Best Auto Insurance Discounts for Good Drivers in 2026 (Save up to 40% With These Companies!)

Allstate, Liberty Mutual, and State Farm have the best auto insurance discounts for good drivers. Allstate gives a 40% discount, while Liberty Mutual and State Farm offer 30%. Most auto insurance companies provide a good driver auto insurance discount, although qualifications vary from company to company.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated November 2025

Allstate, Liberty Mutual, and State Farm offer the best auto insurance discounts for good drivers with a potential to save up to 40%. The vast majority of auto insurance companies reward safe drivers with auto insurance discounts.

Drivers who have clean driving records have proven that they are less risky to insure, as they are less likely to crash due to bad driving habits and file a claim. Some insurance companies want to see a clean record of a few years to issue a discount, while others want to track drivers’ data.

Our Top 10 Company Picks: Best Auto Insurance Discounts for Good Drivers

Company Rank Savings Potential A.M. Best Claim-Free Period

![]()

#1 40% A+ 5 Years

#2 30% A 3 Years

#3 30% B 5 Years

#4 26% A++ 5 Years

#5 25% A+ 4 Years

#6 25% A+ 3 Years

#7 20% A 3 Years

#8 20% A 4 Years

#9 15% A++ 3 Years

#10 15% A++ 5 Years

Continue reading to learn all about how to get a good driver auto insurance discount, as well as other ways to save on your auto insurance policy besides just an insurance discount for good drivers.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- Good driving helps drivers save money and avoid accidents and tickets

- Insurance companies offer discounts for good drivers

- Shopping around for quotes helps drivers save on auto insurance

How to Qualify for a Good Driver Auto Insurance Discount

Many insurance providers reward safe drivers with significant savings on their premiums through programs like the safe drivers discount, as they are seen as lower-risk customers. Below, we’ll explain how to get a good driver discount, including the key requirements to be eligible for this savings opportunity.

You’ll also learn about programs such as “Drive Safe & Save” and have Drive Safe, and Save explained in detail, along with how much you can save by maintaining a clean driving record, avoiding traffic violations, and taking steps to prove you’re a responsible driver.

Maintain a Clean Driving Record

Maintaining a clean driving record is one of the most effective ways To be eligible for a good driver auto insurance discount. This means avoiding accidents, traffic violations, and other incidents that could raise your risk in the eyes of insurance companies.

Drivers with a clean record are considered less likely to file claims, which makes them eligible for significant discounts on their premiums.

For example, many insurance companies offer a good driver discount that can reduce your premium by 10% to 40%. In a year, that could amount to hundreds of dollars in savings.

In states like California, drivers with a spotless record for three consecutive years can qualify for a mandated 20% discount. Similarly, insurers such as Geico or State Farm offer their good driver policyholders lower rates, particularly after five years of accident-free driving.

Some insurance providers offer other incentives to good drivers, like accident forgiveness. This means that if you do get into a minor accident, it won’t automatically raise your rates or jeopardize your good driver status. By maintaining a clean driving record, you benefit from significant, long-term savings on your auto insurance.

Complete a Defensive Driving Course

Completing a defensive driving course is an excellent way to be eligible for a good driver auto insurance discount. Many insurance companies offer discounts to drivers who take these courses, as they are designed to teach safer driving techniques and reduce the likelihood of accidents.

Completing a defensive driving course is an excellent way to be eligible for a good driver auto insurance discount. Many insurance companies offer discounts to drivers who take these courses, as they are designed to teach safer driving techniques and reduce the likelihood of accidents.Schimri Yoyo Licensed Agent & Financial Advisor

For example, in states like New York, completing a state-approved defensive driving course can result in a 10% reduction in your auto insurance premium for up to three years.

Defensive driving courses cover various topics, such as how to avoid collisions, manage road hazards, and navigate dangerous driving conditions. Insurance providers recognize that drivers who take these courses are less likely to file claims.

For instance, Progressive offers a 5% to 10% discount for completing a defensive driving course. In comparison, Allstate’s program may lower your premium by up to 10%, depending on your location and driving history.

Another reason why you should take a defensive driving class is that completing a defensive driving course can help you maintain your good driver status.

For those who may have a minor traffic violation on their record, this course can sometimes help offset the impact of that infraction, allowing you to stay eligible for a good driver discount and continue enjoying lower rates. The course is typically available online or in person and can be completed in hours.

Consistent Insurance Coverage

Insurance providers value drivers who remain continuously insured without any gaps in coverage, as it indicates reliability and lower risk. A lapse in coverage, even for a short period, can signal instability to insurers, making it harder to be eligible for discounts.

