How long does an accident stay on your record? (2026)

How long an accident stays on your record depends on where you live, accident severity, and your insurer. While each state has different laws, the average time is three to five years. For example, in California, serious offenses such as DUIs can stay for up to 13 years. Also, expect rates to go up around 40%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated October 2025

How long does an accident stay on your record? While each state has its own auto insurance laws, accidents typically stay on your record for three to five years.

However, the type and severity of the accident may also impact it. An accident can also lead to higher insurance premiums, making it crucial to compare quotes and find the best rates.

If you’re wondering, “How long does an accident stay on your insurance?” you should know comparing auto insurance quotes can help you save money. Enter your ZIP code using our free tool below to see rates from the top providers near you.

- Accidents usually fall off in three to five years, but it depends on insurer and state

- Rates go up around 40% after at-fault accidents, but some providers raise them less

- Cut coverages, get insurance discounts, and compare quotes to save after a wreck

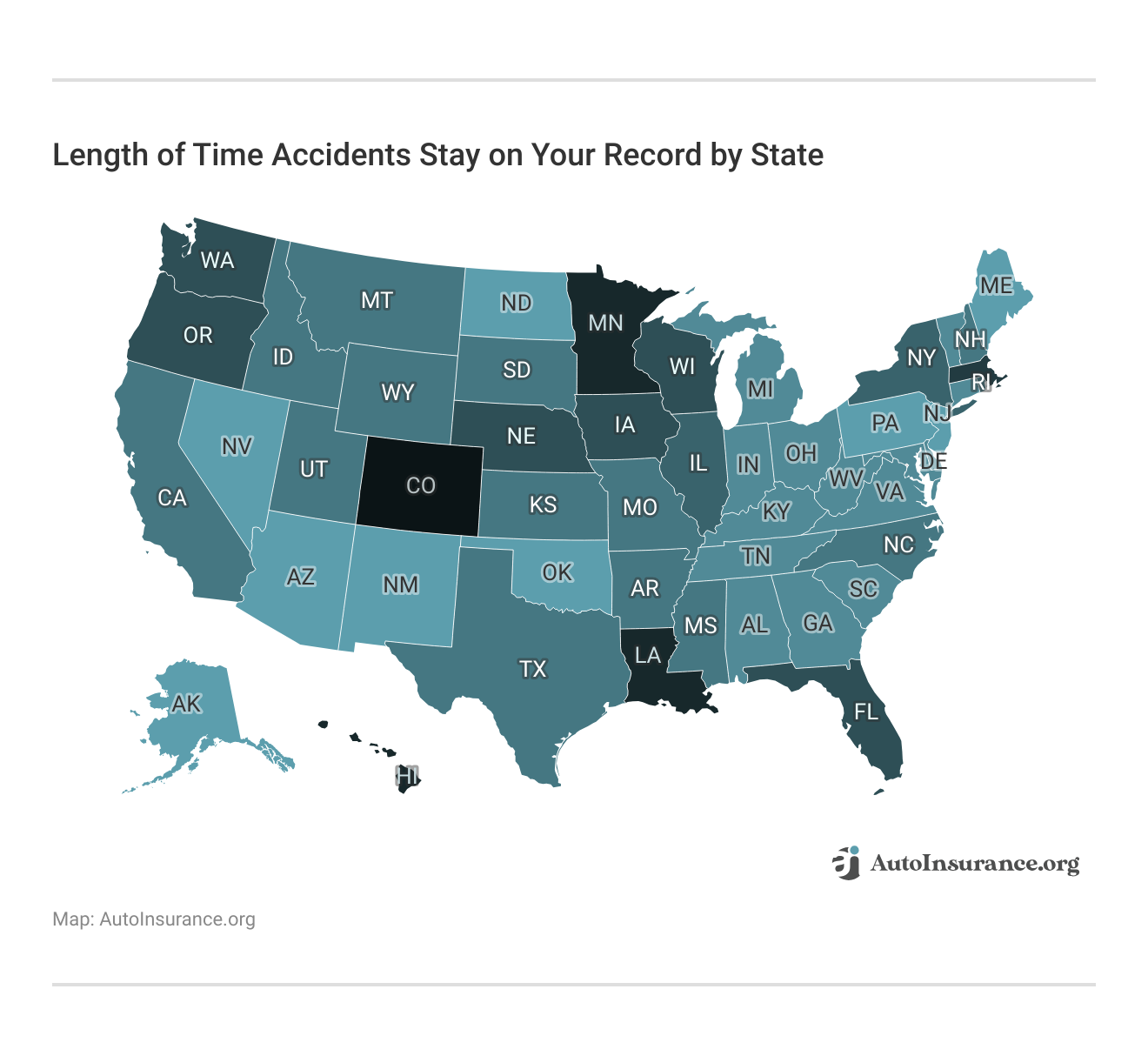

How Long Accidents Stay on Your Record

So, when do accidents fall off insurance? Every state deals with accidents differently, but the typical amount of time an accident remains on your record is between three and five years. You can check your specific state below:

The amount of time an accident will stay on your record also depends on its severity and the insurance company you have.

