Cheap Auto Insurance for a Bad Driving Record in 2026 (Save Big With These 9 Companies!)

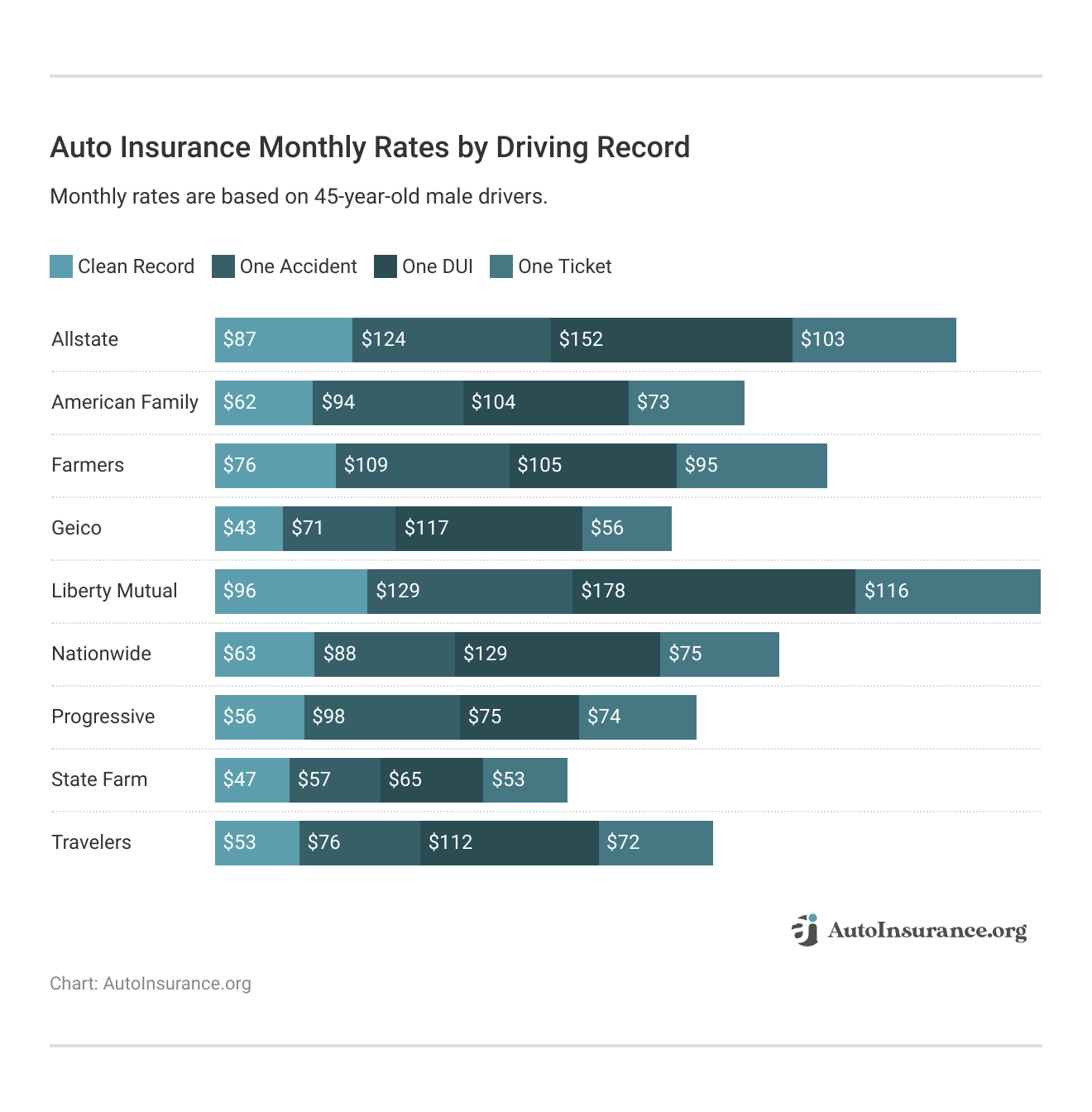

State Farm is the best provider of cheap auto insurance for a bad driving record, followed by Progressive and American Family. While DUIs, tickets, and accidents will raise rates and require SR-22 filings, State Farm's auto insurance rates for a bad driving record start at $65 a month for minimum coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated August 2025

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Bad Driving

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Bad Driving

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for Bad Driving

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe top provider of cheap auto insurance for a bad driving record is State Farm at $65 per month, followed by Progressive and American Family.

For even more options on the cheapest auto insurance companies for those with bad driving records, take a look at the table below.

