Farm Bureau Financial Services Auto Insurance Review for 2026 (See if They’re a Good Fit)

Check this Farm Bureau Financial Services auto insurance review with monthly rates starting at $38. They offer up to 25% discounts on coverage for everything from minivans to farm trucks, tailoring insurance to your life and building strong, personalized relationships to protect your future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated June 2025

Read this Farm Bureau Financial Services auto insurance review to discover offerings starting at just $38 per month.

Farm Bureau Financial Services offers up to 25% discounts on a variety of coverages, from liability to comprehensive auto insurance, suited for vehicles ranging from minivans to farm trucks.

Farm Bureau Financial Services Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.6 |

| Business Reviews | 5.0 |

| Claim Processing | 4.8 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.1 |

| Coverage Value | 4.9 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 3.5 |

| Discounts Available | 4.7 |

| Insurance Cost | 4.8 |

| Plan Personalization | 4.0 |

| Policy Options | 5.0 |

| Savings Potential | 4.7 |

Their personalized service considers your driving history, location, and vehicle type to provide tailored insurance solutions. Committed to strong relationships, they effectively safeguard your automotive future.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

- FBFS auto insurance review shows rates from $38 per month

- Policy includes liability, collision, and comprehensive coverage options

- Discounts up to 25% help lower costs based on driving history and location

Farm Bureau Financial Services Auto Insurance Rates by Age & Coverage

Farm Bureau Financial Services provides auto insurance through Farm Bureau Property & Casualty Insurance Company, part of Farm Bureau Mutual Holding Company. Founded in 1939, FBPCIC offers comprehensive coverage, including liability, collision, and uninsured motorist protection.

With a strong financial foundation and local agents, Farm Bureau Financial Services delivers reliable, personalized service to policyholders across the Midwest and Western states. Farm Bureau Financial Services auto insurance rates depend on age, gender, and coverage level.

Farm Bureau Financial Services Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $315 | $542 |

| Age: 16 Male | $360 | $612 |

| Age: 18 Female | $276 | $473 |

| Age: 18 Male | $325 | $553 |

| Age: 25 Female | $105 | $174 |

| Age: 25 Male | $112 | $184 |

| Age: 30 Female | $95 | $160 |

| Age: 30 Male | $98 | $165 |

| Age: 45 Female | $44 | $95 |

| Age: 45 Male | $42 | $92 |

| Age: 60 Female | $41 | $89 |

| Age: 60 Male | $40 | $88 |

| Age: 65 Female | $38 | $84 |

| Age: 65 Male | $39 | $86 |

Minimum coverage starts at $38 per month for 65-year-old females and $39 per month for males, while 16-year-olds pay the highest at $360 per month.

Insurance rates depend on coverage, age, and gender. Younger male drivers pay more. To save, choose higher deductibles or bundle coverage. For example, older drivers can lower costs with minimum coverage.Kristen Gryglik Licensed Insurance Agent

Full coverage auto insurance costs range from $84 per month for 65-year-old females to $612 per month for 16-year-old males, and rates decrease as drivers age.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farm Bureau Auto Insurance Rates by Credit Score & Competitors

Farm Bureau Financial Services auto insurance rates vary based on credit score, competing with top insurers. Drivers with good credit pay around $92 per month, while those with poor credit may pay up to $145 per month. Rates remain competitive, with Geico at $88 per month and State Farm at $95 per month for good credit, making Farm Bureau a strong option.

Farm Bureau Financial Services Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $135 | $190 | |

