Best Dodge Challenger Auto Insurance in 2025 (Check Out These 10 Companies)

The best Dodge Challenger auto insurance is available from State Farm, Geico, and Progressive, offering rates as low as $80 per month. These providers excel in affordability and comprehensive coverage. If you're wondering how much does it cost to insure a Dodge Challenger, these companies deliver the best value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Dodge Challenger

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Dodge Challenger

A.M. Best Rating Score

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Dodge Challenger

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Dodge Challenger auto insurance providers are State Farm, Geico, and Progressive, offering rates as low as $80 per month. Discover how much to insure a Dodge Challenger with our top pick, State Farm, and compare quotes to find the best coverage for your needs.

This article also explores how Dodge Challenger insurance rates vary. Understanding these variations can help tailor your coverage and manage costs effectively. Discover more about auto insurance rates by age and how it affects your rates.

Our Top 10 Company Picks: Best Dodge Challenger Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 20% A++ Multiple Discount Geico

#3 13% A+ Competitive Rates Progressive

#4 15% A+ Extensive Coverage Allstate

#5 12% A Accident Forgiveness Liberty Mutual

#6 10% A+ Local Agents Farmers

#7 20% A+ Customer Service Nationwide

#8 8% A++ Financial Stability Travelers

#9 15% A Personalized Service American Family

#10 10% A+ Specialized Coverage The Hartford

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- State Farm provides top rates for the Best Dodge Challenger Auto Insurance

- Cheapest Dodge Challenger insurance starts at $85 per month

- See the factors affects Dodge Challenger insurance rates.

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: State Farm offers a variety of coverage options, including comprehensive and collision coverage, which are essential for protecting high-performance vehicles like the Dodge Challenger.

- Discount Opportunities: As mentioned in our State Farm auto insurance review, State Farm provides multiple discount opportunities, such as safe driver and multi-policy discounts, which can significantly lower the $160 monthly premium for Dodge Challenger owners.

- Reliable Roadside Assistance: State Farm offers a robust roadside assistance program, which can be invaluable for Dodge Challenger owners in case of breakdowns or emergencies, ensuring quick and efficient help.

Cons

- Higher Than Average Rates: With a $160 monthly premium, State Farm’s rates are higher compared to other providers like Geico and Progressive, making it less attractive for budget-conscious Dodge Challenger owners.

- Limited Online Tools: State Farm’s online tools and mobile app features are not as robust as competitors, potentially making policy management and claims processes less convenient for tech-savvy Dodge Challenger drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Multiple Discount

Pros

- Competitive Pricing: Geico offers one of the lowest rates at $150 per month, making it a cost-effective option for Dodge Challenger owners seeking affordable insurance without sacrificing essential coverage.

- User-Friendly Online Experience: Geico’s robust online tools and mobile app provide Dodge Challenger owners with easy access to policy management, claims filing, and customer support, enhancing overall convenience.

- Extensive Discounts: Geico auto insurance review highlights the wide range of discounts, including those for good drivers, federal employees, and military personnel, which can further reduce the cost of insuring a Dodge Challenger.

Cons

- Limited Local Agents: Geico’s business model relies heavily on online and phone services, which may not be ideal for Dodge Challenger owners who prefer in-person interactions and local agent support.

- Average Customer Service: While Geico is known for its low rates, customer service reviews are mixed, with some Dodge Challenger owners reporting less satisfaction with claims handling compared to other insurers.

#3 – Progressive: Best for Competitive Rates

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe Dodge Challenger drivers with potential discounts, allowing them to lower their $155 monthly premium based on driving habits. (Read More: Progressive Auto Insurance Discounts).

- Broad Coverage Options: Progressive offers extensive coverage options, including gap insurance and custom parts and equipment coverage, which are beneficial for Dodge Challenger owners looking to protect their vehicle modifications.

- Strong Online Presence: Progressive’s user-friendly website and mobile app make it easy for Dodge Challenger owners to manage their policies, file claims, and access customer support online.

