Cheap Auto Insurance for College Graduates in 2026 (Save With These 8 Companies!)

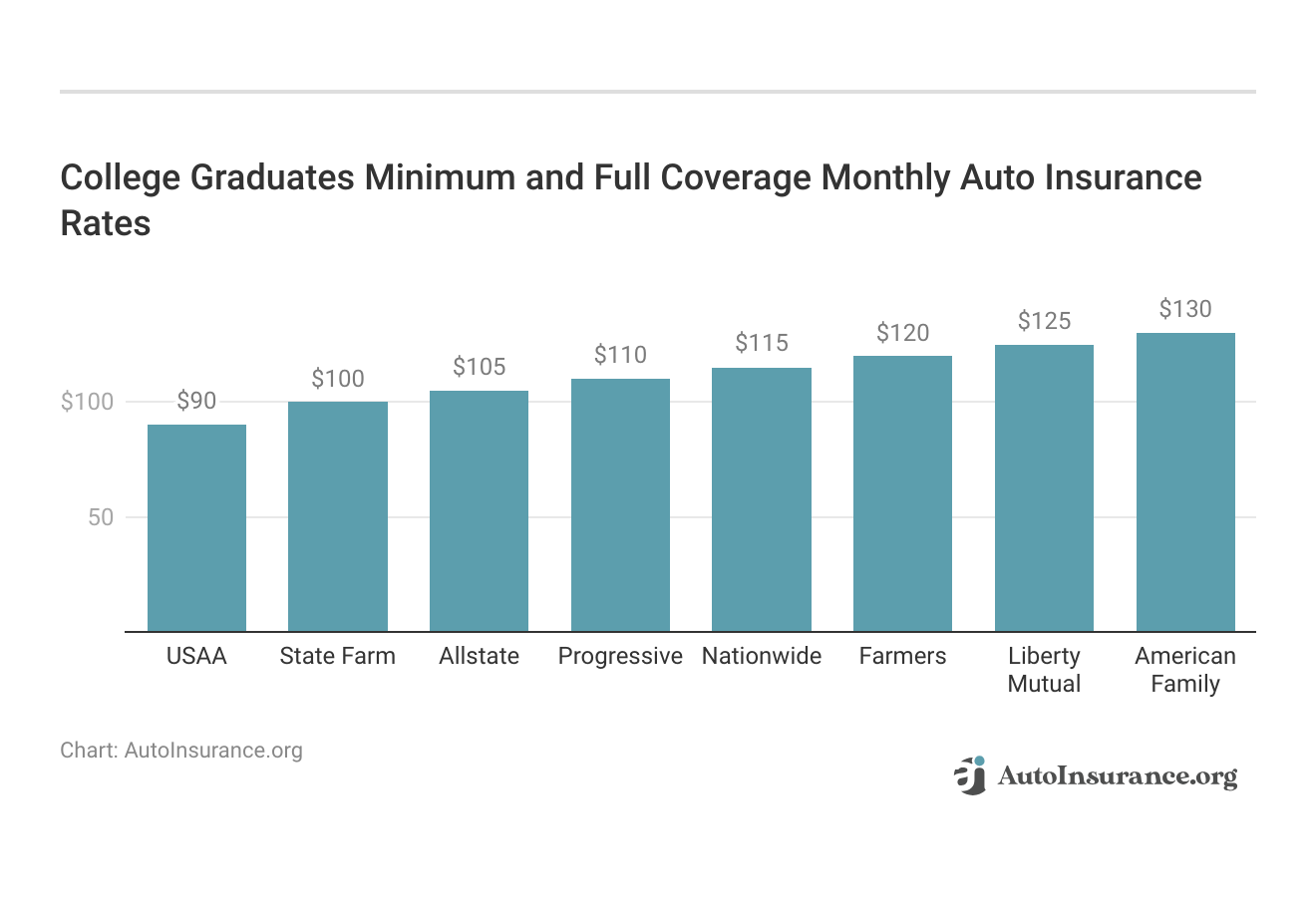

USAA is the top company for cheap auto insurance for college graduates, followed by State Farm and Allstate. At USAA, college graduates pay an average of $60/mo for minimum coverage. However, USAA is only for military members, veterans, and their families, so not all college graduates will qualify.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated April 2025

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for College Graduates

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for College Graduates

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for College Graduates

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsCheap auto insurance for college graduates is at USAA, with State Farm and Allstate’s rates coming in close behind.

