Best Business Auto Insurance in 2026 (Check Out the Top 10 Providers)

Discover the best business auto insurance with Geico, Progressive, and State Farm emerging as top picks. Geico stands out, offering the lowest monthly rate at $30. These companies help by ensuring your business vehicles are well-protected on the road with comprehensive coverage options and best customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated November 2025

Company Facts

Avg. Monthly Rates

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rates

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rates

A.M. Best

Complaint Level

Pros & Cons

Explore the best business auto insurance options with top picks like Geico, Progressive, and State Farm, with Geico leading the pack with a monthly rate of $30. Learn about the distinctions between commercial and personal auto insurance, common situations requiring commercial coverage, and essential tips for finding the most economical policies.

Our Top 10 Company Picks: Best Business Auto Insurance

Company Rank Business Use Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 9% A++ Affordable Rates Geico

#2 7% A+ Online Management Progressive

![]()

#3 11% B Extensive Discounts State Farm

![]()

#4 8% A+ Usage-Based Discount Allstate

#5 7% A+ Bundling Discounts Nationwide

#6 12% A Safety Discounts Farmers

#7 10% A++ Specialized Coverage Travelers

#8 7% A Multi-Policy Discounts Liberty Mutual

#9 8% A Loyalty Discounts American Family

#10 9% A+ Tailored Policies Hartford

Read on to learn more about commercial insurance, from what it is to the best auto insurance companies for commercial car insurance. Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Geico as top pick, offering comprehensive coverage at affordable rates

- Distinguish commercial from personal insurance for custom business solutions

- Geico leads as the top pick, offering rates starting at $80 monthly

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, making it an attractive option for cost-conscious consumers.

- Extensive Coverage Options: Geico’s auto insurance review highlights a wide range of coverage options tailored to meet the needs of businesses, ensuring comprehensive protection for commercial vehicles.

- Convenient Online Tools: Geico offers user-friendly online tools and resources, making it easy for customers to manage their policies, file claims, and access support whenever needed.

Cons

- Limited Local Agents: Geico primarily operates online and over the phone, which may be a drawback for customers who prefer face-to-face interaction with local agents.

- Mixed Customer Service Reviews: While Geico generally receives positive feedback for its customer service, some customers have reported mixed experiences with responsiveness and claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Commercial Car Insurance Explained

Commercial insurance is similar to personal auto insurance in regards to what it covers. However, when it comes to commercial vs. personal auto insurance usage, commercial insurance is strictly for business vehicles, whereas personal is strictly for personal vehicles.

Some of the vehicles that can be covered by company car insurance include:

- Company vehicles

- Delivery vehicles

- Food trucks

- Forklifts

- Service utility vehicles

- Trailers

- Trucks

- Work vans

Essentially, any vehicle used for work should be covered under commercial insurance (Read more: How to Insure a Commercial Truck for Personal Use).

What Commercial Auto Insurance Covers

Commercial auto insurance will pay for repairs and medical bills if you are in an accident. It will usually also protect you if you are sued, depending on what level of coverage you purchase.

Generally, commercial auto insurance will offer a number of different auto insurance coverages to drivers. Take a look at them below:

- Comprehensive Coverage: Comprehensive insurance pays for damages from animals, weather, vandalism, theft, and similar incidents.

- Collision Coverage: Collision pays for damages from hitting another car or object, such as a mailbox.

- Liability Coverage: Liability insurance will pay for damage to property and injuries to others if the driver causes the accident. It may also pay legal fees if the driver is sued.

- Personal injury Protection Coverage: Personal injury protection insurance pays for the driver and passengers’ medical bills, regardless of who caused the accident.

- Uninsured/Underinsured Coverage: Uninsured/underinsured insurance pays for any damages and medical bills if the driver who causes the accident doesn’t have enough insurance or no insurance coverage.

You can usually add these base insurance coverages to any commercial auto insurance policy. You may also be able to add extras like roadside assistance or gap coverage.

Keep in mind that most commercial policies won’t cover any business equipment or tools transported in the business vehicle. Instead, that will be covered under your business insurance policy.

Common Situations Where Drivers Need Commercial Insurance

If you use your vehicle in any of the following situations, you should get commercial auto insurance:

- Delivering goods or services

- Driving to your work sites

- Transporting your work tools, equipment, or products

- Transporting your work clients or your employees

You should also get commercial auto insurance if the vehicle title is under your business name. Whether you are self-employed or a business owner, you’ll need commercial auto insurance if you use your car to earn money.

Not carrying commercial auto insurance when you use your car commercially can result in denied claims.

Read more: Best Commercial General Liability Insurance

Small Businesses and Commercial Auto Insurance

Even small businesses need to carry commercial auto insurance, if vehicles are used for business. In addition, independent contractors and self-employed drivers should also carry commercial auto insurance.

You can often bundle commercial auto insurance with personal auto insurance. So if you are a small business owner, you may purchase commercial auto insurance from your personal auto insurance company to save money.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Commercial Auto Insurance and Personal Cars

Commercial auto insurance won’t cover personal vehicles, as it is only for business-owned vehicles, which includes independent contractors who own their work vehicle.

