10 Best Auto Insurance Companies That Pay Dividends to Policyholders in 2026

USAA, Erie, and Auto-Owners are the best auto insurance companies that pay dividends to policyholders. USAA is our top pick with monthly rates starting at $32. With the right auto insurer, you can start making $100 dividends within the year. Read on to find the top dividend paying insurance companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated June 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best auto insurance companies that pay dividends to policyholders are USAA, Erie, and Auto-Owners. USAA tops the list because of its consistently high customer satisfaction ratings.

When you’re continuously putting money into an auto insurance policy, you may want to see a return on that investment. If so, contacting car insurance companies that pay dividends to policyholders might be your best bet.

Our Top 10 Picks: Best Auto Insurance Companies That Pay Dividents to Policyholders

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | 24/7 Support | Erie |

| #2 | 20% | A+ | Deductible Reduction | Amica Mutual | |

| #3 | 20% | A+ | Online Convenience | Progressive | |

| #4 | 15% | A++ | Military Savings | USAA | |

| #5 | 15% | A++ | Usage Discount | Auto-Owners | |

| #6 | 15% | A++ | Many Discounts | State Farm | |

| #7 | 15% | A++ | Accident Forgiveness | Travelers | |

| #8 | 15% | A+ | Usage Discount | Nationwide | |

| #9 | 15% | A | Local Agents | Farmers | |

| #10 | 10% | A+ | Competitive Rates | Hartford |

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- Mutual insurers offer dividends to policyholders

- The dividends will likely be less than $100 a year

- You will only receive them if the insurer does well

#1 – USAA: Top Pick Overall

Pros

- Military Savings: USAA Insurance provides substantial savings through significant discounts and benefits designed especially for military members and their families.

- Highly-Rated Mobile App: USAA’s mobile app receives high praise for its user-friendly interface, providing convenient access to policy management, claims, and customer support.

- A++ Financial Rating: USAA holds a premier financial strength rating, guaranteeing reliability and trustworthiness in dividend payments, claims, and policy options.

Cons

- Not Cheapest After DUI: USAA may not offer the lowest rates for members who have a DUI on their driving record, potentially increasing auto insurance costs. See how USAA’s rates compare to other insurance providers in our USAA auto insurance review.

- Membership Restrictions: USAA insurance is only available to military members, veterans, and their families, limiting its accessibility to the general public.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie Insurance offers 24/7 customer support, ensuring help is available whenever you need it, day or night.

- New Car Coverage: If you’re a new car owner looking for comprehensive protection, Erie offers gap insurance and new car replacement coverage, making it an excellent choice.

- Many Discounts: Learn more about the available discounts in our Erie auto insurance review.

Cons

- Limited Availability: Erie Insurance is not available in every state.

- Higher Rates for Bad Credit: Erie tends to have higher average rates for drivers with poor credit.

#3 – Auto-Owners: Best for Usage Discount

Pros

- Usage-Based Discount: Auto-Owners Insurance offers excellent discounts based on your driving habits. Read our review of Auto-Owners to see if you’ll get cheaper rates by going with this provider.

- Low Complaint Index: Auto-Owners has a significantly lower-than-average NAIC complaint index, indicating high customer satisfaction and fewer issues.

- Strong Financial Health: Auto-Owners Insurance is known for its excellent financial stability.

Cons

- Limited Availability: Auto-Owners Insurance is available in only 26 states.

- Average Claims Process: Claims process is sometimes rated below average, with reports of longer resolution times compared to some competitors.

#4 – Amica: Best for Deductible Reduction

Pros

- Deductible Reduction: Amica offers options to lower your deductible, potentially reducing out-of-pocket expenses in case of a claim.

- Competitive Rates: Amica’s auto insurance rates are close to the national average, providing good value for the coverage offered.

- Dividend Policies: Amica offers dividend policies in most states. Learn more in our Amica auto insurance review.