| $90 | $112 | $155 | |

| $92 | $110 | $145 |

| $102 | $128 | $180 | |

| $88 | $105 | $140 | |

| $115 | $140 | $195 |

| $98 | $118 | $165 |

| $100 | $125 | $175 | |

| $95 | $120 | $160 | |

| $108 | $132 | $185 |

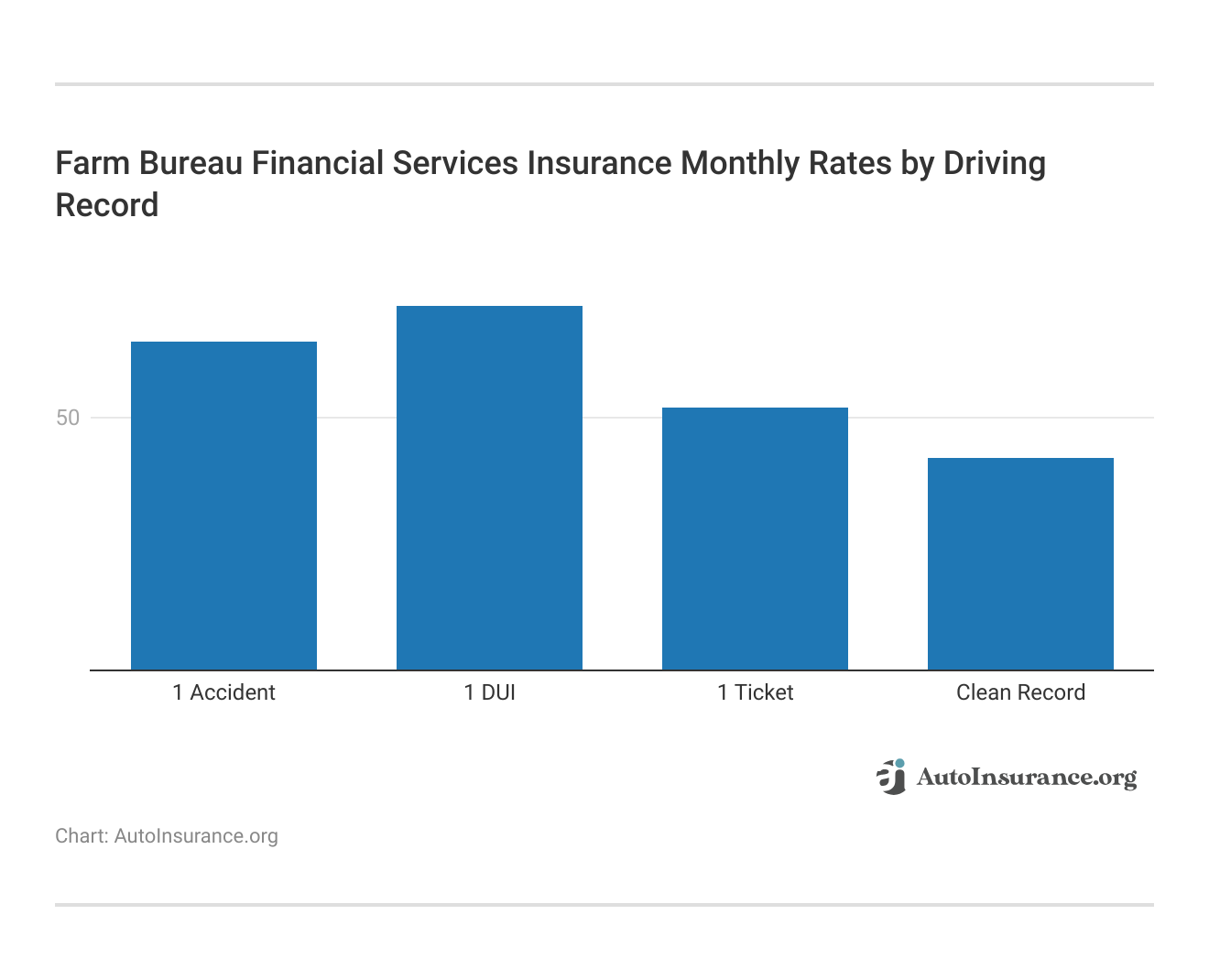

Auto insurance rates depend on driving history. Clean record drivers pay $42 per month, while a DUI increases rates to $72 per month. Cheap auto insurance after a DUI is still possible, but premiums will be higher. A ticket raises rates to $52 per month and an accident to $65 per month.

Farm Bureau auto insurance is competitive as well, with rates affected by your credit score and driving record.