However, if you and your employees use personal, rented, leased, or borrowed vehicles for work, you can purchase hired or non-owned auto insurance coverage:

- Hired Auto Insurance Coverage: Coverage if you or your employees use a rented, leased, or borrowed car for work-related purposes.

- Non-Owned Auto Insurance Coverage: Coverage if you or your employees occasionally use a personal vehicle for work.

For example, if you are using vehicles rented or leased from another company to deliver goods, you would purchase hired auto insurance coverage. Essentially, hired and non-owned car insurance coverages are for vehicles a business uses but doesn’t legally own.

Difference Between Commercial and Personal Auto Insurance

Commercial auto insurance policies are for cars used solely for business purposes. These policies have higher liability limits than personal auto insurance policies, as there is more risk involved with driving around for work all day than just commuting to work. The higher limit also protects a business from being financially ruined after an accident.

Personal auto insurance policies are designed for vehicles used solely for personal use, such as commuting to work or running errands. Personal auto insurance policies usually have lower limits and rates than commercial auto insurance policies.

If you are using a personal car for work, you should purchase non-owned auto insurance coverage. Otherwise, you could be denied a claim after an accident. Read our article titled “Cheap Non-Owner Auto Insurance“, to get the cheapest insurance for non-owned auto insurance coverage.

Cost of Commercial Auto Insurance

Generally, commercial auto insurance costs less than a few hundred dollars per month per vehicle. However, how much you pay for commercial auto insurance depends upon numerous factors.

Business Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $61 $160

American Family $44 $117

Farmers $53 $139

Geico $30 $80

Liberty Mutual $68 $174

Nationwide $44 $115

Progressive $39 $105

State Farm $33 $86

The Hartford $43 $113

Travelers $37 $99

Some of the main factors that insurance companies use to determine car insurance rates for business use include:

- Claim history

- Employees’ driving records

- Location of your business

- Number of vehicles insured

- Risk level of vehicle use

- Policy limits

- Policy deductibles

- Vehicle factors

While commercial auto insurance policies use the same factors as personal auto insurance to determine rates, they aren’t necessarily cheap auto insurance coverages. Because people who frequently drive for work are more at risk of filing a claim, policies will be more expensive to counteract that risk.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

