Direct Auto Auto Insurance Review for 2026 (Updated Score!)

Our Direct Auto auto insurance review found that Direct Auto sells policies to high-risk drivers who may need help finding coverage. High-risk insurance is more expensive, but those with tickets or accidents can get affordable Direct Auto rates. Direct Auto's minimum rates for good drivers start at $44/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated December 2024

Our Direct Auto auto insurance review found that Direct Auto is a decent choice for high-risk drivers, but good drivers should shop elsewhere for cheaper rates.

Direct Auto offers car insurance coverage to high-risk individuals who may need cheap SR-22 auto insurance or who may have trouble finding insurance with other providers.

The company offers straightforward coverage options and allows policyholders to qualify for discounts on coverage.

Direct Auto Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 3.5 |

| Claim Processing | 2.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 4.3 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 3.0 |

| Policy Options | 3.4 |

| Savings Potential | 4.0 |

Auto insurance rates with Direct Auto can be expensive, however, so people need to shop online and compare insurance quotes before committing to a Direct Auto policy. Compare rates now with our free quote tool.

- Direct Auto specializes in high-risk auto insurance

- Direct Auto has an A- financial rating from A.M. Best

- Direct Auto has multiple complaints from customers

Direct Auto Insurance: Average Monthly Rates

A Direct Auto insurance quote will vary in cost from one person to the next. Insurance companies assess a person’s risk by evaluating many different factors, including:

- Age, Gender, and Marital Status

- Car Make and Model

- Driving History

- ZIP Code

- Types of Coverage

The monthly rates you pay at Direct Auto will primarily vary based on your age, gender, and what coverage level you pick. View the rates below for an idea of how much auto insurance will cost based on these factors.

Direct Auto Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $209 | $539 |

| Age: 16 Male | $229 | $564 |

| Age: 18 Female | $170 | $398 |

| Age: 18 Male | $196 | $459 |

| Age: 25 Female | $52 | $139 |

| Age: 25 Male | $54 | $144 |

| Age: 30 Female | $49 | $129 |

| Age: 30 Male | $50 | $134 |

| Age: 45 Female | $44 | $117 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $41 | $104 |

| Age: 60 Male | $42 | $107 |

| Age: 65 Female | $44 | $115 |

| Age: 65 Male | $43 | $113 |

Direct Auto is the most expensive for teenage drivers. However, rates will be cheaper than the ones shown above if teenagers join their parents’ existing policy rather than buying their own Direct Auto policy.

