Best Tyler, Texas Auto Insurance in 2026 (Check out the Top 10 Companies)

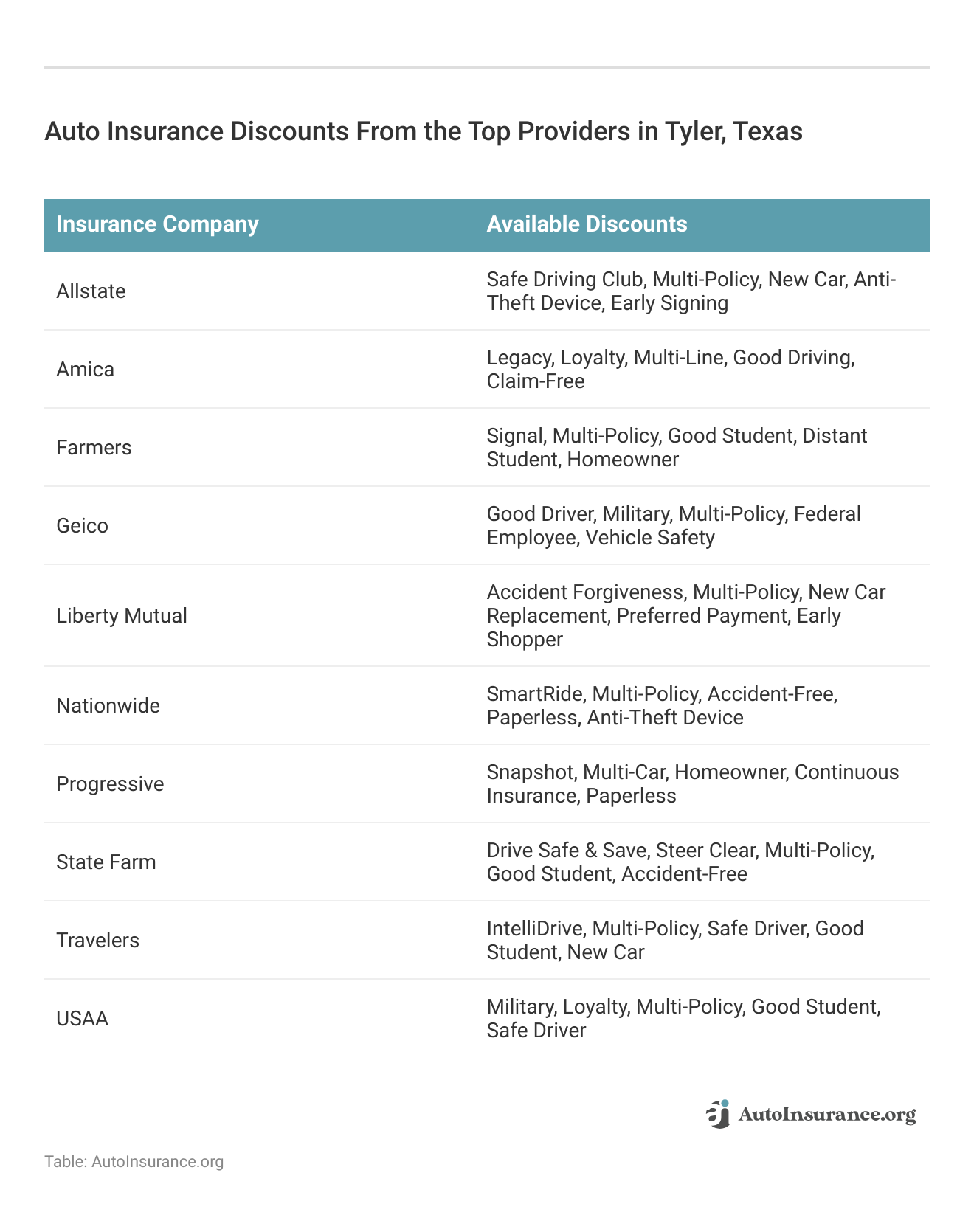

State Farm, Geico, and Progressive are our best and leading insurers for the best Tyler, Texas auto insurance. State Farm stands out with the most competitive rate starting at only $59 per month. These companies offer excellent car insurance options that balance affordability in Tyler, Texas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2024

Company Facts

Full Coverage in Tyler TX

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Tyler TX

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Tyler TX

A.M. Best

Complaint Level

Pros & Cons

Top choices for the best Tyler, Texas auto insurance are State Farm, Geico, and Progressive. Among these, State Farm provides the most competitive rates, with premiums starting at $59 per month.