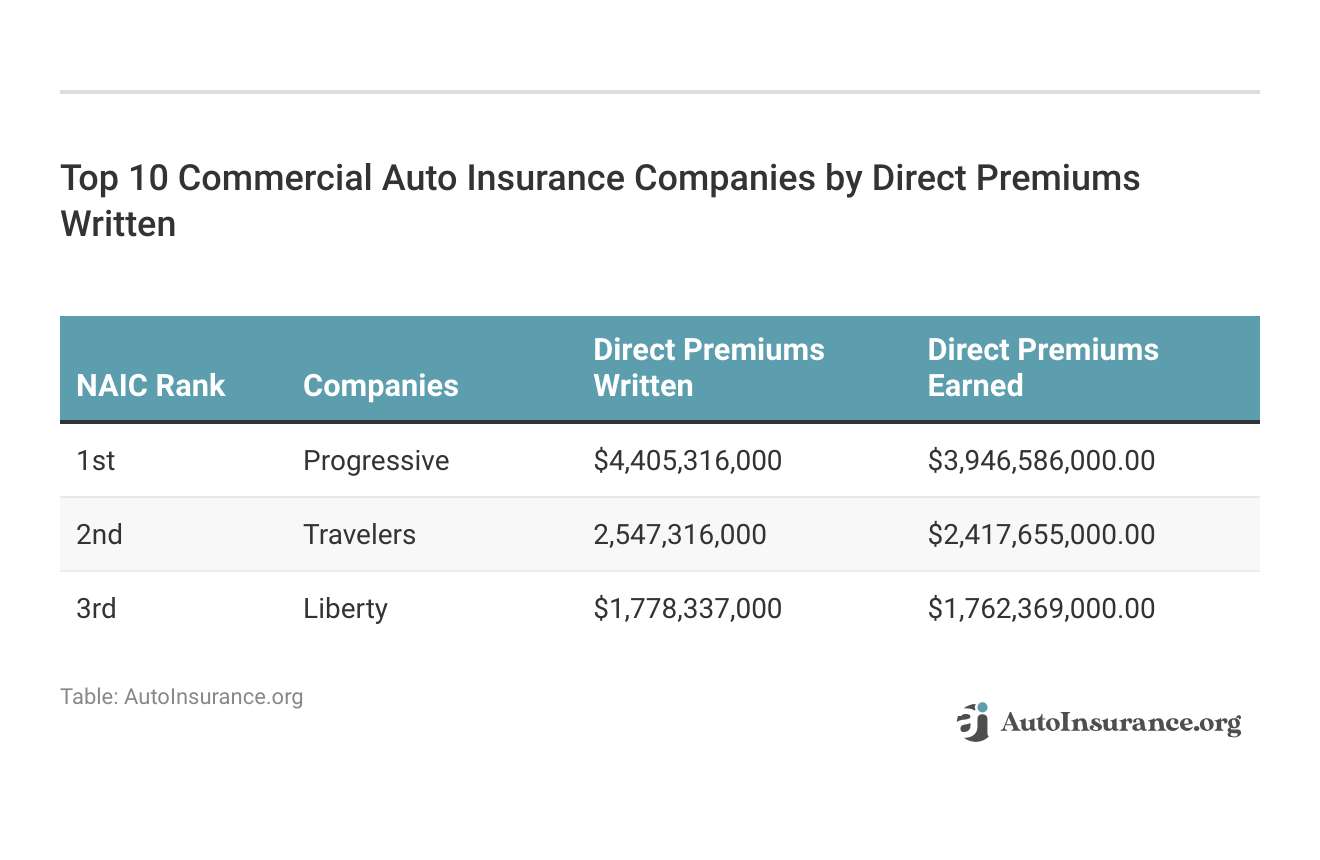

Top Companies for Commercial Car Insurance Policies

Buying from one of the best companies for commercial auto insurance will ensure you get the best protection for your business vehicle. Take a look at the top companies below.

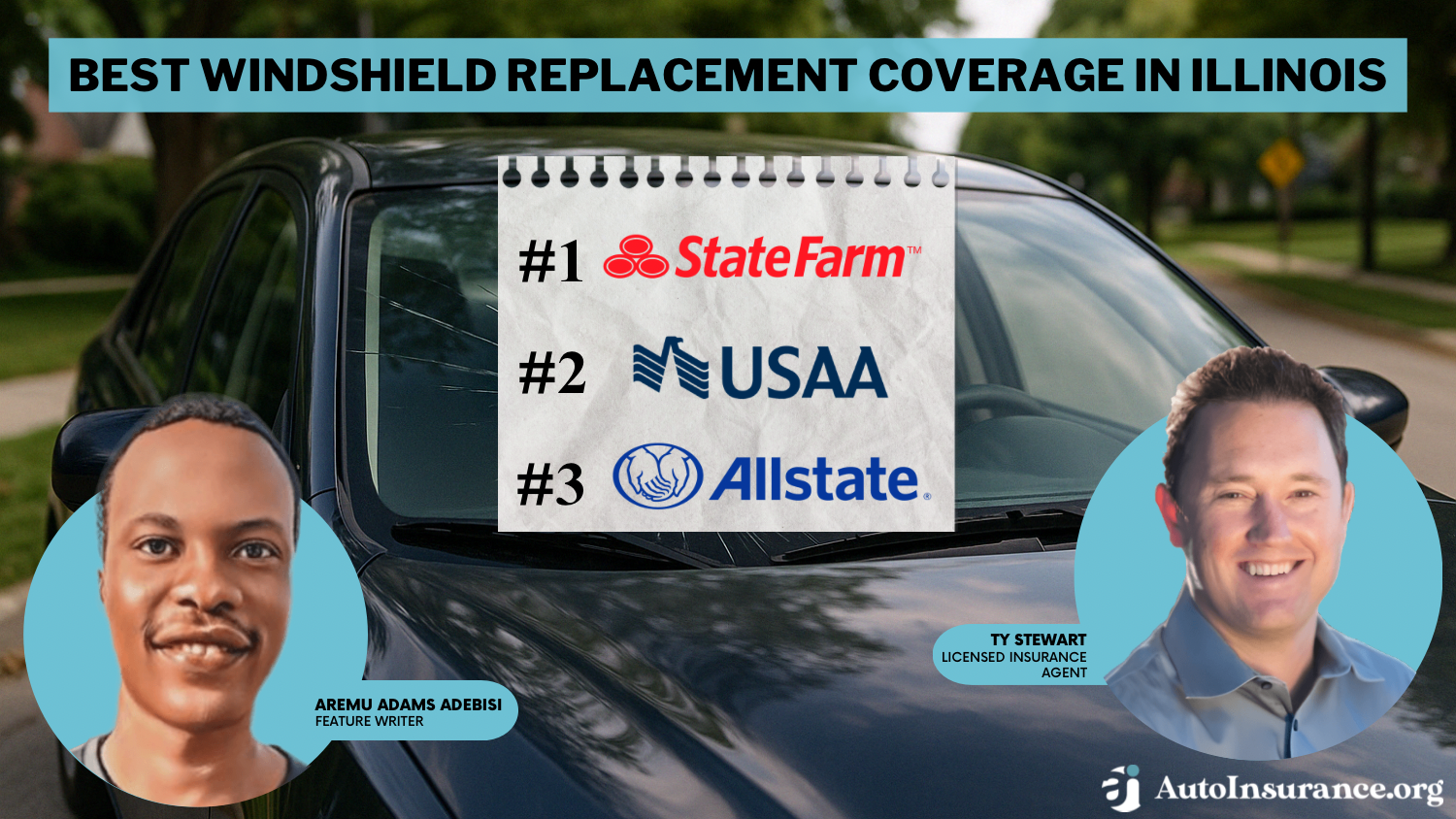

Allstate

Allstate is one of the largest insurance companies and has a wide range of coverages in addition to commercial auto insurance. The company also has great customer satisfaction ratings, which is important when it comes to choosing a company.

