Best Minnesota Auto Insurance in 2026 (Top 10 Companies Ranked)

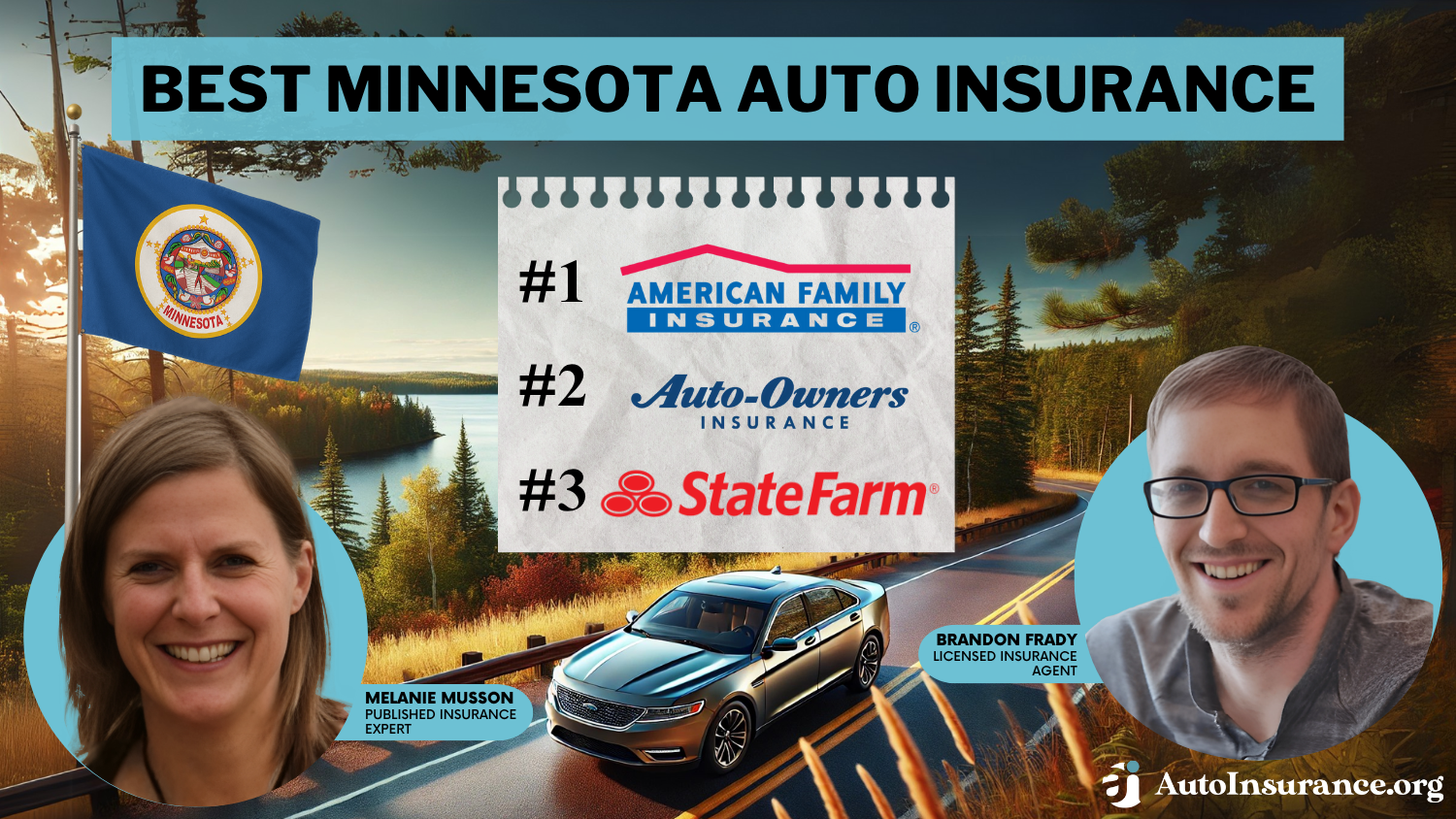

The best Minnesota auto insurance companies are American Family, Auto-Owners, and State Farm, with rates as low as $47 per month. Auto-Owners offers the cheapest minimum coverage rates in the state, while American Family stands out for its strong customer service and claims handling.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2025

Company Facts

Full Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

The best Minnesota auto insurance comes from American Family, Auto-Owners, and State Farm, offering competitive rates that start at just $47 monthly.