Compare auto insurance rates in Tyler with those in Corpus Christi, Plano, and Houston to see how they stack up.

Our Top 10 Company Picks: Best Tyler, Texas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% B Comprehensive Coverage State Farm

![]()

#2 22% A++ Competitive Rates Geico

#3 12% A+ Snapshot Program Progressive

![]()

#4 12% A+ Innovative Program Allstate

#5 14% A Accident Forgiveness Liberty Mutual

#6 14% A+ Vanishing Deductible Nationwide

#7 10% A+ Local Agents Farmers

#8 9% A++ IntelliDrive Program Travelers

#9 10% A+ Customer Service Amica

#10 20% A++ Specialized Coverage USAA

Before buying auto insurance in Tyler, Texas, understand “What is auto insurance?“—coverage that protects you financially in case of accidents. Get free quotes by entering your ZIP code above.

- State Farm offers top auto insurance in Tyler, with rates for only $59/mo

- Leading picks provide tailored coverage and discounts for Tyler drivers

- Online tools and 24/7 support ensure easy insurance management

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: Offers some of the lowest monthly premiums starting at $59, making it a top choice for the best Tyler, Texas auto insurance.

- Extensive Network: A large number of local agents in Tyler provide personalized service for the best Tyler, Texas auto insurance experience.

- Bundling Discounts: Provides a 15% discount when bundling auto with other insurance policies, enhancing the value of the best Tyler, Texas auto insurance, which you can discover in our State Farm review.

Cons

- Inconsistent Rates: Premiums can vary widely based on personal factors and driving history, which might affect the consistency of the best Tyler, Texas auto insurance rates.

- Limited Digital Tools: The online management tools and mobile app features are less advanced compared to competitors, impacting the convenience of the best Tyler, Texas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Known for providing some of the lowest rates in the industry, making it a leading option for the best Tyler, Texas auto insurance. Geico’s pricing is highly competitive and appealing to budget-conscious drivers.

- Excellent Mobile App: Comprehensive app for policy management and claims, improving the overall experience of the best Tyler, Texas auto insurance. The app offers easy access to policy details, claims tracking, and roadside assistance.

- Bundling Discounts: Offers a 22% discount for bundling multiple insurance policies, adding value to the best Tyler, Texas auto insurance. This can result in substantial savings when combining auto with home or other insurance types.

Cons

- Limited Local Presence: Fewer local agents in Tyler may affect personalized service and the quality of the best Tyler, Texas auto insurance experience. This can result in less direct, face-to-face support, which you can read more about in our Geico review.

- Variable Customer Experience: Mixed reviews on claims handling could impact satisfaction with the best Tyler, Texas auto insurance. Inconsistent experiences may lead to dissatisfaction with claim resolutions or customer service.

#3 – Progressive: Best for Snapshot Program

Pros

- Innovative Programs: Snapshot program rewards safe driving habits with potentially lower premiums, making it a smart choice for the best Tyler, Texas auto insurance. This program uses telematics to track driving behavior and adjust rates accordingly.

- Bundling Discounts: Provides a 12% discount for bundling auto with other types of insurance, enhancing the best Tyler, Texas auto insurance value. Bundling can make managing multiple policies simpler and more cost-effective.

- Strong Financial Standing: A.M. Best rating of A+ indicates financial stability, essential for reliable best Tyler, Texas auto insurance. This rating suggests Progressive has the resources to handle large claims and unexpected events.

Cons

- Higher Rates for Poor Credit: Rates may be higher for those with poor credit histories, affecting the affordability of the best Tyler, Texas auto insurance. Drivers with lower credit scores might face higher premiums.

- Complex Policies: The range of coverage options can be overwhelming, potentially complicating the search for the best Tyler, Texas auto insurance. Navigating various options may require more time and effort, outlined in our Progressive review.

#4 – Allstate: Best for Innovative Program

Pros

- Innovative Programs: Includes programs like Drivewise, which rewards safe driving with discounts, improving the best Tyler, Texas auto insurance options. Drivewise tracks driving habits and provides feedback to help you save on premiums.