Geico

Geico is another popular choice for commercial auto insurance. You can bundle your commercial auto insurance policy with other coverages to earn a discount. Geico also has numerous other discounts that you can take advantage of.

Progressive

Progressive is one of the largest insurance companies in the U.S., with solid financial ratings and customer reviews. Additionally, the company offers the option to bundle your commercial auto insurance policy with other types of insurance. Bundling and discounts can help save on your commercial auto insurance policy.

State Farm

State Farm is another major company with great customer reviews and offers several other coverages besides commercial. Since there are many State Farm agents, you should be able to find a local agent to speak to about your policy needs.

Auto Insurance Tips for Commercial Vehicle Use

Cheap commercial auto insurance is out there, and the best way to find it is to shop around. A commercial auto insurance policy covers commercial vehicles that are used to transport people or goods.

Your auto insurance rates can rise by 180% when you add commercial coverage onto an existing personal auto insurance policy, as it’s a separate type of coverage. Keeping a clean driving record, getting auto insurance discounts, and shopping around can help you get the cheapest commercial insurance.

Buying personal cheap auto insurance can be daunting, and finding the cheapest commercial auto insurance isn’t any easier.

The trick is to realize you’re not insuring yourself, but your fleet of vehicles and your employees who are driving those vehicles. The same tools used to evaluate yourself when purchasing personal coverage should be used when purchasing a commercial auto policy for your company.

How much does commercial auto insurance cost? Is commercial vehicle insurance more expensive? What is the most affordable commercial auto insurance? We’ll answer these questions and more.

Ready to buy the cheapest commercial auto insurance? To get free commercial coverage auto insurance quotes today, simply enter your ZIP code in the free box above to receive commercial auto insurance quote online now.

Commercial Auto Insurance Facts

Commercial auto coverage is very similar to personal auto coverage. Many of the same types of coverage offered for personal vehicles are also offered by commercial policies.

The major difference between the two types of coverage is eligibility requirements.

If the vehicle you’re looking to cover is driven in a commercial capacity, meaning you transport goods/people for a fee or you typically transport high-value items, you must buy commercial auto insurance coverage.

If you get commercial auto insurance for company vehicles, it will need to be on top of your personal auto insurance policy.Jeff Root Licensed Insurance Agent

Is commercial auto insurance cheaper? Usually, commercial insurance costs more than its personal counterpart.

Is commercial insurance expensive? How much is a commercial policy? This table shows Progressive quotes for food delivery car insurance for drivers who need additional business insurance on top of their personal coverage.

Progressive Auto Insurance Monthly Rates for Food Delivery Drivers by Coverage Type

| Coverages | Rates | Increase |

|---|---|---|

| Personal Insurance (Delivery) | Won't Cover | Won't Cover |

| Personal Insurance (No Delivery) | $106 | NA |

| Food Delivery (Business Auto Insurance Only) | $273 | 158% |

| Food Delivery (Business & Personal Auto Insurance) | $297 | 180% |

Understanding commercial auto insurance at its most basic level is the first step before purchasing a policy. Information can be found about various insurance policies and state regulations at your local DMV.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

