Best Oceanside, California Auto Insurance in 2026

The cheapest auto insurance in Oceanside, CA is from GEICO, and drivers are required to carry the state minimum auto insurance coverage of 15/30/5. However, San Bernardino drivers who can’t afford car insurance may qualify for the California Low-Cost Auto (CLCA) program, which offers very low coverage amounts. Compare Oceanside, CA auto insurance rates online to find the best price for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated September 2024

- Geico has the cheapest auto insurance in Oceanside, CA

- California offers low-cost car insurance for low-income drivers who meet certain requirements

- Auto insurance rates in Oceanside are affected by the young drivers from Camp Pendelton

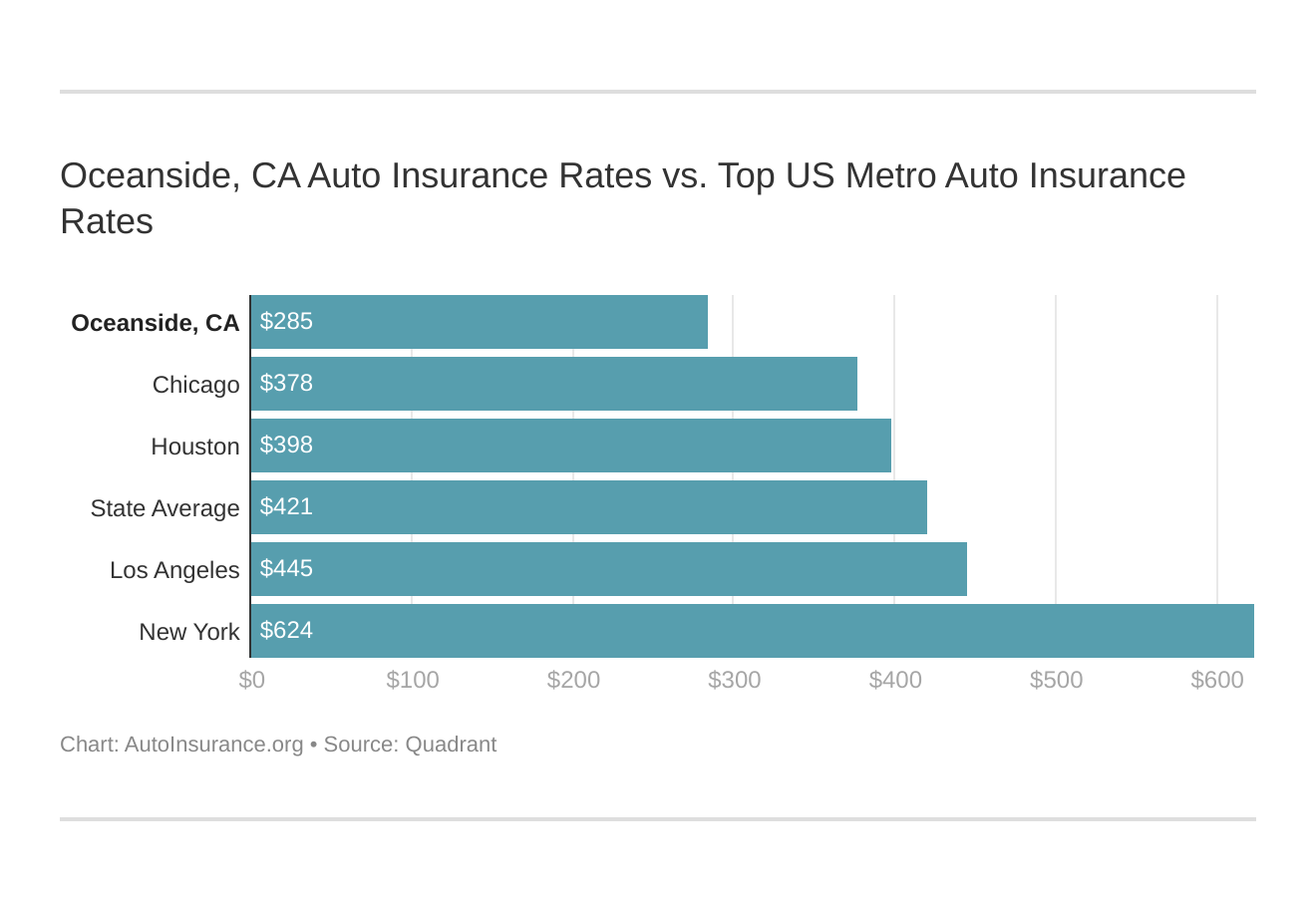

Auto insurance in Oceanside, CA is lower than average for the state but higher than average for the U.S. California auto insurance is among the highest in the nation, but there are ways to bring down those prices.

The best way to find cheap auto insurance is to shop around and compare auto insurance quotes for Oceanside, CA. Each company will charge different rates so compare multiple companies to find the best deal.

Monthly Oceanside, CA Car Insurance Rates by ZIP Code

Find more info about the monthly Oceanside, CA auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Oceanside, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Oceanside, CA against other top US metro areas’ auto insurance rates.

Enter your ZIP code now to find affordable auto insurance in Oceanside, CA.