Our Top 9 Company Picks: Cheapest Auto Insurance for a Bad Driving Record

| Company | Rank | Monthly Rates | Defensive Driving | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $65 | 15% | Cheap Rates | State Farm | |

| #2 | $75 | 30% | Budgeting Tools | Progressive | |

| #3 | $104 | 5% | Bundling Discounts | American Family |

| #4 | $105 | 10% | DUI Policies | Farmers | |

| #5 | $112 | 20% | Filing Claims | Travelers | |

| #6 | $117 | 15% | SR-22 Filings | Geico | |

| #7 | $129 | 10% | UBI Discounts | Nationiwde | |

| #8 | $152 | 10% | Low-Mileage Discounts | Allstate | |

| #9 | $178 | 10% | Affordable Add-Ons | Liberty Mutual |

To help you save money on insurance with a bad driving record, we will go over what the cheapest car insurance companies are for bad drivers, as well as discounts to help lower insurance rates.

- At-fault accidents, traffic tickets, and DUIs will raise auto insurance rates

- Drivers with bad driving records should shop around to find cheaper rates

- Keeping a clean driving record after a violation will reduce rates over time

Some driving violations require SR-22 insurance, which can raise your rates, but you can still save money. Enter your ZIP code to compare quotes to find companies near you with cheap car insurance for a bad driving record.

Compare Auto Insurance Rates by Driving Record

Some of the more affordable car insurance companies for bad drivers are State Farm and Progressive, although there may be cheaper companies depending on your driving offense.

Any moving violation will raise your auto insurance rates. Some examples are speeding, failure to yield, and reckless driving tickets. Some companies may charge more for a DUI than for an at-fault accident, so comparing rates based on your driving offense is important. You can find cheap auto insurance after a DUI here.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How a Bad Driving Record Affects Auto Insurance Rates

A bad driving record is an indicator to insurance companies that you are more likely to engage in poor driving behaviors in the future, which could lead to crashes. Since your insurance company will pay out the claim, your company will raise your auto insurance rates to offset future predicted costs.

Drivers with a history of accidents or DUIs are statistically more likely to file future claims, which makes them riskier to insure.Laura Berry Former Licensed Insurance Producer

However, another factor affecting how much you pay is your state’s average rates and how long offenses stay on your record (Learn More: How long does an accident stay on your record?).

Average rates for major driving offenses vary by state. You may be charged hundreds of dollars more after an accident in some states compared to cheaper states. It may also be harder to find a company willing to insure you if you have an especially bad driving history and are required to file an SR-22 certificate that proves you have coverage as a high-risk driver.

If this is the case, you may have to purchase auto insurance through your state. Because guaranteed auto insurance through your state is more expensive, this should be a last resort for high-risk drivers. You should exhaust all other car insurance companies before applying through your state.

How to Save Money on Insurance With a Bad Driving Record

Despite having a bad driving record, you can still save money on auto insurance by taking advantage of discounts at the top companies for bad driving records.

Top Auto Insurance Discounts for Bad Drivers

| Company | Auto- Pay | Defensive Driving | Multi- Policy | Usage- Based |

|---|---|---|---|---|

| 9% | 10% | 25% | 30% | |

| 4% | 5% | 25% | 15% |

| 5% | 10% | 20% | 30% | |

| 7% | 15% | 25% | 25% | |

| 15% | 10% | 25% | 30% |

| 10% | 10% | 20% | 25% | |

| 12% | 30% | 10% | $231/yr | |

| 13% | 15% | 17% | 20% | |

| 6% | 20% | 13% | 30% |

If you qualify, usage-based insurance (UBI) provides the biggest discounts. State Farm Drive Safe & Save offers up to 30%, while Allstate and Nationwide give up to 40%.

However, some companies may not offer UBI to certain high-risk drivers with a bad record. In that case, you can still find cheap high-risk auto insurance with these tips:

- Increase Your Deductibles: Higher deductibles of $1,000 or more will lower your monthly premiums, but just be sure you can afford the increased out-of-pocket cost if you ever need to make a claim.

- Drop Full Coverage: High-risk drivers with older vehicles can carry liability-only policies to get cheap auto insurance with a bad driving record.

- Try Pay-Per-Mile Plans: If your driving record excludes you from UBI programs, try the best pay-as-you-go auto insurance companies that track only your miles and not your driving habits.

- Compare Quotes Online: Comparing providers online every three to six months can help you find cheap auto insurance companies for a bad driving record that offer better rates.

The easiest way to get cheap car insurance for a bad driving record is to avoid any further infractions. Most accidents and speeding tickets will fall off your record in three years, leading to lower rates over time.

The Best Cheap Auto Insurance Companies For a Bad Driving Record

State Farm, Progressive, and American Family are our top three picks for cheap car insurance for a bad driving record. Scroll through this list of ten affordable companies to find the right provider for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Affordable Rates: On average, State Farm has the most affordable bad driving record insurance rates, starting at $53 after a speeding ticket and $65 after a DUI.