Cons

- Higher Rates for High-Risk Drivers: Progressive tends to charge higher premiums for high-risk drivers, which can be a drawback for Dodge Challenger owners with less-than-perfect driving records.

- Mixed Customer Reviews: Customer reviews for Progressive are varied, with some Dodge Challenger owners reporting issues with claim settlements and customer service responsiveness.

#4 – Allstate: Best for Extensive Coverage

Pros

- Excellent Claims Process: As outlined in our Allstate auto insurance review, Allstate is known for its efficient and reliable claims process, which is a significant advantage for Dodge Challenger owners needing quick and fair settlements.

- Drivewise Program: Allstate’s Drivewise program offers discounts for safe driving, allowing Dodge Challenger owners to reduce their $162 monthly premium by maintaining good driving habits.

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options, including new car replacement and accident forgiveness, which are beneficial for Dodge Challenger owners seeking extensive protection.

Cons

- Higher Premiums: At $162 per month, Allstate’s premiums are higher than many competitors, making it a less budget-friendly option for Dodge Challenger owners.

- Limited Discount Availability: Allstate offers fewer discounts compared to other insurers, potentially limiting savings opportunities for Dodge Challenger owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Lifetime Repair Guarantee: Liberty Mutual offers a lifetime repair guarantee on approved repair shops, providing Dodge Challenger owners with peace of mind and assurance of quality repairs.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program helps prevent rate increases after the first accident, which is beneficial for Dodge Challenger owners concerned about premium spikes.

- Customizable Coverage: As mentioned in our Liberty Mutual auto insurance review, they allow Dodge Challenger owners to customize their policies with various add-ons, ensuring their insurance meets specific needs and preferences.

Cons

- Highest Premiums: With a monthly premium of $165, Liberty Mutual is the most expensive option, which may deter budget-conscious Dodge Challenger owners.

- Average Customer Satisfaction: Liberty Mutual’s customer satisfaction ratings are average, with some Dodge Challenger owners expressing concerns about claims handling and customer service responsiveness.

#6 – Farmers: Best for Local Agents

Pros

- Comprehensive Policy Options: Farmers offers a variety of comprehensive coverage options, including coverage for aftermarket parts, which is ideal for Dodge Challenger owners with vehicle modifications.

- Multiple Discount Opportunities: Farmers provides numerous discounts, such as good driver, multi-policy, and professional group discounts, which can help lower the $158 monthly premium for Dodge Challenger insurance. Check their rates in our Farmers auto insurance review.

- Strong Financial Stability: Farmers has a strong financial stability rating, ensuring that Dodge Challenger owners can rely on the company for dependable claims payouts and overall security.

Cons

- Above Average Rates: Farmers’ $158 monthly premium is higher than some competitors, which may be a concern for Dodge Challenger owners looking for more affordable insurance options.

- Limited Digital Tools: Farmers’ digital tools and mobile app are less advanced compared to some competitors, potentially making policy management and claims processes less convenient for tech-savvy Dodge Challenger drivers.

#7 – Nationwide: Best for Customer Service

Pros

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program allows Dodge Challenger owners to reduce their deductible for safe driving, offering significant savings in the event of a claim.

- Comprehensive Coverage Options: Nationwide offers a wide range of coverage options, including accident forgiveness and new car replacement, which are beneficial for Dodge Challenger owners seeking extensive protection.

- Strong Customer Service: Nationwide is known for its strong customer service, providing Dodge Challenger owners with reliable support and assistance when managing their policies or filing claims. For more information, read our Nationwide auto insurance review.

Cons

- Higher Than Average Rates: Nationwide’s monthly premium of $157 is higher than some other providers, which may be a drawback for Dodge Challenger owners seeking more cost-effective insurance options.

- Limited Local Presence: Nationwide has a more limited local agent presence in some areas, which may be less convenient for Dodge Challenger owners who prefer in-person interactions for policy management.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Financial Stability

Pros

- Comprehensive Coverage Options: As outlined in our Travelers auto insurance review, Travelers offers extensive coverage options, including gap insurance and accident forgiveness, which are beneficial for Dodge Challenger owners seeking thorough protection.