- Comprehensive Coverage: Offers a wide range of coverage options, including unique add-ons, for a customized best Tyler, Texas auto insurance policy. This flexibility allows you to tailor your policy to specific needs and preferences.

- Bundling Discounts: Provides a 12% discount when bundling with other insurance policies, increasing the value of the best Tyler, Texas auto insurance. Combining policies can lead to greater savings and simplified management, as presented in our Allstate review.

Cons

- Higher Premiums: Generally higher premiums compared to some competitors, which may affect the overall affordability of the best Tyler, Texas auto insurance. This could be a concern for drivers seeking lower costs.

- Mixed Customer Service: Quality of customer service can vary by region, leading to inconsistent experiences with the best Tyler, Texas auto insurance. Some customers might experience better service than others, depending on location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers forgiveness for the first accident, helping to prevent rate increases and maintain affordable best Tyler, Texas auto insurance. This feature can help protect your premium after an at-fault accident.

- Customizable Coverage: Wide range of options and add-ons to fit diverse needs, ensuring the best Tyler, Texas auto insurance meets individual requirements. You can select from various coverage levels and additional protections.

- Bundling Discounts: Provides a 14% discount for bundling auto with home or other policies, enhancing the best Tyler, Texas auto insurance value. Bundling can result in substantial savings and streamlined policy management. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Some: Can be more expensive, particularly for drivers with a history of accidents, impacting the affordability of the best Tyler, Texas auto insurance. This could be a drawback for those with a history of claims.

- Limited Local Agents: Fewer local agents compared to other providers, which may affect the personalized service aspect of the best Tyler, Texas auto insurance. This might limit face-to-face interactions and personalized support.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Deductible decreases over time with safe driving, potentially lowering out-of-pocket costs for the best Tyler, Texas auto insurance. This feature rewards safe driving by reducing your deductible incrementally.

- Wide Range of Coverage: Offers various coverage options, including unique add-ons, for a comprehensive best Tyler, Texas auto insurance policy. This flexibility ensures you can find coverage that meets your specific needs, as elaborated in our Nationwide review.

- Good Customer Service: Generally positive feedback for customer service enhances the best Tyler, Texas auto insurance experience. Nationwide’s responsive support can help resolve issues efficiently and effectively.

Cons

- Higher Premiums for Riskier Drivers: Premiums can be less competitive for high-risk drivers, affecting the affordability of the best Tyler, Texas auto insurance. This might make it less appealing for drivers with less favorable risk profiles.

- Limited Discount Options: Fewer discount opportunities compared to some competitors, which may impact the overall savings on the best Tyler, Texas auto insurance. This could result in missed opportunities for additional savings.

#7 – Farmers: Best for Local Agents

Pros

- Local Agents: Strong presence of local agents in Tyler for personalized service and support in finding the best Tyler, Texas auto insurance. This local presence ensures you get tailored advice and assistance, as explored in our Farmers review.

- Bundling Discounts: Provides a 10% discount for bundling with other types of insurance, improving the value of the best Tyler, Texas auto insurance. Bundling can help reduce overall insurance costs and simplify management.

- Good Financial Rating: A.M. Best rating of A+ reflects strong financial stability, crucial for reliable best Tyler, Texas auto insurance. This rating indicates Farmers’ ability to handle large claims and maintain operations.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, affecting the overall affordability of the best Tyler, Texas auto insurance. This could be a concern for budget-conscious drivers.

- Inconsistent Rates: Rates may vary significantly based on individual profiles and driving history, which may affect the stability of the best Tyler, Texas auto insurance. This variability might lead to unpredictable premium changes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Monitors driving to potentially offer lower rates based on driving habits, making it a good option for the best Tyler, Texas auto insurance. The program encourages safe driving and rewards responsible behavior.

- Comprehensive Coverage: Offers extensive coverage options to fit various needs, ensuring the best Tyler, Texas auto insurance meets diverse requirements. Travelers provides a wide array of add-ons and customizable options.

- Bundling Discounts: Provides a 12% discount for bundling auto with other policies, enhancing the overall value of the best Tyler, Texas auto insurance. Bundling can lead to greater savings and simplified policy management, described in detail in our Travelers review.