Other cheap companies for college graduates are Progressive, Nationwide, and Farmers, as shown in the table below.

Our Top 8 Company Picks: Cheapest Auto Insurance for College Graduates

| Company | Rank | Monthly Rates | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $46 | 10% | Military Savings | USAA | |

| #2 | $60 | 17% | Local Agents | State Farm | |

| #3 | $77 | 12% | Budgeting Tools | Progressive | |

| #4 | $78 | 25% | Loyalty Discount | American Family | |

| #5 | $81 | 20% | Vanishing Deductibles | Nationwide |

| #6 | $98 | 15% | Add-On Coverages | Farmers | |

| #7 | $102 | 25% | Bundling Policies | Allstate | |

| #8 | $119 | 20% | Usage Discount | Liberty Mutual |

Read on to learn about the best auto insurance companies for college graduates, as well as tips on how to save on insurance with college graduate car insurance discounts and more.

- USAA has the best car insurance for recent graduates from college

- State Farm and Allstate also have affordable car insurance for college graduates

- College graduates should apply for discounts to maximize savings

#1 – USAA: Best Overall

Pros

- Cheap average rates: USAA has the most affordable car insurance for recent graduates.

- Customer service: USAA’s customer service is highly rated. Learn more in our USAA auto insurance review.

- Usage discount: USAA’s SafePilot program rewards safe drivers with a discount, so college graduates may be able to lower their rates after participating in the program.

Cons

- Limited eligibility: USAA is only sold to veterans, military members, and their families.

- Fewer local branches: USAA doesn’t have many physical locations to visit.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best For Local Agents

Pros

- Agent network: State Farm’s local agent network makes it simple for college graduates to find an in-person agent in their area.

- Financial stability: State Farm’s financial stability ratings are high, making the company less likely to raise insurance rates due to financial distress.

- Multiple discounts: College students have a variety of State Farm auto insurance discounts to choose from, from safe driving discounts to multi-policy discounts.

Cons

- Reviews are mixed: State Farm’s customers aren’t always happy with State Farm’s claims handling. Learn more in our State Farm review.

- Discount availability may be limited: State Farm’s discounts may not be available in a college graduate’s area.

#3 – Allstate: Best For Bundling Policies

Pros

- Usage discount: Allstate Drivewise offers a discount for safe driving to college graduates who participate in the program. Learn more in our Allstate Drivewise Review.

- Coverage options: Allstate’s various auto insurance coverages allow college graduates to customize coverage to fit their needs.

- Discount options: In addition to its usage-based discount, Allstate offers plenty of other discounts that college graduates can take advantage of.

Cons

- Reviews are mixed: Allstate has mixed claims reviews from customers.

- Expensive for high-risk drivers: While college graduates with a clean driving record will find affordable rates at Allstate, drivers with poor records may not find the cheapest rates at Allstate.

#4 – Progressive: Best For Budgeting Tools

Pros

- Budgeting tool: The NameYourPrice tool at Progressive helps college graduates see how much coverage they can afford on their budget.

- Usage discount: Progressive’s Snapshot program will help lower rates of college graduates who drive safely in the program (read more: Progressive Snapshot Review).

- Coverage options: Progressive’s selection of auto insurance coverages allows college graduates to purchase full protection and add-ons as needed.

Cons

- Reviews are mixed: A few of Progressive’s customer reviews are negative regarding claims processing at Progressive. Learn more in our Progressive review.

- Snapshot can raise rates: If college graduates perform poorly in the Snapshot program, they may see a rate increase instead of a discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best For Vanishing Deductibles

Pros

- Vanishing deductibles: College graduates who stay accident and ticket-free will see a decrease in their deductibles over time.

- Usage discount: SmartRide can help college graduates save. Learn how in our Nationwide SmartRide app review.

- Strong financial stability: Nationwide’s financial ratings help ensure it can pay out claims and keep rates reasonable.

Cons

- Limited availability: Auto insurance from Nationwide is not available in a select handful of states. Read more: Nationwide Auto Insurance Review

- Higher rates for high-risk drivers: College graduates with a DUI or similar on their driving record likely won’t find the cheapest insurance at Nationwide.

#6 – Farmers: Best For Add-On Coverages

Pros

- Coverage options: Farmers’ add-on coverage selection allows college graduates to personalize their coverage easily.