A minor fender bender probably won't stay on your record for five years. However, an accident involving a DUI infraction will stay with you for a long time, often 10 or more years.Jeffrey Manola Licensed Insurance Agent

If you’re wondering, “How long does an at-fault accident stay on your insurance record vs. a DUI accident?” check out the table below to compare average length an incident stays on your record by accident type:

Length of Time Accidents Stay on Your Driving Record by Accident Type

| Type | Period |

|---|---|

| First minor accident | 3 years, though some insurance companies will forgive it |

| Minor accident | 3 years |

| Major accident | 5 years |

| DUI | 10 years |

| Hit-and-run | 10 years |

There are two types of accidents you can be involved in: at-fault and not-at-fault. No matter which situation you find yourself in, it will likely be reported to your state’s department of motor vehicles (Learn More: How Auto Insurance Companies Check Driving Records).

While it’s best to avoid all accidents, a DUI is basically the worst offense you can become involved in on the road. Aside from the potential of seriously harming other people, it will affect your life for years, and potentially bring about expensive car accident lawsuits.

Now, we’ll discuss more specifics for those asking, “How long before an accident will fall off insurance if it wasn’t my fault?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Long Not-at-Fault Accidents Remain on Your Record

Many readers have asked, “How long do accidents stay on your insurance if you weren’t at fault?” The amount of time an accident remains on your record, if you’re not at fault, depends on the state in which you reside. However, even a not-at-fault accident will usually stay on your record for three to five years.

Find out More: Best Auto Insurance Without Penalties for No-Fault Accidents

While accidents you’re involved in generally end up on your driving record, the good news is that your insurance company probably won’t hold them against you. Most providers use auto insurance points to track accidents, and some may choose to not add points and maintain your current insurance rates. Check out our guide titled, “Do points affect auto insurance rates?” to learn more.

However, you might find yourself with a price hike if you’re involved in multiple accidents, even if you aren’t responsible for any of them. Check out our expert guide titled “How to Make an Auto Insurance Claim When Not at Fault” for more details.

Now that you know the answer to, “How long until accidents fall off insurance if I didn’t cause them?” we’ll explain how much you could pay for coverage with an accident.

How an Accident Affects Your Auto Insurance Rates

Any accident you’re at fault for will make your insurance rates increase, as it makes you a riskier driver to insure. Check out the table below to see how much car insurance costs with a clean record vs. one accident:

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $228 | $321 | |

| $166 | $251 | |

| $138 | $196 | |

| $198 | $282 | |

| $114 | $189 | |

| $249 | $335 |

| $164 | $230 |

| $150 | $265 | |

| $123 | $146 | |

| $161 | $235 |

| $141 | $199 | |

U.S. Average | $161 | $244 |

While every insurance company treats accidents differently, the average increase for auto insurance after an at-fault accident is 40%.

Statistics show drivers with an accident or claim on their history are more likely to cause another. An accident affects your insurance based on the type of collision you’re involved in and whether or not you have any other incidents on your record.

Consider the following situations:

- You Cause an Accident With Injuries: Any accident you cause will raise your rates, but your insurance company will have to pay more if a person is injured. Higher payouts mean increased insurance rates for you.

- You Total a Car: Similar to injuring someone, your insurance company will have to pay more if you total a car.

- You Get a DUI: DUI infractions are one of the top reasons your insurance rates go up. If the DUI involves an accident or an injury, your rates can triple.

- An Uninsured Driver Is Involved: If the person you hit doesn’t have insurance, your policy has to pay more money to cover damages.

So, how long for an accident to come off insurance? While an accident might stay on your driving record for a few years, insurance companies might hold it against you for up to a decade. Most companies target the last five years of your driving history.

Read More: Cheap Auto Insurance After a DUI

Removing an Accident From Your Driving Record

If you’ve been asking, “How long do accidents stay on your record for insurance?” you may also wonder if there’s a way to get an accident off your record.

Unfortunately, there’s nothing you can do to remove an accident from your record except wait for it to fall off your record. However, it always depends on your insurance provider. For example, the answer to the question, “How long does it take for an accident to come off your record?” varies by company.

