Esurance vs. Geico Auto Insurance in 2026 (Head-to-Head Review)

If you’re looking at Esurance vs. Geico auto insurance, Geico comes in with a $43 monthly rate, along with extras like accident forgiveness and mechanical breakdown coverage. Esurance—no longer offering new policies—had a $69 rate, lower teen premiums, and rideshare coverage for existing customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

1,543 reviews

1,543 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,543 reviews

1,543 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsWhen comparing Esurance vs. Geico auto insurance, Geico stands out with a $43 monthly rate, plus perks like accident forgiveness and mechanical breakdown coverage.

Esurance—though no longer selling new policies—offered a $69 rate, cheaper teen premiums at $383, and rideshare coverage in some states.

Geico scores higher in J.D. Power claims with 881 points and gets fewer complaints through the NAIC. Esurance is more affordable for drivers with speeding tickets at $146 monthly, while Geico offers cheaper rates for at-fault accidents at $115 per month.

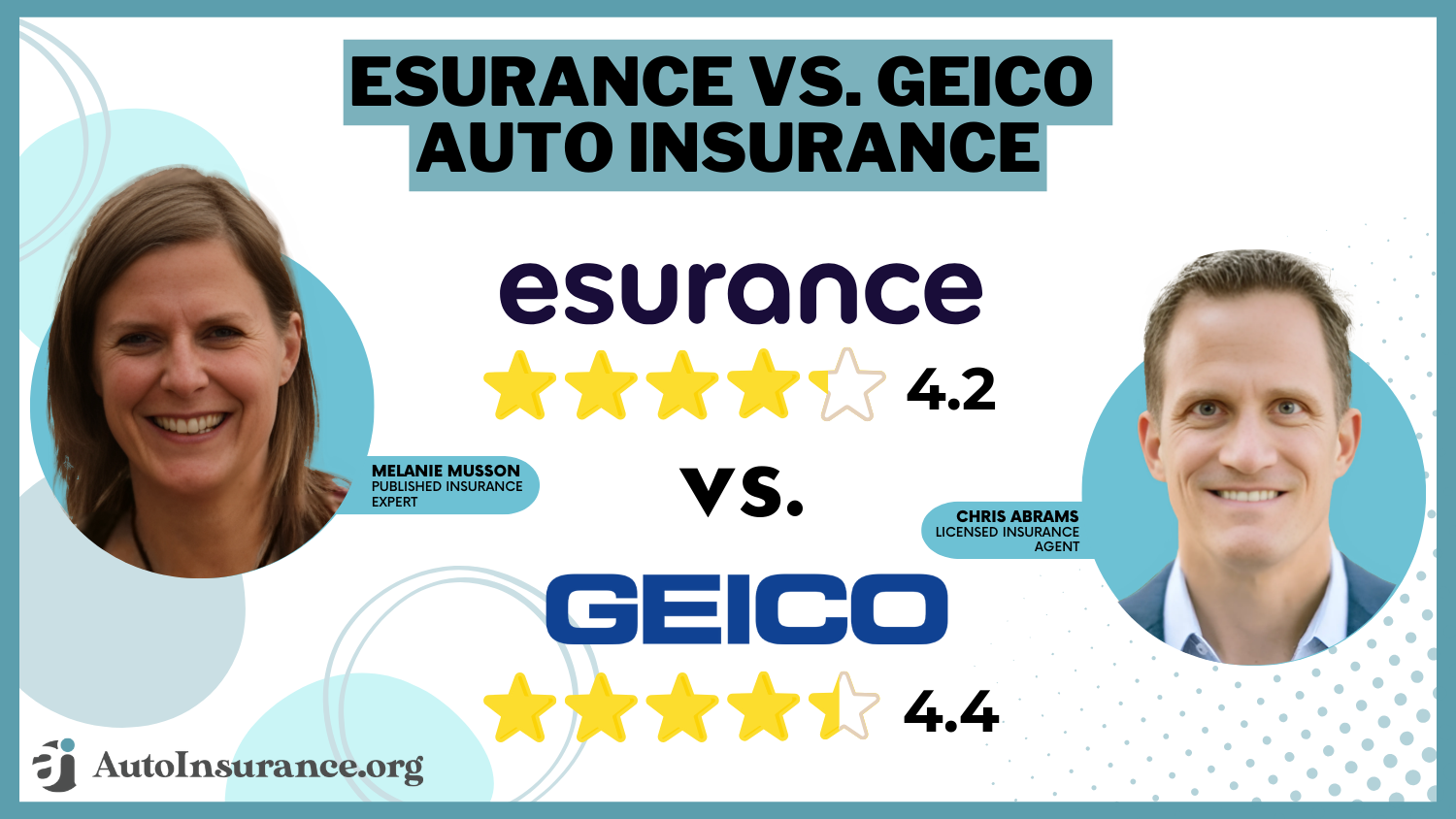

Esurance vs. Geico Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 4.5 | 4.8 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 4.9 | 5.0 |

| Coverage Value | 4.1 | 4.4 |

| Customer Satisfaction | 2.0 | 2.3 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 4.2 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 4.1 |

| Savings Potential | 4.5 | 4.5 |

| Esurance Review | Geico Review |

Geico also offers up to 25% off with DriveEasy, while Esurance’s DriveSense discount depends on your location.

- Geico offers minimum coverage at $43 monthly, Esurance at $69

- Esurance vs. Geico auto insurance shows Geico is cheaper for most

- Esurance wins on teen rates and offers rideshare coverage in states

Unsure whether Geico’s lower rate or Esurance’s teen driver savings suit you better? Use our free comparison tool to find the best value.

Comparing Esurance vs. Geico Auto Insurance Rates

Esurance vs. Geico auto insurance rates vary a lot depending on your age and gender. The table below breaks down how much full coverage costs each month for male and female drivers at different life stages.

Esurance vs. Geico Full Coverage Auto Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $905 | $425 |

| 16-Year-Old Male | $923 | $445 |

| 30-Year-Old Female | $171 | $128 |

| 30-Year-Old Male | $178 | $124 |

| 45-Year-Old Female | $157 | $114 |

| 45-Year-Old Male | $163 | $114 |

| 60-Year-Old Female | $148 | $104 |

