Best Florissant, Missouri Auto Insurance in 2026 (Compare the Top 10 Companies)

State Farm, Progressive, and Geico are the top choices for the best Florissant, Missouri auto insurance, with rates starting at $58/month. These providers excel in offering competitive premiums, robust coverage options, and strong customer service, making them ideal for residents in search of reliable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated March 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Florissant MO

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Florissant MO

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Florissant MO

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, Progressive, and Geico emerge as the cheapest providers for auto insurance in Florissant, Missouri, with rates starting at just $58 per month.

These companies not only offer competitive premiums but also excel in customer service and comprehensive coverage options. With a strong local presence and a variety of discounts available, they cater to the diverse needs of Florissant residents.

Our Top 10 Company Picks: Best Florissant, Missouri Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 16% | B | Local Agent | State Farm | |

| #2 | 12% | A+ | Snapshot Program | Progressive | |

| #3 | 18% | A++ | Extensive Discount | Geico | |

| #4 | 10% | A+ | Drivewise Program | Allstate | |

| #5 | 11% | A+ | Customizable Policies | Farmers | |

| #6 | 14% | A | Accident Forgiveness | Liberty Mutual |

| #7 | 22% | A+ | Good Reputation | Nationwide |

| #8 | 13% | A++ | Customer Service | Auto-Owners | |

| #9 | 9% | A++ | IntelliDrive Program | Travelers | |

| #10 | 16% | A+ | Financial Stability | Amica |

Finding cheap auto insurance in Florissant can seem like a difficult task, but all of the information you need is right here. Before you buy Florissant, Missouri auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Florissant, Missouri auto insurance quotes.

- State Farm, Progressive, and Geico offer rates starting at $58/mo in Florissant

- These providers excel in affordability, customer service, and coverage options

- State Farm is highlighted as the top choice among the cheapest options

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates: Known for providing competitive pricing, especially for full coverage options. Their rates are often lower than average in Florissant, Missouri, making them a top choice for budget-conscious drivers, as highlighted in our State Farm auto insurance review.

- Claims Process: State Farm consistently receives high ratings for its quick and efficient claims handling. Customers in Florissant, Missouri appreciate the ease of filing claims and the promptness of claim settlements.

- Discounts: Offers a variety of discounts that are particularly beneficial in Florissant, Missouri, including multi-policy discounts, good student discounts, and savings for bundling home and auto insurance. These discounts can significantly reduce premiums.

Cons

- Limited Online Tools: Some users in Florissant, Missouri find State Farm’s website and mobile app less user-friendly compared to competitors. While functional, the online experience may not be as seamless, which can be a drawback for tech-savvy customers who prefer managing their policies digitally.

- Pricing Variability: Although generally affordable, some customers in Florissant, Missouri report fluctuations in pricing that can make it difficult to budget long-term.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers Florissant, Missouri drivers the chance to earn significant discounts based on their actual driving habits. This usage-based insurance can lead to substantial savings for safe drivers, particularly in urban areas like Florissant, Missouri, as highlighted in our Progressive auto insurance review.

- Competitive Rates: Progressive is known for offering some of the lowest rates for high-risk drivers in Florissant, Missouri. Their flexible pricing models can provide affordable options for drivers with less-than-perfect records.

- Discount Availability: Progressive offers a variety of discounts, such as multi-policy discounts, continuous insurance discounts, and discounts for homeowners, making it easier for Florissant, Missouri drivers to save on their premiums.

Cons

- Rate Increases: Some customers in Florissant, Missouri have reported unexpected rate hikes after the first policy term, which can be frustrating for drivers who initially signed up for lower rates.

- Limited Local Agents: Unlike companies like State Farm, Progressive has fewer local agents in Florissant, Missouri, which may make it less convenient for customers who prefer in-person service.

#3 – Geico: Best for Extensive Range Discounts

Pros

- Extensive Range Discounts: Geico offers an extensive range of discount options, including those for military personnel, federal employees, good students, and safe drivers. These discounts can lead to substantial savings, particularly in a diverse community like Florissant, Missouri.