With lower premiums for good credit and safe drivers, it provides value alongside major insurers like Geico and State Farm. Comparing rates can help drivers find the best coverage and savings for their needs.

Farm Bureau Financial Services Auto Insurance: Compare Rates & Coverage

Compare Farm Bureau Financial Services auto insurance monthly rates with top providers to find the most cost-effective coverage. Starting at $38 per month, it offers competitive pricing alongside insurers like Geico, which charges $45 for minimum coverage, and Liberty Mutual, which charges $180 for full coverage.

Farm Bureau Financial Services Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $160 | |

| $58 | $140 | |

| $50 | $135 |

| $72 | $175 | |

| $45 | $120 | |

| $70 | $180 |

| $60 | $150 |

| $55 | $145 | |

| $52 | $130 | |

| $68 | $155 |

Location, driving history, and levels of coverage selected all affect final premiums, so comparing options is crucial. Catering to their clients with personalized service alongside familiar local agents, they also offer discounts that can be up to 25%, to help policyholders get the coverage they need while balancing costs.

Reviewing these rates and understanding the types of auto insurance allows drivers to make informed decisions and find the best balance between affordability and coverage.

Farm Bureau Financial Services Auto Insurance Discounts: Save Up to 30%

Maximize savings with Farm Bureau Financial Services auto insurance discounts, offering up to 30% off for bundling home and auto, 25% for multi-vehicle policies, and 20% for safe drivers or accident-free records.

Farm Bureau Financial Services Auto Insurance Discounts

| Discount Name |  |

|---|---|

| Bundling/Home & Auto | 30% |

| Multi-Vehicle | 25% |

| Safe Driver | 20% |

| Accident-Free | 20% |

| Good Student | 15% |

| Pay-in-Full | 10% |

| Low Mileage | 10% |

| Defensive Driving Course | 10% |

| New Car | 10% |

| Anti-Theft Device | 5% |

Additional savings include 15% for good students, 10% for best low-mileage auto insurance discounts, pay-in-full or defensive driving courses, and 5% for anti-theft devices. These discounts help lower premiums while ensuring quality coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farm Bureau Financial Services Auto Insurance Coverage Options

Farm Bureau Financial Services offers a range of auto insurance coverage options to protect you from unexpected costs.

Whether it’s liability, collision auto insurance, comprehensive, medical, or uninsured/underinsured motorist coverage, these policies help ensure financial security in case of accidents or damage.

- Liability Coverage: Protect you if you cause damage to another person’s property or physically injure another person with your car. This type of coverage will not pay for car damage or personal injuries.

- Collision Coverage: If your car is damaged in an accident, collision coverage can help cover the costs to repair it.

- Comprehensive Coverage: If your car is damaged by something other than a collision, this coverage will protect you. Examples include fire, theft, hail, vandalism, etc.

- Medical or No-Fault Coverage: We offer medical or no-fault coverage in all states where we do business, but it varies. See your agent for details.

- Uninsured and Underinsured Coverage: Not everyone is as responsible as you. This coverage protects you and your passengers if a driver causes bodily injury without adequate car insurance.

Farm Bureau also offers SuperCheck, Driveology, and the Young Driver Safety Program to help policyholders optimize coverage and savings. SuperCheck provides a personalized insurance review to identify gaps and ensure adequate protection.

Driveology is a usage-based insurance program, which tracks driving behavior via a telematics device, rewarding safe drivers with the best discounts. Through its Young Driver Safety Program, drivers under the age of 25 can build responsible habits to help qualify for lower insurance rates. Such programs encourage safety, savings, and customized coverage.

Farm Bureau Financial Services Auto Insurance Ratings & Customer Reviews

Farm Bureau Financial Services auto insurance business ratings & consumer reviews, including Farm Bureau auto insurance reviews and Farm Bureau insurance reviews from BBB, highlight strong industry performance and customer satisfaction. With a J.D. Power score of 849/1,000 and an A+ rating for business practices, it consistently ranks above average in service.