Cons

- Higher Rates for Poor Credit: Premiums may be higher for drivers with poor credit histories, impacting the affordability of the best Tyler, Texas auto insurance. This could make it less accessible for those with lower credit scores.

- Complex Policy Options: The range of options can be overwhelming, potentially complicating the search for the best Tyler, Texas auto insurance. This complexity might require more effort to navigate and choose the right coverage.

#9 – Amica: Best for Customer Service

Pros

- Exceptional Customer Service: Consistently high ratings for customer service and support, making it a top choice for the best Tyler, Texas auto insurance. Amica is known for its responsive and helpful customer service team.

- Comprehensive Coverage Options: Offers a wide array of coverage options and customizable policies, ensuring that the best Tyler, Texas auto insurance can be tailored to meet individual needs. This flexibility allows for personalized protection.

- Loyalty Discounts: Provides significant discounts for long-term customers, rewarding loyalty with better rates for the best Tyler, Texas auto insurance. This can lead to substantial savings over time. Learn more through our Amica auto insurance review.

Cons

- Limited Availability of Local Agents: Fewer local agents compared to some competitors, which might affect personalized service in Tyler. This could make it harder to access in-person support and advice.

- Higher Rates for Younger Drivers: May have higher premiums for younger drivers, which could impact affordability for those under 25 seeking the best Tyler, Texas auto insurance. This could be a drawback for younger customers looking for lower rates.

#10 – USAA: Best for Specialized Coverage

Pros

- Excellent Customer Service: High satisfaction ratings for customer service, making it a top choice for the best Tyler, Texas auto insurance. USAA is known for its responsive and supportive customer service team.

- Affordable Rates: Offers some of the most competitive rates in the industry, which can lead to significant savings for the best Tyler, Texas auto insurance. This affordability is especially attractive for eligible members.

- Comprehensive Coverage Options: Provides a wide range of coverage options and add-ons, allowing for a highly customizable best Tyler, Texas auto insurance policy. Members can tailor their policies to meet specific needs, as discussed in our USAA review.

Cons

- Eligibility Restrictions: Only available to military members and their families, limiting access to the best Tyler, Texas auto insurance for those outside this group. This restriction can be a significant drawback for those who do not qualify.

- Limited Local Presence: Fewer local agents and physical locations compared to other providers, which may affect the availability of personalized service in Tyler. This can impact the ease of in-person support and assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Affordable Auto Insurance Rates in Tyler, Texas by Coverage Type

Frequently Asked Questions

Is auto insurance mandatory in Tyler, TX?

Yes, auto insurance is mandatory in Tyler, TX, as it is in most states. Texas law requires all drivers to carry minimum liability insurance coverage to legally operate a vehicle on public roads.

What are the minimum auto insurance requirements in Tyler, TX?

In Tyler, TX, the minimum auto insurance requirements are commonly referred to as 30/60/25 coverage.

This means you must have at least $30,000 in bodily injury liability coverage per person, $60,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage. Enter your ZIP code now to begin.

What factors can affect my auto insurance premium in Tyler, TX?

What are the top three auto insurance providers for Tyler, Texas?

The top three auto insurance providers for Tyler, Texas, are State Farm, Geico, and Progressive. These companies are recognized for their competitive rates and quality coverage options.

How much does State Farm’s auto insurance cost per month in Tyler, Texas?

State Farm’s auto insurance costs $59 per month in Tyler, Texas.

This rate is considered highly competitive among local insurance providers. Enter your ZIP code now to begin.

Which auto insurance provider is noted for its competitive rates?

What unique feature does Progressive offer for auto insurance in Tyler?

Progressive offers the Snapshot program, which allows drivers to potentially lower their premiums based on their driving habits. This program rewards safe driving with discounts.

Which provider is highlighted for its accident forgiveness program?

Liberty Mutual is highlighted for its accident forgiveness program.

This feature prevents rate increases after your first at-fault accident, helping to keep premiums stable. Enter your ZIP code now to begin.

What is the A.M. Best rating for Travelers, and what does it signify?

What factors influence auto insurance rates in Tyler, TX?

Auto insurance rates in Tyler, TX, are influenced by factors such as local crime rates, average commute times, and credit history.

These elements can affect the likelihood of claims and overall risk assessment by insurers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.