Best Hyundai Veloster Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Hyundai Veloster auto insurance providers are State Farm, Geico, and Progressive with rates as low as $75 per month. These companies offer the best value due to their comprehensive coverage options, and high customer satisfaction. Compare quotes now to find affordable insurance for your Hyundai Veloster.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

UPDATED: Jul 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Hyundai Veloster

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Veloster

A.M. Best Rating Score

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Hyundai Veloster

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Hyundai Veloster auto insurance providers are State Farm, Geico, and Progressive, offering rates as low as $75 per month. These companies provide the best value due to comprehensive coverage, safe driver discounts, and high customer satisfaction.

Continue reading to learn how you can be eligible for cheap Hyundai auto insurance and compare quotes to find the best insurance for your Veloster.

Our Top 10 Company Picks: Best Hyundai Veloster Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 10% A+ Flexible Coverage Progressive

#4 10% A+ Comprehensive Coverage Allstate

#5 10% A+ Personalized Service Farmers

#6 12% A Customizable Policies Liberty Mutual

#7 8% A++ IntelliDrive Discounts Travelers

#8 20% A+ Vanishing Deductible Nationwide

#9 20% A++ Military Benefits USAA

#10 15% A+ Customer Satisfaction Amica

You can start comparing quotes for Hyundai Veloster auto insurance rates from some of the best auto insurance companies by using our free online tool now.

- Top auto insurance providers for Veloster are State Farm, Geico, and Progressive

- Learn how to get comprehensive coverage and safe driver discounts

- State Farm stands out as the top pick for Hyundai Veloster auto insurance

#1 – State Farm: Top Overall Pick

Pros

- Extensive Coverage Options: State Farm offers a wide range of coverage options, ensuring that Hyundai Veloster drivers can customize their policies to meet specific needs.

- Safe Driver Discounts: State Farm provides substantial discounts for safe driving, which can significantly lower insurance costs for Hyundai Veloster owners.

- Telematics Program: As mentioned in our State Farm auto insurance review, State Farm’s Drive Safe & Save program allows Hyundai Veloster drivers to earn discounts based on their driving habits, promoting safer driving and potential savings.

Cons

- Higher Premiums: Hyundai Veloster owners under 25 may face higher premiums, which could make State Farm less affordable for younger drivers.

- Limited Availability of Discounts: State Farm’s discounts may not be available in all states, potentially limiting savings for some Hyundai Veloster owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico consistently offers some of the most affordable rates for Hyundai Veloster insurance, starting at $75 per month.

- Online Tools: Geico’s online tools make it easy for Hyundai Veloster owners to manage their policies, file claims, and get quotes.

- Multi-Policy Discounts: As outlined in our Geico auto insurance review, they offer discounts for bundling auto insurance with other policies, helping Hyundai Veloster owners save even more.

Cons

- Customer Service Variability: While Geico generally has good customer service, experiences can vary, which might affect Hyundai Veloster owners needing consistent support.

- Limited Coverage Options: Geico’s coverage options may be less comprehensive compared to other insurers, potentially limiting choices for Hyundai Veloster drivers.

#3 – Progressive: Best for Flexible Coverage

Pros

- Strong Coverage: Progressive is known for providing good rates and coverage for high-risk drivers, making it a strong choice for Hyundai Veloster owners with less-than-perfect driving records.

- Snapshot Program Savings: Hyundai Veloster drivers can benefit from Progressive’s Snapshot program, which offers discounts based on driving habits. Learn more in our Progressive auto insurance review.

- Wide Range of Discounts: Progressive offers various discounts, including multi-car, continuous insurance, and more, helping Hyundai Veloster owners reduce their premiums.

Cons

- Higher Rates: Hyundai Veloster owners with clean driving records might find Progressive’s rates higher compared to competitors.

- Complex Policy Structure: Some Hyundai Veloster owners might find Progressive’s policy options and pricing structure complex and difficult to navigate.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Agent Network: Allstate’s large network of agents provides personalized service and support for Hyundai Veloster owners.

- Comprehensive Coverage Options: Allstate offers a variety of coverage options, ensuring Hyundai Veloster drivers can find policies that fit their needs.

- Discounts for Safe Driving: As mentioned in our Allstate auto insurance review they reward safe driving with various discounts, helping Hyundai Veloster owners save on their premiums.