| 60-Year-Old Male | $152 | $106 |

Geico tends to come in cheaper across the board, but the biggest gap shows up for teen drivers. A 16-year-old male would pay $923 with Esurance compared to just $445 with Geico, which is a massive $478 in monthly savings. That price edge continues as drivers age—30-year-old males save $54 per month, and 45-year-old females pay $43 less with Geico than with Esurance.

Both companies offer digital tools and usage-based discounts, but Geico’s pricing really makes it stand out—especially for families and older drivers who need full coverage auto insurance. Add in extras like accident forgiveness, and Geico’s value holds up strong no matter your age.

Driving History Pricing in Esurance vs. Geico Auto Insurance

In the Esurance vs. Geico auto insurance comparison, even a single violation can dramatically change what you pay for full coverage. This table breaks down how both company’s price policies are based on driving history.

Esurance vs. Geico Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $163 | $114 |

| Not-At-Fault Accident | $257 | $189 |

| Speeding Ticket | $208 | $151 |

| DUI/DWI | $298 | $309 |

Drivers with a clean record get the best rates—Geico charges just $114 a month, while Esurance is higher at $163. If you’ve had a speeding ticket, Geico still comes out ahead at $151, compared to $208 from Esurance. A not-at-fault accident also favors Geico at $189, while Esurance pushes that to $257.

The only exception is with a DUI, where Esurance slightly undercuts Geico at $298 versus $309. For most driving records, Geico delivers the better deal, but Esurance becomes more competitive with serious violations. Discover the best auto insurance companies that don’t penalize you for speeding tickets, and start saving today.

Credit-Based Pricing Gaps in Esurance vs. Geico Auto Insurance

When comparing Geico vs. Esurance auto insurance, your credit score has a big say in how much you’ll spend each month. Even if you’ve never had an accident, your rate can jump just because of your credit. The table below shows how the numbers shake out depending on whether your credit is good, fair, or bad.

Full Coverage Insurance Monthly Rates by Credit: Esurance vs. Geico

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $140 | $110 |

| Fair Credit (580-669) | $165 | $130 |

| Bad Credit (300-579) | $220 | $180 |

Drivers with good credit pay $110 per month with Geico, while Esurance charges $140 for the same profile. With fair credit, Geico increases to $130, but Esurance pushes the rate to $165—a $35 monthly difference.

