Do you need auto insurance to be towed? (What You Should Know for 2026)

You do not need auto insurance to be towed. Regardless, ensure you carry your state's minimum requirement for insurance, as driving without insurance is illegal, with first-offense fines starting at $25. If you get towed because of a moving violation or accident at your fault, your insurance may change.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

You do not need auto insurance to be towed, and you can get your car towed for free through your auto insurance company if you have one of the best roadside assistance plans.

Getting your car towed is not the end of the world, but it can be a hassle. Without roadside assistance or similar insurance coverage for towing, you could pay a lot of money to get your car to the shop.

Keep reading to find out how to get your car towed and answers to common questions like Does getting your car towed affect your insurance? Want to shop for affordable insurance with roadside assistance today? Enter your ZIP in our free comparison tool.

- You can have your car towed without car insurance

- If you are in an accident and do not have insurance, you may face severe penalties

- Some car insurance companies offer roadside assistance plans with towing

Towing Your Car and Auto Insurance Explained

If your car has ever stalled out on the side of the road, or if you’ve ever been in a car accident, you may find that your car needs to be towed.

Can you tow a car without insurance? You are not required to have car insurance to get your vehicle towed.

In fact, most of the cheapest liability-only auto insurance policies do not include towing as a provided service. But do I need insurance to tow a car? If you need a tow and don’t have insurance, your best bet may be to choose a car shop for your vehicle. Then, you can find the right towing company to help.

If your car needs repairs, you will want to have it towed to a local shop that can do the job. Depending on the extensive nature of the repairs, you may need to do a good bit of research before deciding where your car should go.

Once you’ve chosen a shop, call and ask a mechanic or other representative if they have any recommendations on towing services. Some shops will provide a free tow if you live close enough, while others may recommend a local towing company with competitive rates.

Does a car need insurance to be towed or can you tow an uninsured car? Yes, and in fact, most people who have a car towed without insurance coverage typically tow a stored or classic car that needs some repairs and attention. However, if you are driving a car uninsured, you need to purchase car insurance immediately, regardless of whether you need a tow.

Car Towing Options

If you were in a car accident and need a vehicle tow, you may find that the police officers on the scene will decide which towing service to utilize.

When having your car towed from home — whether for planned repairs or emergency services — you will want to call a towing company and ask about rates.

Be sure you know where your vehicle will go and how many miles it is from your house to that location. If the rates with a towing company seem too high, don’t hesitate to call another company to compare.Brandon Frady Licensed Insurance Producer