- Usage discount: College graduates can participate in Farmers’ Signal program to try and earn a discount (learn more: Farmers Signal Review).

- Multiple discounts: Farmers offers other discounts besides Signal, such as multi-policy and payment-in-full discounts.

Cons

- Negative customer reviews: Farmers has some negative customer satisfaction reviews (learn more in our Farmers auto insurance review).

- Fewer add-on coverages: Farmers doesn’t have a few add-on coverages, such as gap insurance.

#7 – Liberty Mutual: Best For Usage Discount

Pros

- Usage discount: College graduates may be able to earn a significant discount by doing well in Liberty Mutual’s RightTrack program (learn more: Liberty Mutual RightTrack Review).

- Coverage options: Liberty Mutual offers plenty of auto insurance coverages for drivers to pick from. Read more in our full Liberty Mutual auto insurance review.

- Discount options: In addition to RightTrack, Liberty Mutual also offers multi-policy discounts, multi-car discounts, and more.

Cons

- Mixed customer reviews: Liberty Mutual’s claims processing had some negative reviews from customers.

- Rates may be higher for some drivers: Liberty Mutual may not be the cheapest auto insurance company for college graduates with poor driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best For Loyalty Discount

Pros

- Loyalty discount: American Family offers loyalty discounts to customers who have been with the company for a set period of time.

- Ease of use: American Family’s app is well-rated, and its website is easy to use.

- Coverage options: American Family has a good coverage selection for college graduates to choose from. Learn more about its coverage options in our American Family auto insurance review.

Cons

- Limited availability: American Family’s auto insurance is not available in every state.

- Mixed reviews: American Family has a few negative customer reviews.

Auto Insurance Rates for College Graduates

After graduating from college, it probably seems like the last thing you would ever want to do is more research. However, understanding how auto insurance premiums are developed is an important step in finding a policy that fits your budget and meets your personal needs.

Also, having that understanding gives you the capability of researching the best auto insurance for recent college graduates on your own.

Insurance companies take your age, location, driving record, and sometimes even your credit history into account when determining your auto insurance rates.

Obviously, some of the factors that affect auto insurance rates are beyond your control, but there are still plenty of things you can do to directly lower your premiums as a recent college graduate.

For example, maintaining a clean driving record can reduce premium rates quite a bit. In addition, maintaining a clean, spotless credit score, especially after college, can also reduce rates.

How much should you expect to pay for auto insurance as a recent college grad? Find out in the table below, which displays the average auto insurance rates for college graduates.

Remember, these rates are simply guidelines. Your individual rates will vary depending on a variety of different factors. Keep reading to learn exactly what those are.

Factors that Affect Auto Insurance Rates for College Graduates

From where you live and park your car at night to how much you drive your vehicle, there are many factors that dictate premium rates. What is the average price for auto insurance?

For most people, the average cost for a full year of auto insurance is around $850. However, for a recent college graduate, you now know that price is higher.

One major reason for this is because of your age. In America, drivers under the age of 25 pay much higher premiums than their older counterparts.

According to EducationData, 70 percent of students enrolled in American college are between the ages of 18 and 21, and the average graduation age is 23.

The fact that you are young will inevitably increase the rate you pay for auto insurance. To insurance companies, age correlates to driving experience. More experienced drivers are less likely to get into an accident or file claims. To mitigate the risk you pose, insurance providers offer you higher rates. Other factors that will impact your auto insurance rates as a college graduate are your driving record, your ZIP code, and your credit history.

Maintaining a good driving record is essential for college graduates, as it helps prove they are responsible drivers. The odds of drivers with a clean record getting into frequent accidents are much lower than drivers with a spotty record.Dani Best Licensed Insurance Producer

Another factor to consider is where you live. Depending on your location, you may have higher premiums. Urban areas typically have higher theft and vandalism occurrences than others do, so residents in larger cities normally pay higher auto insurance premiums.

Finally, your credit score can impact your auto insurance premium. The lower your credit score, the higher the risk an insurance company views you, which results in higher rates.

Making sure your credit score is as high as possible will help reduce your monthly premium costs. If you have to make student loan payments, being on time every month will help you build your credit history.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Companies with the Best Car Insurance for College Graduates

You’ve learned about the many variables insurance companies consider when determining your auto insurance rates, but it’s also important to note that every company uses completely different formulas.

