Liberty Mutual vs. Nationwide Auto Insurance in 2026 (Side-by-Side Review)

Liberty Mutual vs. Nationwide auto insurance varies in cost and savings. Liberty Mutual costs $96 monthly, offering RightTrack for safe driving and a military discount. Nationwide, at $63, provides SmartRide and a loyalty discount. Nationwide is cheaper, while Liberty Mutual offers more discount options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2025

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsLiberty Mutual and Nationwide auto insurance differ in pricing, discounts, and policy benefits, making the choice dependent on individual driver needs.

Liberty Mutual’s RightTrack monitors driving habits and offers up to 30% savings, along with a 10% military discount.

Liberty Mutual vs. Nationwide Auto Insurance Rating

| Rating Criteria |  |  |

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 3.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.7 |

| Liberty Mutual Review | Nationwide Review |

Nationwide’s SmartRide provides up to 40% off, plus a 5% loyalty discount. Nationwide averages $63 monthly, while Liberty Mutual Insurance costs $96.

Liberty Mutual Insurance also gives accident forgiveness, while Nationwide Insurance has a vanishing deductible that lowers rates for responsible drivers. Evaluating these aspects aids in the determination of the optimal fit.

- Nationwide costs $63 monthly, while Liberty Mutual averages $96

- Liberty Mutual’s RightTrack saves up to 30%; Nationwide’s SmartRide up to 40%

- Nationwide offers lower rates, while Liberty Mutual provides broader discounts

If you only need basic coverage to meet legal requirements, enter your ZIP code to find affordable auto insurance quotes in your area.

Age and Gender Impact on Auto Insurance Rates

Auto insurance rates aren’t one-size-fits-all—they shift based on age and gender, which can really impact how much you pay. Looking at Liberty Mutual and Nationwide auto insurance, it’s clear that Nationwide Insurance consistently comes in cheaper across the board.

Liberty Mutual vs. Nationwide Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  |  |

|---|---|---|

| 16-Year-Old Female | $1,031 | 586 |

| 16-Year-Old Male | 1,121 | 679 |

| 30-Year-Old Female | 249 | $177 |

| 30-Year-Old Male | 285 | $194 |

| 45-Year-Old Female | 244 | $161 |

| 45-Year-Old Male | 447 | $164 |

| 60-Year-Old Female | 211 | $141 |

| 60-Year-Old Male | 227 | $149 |

For teen drivers, the difference is huge. A 16-year-old male pays $1,120 per month with Liberty Mutual Insurance but only $679 with Nationwide. Female teens see a similar gap, with Liberty Mutual at $1,031 versus Nationwide’s $586. As drivers get older, rates drop, but Nationwide Mutual Insurance Company still stays lower.

At 30, Liberty Mutual Insurance charges $249 for females and $285 for males, while Nationwide Insurance keeps it at $177 and $194. The trend continues at 45 and 60, where Nationwide always has the edge—Liberty Mutual’s lowest rate for a 60-year-old female is $211, while Nationwide Mutual Insurance Company offers the same coverage for just $141.

If you bundle home and auto insurance, compare multi-policy discounts, as some companies, like Liberty Mutual, offer up to 25% off for bundling.Kristen Gryglik Licensed Insurance Agent

These disparities in cost show that Nationwide Mutual Insurance Company is still the more affordable option for people of all ages and genders. Nationwide Insurance constantly provides greater savings for people who value affordability, even when Liberty Mutual’s higher prices may be mitigated by available reductions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Insurance vs. Nationwide Insurance: Rate Differences by Violation

Your driving history has a big impact on how much you’ll pay for insurance. Auto insurance companies like Liberty Mutual and Nationwide Insurance adjust their rates based on past incidents, but Nationwide Mutual Insurance Company consistently keeps costs lower—even after violations.

