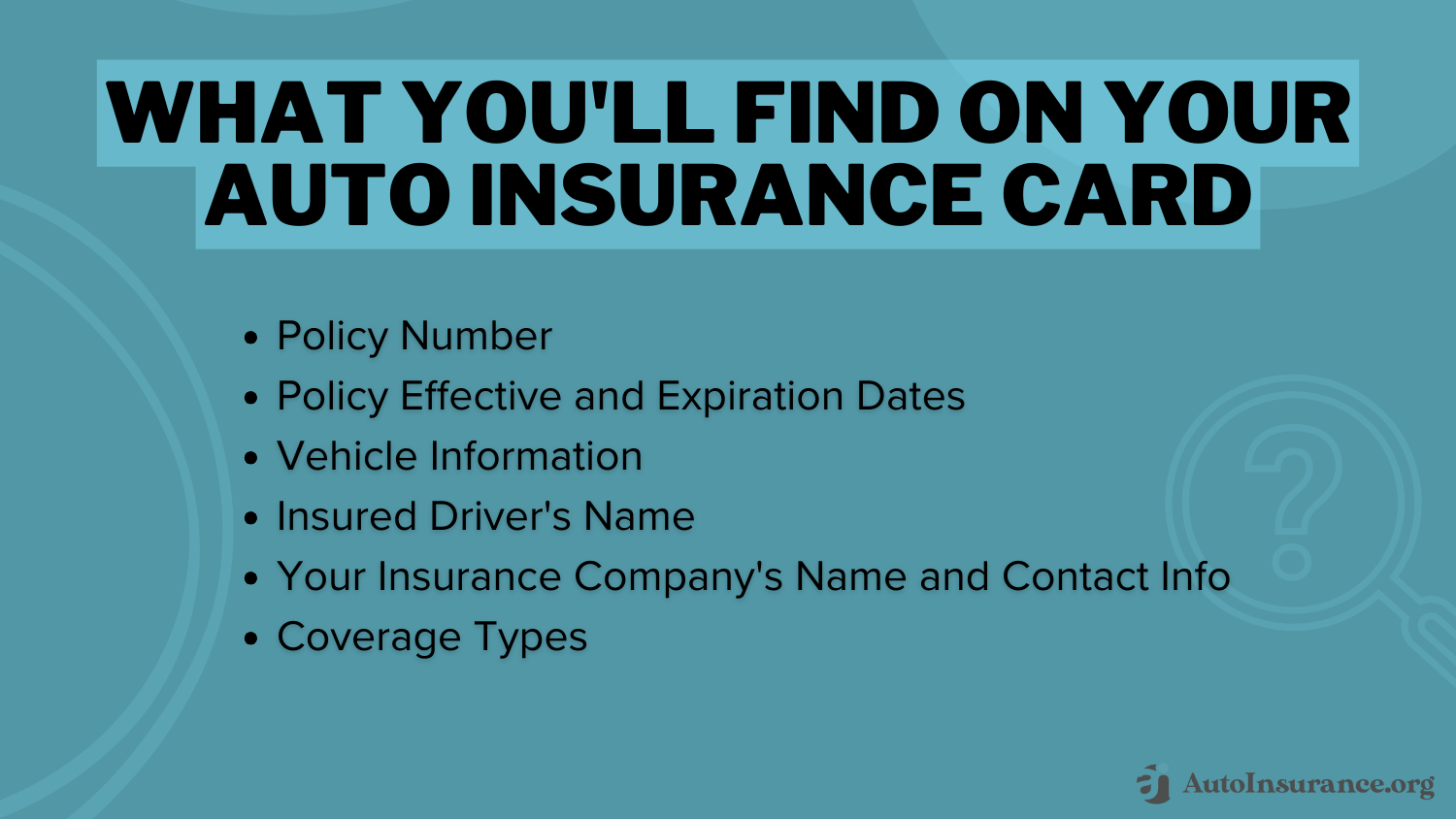

Your insurance certificate is a card companies send you after buying a policy. Many states require physical proof of insurance, so always keep it in your wallet or glove compartment.

If you’re thinking, “I lost my car insurance card. What should I do?” Keep reading to learn how to get a copy. You can also enter your ZIP code above to compare car insurance rates.

- Step #1: Contact Your Insurer – Call or email to get a car insurance certificate

- Step #2: Go to Your Insurer’s Website or App – Get digital proof of insurance

- Step #3: Visit Your Agent’s Office – Get your car insurance certificate in person

- Step #4: Print a Copy Yourself – If you lost your car insurance card, print a new one

4 Steps to Get a Copy of Your Auto Insurance Card

Replacing a lost car insurance card is simple and can be done in a few easy steps. From contacting your insurer to accessing their website or app, you’ll have your new card in no time. Here’s a quick guide to help you get started.