- Low Rates: Geico is known for offering some of the lowest premiums in Florissant, Missouri, making it a top choice for budget-conscious drivers. Their competitive rates are particularly attractive for those seeking minimum coverage or basic liability insurance.

- Efficient Claims Process: Geico is recognized for its streamlined claims process, with many Florissant, Missouri residents reporting quick and hassle-free experiences when filing claims.

Cons

- Repair Shop Restrictions: Some Florissant, Missouri customers have reported that Geico’s preferred repair shop network is somewhat limited, which can restrict choices when getting vehicles repaired after an accident, as noted in our Geico auto insurance review.

- Less Personalized Service: Geico’s business model is heavily reliant on online and phone-based service, which can lead to a less personalized experience for some customers in Florissant, Missouri who prefer face-to-face interactions.

#4 – Allstate: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options, including accident forgiveness, new car replacement, and sound system coverage, allowing Florissant, Missouri drivers to customize their policies according to their needs.

- Claims Satisfaction: Allstate generally receives high satisfaction ratings for its claims process in Florissant, Missouri. Residents appreciate the efficiency and fairness with which Allstate handles claims, as detailed in our Allstate auto insurance review.

- Digital Tools: Allstate’s mobile app and online tools are highly rated for their ease of use, enabling Florissant, Missouri customers to manage their policies, file claims, and access digital ID cards with ease.

Cons

- Higher Premiums: Allstate can be more expensive than other providers, especially for younger drivers or those with less-than-perfect driving records in Florissant, Missouri. This higher cost may be a barrier for some customers.

- Discount Limitations: While Allstate offers various discounts, some Florissant, Missouri customers feel that they are not as extensive or generous as those offered by competitors like Geico or Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: Farmers offers a range of add-ons and customizable coverage options, allowing Florissant, Missouri drivers to tailor their policies to meet specific needs. This includes options like rideshare coverage and new car replacement.

- Claims Handling: Farmers is generally well-regarded for the efficiency of its claims processing. Florissant, Missouri residents report positive experiences with timely claim settlements and helpful claims adjusters.

- Multi-Policy Discounts: Farmers offers substantial discounts for bundling auto insurance with other policies, such as home or life insurance, which can lead to significant savings for Florissant, Missouri residents, as highlighted in our Farmers auto insurance review.

Cons

- Premiums: Farmers tends to have higher-than-average premiums compared to other options in Florissant, Missouri, which can be a deterrent for price-sensitive drivers.

- Discount Availability: While Farmers offers some discounts, they are fewer and less generous than those provided by competitors like Geico or State Farm, making it harder for Florissant, Missouri drivers to reduce their premiums.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness to avoid premium increases after the first accident, which is a valuable feature for Florissant, Missouri drivers concerned about potential rate hikes.

- Flexible Coverage: Liberty Mutual offers a range of optional coverages, including new car replacement, better car replacement, and roadside assistance, allowing Florissant, Missouri drivers to tailor their policies to their specific needs.

- Multi-Policy Discounts: Liberty Mutual offers significant discounts for bundling auto insurance with other types of insurance, such as home or renters insurance, which can lead to substantial savings for Florissant, Missouri residents.

Cons

- High Premiums: Liberty Mutual tends to have higher rates, especially for younger or high-risk drivers in Florissant, Missouri. This can make them a less attractive option for those seeking budget-friendly insurance.

- Rate Increases: Some Florissant, Missouri drivers have reported significant rate increases upon policy renewal, which can be frustrating for those initially attracted by lower rates, as mentioned in our Liberty Mutual auto insurance review.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program, which reduces your deductible by $100 for every year of safe driving, making it an attractive option for Florissant, Missouri drivers focused on minimizing out-of-pocket expenses.

- On Your Side Review: Nationwide’s On Your Side Review provides Florissant, Missouri policyholders with a free, annual insurance review to ensure they have the right coverage at the best possible price, according to Nationwide auto insurance review.