For bad credit, the gap grows even wider: Geico hits $180 while Esurance climbs to $220. That $40 difference equals $480 more per year just for having a lower credit score. Although both companies increase rates as credit drops, Geico penalizes less aggressively, making it the more cost-effective choice for drivers with average or poor credit. Learn how long an accident stays on your record and how it affects insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discount Breakdown in Esurance vs. Geico Auto Insurance

Looking at Esurance and Geico auto insurance, the discounts can seriously shift your monthly bill depending on what you qualify for. This table shows just how much more one company can save you if you hit the right criteria.

Auto Insurance Discounts for Esurance vs. Geico

| Discount | ||

|---|---|---|

| Low Mileage | 20% | 30% |

| Usage-Based Insurance (UBI) | 25% | 25% |

| Multi-Vehicle | 25% | 25% |

| Emergency Deployment | ❌ | 25% |

| Multi-Policy (Bundling) | 15% | 25% |

| Bundling | 10% | 25% |

| Good Driver | 20% | 26% |

| Military | ❌ | 15% |

| Defensive Driving | 10% | 15% |

| Good Student | 10% | 15% |

| New Car | 10% | 15% |

| Federal Employee (Eagle) | ❌ | 8% |

| Auto Pay & Paperless | 4% | 7% |

| Paid-in-Full | 10% | 10% |

| Senior Driver | ❌ | 10% |

| Homeowner | 10% | ❌ |

| Rideshare Driver | 5% | ❌ |

Geico gives a 30% discount for low-mileage drivers, which is 10% higher than Esurance’s offer. For good drivers, Geico’s 26% beats Esurance’s 20%, and bundling earns Geico users up to 25%, while Esurance caps out at 15%. Geico provides a 25% emergency deployment discount and a 15% military discount, while Esurance offers neither.

Always double-check if custom parts or aftermarket upgrades are covered—many standard policies don’t include them.Justin Wright Licensed Insurance Agent

Geico also includes a 15% discount for defensive driving, compared to Esurance’s 10%. Esurance only takes the lead in two spots: a 5% discount for rideshare drivers and 10% off for homeowners, both missing from Geico. The clear edge goes to Geico, offering higher percentages across more categories that actually lower your monthly bill. Find out how to get a defensive driver auto insurance discount through approved courses.

Auto Insurance Coverage Breakdown of Esurance and Geico

When looking at Esurance vs. Geico auto insurance, both companies check off all the basics, but the real differences show up in the extras. Although they both include the usual coverages (liability, collision, and roadside assistance), their distinctive features may significantly influence your choice. You can see what you’re really paying for because this chart breaks everything out.

Esurance vs. Geico Auto Insurance Coverage Options

| Coverage Type | ||

|---|---|---|

| Liability Coverage | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Mechanical Breakdown Insurance | ❌ | ✅ |

| Rideshare Coverage | ✅ | ✅ |

| Custom Equipment Coverage | ✅ | ❌ |

| Accident Forgiveness | ✅ | ✅ |

| New Car Replacement | ❌ | ✅ |

| SR-22 Coverage | ✅ | ✅ |

Both Esurance and Geico cover the essentials like liability, which helps if you cause an accident, and collision, which covers damage to your own car. Comprehensive kicks in for things like car theft, fire, or weather damage.

Uninsured/underinsured motorist coverage protects you if someone hits you without enough insurance, while both MedPay and PIP cover medical costs regardless of fault—though PIP may also reimburse lost wages in some states.

Rental reimbursement and roadside assistance are available through both carriers, covering tow services and rental cars during repairs. Here’s where the differences really count: Geico provides mechanical breakdown insurance, which covers significant engine or transmission problems—coverage Esurance provides is quite limited.

Geico also covers new automobile replacement, which substitutes a brand-new model for your totaled car, so augmenting not only the depreciated worth.

There’s lacks both of these but does provide custom equipment coverage, which protects non-factory additions like custom paint jobs, wheels, and stereo systems—something doesn’t cover. Both insurers include accident forgiveness and rideshare insurance, supporting Uber and Lyft drivers. Finally, SR-22 coverage is available from both, helping high-risk drivers meet state filing requirements.

Geico’s DriveEasy and Esurance’s DriveSense Compared

Esurance Insurance Services, Inc. made a name for itself by keeping everything online and super easy to manage. One cool feature they offered was DriveSense, a usage-based program that tracks your driving habits—like how fast you go or how hard you brake—and could help you earn discounts if you drive safely.