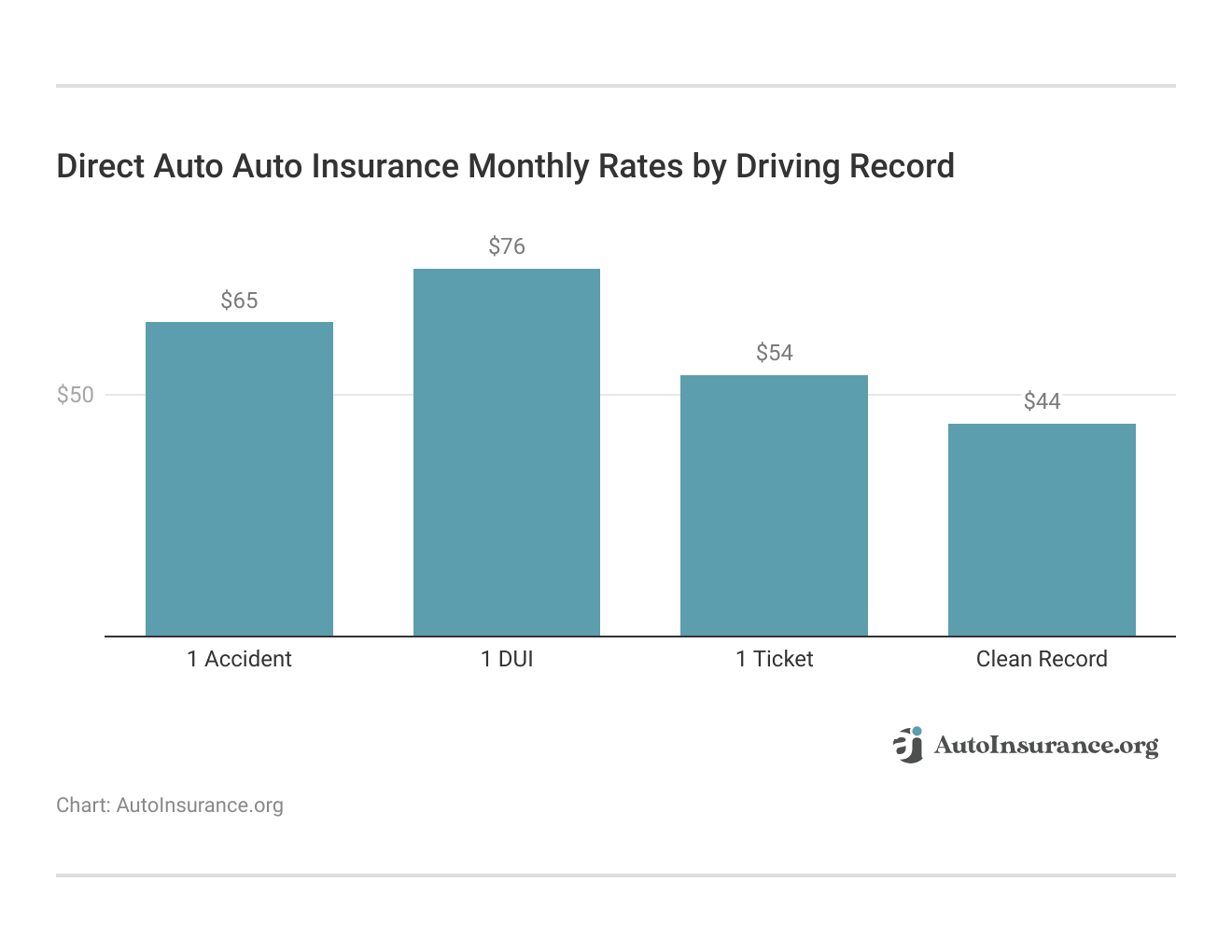

At Direct Auto, rates will also vary significantly based on your driving record.

A DUI will raise rates the most at Direct Auto. If you have a DUI, make sure to check out our guide on cheap auto insurance after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Direct Auto vs. the Competitions: Auto Insurance Rates

It’s important to consider how a company’s rates compare to those of its competitors when shopping for affordable coverage, especially as a higher-risk driver. The table below shows Direct Auto’s liability insurance rates for liability-only policies versus those of other competitors.

Direct Auto Minimum Coverage Auto Insurance Monthly Rates vs. Competitors

| Insurance Company | Monthly Rates |

|---|---|

| $61 | |

| $44 | |

| $44 |

| $53 | |

| $30 | |

| $67 |

| $44 |

| $39 | |

| $33 | |

| $38 | |

| $22 | |

| U.S. Average | $45 |

Direct Auto doesn’t have the cheapest minimum coverage policies on the market, but it is not the most expensive company. For drivers looking for a full coverage policy, look at the rates below.

Direct Auto Full Coverage Auto Insurance Monthly Rates vs. Competitors

| Insurance Company | Monthly Rates |

|---|---|

| $160 | |

| $117 | |

| $115 |

| $139 | |

| $80 | |

| $174 |

| $115 |

| $105 | |

| $86 | |

| $99 | |

| $59 | |

| U.S. Average | $119 |

These comparisons highlight that while Direct Auto offers competitive rates for minimum coverage, its full and minimum coverage rates tend to be higher than those of other major insurance providers.

However, this is mostly because Direct Auto specializes in high-risk insurance for drivers, such as SR-22 auto insurance, which makes the company more expensive because it’s taking on riskier drivers.