Additionally, some insurance companies offer accident forgiveness on their policies. Accident forgiveness policies ignore your first accident by not raising rates, even if you caused it, but not all companies offer it. As an add-on, you’ll likely pay extra for this coverage, or you may have to maintain a certain period with no accidents to qualify.

Curious how much it costs for accident forgiveness? Compare rates for accident forgiveness coverage in the table below:

Accident Forgiveness Cost by Provider

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $20 |

| American Family | $25 |

| Erie | $18 |

| Farmers | $15 |

| Geico | $8 |

| Liberty Mutual | $18 |

| MetLife | $22 |

| Nationwide | $15 |

| Progressive | $18 |

| State Farm | $25 |

| The Hartford | $20 |

| Travelers | $15 |

| USAA | $12 |

| Westfield | $20 |

| Zurich | $18 |

As you can see, some of the best auto insurance companies, including Geico, Progressive, Allstate, State Farm, USAA, and Nationwide offer accident forgiveness (Learn More: Best Auto Insurance Companies for Accident Forgiveness). So, if you have accident forgiveness with these providers and you’re asking yourself, “How long is an accident on your record?” you can rest assured your first accident won’t impact rates.

If accident forgiveness sounds appealing, speak with your insurance company to find out if they offer this sort of program. While it will probably raise your insurance rates, it might save you a lot of money in the long run.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