- Large Agent Network: State Farm has a large agent network, so drivers can get in-person advice on how to save with a bad driving record.

- Various Coverage Options: State Farm offers a good selection of auto insurance coverages for drivers to choose from.

Cons

- Mixed Customer Service: State Farm has some negative reviews regarding claims processing. You can read more ratings in our State Farm auto insurance review.

- Regional Discounts: State Farm’s discount programs don’t apply in all states, so additional savings may be limited for some drivers.

#2 – Progressive: Best for Budgeting Tools

Pros

- Online Budgeting Tools: Progressive’s Name Your Price tool allows drivers to see how much coverage they can get on their set budget.

- Usage-Based Discount: Progressive Snapshot offers discounts for driving safely during the tracking period. Learn more about the program in our Progressive Snapshot review.

- Affordable High-Risk Rates: Progressive insurance starts at $75 per month for drivers with bad records or multiple claims.

Cons

- Mixed Customer Service: Progressive has mixed reviews regarding customer service. You can read more about Progressive’s customer service ratings in our Progressive auto insurance review.

- Lack of Local Agents: Progressive doesn’t have many agents from whom drivers with bad driving records can get in-person assistance.

#3 – American Family: Cheapest for Bundling Policies

Pros

- Multi-Policy Discounts: On top of affordable rates, AmFam offers a competitive 11% discount to drivers with bad records who bundle auto with home or renters policies.

- Usage-Based Discount: American Family’s KnowYourDrive discounts drivers’ policies if they drive safely on the app. Learn how the discount works in our American Family KnowYourDrive review.

- High Customer Satisfaction: American Family has good customer satisfaction ratings, which you can read more about in our AmFam auto insurance review.

Cons

- Limited Availability: American Family doesn’t offer auto insurance coverage in every state, as it sells insurance in only about half of the U.S.

- Fewer Add-On Coverages: American Family doesn’t have as many add-on coverages as other companies, such as roadside assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Farmers: Cheapest for DUI Policies

Pros

- Affordable DUI Policies: Farmers offers more discounts to drivers with DUIs than other providers and is less likely to raise rates as high as the competition.

- Usage-Based Discount: Farmers’ Signal app rewards drivers who track safe driving habits with a discount. Learn how it works in our Farmers Signal review.

- Strong Financial Stability: Our Farmers auto insurance review shows that Farmers has great financial stability ratings and is a well-established auto insurance company.

Cons

- Mixed Customer Service: Farmers has mixed reviews when it comes to the ease of filing a claim and the claims processing services.

- Regional Discounts and Coverage: Not all Farmers’ services and discounts are available in every region.

#5 – Travelers: Cheapest After Filing Claims

Pros

- Cheap After Claims: Travelers’ auto insurance rates after filing a claim for an accident are much cheaper than providers at $76 per month.

- Roadside Assistance Coverage: Travelers offers two types of roadside assistance that drivers can customize. See more add-ons in our Travelers auto insurance review.

- Strong Financial Stability: Travelers has great financial ratings and has been well-established as one of the top auto insurance companies for over a century.

Cons

- Limited Availability: Travelers’ discounts and coverages are limited in some regions.

- Varied Customer Service: Like other companies on our list, Travelers has mixed reviews about customer service for claims and more.

#6 – Geico: Cheapest for SR-22 Filings

Pros

- Competitive SR-22 Rates: Geico’s rates are competitive for drivers who need to file an SR-22, starting at $117 monthly after a DUI. Compare more quotes in our Geico auto insurance review.

- Easy-To-Use App: Geico’s mobile app is highly rated, and its website is also user-friendly.

- Multiple Discount Opportunities: Geico offers a number of discounts unrelated to driving record that can help drivers with accidents or DUIs save on their policies.

Cons

- Limited Local Agents: Geico doesn’t offer many local agents, so most drivers won’t get in-person assistance.

- Mixed Customer Reviews: Geico’s customer service reviews regarding claims are mixed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage-Based Discounts

Pros

- Usage-Based Discount: Nationwide SmartRide will reward drivers who do well in the program with discounts. Learn more in our Nationwide SmartRide app review.

- Vanishing Deductibles: Nationwide’s vanishing deductible program allows drivers with bad driving records to save if they stay accident and ticket-free in the future.

- Good Coverage Options: Nationwide offers a wide selection of auto insurance coverages for drivers to choose from.

Cons

- Mixed Customer Service: Nationwide has mixed reviews about its customer service for claims. Learn more about this in our Nationwide auto insurance review.