For example, Geico rewards drivers with consistent insurance coverage and a clean driving record with savings of up to 22% through their good driver discount (Learn more by reading our Geico insurance review). Similarly, if you maintain continuous coverage for five years with companies like State Farm, you can qualify for their safe driver discount, which could lower your premium by up to 30%.

A key benefit of maintaining uninterrupted insurance is that even small gaps can lead to higher premiums when you renew your policy or switch providers.

For instance, if a driver allows their policy to lapse for just 30 days, their rates could increase significantly when they try to re-insure.

Ensuring continuous coverage, even during periods of low driving or when switching providers, is a simple yet effective strategy to keep your premiums low and maintain your good driver status.

No DUI or Major Violations

To be eligible for a good driver auto insurance discount, avoiding major violations like driving under the influence (DUI) or reckless driving is essential. These types of offenses are seen as high-risk behaviors by insurance companies, and even a single violation can disqualify you from receiving good driver discounts for several years.

For example, a driver with a clean record could qualify for up to 30% in savings through good driver discounts with insurers like State Farm or Progressive. However, depending on the state and insurer, a DUI conviction can lead to premium increases of 80% or more.

In states like California, drivers with a DUI lose their eligibility for the state-mandated good driver discount, which could mean missing out on as much as 20% in premium reductions for up to 10 years.

In addition to losing out on discounts, major violations like DUI often result in the need for high-risk insurance, commonly known as SR-22 auto insurance, which comes with substantially higher premiums. Maintaining a record free of major offenses helps secure discounts and keeps your overall insurance costs much lower.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Companies Offering Good Driver Auto Insurance Discounts

Several top insurance companies provide significant savings for good drivers through special discounts. Among the best are Allstate, Liberty Mutual, and State Farm, each offering considerable savings to drivers with clean records. Here’s a closer look at how these companies reward responsible driving:

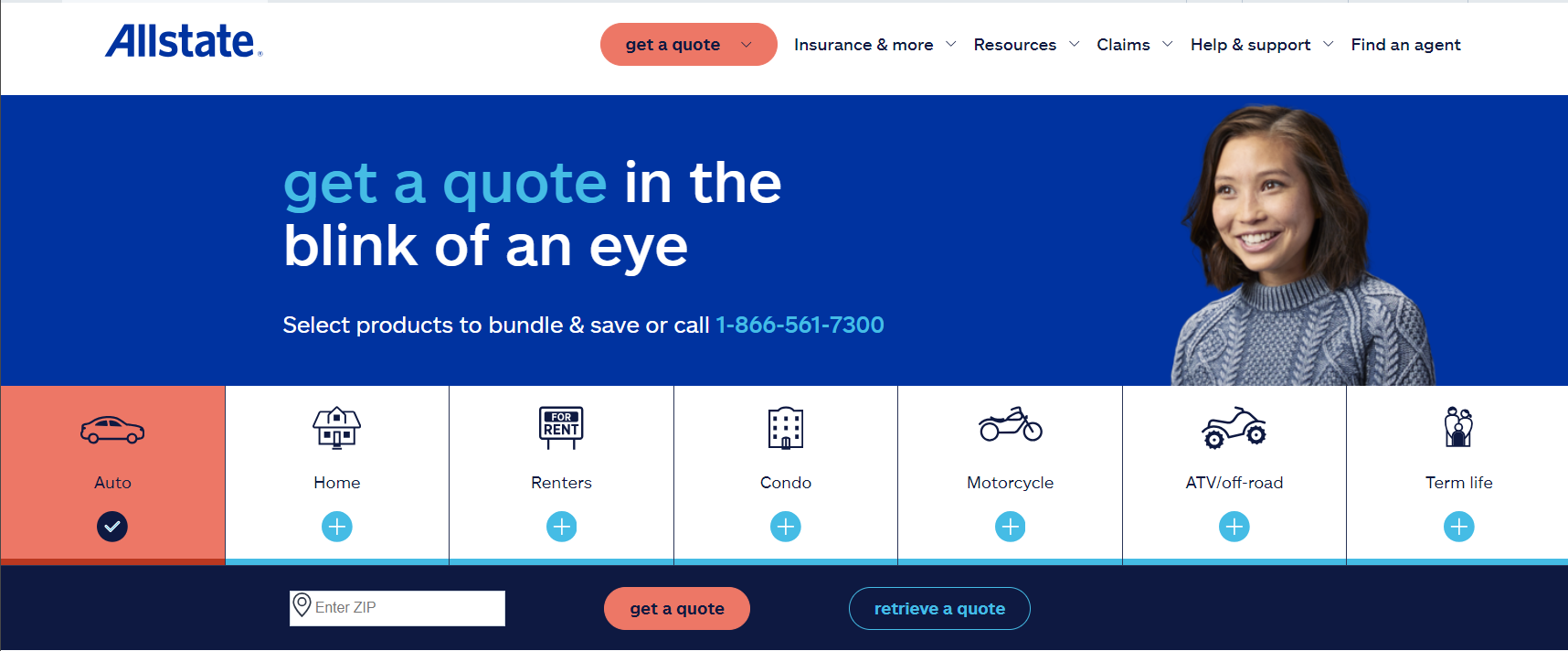

Allstate – Good Driver Discount (Up to 40%)

Allstate offers one of the most generous good driver discounts in the industry, allowing drivers to save up to 40% on their auto insurance premiums. You must uphold a spotless driving record for several years, free of accidents and traffic violations, to qualify.

According to our review of Allstate auto insurance , Allstate offers programs like “Drivewise,” which monitors your driving habits and provides additional savings for safe behaviors such as smooth braking and maintaining a steady speed. This combination of rewards can significantly affect your overall insurance costs, especially for long-term policyholders.

Liberty Mutual – Good Driver Discount (Up to 30%)

Liberty Mutual offers a good driver discount of up to 30% for drivers who maintain a clean record without any at-fault accidents or serious violations for at least five years.

Liberty Mutual also offers accident forgiveness as part of its rewards for safe drivers, meaning your rates won’t increase after your first accident if you qualify. This incentive, combined with the 30% discount, makes Liberty Mutual an excellent option for drivers looking to save on premiums while benefiting from extra peace of mind on the road.

You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual Auto Insurance Review.

State Farm – Good Driver Discount (Up to 30%)

State Farm offers a State Farm good driver discount to customers who maintain a spotless driving record for at least three years. Safe drivers can save up to 30% on their premiums through this State Farm driving discount, and those enrolled in State Farm’s “Drive Safe & Save” program can potentially see even more savings by allowing the insurer to monitor driving habits via a mobile app.

By avoiding accidents and risky driving behaviors, you can reduce your premium costs significantly while remaining eligible for additional perks like accident forgiveness and a good driving discount.

These companies recognize and reward responsible drivers, offering some of the best discounts in the industry for those with clean records.

Good Driver Discounts Explained

Good driver discounts are a certain percentage taken off your auto insurance policy if you meet the insurance company’s qualifications. Insurance companies offer good driver discounts in a few different ways, which we’ve explained below.

Types of Good Driver Auto Insurance Discounts

There are a few different types of good driver discounts, from discounts for being accident-free or traffic ticket free to discounts for driving less than the average driver. Take a look at the different safe driver discounts below.

- Accident-Free Discounts: Drivers have to have no claims filed within at least the last three years.

- Defensive Driver Course Discounts: Drivers must complete an approved defensive driving course successfully, either in person or an online defensive driving course, for a defensive driver discount.

- Low-Mileage Discounts: Drivers need to drive infrequently, usually less than 13,000 or 10,000 miles annually, to qualify for a low-mileage discount.

- Performance-Based Discounts: Drivers need to participate in a safe driver program that tracks their driving for a few months and then gives a discount based on how well the drivers do.

- Violation-Free Discounts: Drivers have to have no moving violation traffic tickets or DUIs.

What is offered depends on the company you are with. A company may offer an accident-free discount and a low-mileage discount but not a defensive driver course discount.

More About Getting a Good Driver Insurance Discount

Being a good driver will qualify you at most places for a discount, but the exact specifications for qualifying will vary from company to company. A State Farm safe driver discount is going to be different than a Geico safe driver discount or a Progressive safe driver discount. For example, some insurance companies may want you to be accident-free for four years, while others only require a year or two of accident-free driving.

To learn about the programs offered by some of the top companies, visit our State Farm Drive Safe and Save review, our Progressive Snapshot review, and our Geico DriveEasy review.

Being a good driver will qualify you for a discount at most places, but the exact specifications for qualifying will vary from company to company.Dani Best Licensed Insurance Producer

The best way to see what you need to qualify is to check your insurance company’s list of discounts and see what the qualifications are. Generally, if you have a clean driving record free of DUIs, accidents, and traffic tickets, you should qualify for at least some type of good driver discount at your insurance company.