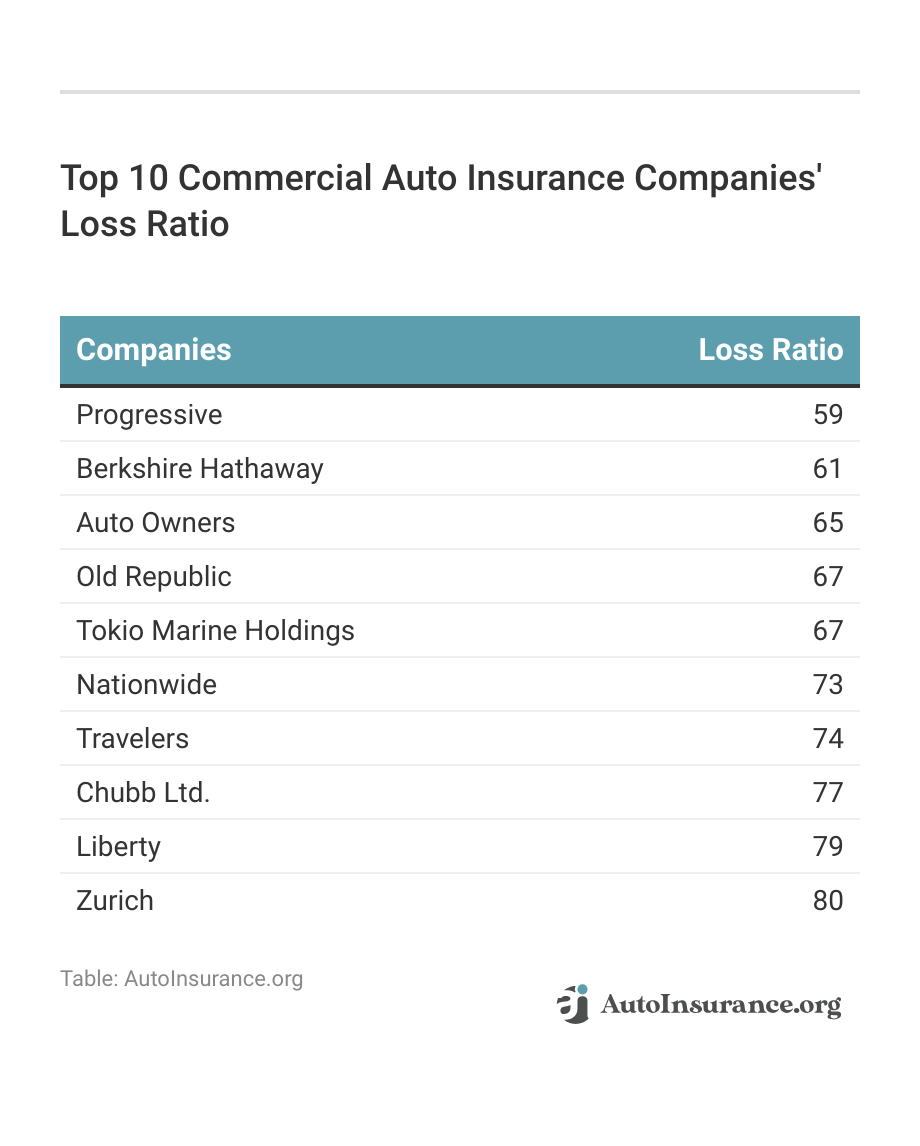

Commercial Auto Insurance Rates Are Based on Your Drivers

One tip for finding cheap business insurance is identifying what type of drivers you’ve employed. Similar to personal auto coverage, companies base their quotes and premiums on driver histories.

If you are looking to hire a new driver for your fleet, consider acquiring a driving record from your local DMV.

This request will give you information about accidents, tickets, and other types of driving-related issues your potential hire has in their history. Learn more in our article titled “Does a criminal record affect auto insurance rates?“

Recognizing how insurance companies develop rates for customers is important.

Not only do auto insurers look at your driving record, but they also take a closer look at credit history, commute length, and location.

Fleet Vehicles Determine Auto Insurance

Another consideration regarding your drivers is whether they are commercially licensed properly. Many insurance companies will offer discounts to drivers who have their Commercial Driver’s License (CDL). When interviewing potential employees, ask questions regarding their licensing; this could save you money in the long run.

A second tip to consider is evaluating what kind of fleet of vehicles you’re looking to insure. As with personal auto coverage, the more expensive the vehicle, the higher the premium will be.

When looking to purchase commercial auto coverage, look at the vehicles you currently own. In addition, consider what types of vehicles will be purchased shortly after acquiring the insurance policy.

If you have a fleet of older trucks, your policy choice and deductible options may vary, thus varying your overall premium price.

Also, note that premiums will differ widely, depending on the insurance company. Consider the type and size of the company and how well they are equipped to cover your assets. Bigger companies may have higher premiums, but they also have more capital to cover their customers’ claims.

Finally, consider the amount of deductible you’re willing to pay. The higher the deductible, the lower your monthly premium will be.

Again, consider your fleet of vehicles and your drivers, evaluate how much your budget can afford to pay for your deductible, and then make your decision.

Read more: Auto Insurance Premium Defined

Cheapest Commercial Auto Insurance Options for Different Vehicles

Many companies will offer a variety of insurance options, depending on the type of vehicle. Business auto coverage, which covers small, compact cars and trucks that handle basic travel, is one example of auto-specific coverage.

Other examples are pickup truck insurance, tow truck insurance, commercial truck insurance, and dump truck insurance. All of the various coverage options will vary in pricing, especially for vehicles that handle dangerous travel conditions on a consistent basis.

If your fleet of vehicles consists of a wide range of types, purchasing similar commercial coverage for each vehicle could also save you money. Also, if you bundle multiple vehicles together, even if they’re different vehicle types, it will save you money.

Read more: How to Save Money by Bundling Insurance Policies

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Research the Auto Insurance Company

A third tip for finding quality commercial auto insurance is evaluating the insurance company itself. Deciding on the right insurance company to cover your assets is vitally important. When discussing coverage options with an agent, remember that they are attempting to sell you coverage.

That means they may not give you full disclosure on the company itself. Doing background research on individual insurance companies is a smart move.

Government groups like the Better Business Bureau can provide quality information regarding companies, especially the smaller, locally owned agencies. You can find information on its website.

