Washington Minimum Auto Insurance Requirements (2024)

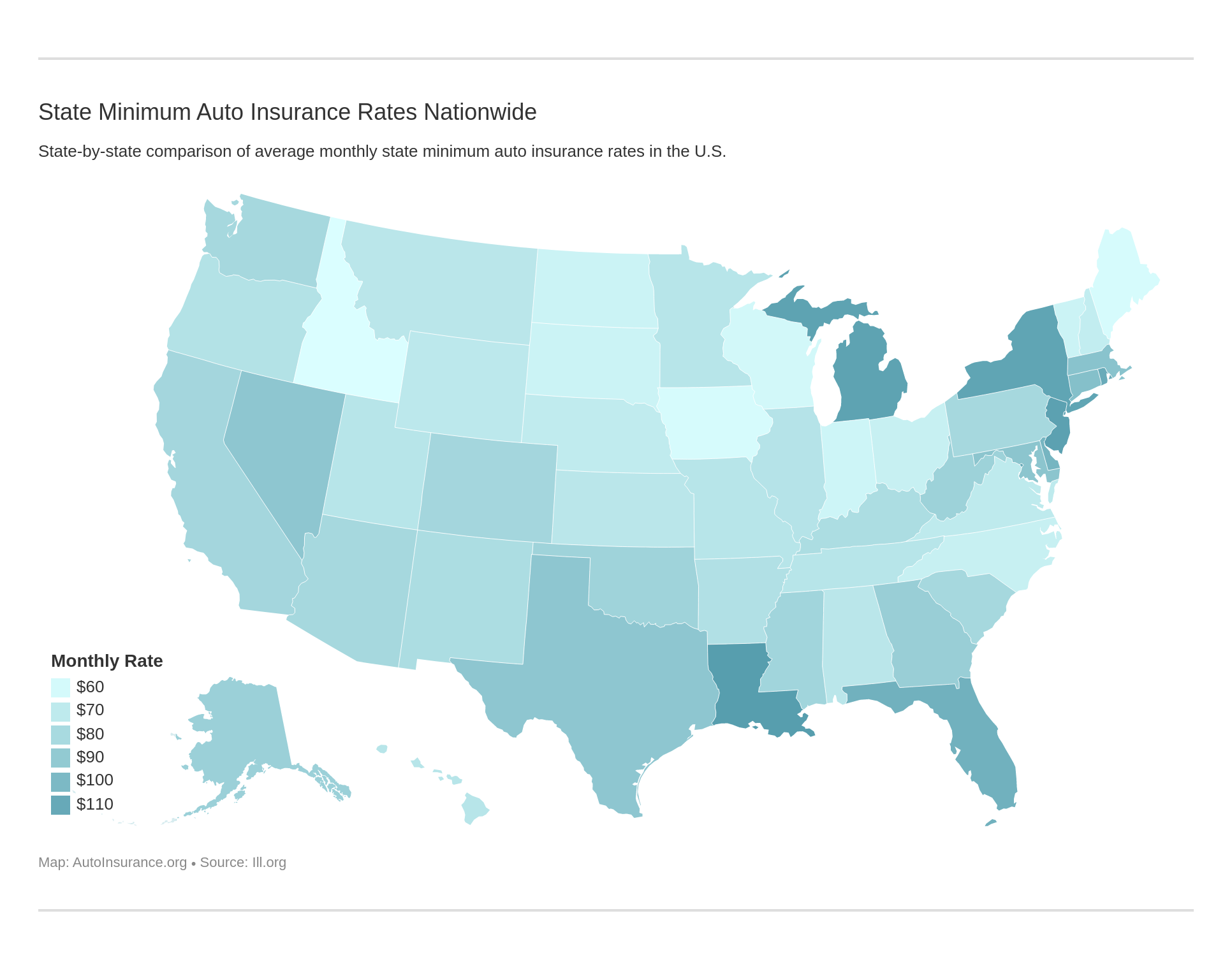

Washington requires a minimum of 25/50/10 for bodily injury and property damage coverage. The average rate for auto insurance is $76.93/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 18, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 18, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- As a licensed driver in the State of Washington, it is your responsibility to be properly insured before getting behind the wheel of any vehicle

- Although all are not mandated under Washington law, there are six specific types of coverage you should be familiar with

- Meeting the minimum car insurance requirements in Washington as set forth by the legislature may not offer you the financial protection you need in the event of an accident

There is no getting around the fact that auto insurance is mandatory in Washington. While there are some exceptions, most motor vehicles are required to be insured with at least minimum coverages as set forth by the state legislature.

Consequently, failure to insure your vehicle per state mandates can have serious consequences, legally as well as financially.

Furthermore, it is your responsibility to understand how these coverages are defined. Yes, you do have to pay for state minimums, but don’t you want to know what you are paying for and why it is in your best interest to get the best coverage possible?

You may stand to lose a great deal if you aren’t adequately insured, so take the time to understand a few basic insurance definitions and how they read on your policy.

Compare car insurance quotes right here to find the coverage you need at the best rate. Enter your ZIP code into our free tool above to get started.

Reading and Understanding Car Insurance Coverages

Many times an insured party reports a claim to their provider only to find that what they thought was covered isn’t, and never was under the coverages they opted for when buying a policy.

Some of the terms used can be a bit confusing because the world of insurance has developed definitions specific to the industry.

For example, do you understand the difference between bodily injury and medical payments? If you aren’t careful, you may not be getting what you think you are paying for!

Before getting comparison quotes on a policy, take the time to read and understand the six basic types of coverage. Some are required and others are optional.

These include:

#1 – Bodily Injury Liability

If you are found at fault for an automobile accident, Bodily Injury Liability will cover up to your personal policy limits for injuries sustained by the driver of the other vehicle and passengers in that vehicle.