Cons

- Higher Premiums: Allstate’s premiums can be higher than competitors, which might not be ideal for Hyundai Veloster owners seeking the most affordable rates.

- Mixed Customer Reviews: Customer experiences with Allstate can vary, with some Hyundai Veloster owners reporting issues with claims and customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Personalized Service

Pros

- Customizable Policies: Farmers allows Hyundai Veloster owners to customize their policies to fit their specific needs. More information is available about this provider in our Farmers auto insurance review.

- Various Drivers Discounts: Farmers provides a variety of discounts, including those for safe driving, bundling policies, and more, benefiting Hyundai Veloster owners.

- Strong Claims Support: Farmers is known for providing strong support during the claims process, ensuring Hyundai Veloster owners receive help when needed.

Cons

- Higher Premiums: Farmers’ premiums can be higher for Hyundai Veloster drivers, potentially making it less affordable.

- Limited Online Tools: Farmers’ online tools may not be as user-friendly as competitors, which could be a drawback for tech-savvy Hyundai Veloster owners.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- New Car Replacement: Liberty Mutual offers new car replacement coverage, which is beneficial for Hyundai Veloster owners with newer vehicles.

- Accident Forgiveness: Hyundai Veloster owners can benefit from accident forgiveness. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Variety of Discounts: Liberty Mutual provides multiple discounts, including those for safe driving, bundling policies, and more, helping Hyundai Veloster owners save.

Cons

- Higher Rates: Liberty Mutual’s premiums can be higher compared to other insurers, potentially making it less attractive for Hyundai Veloster owners seeking the lowest rates.

- Mixed Customer Service: Customer service experiences can vary, with some Hyundai Veloster owners reporting issues with support and claims processing.

#7 – Travelers: Best for IntelliDrive Discounts

Pros

- Hybrid Vehicle Discounts: Travelers offers discounts specifically for hybrid vehicles, which can benefit Hyundai Veloster owners driving hybrid models.

- Strong Financial Stability: Travelers is known for its financial stability, providing peace of mind for Hyundai Veloster owners regarding claims payments.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, allowing Hyundai Veloster owners to tailor their policies to their needs.

Cons

- Higher Premiums: Travelers’ premiums can be higher for high-risk Hyundai Veloster drivers, potentially limiting its appeal. See more details in our guide titled, “Travelers Auto Insurance Review.”

- Limited Availability: Travelers’ coverage options may not be available in all states, potentially restricting access for some Hyundai Veloster owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Multi-Policy Discounts: Nationwide offers substantial discounts for bundling auto insurance with other policies, helping Hyundai Veloster owners save.

- On Your Side Review: Nationwide provides an annual policy review to ensure Hyundai Veloster owners have the best coverage, adjusting as needed.

- Accident Forgiveness: Hyundai Veloster owners can benefit from accident forgiveness. Read up on the Nationwide auto insurance review for more information.

Cons

- Higher Premiums: Nationwide’s premiums can be higher for younger Hyundai Veloster drivers, potentially making it less affordable.

- Mixed Online Tools: Some Hyundai Veloster owners may find Nationwide’s online tools less intuitive compared to other insurers.

#9 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA offers exclusive discounts for military members and their families, benefiting Hyundai Veloster owners with a military background.

- Exceptional Customer Service: USAA is known for its outstanding customer service, ensuring Hyundai Veloster owners receive top-notch support. Unlock details in our guide titled, USAA auto insurance review.

- Comprehensive Coverage: USAA provides comprehensive coverage options, allowing Hyundai Veloster owners to find policies that fit their specific needs.

Cons

- Limited to Military Members: USAA is only available to military members and their families, limiting its availability for other Hyundai Veloster owners.

- Potentially Higher Premiums for High-Risk Drivers: USAA’s premiums can be higher for high-risk Hyundai Veloster drivers, potentially limiting its affordability.

#10 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica consistently receives high ratings for customer satisfaction, providing peace of mind for Hyundai Veloster owners.

- Dividend Policies: Hyundai Veloster owners can benefit from Amica’s dividend policies. See more details in our guide titled, “Amica Auto Insurance Review.”

- Comprehensive Coverage Options: Amica offers a variety of coverage options, allowing Hyundai Veloster owners to customize their policies.

