Best Auto Insurance for Drivers Under 25 (Find the Top 10 Companies Here!)

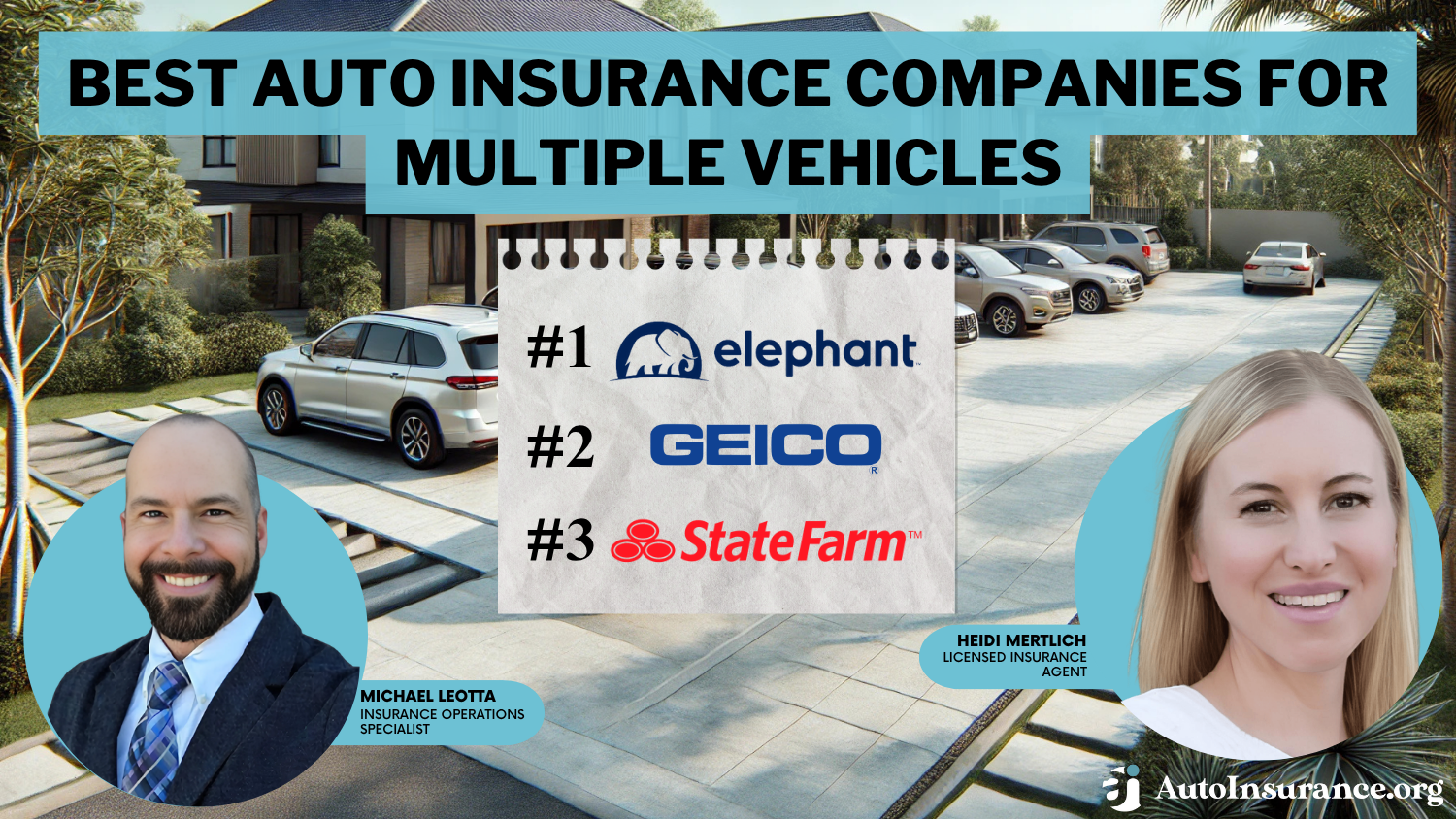

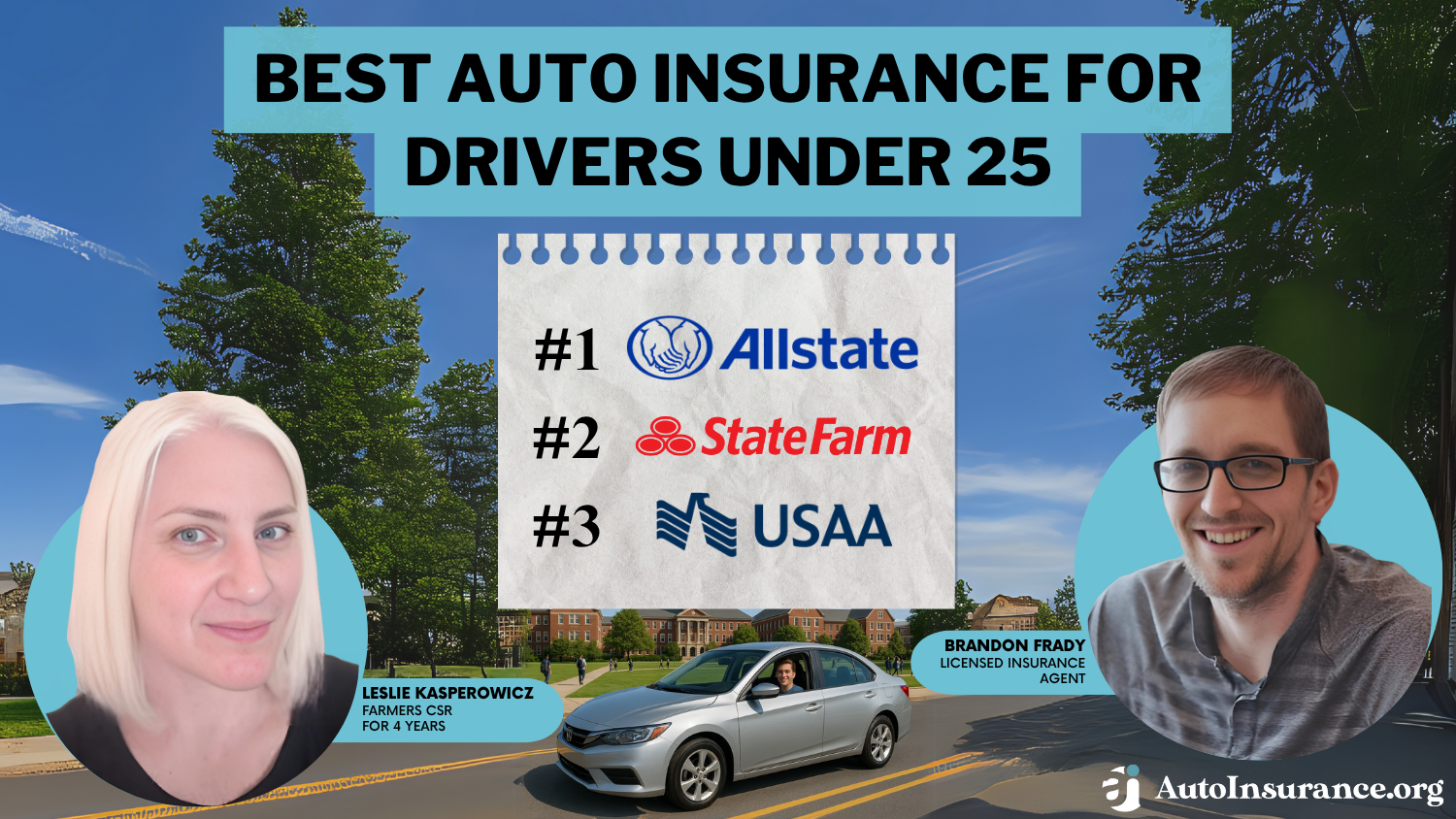

Allstate, State Farm, and USAA have the best auto insurance for drivers under 25, with rates starting at $125 a month. Students with good grades save up to 35% with these top providers. Young adults can also lower their rates by as much as 40% through safe-driving apps and telematics programs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2025

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe best auto insurance for drivers under 25 comes from Allstate, State Farm, and USAA. Good students can save up to 35%.

Our Top 10 Company Picks: Best Auto Insurance for Drivers Under 25

| Company | Rank | Good Student | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 35% | A+ | New Cars | Allstate | |

| #2 | 25% | A++ | Discount Variety | State Farm | |

| #3 | 25% | A++ | Military Families | USAA | |

| #4 | 25% | A | Loyal Drivers | American Family | |

| #5 | 20% | A+ | Teen Drivers | Erie |

| #6 | 20% | A | Personalized Service | Farmers | |

| #7 | 15% | A++ | Broad Coverage | Geico | |

| #8 | 15% | A+ | Accident Forgiveness | Nationwide |

| #9 | 10% | A+ | Online Tools | Progressive | |

| #10 | 8% | A++ | Safe Drivers | Travelers |

Auto insurance for those 25 years old or younger often comes with high rates, because young drivers have less driving experience. Fortunately, many car insurance providers offer discounts to existing policyholders who add a child to their auto insurance policy.