Liberty Mutual vs. Nationwide Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  |  |

|---|---|---|

| Clean Record | $248 | $164 |

| Not-At-Fault-Accident | $335 | $230 |

| Speeding Ticket | $302 | $196 |

| DUI/DWI | $447 | $338 |

A driver with a clean record pays $248 per month with Liberty Mutual Insurance Company, while Nationwide Insurance charges just $164—a $84 difference. A not-at-fault accident raises Liberty Mutual’s rate to $335, compared to Nationwide’s $230, demonstrating how even minor occurrences affect rates.

Speeding citations result in significant increases, with Liberty Mutual Insurance charging $302 and Nationwide Insurance $196. The most significant increase occurs with a DUI, where Liberty Mutual Insurance rises to $447, while Nationwide remains at $338. Liberty Mutual raises rates more aggressively across all categories, making Nationwide the more budget-friendly option, especially for high-risk drivers.

Liberty Mutual Insurance vs. Nationwide: Credit-Based Pricing Differences

Auto insurance companies look at credit scores when setting prices, and a lower score can mean a much higher bill. Liberty Mutual Insurance Company and Nationwide auto insurance adjust rates based on credit, but Liberty Mutual Insurance hits drivers with bad credit much harder.

Full Coverage Insurance Monthly Rates by Credit: Liberty Mutual vs. Nationwide

| Credit Score |  |  |

|---|---|---|

| Good Credit (670-739) | $366 | $244 |

| Fair Credit (580-669) | $467 | $271 |

| Bad Credit (300-579) | $734 | $340 |

Drivers with good credit pay $366 per month with Liberty Mutual Insurance, while Nationwide Insurance offers a significantly lower rate of $244. Liberty Mutual raises rates to $467 with fair credit, compared to Nationwide’s $271. The largest gap appears for drivers with poor credit—Liberty Mutual Insurance spikes rates to $734, while Nationwide remains far lower at $340.

This $394 difference highlights how much credit impacts costs, with Liberty Mutual Insurance nearly doubling auto insurance premiums for poor credit drivers. Some states, like California and Massachusetts, ban insurers from using credit scores to set rates, so drivers in these states may not see this pricing gap. For those in states where credit is a factor, Nationwide is the cheaper option for drivers with lower scores.

Comparing Liberty Mutual Insurance and Nationwide’s Best Auto Insurance Discounts

Both Liberty Mutual and Nationwide auto insurance offer discounts, but the best deal depends on what applies to you. Nationwide Insurance provides bigger savings for good drivers and military personnel, while Liberty Mutual Insurance leads in bundling and anti-theft device discounts.

Liberty Mutual vs. Nationwide Auto Insurance Discounts

| Discount Type |  |  |

|---|---|---|

| Anti-Theft | 35% | 5% |

| Bundling | 25% | 20% |

| Early Signing | 8% | 10% |

| Federal Employee | 10% | 9% |

| Good Driver | 20% | 40% |

| Good Student | 15% | 15% |

| Homeowner Discount | 10% | 15% |

| Membership | 10% | 15% |

| Military | 10% | 25% |

| Multi-Vehicle/Car | 25% | 20% |

| Paperless Billing | 5% | 7% |

| Pay-in-Full | 12% | 15% |

| Safe Vehicle/Passive Restraint | 10% | 12% |

| Senior/Retiree Discount | 5% | 7% |

| Usage-Based Insurance (UBI) | 30% | 40% |

Liberty Mutual Insurance Company offers the highest anti-theft auto insurance discount at 35%, compared to just 5% from Nationwide, making it a better choice for drivers with security systems. However, Nationwide rewards safe drivers more generously, cutting rates by 40% versus Liberty Mutual’s 20%. Usage-based insurance (UBI) discounts also favor Nationwide at 40%, while Liberty Mutual maxes out at 30%.

Military members save more with Nationwide Mutual Insurance Company at 25%, while Liberty Mutual Insurance only offers 10%. Both insurers provide bundling discounts, but Liberty Mutual Insurance edges out Nationwide Insurance with 25% versus 20%.