Therefore, the best auto insurance company for one college graduate will not necessarily be the best for everyone else.

Thankfully, you are a recent college graduate and can relatively dictate where you land your first job. If possible, do some research about potential areas where you may work and find out prices for auto insurance in those areas before moving.

Geico and State Farm tend to have some of the most competitive rates for younger drivers. USAA also offers decent premiums if you’re under the age of 25.

However, USAA is a military company, so only active or retired military personnel and their families are eligible to use that company.

Ultimately, the only way you can be certain you’ve found the best company for you is by comparison shopping. Seek out quotes from multiple different companies and compare the totals. But don’t forget to also look into customer reviews and the specific policy details.

Auto Insurance Discounts for College Graduates

There are a ton of potential auto insurance discounts that college graduates should take advantage of. However, there are a few things you should keep in mind.

For one thing, not every discount will be available through every company. Also, some discounts will not be advertised on a company website, so you’ll have to ask an agent about the availability and details.

In the following tables, we show discounts applicable to college graduates that are available by company.

Below, take a look at various discounts that are applicable to you specifically, as both the policy holder and as a recent graduate.

College Graduates Auto Insurance Discount

Insurance Company Safe Driver Discount

25%

25%

30%

20%

40%

30%

![]()

25%

![]()

30%

To ensure you receive every possible discount, write down anything you believe you are eligible for and ask an agent about each one.

Read more: How to Get an Alumni Auto Insurance Discount

Your auto insurance company views in terms of risk, so providing further safety for your driving situation lowers that risk factor. After a while, the savings really start to add up.

As it turns out, insurance companies also favor certain car models over others. The car you drive can lower or increase your auto insurance rates.

By figuring out the best car for a college graduate, you will have a better idea of which models to stay away from to keep insurance rates low. For example, cars that statistically are vandalized or stolen more will yield higher insurance rates.

In particular, seek out vehicles that are inexpensive to repair and that have great safety ratings. Consider installing safety equipment in your vehicle to help reduce your premium rates even more. Installing an alarm system in your vehicle would meet these criteria.

There are also many courses on safe driving you can volunteer to take. Some companies will, in turn, provide you with a discount.

For example, the American Association for Retired Persons offers a driver safety course that many insurance companies give discounts for taking.

If you don’t drive very much, or if you plan on working from home, ask about low-mileage discounts. If at all possible, consider using public transportation when you can. By reducing the amount of driving you do, you can help lighten the load of your premium.

How to Find the Best Auto Insurance for College Graduates

As a young college graduate, finding affordable auto insurance can be difficult, but there are a few things you can consider to reduce your premium rates. The first step is to decide how much you are willing to pay for your insurance policy.

If budget is your primary concern, a basic auto insurance policy that simply meets your state’s legal minimum requirements will suffice. According to the Insurance Information Institute, most states require you to carry only liability insurance.

To help you better understand common policy types and abbreviations used when discussing auto insurance limits, we’ve taken the time to define the most relevant terms for you. Check them out in the table below.

Common Auto Insurance Policy Definitions

| Abbreviation | Meaning | Definition |

|---|---|---|

| BI | Bodily Injury | Covers bodily injury damage for the other driver in an accident you are found liable for. |

| PD | Property Damage Liability | Covers property damage for the other driver in an accident you are found liable for. |

| PIP | Personal Injury Protection | Covers your medical expenses, lost wages, and other damages when involved in an accident. |

| UM | Uninsured Motorist | Covers damages to your vehicle if you are hit by a driver without auto insurance. |

| UIM | Underinsured Motorist | Covers damages to your vehicle if you are hit by a driver with an insurance policy that does not meet the state's minimum legal standards. |

You’ll see these abbreviations when you start comparing policies from different companies, or when you look into the auto insurance legal limits by state.

Now you can better understand the specific legal auto insurance limits for your state in the table below.