This guide covers which companies have the cheapest insurance for young drivers. We compare rates by age and discuss which discounts reduce rates the most for drivers under 25.

- Policies for drivers under 25 are more expensive due to limited driving history

- Rates for young drivers are often double the national average

- You can save with usage-based insurance and discounts

You can find the best auto insurance for young adults by comparing quotes for teens and students by entering your ZIP code into our free comparison tool above.

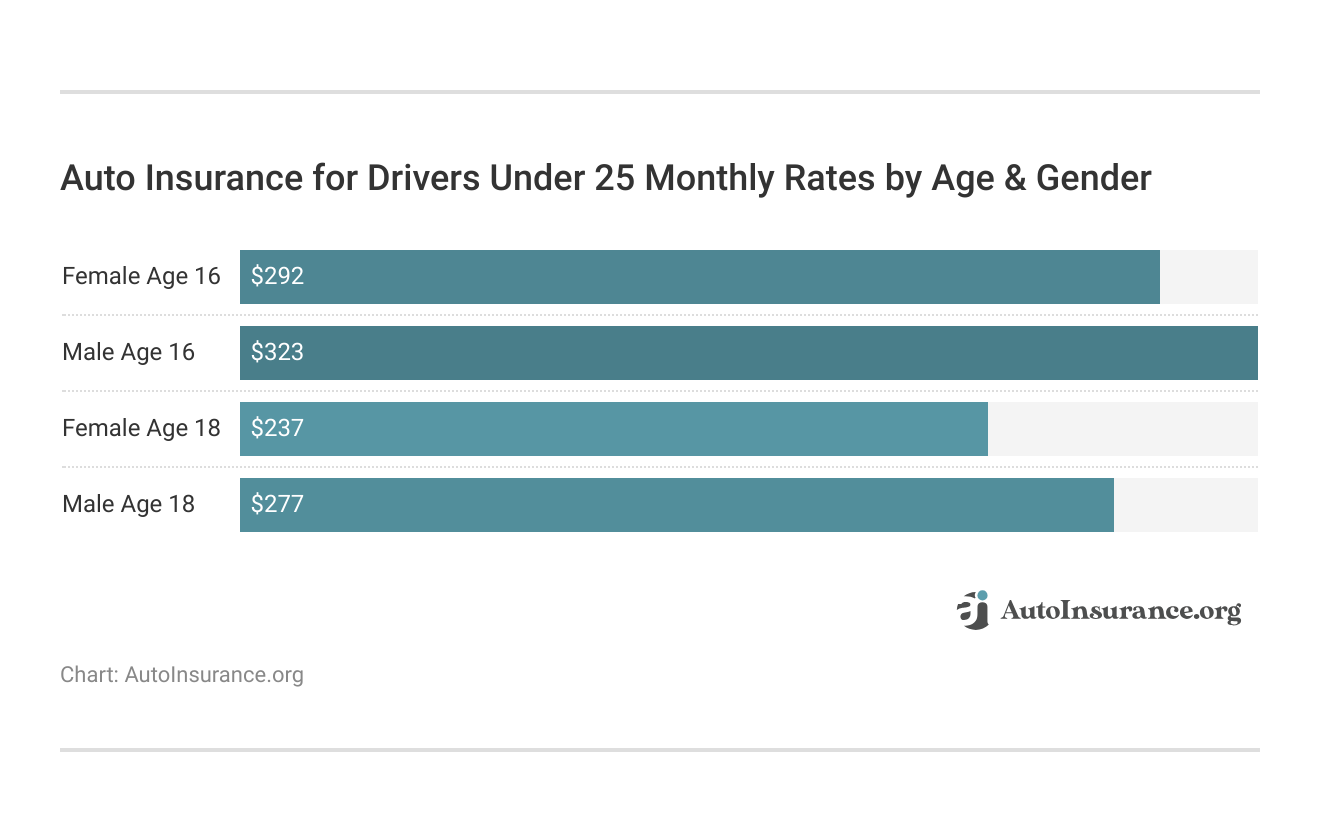

Auto Insurance Cost for Young Drivers

According to the National Highway Traffic Safety Administration (NHTSA), men are involved in more fatal accidents than female drivers. Young drivers are also more likely to be involved in a fatal crash than older drivers. This is one of the major reasons why the average cost of car insurance for a 19-year-old male is so expensive.