- IntelliDrive Program: Travelers’ IntelliDrive program rewards safe driving with potential discounts, allowing Dodge Challenger owners to lower their $159 monthly premium based on their driving habits.

- Strong Financial Stability: Travelers holds a high A.M. Best rating, indicating strong financial stability and ensuring reliable claim payouts for Dodge Challenger insurance policyholders.

Cons

- Higher Premiums for Young Drivers: Travelers tends to charge higher premiums for young drivers, which can be a disadvantage for younger Dodge Challenger owners.

- Mixed Customer Reviews: Customer reviews for Travelers are varied, with some Dodge Challenger owners reporting issues with customer service and claims handling.

#9 – American Family: Best for Personalized Service

Pros

- Affordable Rates: American Family offers competitive rates at $154 per month, making it an attractive option for Dodge Challenger owners seeking affordable insurance without sacrificing coverage.

- Comprehensive Coverage Options: American Family provides a wide range of coverage options, including gap insurance and roadside assistance, which are beneficial for Dodge Challenger owners.

- Good Student Discounts: American Family offers good student discounts, providing savings opportunities for young Dodge Challenger owners who maintain good academic records. (Read More: American Family Auto Insurance Review).

Cons

- Limited Availability: American Family’s insurance products are not available in all states, potentially limiting access for some Dodge Challenger owners.

- Average Digital Tools: The online tools and mobile app offered by American Family are average compared to some competitors, which may be less convenient for tech-savvy Dodge Challenger drivers.

#10 – The Hartford: Best for Specialized Coverage

Pros

- AARP Discounts: In our The Hartford auto insurance review, The Hartford offers exclusive discounts for AARP members, making it a cost-effective option for older Dodge Challenger owners.

- Lifetime Renewability: The Hartford provides a lifetime renewability benefit, ensuring Dodge Challenger owners can maintain their coverage as long as they meet a few basic requirements.

- Strong Financial Stability: The Hartford has a high A.M. Best rating, indicating strong financial stability and reliable claim payouts for Dodge Challenger insurance policyholders.

Cons

- Higher Premiums: With a monthly premium of $161, The Hartford’s rates are higher than many competitors, which may be a drawback for Dodge Challenger owners looking for more affordable options.

- Limited Coverage for Younger Drivers: The Hartford primarily targets older drivers, potentially limiting its appeal and coverage options for younger Dodge Challenger owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dodge Challenger Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Dodge Challenger from various providers.

Dodge Challenger Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $88 $162

American Family $83 $154

Farmers $87 $158

Geico $80 $150

Liberty Mutual $90 $165

Nationwide $84 $157

Progressive $82 $155

State Farm $85 $160

The Hartford $89 $161

Travelers $86 $159

Based on the data, Geico offers the lowest rates for both minimum and full coverage for Dodge Challenger insurance. Liberty Mutual, on the other hand, has the highest rates, making it less ideal for budget-conscious drivers.

Dodge Challenger Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $83 |

| High Deductibles | $122 |

| Average Rate | $141 |

| Low Deductibles | $178 |

| High Risk Driver | $300 |

| Teen Driver | $515 |

Dodge Challenger insurance rates vary significantly based on factors like deductibles and driver profiles. High-risk and teen drivers face the steepest costs, while opting for high deductibles can help lower overall premiums.

Read More: 10 Companies With the Cheapest Teen Auto Insurance

Dodge Challengers are Expensive to Insure

The chart below details how Dodge Challenger insurance rates compare to other coupes like the Cadillac ATS Coupe, Nissan 370Z, and Audi TT.

Dodge Challenger Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Dodge Challenger | $34 | $57 | $35 | $141 |

| Cadillac ATS Coupe | $29 | $57 | $33 | $132 |

| Nissan 370Z | $28 | $60 | $38 | $140 |

| Audi TT | $32 | $60 | $33 | $138 |

| Infiniti Q60 | $32 | $62 | $33 | $140 |

| MINI Hardtop 2 Door | $24 | $45 | $28 | $108 |

| Mercedes-Benz CLA 250 | $34 | $70 | $33 | $150 |

The Dodge Challenger has a higher total insurance cost compared to several other sports cars, including the Cadillac ATS Coupe and the Nissan 370Z. Among the vehicles listed, the MINI Hardtop 2 Door offers the most affordable insurance rates.

