Does auto insurance cover water leaks? (2026)

If you are wondering does auto insurance cover water leaks, the answer is that the only type of auto insurance that covers water damage is comprehensive insurance coverage. Comprehensive coverage is often sold as part of a full coverage insurance policy, which costs an average of $132 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

Does auto insurance cover water leaks? Water can easily cause enough damage to total a car, especially if it is trapped in a flood. Luckily, car insurance can help pay for repairs after water damage if you have the right coverage.

The only type of car insurance that covers flood or leaky sunroof damage is comprehensive auto insurance, which you can add to your insurance policy at any time. Read on to learn more about comprehensive car insurance and if it’s right for you.

Are you wondering, “How do I find sunroof repair near me?” Compare quotes with as many water damage car insurance companies as possible using our free quote comparison tool above and find the best comprehensive auto insurance rates for your needs.

- The only type of insurance that covers flood damage is comprehensive insurance

- Comprehensive insurance pays for repairs or to replace your vehicle after flood damage from natural disasters and extreme weather

- If you don’t have comprehensive insurance, your policy won’t help you if your car gets damaged by water

How to Get Water Leak in Car Covered by Insurance

Does car insurance cover water leaks? Yes, if you have full coverage, which includes comprehensive, you’ll be covered if you need a sunroof seal replacement for your leak.

Does car insurance cover rain water damage if I accidentally leave my sunroof open? If you left sunroof open in the rain, insurance likely won’t pay out since the water damage was caused by negligence. So if you need a sunroof replacement due to damages you caused, it likely won’t be covered.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When does car insurance cover flood damage?

Does auto insurance cover water damage caused by floods? If you want your policy to cover flood damage for your car, you need comprehensive auto insurance. The law doesn’t require comprehensive car insurance, but you might need it if you have a loan or lease on your vehicle. It’s also a good idea if your car is newer or expensive, even if you own it outright.

Comprehensive coverage isn’t just for flood damage — it also covers animal contact, fire, theft, and vandalism.

Is a leaking windshield covered by insurance? Comprehensive plans also typically include windshield damage or leaks, and you might get to skip your deductible if your glass can be repaired.

