Indiana Minimum Auto Insurance Requirements (2024)

Indiana requires a minimum of 25/50/25 of bodily injury and property damage coverage. The average rate of auto insurance is around $31.89/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New residents in Indiana must update their car insurance to comply with state requirements within a few weeks of relocating to the area

- Indiana requires its drivers to buy liability insurance and uninsured motorist coverage

- Some auto lenders may have additional requirements that drivers must meet

- Failure to comply with the state’s insurance laws could result in severe penalties

Whether you have recently moved to Indiana or you are thinking about upgrading your auto insurance, you may be interested to learn more about what Indiana’s auto insurance requirements are.

As is true with many other states, Indiana has a minimum car insurance requirement that drivers must comply with.

This requirement is designed to help drivers comply with the financial responsibility law, which makes you responsible for all damages and expenses you create while operating your vehicle.

While many drivers will purchase the minimum amount of auto insurance required by the state, other Indiana drivers opt for additional coverage. You may increase your coverage limits or add new coverage types to enjoy more substantial benefits from your policy.

Compare car insurance quotes to find the best policy for your needs. Enter your ZIP code into our free rate comparison tool above to begin.

How to Read Car Insurance Requirements

Buying auto insurance in this state is relatively easy to do, and it may only take a few hours of your time to shop around and find the best deal available.

However, before you start reaching out to different providers, you need to know what coverage types and limits to request. A closer look at insurance types available may help you to make a more educated buying decision.

- Bodily Injury Liability – Indiana requires its driver to purchase a minimum amount of bodily injury liability insurance. This coverage pays for the healthcare bills and related expenses that you create for other people when you are driving.

- Personal Injury Protection (PIP) / Medical Payments – Drivers in this state can choose to obtain medical payments coverage. This type of coverage pays for your own medical expenses after an accident up to the coverage limit.

- Property Damage Liability – When you damage someone else’s car or property, you are legally responsible for repairs or for a replacement. Property damage liability insurance is a legal requirement in this state, and this coverage pays for the repairs or replacement up to the limit of the coverage.

- Collision Insurance – Your own vehicle may be damaged or destroyed in an accident as well, and this type of coverage pays for your own car’s replacement or repair work. However, it only pertains to damage caused by a collision. Many car lenders require you to have collision or comprehensive insurance at least until the loan balance is paid off.

- Comprehensive Insurance – As is the case with collision auto insurance, comprehensive insurance pays for your own vehicle’s repair work or replacement, and this coverage is effective for losses caused by theft, a collision with an animal, a fire, bad weather, and more.

- Uninsured and Underinsured Motorist Coverage – If you are involved in an accident where the other party flees the scene or are affected by an uninsured or underinsured motorist, this coverage may provide you with financial benefits for your own expenses. Indiana requires drivers to have this type of coverage.

Keep in mind that both the coverage type and coverage limit are important details of your policy. The insurance company will only pay benefits until the coverage limit specified in the policy, so you need to ensure that your limits are high enough to meet your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Coverage for Indiana

Buying car insurance in Indiana can be stressful, and one of your most significant concerns may be related to getting the coverage that is legally required for all drivers. The state’s minimum car insurance requirements include:

- $25,000 for property damage liability insurance

- $25,000 for bodily injury per person and $50,000 per accident

- Uninsured coverage that matches the limits of your liability insurance

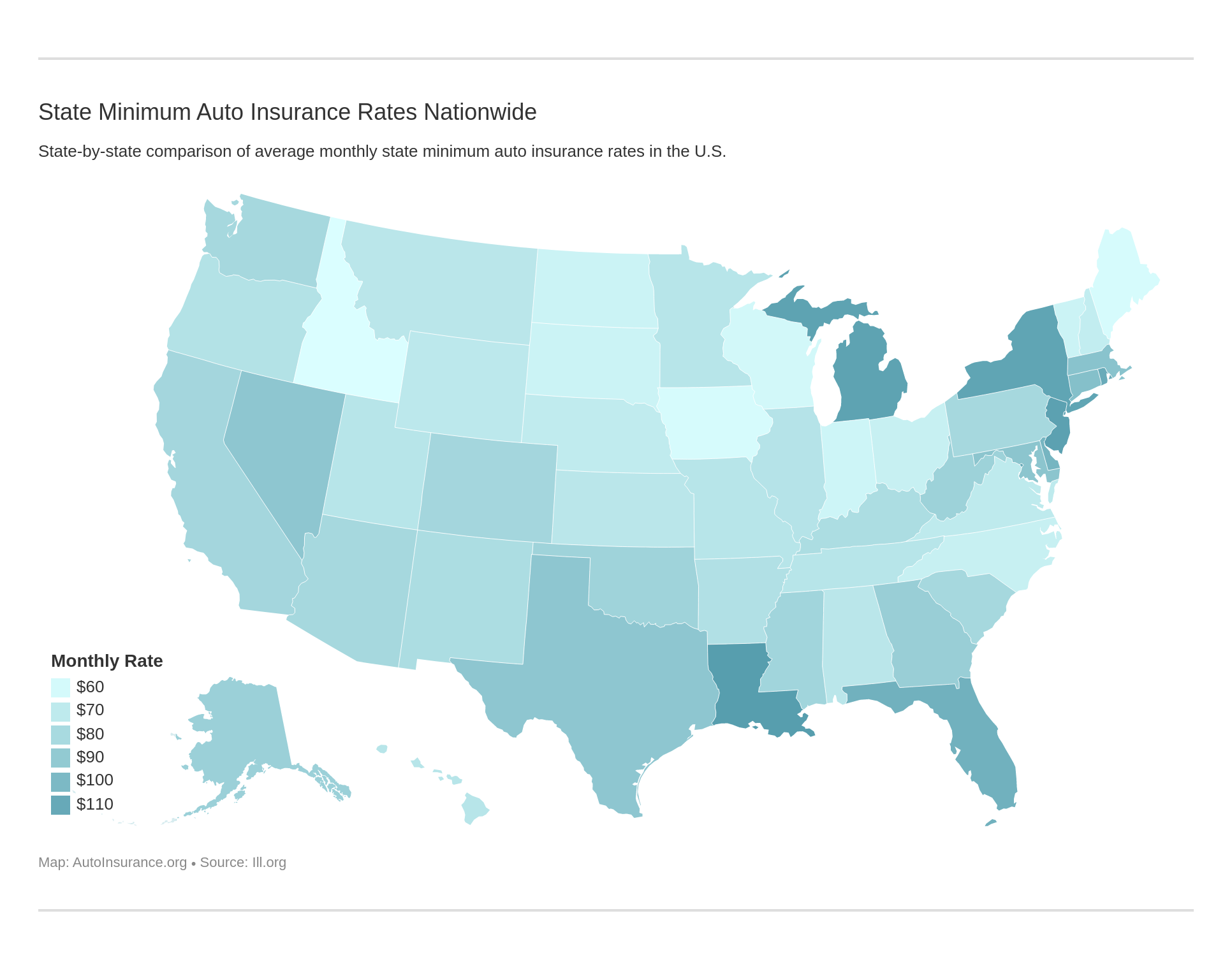

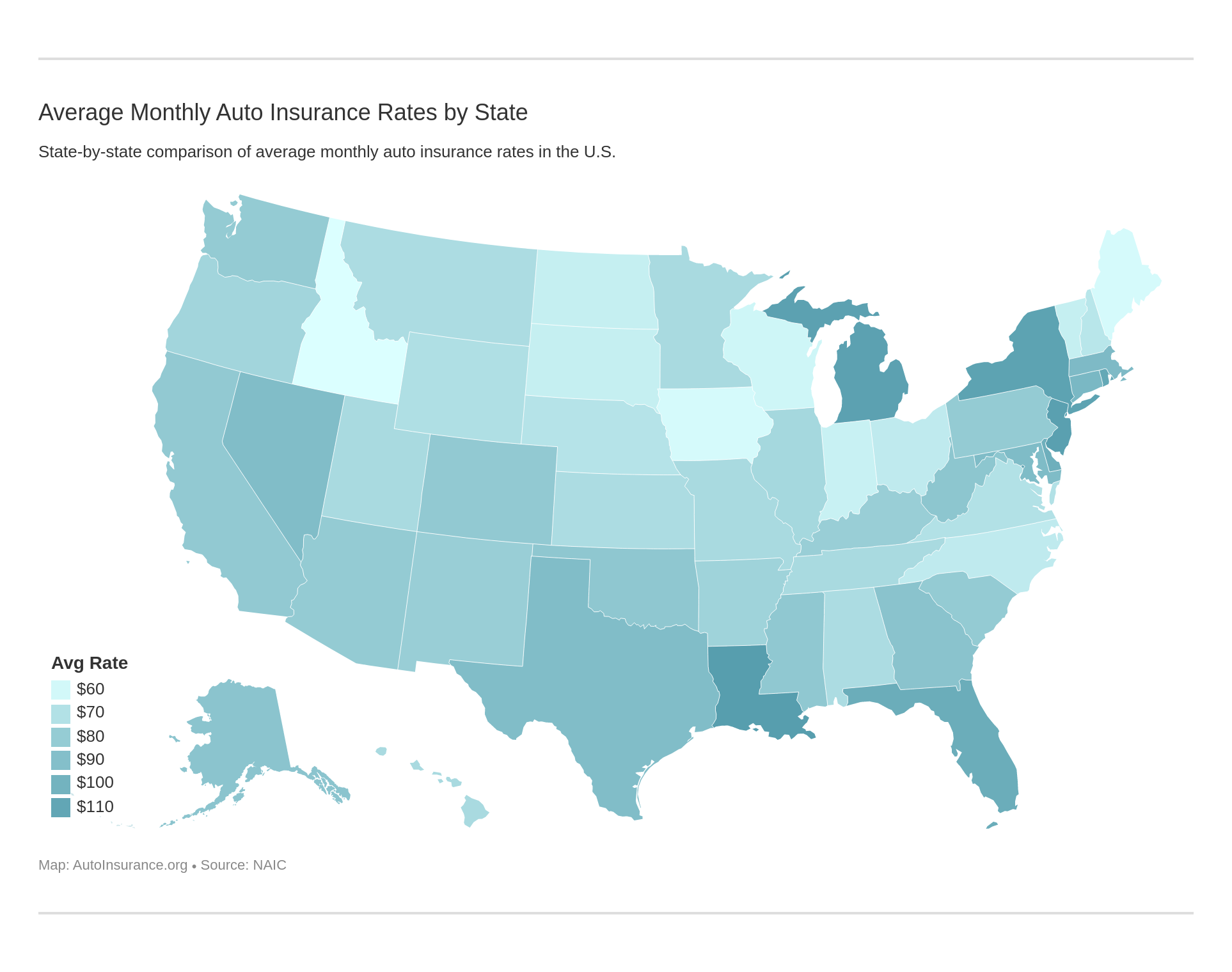

The costs of these minimum coverage policies varies from state to state.

These auto insurance requirements should be met in most cases, but there are instances when other requirements may apply.

For example, if you use your vehicle for commercial purposes or other special purposes, you may need to meet other auto insurance requirements established by Indiana law.

Non-Compliance Penalties

One of the most common instances in which law enforcement officials will discover that you are not compliant with auto insurance requirements in Indiana is when you are cited for a violation.

This citation may be given when you are pulled over for a moving violation or when you are involved in an accident and an officer responds to the scene.

However, the state also uses an electronic database to identify which drivers are not compliant the auto insurance requirement.

Non-compliance with the state’s minimum auto insurance law puts you at unnecessary risk for having to pay significant expenses out of your own pocket. It also could result in the suspension of your driver’s license and the requirement for SR-22 insurance.

This requirement can increase the cost of your auto insurance for several years to come.

Minimum Requirement vs. Recommended Coverage

When you are preparing to shop around and find competitive auto insurance rates in Indiana, you have the choice to request quotes for the minimum amount of insurance required legally or for expanded coverage.

Be aware that any expenses not covered by your policy are still your responsibility.

Overall, these greater coverages increase average rates across the nation.

Some local drivers are concerned about having to pay high out-of-pocket costs after an accident, and this is a prime reason why many drivers in this state choose to buy more than the minimum amount of insurance that is required by Indiana’s laws or by their auto lender.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Getting Your Auto Insurance

Shopping around for rate quotes is a great way to identify potential savings on your car insurance policy in Indiana. Before you shop for new auto insurance in this state, you need to determine how much coverage you want to buy.

Remember that you may need to comply with state requirements and lender requirements, and you may also opt to purchase more than these requirements.

Requesting online quotes is a smart idea, but you do not want to rush around and request quotes from just any providers. Instead, look for providers that are financially solid and that have a great reputation in the industry.