Read More: Best Auto Insurance for Sports Cars

Factors Impacting the Cost of Dodge Challenger Insurance

The trim level and model year of your Dodge Challenger significantly influence the cost of auto insurance. Higher trims with advanced features or performance upgrades typically result in higher insurance premiums due to increased repair costs and higher vehicle values.

For example, a Dodge Challenger SRT or Hellcat with a more powerful engine and enhanced features will usually be more expensive to insure compared to the base model.

Read More: Top 7 Factors That Affect Auto Insurance Rates

Additionally, newer models may cost more to insure because they have higher replacement values and potentially more advanced, and thus more expensive, safety features.

Age of the Vehicle

Insurance costs for the Dodge Challenger decrease with older models. The chart shows how premiums drop for earlier model years compared to newer ones.

Dodge Challenger Auto Insurance Monthly Rates by Model Year

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Dodge Challenger | $35 | $58 | $34 | $143 |

| 2023 Dodge Challenger | $34 | $58 | $34 | $142 |

| 2022 Dodge Challenger | $34 | $57 | $35 | $141 |

| 2021 Dodge Challenger | $33 | $56 | $36 | $140 |

| 2020 Dodge Challenger | $34 | $57 | $35 | $141 |

| 2019 Dodge Challenger | $32 | $55 | $37 | $139 |

| 2018 Dodge Challenger | $31 | $55 | $38 | $138 |

| 2017 Dodge Challenger | $30 | $53 | $39 | $137 |

| 2016 Dodge Challenger | $29 | $51 | $41 | $135 |

| 2015 Dodge Challenger | $27 | $49 | $42 | $133 |

| 2014 Dodge Challenger | $26 | $46 | $43 | $129 |

| 2013 Dodge Challenger | $25 | $43 | $43 | $126 |

| 2012 Dodge Challenger | $24 | $39 | $43 | $121 |

| 2011 Dodge Challenger | $23 | $36 | $43 | $116 |

| 2010 Dodge Challenger | $22 | $33 | $44 | $114 |

Older Dodge Challenger models generally cost less to insure due to lower repair and replacement values. For instance, insurance rates for a 2010 Dodge Challenger are notably lower compared to newer models.

Driver Age

Driver age can significantly impact Dodge Challenger insurance rates, with younger drivers typically paying more than older drivers. For example, a 30-year-old often faces higher premiums compared to a 40-year-old.

Dodge Challenger Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $515 |

| Age: 18 | $425 |

| Age: 20 | $320 |

| Age: 30 | $147 |

| Age: 40 | $141 |

| Age: 45 | $135 |

| Age: 50 | $129 |

| Age: 60 | $126 |

Insurance rates for the Dodge Challenger vary significantly by driver age, with teen drivers facing the highest premiums. Rates decrease progressively as drivers age, with the lowest costs for those in their 60s.

Driver Location

Where you live can significantly impact Dodge Challenger insurance rates, with drivers in certain cities paying much more than those in others. For example, insurance costs can be considerably higher in some locations compared to others.

Dodge Challenger Auto Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $241 |

| New York, NY | $223 |

| Houston, TX | $221 |

| Jacksonville, FL | $204 |

| Philadelphia, PA | $189 |

| Chicago, IL | $186 |

| Phoenix, AZ | $164 |

| Seattle, WA | $137 |

| Indianapolis, IN | $120 |

| Columbus, OH | $117 |

Insurance rates for the Dodge Challenger vary widely across U.S. cities, with significant differences between high-cost and low-cost areas. For instance, cities like Los Angeles and New York have notably higher premiums compared to places like Columbus and Indianapolis.

Your Driving Record

Your driving record can have an impact on the cost of Dodge Challenger auto insurance. Teens and drivers in their 20’s see the highest jump in their Dodge Challenger auto insurance with violations on their driving record.