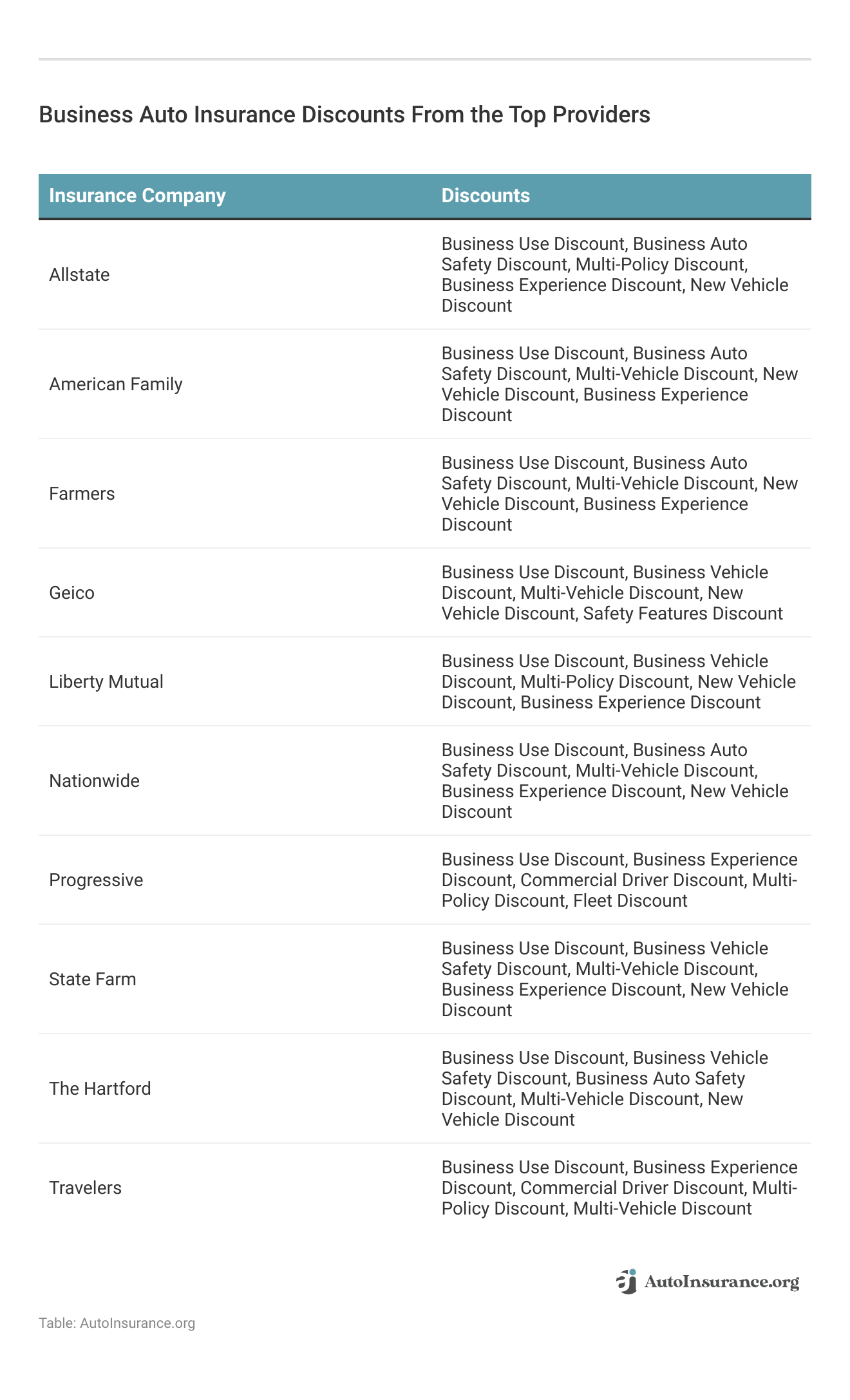

Investigate any discounts insurance companies offer. Discounts vary from company to company, and some can save you quite a bit of money.

From bundling policies together to driver’s license discounts, to being in business for a certain number of years, companies offer all kinds of discount incentives.

You can save a lot of money with discounts on your auto insurance. Take a look at the table below to see some commonly available auto insurance discounts at major insurers.

Auto Insurance Discounts by Provider & Savings Amount

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | NA | NA | 10% | 10% | 5% | 3% | NA | 7% | 10% | NA |

| Adaptive Headlights | 15% | 15% | 10% | 5% | 5% | 10% | 15% | 5% | 5% | 15% |

| Anti-Lock Brakes | 10% | 10% | 10% | 5% | 5% | 5% | 10% | 5% | NA | NA |

| Anti-Theft | 10% | NA | NA | 23% | 20% | 25% | 20% | 15% | NA | NA |

| Claim Free | 35% | 10% | 15% | 26% | 15% | 10% | 15% | 15% | 23% | 12% |

| Continuous Coverage | NA | 10% | 10% | NA | 15% | 15% | 10% | 10% | 15% | 5% |

| Daytime Running Lights | 2% | NA | 2% | 3% | 5% | 5% | 7% | 3% | NA | NA |

| Defensive Driver | 10% | 10% | NA | 10% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 15% | 30% | 30% | 20% | 10% | 20% | 20% | 7% | NA |

