percentage of Income | Customer Service Representatives | Premiums as Percentage of Income | Cashiers | Premiums as Percentage of Income |

|---|---|---|---|---|---|---|---|---|---|---|

| Male | $101,171 | 5.37% | $59,189 | 9.18% | $45,258 | 12.01% | $38,529 | 14.10% | $31,141 | 17.45% |

| Female | $75,103 | 7.24% | $43,340 | 12.54% | $40,675 | 13.36% | $35,050 | 15.50% | $23,873 | 22.76% |

All told, men in the Valley of the Sun made approximately 1.31 times more than their female counterparts in 2017 according to Data USA. It doesn’t matter if you are a man or a woman though when it comes to wanting a good deal for your car insurance policy.

Poverty by Age and Gender

Having a lower-paying job can really add stress to a person’s budget regardless of gender. This is especially true when it comes time to purchase your car insurance policy because, as Consumer Federation of America (CFA) points out:

Nearly all car owners are required by state law to purchase liability coverage [and] all those financing purchases are required by lenders to have collision and comprehensive coverage.

Car insurance doesn’t always come cheap, and lower-income individuals often pay more for their premiums because they often suffer from lower credit scores. This is why it is so important to shop around.

Approximately 21 percent of Phoenix’s population lives at or below the poverty line. Most of these residents are also females between the ages of 25 to 34.

This means that while Consumer Federation of America (CFA) might have been slightly off about women being charged more for car insurance premiums nationally when it comes to the Phoenix area, women in the Valley of the Sun really are paying more of their annual income towards car insurance than their male counterparts.

Poverty by Race and Ethnicity

Gender is not the only thing to combine with socioeconomics and leave a dent in your wallet after you purchase your car insurance policy. Your race and/or ethnicity could also be impacting what you pay.

According to the Insurance Journal and the Insurance Information Institute (III):

Insurance companies do not gather information on race or income, nor do they set rates based on this information.

Why do some races and ethnicities pay more for car insurance, then? One answer is that they earn lower wages which impacts their credit score.

As we discussed earlier, a lower credit rating is used as an indicator by car insurance companies that a person might be more likely to file a claim after an accident. Lower-income also means that the percentage of annual income spent on car insurance increases.

According to Data USA, white residents of Phoenix make up the majority of those living in poverty.

Employment by Occupation

The city of Phoenix is looking into ways to decrease poverty and increase the ability of better-paying jobs for its citizens. One of the industries that the Valley of the Sun is favoring is the fields that involve technological advancements.

Phoenix is also making a concerted effort to use its strong infrastructure as a means for growing the manufacturing industry in the area.

With all of these investments in the community by city leaders and planners, it is no wonder that the Valley of the Sun enjoyed a growth rate of almost 3 percent between 2016 and 2017.

More growth means more competition as we mentioned before. This is good news for residents of Phoenix when it comes to shopping for car insurance because more competitors in the car insurance market mean lower prices overall.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving in Phoenix

Now that you have a good idea about the demographics in the Valley of the Sun and how they can impact car insurance rates in your area, it’s time to start thinking about how road conditions might impact what you pay as well.

Some of these conditions include the amount of traffic that you will face as you try to make it to and from work each day under the blistering Phoenix sun. Other factors that may make or break your day include the state of the roads that your car is traveling on and how these roads impact your maintenance costs.

We have broken all of these things down for you. Keep reading to see how we can help make your commute slightly more enjoyable.

Roads in Phoenix

While you may not always get a chance to head out on such scenic roadways as the Apache Trail, Dobbins Lookout, or Wrigley Mansion when you’re driving around in Phoenix, it’s nice to know that the Valley of the Sun has these great escapes from city driving just minutes away from the hustle and bustle of the I-10.

The stretch of I-10 that passes through Phoenix is not the only place where drivers can become frustrated in traffic, though.

Major Highways

The I-10/I-17 Spine Corridor can be quite a headache for Phoenix drivers during rush hour.

There have been numerous studies done and public meetings held in order to correct some of this interchange’s biggest issues. The ideas and plans generated by these committees and public forums don’t amount to much to a driver stuck in Phoenix traffic, though.

Some of Phoenix’s other popular routes include:

- The Papago Freeway

- The Maricopa Freeway

- The Black Canyon Freeway

- Arizona State Route 24

- Arizona State Route 51

- The U.S. Route 60”¦also known as the Superstition Freeway

- The Agua Fria Freeway

- The Pima Freeway

- The Price Freeway

- The Red Mountain Freeway

- Arizona State Route 143

- The Santan Freeway

- The Northern Parkway

- Arizona State Route 74

- And Arizona Route 85

Because Phoenix does not have a well-developed mass transit system its residents must rely on private passenger vehicles for the most part which has caused the state and local governments to purpose expansions to the roadways such as I-11 project.