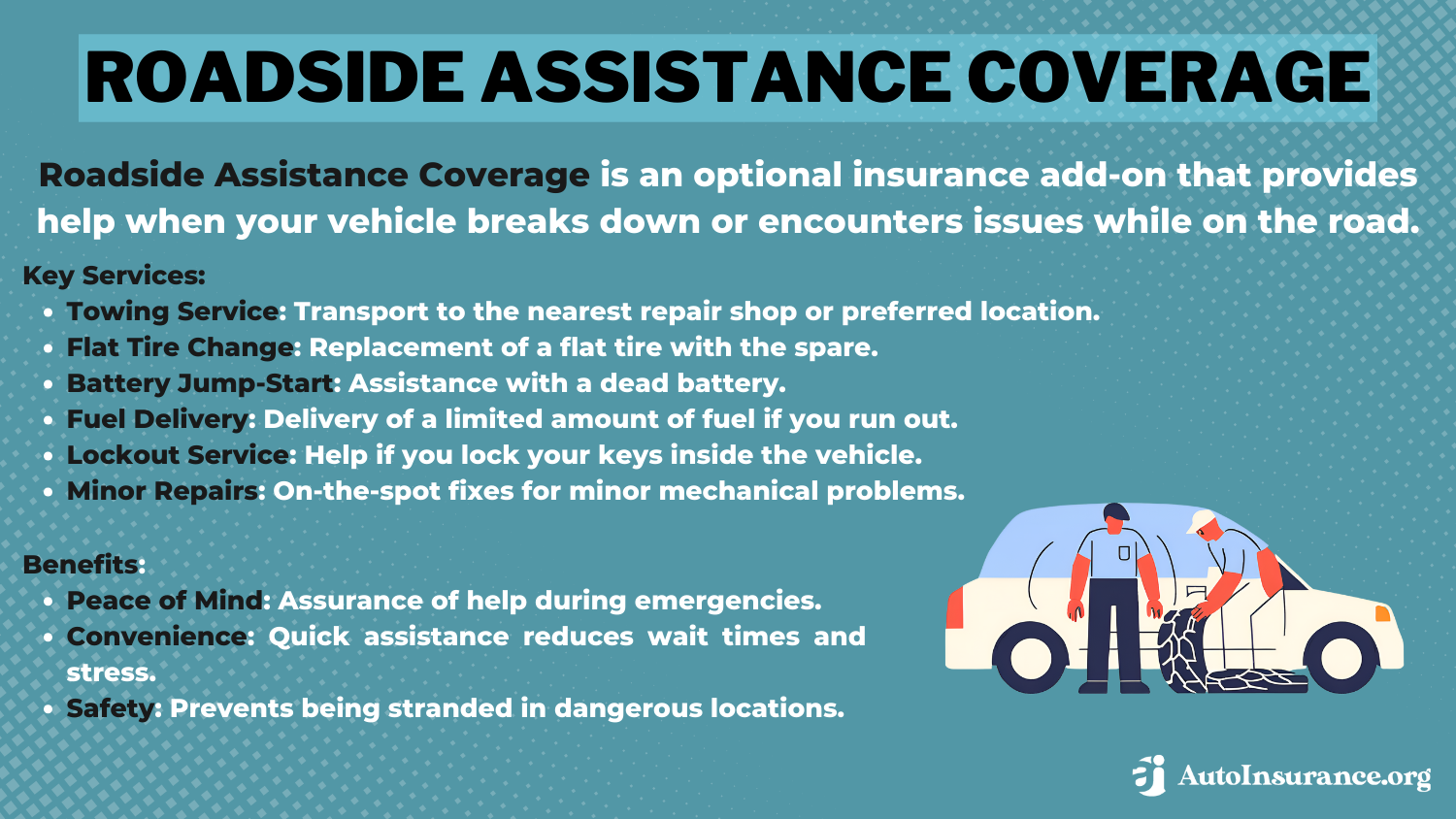

If you’re nervous about having car trouble and ultimately needing a tow, you could look into a roadside assistance coverage plan such as the AAA towing policy (Read More: AAA Auto Insurance Review).

Plenty of companies offer roadside assistance options, and your current insurance company may have a roadside assistance plan that works well for you. If not, you can look into purchasing roadside assistance with one of the many options in your area.

Some of the most common auto insurance companies that offer roadside assistance plans, like AAA towing coverage, include:

- AAA

- Progressive

- USAA

- Geico

- Allstate

Roadside assistance plans with the companies listed above can cost anywhere from $20 to $800 a year. Be sure to read reviews about any roadside assistance plan you’re considering before purchasing towing car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accidents Without Auto Insurance

While you are not required to carry car insurance to have your car towed, you could face legal trouble if you get caught driving without auto insurance.

The following table shows the penalties in each state for driving uninsured.

Driving Without Auto Insurance by State & Offense

State First Offense Second Offense

Alabama Fine up to $500; registration suspension with $200 fee Fine up to $1,000; six-month license suspension with $400 fee

Alaska License suspension for 90 days License suspension for one year

Arizona Fine $500+; license/registration suspension for three months Fine $750+; license/registration suspension for six months

Arkansas Fine $50-$250; suspended registration until proof of insurance Fine $250-$500; suspended registration until proof of insurance

California Fine $100-$200; car may be impounded Fine $200-$500; car may be impounded

Colorado Fine $500+; license suspension until proof of insurance Fine $1,000+; four-month license suspension

Connecticut Fine $100-$1,000; one-month suspension with $175 fee Fine $100-$1,000; six-month suspension with $175 fee

Delaware Fine $1,500+; six-month license suspension Fine $3,000+; six-month license suspension

Florida License suspension until reinstatement fee is paid; $150 fee License suspension until reinstatement fee is paid; $250 fee

Georgia Suspended registration; $25 lapse fee and $60 reinstatement fee Suspended registration; $25 lapse fee and $60 reinstatement fee

Hawaii $500 fine or community service; three-month license suspension $1,500 fine; one-year license suspension

Idaho Fine $75; license suspension until proof of insurance Fine up to $1,000; six-month license suspension

Illinois License plate suspension until $100 reinstatement fee paid Four-month license plate suspension with $100 fee

Indiana License suspension for 90 days to one year One-year license suspension within three years

Iowa Fine $500 if in accident; $250 otherwise NA

Kansas Fine $300-$1,000; license suspension Fine $800-$2,500; license suspension

Kentucky Fine $500-$1,000; one-year license suspension Fine $1,000-$2,500; one-year license suspension