Federal employees, students, and members of certain organizations can also find moderate savings with both companies. If you qualify for multiple discounts, stacking them could make either insurer the better deal, depending on your situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual vs. Nationwide Auto Insurance: Understanding Coverage Options

Nationwide and Liberty Mutual both provide a good range of basic and supplemental auto insurance plans, but these two differ in a few key ways. Here is a comparison of the features and differences of both policies in case you’re attempting to determine which one best suits your lifestyle.

Numerous coverage options are available from Liberty Mutual and Nationwide to keep you safe while driving. Most states mandate liability coverage, which covers harm or injury you cause to other people. Comprehensive coverage covers things like theft, fire, or storm damage, while collision coverage helps pay for repairs following a collision.

Auto Insurance Coverage Offered by Liberty Mutual & Nationwide

| Coverage Type |  |  |

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| Accident Forgiveness | ✅ | ✅ |

| Vanishing Deductible | ❌ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Custom Parts & Equipment | ✅ | ✅ |

PIP assists in covering medical costs and missed wages regardless of who is at fault, while MedPay offers similar support in some countries. Uninsured/underinsured motorist coverage takes effect if you are struck by someone who does not have adequate insurance.

Additionally, you can include extras like roadside assistance, gap insurance, and rental car reimbursement, which helps pay off the remaining balance in the event that your car is totaled.

Nationwide’s SmartRide program can cut your premium by up to 40%, making it one of the best choices for safe drivers.Justin Wright Licensed Insurance Agent

Liberty Mutual offers new car replacement, which means if your new car is totaled early on, they’ll replace it with a brand-new one—not just the depreciated value. That’s a huge perk for anyone driving a new vehicle.

In contrast, Nationwide has the vanishing deductible, which lowers your comprehensive or collision deductible by $100 for every year of safe driving, up to $500. This benefits long-term, claim-free drivers looking to reduce out-of-pocket costs. Both companies also offer rideshare insurance for drivers working with services like Uber or Lyft and provide coverage for custom parts and equipment, which is essential for modified vehicles.

Liberty Mutual Insurance vs. Nationwide: Financial Strength Ratings

Industry ratings and customer feedback help determine how well auto insurance companies handle claims, pricing, and overall service. Liberty Mutual Insurance Company and Nationwide auto insurance both perform well, but Nationwide Insurance maintains stronger financial and customer satisfaction scores.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual vs. Nationwide

| Agency |  |  |

|---|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction | Score: 728 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: A- Good Business Practices | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Excellent Financial Strength |

J.D. Power rates Liberty Mutual Insurance at 717/1,000, while Nationwide Mutual Insurance Company scores slightly higher at 728/1,000, indicating better customer satisfaction. A.M. Best, which assesses financial strength, gives Liberty Mutual Insurance an A rating, while Nationwide Insurance earns an A+, showing a stronger ability to meet policyholder obligations.

Consumer Reports rates Liberty Mutual 74/100 and Nationwide Insurance 75/100 for customer satisfaction. Liberty Mutual has fewer complaints with a 0.55 ratio, while Nationwide’s is 0.78. Nationwide holds a financial edge and slightly better satisfaction, but Liberty Mutual Insurance receives fewer official complaints.