If you’re searching for cheap car insurance in Minnesota, it’s helpful to understand the factors that affect Minnesota auto insurance rates.

Our Top 10 Company Picks: Best Minnesota Auto Insurance

| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 674 / 1,000 | A | Student Savings | American Family |

| #2 | 663 / 1,000 | A++ | Cheapest Rates | Auto-Owners | |

| #3 | 647 / 1,000 | A++ | Many Discounts | State Farm | |

| #4 | 638 / 1,000 | A+ | Online Convenience | Progressive | |

| #5 | 629 / 1,000 | A+ | Add-on Coverages | Allstate | |

| #6 | 628 / 1,000 | A+ | Usage Discount | Nationwide | |

| #7 | 622 / 1,000 | A++ | Online Quotes | Geico | |

| #8 | 622 / 1,000 | A | Local Agents | Farmers | |

| #9 | 616 / 1,000 | A | Customizable Policies | Liberty Mutual |

| #10 | 613 / 1,000 | A++ | Accident Forgiveness | Travelers |

This can help you narrow down the best auto insurance companies in Minnesota based on your driving record, desired coverages, and more.

- Discover the cheapest car insurance provider in Minnesota

- Understand the state laws that impact auto insurance in MN

- State Farm offers the best rates and customer service in Minnesota

We’ll cover the cheap car insurance in MN and the relevant state laws affecting rates. Use our free comparison tool above to see what auto insurance quotes look like in your area.

Auto Insurance Cost in Minnesota

Car insurance rates in Minnesota can vary greatly by driver history, area, and more. A company that is cheap for your friend may not be a cheap auto insurance in Minneapolis for you. If you have a serious infraction on your record, such as a DUI, or you live in an area with high rates, you will have to look harder for cheap insurance.

Read More: Does a criminal record affect auto insurance rates?

Here’s a look at how average annual full coverage auto insurance rates in Minnesota compare with the rest of the U.S.

Minnesota Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $123 | |

| $50 | $110 | |

| $47 | $124 | |

| $50 | $110 | |

| $44 | $98 | |

| $47 | $104 |

| $50 | $111 | |

| $46 | $106 | |

| $47 | $105 | |

| $46 | $102 |

Read on to see what the cheapest auto insurance is in Minnesota by coverage, driver record, and more.

If you only need minimum coverage, your rates will be significantly lower than with full coverage auto insurance. Just keep in mind that if you get in an accident, your out-of-pocket costs will be significantly higher, unless you own an older vehicle.

If you can afford it, purchasing full coverage is a good idea, as it protects you from having to pay out of pocket to repair your car after an accident.

State Farm offers some of the most affordable rates for full coverage in Minnesota, whereas Liberty Mutual has some of the most expensive average rates for insurance coverage. Read our State Farm auto insurance review and Liberty Mutual auto insurance review for more information on the companies.

Minnesota Auto Insurance Rates by Credit

Your credit score will certainly impact auto insurance rates; drivers with poor credit can pay three times as much as drivers with good credit in Minnesota. This is because insurance companies view drivers with low credit scores as riskier to insure, as they will be more likely to miss payments than drivers with good credit.

Minnesota Auto Insurance Monthly Rates by Credit Score

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $56 | $70 | $84 | |

| $50 | $63 | $75 | |

| $50 | $63 | $75 | |

| $44 | $55 | $66 | |

| $47 | $59 | $71 |

| $50 | $63 | $75 | |

| $47 | $59 | $71 | |

| $27 | $34 | $41 |

While USAA is generally one of the cheapest companies, it tends to raise prices substantially for bad credit scores. This is why shopping around is so important, as a cheap company may not actually be the cheapest for you based on your driver profile.

Minnesota Auto Insurance Rates by Driving Violation

A DUI can raise rates by over $1,000 in Minnesota. If you get a DUI, you should shop around and see if an insurance company raises rates less than your current insurance company. The table below shows the average rates that insurance companies will charge after a driver gets convicted of a DUI.

Learn more: DUI Defined

Minnesota Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $56 | $63 | $63 | $139 | |

| $50 | $72 | $72 | $120 |

| $47 | $57 | $69 | $72 | |

| $50 | $72 | $72 | $100 | |

| $44 | $53 | $53 | $141 | |

| $47 | $58 | $58 | $135 |

| $50 | $63 | $63 | $125 | |

| $47 | $59 | $59 | $69 | |

| $46 | $59 | $59 | $133 | |

| U.S. Average | $61 | $76 | 91 | $112 |

The cheapest companies for DUI offenders are State Farm, American Family, and Nationwide. It’s important to note that a DUI in Minnesota may also result in fines, jail time, suspended licenses, and other penalties, depending on the severity of the offense.