- Comprehensive Coverage Options: Nationwide offers a wide range of optional coverages, including gap insurance, accident forgiveness, and total loss deductible waiver, allowing Florissant, Missouri drivers to customize their policies to meet their needs.

Cons

- Higher Premiums: Nationwide tends to have higher-than-average premiums in Florissant, Missouri, which can be a disadvantage for price-sensitive customers.

- Limited Discounts: While Nationwide offers various discounts, they may not be as extensive as those provided by competitors like Geico or Progressive, making it harder for Florissant, Missouri drivers to save on their premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Auto-Owners offers a wide range of coverage options, including rental car coverage, gap insurance, and diminished value coverage, allowing Florissant, Missouri drivers to tailor their policies to their needs.

- Claims Satisfaction: Auto-Owners is known for its smooth and efficient claims process, with many Florissant, Missouri customers reporting positive experiences and quick settlements, as highlighted in our Auto-Owners auto insurance review.

- Multi-Policy Discounts: Auto-Owners offers significant discounts for bundling multiple policies, such as auto and home insurance, which can lead to substantial savings for Florissant, Missouri residents.

Cons

- Limited Online Tools: Auto-Owners’ online platform and mobile app are not as advanced as those of larger insurers, which can be a drawback for Florissant, Missouri customers who prefer managing their policies digitally.

- Higher Premiums: While known for quality service, Auto-Owners’ premiums can be higher than average in Florissant, Missouri, which may be a concern for budget-conscious drivers.

#9 – Travelers: Best for Competitive Rates

Pros:

- Competitive Rates: Travelers is known for offering competitive rates, particularly for bundling auto and home insurance, making it an attractive option for Florissant, Missouri residents looking to save on multiple policies.

- Comprehensive Coverage Options: Travelers provides a wide range of coverage options, including gap insurance, accident forgiveness, and rideshare coverage, allowing Florissant, Missouri drivers to tailor their policies to meet their specific needs.

- Discounts: Travelers offers various discounts, including those for safe drivers, good students, and multi-policy holders, which can result in significant savings for Florissant, Missouri residents.

Cons:

- Limited Local Agents: Travelers has fewer local agents in Florissant, Missouri compared to some competitors, which can be a disadvantage for customers who prefer in-person service, according to Travelers auto insurance review.

- Digital Experience: While functional, Travelers’ online tools and mobile app are not as advanced as those of other insurers, which may be a drawback for tech-savvy Florissant, Missouri residents.

#10 – Amica: Best for Dividend Policies

Pros:

- Dividend Policies: Amica offers dividend policies, which return a portion of the premiums to Florissant, Missouri policyholders at the end of the policy term, providing an opportunity for additional savings, as highlighted in our Amica auto insurance review.

- Claims Process: Amica is known for its smooth and efficient claims handling, with many Florissant, Missouri customers reporting positive experiences and quick settlements.

- Comprehensive Coverage Options: Amica offers a wide range of coverage options, including gap insurance, accident forgiveness, and roadside assistance, allowing Florissant, Missouri drivers to customize their policies to meet their needs.

Cons:

- Higher Premiums: Amica tends to have higher premiums compared to other insurers in Florissant, Missouri, which can be a concern for budget-conscious drivers.

- Digital Experience: While Amica offers online tools and a mobile app, some Florissant, Missouri customers find them less intuitive or comprehensive compared to those offered by larger insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Florissant, Missouri

In Florissant, Missouri, the minimum auto insurance requirements stipulate that drivers must carry liability coverage to address potential financial responsibilities arising from accidents. Discover our comprehensive guide to “Full Coverage Auto Insurance Defined” for additional insights.

Florissant, Missouri Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $142 |

| Amica | $60 | $140 |

| Auto-Owners | $59 | $138 |

| Farmers | $63 | $145 |

| Geico | $59 | $138 |

| Liberty Mutual | $62 | $143 |

| Nationwide | $60 | $140 |

| Progressive | $60 | $140 |

| State Farm | $58 | $135 |

| Travelers | $61 | $142 |

Specifically, the state mandates a minimum of $25,000 in bodily injury coverage per person, $50,000 per accident, and $15,000 for property damage. This basic coverage ensures that drivers are financially protected for damages they may cause to others, while meeting the state’s legal standards.