Cons

- Limited 12-Month Policies: In some states, Amica has discontinued 12-month policies, reducing options for policyholders seeking longer-term coverage.

- Limited Availability: If you live in Hawaii you won’t be able to purchase auto insurance from Amica.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Many Discounts

Pros

- Many Discounts Available: You can save up to 30% on your policy with State Farm auto insurance discounts.

- Strong Reputation: State Farm has a solid reputation in consumer studies, consistently receiving high customer satisfaction and reliability ratings.

- Generous Rental Coverage: State Farm provides extensive coverage for rental cars and travel expenses, ensuring policyholders are well-supported during travel-related incidents.

Cons

- Higher Rates: State Farm often has higher-than-average rates compared to others insurers.

- No Gap Insurance: State Farm does not offer gap insurance.

#6 – The Hartford: Best for Competitive Rates

Pros

- Deductible Reduction Program: Hartford Insurance offers a unique program that reduces your deductible for every year you’re claim-free.

- AARP Member Discounts: Hartford offers discounted insurance rates for AARP members. See our The Hartford auto insurance review for more information about discounts and other member benefits.

- Accident Forgiveness: Hartford offers accident forgiveness, meaning your rates won’t increase after your first accident.

Cons

- High Rates for Young Drivers: Hartford tends to have higher rates for younger drivers, making it less affordable for families with teenage members.

- Frequent Complaints: Hartford receives more customer complaints regarding its auto insurance policies than some other major insurers.

#7 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive provides a user-friendly online experience, making it easy for customers to manage their policies and file claims digitally.

- Affordable DUI Rates: Progressive offers competitive rates for drivers with a DUI on their record, often lower than those of other major insurers. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Accident Forgiveness Programs: Progressive features three distinct accident forgiveness options, including one that automatically enrolls customers, helping to keep premiums stable after an accident.

Cons

- Low Renewal Likelihood: Progressive ranks poorly in customer renewal rates, indicating potential dissatisfaction with service or coverage options.

- Snapshot Rate Increases: The Snapshot program can lead to higher premiums for some drivers if their driving habits are deemed risky based on the monitoring data.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness options, helping to prevent premium increases after an accident.

- New Car Replacement: Travelers provides new car replacement coverage, ensuring that policyholders can replace their vehicles with brand new ones in case of a total loss.

- Fewer Complaints: Travelers has a lower-than-expected number of customer complaints, indicating strong customer satisfaction and reliable service. Read more about Travelers’ ratings in our Travelers insurance review.

Cons

- Limited Discounts by Location: Travelers’ discounts can vary significantly based on your location, potentially limiting savings for some customers.

- Rideshare Coverage Gaps: Travelers does not offer rideshare insurance in all states, which can be a drawback for drivers working for companies like Uber and Lyft.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers significant savings through its SmartRide program, which rewards safe driving behaviors with discounts. Learn more about SmartRide in our Nationwide auto insurance review.

- Affordable for Bad Credit: Nationwide provides competitive rates for drivers with poor credit, making it a cost-effective option for those in this category.

- Teen Driver Rates: Nationwide offers relatively low premiums when adding a teenage driver to your policy, helping families save on insurance costs.

Cons

- High DUI Rates: Nationwide tends to have higher premiums for drivers with a DUI on their record, making it less affordable for these individuals.

- No Rideshare Coverage: Nationwide does not offer rideshare insurance, which can disadvantage drivers working for services like Uber and Lyft.

#10 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers excels in providing personalized service through its extensive network of local agents, ensuring tailored advice and support.

- Coverage Options: Farmers offers various coverage options and add-ons which you can learn more about in our Farmers auto insurance review. Take a look at our Farmers insurance company review to learn more.

- Mobile App: Farmers’ mobile app is highly rated, providing convenient access to policy management, claims filing, and other essential services.

Cons

- Higher Premiums: Farmers’ rates tend to be higher than other insurance companies, making it less competitive in terms of pricing.