When comparing full coverage auto insurance rates for teens, Direct Auto stands out as one of the higher-cost providers. Below is a detailed comparison of monthly rates for 16 and 18-year-old male and female drivers:

Direct Auto Full Coverage Auto Insurance Monthly Rates for Teens vs. Competitors

| Insurance Company | Female: Age 16 | Male: Age 16 | Female: Age 18 | Male: Age 18 |

|---|---|---|---|---|

| $608 | $638 | $448 | $519 | |

| $414 | $509 | $305 | $414 | |

| $539 | $564 | $398 | $459 |

| $810 | $773 | $597 | $629 | |

| $298 | $312 | $220 | $254 | |

| $723 | $785 | $626 | $626 |

| $411 | $476 | $303 | $387 |

| $801 | $814 | $591 | $662 | |

| $311 | $349 | $229 | $284 | |

| $719 | $910 | $530 | $740 | |

| U.S. Average | $566 | $618 | $416 | $501 |

As you can see, Direct Auto does not specialize in cheap auto insurance rates (Learn More: Cheapest Auto Insurance Companies). Instead, the company offers coverage to individuals that other insurance companies may likely turn down.

Steps can be taken to remove points from these high-risk incidents from your license, and if your monthly costs are getting too high, it might be an avenue worth considering.Jeffrey Manola Licensed Insurance Agent

Remember that the average auto insurance rates by age can vary. The following tables show insurance rates for drivers who are considered high-risk.

Direct Auto Auto Insurance Monthly Rates for Drivers With a Ticket vs. Competitors

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $188 | $160 | |

| $136 | $117 | |

| $141 | $115 |

| $173 | $139 | |

| $106 | $80 | |

| $212 | $174 |

| $137 | $115 |

| $140 | $105 | |

| $96 | $86 | |

| $134 | $99 | |

| $67 | $59 | |

| U.S. Average | $147 | $119 |

While getting a ticket won’t raise your rates too drastically, you’ll still notice a difference if you haven’t had one before. A DUI, however, will result in a more severe increase in rates.

Direct Auto Auto Insurance Monthly Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $115 | $172 | $197 | $141 |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 | |

| $59 | $78 | $108 | $67 | |

| U.S. Average | $119 | $173 | $209 | $147 |

Finally, while an accident won’t prevent you from getting insurance, it will increase your rates. Direct Auto’s rates for drivers with an accident compared to those of its competitors are displayed below.

Direct Auto Auto Insurance Monthly Rates for Drivers With an Accident vs. Competitors

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $225 | $160 | |

| $176 | $117 | |

| $172 | $115 |

| $198 | $139 | |

| $132 | $80 | |

| $234 | $174 |

| $161 | $115 |

| $186 | $105 | |

| $102 | $86 | |

| $139 | $99 | |

| $78 | $59 | |

| U.S. Average | $173 | $119 |

Direct Auto could be a good choice if you’re a driver in need of high-risk auto insurance, even if it means paying higher-than-average rates for coverage.

Direct Auto Insurance Coverage Options

Direct Auto offers standard car insurance coverage options. Here are some of the Direct Auto car insurance options:

Direct Auto Auto Insurance Coverage

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage to others if you're at fault in an accident. |

| Collision Coverage | Pays for damage to your vehicle resulting from a collision, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events, like theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're in an accident with a driver who has little or no insurance. |

| Medical Payments Coverage (MedPay) | Pays for medical expenses for you and your passengers, regardless of fault. |

| Personal Injury Protection (PIP) | Provides broader coverage for medical expenses, lost wages, and other related costs. |

| Roadside Assistance | Offers help for breakdowns, including towing, tire changes, and jump-starts. |

| Rental Reimbursement | Covers the cost of a rental car while your vehicle is being repaired after a covered accident. |

| Towing & Labor Coverage | Reimburses you for towing and labor costs if your vehicle is disabled. |

| Accidental Death Coverage | Provides a benefit to your beneficiaries if you die in a car accident. |

| Gap Insurance | Covers the difference between what you owe on your car loan and the car's actual cash value if it's totaled. |

Direct Auto has some great coverage options, like Direct Auto insurance roadside assistance. However, a Direct Auto insurance policy does not offer all of the less common additional coverage options that other insurers include in their policies.

