What an Auto Insurance Specialist Says About Bundling Rates (2026)

Bundling your auto insurance with other policies can save you up to 20% on your auto insurance. Compare multiple rates and save today.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated December 2024

Discounts are everywhere, and everyone wants one. When it comes to car insurance, there is nothing better than to know that you saved a bundle of money when your auto insurance specialist can bundle your rates.

Enter your ZIP code into the FREE quote tool above and see how much you can save on car insurance today!

When shopping for car insurance, you want to find the best coverage as well as the best price you can get. Money does not grow on trees, and sometimes bundling your auto insurance can help save you money by offering a series of discounts.

- When shopping for car insurance, you want to find the best coverage as well as the best price you can get

- If you have more than one vehicle, a home, a boat, and a motorcycle, then bundling your insurance could be the better option

- If you have more than one vehicle that needs to be insured, you are already a candidate for bundling your policies

- Do a little research before deciding upon which company can meet your insurance needs

- Insurance specialists are there to be of assistance to their customers and answer all types of questions

Bundling is Best

Bundling is an insurance company’s way of enticing customers to carry multiple policies with them. By widening their areas of coverage and offering different types of policies, they can draw in a larger customer base.

If you live at home with your parents and only have the need to insure one vehicle, then bundling may not be an option for you.

However, if you have more than one vehicle, a home, a boat, and a motorcycle, then bundling your insurance could be the better option.

Read more: How to Get a Motorcycle Insurance Discount

By bundling your auto, home, and life insurance policies the discounts can really add up.

How much you save per year by bundling is determined by your geographic location, driving record, and overall health. Ask your insurance specialist what your rates would be based on these factors. It could be enough to make you bundle your policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

To Bundle or Not to Bundle – That is the Question

If you have only one car to insure, then bundling is probably not for you since you only need one insurance policy. But if you own a home, have a car, need life insurance, or want to add your teenager’s car to your policy, then bundling may be the best way to save you money.

The amount that is saved by bundling your policies will often depend on how many policies are actually bundled.

The rate for your auto insurance policy may actually be higher than another company, but by bundling your home and auto insurance together, it could actually create a larger discount on your homeowner’s policy, thus creating a lower overall cost to you.

When you bundle your policies, it creates a discount for you. This is because insurance specialists want to attract and keep customers that will remain with their company for years rather than just until their policy expires.

According to a press release by J. D. Powers, insurance customer satisfaction rates have increased this year.

One reason for this is that more and more insurance companies are increasing their areas of policy offerings and the option to receive bigger discounts from bundling multiple insurance policies.

Bundling Your Car Insurance Could Save You Money

If you have more than one vehicle that needs to be insured, you are already a candidate for bundling your policies. Any insurance specialist will tell you that.

A multi-car discount can be automatically applied to your policy when you add a car to an existing account.

Benefits sometimes abound when you bundle. Some insurance companies will offer a single deductible to apply to multiple policies if damage occurred to various insured assets in a single accident.

Caution cannot be thrown to the wind, however, just because you have made the jump to bundle your policies.

Call your auto insurance specialist at least every six months and verify the details of your policy. Rates change all the time. Saving money only happens when you are aware of where your money is going.

A bundling package can sound attractive and easy. But do your homework when picking auto insurance. Call around and inquire of you insurance specialist exactly what they offer.

Not every company will offer the same rates. They might promise you the best quote, but only you can decide which one if for you.

Not every company will offer the same rates. They might promise you the best quote, but only you can decide which one if for you.

The most common bundling is for auto and home insurance policies. Ask your auto insurance specialist if they offer a home and auto-bundling package. Do not assume that they do.

Some insurance companies specialize in only one type of coverage. Other insurance companies will only offer homeowners insurance if that policy is bundled with an auto insurance policy.

Do not assume that they do. Some insurance companies specialize in only one type of coverage. Other insurance companies will only offer homeowners insurance if that policy is bundled with an auto insurance policy.

Consult Your Agent about Bundling Your Policies

Do not be afraid to ask for a discount. No one ever saved any money by being afraid or embarrassed to ask for a lower quote or a discount. If you take the first rate that you are offered, then you could be paying much more than you should.

Not all insurance companies are created equal. Do a little research before deciding upon which company can meet your insurance needs.

