Best Fremont, California Auto Insurance in 2026

The cheapest auto insurance in Fremont, CA is from GEICO, although rates will vary for each person. Fremont, CA auto insurance must meet the state minimum requirements with coverage levels of 15/30/5 for liability. Compare Fremont, California car insurance quotes online to get the best price for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated September 2024

- The cheapest auto insurance company in Fremont, CA is Geico

- Fremont, CA auto insurance rates are affected by the traffic that is shared with San Jose

- The average commute time in Fremont is 33.8 min

Fremont, CA auto insurance rates can be on the high side since it’s nestled between San Francisco and San Jose.

You can save on Fremont, California auto insurance by shopping around, comparing rates, and looking for discounts, and we can help.

Monthly Fremont, CA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Fremont, CA auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

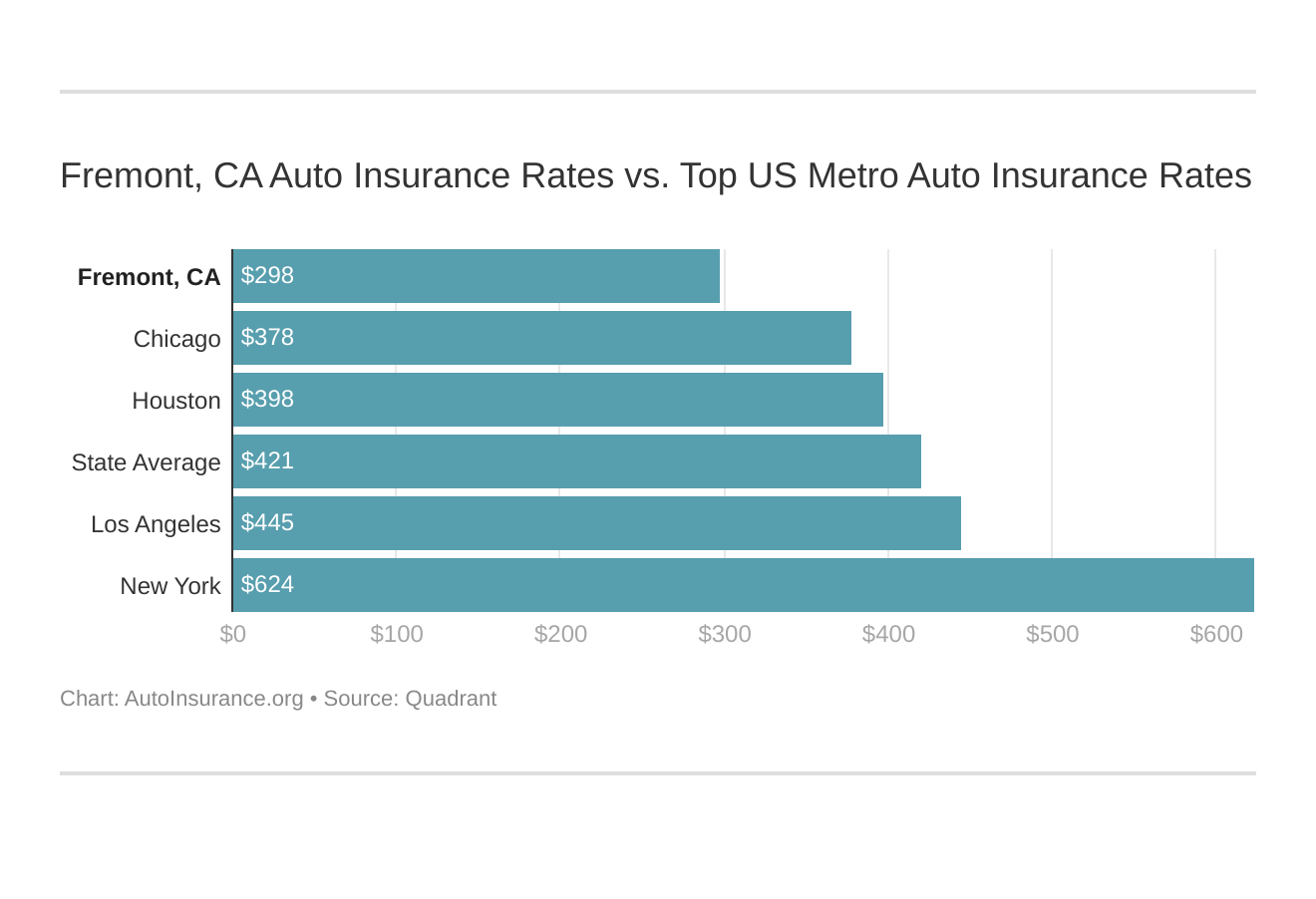

Fremont, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Fremont, CA against other top US metro areas’ auto insurance costs.

Below you’ll find information on how to get cheap auto insurance in Fremont, California for every age, credit history, and driving record.

Ready to find affordable Fremont, CA auto insurance? Enter your ZIP code above to get started.

What is the cheapest auto insurance company in Fremont, CA?

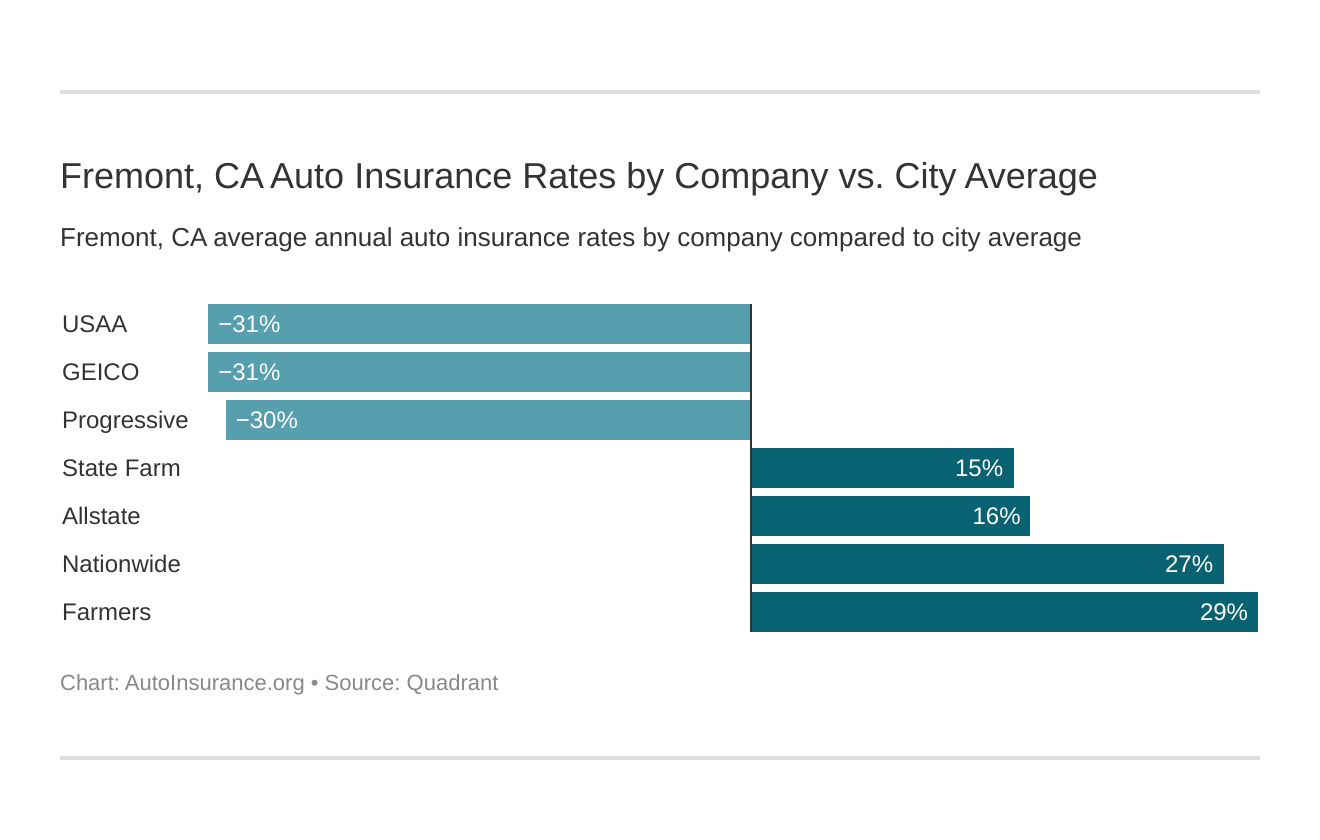

The cheapest auto insurance company in Fremont, based on average rates, is Geico.