Read More: How much car insurance do I need?

For example Direct Auto does not include rideshare insurance, so it may not be the best company for a person looking for robust coverage with many options.

The add-ons offered by Direct Auto will add to your insurance premium, but people often include add-ons in aDirect Auto insurance full coverage policy for peace of mind. For example, if you have towing and labor on your policy, you will feel safe and secure if your car ever breaks down and needs to be towed to a mechanic’s shop.

Direct Auto Insurance Discounts Available

Unlike other companies that offer nonstandard car insurance coverage, Direct Auto provides several opportunities for policyholders to save money on their auto insurance rates by taking advantage of different discounts.

These are some of the discounts Direct Auto offers:

Direct Auto Insurance Discounts

| Discount | Percentage |

|---|---|

| Multi-Car Discount | 25% |

| Prior Coverage Discount | 25% |

| Safe Driver Discount | 10% |

| Good Student Discount | 10% |

| Military Discount | 25% |

| Homeowner Discount | 15% |

| Renewal Discount | 20% |

| Welcome Back Discount | 6% |

| Affinity Discount | 5% |

| Mileage Discount | 5% |

| Senior Citizen Discount | 5% |

If you believe you may qualify for any of the auto insurance discounts listed above, you can contact a Direct Auto representative to see how much a discount could help you save. Some discounts can help individuals save as much as 25% on their insurance policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Direct Auto Customer Reviews

Looking at what other customers are saying about Direct Auto insurance customer service will give you insight into how the company operates. Direct Auto does have some positive feedback left on rating sites, such as the Direct Auto Trust Pilot review posted below.

However, unhappy Direct Auto insurance reviews discuss the lack of timely response from the Direct Auto insurance claims department when handling car insurance claims, so Direct Auto doesn’t stand out in customer service due to numerous Direct Auto insurance complaints.

Read More: Auto Insurance Companies With the Best Customer Service

In addition, many different Direct Auto policyholders have been unhappy with how long it has taken to receive a proper payout from the company following a covered event.

Direct Auto Business Ratings

Looking at Direct Auto’s industry ratings will give you an idea of its financial stability, transparency, and more. The most important Direct Auto reviews from businesses are listed below.

Direct Auto Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 810 / 1,000 Avg. Satisfaction |

|

| Score: B+ Good Business Practices |

|

| Score: 70/100 Mixed Customer Feedback |

|

| Score: 1.25 Avg. Complaints |

|

| Score: B+ Good Financial Strength |

The Direct Auto insurance BBB rating is an A+ rating. However, Direct Auto has a fair number of complaints on the BBB website concerning the claims process.

Learn More: Best Auto Insurance Companies for Paying Claims

Direct Auto also has a higher-than-average number of complaints lodged at the NAIC, and a lower customer claims satisfaction rating at J.D. Power. However, Direct Auto does have a good financial stability rating from A.M. Best, which means its less likely to raise rates if it has a higher number of claims filed.

Pros and Cons of Direct Auto Insurance

So, is Direct Auto insurance a good company? Now that we’ve covered numerous reviews on Direct Auto insurance, let’s look at the pros and cons. Here are some of the best things about Direct Auto insurance plans:

- High-Risk Coverage: Direct Auto covers high-risk drivers who may have issues getting insurance elsewhere and offers SR-22 filings.

- Discount Options: Direct Auto offers discount bundling options with different insurance policies and flexible Direct Auto insurance payment options.

- Online Convenience: Direct Auto offers its customers online quotes and claims filing options.

Still, there are some downsides to a Direct Auto insurance policy, including the following:

- Customer Complaints: Direct Auto has a high number of customer complaints about its slow claims process and customer service.

