AAA vs. State Farm Auto Insurance in 2026 (Side-by-Side Review)

AAA vs. State Farm auto insurance both offer competitive rates, averaging from $33/month. AAA vs. State Farm auto insurance offers AAA's low mileage rates and strong customer service while State Farm's providers more affordable deals for safe driving, consider these factors to find your best option.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

3,027 reviews

3,027 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,155 reviews

18,155 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsComparing rates, coverage options, and customer service is important when looking at AAA vs. State Farm auto insurance.

State Farm’s monthly auto insurance premiums generally undercut AAA, with an average savings of approximately $33/month, since AAA requires a membership, its rates are often on the higher side.

AAA vs. State Farm Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.5 | 5.0 |

| Claim Processing | 3.3 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.0 | 4.2 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 3.9 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 4.4 | 3.8 |

| Savings Potential | 4.3 | 4.3 |

| AAA Review | State Farm Review |

Even though State Farm does well in a few area, including affordable rates and a user-friendly app, AAA stands out for its excellent roadside help and membership advantages. Through comparing them, they can help weigh their car-insurance needs accordingly.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

- State Farm’s rates average $33/month lower than AAA’s premiums

- AAA excels in roadside assistance, while State Farm has a better app

- State Farm offers 30% off for safe driving; AAA gives 9.1% off for mileage

AAA vs. State Farm: Auto Insurance Rates by Age, Gender, and Driving Record

Because State Farm and the American Automobile Association (AAA) function so differently as companies, we want to ensure you know the differences between the two and the possible implications on your auto insurance service and also rate.

Compare AAA and State Farm’s minimum coverage auto insurance monthly rates by age and gender. For drivers aged 16, rates for females and males are closely matched between the two companies. As drivers age, rates stabilize, with both providers offering similar prices for individuals aged 30, 45, and 60.

AAA vs. State Farm Minimum Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $164 | $162 |

| Age: 16 Male | $162 | $160 |

| Age: 30 Female | $52 | $52 |

| Age: 30 Male | $50 | $52 |

| Age: 45 Female | $88 | $88 |

| Age: 45 Male | $46 | $46 |

| Age: 60 Female | $34 | $33 |

| Age: 60 Male | $33 | $33 |

This comparison highlights the monthly rates for full coverage auto insurance from AAA and State Farm, segmented by age and gender. For instance, both 16-year-old females and males can expect to pay $465 with AAA, while State Farm offers a more affordable rate of $349.

AAA vs. State Farm Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $465 | $349 |

| Age: 16 Male | $465 | $349 |

| Age: 30 Female | $99 | $94 |

| Age: 30 Male | $103 | $103 |

| Age: 45 Female | $88 | $86 |

| Age: 45 Male | $86 | $86 |

| Age: 60 Female | $76 | $76 |

| Age: 60 Male | $77 | $76 |

Entering the 30s, drivers are also just a bit more expensive with AAA at $99 for females and $103 for males and State Farm at $94 for females and $103 for males. Still competitive at age 45, AAA prices $88 for females and $86 for males — which is in the ballpark of State Farm’s price range.

By age 60, the rates decrease for both companies, with AAA at $76 for females and $77 for males, while State Farm maintains a steady rate of $76 for both genders. This analysis provides valuable insights for consumers seeking the best auto insurance rates based on demographic factors.

AAA vs Statee Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $86 | $86 |

| Not-At-Fault Accident | $133 | $102 |

| Speeding Ticket | $108 | $96 |

| DUI/DWI | $148 | $112 |

The following table compares AAA and State Farm full coverage auto insurance monthly rates by driving record. The both companies will charge $86 for drivers with clean record. But State Farm’s rate of $102 far outpaces AAA’s $133 for those with a not-at-fault accident.

Drivers with a speeding ticket see a rate of $108 with AAA and $96 with State Farm, while those with a DUI/DWI pay even more: $148 from AAA and $112 from State Farm. That way, consumers can see the impact of their driving history on insurance costs with each provider.

Having a good idea of what impacts auto insurance rates when picking coverage is important. Based on gender, age, and driving record, this comparison will help you decide if State Farm or AAA has the right premium for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Coverage Options: AAA vs. State Farm Auto Insurance Policies

State Farm is the more affordable car insurance company, but we want to check in on the auto coverages AAA and State Farm has to offer. This will give you the ability to tell which provider has more comprehensive policies, because price should only be one determining factor when comparing providers against each other.