The cheapest Fremont, CA insurance providers can be found below. You also might be wondering, “How do those Fremont, CA rates compare against the average California car insurance company rates?” We uncover that too.

The top auto insurance companies in Fremont, CA, ranked from cheapest to most expensive are:

- Geico — $2,602.38

- USAA — $2,603.08

- Progressive — $2,641.32

- Liberty Mutual — $3,056.71

- Travelers — $3,393.44

- State Farm — $4,152.07

- Allstate — $4,203.21

- Nationwide — $4,709.91

- Farmers — $4,804.35

There are a lot of factors that determine your auto insurance rates. The cheapest company for you will depend on your personal factors, including what part of the city you call home, your driving record, what kind of car you drive, and the coverage level you choose.

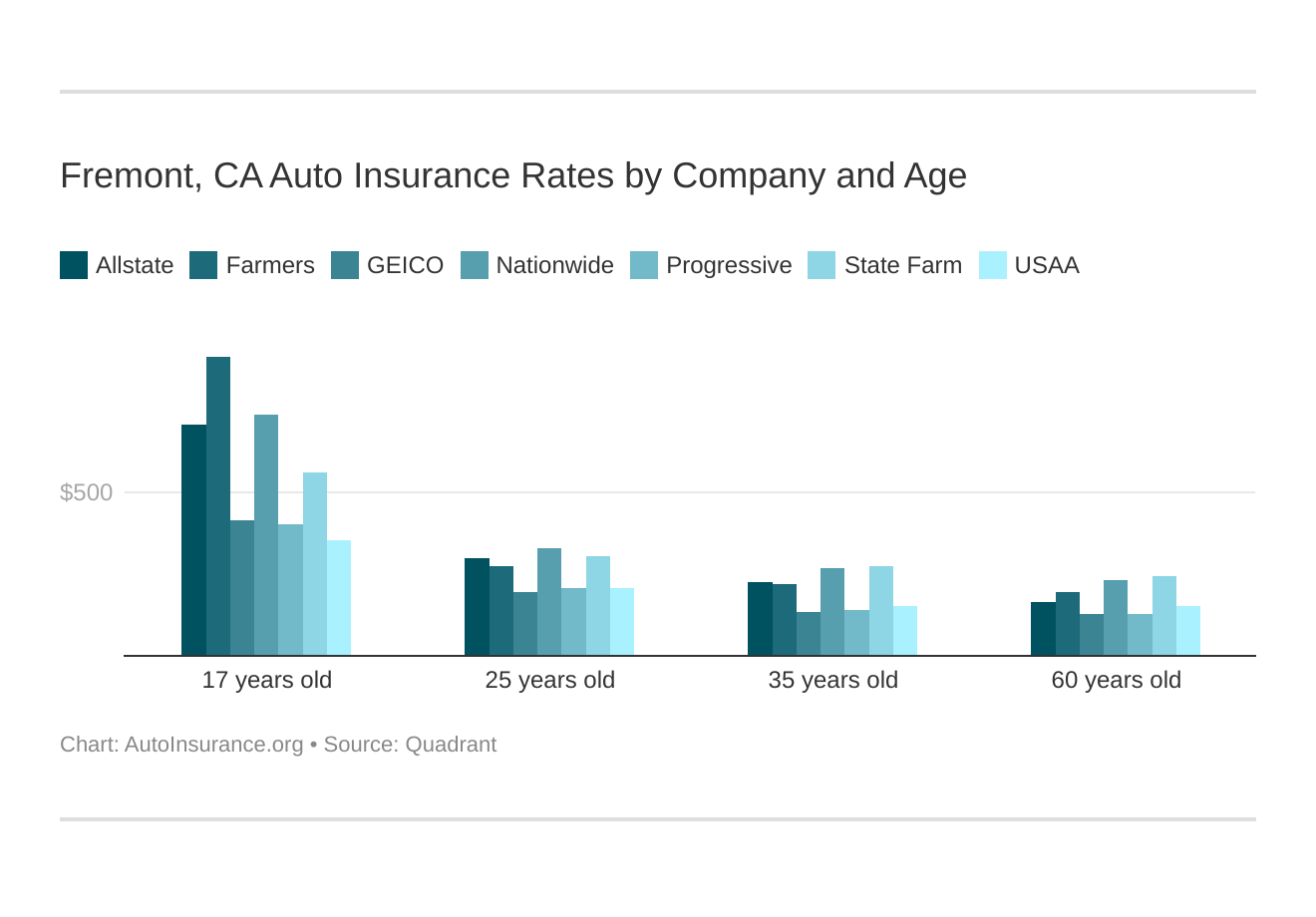

Fremont, California car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

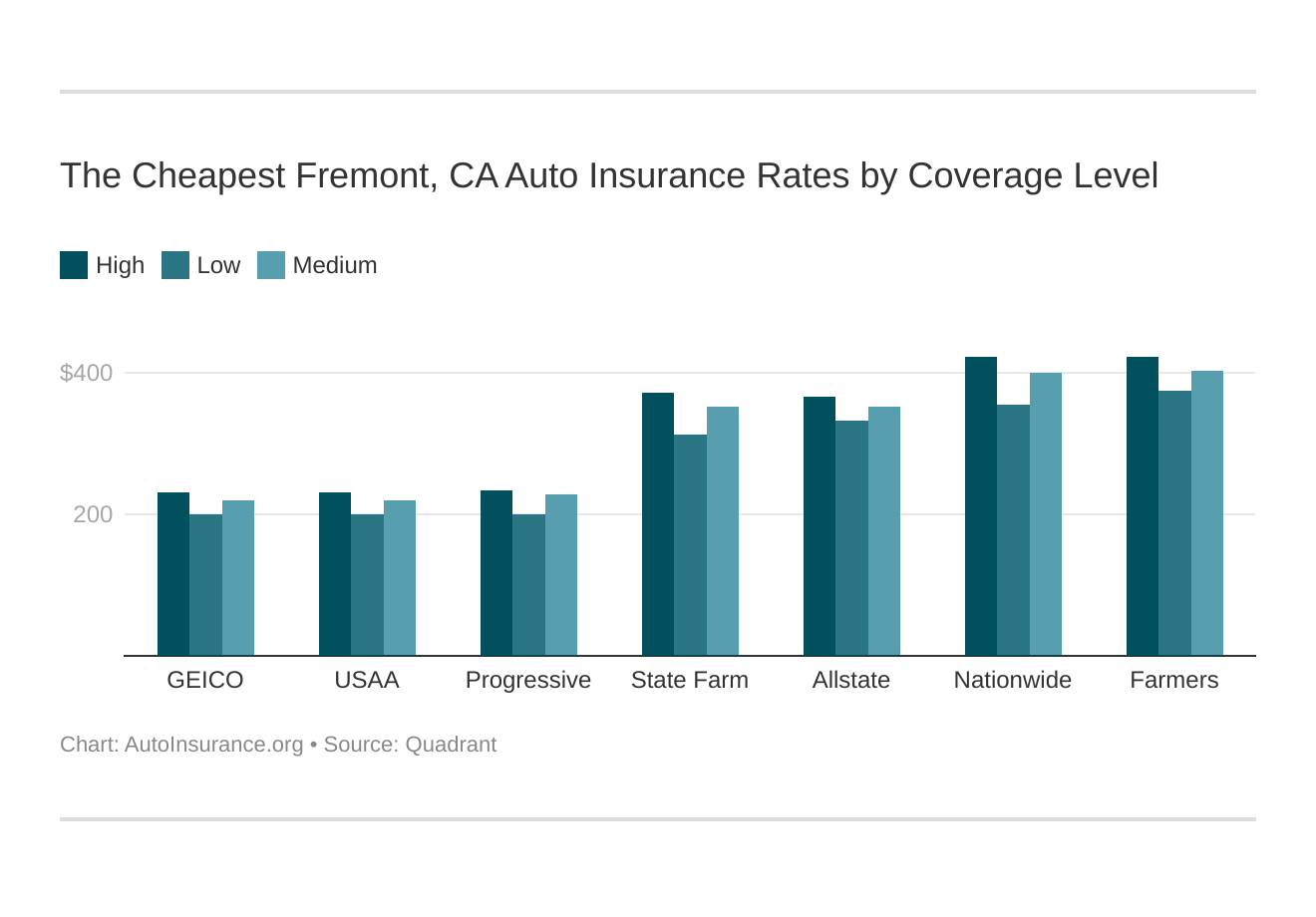

Your coverage level will play a major role in your Fremont, CA car insurance costs. Find the cheapest Fremont, California car insurance costs by coverage level below:

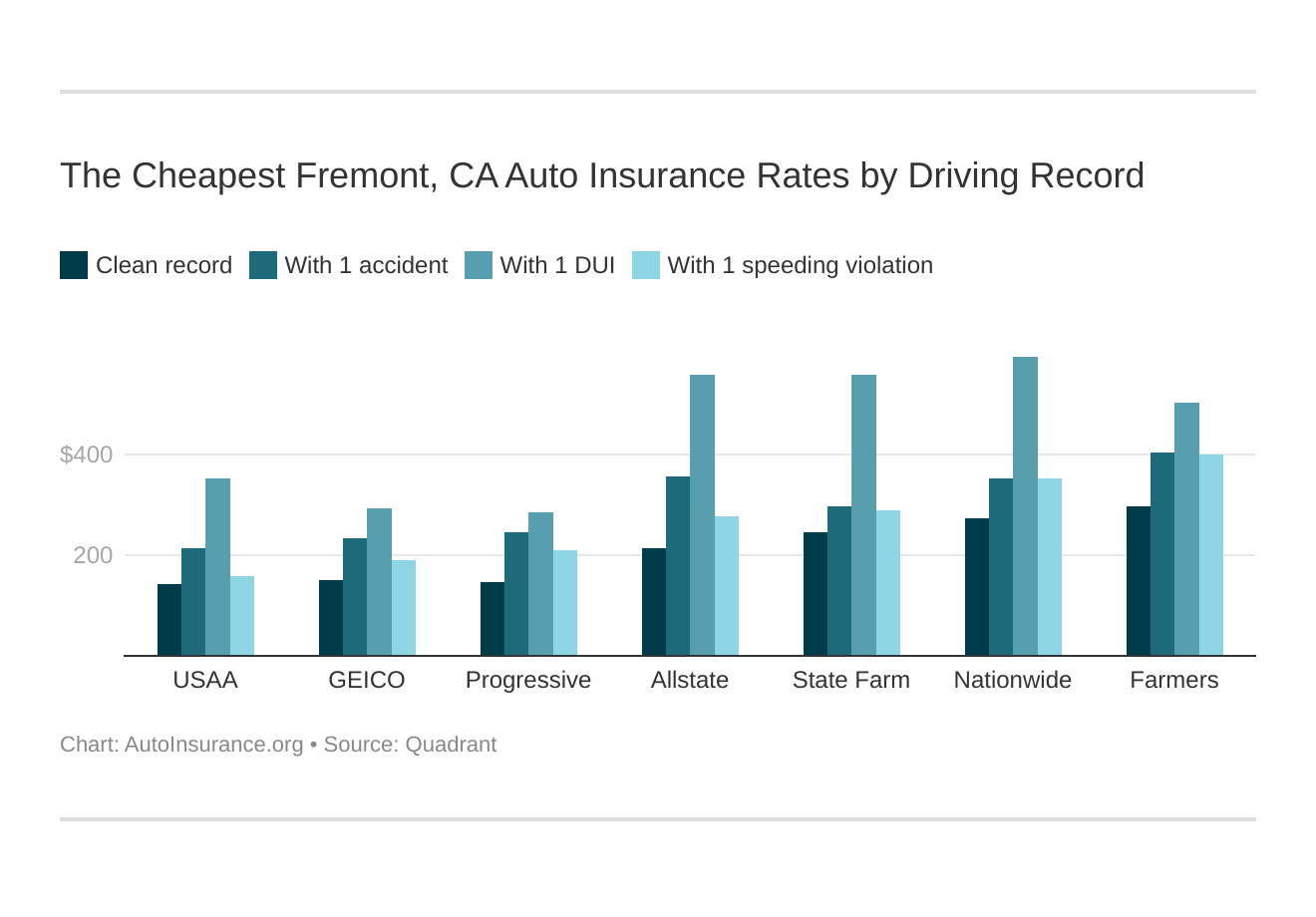

Your driving record will affect your Fremont, CA car insurance costs. For example, a Fremont, California DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Fremont, California car insurance costs by driving record.