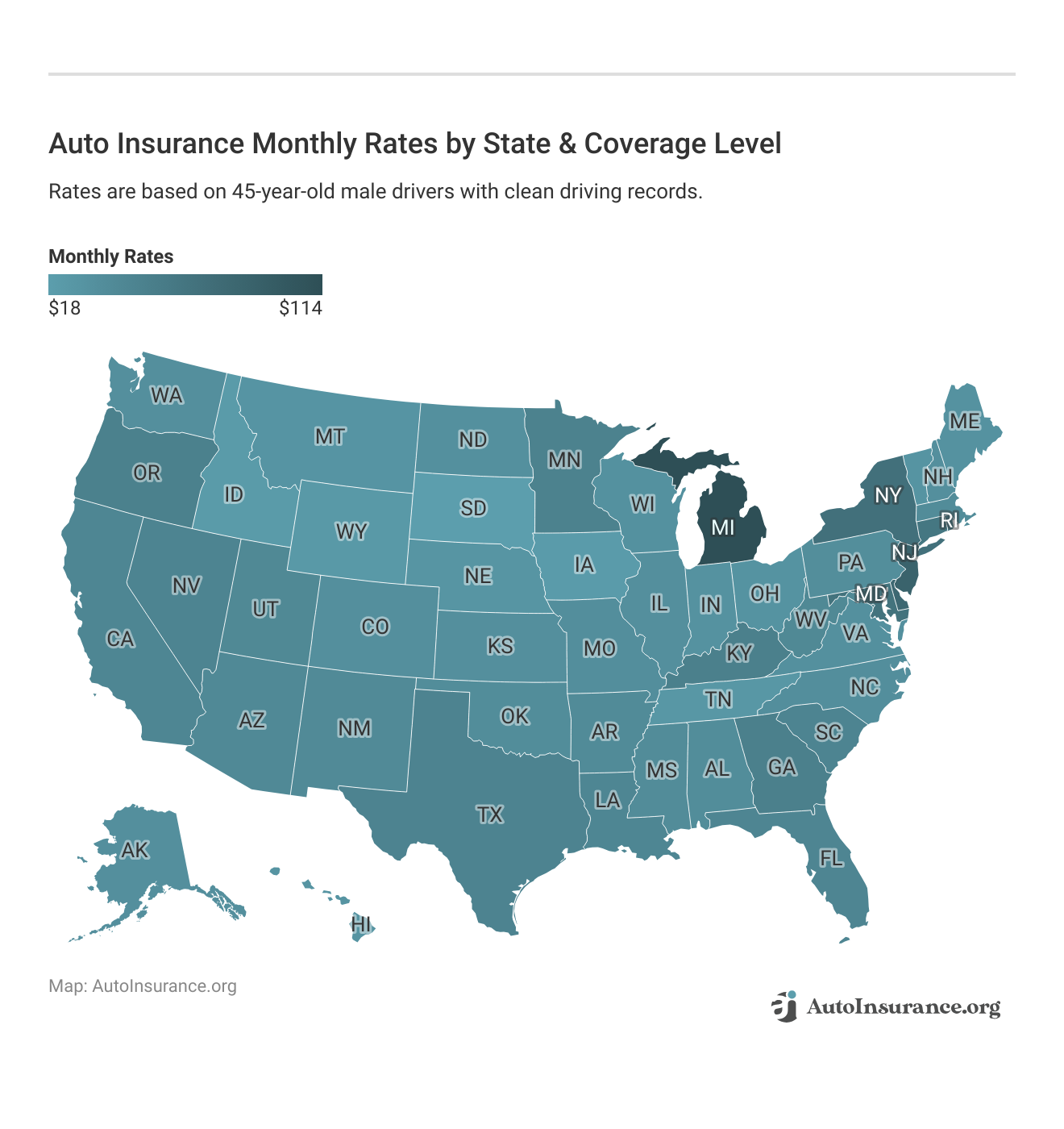

Here’s a look at the best full coverage auto insurance rates across the U.S.

For extensive flood damage, car insurance will reimburse you for your vehicle’s actual cash value (ACV). Your car doesn’t have to be destroyed — damage only needs to reach a percentage of your vehicle’s ACV before your insurance company deems your car a total loss.

However, if insurance won’t total flooded car and you disagree, you can negotiate with your insurance company.

Learn more: How do insurance companies value totaled cars?

How much flood damage will total your car?

There are two levels of flood damage that insurance companies consider. Depending on the amount of flooding in your car, your insurance company will either pay for repairs or replace it.

Minor flood damage occurs when the water rises to the floor of your car or lower. Low-level floods usually don’t cause too much damage to vehicles and often only require minor repairs.

You might see heavy damage to your engine, braking, or electrical systems with flood waters that rise above your floorboard. Flood waters at this level require a thorough examination by a mechanic to ensure everything still works, even if your car seems normal.

Comprehensive insurance still covers extensive flood damage, though the average insurance payout for water damage depends on how badly your car is affected. If it would cost more to repair your vehicle than replace it, your comprehensive insurance will send you a check for your car’s ACV. Another thing to remember about flood damage to your car is that salt water usually does more damage than fresh water.

Additionally, comprehensive insurance only pays for the original parts in your vehicle, meaning modifications don’t have coverage. So if you’ve invested significantly in your vehicle, consider adding auto insurance for custom vehicles, which covers added parts and equipment coverage to your policy.

What do you do if you don’t have comprehensive insurance?

Comprehensive auto insurance pays for flood damage; you won’t have coverage without it. Consider what other types of car insurance cover to see why flood damage is only covered by comprehensive:

- Liability: Liability auto insurance covers damage you cause to other drivers and property. It doesn’t cover your car at all.

- Collision: Collision auto insurance pays for repairs to your car, but only after an accident.

- Uninsured Motorist Coverage: While uninsured motorist auto insurance coverage pays for damages to your car, it only applies when a driver with inadequate coverage.

- Personal Injury Protection/Medical Payments: Personal injury protection (PIP) auto insurance is needed to cover medical bills for you and your passengers after an accident.

Homeowners insurance and renters insurance don’t cover flood damage, including your car and home. If you have a flood damage policy for your home, it doesn’t cover your vehicle. However, a flood damage policy will pay for items you had in your car that were damaged. With extreme weather on the rise, it’s a good idea to get comprehensive insurance if your car is worth more than $3,000.

How do you file a claim for flood damage?

Filing a comprehensive auto insurance claim is as easy as filing any other claim. Most of the best comprehensive auto insurance companies allow customers to file claims using mobile apps or websites. If that’s not possible — or you prefer a different method — you can also file a claim by telephone or in person.

It’s important to file a claim as soon as possible after flood damage for two reasons. The most important is that delaying repairs could allow for more damage to occur within your vehicle. The second is that you’re probably not the only customer filing a claim in the area, which will slow down your company’s ability to make payments.