If you cause an accident, you will see an increase in your insurance rates unless your insurance company offers accident forgiveness for your first at-fault accident.

However, you may be able to find cheap auto insurance for drivers with accidents by comparing company rates. The table below shows the average rates at an insurance company for an at-fault accident.

State Farm offers some of the cheapest auto insurance in MN for drivers who have an at-fault accident on their record. If you find your rates have increased substantially after an accident, make sure to shop around for car insurance quotes in MN to see if another insurance company is cheaper.

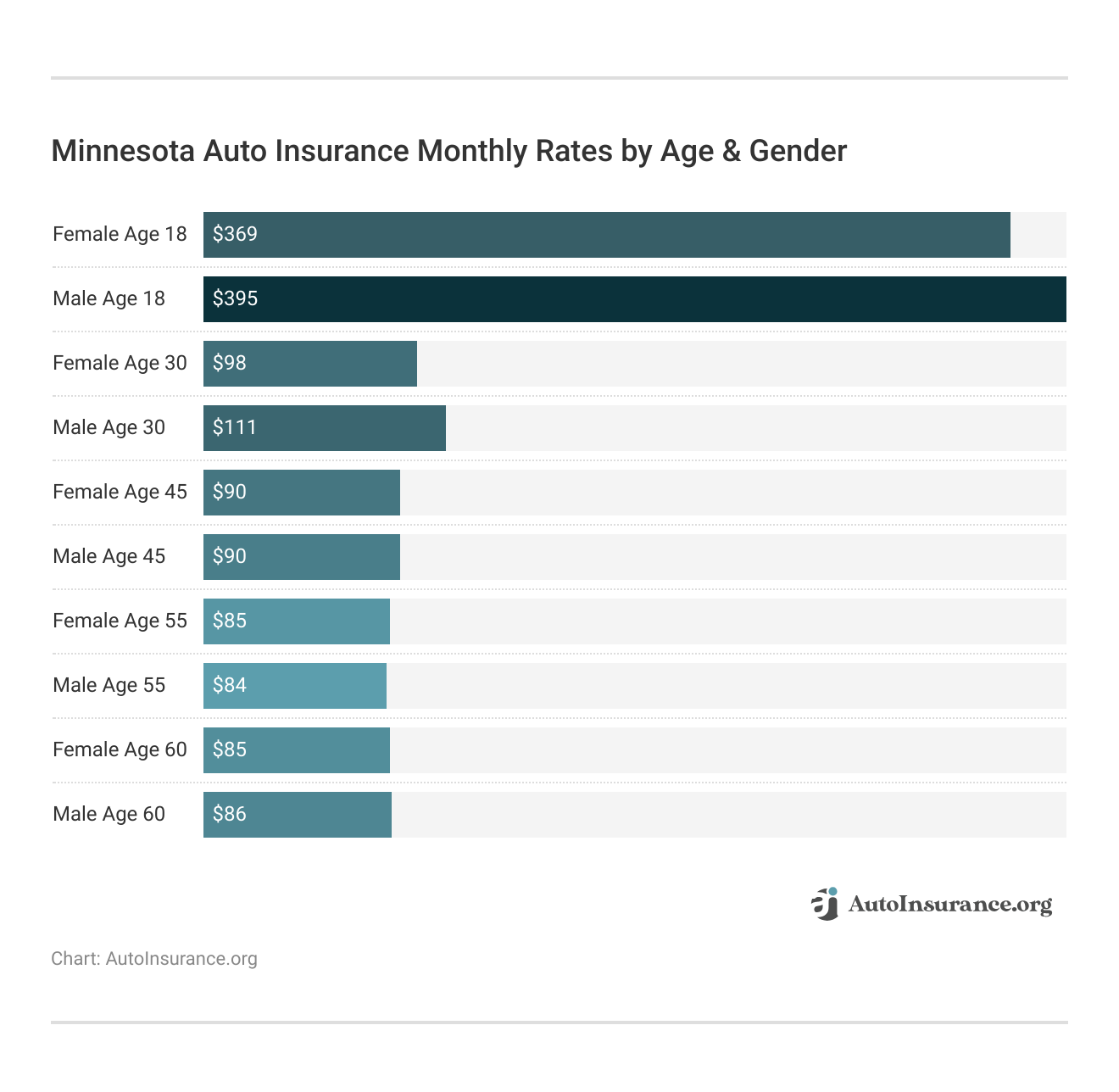

Minnesota Auto Insurance for Young Drivers

Auto insurance costs more for young drivers, as they are more likely to crash due to inexperience. Teenagers who purchase their own policies often pay thousands more than older drivers.