Farm Bureau Financial Services Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Consumer Reports gives it 74/100, reflecting good customer feedback, while its 0.58 complaint ratio is lower than the industry average. A.M. Best rates it A, showcasing excellent financial strength and reliability.

Comment

byu/ridesforfun from discussion

inraleigh

A Reddit review highlights positive experiences with Farm Bureau auto insurance. The customer switched after multiple recommendations and found Farm Bureau’s rates competitive and service fast. After filing an auto insurance claim for two incidents, the customer reports no issues, and body shops also praise Farm Bureau’s claims process.

FBFS continues to earn customer trust with its reliable service and competitive rates. Positive experiences from policyholders and industry recognition reinforce its reputation as a dependable auto insurance provider.

Farm Bureau Financial Services Auto Insurance: Key Benefits & Drawbacks

Farm Bureau Financial Services offers competitive pricing and a range of coverage options designed for customers seeking personalized service. It has high ratings from J.D. Power and A.M. Best, so it is a reliable choice.

However, like any insurer, it has advantages and drawbacks that potential auto insurance policyholders should consider.

- Competitive Rates: Affordable coverage with discounts of up to 30% for bundling and 25% for multi-vehicle policies.

- Strong Customer Satisfaction: High ratings, including 849/1,000 from J.D. Power, reflecting good service.

- Personalized Local Service: Policyholders benefit from dedicated local agents for tailored coverage and claims support.

Farm Bureau auto insurance has strong financial backing, competitive prices, and personalized service, making it a great option for eligible drivers. But not everyone will want a policy that’s hard to get and doesn’t provide quotes online.

- Limited Availability: Coverage is only available in select Midwestern and Western states.

- No Online Quote Tool: Customers must contact a local agent for pricing, which may not be as convenient as online quotes.

Affordable rates, strong financial stability, and personalized service make this auto insurance a solid choice for many drivers.

The bundling discount through Farm Bureau Financial Services saved me 30% after switching, but simplicity in managing both my home and auto insurance was the most significant factor in switching.Tonya Sisler Insurance Content Team Lead

But the limited availability and lack of online quotes can be downsides. Getting quotes from several insurers guarantees you get the coverage, service, and value that meets your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximize Savings With Farm Bureau Financial Services Auto Insurance

Farm Bureau Financial Services auto insurance starts at $38 per month, with discounts of up to 30% for bundling and 25% for multi-vehicle policies. It holds strong customer satisfaction ratings and an A rating from A.M. Best for financial strength.

Strengths include competitive pricing, personalized local agent service, and strong claims support, but limited availability in select Midwestern and Western states and no online quote tool may be drawbacks. Despite these limitations, it remains a solid choice for affordable rates and reliable coverage.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Frequently Asked Questions

How do Farm Bureau Mutual vs Geico compare in pricing and coverage?

Farm Bureau Mutual vs Geico differ in pricing, with Farm Bureau starting at $38 per month and Geico at $45 per month for minimum coverage. Farm Bureau offers local agent support, while Geico operates online and by phone. Both provide similar coverage, but Farm Bureau includes extra discounts for bundling and safe driving programs like Driveology.

How does Farm Bureau Insurance perform in consumer reports reviews?

Farm Bureau Insurance reviews Consumer Reports ratings at 74/100, reflecting intense customer satisfaction in claims, policy options, and service. With a 0.58 complaint ratio, it has fewer disputes than competitors. While praised for agent support and competitive rates, availability is limited in some states, making it essential to compare options.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

How do Farm Bureau vs Progressive auto insurance rates compare?

Farm Bureau vs. Progressive auto insurance rates vary by driving history, location, and coverage. Farm Bureau starts at $38 per month with 30% bundling discounts but has limited availability. Progressive offers nationwide coverage and competitive rates for high-risk drivers, making it one of the best auto insurance companies for high-risk drivers.

How does Ohio Farm Bureau auto insurance compare to other providers?

Ohio Farm Bureau auto insurance is cost-effective, provides local support, and includes special member perks. Policyholders in the know can save by bundling policies, driving safely, and covering farm equipment. It is aimed at rural and suburban drivers looking for local expertise and personalized policies.