Drivers under 25 can pay up to $5,000 or more per year for coverage than drivers over the age of 30. Car insurance rates go down at 25, but men continue to pay more for car insurance even as they get older. Auto insurance rates are higher for males due to several reasons, such as getting into more accidents than women.

Cheapest Auto Insurance Companies for Young Drivers

The best car insurance for young adults will have discounts catering to new drivers, making coverage more affordable.

Monthly Auto Insurance Rates for 18-Year-Olds by Gender

| Company | Age 18: Male | Age 18: Female |

|---|---|---|

| $319 | $275 | |

| $253 | $187 | |

| $116 | $99 |

| $387 | $368 | |

| $153 | $132 | |

| $239 | $187 |

| $400 | $358 | |

| $178 | $144 | |

| $443 | $319 | |

| $125 | $111 |

Some young drivers under 25 may also benefit from companies with usage-based auto insurance (UBI), which uses telematics systems to measure a driver’s speed, braking, mileage, and more.

Avoiding accidents and tickets is the easiest way for drivers under 25 to save on car insurance. A clean record gets you the cheapest quotes.Kristen Gryglik Licensed Insurance Agent

However, UBI is not available with every company. And not every insurer will offer the same discounts to drivers under 25.

Factors Affecting the Cost of Auto Insurance for Young Drivers

Along with age and gender, where you live will also significantly impact how much car insurance for young drivers costs.

For example, drivers in big cities with more traffic and higher rates of auto theft pose more of a risk to the insurance company. So if you’re a young driver under 25 living in a major city, you can expect to pay more for coverage.

Other factors that affect auto insurance rates for drivers under 25 include the kind of car they drive and how often. Newer vehicles will cost more to insure, and auto insurance companies raise rates for drivers who are on the road for more than 12,000 miles per year.

A driving record also has a big impact on car insurance for anyone under 25 years old, mostly because young drivers lack the experience to build a trustworthy record. Auto insurance companies check driving records of young drivers in a variety of ways.

Without the driving experience to prove you are a good driver, you will pay higher-than-average rates. And if you get into an accident before you turn 25, your auto insurance rates will remain high. Being a safe driver is the best way to get cheaper car insurance for young drivers.

At What Age do Auto Insurance Rates go Down

On average, car insurance rates go down after drivers enter their 20s. However, car insurance rates for 21-year-olds and new drivers over 21 will be as high as for new teen drivers. This is because insurance companies are more concerned with driving experience than age.

When does car insurance go down for males? By the time young male drivers turn 25 years old, insurance companies can use their driving records to better determine rates.

You will see auto insurance rates for all drivers over 25 start to drop the longer they spend behind the wheel. And rates will continue to decrease if they avoid speeding tickets and collisions, as a speeding ticket affects auto insurance rates.

Read More: Best Auto Insurance Companies for Drivers With Speeding Tickets

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Discounts for Drivers Under 25

Most of the major auto insurance companies offer good student and defensive driving discounts to new drivers, including the insurers listed above.

Top Auto Insurance Discounts for Drivers Under 25

| Company | Good Student | Student Away | UBI | Driver's Ed | Multi-Car |

|---|---|---|---|---|---|

| 35% | 20% | 40% | 10% | 25% | |

| 25% | 25% | 20% | 5% | 20% | |

| 20% | 10% | 30% | 5% | 10% |

| 20% | 20% | 30% | 10% | 20% | |

| 15% | 25% | 25% | 15% | 25% | |

| 15% | 20% | 40% | 10% | 20% |

| 10% | 10% | $231/yr | 30% | 12% | |

| 25% | 20% | 30% | 15% | 20% | |

| 8% | 10% | 30% | 20% | 10% | |

| 25% | 22% | 30% | 5% | 10% |

However, local companies in your state may offer unique discounts, and you may find additional ways to save money with one company over another based on your unique circumstances. For example, Erie offers additional coverage for drivers away at college.