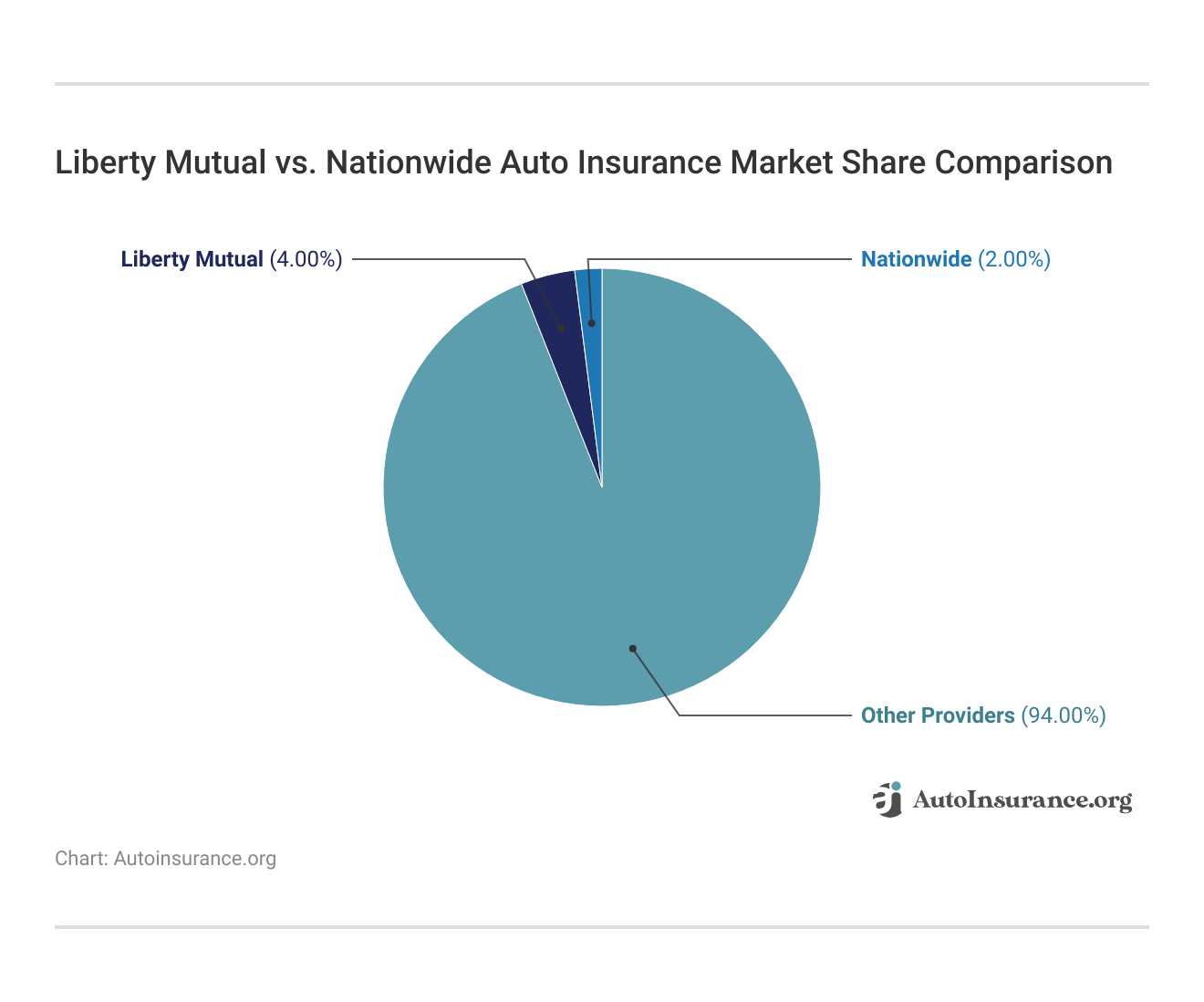

Auto insurance companies fight for their spot in the industry; market share tells a lot about their reach. Looking at Liberty Mutual Insurance Company and Nationwide auto insurance, there’s a clear gap between the two. Liberty Mutual Insurance holds 4% of the market, doubling Nationwide’s 2% share.

This implies Liberty Mutual is more visible, maybe because of its extensive array of insurance and discounts. Nationwide, while smaller, maintains competitiveness with reduced rates and strong financial support. The other 94% shows how fierce the rivalry is as it belongs to larger companies like State Farm and Geico. While Liberty Mutual leads Nationwide in market size, both remain smaller than the industry giants.

A Reddit user shared their thoughts on Liberty Mutual, saying they like the direct sales approach and customer service since there’s no need to go through an agent. They found the pricing reasonable with a group discount but admitted that without it, other companies might be cheaper. They also mentioned filing a claim after a rear-end accident and said the experience was smooth and positive.