State Farm provides more affordable rates and excellent discounts, while AAA offers comprehensive coverage options and a strong reputation for customer service.Kristen Gryglik Licensed Insurance Agent

Both car insurance providers give you the basic auto insurance policy features. Of course, AAA has a few add-on coverages that aren’t available in every state. This could be a dealbreaker if some of the extras are important to you and you live in a state for which AAA does not provide that coverage.

AAA Auto Insurance Coverages

AAA insurance provides various types of coverage, including standard auto insurance policies like liability, collision, and comprehensive coverage, such as:

- Accident Forgiveness: AAA does offer accident forgiveness as an add-on in certain states. This benefit ensures that your premium won’t increase after your first at-fault accident, which can be especially valuable for drivers aiming to maintain stable insurance rates.

- AAA Gap Insurance: Does AAA offer gap insurance? Of course. In the event of a total loss claim, gap car insurance covers the shortfall between your remaining loan balance and the payout you received for the full value of your vehicle.

- Non-Owners Insurance: AAA non-owner car insurance covers you when you drive someone else’s car, and is designed specifically for you if you don’t own a car but drive fairly regularly.

- Rental Car Reimbursement Insurance: AAA rental car discount and reimbursement will pay for your rental car as long as your car is being worked on in a shop during repairs and not 100% road worthy.

- Rideshare Insurance: AAA Rideshare Insurance is intended for those who drive people around for a living through Uber or Lyft. This is to be purchased alongside your standard auto insurance policy and will insure you while you are carrying passengers.

Keep in mind that these coverages may not be available in every state. For instance, you might not be able to find AAA insurance for rideshare drivers in your state.

Other states may not pick up the other add-ons, while others may only offer some, or all, of the other add-ons we listed above. Your best bet is to shop around, and talk with an agent to make sure the options you desire are available before you purchase.

State Farm Auto Insurance Coverages

Is the roadside assistance offered by State Farm? State Farm provides the same protection that AAA mentioned above, like cheap non-owner car insurance or Gap coverage. But as an example, State Farm’s coverages aren’t available only in a handful of states and so it’s easier to locate the add-on coverages with State Farm than AAA.

Is State Farm roadside assistance free? No, State Farm usually does not offer free roadside assistance. Instead, it can be available as an optional coverage added to your current auto insurance policy, or pay-per-use. This depends on the coverage level and the services included.

In the case of an accident out of state, compared to only covering rental car costs at State Farm, its rental car reimbursement insurance will also cover the travel expenses.

AAA vs. State Farm Roadside Assistance Coverage

Both AAA and State Farm offer great roadside assistance coverage. Roadside assistance will get the car repaired or towed to the repair shop if the vehicle becomes disabled in a covered event.

Does auto insurance include roadside assistance? Not really but adding one is fairly inexpensive. Roadside assistance on your policy typically costs less than $20 a month, which can quickly pay for itself with just one or two covered incidents.

At State Farm, the average increase for adding this coverage to your car insurance policy is under $10. AAA also remains quite affordable and you can obtain more comprehensive roadside assistance than the basic policy add-on available for car insurance. Roadside assistance has additional benefits too, such as assistance while traveling, as provided by AAA.

The biggest differentiation compared to State Farm is that State Farm will have tires delivered. If you already don’t have one, this can be a real service. AAA the wont which means AAA will only put your tire with a spare tire so you can drive to the shop and have a new one. AAA also won’t bring you oil, but State Farm will.

The AAA, however, will tow vehicles that have become stuck in snow, mud, etc, which State Farm will not. In other words, if you are trapped at the end of your driveway since the snow is too high, you can call AAA to dig you out to the road.

AAA vs. State Farm Auto Insurance Discounts

As we already pointed out, on average State Farm offers less expensive car insurance than AAA, but auto insurance discounts can help lower your typical AAA insurance rates.

Both companies offer traditional auto insurance discounts that you can find at most insurers such as good driver and multi-policy discounts. However, more rarely offered discounts can vary from one company to the next. As an example of this, the insurance company State Farm offers a defensive driving discount and AAA does not.

AAA Auto Insurance Discounts

The biggest AAA car insurance discounts is the low-mileage discount, which rewards drivers for keeping their mileage down. Drivers will need to provide their odometer readings for mileage verification, but it can help take up to 9.1 percent off their auto insurance policy, which is a big saving.

State Farm's lower premiums and strong discounts make it a cost-effective choice, while AAA's added membership perks and roadside services provide unmatched value for frequent travelers.Daniel Walker Licensed Auto Insurance Agent

Besides the openness for bad credit AAA additionally has a loyalty discount of as much as 10% for those prospects who have been with AAA two years or longer.