We recommend comparing quotes, discounts, and policy options from at least three companies before you buy auto insurance for drivers under 25. This way, you can guarantee you’re getting the best coverage at the best price for young drivers in your area. You can find coverage in your area today with our quote comparison tool below.

How Young Drivers Can Save on Auto Insurance

Avoiding accidents and speeding tickets is the easiest way for drivers under 25 to save money on auto insurance. A clean driving record will get you the cheapest car insurance quotes for young drivers.

Points can negatively affect your auto insurance rates. Although having points on your license will raise your auto insurance rates, young drivers can still save money on car insurance by doing the following:

- Have Good Grades: Students who maintain a B average or higher can earn a discount of 3%-10%.

- Attend a Driving School: Be proactive and take a defensive driving course to reduce your rates.

- Drive an Older Vehicle: The cheapest vehicles for drivers under 25 are models from 2018 or earlier.

- Reduce Your Coverage: If you drive an older vehicle, consider dropping collision or comprehensive coverage to lower your insurance rates.

- Increase Your Deductible: Insurance companies charge less per month if you’re willing to pay more out of pocket for repairs.

- Consider VIN Etching: Etching the VIN (vehicle identification number) on your car’s windshield reduces auto theft and can earn you 5% to 15% off your rates.

- Enroll in Usage-Based Insurance: Usage-based insurance (UBI) tracks driving habits, such as speed and braking, and safe drivers can pay significantly less for coverage.

- Shop Around: Compare auto insurance quotes online before renewing your policy, just in case another insurer offers better rates.

Although reducing your coverage can lower your monthly rates, check your state minimums before dropping any insurance. Liability-only will have the cheapest rates, but you still need to meet the minimum to legally drive in your state.

Auto Insurance Coverage for Drivers Under 25

The auto insurance laws in your state determine how much insurance drivers need. Driving without the required amount of coverage can cost you your license and raise your rates in the future.

Here is the minimum amount of coverage drivers under 25 need:

- Liability: Liability insurance pays for damages and injuries you cause to others in an accident, but the policy will not apply to your own injuries or property damage.

- Personal Injury Protection: Personal injury protection (PIP) covers injuries you or your passengers sustained in a collision and will pay back lost wages if you miss work for recovery.

- Medical Payments: Medical payments (MedPay) coverage helps pay for medical costs after an accident or collision but will not cover lost wages.

Not every state will require PIP or MedPay, so check your state laws carefully before you buy a teen or young driver auto policy.

As long as you carry your state’s minimum requirements, you can customize teen auto insurance coverage to meet your needs. For example, most companies offer policy add-ons to provide additional coverage for drivers under 25.

Auto insurance add-ons vary by company, but roadside assistance is the most common type for young drivers. For an additional fee, roadside assistance will provide reimbursement for towing, tire changes, and more.

Other types of insurance add-ons help young drivers who use their vehicles for work. If you drive for a rideshare or delivery service, adding rideshare insurance or commercial coverage to an existing policy will be much cheaper than buying a separate business policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Auto Insurance Protects Teen Drivers

Due to their inexperience behind the wheel, teens and young drivers are more likely to get into an accident. And since young drivers are more likely to be students or have low incomes, having auto insurance will ensure they are protected from paying hefty medical and repair bills after a collision.

Finding cheap car insurance as a new driver can be challenging. However, there are several strategies you can use to potentially lower your insurance costs.

Teen auto insurance rates may be expensive, but having coverage will protect young drivers from paying out of pocket for injuries and vehicle repairs. Full coverage insurance is the best policy for teens because it provides the most protection.

Learn More: Cheapest Teen Driver Auto Insurance in California

10 Best Car Insurance Companies for Drivers Under 25

We found that Allstate, State Farm, and USAA have the best car insurance for drivers under 25. See exactly why these providers stand out for young adults:

#1 – Allstate: Top Pick Overall

Pros

- New Car Discount: Young drivers with newer vehicles may qualify for a discount. Find more information about Allstate’s rates in our review of Allstate insurance.

- Good Financial Ratings: Instilling confidence in young drivers insured with Allstate.

- Drivewise: Young drivers who value safety when driving can benefit from this program.

Cons

- High Rates: Young drivers with limited driving experience may incur higher rates.

- High Premiums: Some customers have reported higher premiums following accidents.

#2 – State Farm: Best for Discount Options

Pros

- Steer Clear: The Steer Clear program for drivers under 25 improves driving habits and offers a discount upon course completion.