- Mixed Reviews: There are mixed reviews about Farmers’ customer service, with some customers reporting issues with claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

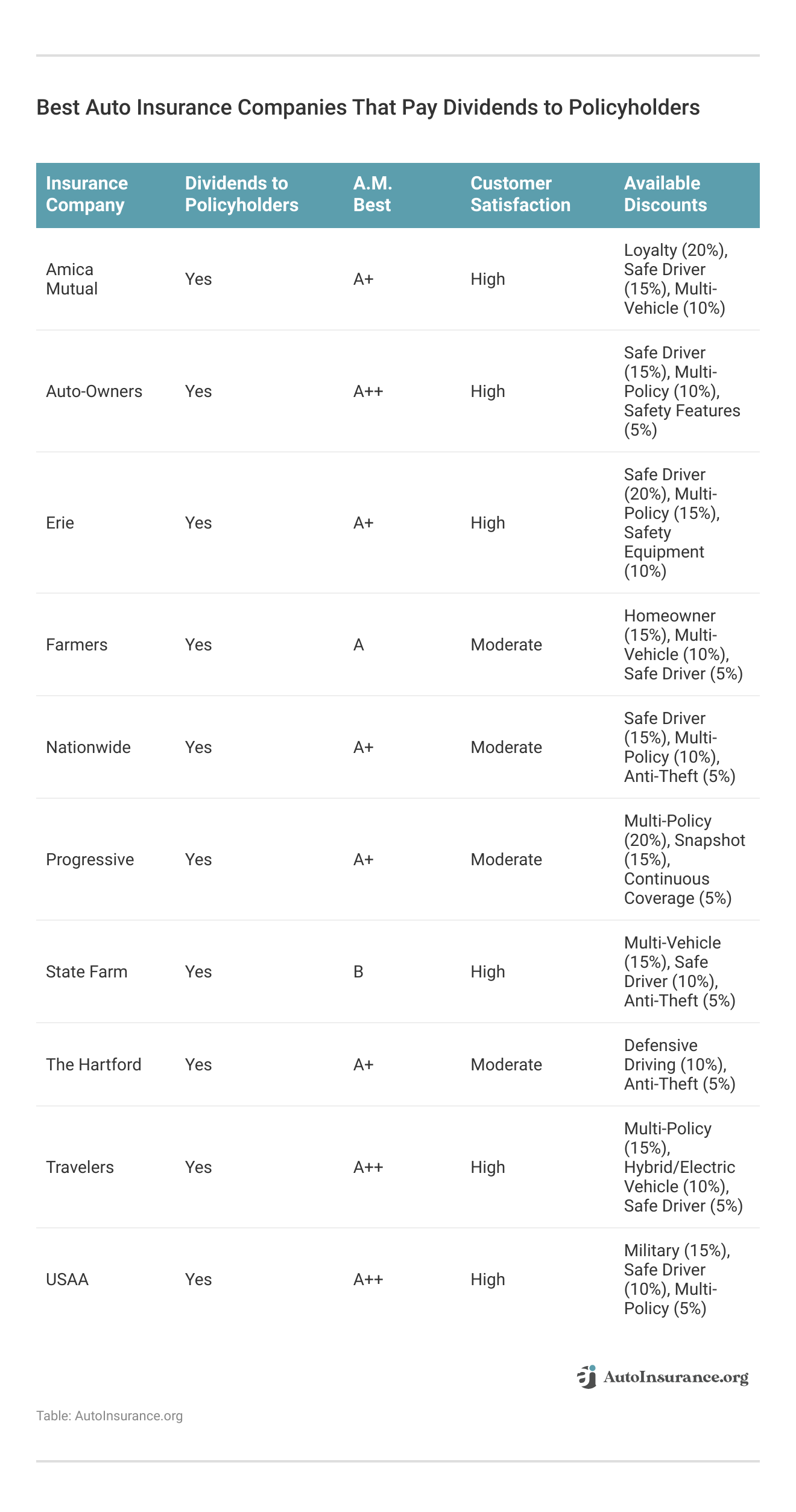

Auto Insurance Companies That Offer Policyholder Dividends

Not all insurers will give out payments on insurance policies, but not all insurers are owned by their policyholders either. If you’re looking to get policyholder dividends, then you’ll want to focus your search on mutual insurance companies.