Dodge Challenger Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $500 | $550 | $600 | $650 |

| Age: 18 | $450 | $495 | $540 | $585 |

| Age: 20 | $320 | $348 | $380 | $415 |

| Age: 30 | $147 | $160 | $175 | $190 |

| Age: 40 | $141 | $153 | $167 | $182 |

| Age: 45 | $134 | $146 | $160 | $175 |

| Age: 50 | $129 | $140 | $153 | $166 |

| Age: 60 | $126 | $137 | $150 | $163 |

Insurance costs for the Dodge Challenger increase significantly with traffic violations and accidents, particularly for younger drivers. The chart shows that having a clean driving record results in the lowest premiums, while speeding tickets and accidents lead to much higher costs.

Safety Ratings

Your Dodge Challenger insurance rates are tied to the safety ratings of the Dodge Challenger. See the breakdown below:

Dodge Challenger Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Marginal |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Acceptable |

| Head restraints and seats | Acceptable |

The safety ratings of the Dodge Challenger, including its performance in various crash tests, influence insurance rates. The vehicle’s mixed ratings, such as “Good” for moderate overlap front and side tests, affect how insurers calculate premiums.

Crash Test Ratings

Dodge Challenger crash test ratings can impact your Dodge Challenger insurance rates. See Dodge Challenger crash test results below:

Dodge Challenger Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2024 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2023 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2022 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2021 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2020 Dodge Challenger 2 DR RWD | N/R | 4 stars | N/R | 4 stars |

| 2020 Dodge Challenger 2 DR AWD | N/R | 4 stars | N/R | 4 stars |

| 2019 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2019 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Dodge Challenger SRT Demon 2 DR RWD | N/R | N/R | N/R | N/R |

| 2018 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2018 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2017 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Dodge Challenger 2 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Dodge Challenger SRT 2 DR RWD | N/R | N/R | N/R | N/R |

| 2016 Dodge Challenger 2 DR RWD | 5 stars | 4 stars | 5 stars | 4 stars |

The crash test ratings for the Dodge Challenger play a crucial role in determining insurance costs. Higher ratings in categories like frontal and side impact contribute to potentially lower premiums, reflecting better overall safety.

Safety Features

Good Dodge Challenger safety features can result in insurers giving you insurance discounts. The safety features for the 2020 Dodge Challenger are:

- Air bags: Driver, passenger, front head, rear head, front side

- 4-wheel ABS and disc brakes

- Electronic stability control and traction control

- Blind spot monitor and cross-traffic alert

- Daytime running lights and brake assist

The 2020 Dodge Challenger’s advanced safety features can help lower insurance premiums through potential discounts. Enhanced protection technologies like air bags and electronic stability control contribute to safer driving and reduced insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dodge Challenger Finance and Insurance Cost

When financing a Dodge Challenger, lenders typically require more extensive coverage, including comprehensive and collision insurance, to protect their investment.

Comprehensive and collision coverage ensures that both the vehicle and your financial interests are safeguarded in the event of an accident or damage.Kristen Gryglik LICENSED INSURANCE AGENT

To find the best rates for this higher level of coverage, it’s important to compare insurance quotes from multiple providers. Using our free comparison tool can help you find competitive rates and ensure you get the necessary protection while staying within your budget.

Read More: Collision vs. Comprehensive Auto Insurance

5 Ways to Save on Dodge Challenger Insurance

Drivers can end up saving more money on their Dodge Challenger insurance rates by employing any one of the following strategies.