- Availability: Direct Auto has limited availability depending on location and other qualifications

If you feel like Direct Auto may be the company for you, it’s still essential to find Direct Auto insurance quotes online and compare them with other competitors.

Learn More: How to Evaluate Auto Insurance Quotes

Comparing auto insurance quotes will allow you to learn which companies will offer you the coverage you need at the best price and help you decide whether finding Direct Auto insurance near you is worth it.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Direct Auto Insurance is Right for You

If you are a high-risk driver looking for nonstandard car insurance, you may want to consider Direct Auto, a National General Insurance Group subsidiary. Direct Auto car insurance sells affordable high-risk auto insurance and allows SR-22 filings for people who need them.

High-risk car insurance can get expensive, but Direct Auto auto insurance reviews find a variety of options for discounts on coverage, including bundling auto and life insurance, to help policyholders save on coverage. So, if you’re looking for a basic auto insurance policy that allows you to drive safely and legally in your state, the Direct Auto insurance company may be a good fit.

Ready to shop for affordable auto insurance in your area? Enter your ZIP in our free quote tool to find the best auto insurance company for you.

Frequently Asked Questions

Is Direct Auto insurance legit?

Yes, Direct Auto insurance is legit. In fact, Direct Auto is a good insurance company that offers various insurance products, including car insurance, term life insurance, and health insurance. You can get Direct Auto car insurance quotes directly from their website if you are interested or use a quote comparison tool.

How long has Direct Auto insurance been around?

Direct Auto was founded in 1991 and has been around for 32 years.

Who bought Direct Auto insurance?

Direct Auto insurance is owned by National General since 2016 through its affiliate Direct General Group. Read our review of National General auto insurance to learn more about Direct Auto’s parent company.

Are Direct Auto and Direct General Insurance the same company?

They are not the same company, but Direct Auto is a part of the Direct General Group, which is owned by National General.

Can I customize my coverage with Direct Auto auto insurance?

Yes, Direct Auto Auto Insurance offers customizable coverage options for drivers. You can select the type and level of coverage that suits your needs, including adding additional features like roadside assistance or rental car reimbursement. You can also adjust your auto insurance deductibles on your coverages.

What factors affect Direct Auto insurance rates?

The cost of Direct Auto auto insurance depends on several factors, such as your driving record, the type of vehicle you own, your age and gender, your location, and the coverage options you choose. These factors help determine the risk profile and premium rate for your policy (Learn More: Factors That Affect Auto Insurance Rates).

How to file a claim with Direct Auto auto insurance?

To file Direct Auto insurance claims, you can contact their claims department through Direct Auto insurance website or by phone. They will guide you through the process, including documenting the incident, providing necessary information, and assisting with repairs or compensation.

Does Allstate own Direct Auto insurance?

No, Direct Auto is owned by National General.

Does Direct Auto have homeowners insurance?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

Is Direct Auto insurance the same as Allstate?

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Yes, Direct Auto insurance is legit. In fact, Direct Auto is a good insurance company that offers various insurance products, including car insurance, term life insurance, and health insurance. You can get Direct Auto car insurance quotes directly from their website if you are interested or use a quote comparison tool.

Direct Auto was founded in 1991 and has been around for 32 years.

Who bought Direct Auto insurance?

Direct Auto insurance is owned by National General since 2016 through its affiliate Direct General Group. Read our review of National General auto insurance to learn more about Direct Auto’s parent company.

Are Direct Auto and Direct General Insurance the same company?

They are not the same company, but Direct Auto is a part of the Direct General Group, which is owned by National General.

Can I customize my coverage with Direct Auto auto insurance?

Yes, Direct Auto Auto Insurance offers customizable coverage options for drivers. You can select the type and level of coverage that suits your needs, including adding additional features like roadside assistance or rental car reimbursement. You can also adjust your auto insurance deductibles on your coverages.

What factors affect Direct Auto insurance rates?