Cons

- Higher Premiums: Amica’s premiums can be higher compared to other insurers, potentially making it less attractive for Hyundai Veloster owners seeking the lowest rates.

- Limited Availability: Amica’s coverage options may not be available in all states, potentially restricting access for some Hyundai Veloster owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hyundai Veloster Insurance Cost

When comparing insurance providers for your Hyundai Veloster, it’s essential to look at both minimum and full coverage options. Different insurance companies offer varying rates, so it’s beneficial to compare them to find the best deal that fits your needs. Here are the monthly rates for Hyundai Veloster auto insurance by coverage level and provider:

Hyundai Veloster Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $90 $165

Amica $81 $154

Farmers $84 $156

Geico $80 $155

Liberty Mutual $88 $170

Nationwide $83 $159

Progressive $82 $158

State Farm $85 $160

Travelers $86 $162

USAA $75 $145

These costs can vary based on several factors, including your driving history, location, and the coverage options you select.

Hyundai Veloster Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $134 |

| Discount Rate | $80 |

| High Deductibles | $118 |

| High Risk Driver | $290 |

| Low Deductibles | $170 |

| Teen Driver | $490 |

Comparing these rates helps ensure you are getting the best Hyundai Veloster auto insurance that meets your financial and coverage needs.

When selecting the best Hyundai Veloster auto insurance, it's vital to consider both coverage levels and provider rates.Michelle Robbins LICENSED INSURANCE AGENT

Remember, while cost is an important factor, it’s equally important to consider the quality of service and coverage each company offers. Learn more by reading our guide, “What is the average auto insurance cost per month?“

Are Hyundai Velosters Expensive to Insure

When considering insurance for a Hyundai Veloster, it’s helpful to compare its rates to those of other coupes. This comparison gives a clearer picture of where the Veloster stands in terms of insurance costs.

The chart below shows how Hyundai Veloster insurance rates stack up against other popular coupe models such as the Mercedes-Benz CLA 250, Dodge Challenger, and Audi S5.

Hyundai Veloster Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz CLA 250 | $55 | $116 | $35 | $210 |

| Dodge Challenger | $49 | $92 | $33 | $183 |

| Audi S5 | $37 | $60 | $28 | $132 |

| Audi TT | $34 | $70 | $33 | $150 |

| Nissan 370Z | $29 | $50 | $31 | $123 |

| MINI Hardtop 2 Door | $29 | $60 | $35 | $139 |

As the chart indicates, insurance costs for the Hyundai Veloster are relatively moderate compared to these other vehicles.

The Mercedes-Benz CLA 250 and Audi S5, for example, tend to have higher total insurance costs, while the MINI Hardtop 2 Door is on the lower end of the spectrum. These differences are due to various factors including vehicle value, repair costs, and safety features.

Read More: Top 7 Factors That Affect Auto Insurance Rates

What Impacts the Cost of Hyundai Veloster Insurance

You might have noticed that there is a multitude of factors that impact Hyundai Veloster auto insurance rates. Your age, location, driving record, and model year all play a significant role in determining what you will ultimately pay to insure the Hyundai Veloster.

Additionally, factors such as the vehicle’s safety features, the type of coverage you choose, and your credit score can also influence the cost.

High-risk insurance can particularly affect those with poor driving records or young drivers, resulting in higher premiums. By understanding these variables, you can make informed decisions to potentially lower your insurance premiums and find the best coverage for your Hyundai Veloster.

Age of the Vehicle

Older Hyundai Veloster models generally cost less to insure. For example, auto insurance for a 2017 Hyundai Veloster costs $117 while 2012 Hyundai Veloster insurance costs are $103.

Hyundai Veloster Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Hyundai Veloster | $22 | $43 | $28 | $118 |

| 2023 Hyundai Veloster | $23 | $45 | $30 | $121 |

| 2022 Hyundai Veloster | $24 | $46 | $32 | $123 |

| 2021 Hyundai Veloster | $25 | $48 | $33 | $125 |

| 2020 Hyundai Veloster | $26 | $49 | $35 | $128 |

| 2019 Hyundai Veloster | $27 | $51 | $36 | $130 |

| 2018 Hyundai Veloster | $28 | $52 | $38 | $132 |

As vehicles age, their insurance costs generally decrease due to lower market value and repair costs. It’s beneficial to evaluate the cost differences across model years when choosing a Hyundai Veloster. Learn more in our article titled “How Vehicle Year Affects Auto Insurance Rates.”