State Farm has some of the cheapest rates for teenagers, whereas Liberty Mutual has some of the most expensive, costing thousands more on average than State Farm.

Auto Insurance Rates by Minnesota Cities

Even within a state, rates can change from city to city depending on each city’s risk factors, such as local crime or heavy traffic.

Minnesota Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Bloomington | $85 |

| Brooklyn Park | $91 |

| Duluth | $70 |

| Maple Grove | $76 |

| Minneapolis | $95 |

| Plymouth | $80 |

| Rochester | $75 |

| Saint Cloud | $72 |

| Saint Paul | $90 |

| Woodbury | $81 |

Some of the most expensive rates can be found in Minneapolis, whereas some of the cheapest rates are in Rochester. Explore the varying costs of auto insurance in different Minnesota cities.

Read More: Minnesota City Auto Insurance Articles

We recommend comparing rates from multiple providers to find affordable insurance in your area. Enter your ZIP code into our free quote comparison tool to find the cheapest car insurance in Minnesota.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minnesota Car Insurance Laws

State laws and penalties can impact insurance rates, including the minimum amount of insurance a state requires drivers to carry. Car insurance is mandatory in Minnesota, so all drivers are required to carry it.

Read on to see how much insurance you must carry, Minnesota’s DUI laws, and when you need high-risk insurance.

Minimum Coverage Requirements in Minnesota

All Minnesota drivers must carry the following types of coverage to drive legally:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident

- Property Damage Liability: $10,000 per accident

- Uninsured/Underinsured Motorist: $25,000 per person / $50,000 per accident

- Personal Injury Protection (PIP): $40,000 per person per accident (includes $20,000 medical expenses and $20,000 for non-medical expenses)

You don’t need to purchase coverages like collision, comprehensive, or roadside assistance to drive legally in Minnesota.

However, you’ll have better protection from out-of-pocket expenses with a full coverage policy. Collision auto insurance and comprehensive auto insurance will cover repairs to your car in accidents caused by you or factors beyond your control, such as weather conditions.

Minnesota DUI Laws

Several penalties are associated with a DUI charge in Minnesota. Some of the consequences of DUIs include:

- Fines and court fees

- Suspended licenses

- Ignition interlocks once the license is restored

- Potential jail time

- Increased SR-22 insurance rates

Consequences will increase in severity for each DUI offense. So while a driver might not go to jail for their first DUI offense, they may have to serve jail time for a second offense.

Minnesota SR-22 Insurance Laws

In Minnesota, drivers with serious infractions on their record, such as a DUI or driving without insurance or with a suspended license, must carry an SR-22 certificate. It ensures that you have Minnesota car insurance, although having an SR-22 certificate will increase your rates because it shows you are a high-risk driver.

Minnesota requires SR-22s for drivers with serious infractions, like DUIs or driving without insurance, which usually results in higher rates.Michelle Robbins LICENSED INSURANCE AGENT

If you are currently insured, you can call and ask MN car insurance companies to apply for your SR-22 certificate. If you are uninsured, you may have to pay a fee to the new insurance company for them to file your SR-22 certificate. Some insurance companies may deny you coverage if you need an SR-22 certificate.

If you don’t have a vehicle, keep in mind that you will need to purchase non-owner auto insurance to get SR-22 insurance because you need to show proof of insurance when applying for SR-22 certificates.

Top 10 Best Auto Insurance Companies in Minnesota

American Family, Auto-Owners, and State Farm have the best auto insurance in Minnesota. Check out exactly why we chose these providers:

#1 – American Family: Top Overall Pick

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing drivers in Minnesota to tailor their policies to meet their unique needs.

- Discounts: Offers a variety of discounts, including for bundling policies, which can help Minnesota customers save money.