- Regional Discounts: Nationwide’s discount and program availability may be limited in some states.

#8 – Allstate: Best for Low-Mileage Discounts

Pros

- Pay-As-You-Go Discounts: Low-mileage drivers can lower their rates through Allstate’s pay-per-mile insurance programs, Allstate Milewise and Milewise Unlimited. Get details in our Allstate review.

- Usage-Based Discount: Allstate’s Drivewise program rewards drivers with a discount for demonstrating safe driving skills (Learn More: Allstate Drivewise Review).

- Strong Financial Stability: Allstate is one of the largest auto insurance companies on the market and has strong financial stability.

Cons

- Mixed Customer Service: Like other companies, Allstate has mixed customer service reviews regarding claims.

- Few Local Agents: Drivers with bad driving records will find it hard to get in-person assistance with their policies.

#9 – Liberty Mutual: Best for Affordable Add-Ons

Pros

- Multiple Coverage Add-Ons: Liberty Mutual offers a great selection of auto insurance coverages to drivers who need new car replacement or custom parts coverage.

- Usage-Based Discount: Liberty Mutual’s RightTrack program is a great way for drivers with bad driving records to save up to 30%. Learn more in our Liberty Mutual RightTrack review.

- User-Friendly Mobile App: Liberty Mutual auto insurance apps have good ratings, and its website is easily navigated.

Cons

- Mixed Customer Service: Liberty Mutual’s customer service reviews for claims are mixed (Read More: Liberty Mutual auto insurance review).

- Regional Discounts: Liberty Mutual’s discount amounts and availability vary by state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Buy Auto Insurance When You Have a Bad Driving Record

If you have a bad driving record, shopping around for auto insurance quotes at our top companies will help you see if you can find a cheaper rate elsewhere. State Farm, Progressive, and American Family have cheap auto insurance for a bad driving record.

Can an auto insurance company deny you coverage if you have a bad record? Providers can deny you coverage, so the best thing you can do is look into the cheapest companies for your particular driving record. Just because a company is cheap for at-fault accidents doesn’t mean it will be cheap for DUIs or traffic tickets.

To get started on finding cheaper car insurance for bad driving records today, use our free quote comparison tool. It will help you find cheap insurance for bad driving records.

Frequently Asked Questions

Can I still get auto insurance with a bad driving record?

Yes, you can generally still obtain auto insurance with a bad driving record. However, it may be more challenging to find affordable coverage, and insurance premiums are likely to be higher due to the increased risk associated with your driving history.

Are there insurance companies that specialize in auto insurance for a bad driving record?

Yes, the best auto insurance companies for high-risk drivers specialize in providing coverage for those with a bad driving record. Companies like State Farm, Progressive, and AmFam are more willing to offer coverage despite a problematic driving history. However, it’s important to note that premiums may still be higher compared to drivers with clean records.

What should I do if I have a terrible driving record?

If you have a terrible driving record and are denied coverage, you may have to applyfor insurance through your state’s guaranteed auto insurance prograe. If you can find insurance companies willing to insure you, you should shop around and compare costs to see if you can find a cheaper rate.

How much will auto insurance cost after an at-fault accident?

How much car insurance will cost after an at-fault accident depends on your insurance company. State Farm has cheap auto insurance for bad drivers after an accident, starting at $57 per month.

Read More: How long does an accident affect your auto insurance rate?

How much will auto insurance cost after a traffic ticket?

State Farm and Geico have the best insurance for high-risk drivers with speeding tickets for under $60 a month, but costs depend on your auto insurance company and the severity of the traffic ticket. If you find your rates have increased significantly after a ticket, you should get quotes from a few different auto insurance providers to see if anyone else has a cheaper rate.

How many insurance claims can you make in a year?

If you are wondering how many insurance claims you can file in a year, the answer is that you can file as many claims as you need to. However, it is recommended that you should never file more than one claim a year, if possible, as multiple claims in a short period of time will drastically increase your auto insurance rates.

What is the best auto insurance for someone with a bad driving record?

The best car insurance for bad drivers is a full coverage policy, even though it costs more, as it provides full financial protection in case of an accident.

What is the cheapest auto insurance for people with bad driving records?

State Farm is the best company for cheap car insurance for a bad driving record. Progressive and American Family are also good companies.

How can I find affordable auto insurance with a bad driving record?

Finding affordable auto insurance with a bad driving record can be challenging, but it’s not impossible. Some strategies to explore include shopping around and obtaining quotes from multiple insurance companies. Enter your ZIP code to find cheap auto insurance near you.

How do you get around a bad driving record?

You can’t erase your record, but you can work to reduce rates and get cheap car insurance for bad driving records by shopping around.

Is there auto insurance that doesn’t check driving records?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.