Best Pay-in-Full Auto Insurance Discounts in 2026 (Save up to 20% With These 10 Companies)

The best pay-in-full auto insurance discounts save drivers 10% or more if they pay premiums in one lump sum. Progressive and Geico offer the most generous discounts at 20%. However, customers should consider their financial situation, as they may face late fees if they can't afford the lump sum.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated October 2024

The best pay-in-full auto insurance discounts reward drivers who settle their auto insurance premiums upfront, often leading to significant savings. For instance, many insurance companies offer a pay-in-full discount that can range from 10% to 20% off your total premium.

The discount for paying car insurance in full eliminates installment fees and locks in lower rates. A standout example is the Progressive paid-in-full discount, which can yield up to 20% off your Progressive policy.

Our Top 10 Company Picks: Best Pay-in-Full Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Accepted Payments |

|---|---|---|---|---|

| #1 | 20% | A+ | Credit Card, Debit Card, PayPal, Bank Transfer | |

| #2 | 20% | A++ | Bank Account, Credit Card, PayPal | |

| #3 | 15% | A | Credit Card, Debit Card, Venmo, Mobile Wallet |

| #4 | 10% | A+ | Bank Account, Credit Card, Mobile Wallet | |

| #5 | 10% | B | Credit Card, Bank Transfer, Mobile Wallet | |

| #6 | 10% | A+ | Bank Account, Credit Card, Apple Pay |

| #7 | 10% | A | Bank Account, Credit Card, Debit Card | |

| #8 | 10% | A | Credit Card, PayPal, Venmo | |

| #9 | 10% | A++ | Bank Account, Credit Card, PayPal | |

| #10 | 10% | A++ | Credit Card, Debit Card, Mobile Wallet |

Additionally, drivers can maximize savings by bundling policies or taking advantage of loyalty programs, ensuring you lower your auto insurance rates.

This guide will provide an overview of pay-in-full auto insurance discounts, including how they work and why they may be a good option for some drivers. Looking to find affordable auto insurance? Compare rates with our quote comparison tool for free.

- The Progressive discount for paying in full is one of the best discounts

- Payment-in-full discounts vary among providers

- Drivers should check their budget before committing to paying in full

How to Qualify for Pay-In-Full Auto Insurance Discounts

When it comes to auto insurance, a pay-in-full discount can be an excellent way to save money. A pay-in-full discount is one of the best auto insurance discounts and rewards customers for paying their premiums in one lump sum rather than breaking them up into monthly payments. When you purchase a policy and select the pay-in-full option, you’ll receive a discounted rate on your coverage.

Paying your premiums in one full payment can be beneficial in several ways. First, it grants you access to cheaper rates because it reduces administrative costs associated with processing multiple payments during the year. Second, many insurers offer additional discounts for choosing the pay-in-full option, making it an ideal way to save money on your policy.

Finally, when you pay in full, you lock in the current rates regardless of any changes that may occur during the policy period. This helps protect you from potential rate increases due to inflation or other factors.

To qualify for this type of discount, drivers must first make sure they have enough funds available upfront to pay their policy in full.

Once you’ve taken this step, there are several ways that you can budget and prepare for the payment deadline. It’s important to note that paying all of your car insurance upfront is a commitment, so it’s essential to plan ahead and make sure you can afford your premium before committing to this option.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Companies for Pay-In-Full Auto Insurance Discounts

Once you’ve budgeted appropriately and are ready to purchase your policy, the next step is finding an insurance company that offers a pay-in-full discount option. See how much your rates will decrease at the best auto insurance companies with pay-in-full car insurance discounts.

Top Pay-in-Full Savings: Monthly Min. Coverage Rates After Discount

| Insurance Company | After Discount |

|---|---|

| $387 | |

| $405 | |

| $425 | |

| $432 | |

| $441 | |

| $445 | |

| $450 |

| $459 | |

| $468 | |

| $477 |

With careful preparation and research, you can get the coverage you need while still saving money on premiums (Learn More: How much car insurance do I need?). Taking the time to plan ahead and do your research will help ensure that you get the best deal possible while still receiving the protection that you need.

The Benefits of Getting a Pay-In-Full Discount

There are several benefits of choosing a pay-in-full discount when purchasing auto insurance. For starters, it allows you to receive an immediate discount on your premiums as well as additional discounts for paying upfront.

Learn More: Should I pay my auto insurance in full?

In addition, it guarantees that your rates won’t increase throughout the policy period and protects you from unexpected financial obligations in case of an accident. Finally, it allows you to avoid monthly payments so that more money can stay in your pocket instead of going toward administrative fees.

Overall, selecting a pay-in-full discount could be a great way to save money on your auto insurance coverage while still providing you with the necessary protection.

It’s important to compare different policies and make sure that the discounted rate is worth it before committing to a policy.

This type of discount is particularly useful if you have enough funds available upfront to pay for your policy in full. This will provide a cost-effective option that helps protect your pocketbook from unexpected expenses in case of an accident.

How to Take Advantage of a Pay-in-Full Discount

When it comes to auto insurance, one of the most cost-effective ways to save money is by taking advantage of the pay-in-full discount.