Large bundling discounts are available if you bundle home or renters insurance with auto insurance.For instance, the discount for buying AAA home insurance alongside your auto insurance can yield up to 14% off your auto policy. It can be worth checking to see how bundling savings might work when comparing AAA vs. State Farm home insurance.

State Farm Auto Insurance Discounts

We also mentioned the good discounts available to help customers lower their auto insurance rates in a State Farm auto insurance review. You can save on a number of things, including one of its largest discounts: a safe driving discount if you enroll in State Farm Drive Safe & Save. Insurance companies have a habit of offering 30% discounts on your auto insurance policy if you are a safe driver.

For young drivers younger than 25 years old who are three years free of at-fault accidents and moving violations, State Farm also has its Steer Clear program. Young drivers can obtain up to 15% off their policy upon successful completion of the program; a steep discount when you consider young drivers are already facing some of the highest insurance rates available.

Thus, if parents already have kids joining the family auto insurance policy, they should encourage their new drivers to take part in the program to lower their policy price.

AAA vs. State Farm Auto Insurance Mobile Experiences

One important consideration customers sometimes overlook in judging an auto insurer is the ease of use of its mobile apps and websites. Based on this review, we found the websites for both AAA and State Farm to be fairly easy-to-navigate, providing consumers with information on several types of auto insurance, such as coverages, discounts, etc.

data-media-max-width=”560″>

AAA tests revealed that new vehicles (2024) equipped with Automatic Emergency Braking systems avoided collisions at speeds up to 35 mph 100% of the time compared to older systems (2017-2018).

Read the full report: https://t.co/9FhBevY8R8 #AAA #ADAS #SafetyWin #NextGenCars 🚗🙌 ✅— AAA (@AAAnews) October 24, 2024

But State Farm has the upper hand in mobile app ratings, while Geico actually has better reviews in other key writer categories. We’ll discuss the mobile app ratings in more depth in the following sections.

AAA Mobile Experience

AAA has an app available on Google Play or Apple Store. This AAA car insurance app garnered the following AAA auto insurance ratings and reviews on those two sites:

- Google Play: 4.4 / 5 Stars (50, 000 Reviews)

- Apple Store: 4.5 / 5 Stars (47,159 Reviews)

You can do more with the app because it is not designed to service auto and home insurance customers. Instead, you could view your AAA membership and request roadside assistance.

State Farm is a solid choice for affordable rates, while AAA offers added value through its exclusive benefits and top-tier roadside assistance.Jeff Root Licensed Insurance Agent

You will have to make all future edits to your auto insurance policy online at the AAA website.

State Farm Mobile Experience

You can get the State Farm auto insurance app on Google Play or the Apple store, according to the brand of Smartphone you have. A step ahead of AAA’s mobile app, as the ratings below illustrate.

- Google Play: 4.7 / 5 Stars (130, 000 Reviews)

- Apple Store: 4.7 / 5 Stars (619,000 Reviews)

The online mobile app from State Farm gives you access to your auto insurance plan and manage your auto insurance policy, whether you have to pay a bill or monitor a claim. State Farm auto roadside assistance can also be requested through the app. So with State Farm, it’s easier to get information on the mobile app than AAA, so it is the better app for drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA vs. State Farm Customer Service Rating

Comparing insurance business ratings and customer reviews AAA is respected at 823 out of 1,000 in the eyes of the customer, with J.D. Power scoring State Farm the highest with an average of 877 out of 1,000 among the 20 largest auto insurers. However, AAA also garnered an A for solid business practices but not as high as State Farm’s, given AAA’s C- business practices score.

Insurance Business Ratings & Consumer Reviews: AAA vs. State Farm

| Agency |  | |

|---|---|---|

| Score: 823 / 1,000 Avg. Satisfaction | Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: C- Below Avg. Business Practices |

|

| Score: 74/100 Good Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A+ (Superior) Excellent Financial Strength | Score: B Fair Financial Strength |

In customer feedback, State Farm scores 75 compared to AAA at 74 according to Consumer Reports. According to A.M. Best, the financial strength ratings for AAA comes in at an A+ (Superior) while State Farm has a B (fair). The following overview outlines where the two compare in terms of customer satisfaction, their way of doing business, and their financial strength.

AAA Roadside Assistance vs State Farm while AAA has excellent roadside assistance and member benefits, State Farm typically has cheaper rates and better customer service.Michelle Robbins Licensed Insurance Agent

Customer service is another important consideration when comparing two auto insurance companies. Customer service that is good means the company processes claims fast, communicative and ready to help customers with issues and questions.