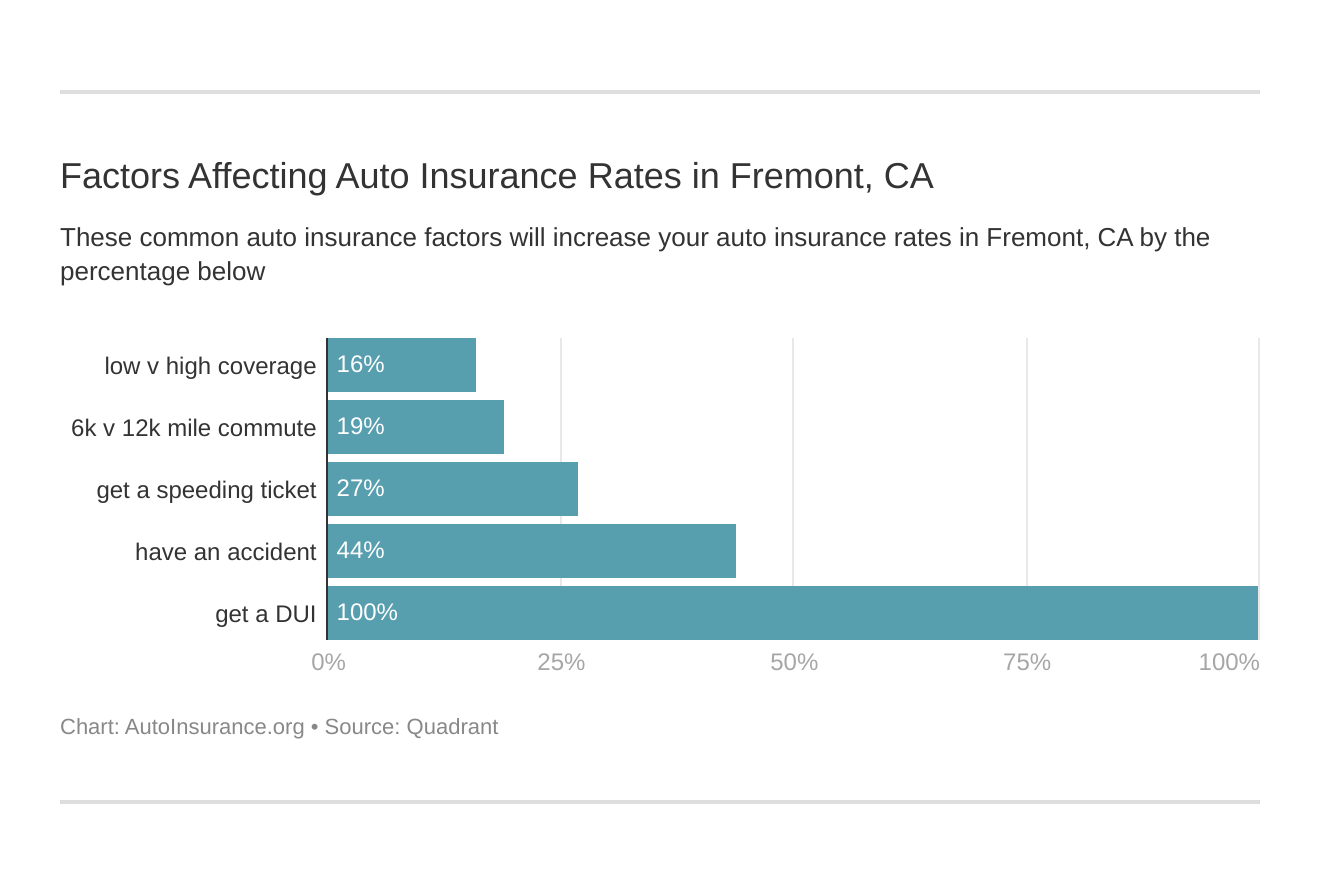

Controlling these risk factors will ensure you have the cheapest Fremont, California car insurance. Factors affecting car insurance rates in Fremont, CA may include your commute, coverage level, tickets, DUIs, and credit.