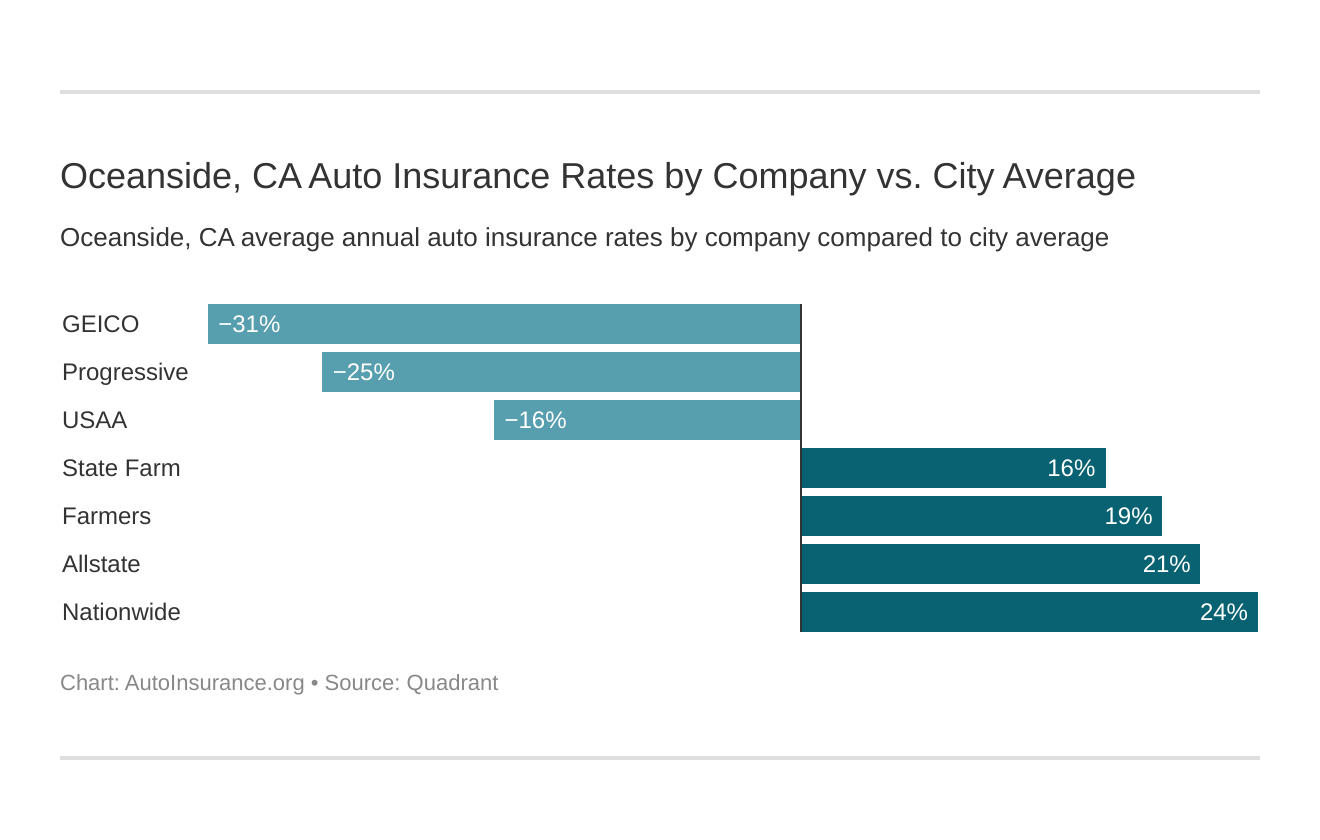

What is the cheapest auto insurance company in Oceanside, CA?

The cheapest auto insurance company in Oceanside, CA is Geico. This is based on average rates, but your personal information can influence those prices.

The cheapest Oceanside, CA car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average California car insurance company rates?” We cover that as well.

The top Oceanside, CA auto insurance companies are:

- Geico – $2,496.15

- Progressive – $2,650.62

- USAA – $2,918.19

- Liberty Mutual – $2,920.07

- Travelers – $3,046.50

- State Farm – $4,007.91

- Farmers – $4,144.73

- Allstate – $4,216.12

- Nationwide – $4,353.31

The best company for you will depend on many different factors, such as age, marital status, driving record, ZIP code, and credit score. California does not allow gender to be used to calculate auto insurance rates.

There is also low-cost auto insurance available for low-income drivers in California. The California Low-Cost Auto (CLCA) program offers very low coverage that is below the state minimum for drivers who meet certain requirements.