Everything from checking your driving habits to reviewing policy details can be done straight through the Esurance mobile app or website.

Geico, short for Government Employees Insurance Company, has long been known for offering affordable auto insurance and fast digital service. Its own usage-based insurance program, called Geico DriveEasy, works similarly to DriveSense. It monitors things like braking, phone use while driving, and speed, rewarding safe drivers with lower rates over time.

Both Esurance and Geico give customers access to powerful online tools and mobile apps. You can file and track claims, pull up your digital ID card, update policy details, and speak with a representative all from your phone or browser. Whether you use DriveSense or Geico DriveEasy, your trip data and discount status are updated in real-time, making it easy to stay on top of how your driving affects your premium.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Esurance vs. Geico Auto Insurance Financial Ratings Compared

When comparing Esurance vs. Geico auto insurance, customer reviews and business ratings show just how different these two companies perform beyond pricing. The table highlights real numbers from J.D. Power, Consumer Reports, NAIC, and A.M. Best to paint a full picture of satisfaction and financial reliability.

Insurance Business Ratings & Consumer Reviews: Esurance vs. Geico Auto Insurance

| Agency | ||

|---|---|---|

| Score: 810 / 1,000 Avg. Satisfaction | Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Mixed Customer Feedback | Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.20 Avg. Complaints | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A- Excellent Financial Strength | Score: A++ Superior Financial Strength |

Geico scores a 0.55 complaint index, which is well below the national average and much better than Esurance’s 1.20, meaning Geico gets fewer customer complaints. In J.D. Power’s customer satisfaction study, Geico scored 810 out of 1,000, while Esurance lagged at 692—over 100 points lower.

Geico scored 74 out of 100 on Consumer Reports, which is somewhat higher than Esurance’s score of 72 but still more consistent with better customer experiences. In terms of financial strength, Esurance only has an A-, which is good but not quite on par with Geico’s top-tier A++ rating from A.M. Best. If you want stronger support, better service, and fewer headaches, Geico has the advantage here.