However, while these minimums satisfy legal requirements, many drivers opt for higher coverage limits to secure more comprehensive protection and safeguard against significant financial liabilities that could exceed the state’s minimum thresholds.

Cheap Florissant, Missouri Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Florissant, Missouri, are influenced by various factors, including age, gender, and marital status. Younger drivers typically face higher premiums due to their perceived higher risk, while older drivers may benefit from lower rates as they gain more driving experience.

Florissant, Missouri Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $314 | $303 | $284 | $293 | $915 | $993 | $297 | $305 |

| American Family | $222 | $222 | $198 | $198 | $614 | $797 | $222 | $259 |

| Farmers | $250 | $249 | $223 | $237 | $1,066 | $1,103 | $286 | $297 |

| Geico | $211 | $239 | $166 | $218 | $684 | $719 | $190 | $188 |

| Liberty Mutual | $261 | $283 | $216 | $243 | $927 | $1,030 | $272 | $288 |

| Nationwide | $160 | $162 | $143 | $151 | $410 | $522 | $183 | $197 |

| Progressive | $233 | $211 | $191 | $198 | $793 | $883 | $280 | $277 |

| State Farm | $482 | $605 | $174 | $199 | $153 | $153 | $140 | $140 |

| USAA | $375 | $457 | $155 | $172 | $125 | $124 | $113 | $115 |

Additionally, gender can play a role, with male drivers often paying more, especially in their younger years. Discover our comprehensive guide to “Comparing Auto Insurance” for additional insights.

Marital status is another key demographic factor that impacts insurance costs. Married individuals often receive lower rates compared to single drivers, as they are statistically considered to be more responsible and less likely to engage in risky driving behavior. Understanding how these demographics affect your rates can help you make informed decisions when shopping for auto insurance in Florissant.

Cheap Florissant, Missouri Auto Insurance for Teen Drivers

Finding affordable teen auto insurance in Florissant, Missouri can be challenging due to the higher risk associated with young drivers. Teen drivers often face significantly higher premiums compared to older, more experienced drivers, making it essential to explore different insurance providers and compare rates.

Florissant, Missouri Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $314 | $303 |

| American Family | $222 | $222 |

| Farmers | $250 | $249 |

| Geico | $211 | $239 |

| Liberty Mutual | $261 | $283 |

| Nationwide | $160 | $162 |

| Progressive | $233 | $211 |

| State Farm | $482 | $605 |

| USAA | $375 | $457 |

By reviewing the annual teen auto insurance rates in Florissant, parents and teens can better understand the costs involved and identify the most budget-friendly options available. For further details, check out our in-depth “Companies With the Cheapest Teen Auto Insurance” article.

Cheap Florissant, Missouri Auto Insurance for Seniors

Senior auto insurance rates in Florissant, Missouri, tend to be more favorable compared to those for younger drivers, as older, more experienced drivers are generally seen as lower risk by insurers.

Florissant, Missouri Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $297 | $305 |

| American Family | $222 | $259 |

| Farmers | $286 | $297 |

| Geico | $190 | $188 |

| Liberty Mutual | $272 | $288 |

| Nationwide | $183 | $197 |

| Progressive | $280 | $277 |

| State Farm | $140 | $140 |

| USAA | $113 | $115 |

By examining the annual average rates for older drivers, seniors can gain insight into the costs associated with their coverage and find options that suit their budget and needs. Learn more by visiting our detailed “How to Compare Auto Insurance Quotes” section.

Cheap Florissant, Missouri Auto Insurance by Driving Record

A clean driving record is crucial for affordable auto insurance. Accidents, traffic violations, and even the number of years driving can significantly impact premiums. Young drivers often face higher rates due to perceived risk.