- Pay your Dodge Challenger insurance upfront

- Add a more experienced driver to your Dodge Challenger policy

- Ask about retiree discounts

- Avoid the temptation to file a claim for minor incidents

- Install an aftermarket anti-theft device for your Dodge Challenger

Read More: Best Auto Insurance for Retirees

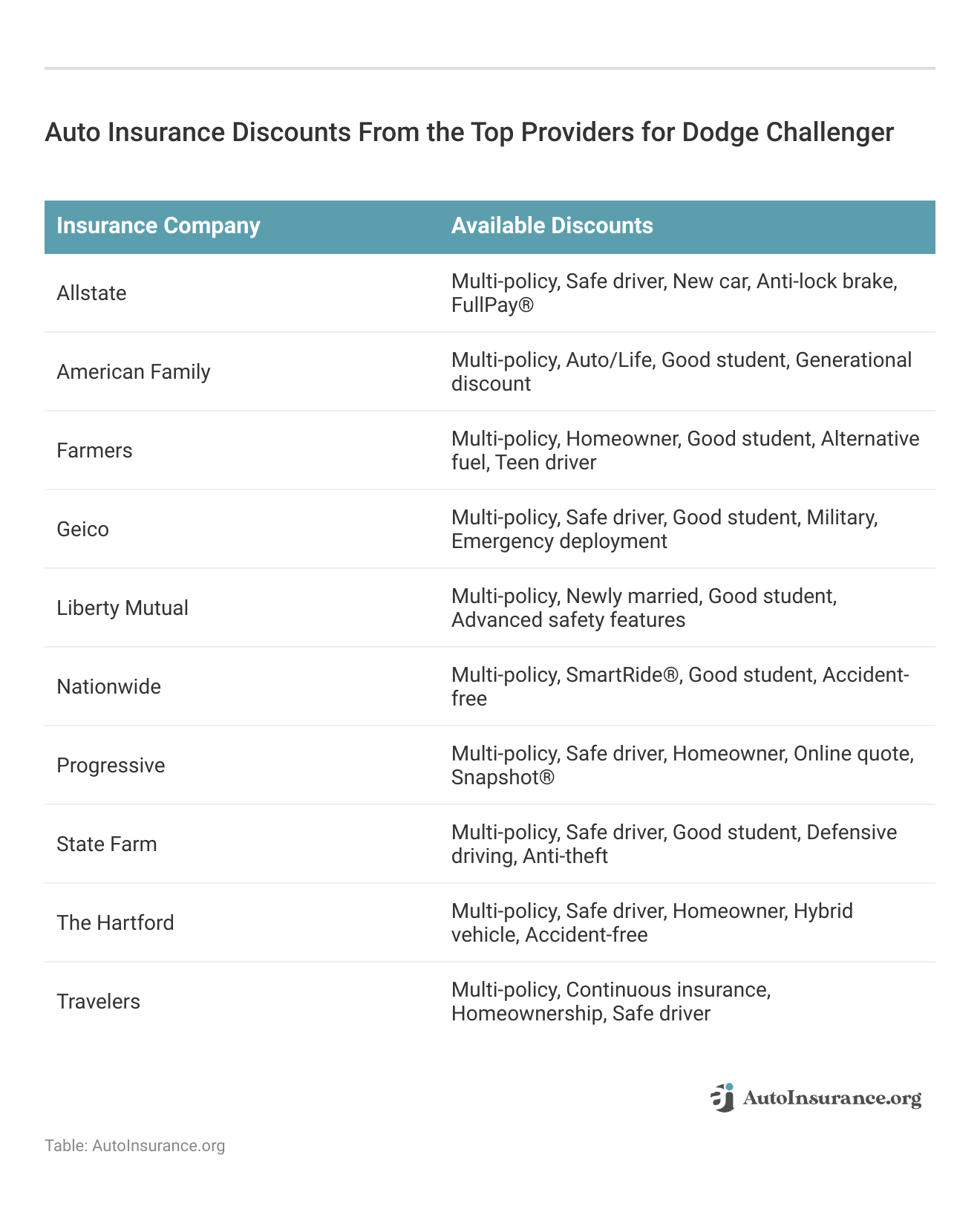

Discover the variety of auto insurance discounts offered by top providers for Dodge Challenger to help you save on your premiums.

These discounts from top insurance providers in Iowa offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Dodge Challenger Insurance Companies

Several insurance companies offer cheap Dodge auto insurance based on factors like discounts for safety features. Take a look at these top auto insurance companies that are popular with Dodge Challenger drivers organized by market share.