The user shared a Reddit comment about their positive experience with AAA. They highlighted quick and helpful service when their car was totaled years ago, great customer service, and significant savings over State Farm after switching. They also mentioned that the person responsible for the accident had State Farm, and their customer service was also excellent.

Comment

byu/MShorter02 from discussion

inInsurance

They have had good experiences with the best roadside assistance plans, customer service reviews and ratings are a good indicator of a company’s reputation.

A Reddit post describes an auto accident injury settlement from State Farm. The poster’s mother was involved in a rear-end accident, with her car totaled. State Farm accepted full liability and is offering compensation: $2,500 for pain and discomfort, up to $15,000 for medical bills, and $300 for lost wages on the day of the accident. The poster is seeking feedback from others with similar experiences.

Lack of clarity from their agent about policy details and trouble changing from one type of policy to another also factored into their frustration. We strongly suggest that you assess any company you are going to join to see reviews and ratings.

Although you can never find an auto insurance company without negative reviews, a large number of consumers that were unhappy should be a major red flag. Good reviews mixed with bad reviews, with poor reviews being the majority are a sign that their customer service is lacking.

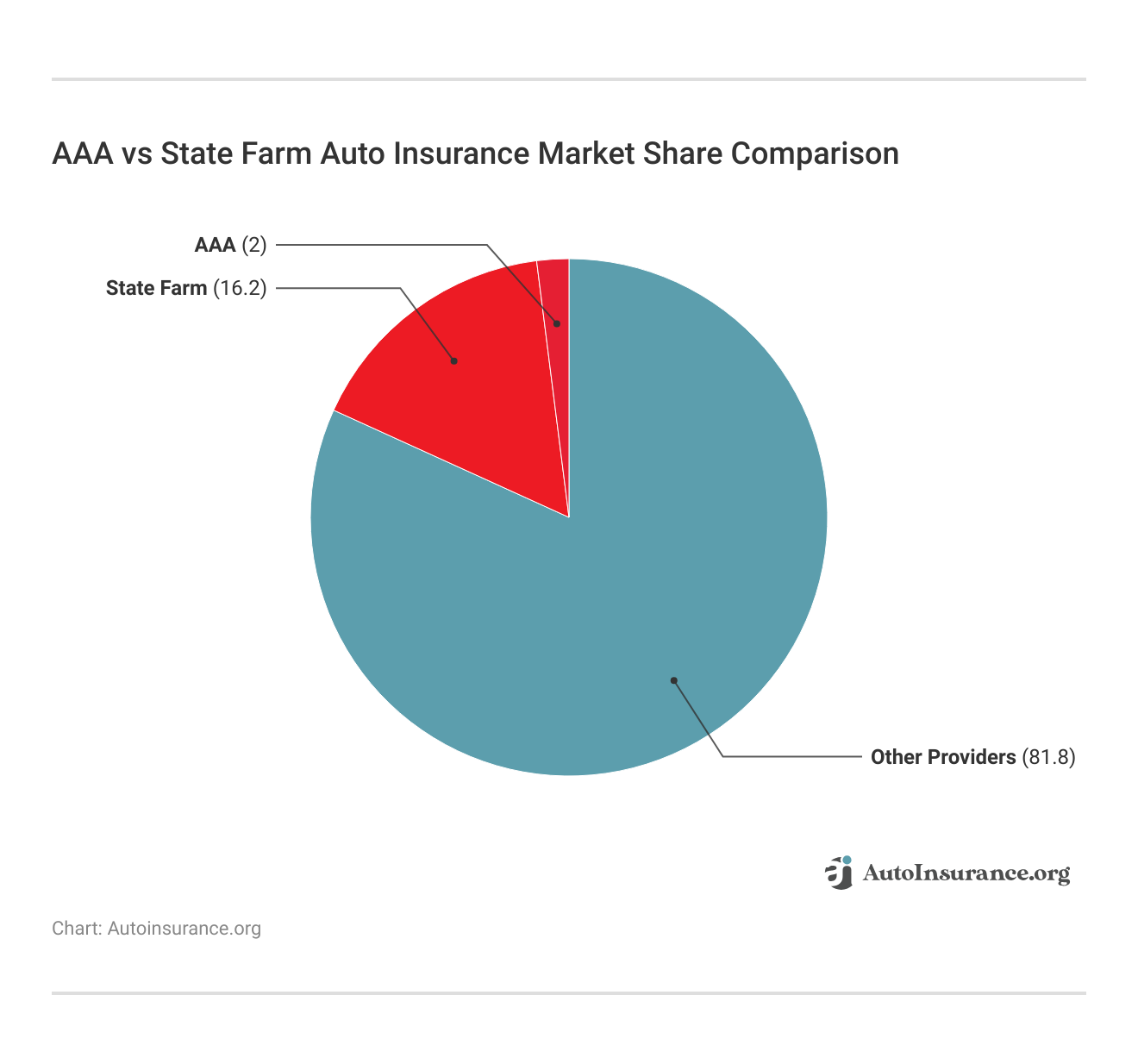

This side by side comparison will look at AAA and State Farm, and the market share they hold within the auto insurance market. Top providers are State Farm, AAA and others, making up a combined 81.8% of the market.