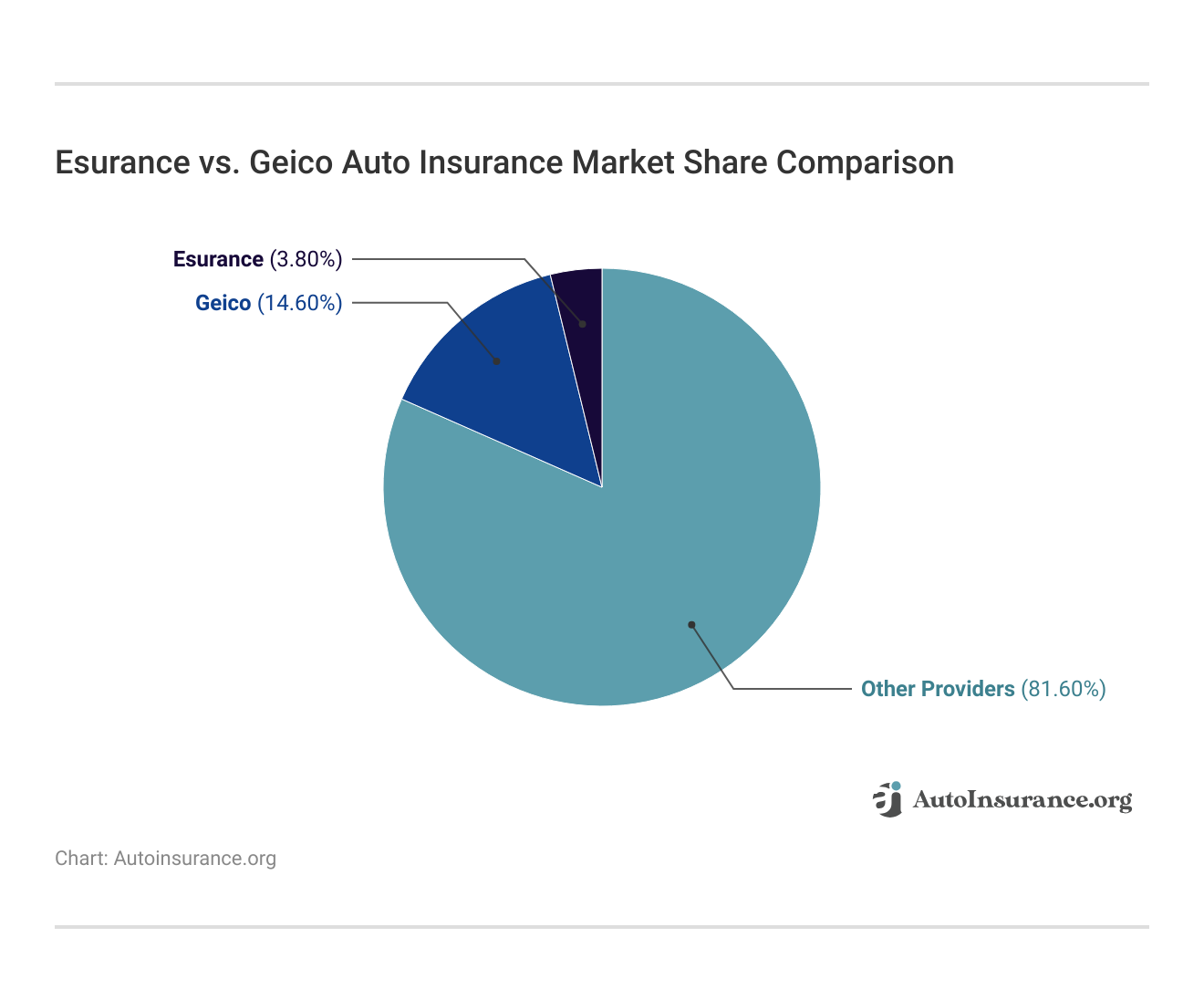

There is a considerable size difference between Esurance and Geico when it comes to auto insurance. Each company’s true market share in the US vehicle insurance market is shown in this graphic, and it’s not even close.

One of the largest companies in the game, Geico holds a 14.60% market share. Esurance only has 3.80%, which is significantly less than that.

Over on Reddit, a user in the BMW thread shared that they ditched Esurance and went with Geico after realizing Geico gave them a way better rate for the same coverage. They also mentioned Geico handled a past accident more smoothly, which made sticking with them an easy choice.

Comment

byu/Murky-Read-3975 from discussion

inBMW

Esurance worked fine at first, but once their driving situation changed, the price just didn’t make sense anymore. Back on Reddit, a bunch of commenters seemed to agree—once people start shopping around, Geico often comes out ahead, especially for drivers with newer or pricier cars like BMWs.

Discover top-rated auto insurance companies with the best customer service and coverage.

Geico: Pros and Cons

Geico always comes up as one of the cheapest and easiest-to-reach insurance companies in the country.It is very good for drivers who have clean driving records or are looking for coverage that is easy to get almost everywhere.

Pros

- $43 Minimum Coverage Rate: Geico offers the lowest minimum monthly premium in the comparison, saving drivers $26 compared to Esurance.

- Extensive Discount Portfolio: Drivers can save up to 30% with low-mileage usage, 26% for safe driving, and 25% when bundling multiple policies.

- Superior Financial Strength: Rated A++ by A.M. Best, Geico has the highest possible score for claims-paying ability, providing peace of mind in long-term coverage.

Cons

- Limited Customization Coverage: Geico does not offer custom equipment protection, which may be a drawback for drivers with aftermarket vehicle modifications.

- $309 Monthly DUI Rate: Geico charges $309 per month for drivers with a DUI, $11 more than Esurance.

Geico is a strong choice for drivers who want low-cost coverage, excellent service scores, and coast-to-coast availability, though those with modified vehicles or DUI history may want to compare carefully. Explore a detailed Geico auto insurance review before choosing a policy.

Esurance: Pros and Cons

Esurance is good for drivers who need insurance covering auto upgrades and want good prices in some high-risk situations. They give discounts to gig economy drivers and homeowners, which are two groups that Geico does not focus on much.

Pros

- Covers Aftermarket Parts: Esurance includes custom equipment coverage for non-factory features like rims, body kits, or custom paint, which Geico doesn’t insure.

- Better Rate After Speeding Violation: Drivers with a speeding ticket pay $208 per month with Esurance, compared to $251 with Geico, saving $516 annually.

- Offers Niche Discounts: Esurance gives a 5% discount for rideshare drivers and 10% off for homeowners, both of which are not available through Geico.