Minimum Legal Auto Insurance Requirements by State

| State | Minimum BI & PD Liability Limits | Required Insurance Policies |

|---|---|---|

| Alabama | 25/50/25 | BI + PD Liability |

| Alaska | 50/100/25 | BI + PD Liability |

| Arizona | 15/30/10 | BI + PD Liability |

| Arkansas | 25/50/25 | BI + PD Liability, PIP |

| California | 15/30/5 | BI + PD Liability |

| Colorado | 25/50/15 | BI + PD Liability |

| Connecticut | 25/50/20 | BI + PD Liability, UM, UIM |

| Delaware | 25/50/10 | BI + PD Liability, PIP |

| District of Columbia | 25/50/10 | BI + PD Liability, UM |

| Florida | 10/20/10 | BI + PD Liability, PIP |

| Georgia | 25/50/25 | BI + PD Liability |

| Hawaii | 20/40/10 | BI + PD Liability, PIP |

| Idaho | 25/50/15 | BI + PD Liability |

| Illinois | 25/50/20 | BI + PD Liability, UM, UIM |

| Indiana | 25/50/25 | BI + PD Liability |

| Iowa | 20/40/15 | BI + PD Liability |

| Kansas | 25/50/25 | BI + PD Liability, PIP |

| Kentucky | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Louisiana | 15/30/25 | BI + PD Liability |

| Maine | 50/100/25 | BI + PD Liability, UM, UIM, Medpay |

| Maryland | 30/60/15 | BI + PD Liability, PIP, UM, UIM |

| Massachusetts | 20/40/5 | BI + PD Liability, PIP |

| Michigan | 20/40/10 | BI + PD Liability, PIP |

| Minnesota | 30/60/10 | BI + PD Liability, PIP, UM, UIM |

| Mississippi | 25/50/25 | BI + PD Liability |

| Missouri | 25/50/25 | BI + PD Liability, UM |

| Montana | 25/50/20 | BI + PD Liability |

| Nebraska | 25/50/25 | BI + PD Liability, UM, UIM |

| Nevada | 25/50/20 | BI + PD Liability |

| New Hampshire | 25/50/25 | Financial Responsibility only |

| New Jersey | 15/30/5 | BI + PD Liability, PIP, UM, UIM |

| New Mexico | 25/50/10 | BI + PD Liability |

| New York | 25/50/10 | BI + PD Liability, PIP, UM, UIM |

| North Carolina | 30/60/25 | BI + PD Liability, UM, UIM |

| North Dakota | 25/50/25 | BI + PD Liability, PIP, UM, UIM |

| Ohio | 25/50/25 | BI + PD Liability |

| Oklahoma | 25/50/25 | BI + PD Liability |

| Oregon | 25/50/20 | BI + PD Liability, PIP, UM, UIM |

| Pennsylvania | 15/30/5 | BI + PD Liability, PIP |

| Rhode Island | 25/50/25 | BI + PD Liability |

| South Carolina | 25/50/25 | BI + PD Liability, UM, UIM |

| South Dakota | 25/50/25 | BI + PD Liability, UM, UIM |

| Tennessee | 25/50/15 | BI + PD Liability |

| Texas | 30/60/25 | BI + PD Liability, PIP |

| Utah | 25/65/15 | BI + PD Liability, PIP |

| Vermont | 25/50/10 | BI & PD Liab, UM, UIM |

| Virginia | 25/50/20 | BI + PD Liability, UM, UIM |

| Washington | 25/50/10 | BI + PD Liability |

| West Virginia | 25/50/25 | BI + PD Liability, UM, UIM |

| Wisconsin | 25/50/10 | BI + PD Liability, UM, Medpay |

| Wyoming | 25/50/20 | BI + PD Liability |

You must carry at least the minimum level of auto insurance the state you live in requires.

However, if you drive a newer vehicle, or if you are financially unable to replace your current vehicle in the event of a total loss, you might consider investing in a fuller coverage policy.

Collision and comprehensive insurance are two of the most common additional policies drivers choose to purchase.

Both collision and comprehensive policies have deductibles associated with them. If you get into an accident or if a hail storm dents up your car, your deductible is how much you pay out of pocket before your insurance kicks in.

Depending on your financial situation, you may be able to afford a high deductible, which in turn would lower your monthly premium.

Spend some time looking at your personal financial situation and find out how much you can afford to pay towards auto repairs.

When you are doing research on insurance, do not forget to compare multiple companies and their prices. In addition to doing your research, you might also consider locating an insurance agent to work for you.

The primary difference between an independent insurance agent and one that works for a major organization, such as Farmers, is that the independent agent has access to providing you insurance from a variety of sources. An agent with a major company can only offer you policies from their pool of resources.

An independent agent is not limited to only one company’s policies. They can locate every discount out there and find a plan that fits your budget.