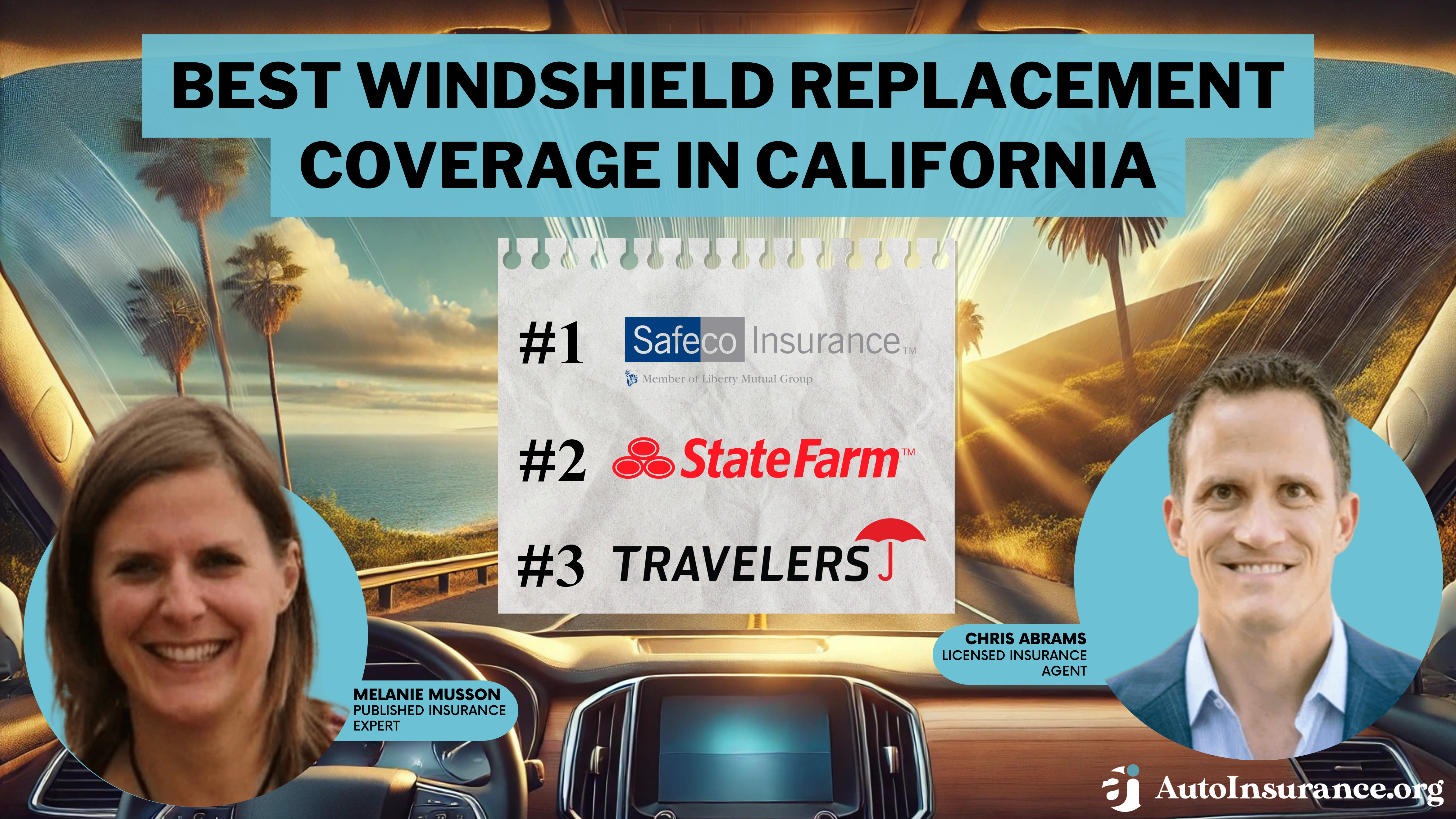

Weiss Ratings found the three best insurance companies in the nation this year to be State Farm Mutual Automobile Insurance Company, Allstate Insurance Company, and Federal Insurance Company.

Part of the reason that these insurance companies scored higher than others is that they offer to bundle packages to their customers.

Their insurance specialists know that by bundling multiple policies, their customers are more likely to renew their policies than to change companies when the new premiums are due.

Rating companies can help shed some light on your search for an insurance company. Ask your insurance agent if their company has been rated and what rate they received. You can always confirm it by doing your own search online.

Another company that conducts business ratings on auto insurance is FitchRating.com. Information is conducted about various companies and assigned a rating based on that company’s risk assessment.