| Driver's Education | 10% | 10% | 8% | NA | 10% | 8% | 10% | 15% | 8% | 3% |

| Early Signing | 10% | 12% | 15% | 15% | 8% | 8% | 8% | 15% | 10% | 12% |

| Electronic Stability... | 2% | 3% | 3% | 2% | 5% | NA | 5% | NA | 3% | 2% |

| Emergency Deployment | 5% | NA | 20% | 25% | NA | NA | NA | NA | 20% | 25% |

| Engaged Couple | 10% | 10% | 5% | NA | 5% | 10% | 5% | NA | NA | 10% |

| Family Legacy | NA | 10% | NA | 5% | 10% | 5% | 5% | NA | 5% | 10% |

| Family Plan | 20% | NA | 15% | NA | 10% | 25% | NA | 15% | 15% | NA |

| Farm Vehicle | 10% | NA | 10% | NA | 10% | 5% | NA | 5% | 10% | NA |

| Fast 5 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Federal Employee | 13% | 15% | NA | 12% | 10% | 16% | NA | 15% | NA | NA |

| Forward Collision Warning | 5% | 10% | 5% | 10% | 5% | NA | 5% | 5% | 5% | 10% |

| Full Payment | 10% | 10% | 8% | NA | $50 | 8% | 10% | NA | 8% | NA |

| Further Education | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| Garaging/Storing | NA | NA | NA | NA | NA | NA | NA | NA | NA | 90% |

| Good Credit | 10% | NA | 5% | 10% | 5% | NA | 10% | NA | 10% | NA |

| Good Student | 20% | 23% | NA | 15% | 23% | 10% | 8% | 25% | 8% | 3% |

| Green Vehicle | 10% | NA | 5% | NA | 10% | NA | NA | 10% | 10% | NA |

| Homeowner | 3% | 3% | 5% | NA | 5% | 5% | NA | 3% | 5% | NA |

| Lane Departure Warning | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Low Mileage | 30% | 30% | 25% | 25% | 30% | 25% | NA | 25% | 30% | 25% |

| Loyalty | 5% | 15% | 5% | NA | 15% | 5% | 15% | 15% | 5% | NA |

| Married | 5% | NA | 5% | NA | NA | NA | 5% | NA | NA | NA |

| Membership/Group | NA | 7% | NA | NA | 10% | 7% | NA | NA | NA | 7% |

| Military | NA | NA | 15% | 15% | 4% | 10% | NA | NA | NA | 30% |

| Military Garaging | NA | NA | NA | NA | NA | NA | NA | NA | NA | 15% |

| Multiple Drivers | 25% | 20% | 20% | NA | NA | 25% | NA | NA | 25% | NA |

| Multiple Policies | 10% | 29% | 20% | 10% | 20% | 10% | 12% | 17% | 13% | NA |

| Multiple Vehicles | NA | 10% | 8% | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | NA | 5% | NA | NA | 5% | 5% | NA | 5% | NA | NA |

| New Customer/New Plan | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| New Graduate | 5% | 15% | 10% | NA | 5% | 15% | 10% | 5% | 15% | 10% |

| New Vehicle | 30% | NA | 30% | 15% | 40% | NA | 40% | 10% | 12% | NA |

| Newly Licensed | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Newlyweds | 10% | NA | 5% | 5% | 5% | NA | 10% | NA | 10% | NA |

| Non-Smoker/Non-Drinker | NA | NA | 10% | NA | 10% | 10% | NA | NA | NA | 10% |

| Occasional Operator | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Occupation | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| On-Time Payments | 5% | 10% | NA | 10% | 10% | 15% | 15% | NA | 15% | NA |

| Online Shopper | 10% | NA | NA | NA | 10% | NA | 7% | NA | 10% | NA |

| Paperless Documents | 10% | 5% | NA | 5% | 5% | 5% | $50 | 10% | 5% | 10% |

| Paperless/Auto Billing | 5% | 5% | NA | NA | 3% | $30 | NA | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | NA | 20% | NA | 40% | NA | NA |

| Recent Retirees | NA | NA | NA | NA | 4% | NA | NA | NA | NA | NA |

| Renter | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Roadside Assistance | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Safe Driver | 45% | NA | NA | 15% | NA | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | NA | NA | NA | 15% | NA | NA | NA | NA | NA | NA |

| Senior Driver | 10% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Stable Residence | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Students & Alumni | NA | NA | NA | NA | 10% | 7% | NA | NA | NA | NA |

| Switching Provider | NA | NA | NA | NA | 10% | NA | NA | NA | NA | NA |

| Usage-Based Discount | 20% | 40% | 20% | NA | 30% | 40% | 20% | 50% | 30% | 5% |

| Utility Vehicle | 15% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Vehicle Recovery | 10% | NA | NA | 15% | 35% | 25% | NA | 5% | NA | NA |

| VIN Etching | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Volunteer | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Young Driver | NA | NA | NA | NA | NA | NA | NA | NA | NA | $75 |

You can save up to 35 percent with these auto insurance discounts. When shopping around, ask questions about possible discounts.

Things That Determine Your Auto Insurance Rates

Some insurance companies offer other discounts related to how you pay for your policy. Sometimes you can receive a discount for paying online or by an electronic funds transfer.