Mutual car insurance companies are owned by their policyholders, so it follows that the auto insurance policyholders should also succeed when the company does. Dividends will be higher or lower depending on the level of success.

For the best results, you should go to an insurer that has a proven history of quality dividends.Justin Wright Licensed Insurance Agent

Some examples of companies that currently offer dividends include:

- USAA

- Erie

- Auto-Owners

- State Farm

State Farm Mutual was able to issue $400 million to its car insurance customers in California as of March 2021. This is due to better than anticipated claim results, and each customer is expected to receive $100 per policy.

The State Farm dividend history is a strong asset in proving its policies are worth sticking around for. According to the Insurance Information Institute, this could be in response to the COVID-19 pandemic.

Policy Dividends Explained

In insurance, dividends are an annual payment made out to either policyholders or shareholders. In mutual insurance, the insurance company is owned by its policyholders, so they take the place of a stock insurance company’s investors.

Each year the insurer will send out a payment if the company has done well in the last year.

On the other hand, if your insurer hasn’t done well in the same period, you likely won’t receive anything at all.

Read more: Best Auto Insurance Companies According to Consumer Reports

All the dividends payable to a policy owner are declared by the insurance company and then split up amongst the recipients.

How to Get Dividends From Your Insurer

The most important thing to do is to look for a mutual insurance company that offers the kind of auto insurance you’re looking for. See if any of the above companies offer policies in your area and get in contact with an agent.

You’ll also want to make sure that you properly research things like:

- The company’s recent financial history

- If the company evaluates dividends locally or nationally

- What past dividends have been given to customers

If you want to receive dividends shortly after starting your policy, it would be a smart decision to know how the company handles its finances. If it hasn’t been doing well, then it’s much less likely that you’ll get dividends anytime soon from that insurer.

As our mission is to empower our members to achieve

financial security and be the #1 choice for the military community and their families, we’re proud to have been recognized again as the #1 U.S. Bank by @Forbes. Learn more: https://t.co/BCveN5byFT pic.twitter.com/BwJEwwt7Th— USAA (@USAA) May 9, 2024

If you live in a state that has a history of low claims, then you’ll likely see more dividends over the life of your policy. This is because the best drivers in the U.S. by state are often less likely to need to file a claim. When a state has fewer claims, the insurer has more money to pay towards dividends.

How Much You Will Receive in Dividends

Unfortunately, it’s likely not going to be much.

Even State Farm’s $400 million dividends across a single state led to most people getting $100 per policy. While this is still nice, it’s not guaranteed at all.

Still, the money can be used for things like groceries, gas, or even to pay monthly premiums.

Read more: What is the average auto insurance cost per month?

Some insurers will also allow the policyholder to put the dividends into a savings account that works as an investment and will increase at a steady rate over time.

Pros and Cons of Policyholder Dividends

There are several benefits to insuring with a mutual insurance company, but there are also some negative aspects to watch out for. As with all insurers, whether or not this type of insurance suits you will largely depend on your needs, income, and other life factors.

One of the biggest benefits of insuring with a mutual company is that the policyholder now has a stake in the success of the company and they will be rewarded when it does well.

Some of the other benefits of mutual insurance with policy dividends include:

- Receive dividends when your insurer does well

- Options to invest those dividends

- Extra value on your auto insurance policy

However, there are also some drawbacks that the client will need to weigh based on their circumstances. Some of these might include:

- Higher premiums

- No dividends when the insurer does poorly

- The dividend payments won’t be very high

The dividends that an insurer gives out aren’t likely to be anything astronomical, usually ranging somewhere below $100 a year. The dividends shouldn’t be your only reason for getting a mutual policy, as you’re guaranteed to lose more than you make.