The cost of Direct Auto auto insurance depends on several factors, such as your driving record, the type of vehicle you own, your age and gender, your location, and the coverage options you choose. These factors help determine the risk profile and premium rate for your policy (Learn More: Factors That Affect Auto Insurance Rates).

How to file a claim with Direct Auto auto insurance?

To file Direct Auto insurance claims, you can contact their claims department through Direct Auto insurance website or by phone. They will guide you through the process, including documenting the incident, providing necessary information, and assisting with repairs or compensation.

Does Allstate own Direct Auto insurance?

No, Direct Auto is owned by National General.

Does Direct Auto have homeowners insurance?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

Is Direct Auto insurance the same as Allstate?

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Direct Auto insurance is owned by National General since 2016 through its affiliate Direct General Group. Read our review of National General auto insurance to learn more about Direct Auto’s parent company.

They are not the same company, but Direct Auto is a part of the Direct General Group, which is owned by National General.

Can I customize my coverage with Direct Auto auto insurance?

Yes, Direct Auto Auto Insurance offers customizable coverage options for drivers. You can select the type and level of coverage that suits your needs, including adding additional features like roadside assistance or rental car reimbursement. You can also adjust your auto insurance deductibles on your coverages.

What factors affect Direct Auto insurance rates?

The cost of Direct Auto auto insurance depends on several factors, such as your driving record, the type of vehicle you own, your age and gender, your location, and the coverage options you choose. These factors help determine the risk profile and premium rate for your policy (Learn More: Factors That Affect Auto Insurance Rates).

How to file a claim with Direct Auto auto insurance?

To file Direct Auto insurance claims, you can contact their claims department through Direct Auto insurance website or by phone. They will guide you through the process, including documenting the incident, providing necessary information, and assisting with repairs or compensation.

Does Allstate own Direct Auto insurance?

No, Direct Auto is owned by National General.

Does Direct Auto have homeowners insurance?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

Is Direct Auto insurance the same as Allstate?

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Yes, Direct Auto Auto Insurance offers customizable coverage options for drivers. You can select the type and level of coverage that suits your needs, including adding additional features like roadside assistance or rental car reimbursement. You can also adjust your auto insurance deductibles on your coverages.

The cost of Direct Auto auto insurance depends on several factors, such as your driving record, the type of vehicle you own, your age and gender, your location, and the coverage options you choose. These factors help determine the risk profile and premium rate for your policy (Learn More: Factors That Affect Auto Insurance Rates).

How to file a claim with Direct Auto auto insurance?

To file Direct Auto insurance claims, you can contact their claims department through Direct Auto insurance website or by phone. They will guide you through the process, including documenting the incident, providing necessary information, and assisting with repairs or compensation.

Does Allstate own Direct Auto insurance?

No, Direct Auto is owned by National General.

Does Direct Auto have homeowners insurance?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

Is Direct Auto insurance the same as Allstate?

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

To file Direct Auto insurance claims, you can contact their claims department through Direct Auto insurance website or by phone. They will guide you through the process, including documenting the incident, providing necessary information, and assisting with repairs or compensation.

No, Direct Auto is owned by National General.

Does Direct Auto have homeowners insurance?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

Is Direct Auto insurance the same as Allstate?

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Direct Auto does not offer homeowners insurance. They specialize primarily in auto insurance, particularly for high-risk drivers. Direct Auto also provides term life insurance, motorcycle, and commercial auto insurance.

No, Direct Auto Insurance and Allstate are two separate companies. If you are interested in Allstate, make sure to read our Allstate auto insurance review to learn more about the company.

Does Direct Auto have renters insurance?

How to add vehicle to Direct Auto insurance?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

How much is Direct Auto insurance?

How to cancel Direct Auto insurance?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

How good is Direct Auto insurance?

Does Direct Auto have gap insurance?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Does Direct Auto insurance have a 24-hour customer service?

What’s Direct Auto insurance address?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

How is Direct Auto insurance rated?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Direct Auto insurance have an app?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.