Arizona and the Phoenix area are also considering adding toll roads as a means of paying for new projects in the future.

Arizona is one of only 15 states in the nation that does not have toll roads and one-third of Arizona residents would like to keep it that way.

Popular Road Trips and Sites

If you’re looking to get away from the winding interstates and congested freeways that make up the Phoenix metro area it’s nice to know that the beauty of nature and a plethora of history lay just outside the city limits.

The Sonora Desert is under an hour from downtown and offers a wealth of tours to see the wonders of the natural world. The Rosson House is another great option for sightseers who wish to stay in town. The Montezuma Castle National Monument is also a wonderful place to visit if you want to see how history and nature combine.

No matter which day trip you decide on you will want to check out the road conditions along your route before heading out. After all, no one likes a bumpy ride.

Road Conditions

The average vehicle operating costs for Phoenix-Mesa residents according to Tripnet.org is around $550 a year. Poor road conditions can also add a substantial amount to your vehicle operating costs which is why residents of the Valley of the Sun are so concerned with things such as potholes or poor drainage.

The concerns by Phoenix residents are not unfounded, either. In fact,

According to the city, 3,227 of the city’s 4,863 miles of streets — or about 70 percent — are in less than good condition, and another 800 will slip into that category in the next five years if not repaired.

If you need to report an issue with your street you can go to the City of Phoenix website and fill out a simple form.

Want to see when and if your road will be repaired? The City of Phoenix has you covered there too. Just visit their Pavement Maintenance Dashboard. Type in a few details, and see what the city has planned.

Does Phoenix Use Red Light Cameras?

Knowing what road conditions await you as you head out the door is one way of keeping your vehicle operating costs down. Another way is to save money on your car insurance policy.

One of the best ways to save a few bucks on car insurance is to keep your driving record clean. This means avoiding tickets and accidents. One of the best ways to do this is to remain alert behind the wheel at all times and ay attention to all traffic signals and signs.

According to the Insurance Institute for Highway Safety (IIHS):

Red light camera programs in 79 large U.S. cities saved nearly 1,300 lives through 2014.

Even with this knowledge, many drivers continue to blow through red lights in the Phoenix area. To help combat this, the City of Phoenix offers some interesting facts regarding its Red Light Camera Enforcement Program.

The City of Phoenix also warns drivers that:

Phoenix Police Department deploys Photo Enforcement Vans at or around schools throughout the City. The vans are setup with sophisticated radar equipment that monitors vehicle speeds as traffic approaches and passes the van. If a vehicle is exceeding the posted speed, the radar equipment signals the cameras to take a picture of the vehicle as it approaches the enforcement van and a second image as it goes past the van.

Running a red light can cost you up to $250 in fines and two points on your license. Speeding can also cost you about $165 and an additional $35 in surcharges and fees.

The bottom line then is to drive at a safe speed and pay attention to all road signs and traffic signals.

Vehicles in Phoenix

Residents of the Valley of the Sun really love their cars. They also have a flair for being unique. This is probably why Your Mechanic lists the Nissan 350Z as the Most Unusually Popular Car for Phoenix.

Your Mechanic also asserts that the top-selling car in Arizona is the Dodge Ram 1500.

This truck is a serious business. With options for a V-6, V-8, or HEMI motor, it is no wonder that this beast only gets 20 mpg in the city and 25 on the highway. Many residents of Arizona are ranchers, though, so the 10,000-plus pounds of towing capacity really comes in handy.

This truck has a plethora of safety features as well.

With a good balance of pros and cons, it is no wonder Arizona residents like this truck. Insuring a vehicle like this doesn’t come cheap sometimes, though, which is why we are here to help you get the best deal possible.

Cars Per Household in Phoenix

Purchasing car insurance for one car can get expensive depending on the make and model as you have seen. Given that most households in Phoenix have two cars, according to Data USA, that price could double as well.

Two cars also means double the maintenance and therefore double the vehicle operating costs per household. Considering this, it’s no wonder that shopping around for car insurance can be a big help to your bottom line.

Phoenix Households without a Car

Governing.com asserts that in 2016 only 8.4 percent of all Phoenix households did not own a car. This is down from 2015 which saw 9.1 percent of households in the Valley of the Sun without a vehicle.

Just because you don’t own a car doesn’t mean that you shouldn’t purchase a car insurance policy though. Many car insurance companies offer Non-Owner Car Insurance for people who drive on occasion even if they don’t personally own a vehicle.

Non-Owner Insurance provides you with limited liability coverage even if the car you are driving isn’t registered to you.

Speed Traps in Phoenix

Owning two or more cars and running red lights are two of the many reasons why you might be paying more for car insurance. Another reason could be that you have found yourself tangled in a speed trap.