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $39.2 million | 5% |

| #4 | Allstate | $35.6 million | 5% |

| #5 | Liberty Mutual | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3% |

| #8 | Chubb | $23.3 million | 3% |

| #9 | Farmers | $20.6 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

When selecting insurance for your Dodge Challenger, consider the top providers that offer competitive rates and discounts for safety features. The market share data highlights the most popular companies, helping you make an informed choice for optimal coverage and cost savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Free Dodge Challenger Insurance Quotes Online

To find the best Dodge Challenger auto insurance, begin by comparing quotes from top-rated insurance companies using our free online tool.

Read More: How long does it take to compare auto insurance quotes?

This tool allows you to evaluate various coverage options, discounts, and rates tailored specifically for your Dodge Challenger, ensuring you secure the most comprehensive and cost-effective policy available.

By exploring multiple providers, you can find the ideal insurance solution that meets your needs and budget while protecting your high-performance vehicle.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

What types of coverage are available for Dodge Challenger auto insurance?

The types of auto insurance coverage for Dodge Challenger insurance include liability (damages to others), collision (repairs after a crash), comprehensive (non-collision incidents), uninsured/underinsured motorist (protection against underinsured drivers), and personal injury protection (medical expenses for you and passengers).

How do Dodge Challenger safety ratings influence my insurance premium?

Dodge Challenger safety ratings influence insurance premiums because higher ratings usually result in lower costs. Vehicles with advanced safety features and strong crash test performance are less likely to be involved in severe accidents, reducing the insurer’s risk and potentially qualifying you for lower rates.

How does State Farm rank for Dodge Challenger auto insurance coverage?

State Farm is highly ranked for Dodge Challenger auto insurance due to its comprehensive coverage options and customer satisfaction, making it our top pick for overall insurance value. Uncover affordable auto insurance rates from the top providers by entering your ZIP code into our free quote comparison tool below.

How do Dodge Challenger crash test ratings affect insurance rates?

Dodge Challenger crash test ratings impact insurance rates as higher ratings generally lead to lower premiums. Vehicles with better safety ratings from crash tests are considered less risky to insure, resulting in potential discounts on premiums. Insurers use these ratings to assess the risk associated with covering your Dodge Challenger.

What is Dodge Challenger auto insurance?

Dodge Challenger auto insurance refers to insurance coverage specifically designed for the Dodge Challenger, a popular sports car model manufactured by Dodge. It provides protection against financial losses in the event of accidents, theft, or other covered incidents involving the Dodge Challenger.

Read More: Does auto insurance cover vehicle theft?

Can I insure my Dodge Challenger with any insurance company?

Yes, you can insure your Dodge Challenger with any insurance company that offers auto insurance. Many insurance providers offer coverage for sports cars like the Dodge Challenger, allowing you to compare quotes and select the one that best fits your needs and budget.

What factors affect Dodge Challenger auto insurance rates?

Dodge Challenger insurance rates depend on vehicle-specific factors like make, model, and safety features, as well as driver-related aspects including age, driving record, and location. Coverage type and deductibles also impact premiums, with higher coverage limits and lower deductibles leading to higher costs. Insurance company algorithms vary, influencing rates.

Read More: What is the difference between car make and car model?

Are there any specific considerations for insuring a Dodge Challenger?

Insuring a Dodge Challenger involves higher costs due to its high-performance nature. Advanced safety features can lower rates, so inform your insurer about them. Disclose any modifications to your car, as they might increase premiums or require extra coverage.

How can I find affordable insurance for my Dodge Challenger?

To find affordable insurance, compare quotes from multiple providers, bundle policies for discounts, maintain a clean driving record, consider higher deductibles, and ask about discounts for safety features or defensive driving courses.

How does financing a Dodge Challenger affect my auto insurance requirements?

When financing a Dodge Challenger, lenders often require comprehensive and collision coverage to protect their investment. This typically results in higher insurance premiums compared to minimum coverage, as the policy must cover the vehicle’s full value and potential repair costs.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.