Mutual Insurance Company vs. Stock Insurance Company

So, what’s the difference between mutual and stock insurance companies? The main difference between a mutual and stock car insurance company is the people who fund them. Stock auto insurance companies don’t pay dividends to policyholders.

Stock insurance companies are funded by stocks on the market and people that might not be policyholders. However, with a mutual insurance company, the company is owned by its policyholders.

Auto Insurance Monthly Rates by Coverage Level & Top Providers That Pay Dividends to Policyholders

Insurance Company Minimum Coverage Full Coverage

![]()

$65 $215

$47 $124

$32 $83

$76 $198

$63 $164

$56 $150

$47 $123

$61 $161

$53 $141

$32 $84

When a company does particularly well, either stock or mutual, it will send out a payment to its investors to commemorate that. In the case of mutual insurance, a large payout is dispersed amongst the hundreds of thousands of clients, making the payouts significantly smaller.

A stock insurer’s investors will likely receive higher dividends that are based on the number of shares they hold.

Whoever owns the most of the company’s stock will receive the biggest payout from the business’s success.

Both of these types of insurance companies offer benefits, but there are limitations for each as well. A stock insurer’s policyholder is just a customer, and a mutual insurance customer doesn’t have much say over the company’s makeup, for example.

Read more: How to Research Auto Insurance Companies

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Companies That Pay Dividends to Policyholders: The Bottom Line

The potential for passive income is enough to make anyone stop and consider the options. With a mutual insurance company, you have the opportunity to see a yearly return on your policy. While it won’t be near what you pay in premiums, it’s good to be a part of your insurer’s success.

If you’re looking for the best auto insurance companies that pay dividends to policyholders, enter your ZIP code into our free quote tool.

Frequently Asked Questions

Are policy dividends taxable?

Dividends from life insurance policies are usually not taxable, but non-life insurance dividends are typically taxable as ordinary income. Consult a tax professional for accurate information.

Are policy dividends guaranteed?

No, policy dividends are not guaranteed and depend on the insurer’s performance.

Can I invest my policy dividends?

Some insurers offer options to invest dividends, allowing them to grow over time.

How do I find affordable auto insurance companies that pay dividends?

You can get free online auto insurance quotes or use comparison websites to compare rates, dividend history, customer reviews, and financial stability.

Which auto insurance companies pay dividends to policyholders?

Examples of insurers that pay dividends to policyholders include State Farm, USAA, Amica, and Auto-Owners.

What is the difference between mutual and stock insurance companies?

Mutual insurers are owned by policyholders and distribute dividends to them, while stock insurers are funded by shareholders who may not be policyholders.

What is a good dividend?

A good dividend is typically one that offers a high yield relative to the stock’s price, is consistently paid out, and has a history of increasing over time. It reflects the company’s financial health and ability to generate profits.

What is an auto dividend?

Many people wonder, “What is an auto insurance dividend?” An auto dividend is a return of a car insurance premium paid to policyholders by an auto insurance company. Insurance policy dividends are usually issued when the insurer experiences lower-than-expected claims and operational costs.

What life insurance pays dividends?

Life insurance policies that pay dividends are typically “participating” whole-life policies. Companies like Northwestern Mutual, MassMutual, and New York Life are known for offering such policies where policyholders may receive dividends. You can learn more in our Northwestern Mutual review.

When does a policy pay dividends to its policyholders?

Amica typically pays dividends to its eligible policyholders annually. Looking at Amica’s dividend history, the specific timing and amount can vary based on the company’s financial performance and other factors. Learn more here: Who are the reputable auto insurance companies?

Who might receive dividends from a mutual insurer?

Does State Farm pay dividends?

When does Amica pay dividends?

Is Amica’s dividend policy worth it?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.