Florissant, Missouri Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $394 | $448 | $562 | $449 |

| American Family | $255 | $365 | $453 | $292 |

| Farmers | $399 | $501 | $489 | $467 |

| Geico | $250 | $330 | $455 | $272 |

| Liberty Mutual | $318 | $460 | $472 | $509 |

| Nationwide | $188 | $243 | $326 | $207 |

| Progressive | $330 | $447 | $367 | $389 |

| State Farm | $232 | $279 | $256 | $256 |

| USAA | $163 | $199 | $277 | $179 |

To illustrate, compare insurance costs between two drivers in Florissant, Missouri: one with a clean record and another with multiple infractions. The difference can be substantial. Get more insights by reading our expert “How to Get a Good Driver Auto Insurance Discount” advice.

While a clean record is vital, factors like vehicle type, location, age, and coverage also influence premiums. Focus on safe driving to reduce your insurance costs.

Cheap Florissant, Missouri Auto Insurance Rates After a DUI

A DUI conviction significantly impacts auto insurance premiums. Finding affordable coverage in Florissant, Missouri becomes a complex challenge. Insurance rates skyrocket after a DUI, making it crucial to compare multiple insurers to find the best deal.

Florissant, Missouri DUI Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $562 |

| American Family | $453 |

| Farmers | $489 |

| Geico | $455 |

| Liberty Mutual | $472 |

| Nationwide | $326 |

| Progressive | $367 |

| State Farm | $256 |

| USAA | $277 |

Factors such as the severity of the DUI, the driver’s age, and the type of vehicle will influence the exact cost. It’s essential to explore various options and consider the overall value of the policy beyond just the premium.

Remember, while securing affordable insurance post-DUI is challenging, it’s essential to have adequate coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Florissant, Missouri Auto Insurance by Credit History

Your financial history, as reflected in your credit score, can significantly influence your auto insurance premiums. Insurers often use credit-based insurance scores (CBIS) to assess your risk profile. A strong credit history typically correlates with responsible financial behavior, which insurers often equate to a lower likelihood of filing claims.

Florissant, Missouri Auto Insurance by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $337 | $411 | $642 |

| American Family | $264 | $314 | $446 |

| Farmers | $421 | $442 | $528 |

| Geico | $234 | $294 | $452 |

| Liberty Mutual | $303 | $386 | $630 |

| Nationwide | $203 | $235 | $284 |

| Progressive | $337 | $367 | $445 |

| State Farm | $179 | $225 | $363 |

| USAA | $115 | $159 | $340 |

To illustrate the impact, comparing auto insurance rates in Florissant, Missouri based on different credit scores can be illuminating. Drivers with excellent credit often enjoy lower premiums compared to those with poor credit. Explore our detailed analysis on “How Credit Scores Affect Auto Insurance Rates” for additional information.

It’s important to note that while credit score is a factor, it’s not the sole determinant of insurance costs. Other elements such as driving history, age, vehicle type, and coverage level also influence premiums. However, understanding the connection between credit and insurance can empower you to make informed decisions about managing your financial well-being and potentially saving on auto insurance.

Cheap Florissant, Missouri Auto Insurance Rates by ZIP Code

Auto insurance rates by ZIP code in Florissant, Missouri can vary. Your ZIP code can significantly influence the cost of auto insurance in Florissant, Missouri. Factors such as crime rates, accident statistics, and population density contribute to these variations.

By comparing annual insurance costs across different ZIP codes within Florissant, you can gain valuable insights into how location affects premiums. This knowledge empowers you to make informed decisions when choosing a neighborhood and potentially save on your insurance.

Florissant, Missouri Auto Insurance Monthly Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 63031 | $286 |

| 63033 | $297 |

Remember, while ZIP code is a crucial factor, it’s not the sole determinant of insurance costs. Other variables like driving history, vehicle type, and coverage level also influence premiums.

To get a precise understanding of how location impacts your insurance rates, use online comparison tools or consult with an insurance agent.