- Student Discount: Young drivers under 25 may qualify for a Good Student discount. Find more discounts in our State Farm auto insurance review.

- Fantastic Service: State Farm is known for having excellent customer service and a wide range of coverage options.

Cons

- Limited Availability In Certain Regions: State Farm does not cover every region.

- Higher Rates: Rates can be higher for drivers under 25 compared to other age groups.

#3 – USAA: Best for Military Members and Family

Pros

- Military Friendly Discounts: USAA offers a discount for those who live on military bases.

- Student Discount: Drivers under 25 may qualify for a student discount through USAA.

- Military Base Discount: Customers who live on a military base can receive additional savings.

Cons

- Limited Area Coverage: USAA is only available in certain regions. Find out more in our USAA auto insurance review.

- Exclusive to Military: USAA is exclusive to military members and their families.

#4 – American Family: Best for Generational Discount

Pros

- Generational Discount: Young drivers with parents who are American Family customers can receive an additional discount.

- Personalized Service: American Family provides innovative coverage with the option to personalize your policy.

- KnowYourDrive program: The KnowYourDrive program rewards safe driving with a discount.

Cons

- Rates Can Be High: Rates may be higher for younger drivers, especially high-risk drivers with accidents or violations. Learn more in our American Family auto insurance review.

- Limited Availability in Some Areas: American Family is only available in select states, so it may not be an option for everyone.

#5 – Erie: Best for Teen Drivers

Pros

- Young Driver Discount: Erie offers discounts for young drivers under 21 who reside with their parents.

- Good Student Discount: Students under 25 who maintain a B average or better can qualify for a discount.

- Driver Training Discount: Young drivers under 21 who complete an approved driver training course can save on their premiums

Cons

- Limited Availability: Erie is only available in 12 states, located mostly in the Northeast and Midwest. See if you live in an eligible state in our Erie auto insurance review.

- Higher Prices: While Erie Insurance generally offers competitive rates, rates for young drivers under 25 can still be relatively high compared to older drivers.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmer’s offers a comprehensive range of discounts and coverage plans. Check out our online Farmers review for more information.

- Signal Program: The Signal Program offers lower rates for safe driving habits.

- Distant Student Discount: Customers attending school away from home may qualify for this additional discount.

Cons

- Prices Based on Driving Record: Those with limited driving history, including young drivers, report higher costs.

- Higher Premiums: Customers experience higher premiums after accidents or traffic tickets.

#7 – Geico: Best for Coverage Options

Pros

- Wide Coverage: Geico offers a variety of coverage options, including liability, collision, and comprehensive coverage.

- Student Discount: A good student discount is available for young drivers under 25.

- Safe Driver Discount: Young drivers can receive a discount for completing a defensive driving course.

Cons

- Rate Increases: Rates can increase significantly for young drivers with accidents or tickets. (Learn more by reading our Geico insurance review)

- Mixed Customer Reviews: Some customer reviews state issues with customer service.

#8 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Young drivers under 25 can receive accident forgiveness.

- Extensive Coverage: Nationwide has a wide range of coverage options.

- Distance Discount: Students who are away at school qualify for a discount.

Cons

- Higher Costs: High-risk drivers may have higher rates. See average Nationwide rates in our Nationwide auto insurance review.

- Difficult Claims Process: Some customers report issues with the claims process.

#9 – Progressive: Best for Online Budgeting Tools

Pros

- Name Your Price Tool: This tool allows you to enter a monthly budget to see what type of coverage Progressive can offer.

- Competitive Rates: Progressive offers innovative programs at competitive rates.

- Snapshot Program: Progressive’s Snapshot program monitors young drivers’ driving behaviors to reward customers for their safe driving habits. This is one of the best Progressive auto insurance discounts you can receive.

Cons

- Higher Rates for Inexperienced Drivers: Those with limited driving history may have higher monthly costs.

- Premium Increases: Premiums have reportedly been increased after drivers are involved in accidents. Our complete Progressive review goes into more detail on this.

#10 – Travelers: Best for Safe Drivers

Pros

- IntelliDrive: This program helps young drivers under 5 save based on their driving habits.

- Financial Stability: Travelers has a strong financial rating, which means you won’t have to worry about your claims going unpaid.

- Distant Student Discount: Students who live and study away from home may qualify for an additional benefit.

Cons

- Higher Rates: Monthly costs are higher for drivers under 25 due to limited driving history.

- Limited to Few Areas: Travelers Auto Insurance is not available in every region (read more in our detailed Travelers review).