To take advantage of this discount, drivers must budget properly, prepare for the payment deadline, and then find an insurance company that offers a pay-in-full discount option.

Many companies have online resources where you can compare different policies and make sure that the discounted rate is worth it. Alternatively, you could speak with an independent insurance agent who can help find you competitive rates from multiple insurers. Find out more about the best auto insurance companies.

Aside from finding a policy that offers a pay-in-full discount, there are several other ways drivers can save on auto insurance. Comparing auto insurance rates is key when it comes to finding the best deal, as different companies offer different discounts and premiums.

Bundling multiple policies with the same company may lead to further savings, as will raising deductibles, meaning the amount of money paid out in the event of an accident or claim before your insurer covers any costs.

When Drivers Shouldn’t Pay In Full for Auto Insurance

When should you avoid paying your premiums in one lump sum? For those who are struggling to budget or who may face cash flow issues, it’s important to keep in mind that paying for auto insurance premiums in one lump sum may not be the best option.

The pay-in-full insurance discount is designed to save money in the long run, but if you don’t have enough funds available at once, then you may incur late fees and other penalties from your insurer.

If this is the case, then you should consider opting for monthly payments instead (Learn More: How often is auto insurance paid?). This will allow you to spread out the cost of your policy over time and make sure that you always have enough funds available when your payment deadline comes around.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Explained

Auto insurance is a type of insurance that covers the cost of damages or injuries caused by a car accident. It can also help cover medical expenses and property damage for people involved in an accident, as well as cover legal costs if necessary. Find out more about the types of auto insurance coverage.

The purpose of auto insurance is to provide financial protection in case of an accident, with the goal of minimizing financial losses for all parties involved.

The law requires that drivers carry certain minimum levels of auto insurance coverage, so they can be financially responsible for any damages or losses caused by their vehicle.

Generally speaking, this includes liability auto insurance coverage to pay for bodily injury and property damage resulting from an accident, uninsured motorist coverage in case the other driver is uninsured, personal injury protection (PIP) auto insurance, which pays for medical expenses, and comprehensive auto insurance or collision auto insurance coverage which pays for damage to your vehicle.

Find more advice on how to get auto insurance for you.