Cheap Florissant, Missouri Auto Insurance Rates by Commute

Your daily commute and how much you hit the road can affect your car insurance cost in Florissant. People who drive a lot or have longer commutes might pay more. It’s like, the more you drive, the riskier it is, so insurance companies might charge you a bit extra.

Florissant, Missouri Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $463 | $463 |

| American Family | $338 | $345 |

| Farmers | $464 | $464 |

| Geico | $321 | $333 |

| Liberty Mutual | $440 | $440 |

| Nationwide | $241 | $241 |

| Progressive | $383 | $383 |

| State Farm | $249 | $262 |

| USAA | $197 | $212 |

So, if you’re trying to save money on car insurance, cutting back on those long drives might help. But remember, other things like your driving record and the kind of car you have also matter. For further details, check out our in-depth “Minimum Auto Insurance Requirements by State” article.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Florissant, Missouri Auto Insurance Rates by Coverage Level

The level of coverage you choose significantly impacts your auto insurance cost in Florissant, Missouri. Opting for minimum liability coverage will result in a lower premium, but it also offers limited protection in case of an accident. Conversely, comprehensive and collision coverage provides more extensive protection but comes with a higher price tag.

To make an informed decision, compare annual insurance rates for different coverage levels in Florissant. This will help you determine the best balance between cost and protection for your specific needs. Remember, underinsured/uninsured motorist coverage is also crucial, as it protects you in case of accidents with drivers who lack adequate insurance.

By carefully considering your options and comparing rates, you can find the right coverage to safeguard your financial well-being and meet your insurance needs. Learn more by visiting our detailed “Car Insurance Quotes: Compare Cheap Coverage” section.