Driver Age

Driver age can have a significant impact on Hyundai Veloster auto insurance rates. For example, 20-year-old drivers pay approximately more each year for their Hyundai Veloster auto insurance than 30-year-old drivers.

Hyundai Veloster Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $484 |

| Age: 20 | $300 |

| Age: 30 | $138 |

| Age: 40 | $132 |

| Age: 45 | $128 |

| Age: 50 | $121 |

| Age: 60 | $118 |

Insurance rates generally decrease with age as drivers gain experience and a track record of safe driving. Younger drivers often face higher premiums due to increased risk factors.

Driver Location

Where you live can have a large impact on Hyundai Veloster insurance rates. For example, drivers in New York may pay more than drivers in Seattle.

Hyundai Veloster Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $226 |

| New York, NY | $208 |

| Houston, TX | $207 |

| Jacksonville, FL | $192 |

| Philadelphia, PA | $177 |

| Chicago, IL | $175 |

| Phoenix, AZ | $154 |

| Seattle, WA | $128 |

| Indianapolis, IN | $113 |

| Columbus, OH | $110 |

Location affects insurance rates due to factors such as traffic density, crime rates, and local regulations. It’s important to consider regional variations when evaluating insurance costs.

Your Driving Record

Your driving record can have an impact on the cost of Hyundai Veloster auto insurance. Teens and drivers in their 20’s see sees the highest jump in their Hyundai Veloster auto insurance with violations on their driving record.

Hyundai Veloster Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $930 | $1,240 | $775 |

| Age: 20 | $484 | $725 | $967 | $605 |

| Age: 30 | $300 | $450 | $600 | $375 |

| Age: 40 | $138 | $207 | $276 | $173 |

| Age: 50 | $132 | $198 | $264 | $165 |

| Age: 60 | $128 | $192 | $256 | $160 |

| Age: 50 | $121 | $181 | $242 | $151 |

| Age: 60 | $118 | $177 | $236 | $148 |

Maintaining a clean driving record can significantly lower your insurance rates. Avoiding violations and accidents is key to keeping premiums affordable.

Hyundai Veloster Safety Ratings

The Hyundai Veloster’s safety ratings will affect your Hyundai Veloster auto insurance rates. See the chart below:

Hyundai Veloster Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Strong safety ratings can lead to lower insurance rates due to reduced risk of injury and damage. Hyundai Veloster’s high safety scores contribute to more favorable insurance costs.

Hyundai Veloster Crash Test Ratings

Not only do good Hyundai Veloster crash test ratings mean you are better protected in a crash, but good Hyundai Veloster crash ratings also mean cheaper insurance rates.

Hyundai Veloster Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Veloster N 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Veloster 3 HB FWD | 4 stars | 4 stars | 5 stars | 4 stars |

High crash test ratings from reputable organizations indicate that the Hyundai Veloster is a safe vehicle, which can lower insurance premiums.

Hyundai Veloster Safety Features

Most drivers don’t realize that not only do Hyundai Veloster safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Hyundai Veloster auto insurance rates. The Hyundai Veloster’s safety features include:

- Comprehensive Air Bag System: Includes driver, passenger, front head, rear head, and front side air bags.

- Advanced Braking System: Features 4-wheel ABS, 4-wheel disc brakes, and brake assist for enhanced stopping power.

- Stability and Traction Control: Equipped with electronic stability control and traction control to maintain vehicle stability.

- Safety Enhancements: Includes daytime running lights, child safety locks, lane departure warning, and lane keeping assist for additional protection.

These advanced safety features not only enhance the protection of the vehicle’s occupants but also contribute to reduced insurance costs due to the lower risk of injury and accidents.

Hyundai Veloster Insurance Loss Probability

The Hyundai Veloster’s insurance loss ratio varies between different coverage types. While some types of insurance loss ratios are higher for the Hyundai Veloster, others are more favorable and lead to lower insurance rates.