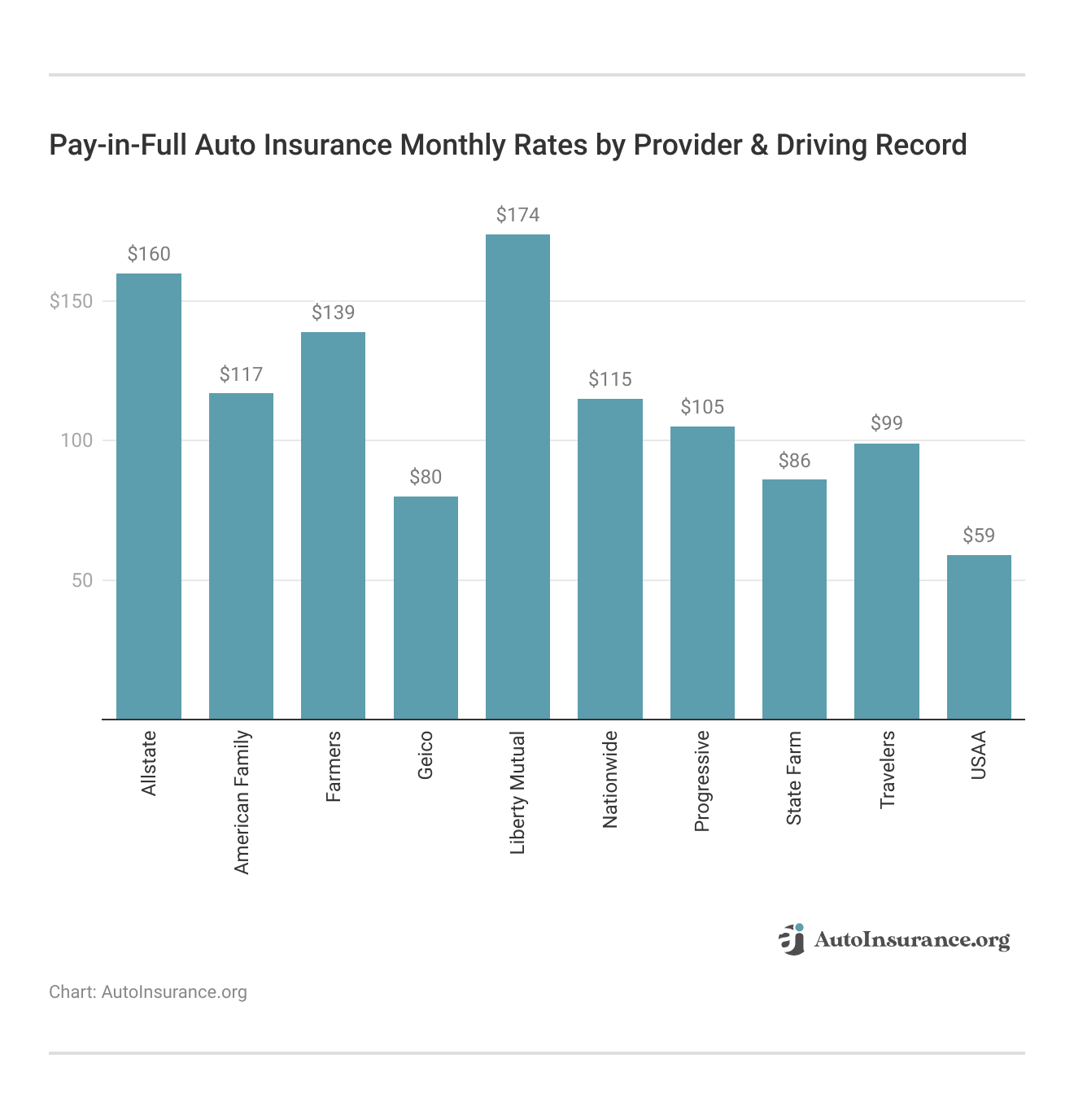

When purchasing auto insurance, the cost of a policy will depend on several factors that affect auto insurance rates, including your driving record, the type of vehicle you drive, and other circumstances. See how rates compare among the best companies based on driving records below.

Generally speaking, drivers can choose from a variety of policies with varying levels of coverage as well as auto insurance deductibles that determine how much they’ll have to pay out-of-pocket in case of an accident.

Once you’ve chosen a policy that meets all the legal requirements, you can usually buy auto insurance online instantly or through an agent.

Ultimately, auto insurance is important to maintain financial responsibility in the event of accidents or damages caused by vehicles. While the law requires drivers to carry certain minimum levels of coverage, it’s usually beneficial to purchase additional coverage if you can afford it.

Shopping around and comparing policies is a great way to make sure you get the best value for your money.

Getting the Best Pay-in-Full Auto Insurance Discount

In summary, taking advantage of the best auto insurance discount for paying in full can be a great way to save money while protecting yourself from unexpected expenses. To make the most out of full-payment car insurance savings, it’s important to budget for your payments, choose a policy with a pay-in-full discount option, and compare different policies from the cheapest auto insurance companies before committing to one.

Before opting for the pay-in-full route, drivers should consider their cash flow situation and whether it makes more sense for them to spread out their payments over time instead.Dani Best Licensed Insurance Producer

With careful preparation and research, you can get the coverage you need while still saving money on premiums. Shop for affordable auto insurance coverage by entering your ZIP in our quote tool.

Frequently Asked Questions

What is the insurance paid in full discount?

The pay-in-full discount is a type of discount offered by some insurers that rewards customers for paying their premiums in one lump sum rather than breaking them up into monthly payments.

Does paying auto insurance in full save money?

Wondering is car insurance cheaper if you pay in full? Paying auto insurance in full can result in significant savings depending on the insurer and policy. Many insurers offer pay-in-full discounts that reward customers for paying their premiums upfront.

Does Geico give discounts for paying in full?

Yes, there is a Geico paid-in-full discount for those who choose to pay their premiums in one lump sum. Visit our article on the best Geico auto insurance discounts to learn other ways to save besides the Geico discount for paying in full.

Does Progressive have a pay-in-full discount?

Yes. Progressive offers a pay-in-full discount for those who choose to pay their premiums in one lump sum.

Does State Farm give a discount for paying in full?

Yes, there is a State Farm pay-in-full discount. The State Farm discount for paying in full is 10% off on a policy.

Are there any disadvantages to paying in full for auto insurance?

Yes, there are some disadvantages to paying in full for auto insurance.

- Large Upfront Payment: Paying the full auto insurance premium at once requires a substantial amount of money upfront, which may be challenging for some individuals.

- Cash Flow Impact: Opting for a pay-in-full discount may affect your overall cash flow, particularly if you have other significant financial obligations or expenses.

- Missed Payment Opportunity: By paying in full, you miss the chance to spread the premium cost over several months, which can be beneficial for budgeting purposes.

If you are hesitant about paying in full because of these reasons, then it may be best to continue to pay monthly. Shop for a cheap auto insurance company by using our free quote tool.

What are the benefits of a pay-in-full auto insurance discount?

There are several benefits to paying in full discounts, such as:

- Cost Savings: By paying your premium in full and earning a pay-in-full discount, you can potentially save a significant amount of money compared to monthly installments.

- Convenience: Paying the entire premium upfront eliminates the hassle of monthly payments and reduces the chances of missed or late payments.

- Improved Credit Rating: Some insurance companies consider your payment history when calculating your premium. Paying in full can demonstrate financial responsibility and positively impact your credit rating.

Drivers who can pay in a lump sum and aren’t planning to leave the company may want to consider paying in full for full payment auto insurance savings.

What happens when an insurance policy is paid in full?

When paying car insurance in full, drivers won’t have to worry about monthly payments and can earn a paid-in-full auto insurance discount.

Do you get a discount for paying car insurance in full at USAA?

Yes, USAA offers a 10% discount to customers who pay in full. Learn more about the company in our USAA auto insurance review.

Which insurance company offers the most discounts?

Geico and Progressive have some of the largest discount lists for customers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.