Best by Category: Cheapest Auto Insurance in Florissant, Missouri

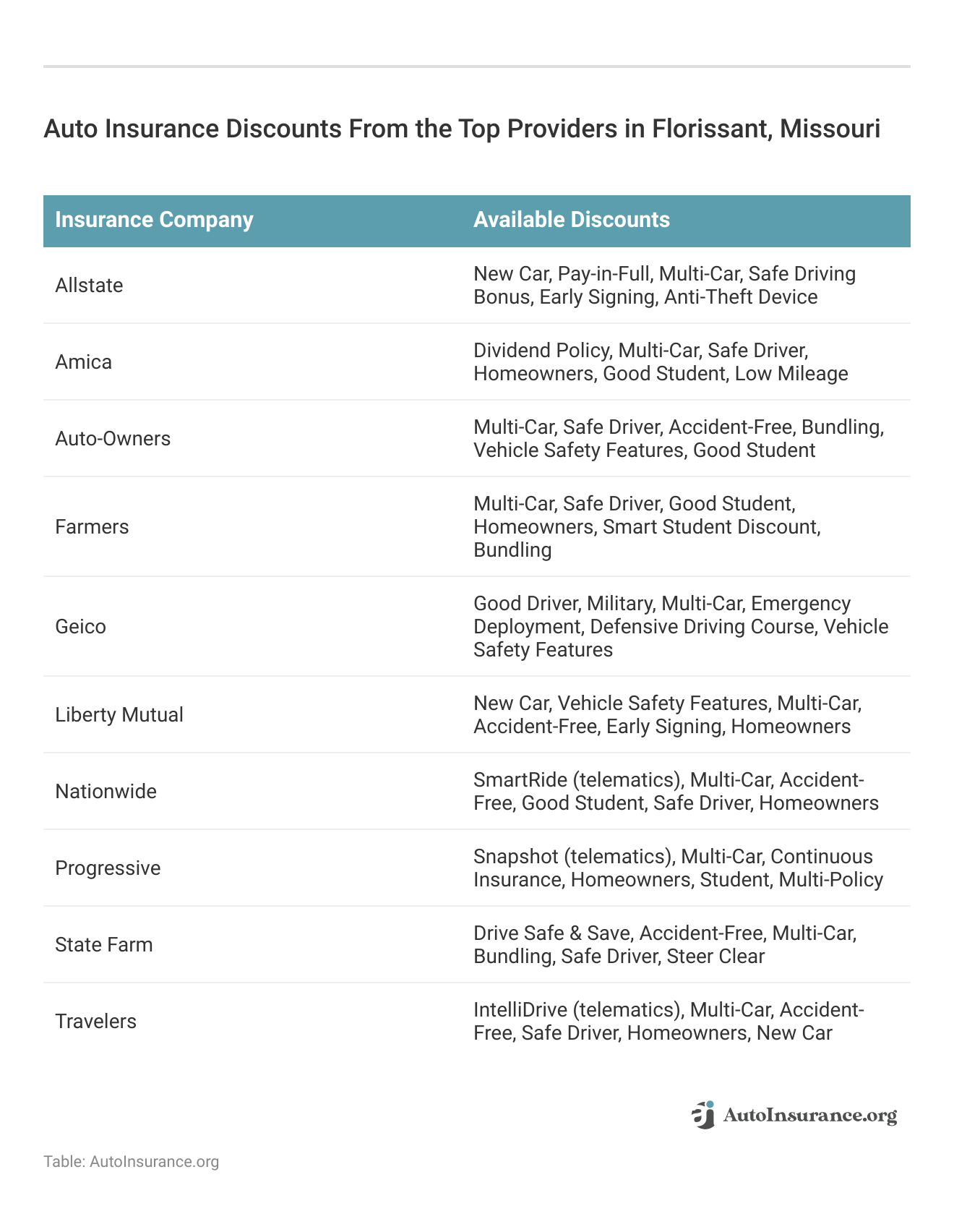

Alright, let’s talk about finding the cheapest car insurance in Florissant. Don’t just grab the first deal you see. Check out a bunch of different companies and compare prices. Look at what kind of coverage you’re getting for your buck.

Cheapest Florissant, Missouri Auto Insurance Providers by Driver Profile

| Company | Category |

|---|---|

| State Farm | One DUI |

| USAA | Teenagers |

| USAA | Seniors |

| USAA | Clean Record |

| USAA | One Accident |

| USAA | One Ticket |

Think about your driving habits too. If you’re a safe driver, you might get some sweet discounts. And hey, don’t forget about your credit score – it can actually affect how much you pay.

So, shop around, compare prices, and find a deal that works for you. Read our extensive guide on “Companies With the Cheapest Teen Auto Insurance” for more knowledge.

The Cheapest Florissant, Missouri Auto Insurance Companies

Uncovering the cheapest auto insurance company in Florissant, Missouri requires diligent comparison. Several factors influence rates, including driving history, age, vehicle type, and coverage level. For more information, explore our informative “Receiving and Evaluating Quotes” page.

Top-rated insurers in the area often offer competitive prices and comprehensive coverage. However, it’s essential to delve deeper and compare quotes from multiple providers to find the best deal tailored to your specific needs.

Consider factors like customer service, claims handling, and available discounts when making your decision. By carefully evaluating these elements, you can select an insurance company that not only offers affordable rates but also provides excellent service.

Remember, the cheapest option isn’t always the best. Prioritize coverage that aligns with your needs and budget while considering the insurer’s reputation and financial stability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Critical Factors Determining Car Insurance Costs in Florissant, Missouri

Numerous factors contribute to the variation in auto insurance rates in Florissant, Missouri compared to other cities. Elements such as traffic congestion and the frequency of vehicle thefts in Florissant play a significant role.

Additionally, various local conditions can impact your auto insurance rates in Florissant, making them higher or lower depending on specific circumstances. Explore our detailed analysis on “Factors That Affect Auto Insurance Rates” for additional information.

Florissant Commute Time

Cities where drivers face longer average commute times generally see higher auto insurance costs. For example, City-Data reports that the average commute length in Florissant, Missouri is 25.7 minutes.

Compare Florissant, Missouri Auto Insurance Quotes

When searching for the best auto insurance in Florissant, Missouri, comparing quotes is essential. By evaluating different providers, you can find the most competitive rates and coverage that suits your needs.