Comment

byu/Help_Me_Reddit01 from discussion

inInsurance

If you like handling your policy without an agent and qualify for a group discount, Liberty Mutual could be a solid option. But if price is your main concern, comparing quotes is still the way to go.

Comparing Liberty Mutual Insurance and Nationwide’s Industry Influence

Auto insurance companies fight for their place in the industry, and market share gives a clear picture of their influence. Liberty Mutual Insurance Company and Nationwide auto insurance both have strong histories, but Liberty Mutual Insurance holds a larger slice of the market.

Liberty Mutual has been around since 1912 and is based in Boston, MA. As a mutual insurance company, it’s owned by its policyholders. It offers auto, home, and business insurance, with Liberty Mutual RightTrack rewarding safe drivers with potential savings. With 4% of the market, it holds a bigger share than Nationwide’s 2%.

Nationwide started as Farm Bureau Mutual in 1926, initially providing auto insurance for farmers in Ohio before expanding nationwide and rebranding in 1955.

Today, it offers various insurance and financial services, including Nationwide CareMatters, a long-term care insurance solution that provides flexible benefits for policyholders who need assisted living, in-home care, or nursing facility coverage. Unlike traditional long-term care policies, CareMatters offers a cash indemnity benefit, meaning policyholders receive payments directly without reimbursement restrictions.

Nationwide Insurance may have a smaller market share than Liberty Mutual Insurance, but it still holds its ground with lower rates and strong financial stability. Meanwhile, major players like State Farm and Geico dominate the remaining 94% of the market, showing just how competitive the industry is.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual Insurance and Nationwide Mobile App Features Compared

Auto insurance mobile apps simplify policy management, claims filing, and discount tracking. Liberty Mutual Insurance Company and Nationwide Insurance both provide these functions, but their telematics programs differ in accessibility and savings potential.

Users of Liberty Mutual’s mobile app can check claims, examine ID cards, and pay bills. Offering up to a 30% discount, its RightTrack program, a separate app, tracks braking, acceleration, and mileage. In certain states, meanwhile, it calls for a plug-in device, adding still another step for drivers.

Nationwide’s mobile app combines policy access with its SmartRide telematics program, providing up to 40% savings without needing a separate app or device. It also features on-demand roadside assistance for towing, fuel delivery, and jump-starts.

Nationwide’s app is more streamlined, integrating telematics within the main app, while Liberty Mutual’s RightTrack setup may be less convenient for some users.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros and Cons of Liberty Mutual Insurance

Pros

- Strong Anti-Theft Discount: Liberty Mutual offers up to 35% off for vehicles with anti-theft systems, significantly more than Nationwide’s 5%.

- RightTrack Savings: Safe drivers using Liberty Mutual RightTrack can earn up to 30% off premiums by tracking driving habits. To find out more, explore our Liberty Mutual auto insurance review.

- Diminished Complaint Ratio: Liberty Mutual Insurance has a lower complaint ratio of 0.55 compared to both the industry average and Nationwide, which both have ratios of 0.78.

Cons

- Higher Monthly Rates: Liberty Mutual’s average full coverage rate is $96 per month, while Nationwide Insurance offers the same coverage for $63, making it a pricier option.

- Expensive for Poor Credit Drivers: Liberty Mutual Insurance charges $734 per month for poor credit drivers, significantly more than Nationwide’s $340.

Pros and Cons of Nationwide Insurance

Pros

- Superior Good Driver Discount: Nationwide rewards safe drivers with a 40% discount, double Liberty Mutual’s 20%.

- Better Usage-Based Savings: Nationwide SmartRide offers up to 40% off for tracking driving behavior, while Liberty Mutual Insurance caps its discount at 30%.

- Stronger Financial Rating: Nationwide Insurance holds an A+ rating from A.M. Best, indicating superior financial strength compared to Liberty Mutual’s A rating.

Cons

- Lower Anti-Theft Savings: Nationwide provides only a 5% discount for vehicles with anti-theft devices, whereas Liberty Mutual Insurance offers up to 35%.