Also, BI, as it is commonly referred to in the industry, may cover the cost of legal defense if you are being sued as a result of that accident.

#2 – Medical Payments and/or Personal Injury Protection

When you are found at-fault for an accident which occurred in Washington State, Med Pay or PIP will kick in to cover you, as the at-fault driver, and any passengers in your vehicle. Along with BI, Med Pay and PIP may also cover a pedestrian injured in that accident.

Although PIP is not required under Washington State law, it is required that insurance providers offer you this optional coverage.

Med Pay is specifically designed to cover you, as the driver of your insured vehicle, and any passengers within your vehicle. The main difference between Med Pay and PIP is that PIP also covers injuries sustained when the other driver is all or partially at-fault in an accident.

#3 – Property Damage Liability

Property Damage Liability insurance is that coverage on your policy that pays for damage to the property of another, or others, resulting from an at-fault accident. This is a required coverage in the State of Washington.

#4 – Underinsured (UIM) and/or Uninsured Motorist (UI)

This is a coverage typically kicking in when the other driver is found at least partially at-fault and is uninsured or underinsured.

Only Uninsured Motorist is required by law in Washington while Underinsured Motorist Property Damage, Underinsured Motorist Bodily Injury, and Basic Personal Injury Protection can be rejected, usually by filling out a specific rejection form.

#5 – Collision

Collision is a coverage that provides the replacement value for your vehicle when damaged in a covered accident.

This coverage is not a requirement in the state but it is always a good idea to add this to your policy, especially if you have a high-value vehicle which would be too costly to replace.

Also, most lenders will require you to protect their investment by carrying collision at least equal to the value of the vehicle.

#6 – Comprehensive

Comprehensive coverage is protection against loss or damage to your vehicle resulting from:

- Vandalism

- Theft

- Animal damage

- Natural disasters

- Fire

- Hail

- Floods

- Damage accidents with an animal

What many people are most confused about is the animal damage coverage.

When a deer is hit, for example, you might think you would be filing under your Collision coverage, but you would actually need to file under Comprehensive.

Damage to your vehicle would then be covered by Comprehensive, so if you live in a rural area with greater exposure to animals on roadways, this is a good coverage to opt for.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Coverage under Title 46 RCW

Each state legislates its own insurance laws and in the State of Washington, those would be found in Title 46 of the Revised Code of Washington.

This is the section that deals primarily with motor vehicles, with Chapter 46.29 and Chapter 46.30 dealing specifically with financial responsibility and mandatory liability insurance respectively.

Minimum coverage for vehicles in Washington includes:

- Minimum of $25,000 Personal Injury liability for the first person in one accident.

- Minimum of $50,000 Personal Injury liability in a single accident for multiple people.

- Minimum of $10,000 Property Damage to cover vehicles and/or property in a single accident.

Bear in mind that these are just the minimum coverage you are required to carry by law.

However, many people choose higher limits to protect themselves from being sued in a court of law for amounts not payable under their auto insurance policies.

Also, certain entities are excluded from these requirements.

Government vehicles and self-insured fleets of 26 or more vehicles are excluded as well as those persons or companies that place a $60,000 deposit with the Washington State Treasurer or purchase from a broker a $60,000 Certificate of Deposit.

It is also possible to buy a liability bond for a minimum of $60,000. The security bond provider must be licensed in the state to provide this type of surety.

Why Minimum Coverage May Not Meet Your Personal Needs

While it is understood that the reason most people buy insurance is due to legal requirements, those who go the extra mile with additional and optional coverages are best served.

As the old saying goes, the more you have, the more you have to lose.

Also, Washington is one of the few remaining Contributory Negligence fault states in which any party contributing to the accident may be held at least partially liable (at-fault).

In such a case, the at-fault driver may not be held 100-percent responsible for injuries and property damage. Even pedestrians can be found partially at-fault if it can be proven their actions contributed to the accident.

In some states, you are either at-fault or not-at-fault, but in Washington, you can suffer great losses even if only partially at-fault in an accident.

Even pedestrians can be found to have contributed to the ultimate cause of a collision, which would then revert to your own personal auto insurance policy for restitution.

In the end, you are paying for protection against loss. The actuaries who are tasked with pricing coverage base premiums on risk.

Insurance companies are ultimately the ones with the greatest exposure to risk, and some may be willing to take on higher risks for lower prices.

Take the time to shop around. You never know when you might need a coverage you opted out of, and in times like this, it truly is better to be safe than sorry. Enter your ZIP code into our free rate tool below to get started comparison shopping today!

Frequently Asked Questions

What are the minimum auto insurance requirements in Washington?

In Washington, the minimum auto insurance requirements are as follows:

- Liability coverage: $25,000 for bodily injury or death per person, $50,000 for bodily injury or death per accident, and $10,000 for property damage per accident.

- Uninsured motorist coverage: $25,000 for bodily injury or death per person, $50,000 for bodily injury or death per accident.

- Personal injury protection (PIP): $10,000.

Is it mandatory to have auto insurance in Washington?

Yes, it is mandatory to have auto insurance in Washington. All drivers are required to carry a minimum level of liability insurance coverage to legally operate a vehicle.

What is liability insurance?

Liability insurance is coverage that helps protect you if you cause an accident that results in bodily injury or property damage to others. It helps pay for the injured party’s medical expenses, lost wages, and property repairs.

What is uninsured motorist coverage?

Uninsured motorist coverage is designed to protect you if you are involved in an accident caused by a driver who doesn’t have insurance. It helps cover your medical expenses, lost wages, and other damages resulting from the accident.

What is personal injury protection (PIP)?

Personal injury protection, or PIP, is a type of coverage that helps pay for medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. It provides benefits to you and your passengers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.