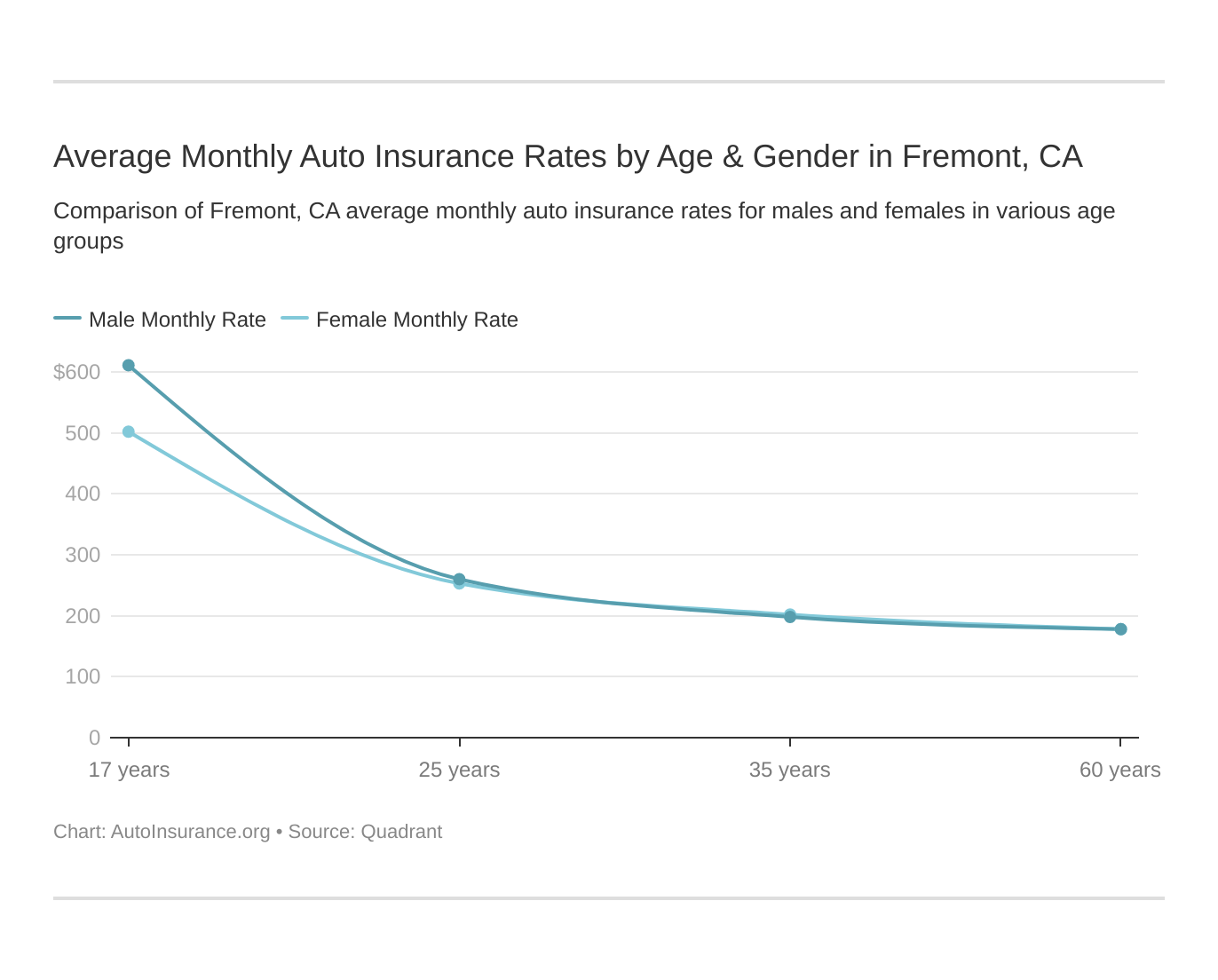

Age is a significant factor for Fremont, CA car insurance rates. Young drivers are often considered high-risk. This Fremont, California does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Fremont, CA.

What auto insurance coverage is required in Fremont, CA?

All Fremont drivers have to meet the California state law minimum requirements for car insurance.

In California, you have to carry at least:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

It’s recommended that most drivers carry more than the state minimum.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Fremont, CA?

Fremont is a busy city with a lot of people on the road, including a lot of commuters. A lot of traffic can mean a higher risk of accidents.

INRIX ranks San Francisco as the 30th most congested city in the U.S. but has no specific information for Fremont or San Jose. Fremont is north of San Jose and San Francisco is north of Fremont, so much of the traffic between the two larger cities affects Fremont.

According to City-Data, the average commute time in Fremont is 33.8 minutes.

Auto theft in Fremont also affects rates, and the most recent annual statistics list 865 auto thefts in a city population of 236,368. That’s a rate of 365.9 cars stolen per 100,000 population.

Fremont, CA Auto Insurance: The Bottom Line

Fremont has some of the highest auto insurance rates in California, but you can save by shopping around and comparing.

Before you buy auto insurance in Fremont, CA, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Fremont, CA auto insurance quotes.

Frequently Asked Questions: Fremont, CA Auto Insurance

If you still have questions about auto insurance in Fremont, CA, check out the answers below.

#1 – Is Fremont cheaper than San Jose for auto insurance?

San Jose ZIP codes have some of the highest rates in the state, but some areas of Fremont may be more expensive. Where you live is just one factor.

Frequently Asked Questions

Is auto insurance mandatory in Fremont, CA?

Yes, auto insurance is mandatory in Fremont, CA, as it is in most states in the United States. California law requires drivers to carry liability insurance to cover potential damages or injuries to other people in an accident.