- Smaller Market Share: Nationwide holds just 2% of the auto insurance market, half of Liberty Mutual’s 4%, suggesting a smaller industry presence. See more details on our Nationwide insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Auto Insurance Policy Through Comparisons

Liberty Mutual vs. Nationwide auto insurance caters to different customer priorities. Liberty Mutual Insurance excels in discount variety, offering a 35% anti-theft discount and bundling savings up to 25%, but its higher rates—$96 monthly compared to Nationwide’s $63—can be a drawback.

Nationwide Insurance stands out with SmartRide’s 40% safe driving discount and an A+ financial strength rating, yet its market share is half of Liberty Mutual’s at 2%. At the same time, Liberty Mutual Insurance is ideal for drivers looking for extensive auto insurance discount options, while Nationwide Mutual Insurance Company benefits those who prioritize affordability and safe driving rewards.

With so many insurers offering different rates and discounts, shopping around is the best way to find the right coverage. Use our free comparison tool to get the best deal for your needs.

Frequently Asked Questions

Which company offers better coverage options, Liberty Mutual or 21st Century?

Liberty Mutual provides more coverage add-ons, including accident forgiveness, new car replacement, and gap insurance, while 21st Century focuses on basic, low-cost coverage with fewer customization options.

Who benefits more from Liberty Mutual or Erie auto insurance?

Drivers looking for lower rates and high customer satisfaction may prefer Erie. At the same time, those wanting nationwide availability and more discount options will find Liberty Mutual’s 35% anti-theft discount and accident forgiveness program more valuable.

Is Liberty Mutual or The General better for high-risk drivers?

Liberty Mutual offers standard coverage with better financial stability (A rating from A.M. Best), while The General is more lenient for drivers with poor records but comes with higher rates.

Which company offers better rates for high-risk drivers, Nationwide or Infinity?

Nationwide provides better coverage and a 40% SmartRide discount for safe drivers. At the same time, Infinity specializes in high-risk auto insurance, offering non-standard policies with flexible payment options for drivers with poor records.

What are some good alternatives to Nationwide insurance?

State Farm, Liberty Mutual, Travelers, and Allstate offer similar bundling discounts, financial stability, and safe driver programs. USAA is a great alternative but is limited to military families.

Is Root a good alternative to Nationwide?

Root bases rates entirely on driving behavior using telematics, while Nationwide offers traditional pricing and discounts. Root may save money for safe drivers, but its rates are unpredictable and unavailable in all states.

Which company offers the best discounts, Nationwide or Liberty Mutual?

Nationwide provides a 40% safe driver discount and a vanishing deductible, while Liberty Mutual offers a 35% anti-theft discount and accident forgiveness, making it better for those with security-equipped vehicles.

Is Liberty Mutual or Infinity better for drivers with bad credit?

Infinity caters to high-risk drivers with flexible payment plans. At the same time, Liberty Mutual offers more standard coverage but has higher rates for drivers with poor credit ($734 a month vs. Infinity’s lower-cost options).

Which companies offer discounts and coverage similar to Liberty Mutual?

Nationwide, State Farm, Travelers, and Allstate offer similar discounts, bundling options, and financial stability for drivers wanting comprehensive policies.

Who offers more coverage benefits, Geico or Liberty Mutual?

Geico has lower average rates, but Liberty Mutual provides more coverage options like new car replacement insurance and accident forgiveness, making it a better choice for drivers who want extra protection.

Which company is better for drivers needing minimum coverage?

Who offers better customer satisfaction, Liberty Mutual or Amica?

Who should choose Liberty Mutual over Safe Auto?

Which company is better for drivers with a poor driving record?

Who should consider Nationwide over Safeco?

Can high-risk drivers get SR-22 insurance through Liberty Mutual?

What is the average monthly premium for Nationwide?

Which companies typically offer lower rates than Nationwide?

Who should choose USAA over Liberty Mutual?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.