According to The Phoenix Times, the 10 worst speed traps in the Phoenix area are

- Near Phoenix schools

- On Scottsdale Road

- On Rio Verde Drive, in Scottsdale

- On Power Road, in Mesa

- Near Scottsdale schools

- In Mesa school zones

- On Grand View Avenue, in El Mirage

- In North Chandler

- On Lincoln Drive, in Paradise Valley

- And on Tatum Boulevard, in Paradise Valley

All of these areas have fixed cameras designed to catch speeders in the act. If you get caught it could cost you $165 minimum, with additional costs being added for every 10 mph that you are found to be over the designated speed limit.

Getting caught will also raise your insurance premiums, so slow down and save a few bucks.

Vehicle Theft in Phoenix

The FBI reported that there were 6,355 vehicle thefts in Phoenix in 2013. That seems like a lot, but with a lot of people comes a lot of vehicles and therefore more of a chance for vehicle theft.

Having your car stolen can be quite a hassle. You can reduce your headache by purchasing comprehensive car insurance which can protect you against loss or damage resulting from this type of crime.

Comprehensive coverage can also protect you if your car has been vandalized which might be a comfort to residents who live near West Indian School Road and North 39th Avenue or those who reside around South 16th Street and East Buckeye road since these areas are reported to be some of the neighborhoods with the highest crime rates according to NeighborhoodScout.com.

Phoenix also has some crime statistics that might seem alarming when taken out of context as well. Take a look at the pair of tables below to see what we mean.

| Phoenix Violent Crimes 2017 | Murder | Rape | Robbery | Assault |

|---|---|---|---|---|

| Report Total | 157 | 1,142 | 3,293 | 7,919 |

| Rate per 1,000 | 0.1 | 0.7 | 2.03 | 4.87 |

These statistics are why Phoenix is ranked as being safer than 7 percent of other U.S. cities. Your chances of becoming a victim of violent crime in Phoenix, on the whole, are also one in 130 which is lower than Arizona in total.

| Phoenix Annual Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 12,511 | 60,353 | 72,864 |

| Crime Rate (per 1,000 Residents) | 7.69 | 37.12 | 44.81 |

Phoenix is not all bad though, and the residents who live in the Valley of the Sun really do care about their friends and neighbors so don’t let the statistics scare you.

Whether you live in a neighborhood where crime is prevalent, or your neighborhood seems to be one of the more quiet ones, having the right amount of coverage for your vehicle is always a good investment.

Phoenix Traffic

Having the right amount of coverage can also help you out if you are ever involved in an accident. Given that Phoenix ranks 125th in the world, according to Inrix, the chances of being involved in a traffic incident are pretty significant.

Phoenix residents lose approximately 73 hours in traffic as well, according to Inrix, at a cost of $1,013 per driver.

Spending so much time in traffic increases your chance of an accident which could put the cost of your rates for insurance at risk. The loss of time and money to congestion-related costs is also another reason to get the best price for your car insurance policy.

Transportation

Data USA reports that the average commute time for Phoenix residents is around 25 minutes. This is lower than New River which is indicated by the top bar line on the table below, and which has an average commute time of 29 minutes.

This commute time is also lower than the national average of approximately 26 minutes. It may not feel like it, though, when you’re stuck in traffic in the Spine Corridor.

Commuter Transportation

Part of the reason why Phoenix suffers from congestion is that about 74 percent of its residents chose to drive alone each day according to Data USA.

More cars on the road mean increased traffic incidents which could translate into higher rates for some people. Comparing coverage and rates across a variety of car insurance providers could save you money, though.

How Safe Are Phoenix Streets and Roads?

Knowing that there are more cars on the road and how that can impact your car insurance rates is just part of the total picture. Being able to prevent an accident altogether is another key component to keeping your rates low.

Part of avoiding an accident is understanding which types are more common in your area so that you can drive defensively and try to avoid them. Below is a table with data provided by the National Highway and Transportation Safety Administration (NHTSA) which gives you an idea about the road conditions and the number of fatal crashes reported in your county.

| County | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Apache | 28 | 26 | 49 | 35 | 42 |

| Cochise | 20 | 12 | 17 | 26 | 22 |

| Coconino | 40 | 45 | 58 | 50 | 47 |

| Gila | 23 | 17 | 31 | 19 | 27 |

| Graham | 2 | 10 | 7 | 5 | 8 |

| Greenlee | 6 | 1 | 0 | 1 | 1 |

| La Paz | 13 | 11 | 19 | 18 | 18 |

| Maricopa | 398 | 367 | 405 | 478 | 471 |

| Mohave | 55 | 29 | 49 | 53 | 44 |

| Navajo | 34 | 39 | 43 | 31 | 48 |

| Pima | 96 | 88 | 93 | 111 | 114 |

| Pinal | 59 | 45 | 55 | 62 | 71 |

| Santa Cruz | 8 | 8 | 6 | 3 | 6 |

| Yavapai | 41 | 42 | 47 | 41 | 55 |

| Yuma | 24 | 33 | 16 | 18 | 26 |

As you can see, Maricopa County, which includes Phoenix, has had the highest number of traffic fatalities in the state over the past few years.