Hyundai Veloster Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | -19% |

| Collision | 13% |

| Comprehensive | 16% |

| Medical Payment | -19% |

| Personal Injury | -18% |

| Property Damage | -19% |

Higher loss ratios in collision and comprehensive coverage indicate a higher frequency or cost of claims, which can result in higher premiums. Understanding these metrics helps in assessing the overall insurance cost for the Hyundai Veloster.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

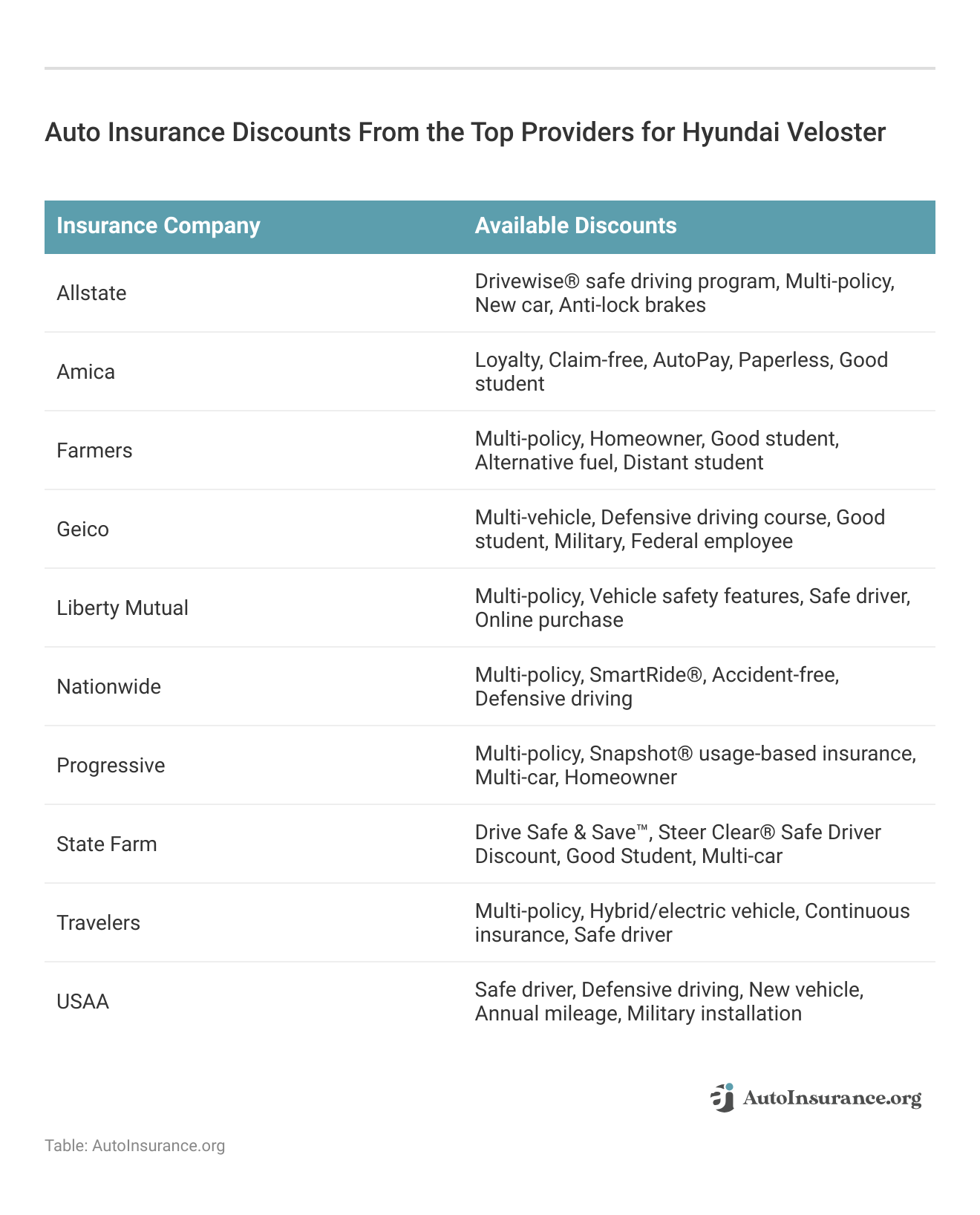

Ways to Save on Hyundai Veloster Insurance

Saving on Hyundai Veloster insurance can be achieved through various strategies tailored to reduce premiums and maximize discounts. Implementing these tips can help you manage your insurance costs effectively:

- Save money on young Driver Hyundai Veloster insurance rates by mentioning grades or GPA.

- Buy a Hyundai Veloster with an anti-theft device.