This summary presents how auto insurance is competitive and where these two major insurers rank among other competitors in the industry.

Evaluating Thoughts on AAA vs. State Farm Auto Insurance

When it comes to their average rates, State Farm is cheaper than AAA, with monthly rates of $33 less than that of AAA on average. For example, AAA is well-regarded for its incomparable roadside assistance and membership perks, but its premiums are usually higher, in part because of membership requirements.

While this may not seem like a big deal, it means that State Farm offers a much better mobile experience and competitive coverage options with no restrictions on certain states. State Farm is not only more affordable than AAA, but it also beats its rival in customer satisfaction, making it the insurance provider of choice for many drivers looking for comprehensive auto insurance.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various companies near you.

Frequently Asked Questions

What’s the difference between State Farm roadside assistance and AAA?

State Farm roadside assistance offers basic services like tire changes and towing, but it is generally available as an add-on to your policy. AAA provides more extensive roadside help, including services like snow and mud towing, and offers additional travel-related benefits for members.

How does AAA car insurance compare to State Farm?

AAA car insurance prices generally run high thanks to mandatory membership but it also comes with the best roadside assistance under the sun and plenty of membership-based frills. While State Farm rates and premiums are generally better than AAA and even more so for drivers with a clean record, you won’t get some of the membership perks AAA offers.

What types of coverage does State Farm insurance provide?

State Farm provides liability, collision and comprehensive coverage options. They also offer add-on coverages such as roadside assistance and rental reimbursement, with competitive rates for the cheapest liability-only auto insurance.

How do I get an AAA insurance quote online?

To receive an AAA insurance quote online, go to the site or use its tool. For an accurate quote, you will need to enter information about your vehicle, driving history and coverage preferences. Additionally, you have the option to reach out to an agent with any questions or concerns.

How does State Farm auto insurance compare to other providers?

They provides competitive prices per liability, collision, and comprehensive insurances. For example, they will discount you greatly if you drive safely through Drive Safe & Save. In addition, it can be any type of full-coverage auto insurance at a low cost as long as the app is easy to use and has high availability for customer support.

What’s the difference between AAA and Mercury auto insurance?

AAA provides additional benefits like discounts for low-mileage drivers and roadside assistance, while Mercury focuses on offering more affordable rates for high-risk drivers. As one of the best auto insurance companies for high-risk drivers, Mercury’s policies tend to have fewer additional perks but can be a cost-effective option for those looking for basic coverage.

What should I know when choosing a State Farm agent?

When choosing a State Farm agent, consider their experience, customer service reviews, and ability to tailor coverage to your needs. State Farm agents are known for providing personalized service, offering a wide range of auto insurance options, and guiding you through claims efficiently.

How does AAA compare to Nationwide for auto insurance?

Overall, AAA provides great membership perks and roadside assistance, while Nationwide has good customer satisfaction marks and rates that are hard to beat. AAA has a more expensive membership surprisingly, if you know then little arrangements with Nationwide befits the pocket.

What are the key differences between AAA and Liberty Mutual auto insurance?

AAA offers perks like roadside assistance but higher rates due to membership. Liberty Mutual provides competitive pricing with multi-policy and safe driver discounts, making it a more affordable option. Best auto insurance companies for multiple vehicles include Liberty Mutual, offering savings for multi-car households.

How do AAA and Erie Insurance compare for auto coverage?

Erie Insurance offers great rates and good customer service for new drivers and drivers with a clean driving history. AAA is one of the better picks for roadside assistance and a range of member discounts, but its prices tend to be higher than Erie’s. However, Erie is probably going to come out ahead on pricing.

What is the official website for State Farm auto insurance?

What’s the difference between AAA auto insurance and State Farm?

How does AAA auto insurance compare to Progressive?

How can I get an AAA auto insurance quote in California?

What does AAA full coverage car insurance include?

What are AAA auto insurance prices?

How does AAA auto insurance compare to Travelers?

How much does AAA insurance increase after an accident?

What is included in AAA’s towing coverage?

What is the State Farm roadside assistance phone number?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.