Some of these fatal accidents include drivers who are under the influence. Take a look at the data below to see what this means to you as a resident of Phoenix.

| County | 2013 Alcohol Fatalities | 2014 Alcohol Fatalities | 2015 Alcohol Fatalities | 2016 Alcohol Fatalities | 2017 Alcohol Fatalities |

|---|---|---|---|---|---|

| Apache | 11 | 7 | 22 | 15 | 14 |

| Cochise | 6 | 5 | 6 | 5 | 8 |

| Coconino | 10 | 17 | 15 | 8 | 18 |

| Gila | 7 | 5 | 11 | 4 | 9 |

| Graham | 2 | 4 | 2 | 5 | 2 |

| Greenlee | 2 | 0 | 0 | 1 | 1 |

| La Paz | 2 | 1 | 2 | 3 | 3 |

| Maricopa | 97 | 77 | 115 | 128 | 131 |

| Mohave | 12 | 6 | 12 | 14 | 14 |

| Navajo | 11 | 10 | 15 | 7 | 14 |

| Pima | 29 | 25 | 32 | 24 | 33 |

| Pinal | 14 | 18 | 18 | 16 | 14 |

| Santa Cruz | 3 | 3 | 1 | 0 | 1 |

| Yavapai | 10 | 10 | 10 | 5 | 9 |

| Yuma | 7 | 11 | 5 | 5 | 6 |

Here again, Maricopa County is the front runner in these types of fatal car accidents. Maricopa County is also out front when it comes to single-vehicle crash fatalities.

| County | 2013 Single Vehicle Crash Fatalities | 2014 Single Vehicle Crash Fatalities | 2015 Single Vehicle Crash Fatalities | 2016 Single Vehicle Crash Fatalities | 2017 Single Vehicle Crash Fatalities |

|---|---|---|---|---|---|

| Apache | 26 | 18 | 32 | 25 | 24 |

| Cochise | 13 | 10 | 6 | 21 | 13 |

| Coconino | 34 | 28 | 41 | 39 | 25 |

| Gila | 19 | 12 | 18 | 11 | 22 |

| Graham | 1 | 4 | 5 | 2 | 6 |

| Greenlee | 4 | 1 | 0 | 1 | 1 |

| La Paz | 9 | 6 | 13 | 12 | 10 |

| Maricopa | 197 | 206 | 200 | 258 | 246 |

| Mohave | 31 | 20 | 29 | 24 | 25 |

| Navajo | 26 | 34 | 17 | 18 | 32 |

| Pima | 67 | 52 | 62 | 61 | 78 |

| Pinal | 36 | 20 | 33 | 39 | 31 |

| Santa Cruz | 4 | 6 | 3 | 3 | 5 |

| Yavapai | 22 | 26 | 27 | 17 | 33 |

| Yuma | 15 | 19 | 11 | 10 | 15 |

Given that most Phoenix drivers choose to commute alone, this is not surprising. What is surprising is that drivers in Maricopa County also have the highest number of speeding-related fatalities compared to neighboring counties.

| County | 2013 Speeding Fatalities | 2014 Speeding Fatalities | 2015 Speeding Fatalities | 2016 Speeding Fatalities | 2017 Speeding Fatalities |

|---|---|---|---|---|---|

| Apache | 13 | 3 | 18 | 12 | 6 |

| Cochise | 9 | 6 | 6 | 11 | 4 |

| Coconino | 11 | 18 | 17 | 18 | 10 |

| Gila | 11 | 7 | 13 | 8 | 8 |

| Graham | 1 | 7 | 2 | 2 | 4 |

| Greenlee | 2 | 1 | 0 | 1 | 0 |

| La Paz | 4 | 3 | 12 | 5 | 8 |

| Maricopa | 111 | 111 | 132 | 148 | 128 |

| Mohave | 28 | 9 | 26 | 21 | 17 |

| Navajo | 13 | 15 | 10 | 5 | 21 |

| Pima | 38 | 27 | 33 | 45 | 36 |

| Pinal | 24 | 17 | 16 | 24 | 21 |

| Santa Cruz | 5 | 5 | 0 | 2 | 2 |

| Yavapai | 14 | 14 | 22 | 17 | 25 |

| Yuma | 9 | 12 | 8 | 6 | 9 |

Knowing that your neighbors are in such a hurry could help you avoid a traffic accident because it helps you understand how advantageous leaving the house a bit earlier can be. Paying attention behind the wheel can also have a positive impact on your life and the lives of others considering that 122 people died in 2017 as a result of roadway departures.