Finding your own policy can be effective, but sometimes, even an intelligent, self-driven college graduate needs some assistance. Finding an independent insurance agent could be a wise choice.

Do college graduates need riders or endorsements on their auto insurance policy?

Riders, also known as policy endorsements, are additional pieces added to a policy that tailor the policy for a specific individual. Some states require certain endorsements depending on the vehicle that is being driven.

Understanding how riders and endorsements function is important. They do give further coverage, but most of the time they create higher premiums.

When purchasing auto insurance, be hesitant when an agent wants to add policy endorsements. Most of these, however beneficial they are to the insurance agent, simply do not help much in the long run.

An endorsement to consider would be roadside assistance, but outside of that one, there are not many others that give you enough benefit for the amount you pay. This is where doing quality research can pay off.

Remember, insurance agents want to make money, so they will try to throw endorsements at you. You may not need them, but you do need to know what they are.

Other endorsements are things like comprehensive coverage, which cover events that are outside of human control like hail damage or a flood, additional insured for children who are added to a policy, or reimbursement for a rental car if your vehicle is in the shop for repairs.

As some of these are great to have, consider your situation and what you are willing to pay for.

Bundling Policies for College Graduates

Again, because most recent college graduates are under the age of 25, auto insurance premiums will be more expensive. But that doesn’t mean it’s impossible to find affordable insurance for recent college graduates.

An easy way to acquire discounts on your policy is to bundle different kinds of insurance. If you have renter’s insurance, you may want to move that policy over to the company that handles your auto insurance.

Bundling multiple policies with one insurance company will guarantee you receive a quality discount. If you have more than one vehicle, you can also receive a multi-vehicle discount from nearly every insurance company out there.

Graduating college is a fantastic rite of passage in American culture, so understanding various topics, like auto insurance, can help ease the transition into functioning as an independent adult.

Despite a few factors that you cannot control, there are easy ways to reduce your premiums so you receive the best auto insurance for college graduates.

Are you ready to buy auto insurance for college graduates? For quotes that can fit your budget and meet your needs as a recent college graduate, enter your five-digit ZIP code into our FREE quote comparison tool below and find affordable auto insurance for college graduates now.

Which auto insurance company for college graduates is for you? Find out now.

Frequently Asked Questions

Do college graduates get discounts on auto insurance?

Yes, many insurance companies offer discounts specifically tailored for college graduates. These discounts are often available to individuals who have completed their undergraduate or graduate degrees within a certain timeframe.

What are the common discounts available for college graduates?

Some common auto insurance discounts for college graduates include:

- Good student discount: If you maintained a certain GPA during your college education, you may be eligible for a discount.

- Alumni discount: Some insurance companies provide discounts to graduates of specific colleges or universities.

- Professional organization discount: If you belong to a professional organization or alumni association, you may qualify for additional discounts.

How can I prove my eligibility for college graduate discounts?

Insurance companies typically require proof of your college graduation to qualify for these discounts. You may need to provide a copy of your diploma, official transcript, or other documentation verifying your completion of a degree program.

How much can I save with college graduate discounts?

The amount you can save varies depending on the insurance company and the specific discounts available. On average, discounts for college graduates can range from 5% to 25% off your auto insurance premiums.

Can I still get college graduate discounts if I graduated a few years ago?

Eligibility for college graduate discounts varies among insurance providers. Some companies may have a specific timeframe within which you must have graduated, while others may offer discounts to graduates regardless of when they completed their degrees. It’s best to inquire with individual insurance companies to determine their specific policies.

Are there any other benefits for college graduates when it comes to auto insurance?

Besides discounts, college graduates may also benefit from better rates due to their improved credit history and increased responsibility associated with completing a degree. Insurance companies often consider education level and occupation as factors when calculating premiums.

How much is car insurance for college students?

The average car insurance cost for college students will be similar to that of recent college graduates unless they remain on their parents’ policy.

Is car insurance cheaper for students than for the employed?

It depends. Usually, students pay higher rates due to their younger age, but because some companies offer student discounts, the rates may be similar.

Who has the best cheap car insurance for graduates?

On average, USAA, State Farm, and Allstate have the cheapest auto insurance for recent graduates.

What GPA qualifies students for an auto insurance discount?

Students will need a 3.0 GPA to qualify for a good student discount.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.