- Understand the different types of auto insurance for your Hyundai Veloster.

- Ask about a student away from home discount.

- Don’t assume your Hyundai Veloster is cheaper to insure than another vehicle.

By utilizing these strategies, Hyundai Veloster owners can find affordable insurance options without compromising on coverage quality.

Taking advantage of these discounts can result in significant savings on your Hyundai Veloster insurance. Always inquire about available discounts when comparing insurance providers to ensure you receive the best possible rate.

Top Hyundai Veloster Insurance Companies

Who is the best auto insurance company for Hyundai Veloster insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Hyundai Veloster auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Hyundai Veloster offers.

Top 10 Hyundai Veloster Auto Insurance Providers by Market Share

| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Choosing the right insurer involves more than just comparing rates; consider the benefits each company offers, such as discounts for safety features, customer service reputation, and the ease of filing claims.

You can start comparing quotes for Hyundai Veloster auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

How much does insurance for a Hyundai Veloster cost?

The cost of insurance for a Hyundai Veloster can vary based on several factors, including your location, driving record, age, gender, credit history, coverage options, and the insurance provider you choose. It is recommended to obtain quotes from multiple insurers to compare prices and find the best coverage that suits your needs and budget.

Is Hyundai Veloster considered a sports car for insurance purposes?

The classification of a Hyundai Veloster as a sports car can vary among insurance providers. While the Hyundai Veloster is known for its sporty appearance, some insurers may not classify it as a sports car, while others might. It’s best to consult with insurance providers directly to understand how they classify the Hyundai Veloster and the associated insurance rates.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Are there any specific insurance considerations for insuring a modified Hyundai Veloster?

Insuring a modified Hyundai Veloster can present additional considerations. If you have made modifications to your vehicle, such as engine modifications, body kit installations, or performance upgrades, it’s important to inform your insurance provider. Learn more by reading our guide titled, “Best Auto Insurance Companies That Offer OEM Parts Coverage.”

Are there any specific insurance considerations for leasing or financing a Hyundai Veloster?

If you are leasing or financing a Hyundai Veloster, there may be specific insurance requirements to fulfill. Typically, leasing or financing companies will require you to carry comprehensive and collision coverage to protect the vehicle against damage or loss.

Additionally, they may specify certain coverage limits and may require you to list them as a lienholder on the policy. It’s essential to review your lease or financing agreement and consult with your insurance provider to ensure compliance with the required insurance coverage.

Can I transfer my current auto insurance policy to a Hyundai Veloster?

In most cases, you can transfer your current auto insurance policy to a Hyundai Veloster. However, it’s important to notify your insurance provider about the change in your vehicle to ensure that you have the appropriate coverage.

They may need to adjust the policy to reflect the new vehicle’s details, such as the VIN (Vehicle Identification Number), year, make, and model. It’s recommended to contact your insurance provider as soon as possible to update your policy after purchasing or acquiring a Hyundai Veloster.

What are the best companies for Hyundai Veloster auto insurance?

The top companies for Hyundai Veloster auto insurance include State Farm, Geico, and Progressive. These companies are known for their comprehensive coverage options, discounts for safe driving, and high customer satisfaction. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

Is high-risk insurance available for Hyundai Veloster drivers?

Yes, high-risk insurance is available for Hyundai Veloster drivers, particularly those with poor driving records or young drivers. Companies like Progressive and Geico offer coverage options for high-risk drivers, though premiums may be higher.

How can I lower my Hyundai Veloster insurance premiums?

To lower your Hyundai Veloster insurance premiums, consider maintaining a clean driving record, comparing quotes from multiple insurers, taking advantage of discounts for safety features, and adjusting your coverage levels to better suit your needs. To find out more, explore our guide titled, “Auto Insurance Discounts.”

Do safety features on the Hyundai Veloster affect insurance rates?

Yes, the safety features on the Hyundai Veloster, such as airbags, electronic stability control, and lane departure warning, can help lower insurance rates by reducing the risk of injury and accidents. Insurers often offer discounts for vehicles equipped with these features.

How does the location impact Hyundai Veloster insurance costs?

The location where you live significantly impacts Hyundai Veloster insurance costs. For example, drivers in urban areas with higher traffic density and crime rates may pay more for insurance compared to those in rural areas. Factors like regional regulations and local accident statistics also play a role.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.