| County | 2013 Roadway Departure Fatalities | 2014 Roadway Departure Fatalities | 2015 Roadway Departure Fatalities | 2016 Roadway Departure Fatalities | 2017 Roadway Departure Fatalities |

|---|---|---|---|---|---|

| Apache | 14 | 9 | 25 | 19 | 13 |

| Cochise | 17 | 4 | 7 | 20 | 9 |

| Coconino | 22 | 28 | 37 | 29 | 25 |

| Gila | 16 | 13 | 17 | 15 | 14 |

| Graham | 0 | 8 | 2 | 5 | 7 |

| Greenlee | 4 | 1 | 0 | 1 | 1 |

| La Paz | 9 | 5 | 12 | 6 | 15 |

| Maricopa | 129 | 98 | 122 | 136 | 122 |

| Mohave | 30 | 16 | 22 | 29 | 25 |

| Navajo | 18 | 23 | 21 | 14 | 18 |

| Pima | 46 | 34 | 41 | 43 | 41 |

| Pinal | 27 | 21 | 25 | 33 | 29 |

| Santa Cruz | 4 | 4 | 4 | 3 | 6 |

| Yavapai | 32 | 27 | 34 | 26 | 35 |

| Yuma | 9 | 10 | 10 | 9 | 11 |

Phoenix neighbors in Pinal County should also keep their eye on the road. Especially since their number of roadway departure deaths seem to be on the rise.

Keeping your eyes on the road can also help you avoid intersection-related accidents which could lower the number of 160 deaths from this type of accident that were reported for Maricopa County alone.

| County | 2013 Intersection Fatalities | 2014 Intersection Fatalities | 2015 Intersection Fatalities | 2016 Intersection Fatalities | 2017 Intersection Fatalities |

|---|---|---|---|---|---|

| Apache | 2 | 1 | 2 | 2 | 6 |

| Cochise | 1 | 0 | 5 | 2 | 4 |

| Coconino | 0 | 1 | 5 | 6 | 2 |

| Gila | 1 | 1 | 6 | 0 | 1 |

| Graham | 1 | 0 | 0 | 1 | 1 |

| Greenlee | 0 | 0 | 0 | 0 | 0 |

| La Paz | 4 | 2 | 0 | 0 | 0 |

| Maricopa | 153 | 141 | 163 | 180 | 160 |

| Mohave | 10 | 4 | 14 | 13 | 3 |

| Navajo | 3 | 1 | 5 | 1 | 3 |

| Pima | 36 | 29 | 28 | 37 | 48 |

| Pinal | 12 | 11 | 11 | 14 | 23 |

| Santa Cruz | 2 | 1 | 2 | 0 | 0 |

| Yavapai | 3 | 9 | 3 | 7 | 11 |

| Yuma | 11 | 11 | 4 | 6 | 10 |

All of the data collected by the NHTSA seems to indicate that Phoenix drivers should be among some of the most aware in the state. The NHTSA has also collected data on passenger car occupant fatalities which express why it is so important to buckle up when riding in a motor vehicle. Take a look.

| Country | 2013 Passenger Car Occupant Fatalities | 2014 Passenger Car Occupant Fatalities | 2015 Passenger Car Occupant Fatalities | 2016 Passenger Car Occupant Fatalities | 2017 Passenger Car Occupant Fatalities |

|---|---|---|---|---|---|

| Apache | 7 | 6 | 3 | 10 | 10 |

| Cochise | 5 | 2 | 5 | 6 | 3 |

| Coconino | 5 | 11 | 10 | 7 | 14 |

| Gila | 5 | 6 | 4 | 3 | 5 |

| Graham | 1 | 6 | 0 | 2 | 3 |

| Greenlee | 4 | 1 | 0 | 0 | 0 |

| La PAz | 0 | 4 | 5 | 5 | 4 |

| Maricopa | 103 | 103 | 126 | 121 | 120 |

| Mohave | 15 | 6 | 18 | 17 | 13 |

| Navajo | 3 | 6 | 16 | 7 | 8 |

| Pima | 25 | 29 | 31 | 39 | 27 |

| Pinal | 13 | 14 | 9 | 25 | 18 |

| Santa Cruz | 1 | 4 | 4 | 1 | 3 |

| Yavapai | 15 | 8 | 19 | 12 | 14 |

| Yuma | 7 | 10 | 4 | 10 | 8 |

Some of these numbers can be attributed to the fact that Maricopa County is the most populated county in Arizona.

Even with these vast differences in populations between the counties though driving defensively, drinking responsibly, slowing down, and paying attention behind the wheel could help you save money on car insurance and prevent yourself from becoming a statistic.