Get the Best Auto Insurance for Young Drivers Today

Drivers under 25 should sign up for usage-based car insurance programs and telematic systems that base rates on driving habits and mileage. Safe driving habits can reduce rates by 30% or more, and most major insurers offer UBI and other telematics programs.

Discounts are another excellent way to find the best auto insurance companies for drivers under 25. Look for insurers that offer discounts designed for young and new drivers, such as good student and driving school discounts.

If you’re looking for the best auto insurance company near you, take advantage of free online comparison tools like the one below to start comparing quotes online. Get quotes from at least three different companies in your area to get an average, and then start asking about discounts.

It may take some time to find the best insurance for young adults, but researching quotes and discounts online before you buy will guarantee that you aren’t overpaying for car insurance.

Frequently Asked Questions

Why is auto insurance more expensive for young adults?

Auto insurance tends to be more expensive for young adults due to several factors, including lack of driving experience, higher risk of accidents, and statistical data showing that young drivers are more likely to engage in risky driving behaviors. Insurance companies calculate premiums based on risk factors, and since young adults are considered higher risk, their insurance rates are typically higher.

What is the best car insurance for young drivers?

Erie Insurance offers the most competitive rates to young drivers under 25 for full coverage auto insurance, but coverage is only available in 12 states. State Farm, Geico, and USAA offer the next most affordable rates.

Are there any ways for young adults to save money on auto insurance?

Yes, young adults can take several steps to potentially save money on auto insurance:

- Good Student Discounts: Maintaining good grades in school may qualify young adults for discounts with certain insurance providers.

- Defensive Driving Courses: Completing a defensive driving course can sometimes result in a discount on auto insurance premiums.

- Bundling Policies: If a young adult has other insurance policies, such as renters or homeowners insurance, bundling them with their auto insurance can lead to savings.

- Comparison Shopping: It’s essential to shop around and compare quotes from different insurance companies to find the most competitive rates.

- Clean Driving Record: Avoiding traffic violations and accidents helps build a good driving history, which can lead to lower premiums over time.

Where can you get cheap car insurance for a new driver?

Finding cheap car insurance as a new driver can be challenging. However, there are several strategies you can use to potentially lower your insurance costs. Shopping around for the best discounts, bundling policies, and usage-based insurance can help drivers under 25 save in the long run. Find out how to get multiple quotes for auto insurance at once.

How will adding a young driver to my policy affect my rates?

Adding a teen driver or anyone under 25 to an auto insurance policy will raise your rates. The good news is that your rates will not be nearly as high if you were to buy a new policy for a young driver.

Can young adults stay on their parents’ auto insurance policy?

In many cases, young adults can stay on their parents’ auto insurance policy if they are living in the same household. However, this may vary depending on the insurance company’s specific rules and guidelines. It’s important to consult with the insurance provider to determine eligibility and any potential limitations.

Why is car insurance so high for people under 25 years old?

Auto insurance rates are influenced by many different factors. Drivers under 25 years old pay the most for auto insurance due to inexperience. Inexperience behind the wheel leads to an increased risk of accidents and insurance claims, so companies charge higher rates. Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for affordable premiums from the top companies.

When should young adults consider getting their own auto insurance policy?

Young adults should consider getting their own auto insurance policy when they move out of their parents’ household, purchase their own vehicle, or if their parents’ insurance company does not allow them to stay on the policy. It’s recommended to discuss the situation with the insurance provider to determine the best course of action.

What type of coverage do young adults typically need?

The type of coverage young adults need may vary based on individual circumstances and preferences. However, it’s generally advisable to have at least the following coverage:

- Liability Coverage: This coverage is typically required by law and helps cover costs if the young adult is at fault in an accident and causes injury or property damage to others.

- Collision Coverage: This coverage helps pay for repairs or replacement of the young adult’s vehicle if it is damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects against damage or loss due to non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if the young adult is involved in an accident with a driver who does not have insurance or has insufficient coverage.

At what age is car insurance most expensive?

Car insurance is typically most expensive for young drivers under the age of 25. This is because younger drivers are statistically more likely to be involved in accidents compared to older, more experienced drivers. Insurers base their rates on risk, and younger drivers are seen as higher risk due to inexperience. Many auto insurers have auto insurance discounts, though, which can help younger drivers save.

Will my insurance go down when I’m 25?

What are the risks young drivers pose to insurance companies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.