How do Farm Bureau Insurance reviews in Michigan reflect customer satisfaction?

Reviews highlight competitive rates, personalized service, and strong claims support. Many appreciate local agents’ responsiveness, though some note limited availability and the need to contact an agent for quotes. Comparing reviews helps determine if Farm Bureau Insurance in Michigan fits your needs.

Is Farm Bureau a good insurance company for auto coverage?

Farm Bureau offers affordable rates, strong financial stability, and personalized service, making it a top contender for the best auto insurance discounts. It holds an A rating from A.M. Best and a J.D. Power score of 849/1,000 for customer satisfaction. While it provides competitive pricing and discounts, coverage is limited to select states, and online quotes are unavailable.

What are common complaints about Farm Bureau insurance?

Complaints typically focus on claims processing times and customer service responsiveness. However, many customers also report positive experiences, particularly with local agents.

Is Farm Bureau insurance considered expensive?

Farm Bureau insurance rates are competitive and often considered reasonable, especially given the personalized service and discounts offered. Rates vary based on location, driving history, and the type of coverage.

Does Farm Bureau offer SR-22 insurance for high-risk drivers?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

How do Farm Bureau Financial Services reviews generally affect the company?

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Farm Bureau Mutual vs Geico differ in pricing, with Farm Bureau starting at $38 per month and Geico at $45 per month for minimum coverage. Farm Bureau offers local agent support, while Geico operates online and by phone. Both provide similar coverage, but Farm Bureau includes extra discounts for bundling and safe driving programs like Driveology.

Farm Bureau Insurance reviews Consumer Reports ratings at 74/100, reflecting intense customer satisfaction in claims, policy options, and service. With a 0.58 complaint ratio, it has fewer disputes than competitors. While praised for agent support and competitive rates, availability is limited in some states, making it essential to compare options.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

How do Farm Bureau vs Progressive auto insurance rates compare?

Farm Bureau vs. Progressive auto insurance rates vary by driving history, location, and coverage. Farm Bureau starts at $38 per month with 30% bundling discounts but has limited availability. Progressive offers nationwide coverage and competitive rates for high-risk drivers, making it one of the best auto insurance companies for high-risk drivers.

How does Ohio Farm Bureau auto insurance compare to other providers?

Ohio Farm Bureau auto insurance is cost-effective, provides local support, and includes special member perks. Policyholders in the know can save by bundling policies, driving safely, and covering farm equipment. It is aimed at rural and suburban drivers looking for local expertise and personalized policies.

How do Farm Bureau Insurance reviews in Michigan reflect customer satisfaction?

Reviews highlight competitive rates, personalized service, and strong claims support. Many appreciate local agents’ responsiveness, though some note limited availability and the need to contact an agent for quotes. Comparing reviews helps determine if Farm Bureau Insurance in Michigan fits your needs.

Is Farm Bureau a good insurance company for auto coverage?

Farm Bureau offers affordable rates, strong financial stability, and personalized service, making it a top contender for the best auto insurance discounts. It holds an A rating from A.M. Best and a J.D. Power score of 849/1,000 for customer satisfaction. While it provides competitive pricing and discounts, coverage is limited to select states, and online quotes are unavailable.

What are common complaints about Farm Bureau insurance?

Complaints typically focus on claims processing times and customer service responsiveness. However, many customers also report positive experiences, particularly with local agents.

Is Farm Bureau insurance considered expensive?

Farm Bureau insurance rates are competitive and often considered reasonable, especially given the personalized service and discounts offered. Rates vary based on location, driving history, and the type of coverage.

Does Farm Bureau offer SR-22 insurance for high-risk drivers?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

How do Farm Bureau Financial Services reviews generally affect the company?

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Farm Bureau vs. Progressive auto insurance rates vary by driving history, location, and coverage. Farm Bureau starts at $38 per month with 30% bundling discounts but has limited availability. Progressive offers nationwide coverage and competitive rates for high-risk drivers, making it one of the best auto insurance companies for high-risk drivers.