Watching where you are walking can also help prevent a car accident. Just in 2017, Maricopa County saw 143 car accidents that resulted in pedestrian deaths. This is much higher than Phoenix neighbors in La Paz County or Pinal County.

| County | 2013 Pedestrian Fatalities | 2014 Pedestrian Fatalities | 2015 Pedestrian Fatalities | 2016 Pedestrian Fatalities | 2016 Pedestrian Fatalities |

|---|---|---|---|---|---|

| Apache | 5 | 4 | 8 | 5 | 7 |

| Cochise | 0 | 1 | 0 | 2 | 4 |

| Coconino | 7 | 4 | 7 | 5 | 3 |

| Gila | 4 | 1 | 1 | 2 | 4 |

| Graham | 0 | 0 | 3 | 0 | 0 |

| Greenlee | 1 | 0 | 0 | 0 | 0 |

| La Paz | 0 | 0 | 0 | 1 | 2 |

| Maricopa | 84 | 91 | 97 | 131 | 143 |

| Mohave | 7 | 6 | 6 | 4 | 1 |

| Navajo | 7 | 5 | 3 | 4 | 8 |

| Pima | 23 | 13 | 19 | 21 | 28 |

| Pinal | 4 | 4 | 9 | 6 | 11 |

| Santa Cruz | 1 | 0 | 0 | 0 | 0 |

| Yavapai | 2 | 4 | 1 | 4 | 2 |

| Yuma | 6 | 9 | 1 | 1 | 3 |

Maricopa County also saw 22 people lose their lives as a result of an accident involving a bicycle and a car.

| County | 2013 Pedalcyclist Fatalities | 2014 Pedalcyclist Fatalities | 2015 Pedalcyclist Fatalities | 2016 Pedalcyclist Fatalities | 2017 Pedalcyclist Fatalities |

|---|---|---|---|---|---|

| Apache | 0 | 0 | 0 | 0 | 0 |

| Cochise | 0 | 0 | 0 | 0 | 0 |

| Coconino | 0 | 1 | 1 | 0 | 0 |

| Gila | 0 | 0 | 0 | 0 | 0 |

| Graham | 1 | 1 | 0 | 0 | 1 |

| Greenlee | 0 | 0 | 0 | 0 | 0 |

| La Paz | 0 | 0 | 1 | 0 | 0 |

| Maricopa | 19 | 18 | 14 | 22 | 22 |

| Mohave | 3 | 0 | 2 | 0 | 1 |

| Navajo | 1 | 0 | 0 | 0 | 0 |

| Pima | 5 | 7 | 5 | 6 | 4 |

| Pinal | 2 | 0 | 4 | 2 | 3 |

| Santa Cruz | 0 | 0 | 0 | 0 | 0 |

| Yavapai | 0 | 1 | 1 | 0 | 1 |

| Yuma | 0 | 1 | 0 | 0 | 0 |

NHTSA also has statistics on fatalities by road type that could help you be more aware behind the wheel. The table below reveals the amount of fatal car crashes in the entire state of Arizona by road type.

| Arizona Road Type | Fatal Crashes |

|---|---|

| Rural | 76 |

| Urban | 66 |

| Freeway and Expressway | 48 |

| Other | 256 |

| Minor Arterial | 203 |

| Collector Arterial | 142 |

| Local | 108 |

| Unknown | 5 |

| Total Fatal Crashes | 1 |

As you can see from the data, most fatal accidents occur on principal arterials. These include interstate highways, freeways, and expressways. Because traffic is often traveling much faster on these types of roads this may come as no surprise.

Because Phoenix is home to over 20 different types of principal arterials this should be of concern to residents of the Valley of the Sun.

Allstate America’s Best Drivers Report

With all of the statistics on fatal crashes in the Phoenix area, it may seem as if the Valley of the Sun has the worst drivers in the nation. Phoenix actually ranks 83rd though on Allstate’s Best Driver Report for 2018.

Residents of Phoenix also have an average of 8.5 years between claim filings and are 17 percent less likely than the national average to file a claim. Phoenix drivers do experience a hard-braking incident approximately every 26 miles though so be careful out there.

Taking your eyes off the road could cause you to collide with the car in front of your resulting in damage to the vehicles involved and injuries to the occupants. Both of these could raise your rates so it pays to pay attention.

Ridesharing

Sometimes you just don’t feel like driving, and sometimes it is just better if you don’t. On these occasions, it is nice to know that Phoenix has a plethora of ridesharing options available to you.

According to RideGuru.com, Phoenix has the following ridesharing services for you to choose from:

- Blacklane

- Carmel

- Limos.com

- Lyft

- SuperShuttle

- Traditional Taxi services

- Total Ride

- Uber

Some of these services cater to specialized clientele or only service certain areas so be sure to check with each service before as part of making your transportation plans.

EStar Repair Shops

If you do choose to drive yourself and the unfortunate happens it is nice to know that there are quality repair EStar shops in your area.