Their areas of coverage consist of auto, home, and life insurance policies as well as other types of coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundle All Your Other Insurance Policies with Your Auto Coverage and Save

There is a myriad of things in our lives that can and need to be insured ranging from boats to cars in addition to our lives to protect our families.

Many insurance specialists will advise you what their company is licensed to insure and can provide rates right over the phone.

The point of bundling is to receive a discount. The more you insure with your insurance company, the more of a discount they can offer to you.

Auto, home, life, and even things like medical and dental insurance can be provided through a single insurance company sometimes.

Larger insurance companies train their insurance specialists to know the benefits of policy bundling and encourage them to offer that service.

It helps to build their company while amassing a larger group of customers who are satisfied with not only their coverage but also their insurance company for taking an interest in keeping their customers happy.

Your Insurance Agent is There to Help

It can be difficult to have an in-depth conversation with a complete stranger on the phone about your possessions and details about your life.

But remember in order to keep those things you care about safe, you will need to open up to you insurance specialist and let them help you.

Insurance specialists are there to be of assistance to their customers and answer all types of questions.

Your questions are not unusual and chances are that they have been asked those same questions by other customers.

Another benefit of bundling multiple insurance policies with one company is the simple fact of having to only deal with that single company. Your policy information is in one database.

When you call, you may speak to a different person each time, but they all have access to the same computer system where you have only one profile.

Bundling Allows You to Pay One Bill for Multiple Policies

Home insurance, auto insurance, life insurance, boat insurance, and other types of insurance can cause anyone a headache when trying to keep track of them all.

If you have multiple policies for your personal property, would it not be much easier to just pay one bill once a month?

Rather than have a slew of bills from a variety of different companies, it is much less complicated to have one set payment per month with one due date. Insurance specialists know this and this is why they often recommend bundling your insurance policies.

When you bundle your policies, it not only simplifies your life but it also helps to ensure that the insurance companies receive their payments for all of your policies promptly.

Often times, customers do not even need to ask about bundling, the insurance specialist will inquire if it may be of benefit to you based on your insurance needs.

The Insurance Information Institute (III) says that another factor that plays into reducing your insurance rate is a good credit score.

Your credit score does not affect the insurance specialist’s ability to bundle your policies, but it does play into giving you another good driver discount.

For a quote on auto insurance, click here to type in your ZIP code in our FREE quote tool finder and see the savings!

Frequently Asked Questions

What is bundling when it comes to auto insurance?

Bundling refers to combining multiple insurance policies, such as auto and home insurance, with the same insurance company. This allows policyholders to manage their insurance coverage conveniently and often leads to potential discounts on premiums.

What are the advantages of bundling auto insurance policies?

Bundling auto insurance policies can offer several advantages:

- Cost savings: Insurance companies often provide discounted rates for bundling policies, resulting in potential savings on premiums.

- Convenience: Managing multiple policies with the same insurer simplifies administrative tasks, such as making payments and handling claims.

- Enhanced coverage: Some insurers offer additional benefits or coverage options when policies are bundled, providing policyholders with more comprehensive protection.

Are there any disadvantages to bundling auto insurance policies?

While bundling has its advantages, there are also some potential disadvantages to consider:

- Limited options: Bundling policies may restrict your options for choosing different insurers or customized coverage for specific needs.

- No guarantee of savings: Although bundling can lead to cost savings, it’s essential to compare bundled rates with standalone policies from different insurers to ensure you’re getting the best deal.

- Changes in circumstances: If you need to make changes to one of your bundled policies, such as cancelling or modifying coverage, it may impact the entire bundle, potentially resulting in higher costs.

Can I bundle my auto insurance policy with any other type of insurance?

Yes, in addition to home insurance, you can often bundle your auto insurance policy with other types of insurance, such as renters insurance, motorcycle insurance, or even life insurance. However, the availability of bundling options may vary depending on the insurance company.

How can I determine if bundling auto insurance policies is the right choice for me?

To determine if bundling is the right choice, consider the following:

- Evaluate your insurance needs: Assess the coverage you require for each policy and determine if bundling provides adequate protection.

- Compare costs: Obtain quotes for bundled policies from different insurers and compare them with standalone policies to ensure you’re getting the best value for your coverage needs.

- Consider flexibility: If you value the ability to customize your coverage or prefer different insurers for specific policies, bundling may not be the ideal option.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.