Some drivers will keep their auto insurance coverage in place for years, but you may be able to identify savings on your coverage if you make an effort to shop around every six months.

Compare car insurance quotes today for free by using our comparison tool below. You might be surprised by how much you could save on the coverage you need.

Frequently Asked Questions

What are the minimum auto insurance requirements in Indiana?

In Indiana, the minimum auto insurance requirements are as follows:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured Motorist Coverage: $25,000 per person and $50,000 per accident

- Underinsured Motorist Coverage: $50,000 per person and $50,000 per accident

What is Bodily Injury Liability coverage?

Bodily Injury Liability coverage is designed to cover the medical expenses, lost wages, and legal costs if you injure someone in an accident. The minimum coverage required in Indiana is $25,000 per person and $50,000 per accident.

What is Property Damage Liability coverage?

Property Damage Liability coverage pays for damages to someone else’s property caused by you in an accident. In Indiana, the minimum coverage required is $25,000 per accident.

What is Uninsured Motorist Coverage?

Uninsured Motorist Coverage provides protection if you are injured by a driver who doesn’t have insurance. It covers your medical expenses, lost wages, and other damages. The minimum required coverage in Indiana is $25,000 per person and $50,000 per accident.

What is Underinsured Motorist Coverage?

Underinsured Motorist Coverage kicks in when the at-fault driver’s insurance is insufficient to cover your damages. It helps pay for medical expenses, lost wages, and other damages. In Indiana, the minimum coverage required is $50,000 per person and $50,000 per accident.

Are the minimum requirements in Indiana enough coverage?

The minimum requirements in Indiana are the legally mandated minimums. While they fulfill the state’s requirements, they may not provide adequate protection in all situations. It’s recommended to consider higher coverage limits to better protect yourself financially in the event of an accident.

Can I drive without insurance in Indiana?

No, it is illegal to drive without insurance in Indiana. You must have at least the minimum required insurance coverage in order to legally drive a vehicle.

What happens if I drive without insurance in Indiana?

Driving without insurance in Indiana can result in penalties and consequences, including fines, license suspension, and potential legal liabilities if you are involved in an accident. It’s important to maintain the required insurance coverage to comply with the law.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.