Louisiana Fine $500-$1,000; license suspension for 180 days if in accident NA

Maine Fine $100-$500; license suspension until proof of insurance NA

Maryland Loss of plates and registration; penalty fees NA

Massachusetts Fine $500-$5,000; one-year license suspension License suspension for one year

Michigan Fine $200-$500; 30-day license suspension NA

Minnesota Fine $200-$1,000; license suspension up to 12 months NA

Mississippi Fine $1,000; one-year license suspension NA

Missouri License suspension until $20 reinstatement fee paid 90-day license suspension with $200 fee

Montana Fine $250-$500; up to 10 days imprisonment Fine $350; up to 10 days imprisonment

Nebraska License suspension; $50 reinstatement fee NA

Nevada Fine $250-$1,000; registration suspension with $250 reinstatement fee Fine $500-$1,000; registration suspension with $500 fee

New Hampshire No mandatory insurance; SR-22 may be required after a conviction NA

New Jersey Fine $300-$1,000; one-year license suspension Fine up to $5,000; two-year suspension

New Mexico Fine up to $300; 90-day license suspension NA

New York Fine up to $1,500; one-year license suspension NA

North Carolina Fine $50; 30-day suspension if in accident Fine $100; 30-day suspension if in accident

North Dakota Fine up to $1,500; 14 points against license Fine up to $1,500; plates impounded

Ohio License suspension; $100 reinstatement fee One-year suspension; $300 reinstatement fee

Oklahoma Fine $250; 30 days jail time or license suspension NA

Oregon Fine $130-$1,000; one-year license suspension NA

Pennsylvania Registration suspension for three months; $88 reinstatement fee NA

Rhode Island Fine $100-$500; three-month license suspension Fine $500; six-month suspension

South Carolina Fine $100-$200 or 30 days jail time; registration suspension Fine $200; 30-day jail or suspension

South Dakota Fine $100; 30-day license suspension NA

Tennessee Pay $25 coverage failure fee or registration suspension NA

Texas Fine $175-$350; pay up to $250 surcharge for three years Fine $350-$1,000; surcharge and license suspension

Utah Fine $400; license suspension until proof of insurance Fine $1,000; license suspension until proof of insurance

Vermont Fine up to $500; license suspension NA

Virginia Pay $500 uninsured fee or license suspension NA

Washington Fine up to $250 NA

West Virginia Fine $200-$5,000; 30-day license suspension Fine $200-$5,000; 90-day suspension

Wisconsin Fine up to $500 NA

Wyoming Fine up to $750 or six months in jail NA

As you can see, you could end up paying thousands of dollars and even spending time in jail if you get caught driving uninsured. Regardless of how much you drive, you need at least your state’s required amount of minimum liability coverage on your vehicle.

How Towing Affects Auto Insurance

Does getting towed affect insurance? In most cases, having your car towed is unlikely to impact your insurance rates. Depending on your towing needs, your car insurance company may not even know that your vehicle got towed. The exception may be if you purchased a roadside assistance plan or another towing service provided through your car insurance company.

But does getting your car towed affect your record? Does towing affect car insurance rates? Having your car towed may affect your auto insurance rates if your car gets towed because of a moving violation that will go on your driving record, like a DUI. The violation would be what made your insurance rates increase.

Learn More: Factors That Affect Auto Insurance Rates

Another way you might see an increase in car insurance rates is if you take advantage of towing services through your insurance company’s roadside assistance plan too frequently. If you know the AAA towing cost per mile without looking it up, or if you have the Allstate roadside number memorized, you might be using that service too much.

If you have roadside assistance and want to know more about does getting your car towed affect insurance, you should call your insurance company to speak with an agent.

Determining if You Need Auto Insurance for Car Towing

So, ultimately, can you get your car towed without insurance? Yes, but if you need to have your car towed, it can be a bit of a headache when towing a car without insurance. As long as you carry the state minimum auto insurance requirements on any vehicle you drive, you don’t have to stress about getting into any trouble.

Anyone who worries about being stranded in their vehicle should consider purchasing a roadside assistance plan that includes tow insurance for cars.

Before having your car towed, speak to the towing company and ask about the cost. If you find that the tow will be more expensive than you thought, you can call around and speak with representatives from other local companies to see if you could get a cheaper tow elsewhere.

To find an affordable auto insurance policy with towing auto insurance coverage today, compare rates with our free tool.

Frequently Asked Questions

Do you need auto insurance to be towed?