What is an EStar repair shop? It is a repair shop that is constantly monitored by Esurance to make sure that you get the best repairs that your money can buy. Check out the list below to find the one closest to you.

| Shop Name | Address | Contact Info |

|---|---|---|

| GERBER - TEMPE/UNIVERSITY DRIV | 2100 W UNIVERSITY DR TEMPE AZ 85281 | email: gerberazaudits@gerbercollision.com P: (480) 774-9999 F: (480) 774-9997 |

| CARSTAR MICHAEL'S COLLISION | 11044 N CAVE CREEK RD PHOENIX AZ 85020 | email: tyra@michaelscollision.com P: (602) 371-1700 |

| GERBER - TEMPE/PRIEST DR. | 8045 S PRIEST DRIVE TEMPE AZ 85284 | email: gerberazaudits@gerbercollision.com P: (480) 422-3870 F: (480) 705-3212 |

| GERBER - MESA/BROADWAY RD | 1015 W BROADWAY RD MESA AZ 85210 | email: gerberazaudits@gerbercollision.com P: (480) 969-5485 F: (480) 962-8745 |

| GERBER - SCOTTSDALE/SAN VICTOR DRIVE | 8910 E SAN VICTOR DR SCOTTSDALE AZ 85258 | email: gerberazaudits@gerbercollision.com P: (480) 391-7000 F: (480) 391-0200 |

| CHANEY'S COLLISION CENTERS | 7161 N 61ST AVE GLENDALE AZ 85301 | 7161 N 61ST AVE GLENDALE AZ 85301 email: martin@chaneys.biz P: (623) 934-9000 F: (623) 939-8658 |

| CHAPMAN AUTO BODY | 999 W BELL ROAD PHOENIX AZ 85023 | email: dannyharwell@chapmanchoice.com P: (602) 866-6180 |

| SERVICE KING GILBERT | 1572 W. HARVARD AVENUE GILBERT AZ 85233 | email: ccc@serviceking.com P: (480) 507-8778 F: (480) 507-8194 |

| GERBER - GILBERT | 477 N COOPER RD GILBERT AZ 85233 | email: gerberazaudits@gerbercollision.com P: (480) 632-4747 F: (480) 497-0786 |

| GERBER - CHANDLER | 725 E. CHANDLER BLVD. CHANDLER AZ 85225 | email: gerberazaudits@gerbercollision.com P: (480) 917-8833 F: (480) 917-8836 |

If none of these are within a suitable distance don’t worry. You can just use Esurance’s convenient EStar repair shop finder tool.

Weather

Even if the traffic in Phoenix is not always nice, the weather usually is. It’s also usually hot, but it beats the frozen wasteland of Minnesota in the winter.

The average annual high temperature in the Valley of the Sun is 86.7 degrees and the average low is only around 63.4 degrees according to U.S. Climate Data.

Phoenix only experiences about 36 days with rainfall as well and has about 3,832 hours a year of sunshine which is how the city got its nickname.

Maricopa County as a whole has had 15 natural disasters which is on par with the national average of 13. Of the 15 declared, 11 of these were declared by the president.

While natural disasters are rare in the Valley of the Sun it might be a good idea to invest in comprehensive coverage for your car just in case.

Public Transit

While most people choose to take their personal vehicle wherever they go in the Phoenix area there are other options besides ridesharing if you decide not to.

The regional transit system in the Valley of the Sun is called the Valley Metro. This system includes:

- Public buses

- Neighborhood circulators

- Dial-a-Ride services

- Vanpool service

- Online carpool matching

- The Valley Metro Rail

Alternate Transportation

Buses, trains, and cars are not the only way to get around in the Valley of the Sun. Phoenix residents can also rent a bike from places like Grid, or check out options for renting a Scooter or even a wheelchair.

You can also rent a Vespa if you are looking to get around the city on the cheap.

Be aware though that some of these places might make you sign an insurance waiver or pick up rental insurance.

Parking in Metro Areas

If you decide to brave the city streets with your car then you will probably need to find parking at some point.

Sites like Best Parking and Parkopedia can help you find convenient parking and the most recent rates if you are looking to park in downtown Phoenix.

DTPHX also asserts that there are over 25,000 parking spaces in the metro area so there is no reason for getting a parking ticket. If you do get one though the CIty of Phoenix offers you several ways to pay for it:

- By Mail at Phoenix Municipal Court, PO Box 25650, Phoenix, Az. 85002-5650

- Online

- By Phone by calling 602-262-6421, Monday through Friday from 8:00 a.m. to 5:00 p.m., except for legal holidays. You must have a credit or debit card ready when calling.

The sooner you pay the more you will save.

Air Quality in Phoenix

It is no secret that the more cars that are on the road in any given area the more likely that area is to have bad air quality.