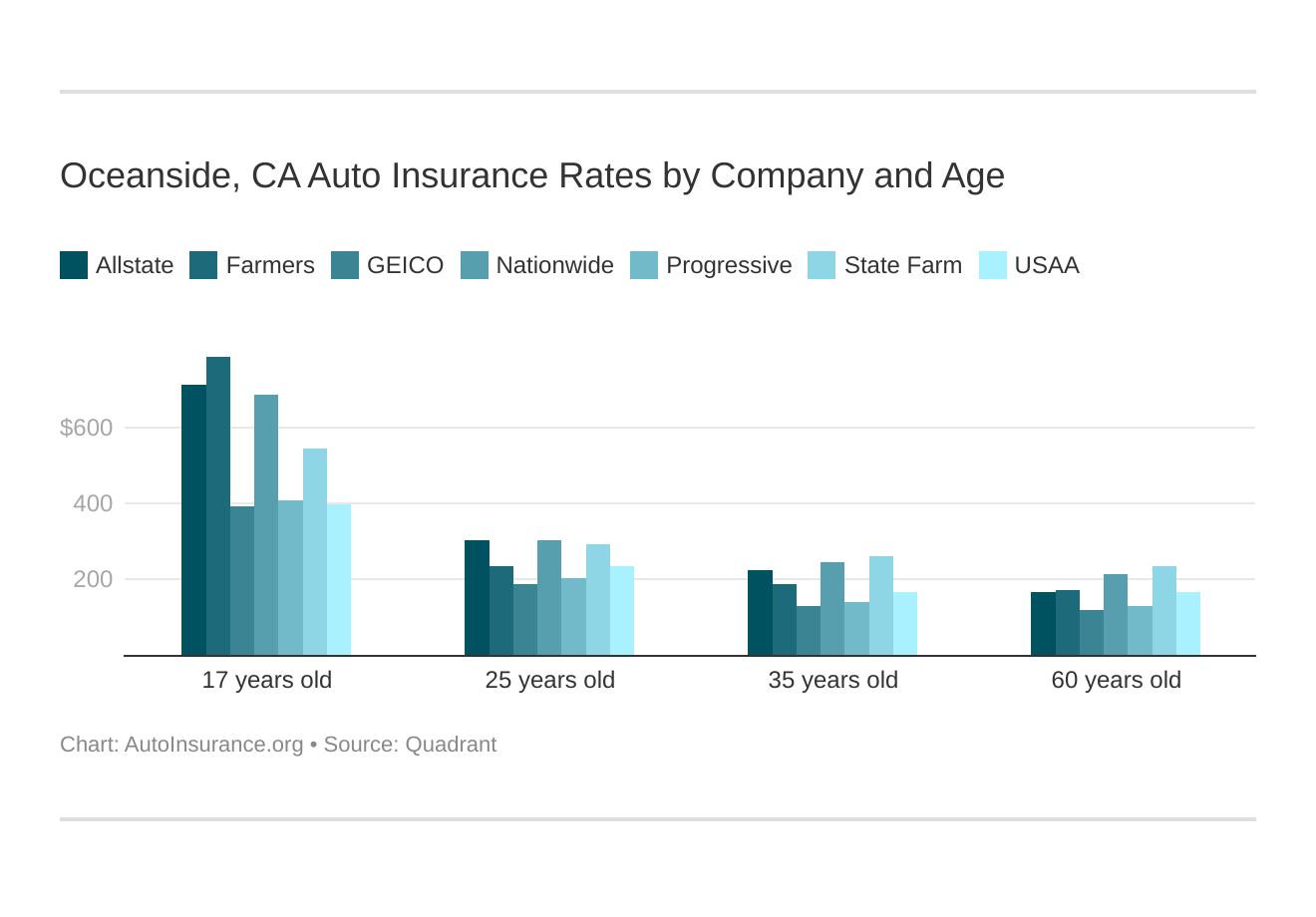

Oceanside, California car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

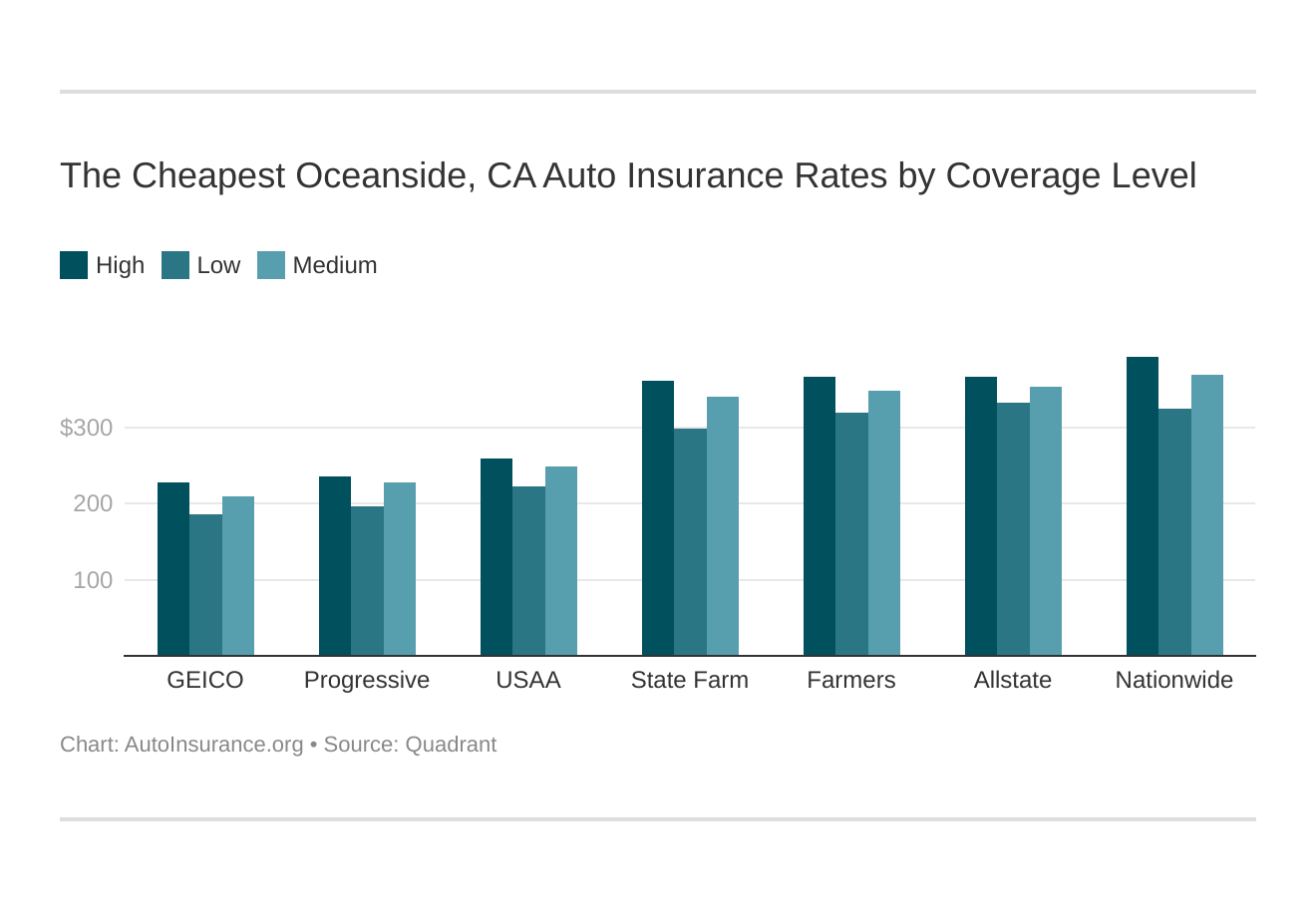

Your coverage level will play a major role in your Oceanside, CA car insurance rates. Find the cheapest Oceanside, California car insurance rates by coverage level below:

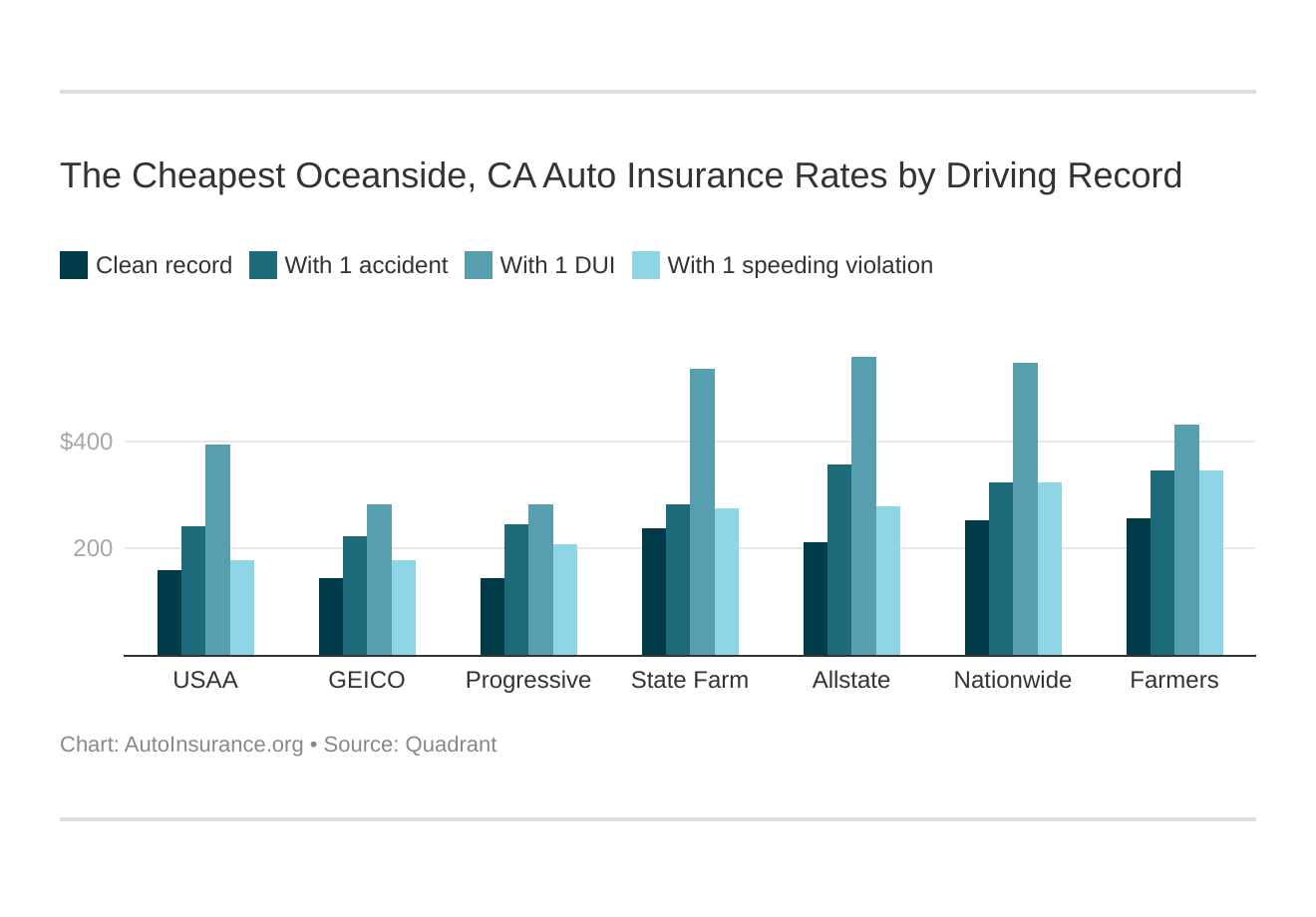

Your driving record will affect your Oceanside car insurance rates. For example, a Oceanside, California DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Oceanside, California car insurance rates by driving record.