- Customer Service: Generally good customer service ratings, with a 674/1,000 from J.D. Power (Read More: American Family Auto Insurance Review).

Cons

- Cost: Premiums may be higher compared to some competitors, which could be a drawback for price-sensitive customers.

- Availability: Availability is limited in certain areas of Minnesota, restricting access for some customers.

#2 – Auto-Owners: Cheapest Rates

Pros

- Cheapest Rates: Auto-Owners has the lowest rates in Minnesota, with liability insurance starting at just $47 per month. Read our Auto-Owners car insurance review to compare pricing and real customer experiences.

- Robust Coverage Add-Ons: Minnesota drivers can customize their Auto-Owners policy with optional protections like roadside assistance, accident forgiveness, and gap insurance.

- High Claims Satisfaction: J.D. Power ranks Auto-Owners 663/1,000 for claims satisfaction, beating out top competitors like State Farm and Progressive.

Cons

- Limited Digital Tools: Auto-Owners doesn’t offer online quotes or claims filing, so Minnesota drivers must work with a local agent for policy updates and support.

- Limited Availability: Only operates in 26 states, including Minnesota, so you may need to switch insurers if you move to a state they don’t serve.

#3 – State Farm: Many Discount Options

Pros

- Discount Variety: Offers a variety of discounts, including for safe driving and bundling policies. Learn more in our guide titled “State Farm Auto Insurance Discounts.”

- Extensive Agent Network: Provides personalized service through a large network of agents, ensuring customers have access to knowledgeable support and assistance in person.

- Financial Stability: State Farm has strong financial stability and high customer satisfaction ratings, reflecting its reliability and trustworthiness as an insurer.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, potentially making it less affordable for some customers.

- Limited Online Quoting: Limited online quoting options compared to other insurers, which may inconvenience tech-savvy customers looking for quick and easy quotes online.

#4 – Progressive: Best for Online Convenience

Pros

- Competitive Rates: Offers competitive rates and a variety of discounts, including those for safe driving, making it an affordable choice for many drivers.

- Coverage Options: Our Progressive auto insurance review highlights the extensive coverage options, including for high-risk drivers.

- Online Tools: Robust online tools and a mobile app for managing policies, making it easy for customers to access and manage their insurance information anytime, anywhere.

Cons

- Mixed Customer Service: Customer service ratings are mixed, with some complaints about claim handling, which could affect the overall customer experience.

- Rate Increases: Rates may increase significantly after an accident or ticket, potentially leading to unexpectedly high premiums for some customers.

#5 – Allstate: Best for Add-On Coverages

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing customers to customize their policies to meet their unique needs.

- Innovative Features: Offers innovative features like Claim Satisfaction Guarantee, providing added peace of mind for policyholders.

- Digital Tools: User-friendly mobile app and online tools. Learn more about their online tools in our Allstate auto insurance review.

Cons

- Premiums: Higher premiums compared to some competitors, which could be a drawback for price-sensitive customers.

- Customer Satisfaction: Mixed customer satisfaction ratings, indicating that some customers may have experienced issues with service or claims handling.

#6 – Nationwide: Best for Usage Discount

Pros

- Coverage Options: Offers a variety of coverage options and discounts, allowing customers to tailor their policies to their specific needs.

- Customer Service: Generally good customer service and claims handling, ensuring that customers receive the support they need when filing a claim.

- Financial Stability: Strong financial stability. For more information, read our Nationwide auto insurance review.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors, which could make it less affordable for some customers.

- Limited Availability: Fewer local agents compared to other insurers, which might limit personal service options in some areas.

#7 – Geico: Best for Online Quotes

Pros

- Online Quoting: Easy-to-use online quoting process, allowing customers to quickly obtain and compare insurance quotes.

- Low Rates: As mentioned in our Geico auto insurance review, Geico is known for competitive and often lower rates, making it an attractive option for budget-conscious drivers.

- Customer Satisfaction: Generally high customer satisfaction ratings, indicating that many customers are happy with their coverage and service.

Cons

- Limited Agent Interaction: Less personal interaction due to reliance on online and phone services, which may not appeal to those who prefer face-to-face support.

- Discounts: May offer fewer discounts compared to some competitors, potentially limiting savings opportunities for some customers.

#8 – Farmers: Best for Local Agents

Pros

- Personalized Service: Provides personalized service through local agents, offering customers face-to-face support and assistance.