According to the EPA. the Phoenix-Mesa-Scottsdale enjoyed both good days and bad days in between 2016 and 2018. Take a look.

| Phoenix-Mesa-Scottsdale Air Quality Index | 2016 | 2017 | 2018 |

|---|---|---|---|

| Good Days | 26 | 32 | 42 |

| Moderate Days | 265 | 238 | 238 |

| Days Unhealthy for Sensitive Groups | 67 | 82 | 66 |

| Days Unhealthy | 5 | 11 | 7 |

| Days Very Unhealthy | 3 | 2 | 12 |

Most of the days over this three-year period were spent in the moderate range for the Phoenix-Mesa-Scottsdale area. You could do your part to reduce these days by carpooling or taking alternative forms of transportation whenever possible.

When you carpool or chose alternative transportation options you are reducing your carbon footprint because each car operation is emitting carbon monoxide into the air. In fact:

According to the EPA, motor vehicles collectively cause 75 percent of carbon monoxide pollution in the U.S.

Sometimes you just have to drive through, but choosing a fuel-efficient car or even driving a hybrid can really help the environment. Some of these options can even qualify you for car insurance discounts so be sure to ask your agent about them when you start to put your policy together.

Military Members and Veterans

Being active duty military or having veteran status can also qualify you for certain discounts on your car insurance policy. This is good to know if you are one of the 4,786 active duty members, 6,966 active duty family members, or 3,868 National Guard members that call Maricopa County their home.

All told, there are 11 military installations in the Phoenix area including Luke Air Force Base, the U.S. Defense Investigation Services outpost, the Arizona National Guard Post ar Papago Park, and the U.S. Marine Corps base off of Interstate 17.

Maricopa County is also home to over 300,000 veterans; many of whom served in Vietnam and the Gulf Wars.

With such a proud and diverse group of military and veteran families in the Valley of the Sun, it’s no wonder that car insurance companies would want to reward them for their service.

Some of the providers with Military Discounts on car insurance include:

- Allstate

- Esurance

- Farmers

- Geico

- Liberty Mutual

- MetLife

- SafeAuto

- State Farm

- The General

- USAA

Some of these providers only offer discounts to active duty members while others extend the savings to family members and veterans. Just be sure to ask your agent if you qualify so you don’t miss out on the savings.

Unique City Laws

Some of the laws in the Valley of the Sun are as unique as the people who call this great city home.

One of the most fascinating laws is actually statewide though, and it is called The Stupid Motorist Law.

This law makes anyone who bypasses barricades and gets caught in a flooded area liable for the costs if they require emergency assistance.

Anyone riding a horse or driving a horse-drawn carriage is also held accountable to the same rights and responsibilities as a person operating a motor vehicle. Arizona also has a ban on handheld devices.

If you choose to use your vehicle as a food truck you will also need to be permitted by the City of Phoenix and will be subject to health inspections.

The Valley of the Sun also offers monthly rates for parking in certain areas as well as reserved parking for residents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What time is it in Phoenix, AZ?

Phoenix is in the Mountain Standard Time zone. This means that if you are not in the same time zone you will need to add or subtract hours from your day in order to determine what time it is in the Valley of the Sun, or you can use Timeanddate.com’s convenient tool. Simply enter a city or time zone and hit the go button.

How can I get current road conditions near Phoenix?

Arizona DOT offers realtime traffic and weather conditions online for your convenience. You can also enter start and ending addresses and this tool will help you map your route.

Does Arizona have a concealed weapon law?

Arizona does allow its residents to conceal carry with a permit. Arizona does honor all other out of state concealed carry permits except for those issued by Idaho. When it comes to Idaho, Arizona only recognizes the Enhanced Permit, not the Standard Permit.

Are the laws different on tribal lands?

There are 22 sovereign American Indian communities residing within the state of Arizona. Each of these Indian Nations has its own lands, government, laws, and rules for visitors. Before traveling to any of these lands you should check with their local law enforcement division for specific laws or regulations that might be of concern to you.

Does Arizona have a concealed weapon law?

Arizona does allow its residents to conceal carry with a permit. Arizona does honor all other out of state concealed carry permits except for those issued by Idaho. When it comes to Idaho, Arizona only recognizes the Enhanced Permit, not the Standard Permit.

Where is the Phoenix Airport?

Phoenix Sky Harbor International Airport is located at 3400 E Sky Harbor Blvd, Phoenix, AZ 85034. The airport is not just for travelers either. Phoenix Sky Harbor boasts an impressive art collection on display to the public.

Can I get insurance coverage for my rental car in Phoenix, AZ?

Yes, you can typically get insurance coverage for a rental car in Phoenix, AZ. Your personal auto insurance policy may provide coverage for rental vehicles. Additionally, rental car companies offer their own insurance options. Review your existing coverage and consider the rental car company’s insurance offers to determine the best option for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.