Ohio Farm Bureau auto insurance is cost-effective, provides local support, and includes special member perks. Policyholders in the know can save by bundling policies, driving safely, and covering farm equipment. It is aimed at rural and suburban drivers looking for local expertise and personalized policies.

How do Farm Bureau Insurance reviews in Michigan reflect customer satisfaction?

Reviews highlight competitive rates, personalized service, and strong claims support. Many appreciate local agents’ responsiveness, though some note limited availability and the need to contact an agent for quotes. Comparing reviews helps determine if Farm Bureau Insurance in Michigan fits your needs.

Is Farm Bureau a good insurance company for auto coverage?

Farm Bureau offers affordable rates, strong financial stability, and personalized service, making it a top contender for the best auto insurance discounts. It holds an A rating from A.M. Best and a J.D. Power score of 849/1,000 for customer satisfaction. While it provides competitive pricing and discounts, coverage is limited to select states, and online quotes are unavailable.

What are common complaints about Farm Bureau insurance?

Complaints typically focus on claims processing times and customer service responsiveness. However, many customers also report positive experiences, particularly with local agents.

Is Farm Bureau insurance considered expensive?

Farm Bureau insurance rates are competitive and often considered reasonable, especially given the personalized service and discounts offered. Rates vary based on location, driving history, and the type of coverage.

Does Farm Bureau offer SR-22 insurance for high-risk drivers?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

How do Farm Bureau Financial Services reviews generally affect the company?

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Reviews highlight competitive rates, personalized service, and strong claims support. Many appreciate local agents’ responsiveness, though some note limited availability and the need to contact an agent for quotes. Comparing reviews helps determine if Farm Bureau Insurance in Michigan fits your needs.

Farm Bureau offers affordable rates, strong financial stability, and personalized service, making it a top contender for the best auto insurance discounts. It holds an A rating from A.M. Best and a J.D. Power score of 849/1,000 for customer satisfaction. While it provides competitive pricing and discounts, coverage is limited to select states, and online quotes are unavailable.

What are common complaints about Farm Bureau insurance?

Complaints typically focus on claims processing times and customer service responsiveness. However, many customers also report positive experiences, particularly with local agents.

Is Farm Bureau insurance considered expensive?

Farm Bureau insurance rates are competitive and often considered reasonable, especially given the personalized service and discounts offered. Rates vary based on location, driving history, and the type of coverage.

Does Farm Bureau offer SR-22 insurance for high-risk drivers?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

How do Farm Bureau Financial Services reviews generally affect the company?

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Complaints typically focus on claims processing times and customer service responsiveness. However, many customers also report positive experiences, particularly with local agents.

Farm Bureau insurance rates are competitive and often considered reasonable, especially given the personalized service and discounts offered. Rates vary based on location, driving history, and the type of coverage.

Does Farm Bureau offer SR-22 insurance for high-risk drivers?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

How do Farm Bureau Financial Services reviews generally affect the company?

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Farm Bureau provides SR-22 auto insurance for drivers needing proof of financial responsibility after violations like DUIs or reckless driving. Coverage varies by state, and policyholders may face higher premiums. A Farm Bureau agent can help determine eligibility and find ways to reduce costs through available discounts.

Reviews often highlight the company’s strong customer service and reliable coverage options. Farm Bureau Financial Services typically receives positive ratings for its local agent network and customer support.

Is Farm Bureau homeowners insurance good?

Does Farm Bureau cover rental cars?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

How is Missouri Farm Bureau insurance rated by customers?

What are the Farm Bureau ratings for their vehicle insurance services?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

What do reviews say about Georgia Farm Bureau insurance?

How does Farm Bureau insurance address complaints related to Driveology?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

What are the main differences in coverage options between State Farm and Farm Bureau homeowners insurance?

What do Texas Farm Bureau car insurance reviews say about the company’s service?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

What do Indiana Farm Bureau insurance reviews typically say about their service and coverage?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does Farm Bureau homeowners insurance typically cover?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.