How much auto insurance coverage do I need in Fremont, CA?

The three minimum required coverage in Fremont, CA is as follows:

- $15,000 for injury/death to one person

- $30,000 for injury/death to more than one person

- $5,000 for property damage

However, it’s generally recommended to carry higher coverage limits to adequately protect yourself in case of an accident. It’s best to consult with an insurance professional to determine the appropriate coverage for your specific needs.

How are auto insurance rates determined in Fremont, CA?

The following eight factors influence auto insurance premiums in Fremont, CA:

- Your driving record

- Age

- Gender

- Marital status

- Vehicle type

- Annual mileage

- Credit history

- The coverage options you select

Insurance companies also consider local factors such as crime rates and accident statistics in your area.

Are there any discounts available for Fremont, CA auto insurance?

Yes, insurance companies often offer discounts on auto insurance policies. The five common discounts include:

- Safe driver discounts

- Multi-policy discounts (e.g., bundling auto and home insurance)

- Good student discounts

- Anti-theft device discounts

- Discounts for completing a defensive driving course.

It’s advisable to check with your insurance provider to see which discounts you may qualify for.

What should I do after an accident in Fremont, CA?

After an accident in Fremont, CA, it’s important to prioritize safety and follow these seven steps:

- Check for injuries and call emergency services if necessary.

- Exchange information with the other driver(s) involved, including names, contact information, and insurance details.

- Take photos of the accident scene and any damages.

- Notify your insurance company about the accident.

- Cooperate with law enforcement and provide an accurate account of the incident.

- Seek medical attention if needed, even for seemingly minor injuries.

- Consult with an attorney if you have legal concerns or if the accident resulted in significant damages.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.