Understanding the local factors that influence rates will help you make an informed decision. Get more insights by reading our expert “Where can I compare online auto insurance companies?” advice.

With competitive rates and a strong local presence, State Farm stands out for its reliability and customer satisfaction.Daniel Walker Licensed Insurance Agent

After comparing auto insurance quotes in Florissant, Missouri, you’ll be better equipped to choose the right policy. Make sure to review the details carefully to ensure you’re getting the best value and protection for your vehicle. Finding the right coverage can lead to significant savings and peace of mind on the road.

Before you buy Florissant, Missouri auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Florissant, Missouri auto insurance quotes.

Frequently Asked Questions

What is the most trusted car insurance company in Florissant, Missouri?

In Florissant, Missouri, the most trusted car insurance companies often include State Farm and USAA. These companies are known for their high levels of customer satisfaction, reliable service, and effective claims handling, as reflected in customer reviews and industry ratings.

Who offers the cheapest car insurance in Florissant, Missouri?

Geico, Progressive, and State Farm are typically recognized for offering the cheapest car insurance in Florissant, Missouri. Rates can vary depending on your driving record, vehicle type, and coverage levels, so it’s beneficial to compare quotes from these providers.

Which company is considered the best car insurer in Florissant, Missouri?

State Farm and USAA are often considered the best car insurers in Florissant, Missouri. They are highly rated for their comprehensive coverage options, competitive pricing, and exceptional customer service, making them popular choices among residents.

Discover our comprehensive guide to “Where to Compare Auto Insurance Rates” for additional insights.

What is the required automobile insurance in Florissant, Missouri?

Florissant, Missouri requires drivers to carry liability insurance that meets the state’s minimum coverage limits for bodily injury and property damage. This insurance helps cover costs if you are at fault in an accident.

What is the average car insurance payment in Florissant, Missouri?

The average monthly car insurance payment in Florissant, Missouri ranges from $100 to $150. This cost can fluctuate based on factors such as your driving history, the type of vehicle you drive, and the coverage options you select.

What does full coverage insurance in Florissant, Missouri include?

Full coverage insurance in Florissant generally includes liability, collision, and comprehensive coverage. This combination provides extensive protection, covering not only damages from accidents but also theft, vandalism, and natural disasters.

Is there an insurance better than Geico in Florissant, Missouri?

While Geico is known for its competitive rates, some drivers might find that State Farm or USAA offer better overall value, particularly if they prioritize high-quality customer service or specific coverage benefits that Geico may not provide.

For further details, check out our in-depth “How Much Coverage You Need” article.

Which is the best insurance company in Florissant, Missouri?

The best insurance company in Florissant, Missouri often depends on personal needs and preferences, but State Farm and USAA are frequently favored for their reliability, excellent coverage options, and strong customer service.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What should I consider when choosing an insurer in Florissant, Missouri?

When choosing an insurer in Florissant, Missouri, consider coverage options, customer service quality, claim handling efficiency, and overall costs. Evaluating these factors can help ensure you select an insurer that meets your needs and budget.

How can I reduce premium rates in Florissant, Missouri?

To lower premium rates in Florissant, Missouri, you might bundle your insurance policies, maintain a clean driving record, increase your deductibles, or take advantage of discounts for safe driving, low mileage, or completing defensive driving courses.

Learn more by visiting our detailed “How to Get a Multi-Vehicle Auto Insurance Discount” section.

What is the penalty for driving without insurance in Florissant, Missouri?

Driving without insurance in Florissant, Missouri can result in hefty fines, license suspension, and potentially having your vehicle impounded. The severity of the penalties can increase with repeat offenses or additional violations.

Which insurance company denies most claims in Florissant, Missouri?

How does Progressive compare to Geico in Florissant, Missouri?

Who has the cheapest car insurance rates in Florissant, Missouri?

Why are insurance rates so high in Florissant, Missouri?

What is the minimum car insurance required in Florissant, Missouri?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.