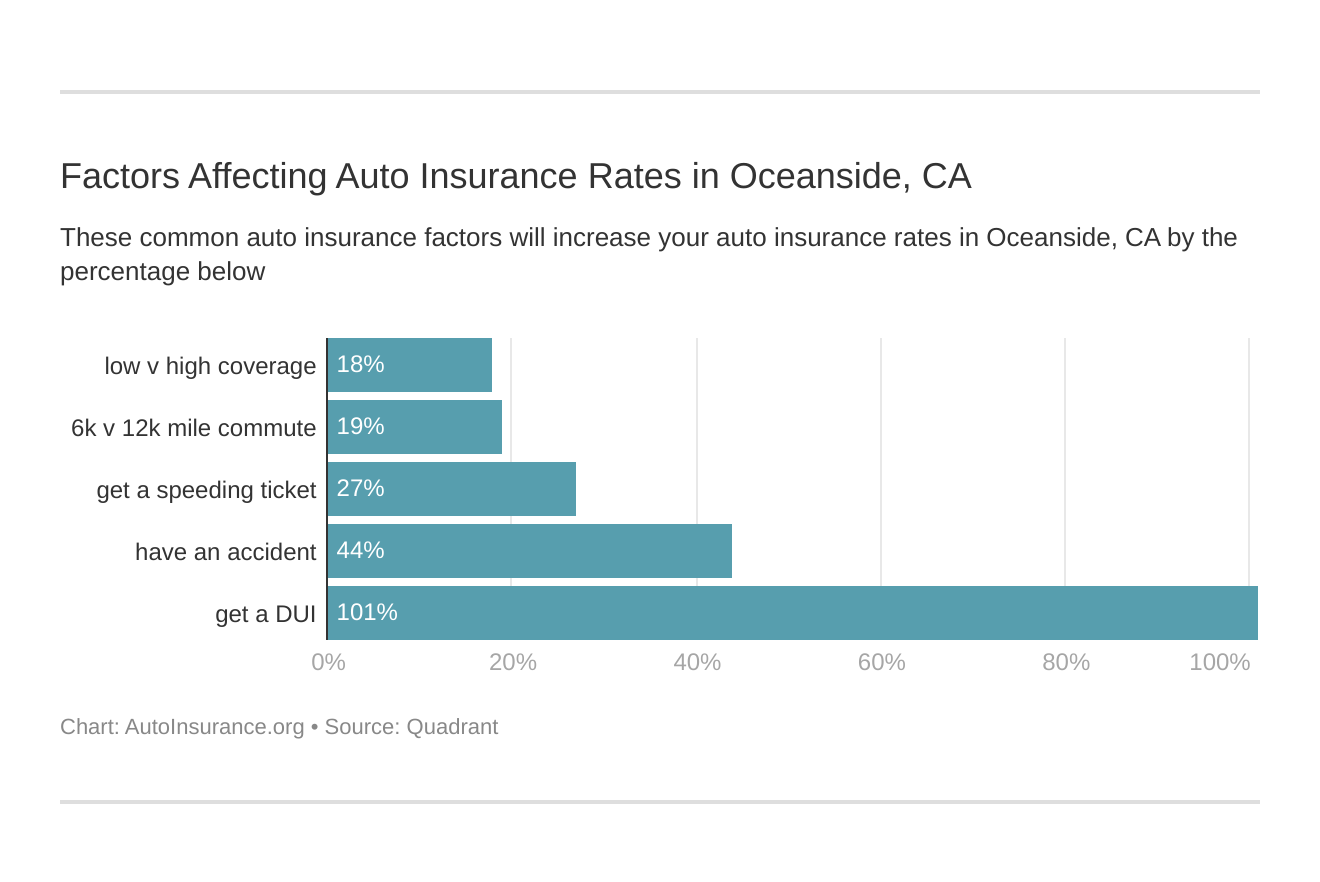

Factors affecting car insurance rates in Oceanside, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Oceanside, California car insurance.