Cons

- Unavailable in 7 States: Esurance does not operate in Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont, or Wyoming, limiting access for drivers in those areas.

- Lower Financial Strength: Esurance holds an A- A.M. Best rating, while Geico is rated A++, indicating significantly stronger long-term financial backing.

Esurance works well for drivers who value customization, tech-based service, and specific discount needs. However, limited state availability and lower financial strength might be deal-breakers for drivers wanting broader access and stronger institutional reliability. Take a look at our full Esurance auto insurance review before you buy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico and Esurance Offer Different Strengths for Modern Drivers

Esurance vs. Geico auto insurance really comes down to what kind of driver you are. Geico keeps things affordable with $43 a month for minimum coverage, solid nationwide access, and a 30% discount for low-mileage drivers.

It also holds an A++ A.M. Best rating, showing strong financial stability. Geico doesn’t cover custom upgrades, but Esurance does, which is ideal for drivers with modified vehicles.

Esurance and Allstate now work together, as Esurance no longer sells new policies, but current policyholders still have access to collision, comprehensive, MedPay, PIP, and rideshare coverage, while Allstate handles all new Esurance business. If you’re deciding between these or other providers, use our free comparison tool to quickly find the best rates and coverage options for your driving needs.

Frequently Asked Questions

What’s the difference between Allstate vs. Esurance?

Allstate vs. Esurance is now a brand transition. Esurance was acquired by Allstate in 2011 for around $1 billion and phased out in 2020. New policies are written under Allstate, but existing Esurance customers still maintain coverage—including Esurance boat insurance—for auto, renters, and boat insurance through Allstate’s system.

Why is Esurance so cheap compared to other companies?

Why is Esurance so cheap is mainly because it operated online without physical branches, reducing overhead. It also targeted high-risk drivers with limited but affordable coverage options, which lowered premiums compared to traditional insurers.

How does Esurance vs. American Family compare?

Esurance vs. American Family shows Esurance offered competitive rates and easy online policy management, while American Family focuses on full-service support with in-person agents, more coverage customization, and additional endorsements like accident forgiveness and roadside assistance.

Which company offers more flexibility in Liberty Mutual vs. Esurance?

Liberty Mutual vs. Esurance reveals that Liberty Mutual offers more flexible options such as accident forgiveness and new car replacement. Esurance leaned into flat-rate quotes and a faster digital sign-up process.

What should I know about Elephant vs. Geico?

Elephant vs. Geico shows Geico has broader state availability and higher customer satisfaction, while Elephant targets budget-conscious drivers in select states with flexible payment plans and unique add-ons like pet injury protection.

What’s the difference between Progressive vs. Esurance?

Progressive vs. Esurance highlights that Progressive provides more advanced features like Name Your Price tools, gap coverage, and usage-based auto insurance discounts through Snapshot. Esurance offered a simplified, tech-focused experience with DriveSense and lower rates for less-than-perfect drivers.

How does Esurance vs. State Farm stack up?

Esurance vs. State Farm compares Esurance’s app-based claims system and online tools to State Farm’s large agent network and highly-rated Drive Safe & Save program, which offers up to 30% off for safe drivers.

Which is better for minimum coverage in Geico vs. Safe Auto?

Geico vs. Safe Auto shows Geico generally has lower minimum coverage rates, better customer service, and more discount options. Safe Auto focuses on high-risk drivers and those needing SR-22 filings.

Is Esurance vs. Nationwide a fair comparison?

Esurance vs. Nationwide compares digital-first convenience to Nationwide’s SmartRide and SmartMiles telematics programs, which reward safe and low-mileage drivers. Nationwide also offers optional coverages like vanishing deductibles, which Esurance did not.

How does Farmers vs. Esurance compare in terms of options?

Farmers vs. Esurance shows Farmers gives customers access to more optional coverages like OEM parts replacement and custom equipment protection. Esurance, however, was ideal for drivers looking for a quick, affordable online policy setup.

What’s the advantage of USAA vs. Esurance?

What are the main differences between Esurance vs. Travelers?

Does Esurance offer boat insurance?

How does Esurance vs. The General compare for high-risk drivers?

What do Esurance car insurance reviews say?

What is Esurance umbrella coverage?

Which is better for coverage in Florida Farm Bureau Insurance vs. Geico?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.