- Coverage Options: Offers a variety of coverage options. Check out this Farmers auto insurance review to know more details.

- Discounts: Available discounts, including for safe driving and bundling policies, which can help customers save on their premiums.

Cons

- Cost: Premiums can be higher compared to some competitors, potentially making it less affordable for some drivers.

- Customer Service: Some complaints about customer service responsiveness, which could affect the overall customer experience.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

- Discounts: Our Liberty Mutual auto insurance review highlights the variety of discounts they offer, including for bundling policies.

- Financial Stability: Strong financial stability, providing confidence in the company’s ability to pay out claims.

Cons

- Higher Premiums: Premiums may be higher compared to other insurers, which could be a drawback for those looking for the lowest rates.

- Customer Service: Mixed customer service ratings, indicating that some customers may have experienced issues with service or claims handling.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Coverage Options: Offers a wide range of coverage options, ensuring that customers can find a policy that fits their needs.

- Financial Strength: As outlined in our Travelers auto insurance review, the company has strong financial stability, with an A++ rating from A.M. Best.

- Online Services: Convenient online services and tools make it easy for customers to manage their policies and access information.

Cons

- Customer Service: Some Minnesota policyholders have complained about poor customer service and claims handling.

- Cost: Premiums can be higher compared to some competitors, potentially making it less affordable for some drivers.

Secure Affordable Minnesota Insurance Coverage Now

Finding cheap insurance in Minnesota requires comparing companies and doing your research into what raises rates. Serious driving infractions, such as a DUI, will raise your rates substantially.

Read More: Auto Insurance Laws

If you want to find cheap insurance in MN, shopping around for Minnesota auto insurance quotes will help you find which company is the cheapest based on your coverage needs and driving profile. Use our free rate comparison tool to find cheap Minnesota auto insurance rates from companies in your area.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

What are the key factors to consider when choosing the best auto insurance in Minnesota?

When choosing the best auto insurance in Minnesota, consider the factors that affect auto insurance rates, such as coverage options, premium rates, customer service quality, discounts offered, and the company’s financial stability. Comparing quotes from multiple providers can also help you find the most affordable and comprehensive coverage for your needs.

What company has the cheapest auto insurance in Minnesota?

Auto-Owners offers the most affordable rates for minimum coverage in Minnesota, while State Farm has lower rates for full coverage car insurance. However, other providers may be more affordable for you, depending on factors such as age, driving record, ZIP code, and coverage needs.

Why is car insurance expensive in Minnesota?

Minnesota isn’t one of the most expensive states for insurance in the U.S. Rates may be higher for you than for other Minnesota drivers, depending on your driving risk and choice of car insurance company.

What is personal injury protection (PIP) coverage in Minnesota?

Personal injury protection (PIP) auto insurance coverage is a type of auto insurance coverage that helps pay for medical expenses, lost wages, and other related costs resulting from injuries sustained in an accident.

In Minnesota, PIP coverage is required and provides a minimum of $20,000 for medical expenses and $20,000 for non-medical expenses, such as lost wages and replacement services.

How does having a high-risk driver status affect finding the best auto insurance in Minnesota?

High-risk drivers in Minnesota, such as those with a DUI or multiple traffic violations, will face higher premiums and may have fewer options. Companies like State Farm, Progressive, and American Family tend to offer more competitive rates and options for high-risk drivers, including SR-22 certificates.

How much is car insurance in Minnesota?

On average, Minnesota drivers will pay around $100 a month for full coverage car insurance and less than $100 for minimum coverage insurance in Minnesota. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Is auto insurance mandatory in Minnesota?

Yes, auto insurance is mandatory in Minnesota. The state requires all drivers to carry a minimum amount of liability insurance coverage to legally operate a motor vehicle.

What is the recommended coverage beyond the minimum requirements in Minnesota?

While the minimum Minnesota auto insurance coverage is required by law, it is often advisable to consider additional coverages to provide better protection. Some common additional coverages include uninsured/underinsured motorist coverage, personal injury protection (PIP), collision coverage, and comprehensive coverage.

These coverages can help protect you financially in various situations, such as accidents involving uninsured drivers or non-collision-related damages to your vehicle.

Is Minnesota a no-fault state?

Yes, Minnesota has a no-fault auto insurance system.

What are the consequences for not having auto insurance in Minnesota?

Minnesota drivers can face suspended licenses, fines, and more if they don’t carry the required auto insurance in Minnesota. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.