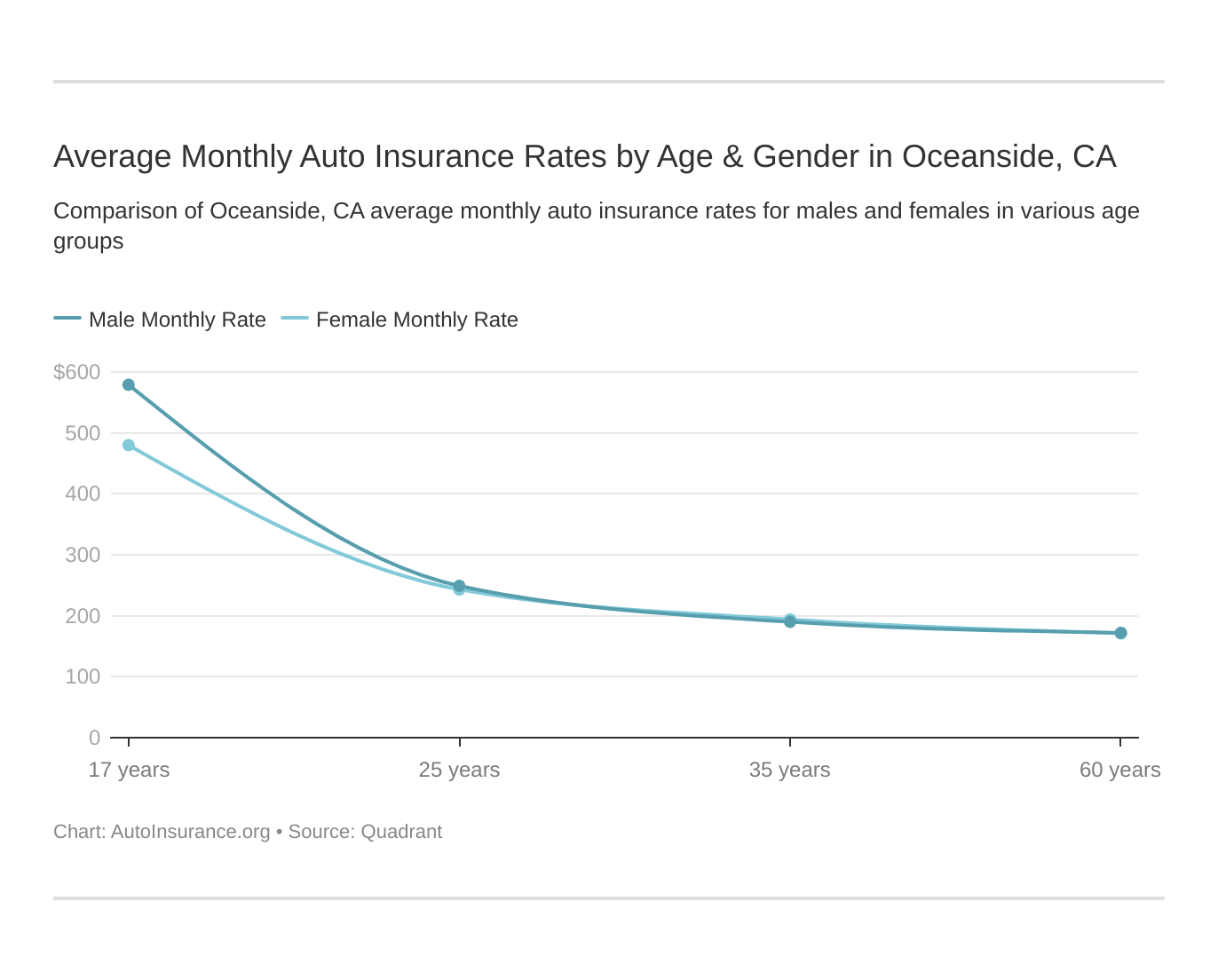

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Oceanside. CA does use gender, so check out the average monthly car insurance rates by age and gender in Oceanside, CA.

What auto insurance coverage is required in Oceanside, CA?

Almost every state requires drivers to carry a certain minimum amount of auto insurance to drive legally.

Oceanside drivers must carry these minimum auto insurance coverages in California:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These minimums are very low, and drivers should consider carrying additional coverages. In a serious accident, these low minimums won’t fully cover you, and you’ll be left to pay out of pocket for anything not covered.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Oceanside, CA?

Oceanside has a lot of drivers on the road, which can mean a higher chance of an accident.

INRIX reports that Oceanside, CA ranks 56th for the most congested city in the country. With Camp Pendleton nearby, there are a large number of young male drivers on the roads. This can also drive up auto insurance prices.

According to City-Data, most commuters travel 20 minutes or less. Most drivers prefer to spend that time alone.

Oceanside had 496 motor vehicle thefts, according to the FBI. The equals about one theft for every 356 people.

Oceanside, CA Auto Insurance: The Bottom Line

Although auto insurance rates in Oceanside, CA are higher than the national average, you can still get good deals. Shopping around will help you see how companies stack up against each other.

Before you buy auto insurance in Oceanside, CA, enter your ZIP code and compare quotes.

Frequently Asked Questions

What is the cheapest auto insurance company in Oceanside, CA?

The cheapest auto insurance company in Oceanside, CA is Geico.

Are there any low-cost auto insurance options for low-income drivers in California?

Yes, low-income drivers in California may qualify for the California Low-Cost Auto (CLCA) program, which offers very low coverage amounts.

What factors affect auto insurance rates in Oceanside, CA?

Factors that can affect auto insurance rates in Oceanside, CA include your ZIP code, driving record, coverage level, tickets, DUIs, and credit.

What auto insurance coverage is required in Oceanside, CA?

Oceanside drivers are required to carry the state minimum auto insurance coverage of 15/30/5, which means $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, and $5,000 property damage liability.

How can I find the best price for auto insurance in Oceanside, CA?

The best way to find the best price for auto insurance in Oceanside, CA is to shop around and compare quotes from multiple companies. Each company will charge different rates, so comparing is essential.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.