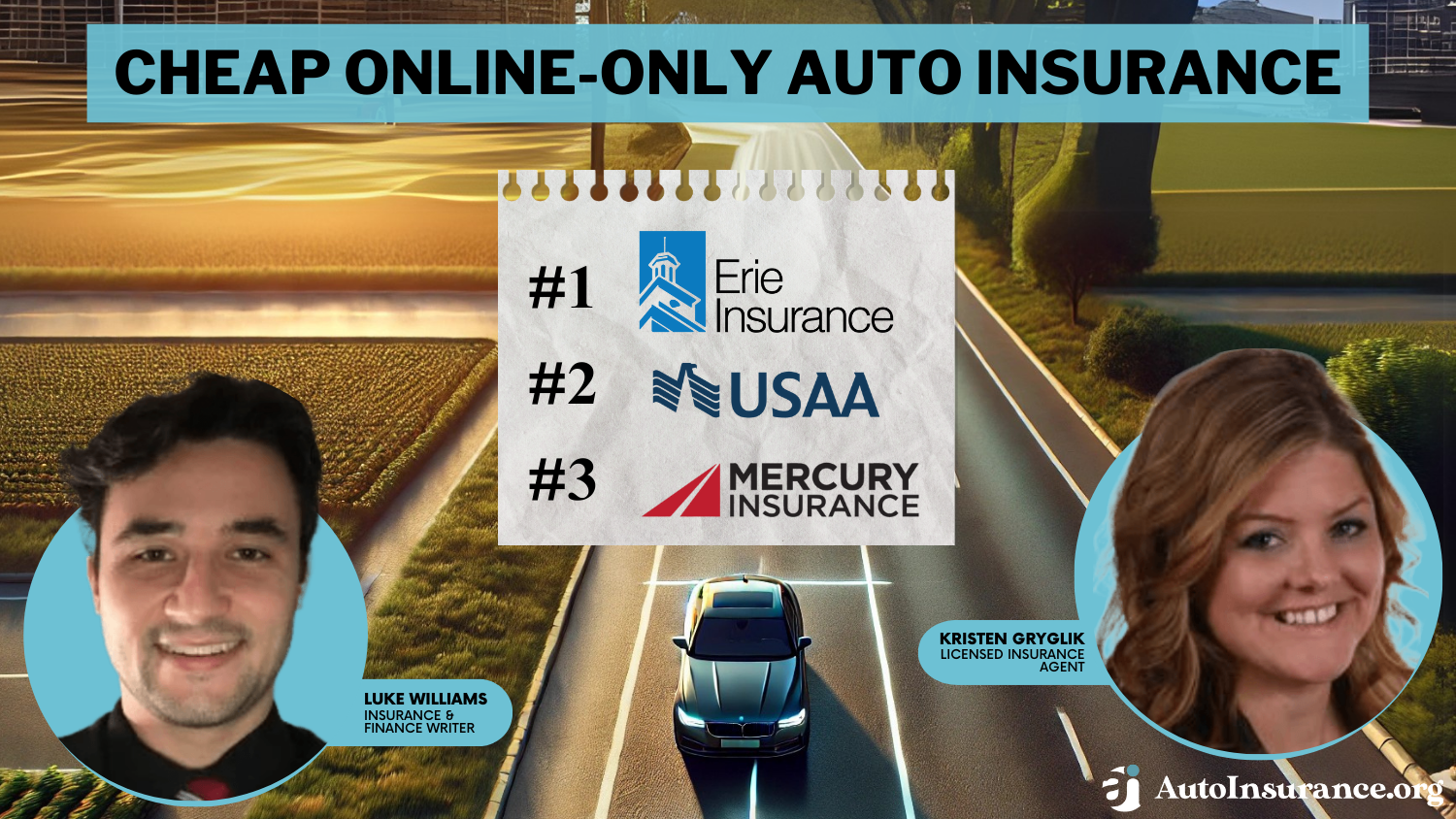

The Best Car Insurance Companies for High-Risk Drivers

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for High-Risk Drivers

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsIf you’re still left wondering, “How long before accidents fall off insurance?” why wait when drivers with a bad driving record, including several accidents, can get competitive rates from the best high-risk insurance providers: Progressive, Geico, and State Farm.

These companies provide options that cater to the needs of high-risk drivers, making them ideal choices for those looking to secure car insurance coverage despite a challenging auto accident history. We’ll overview average monthly rates for good drivers from these companies to serve as a baseline for understanding their pricing structure.

Our Progressive insurance review found the company offers monthly rates averaging $105, and is known for flexible coverage options to accomodate drivers with several accidents. Progressive’s reputation for providing affordable rates without compromising on coverage makes it one of the best auto insurance companies for high-risk drivers seeking a balance between cost and protection.

How long does an at-fault accident stay on your record with Progressive? Like most providers, expect at-fault accidents to impact rates and stay on your record for three to five years. However, Progressive accident forgiveness could help you avoid a rate hike.

State Farm, with an average monthly rate of $156 for good drivers, is often hailed for its reliability and competitive offerings for high-risk individuals. The company’s emphasis on the recent accident history of a driver makes it an appealing choice for those looking to rehabilitate their driving records and secure affordable auto insurance with accident history.

How long does a wreck stay on your record at State Farm? Your accident will stay on your record for three to five years with State Farm, and you can get the State Farm insurance discount for good driving again after five years.

Learn More: State Farm Auto Insurance Review

On the other hand, USAA offers an exceptionally affordable rate of $59 per month for its eligible military members and their families. Check out review of USAA to see if the company is right for you.

@usaa As part of USAA’s #RecycledRides program, we worked with Gerber Collision, #VFW Post 2245, and the Gurnee #AmericanLegion to provide the gift of reliable transportation to this #Sailor. #MilitaryAppreciation ♬ original sound – USAA

This insurer is celebrated for its tailored solutions that cater specifically to the unique needs of the military community, providing significant value and support to those who have served or are serving in the armed forces.

Read More: Cheap Auto Insurance for a Bad Driving Record

So, how long does a car accident stay on your insurance record with USAA? While it depends on accident severity, expect it to stay on your record with USAA for three to five years.

Tips to Save Money on Car Insurance After an Accident

Now that you know, “When do at-fault accidents fall off?” let’s discuss how to lower rates after one. While your rates will increase after an accident, there are ways you can save. Try the following suggestions:

- Increase Your Deductible: The higher your car insurance deductible, the less you owe on your bill. However, raising your deductible comes with a risk. If you need to make a claim in the future, you’ll have to pay more out of pocket.

- Ask for Discounts: There are numerous discounts available to help you save money. From good student to good driving, ask your insurance agent to determine whether or not you’re eligible for discounts. Find the best good student auto insurance discounts here.

- Reduce Coverage: If an accident pushes the price of your insurance beyond your budget, consider lowering your amount of coverage. As long as you meet the minimum insurance requirement in your state, you can go as low as you’d like.

- Improve Your Credit Score: People don’t realize that their credit score affects their insurance rates. You can improve your rates by raising your score — try to pay down your debt, ensure that your bills are on time, and avoid credit checks for a while (Learn More: How Credit Scores Affect Auto Insurance Rates).

Of course, the best way to lower your car insurance rates is to compare quotes from as many companies as possible. Your insurance might drop you if you have too many accidents on your record, but even if they don’t, your rates will assuredly increase.

However, some companies don’t punish accidents as often as others. You can review insurance quotes without risking your current policy.

After an accident, leveraging strategies like increasing deductibles, tapping into discounts, adjusting coverage, and enhancing credit scores can carve pathways to significant insurance savings, despite the inevitable rate hikes.Kristen Gryglik Licensed Insurance Agent

Researching separate companies can help you obtain the best price on your insurance, regardless of whether or not you have an accident or any other incident on your record.