Does insurance cover towing a car? Yes, in most cases, you will need auto insurance when you think, “I have to get my car towed.” Auto insurance typically covers various aspects of owning and operating a vehicle, including situations where your vehicle needs to be towed. The specific car towing insurance coverage and requirements may vary depending on your insurance policy and the circumstances of the towing.

What does auto insurance cover when it comes to towing?

You want to know, does car insurance cover towing? Auto insurance policies usually offer coverage for towing expenses as part of their comprehensive or roadside assistance coverage. This coverage can help pay for the costs associated with towing your vehicle if it breaks down or is involved in an accident.

However, it’s important to review your policy to understand the specific coverage limits and any conditions or exclusions that may apply when you need to tow a car. And check with your agent if you’re wondering, does getting my car towed increase insurance.

Are towing services always covered by auto insurance policies?

Not all auto insurance policies automatically include towing coverage. It depends on the type of policy you have and the coverage options you’ve selected when you need your car towed. Some policies offer towing coverage as a standard inclusion, while others may require you to add it as an optional coverage or purchase it separately as part of a roadside assistance package.

Review your policy documents or contact your insurance provider to confirm whether towing services are covered and if you need to find other ways for how to get your car towed to a mechanic (Learn More: How much car insurance do I need?).

What if I don’t have towing coverage in my auto insurance policy?

Can I tow a car without insurance? If your auto insurance policy does not include towing coverage, you may have to pay for towing expenses out of pocket. In such cases, it can be beneficial to explore alternative options like standalone roadside assistance programs offered by automobile clubs or specialized towing service providers.

These programs often offer towing services and other roadside assistance benefits for a fee. When you need to know, can I tow an uninsured car, you can check out some of these programs.

Are there any situations where towing may be covered even without auto insurance?

So, can you tow an uninsured car? While auto insurance is typically the primary source of coverage for towing, there may be instances where towing services are covered by other entities. For example, some vehicle manufacturers offer complimentary roadside assistance programs that may include towing services during the warranty period.

Additionally, certain credit cards or auto club memberships may provide limited towing benefits. It’s essential to review the terms and conditions of these programs to determine if towing is included and under what circumstances. You should know what to do when you get your car towed before the actual situation arises.

Will my auto insurance cover towing if my vehicle is impounded?

So you want to know, does insurance cover impound fees? And you also might want to know, does getting your car impounded affect your insurance? And if so, how does the impound of a car affect insurance? Auto insurance typically does not cover towing expenses related to impoundment. Impoundment usually occurs as a result of legal or law enforcement actions, such as parking violations or driving without proper documentation.

These situations are typically not covered by standard auto insurance policies, and you will likely be responsible for the costs associated with impoundment and towing. And there are some instances when the answer to the question, “can your car be impounded for no insurance?” is yes. Make sure you know how to get a car out of impound without insurance if you ever find yourself in this case.

Can I get towed even if I don’t have auto insurance?

Many drivers wonder, can your car get towed if you don’t have insurance? Yes, you can still get your vehicle towed even if you don’t have auto insurance. Towing services are generally available to anyone who needs assistance, regardless of their insurance status.

However, you will be responsible for covering the costs associated with the towing service if you don’t have insurance coverage or if towing services are not included in your policy. Shop for auto insurance today with our free quote tool.

What should I do if my vehicle needs to be towed?

If your vehicle needs to be towed, the first step is to contact your insurance provider to determine if towing services are covered under your policy. If towing is covered, they will provide guidance on how to proceed and may have a list of authorized towing service providers you can contact.

But can your car be towed for no insurance? If towing is not covered by your insurance, you can search for reputable towing companies in your area and inquire about their services and pricing.

Are there any restrictions on towing coverage in auto insurance policies?

Yes, there may be restrictions and limitations on towing coverage within auto insurance policies. These restrictions can include factors such as distance limits (e.g., coverage only up to a certain number of miles), service provider limitations (e.g., coverage only if using authorized towing companies), or restrictions based on the cause of the towing (e.g., coverage only for mechanical breakdowns and not for accidents).

It’s crucial to carefully review your policy or contact your insurance provider to understand any restrictions that may apply.

Is towing covered if my vehicle is stolen?

In most cases, towing expenses related to a stolen vehicle are covered by comprehensive auto insurance. Comprehensive coverage protects against theft, vandalism, and other non-collision incidents. If your vehicle is stolen and later recovered, your insurance company may arrange for it to be towed to a designated location for assessment.

However, it’s essential to review your policy or consult with your insurance provider to understand the specific coverage and any deductible that may apply.

Can your car get towed for no insurance?

Can I get my car towed without being present?

How much is a tow truck without insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.