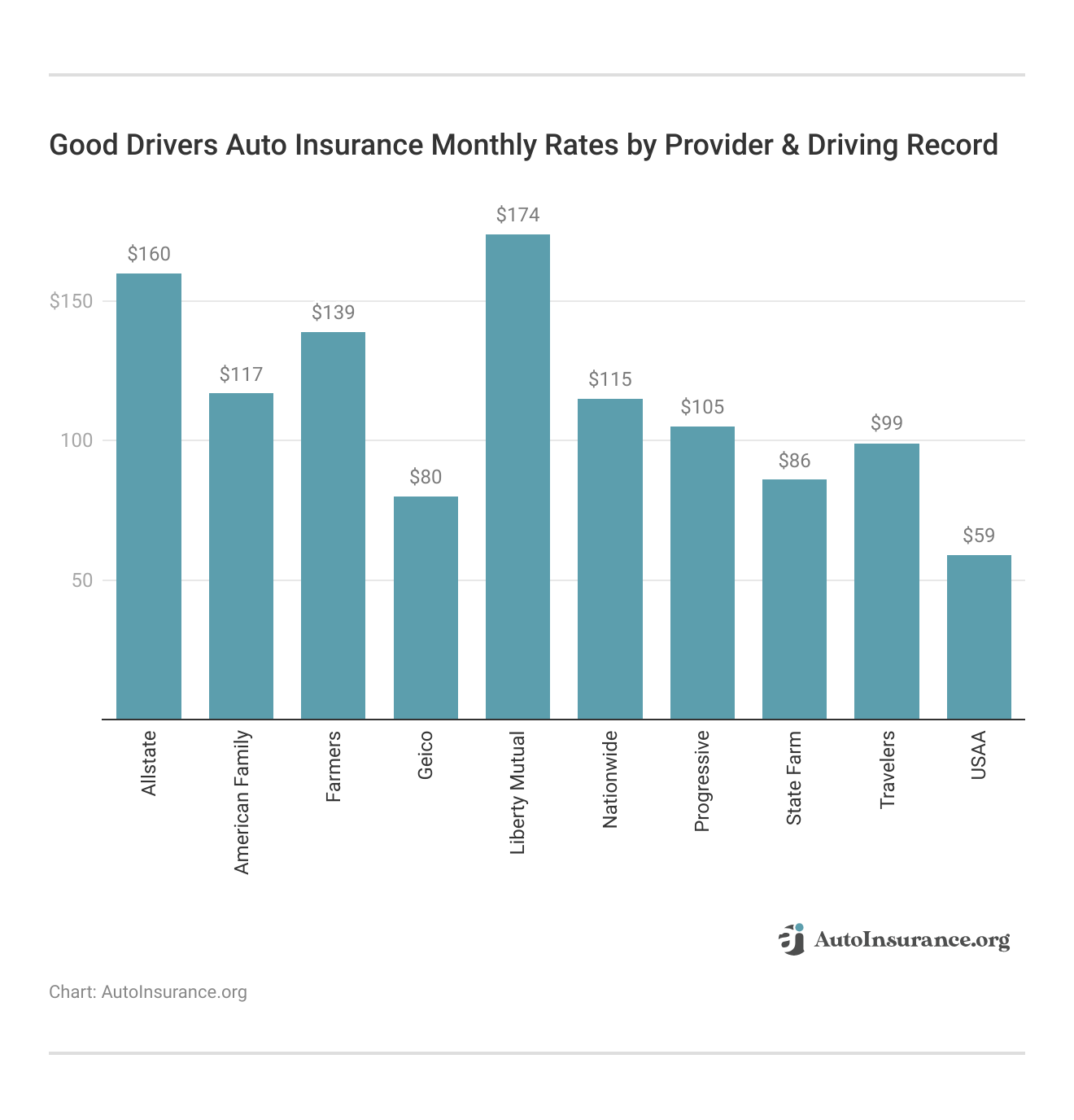

Benefits of Being a Good Driver

One of the benefits of being a good driver is the lower average rates due to discounts. You can look at the rates below to see good driver rates compared to poor driver rates.

Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

Having lower rates is just one safe driver bonus. Practicing safe driving habits will also reduce your chances of being in an accident. This means less of a chance of you being injured and having to deal with car repairs and all the other headaches that come after a car accident.