Find the Best Car Insurance After an Accident

So, how long before accidents fall off insurance? While it depends on the accident and your insurer, it usually stays on your record for three to five years. Check out our expert guide that answers the question, “How long does an accident affect your car insurance rate?”

However, don’t let this discourage you from having the best policy — shopping for quotes can help you save money. Enter your ZIP code into our free quote tool below to instantly discover what rates with an accident might look like for you.

Frequently Asked Questions

How long does a car accident stay on your record for insurance?

A top question readers ask is, “How long does it take for an accident to come off your insurance?” The duration for which an accident stays on your driving record depends on various factors, including the specific jurisdiction and the severity of the accident. In general, accidents can remain on your record for several years.

Does an accident affect my insurance rates?

Yes, an accident is one of many factors that affect auto insurance rates. Insurance companies typically consider accidents as a factor when determining premiums. If you are at fault in an accident, it may result in an increase in your insurance rates.

How many years does an accident stay on your record? Expect it to stay on your record and impact your rates for three to five years.

How long do accidents typically impact insurance rates?

If you’re wondering, “How long do accidents affect insurance rates?” it depends on the insurance provider and the circumstances surrounding the accident. Generally, auto insurance with accidents can impact your rates for a few years, typically ranging from three to five years. However, the exact duration may vary based on your location and insurance company policies.

Will an accident always increase my insurance premiums?

Not necessarily. Whether an accident will increase your insurance premiums depends on various factors, such as your insurance provider’s policies, the severity of the accident, and your previous driving history. In some cases, if the accident was minor and you have a good driving record, your premiums may not increase significantly or at all.

Do accidents affect my ability to get insurance coverage?

Accidents can potentially affect your ability to obtain insurance coverage, especially if you have a history of multiple accidents or serious offenses. Insurance companies assess risks when deciding whether to provide coverage, and a poor driving record with multiple accidents may make it more difficult to find affordable insurance or result in higher premiums.

Why doesn’t New Hampshire require auto insurance?

New Hampshire is unique in the United States for its approach to auto insurance: it does not strictly require its residents to carry it. This policy stems from the state’s strong emphasis on personal freedom and responsibility.

Instead of mandating auto insurance, New Hampshire requires that drivers demonstrate their ability to meet New Hampshire Motor Vehicle Financial Responsibility Requirements. This means a driver must be able to cover the costs of damages in the event of an at-fault accident.

Wondering how to find the best New Hampshire auto insurance? Enter your ZIP code into our quote comparison tool below to get started.

How long does a not at-fault accident stay on your record?

How long do accidents stay on insurance if you weren’t at fault? The duration a not-at-fault accident stays on your driving record can vary significantly depending on the state you’re in and the policies of your insurance company. Typically, accidents might remain on your driving record for about three to five years, but this is not a uniform rule, and in some cases, it could be longer.

Can you clear your driving record?

Generally, you can’t manually remove an accident from your driving record. However, accidents usually fall off your record after three to five years, depending on state laws. You might mitigate an accident’s impact by enrolling in accident forgiveness with your insurer, completing a defensive driving course, or disputing any errors on your record.

If an accident is inaccurately reported, you can contest this with your state’s DMV. Shopping around for new insurance can also help you find better rates even with an accident on your record.

How long does a minor accident stay on your insurance?

You may be wondering, “How long does a wreck stay on your insurance if it was minor?” A minor accident typically stays on your auto insurance record for about three to five years. However, the exact duration can vary based on your insurance company’s policies and the laws of the state where you reside.

Insurance providers may consider the severity of the accident and your overall driving history when determining how long the accident affects your auto insurance premiums. After this period, the accident may no longer impact your insurance rates, assuming you’ve had no further incidents.

Do fender benders go on your driving record?

How long do wrecks stay on your record if it’s just a fender bender? Fender benders can go on your driving record, especially if the incident involves a police report or a car insurance claim filed with an insurance company. The specifics, however, can depend on the severity of the fender bender, state laws, and whether any traffic violations were involved.

Not all minor accidents are reported to the DMV, but it’s common for insurance companies to record any claims made, which can affect your insurance premiums. If no claim is filed and no police report is made, a minor fender bender might not appear on your driving record.

What are the consequences for driving without insurance?

How long does a driving suspension stay on your record?

Should I get a lawyer for a car accident that was my fault?

What happens with a hit and run charge?

Can I get car insurance after an accident?

How long does an accident stay on your record with Geico?

How long does an accident stay on your insurance with Progressive?

How long does an accident stay on your record in Virginia?

How long does an accident stay on your record in Alabama?

Do all accidents show up on your driving record in California, and when do they fall off?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.