Other times, you can receive a discount by paying for your policy in full when you first make your purchase.

Many insurance companies offer percentage-based discounts for customers that combine personal and commercial policies. Most of the time, these are referred to as package discounts or multi-policy discounts.

Another thing to consider is where you live. Depending on the state in which your company is located, insurance rates and premiums may vary. To find out further information and details regarding individual state insurance regulators, visit A.M. Best’s website.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

There’s a wealth of information regarding state-based auto insurance policies and national policies at the American Insurance Association’s website. The AIA has a database of web links that will give you access to quality information.

Finally, the type of business you own will also impact which insurance companies will cover your vehicles. For many companies, rates and premiums are also based on the type of business you own.

If you happen to own a business that deals with high-risk driving situations, your quotes will be higher. Finding companies that offer quality discounts, in addition to quality prices for your individual business type, will save you money.

Understanding How Auto Insurance Works

Having a basic understanding of how auto insurance works, how companies price policies, and how to evaluate your situation is the first step in finding affordable commercial auto insurance. Keep in mind that every company has different needs.

Although finding quality auto insurance can be a hassle, by doing your homework and being prepared and educated, you will save money.

Just remember to consider all of the various elements that go into the auto insurance companies’ decisions and understand your situation first.

It’s not that hard to find cheap commercial auto insurance. But what are the best commercial auto insurance companies for you?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Final Word on Commercial Auto Insurance

If your vehicle is used mainly for business, you must purchase commercial auto insurance to protect your assets after a crash. Several popular auto insurance companies offer commercial auto insurance for customers so that you can find commercial auto insurance in your price range.

Read more: 8 Best Commercial Truck Insurance Companies

If you need to buy commercial vehicle insurance, we can help. To find quality, affordable commercial auto insurance rates, enter your ZIP code in the box below.

Frequently Asked Questions

What is the difference between commercial and personal auto insurance?

While both commercial and personal auto insurance policies have similar coverages, commercial insurance is intended for business vehicles only. As a result, commercial insurance also has higher liability amounts than personal insurance.

How much does commercial auto insurance cost?

Your commercial auto insurance rates depend on your driving record, vehicle type, location, and more. However, most drivers won’t pay more than a few hundred dollars per month for commercial auto insurance.

Read more: Best Commercial Auto Insurance Companies

Where can I buy commercial auto insurance?

You can buy commercial auto insurance from several auto insurance companies, such as Allstate, Geico, State Farm, Progressive, and Liberty Mutual. Commercial auto insurance is more expensive than personal auto insurance, so you should get quotes from several auto insurance companies before committing.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Do small businesses need commercial auto insurance?

Yes, even small businesses need commercial auto insurance if they use vehicles for business purposes. Independent contractors and self-employed drivers should also carry commercial auto insurance. Small business owners can often bundle commercial auto insurance with personal auto insurance to save money.

Can commercial auto insurance cover personal cars?

No, commercial auto insurance is specifically for business-owned vehicles. However, if personal vehicles are used for work purposes, additional coverage options such as hired auto insurance (for rented, leased, or borrowed vehicles) or non-owned auto insurance (for occasional use of personal vehicles) can be purchased.

Read more: Cheap Non-Owner Auto Insurance

What factors determine the best business auto insurance policy?

The best business auto insurance policy depends on various factors, including the specific needs of your business, the types of vehicles you own, your budget, and the level of coverage required. It’s essential to consider factors such as coverage options, discounts, customer service reputation, and financial stability when selecting the right insurer for your business.

Are there any additional benefits or features I should look for in a business auto insurance policy?

In addition to standard coverage options, look for insurers that offer extra benefits or features that can enhance the value of your policy. These may include roadside assistance, accident forgiveness, risk management services, and customizable coverage options tailored to your business needs.

How can I ensure I’m getting the most affordable rates for business auto insurance?

To ensure you’re getting the most affordable rates for business auto insurance, it’s crucial to compare quotes from multiple insurers. Additionally, take advantage of discounts offered by insurers, such as multi-policy discounts, loyalty discounts, and safe driving discounts.

Working with an independent insurance agent can also help you find the best rates by accessing multiple insurance carriers (Read more: Best Business Auto Insurance).

What are some common mistakes businesses make when purchasing auto insurance for their fleet?

One common mistake is not accurately assessing the insurance needs of the business, leading to either underinsured or overinsured vehicles. Another mistake is failing to review coverage regularly to ensure it aligns with changes in the business, such as adding or removing vehicles or changing business operations.

Additionally, overlooking available discounts or assuming that the current insurer always offers the best rates can result in missed savings opportunities.

How important is it to have specialized coverage for my business vehicles?

Specialized coverage tailored to your business vehicles can be essential for ensuring adequate protection against specific risks associated with your industry or operations. For example, businesses involved in transporting hazardous materials or operating in high-risk environments may require specialized coverage options not offered by standard policies.

Investing in specialized coverage can provide peace of mind and financial protection in the event of an accident or unexpected event.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.