Tips on Driving Safely

Drivers should do a few things to ensure they are driving as safely as possible and keeping their driving skills sharp. The first is to make sure to follow all traffic laws and regulations. This will help drivers avoid traffic tickets or at-fault accidents that will raise their auto insurance rates.

Avoiding distracted driving is also another great way to avoid accidents. Anything that takes your attention off the road, whether it’s fiddling with your Spotify playlist on your phone or eating a sandwich with one hand, should be avoided. All it takes is a few seconds of lapsed concentration on the road to get into a car accident.

Finally, most drivers will benefit from taking a defensive driving course or completing a safe driver program so they can practice defensive driving techniques. Knowing how to brake in icy conditions or how to avoid deer collisions can help drivers avoid accidents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Ways to Save on Auto Insurance

Good driver discounts aren’t the only way to save on auto insurance rates. One of the other ways to reduce your auto insurance rates is to shop around and see if a different company offers you a cheaper rate on your auto insurance policy.

You can also adjust your coverage levels and your deductible levels. If you have an older car, for example, you could carry a lower amount of collision and liability insurance. You can also raise your deductible to lower rates, although, remember, you will have to pay this amount out of pocket after an accident. You can read our article about what is an auto insurance deductible for more information.

Finally, if your insurance company uses credit score as a factor to determine rates, improving your credit score will help you find savings. Drivers with poor credit scores are viewed as more likely to file claims, so most insurance companies reward drivers with good credit scores with a discount.

The Definitive Guide to Good Driver Auto Insurance Discounts

Good driving can help you earn a discount at your insurance company, which will lower your auto insurance premium. It also helps ensure your and your passengers’ safety. Safe drivers are less likely to get into a car accident due to practicing safe driving habits and defensive driving skills.

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

If you want to try and find a cheaper rate on your auto insurance company, you can use our free quote comparison tool. It will help you find the company with the cheapest rate for your needs and budget.

Frequently Asked Questions

Do good grades help you save on auto insurance?

Yes, some insurance companies offer a good student auto insurance discount. Generally, drivers can’t be older than 25 and must have a B average or higher to qualify.

Are there requirements for getting a good driver discount policy?

Yes, there are requirements, but they are different from company to company. So companies may want you to participate in their safe driving performance program, while others just want to know you’ve been claim free for a few years.

How much will the California good driver discount save drivers?

The California good driver discount saves drivers 20% on their auto insurance policy. Drivers must have had a driver license for at least three years and have one or fewer points on their driving record.

Why do companies give good student discounts?

Teenage drivers have some of the highest average auto insurance rates. Of course, there are reasons why auto insurance costs more for young drivers, but some companies offer discounts to good students to help make auto insurance more affordable and encourage students to do well.

What are the benefits of being a good driver for auto insurance?

Some potential benefits of being a good driver for auto insurance include:

- Lower Insurance Premiums: Good drivers often enjoy discounted rates compared to drivers with a history of accidents or violations.

- Improved Coverage Options: Insurance companies may offer additional coverage options or policy features specifically tailored for good drivers.

- Higher Deductibles: Good drivers may be eligible for higher deductibles, which can help reduce their premiums further.

- Enhanced Reputation: Maintaining a good driving record demonstrates responsibility and can positively impact your overall reputation as a driver.

How much is Drive Safe and Save discount?

The Drive Safe discount with State Farm can save you up to 30% on your auto insurance premium. The amount varies based on your driving habits, which are monitored through the Drive Safe & Save program. Safer driving behaviors typically result in higher discounts.

What are the requirements To be eligible for the California Good Driver discount?

The California good driver discount requirements are a clean driving record for the past three years with no more than one point on your license. You must also be licensed for at least three years to qualify. These California good driver discount requirements can significantly lower car insurance for good drivers.

How can I qualify for the AAA Good Driver discount?

To be eligible for the AAA good drivers discount, you must avoid tickets and have no accidents or violations for at least three years. You must also meet your state’s specific eligibility requirements. Being among the best AAA auto insurance discounts, this good driver’s discount can significantly save your auto insurance premium.

What is the best auto insurance for good drivers?

Allstate offers the best auto insurance for good drivers. They provide a 40% discount for maintaining a clean driving record. This makes them a top choice for safe drivers seeking significant savings.

How can I qualify for the California Good Driver Discount with State Farm?

To be eligible for the State Farm good driver discount in California, all operators of your vehicle must meet the “good drivers” criteria as defined by California law. This includes having no at-fault accidents or moving violations for at least three years. Meeting these requirements can help you secure lower insurance rates.

How can I qualify for the State Farm defensive driving discount?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.