Learn more: Auto Insurance Comprehensive Claim Defined (2023)

No matter when you file your claim, take photos or videos of the damage to your car from as many angles as possible. Then, do your best to dry your car out. Most experts agree that you shouldn’t start your vehicle until a mechanic can look at it since it might force water deeper into your engine.

You’ll also need to get your oil, transmission fluid, and lube checked, as they might need to be drained and replaced.

Your insurance company will send a claims adjustor as soon as possible to evaluate the extent of your car’s damage and determine if it’s a water damage car write-off.

Does GAP insurance cover flood damage?

When you buy a car, it immediately starts to depreciate. As a result, your new car will never be worth the price you paid at the dealership, though some cars depreciate faster than others.

Some drivers have an upside-down loan during the first few years of ownership. An upside-down loan happens when your car’s value is worth less than the total you owe on your loan.

Guaranteed Auto Protection (GAP) insurance covers the difference in this situation. It applies to flood damage, but only if you have a pre-existing comprehensive insurance policy. GAP insurance won’t help you pay off your loan if you don’t have comprehensive coverage.

If you total your car while you have an upside-down loan, your insurance only pays for your car’s total value, meaning you won’t get a full water-damaged car write-off from your insurance. So, without GAP insurance, you’ll be stuck paying for a vehicle you no longer own.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How can you avoid buying a car with flood damage?

Hundreds of thousands of flood-damaged cars are for sale in the U.S. While flood damage doesn’t mean that a used car is unsafe to drive, you should take steps to determine how the vehicle was affected.

The first thing you should look at is the car’s title. When a vehicle is declared a total loss, it’s issued a salvage title (learn more: Salvage Title Defined). Cars with salvage titles can’t be driven or insured and usually get bought for scrap. However, you can repair a salvage title car and make it street-legal again if it passes a state inspection.

Once it passes inspection, the car gets a rebuilt title. If you see a rebuilt title for a used car, inquire about the damage. Most states require that rebuilt titles state if floodwaters damaged the car.

However, flood damage in a car isn’t always easy to spot. If you’re in the market for a used car, look for musty odors, mismatched carpets, rust around pedals, inside the hood, and around the doors, mud under seats, and dampness.

You can also check a car’s history through companies like Carfax or access the National Insurance Crime Bureau’s free VIN check.

Find the Best Car Insurance to Cover Water Leaks Today

Does car insurance cover leaking roof? Yes, a full coverage car insurance policy will cover repairs for a sunroof leaking into the floorboard.

With the rising risk of water damage from swelling rivers and extreme weather, protecting your car is more crucial than ever. Comprehensive auto insurance is all you need to ensure your vehicle gets repaired or replaced after flooding or a water leak.

Comprehensive insurance is usually an affordable add-on for your policy, but you should still research your options. Looking at rates from as many companies as possible will ensure you get the most affordable price.

Are you wondering, “How can I find sunroof drain cleaning near me?” Enter your ZIP code into our quote comparison tool below to instantly compare prices from various insurers to secure auto water damage repair coverage.

Frequently Asked Questions

What happens if your car gets ruined in a flood?

Can I claim on my car insurance for water damage caused by flooding? Yes, you can file a car water damage insurance claim, but you’ll need comprehensive insurance to pay for car repairs if it gets ruined in a flood. You’ll be stuck paying for your vehicle from your pocket without comprehensive insurance.

Does car insurance cover flood damage with Geico?

Does insurance cover water damage in car resulting from flood with Geico? Geico auto insurance covers flood damage if you have a comprehensive policy. Comprehensive insurance allows you to file a car insurance claim for water damage or floods caused by weather, regardless of where you shop.

Does car insurance cover rain damage?

You may be wondering, “Does car insurance cover rain water damage?” The only type of car insurance that covers water damage from rain or other natural sources is comprehensive insurance. Comprehensive insurance pays to repair or replace your car if the flooding is beyond your control.

Will FEMA pay for your flooded car?

FEMA might help with car repairs after a natural disaster or extreme weather, but only if you don’t have comprehensive insurance.

What do you do if you don’t have comprehensive insurance?

If you don’t have comprehensive auto insurance, you won’t have coverage for flood damage. Homeowners insurance and renters insurance also do not cover flood damage to your car. It’s recommended to get comprehensive insurance if your car is worth more than $3,000.

Does car insurance cover leaking sunroof?

A top question readers ask is, “Does car insurance cover sunroof leaks?” Comprehensive coverage will cover the cost of a sunroof drain hose replacement if the damage was caused by bad weather. However, if you don’t carry this policy, you won’t be covered if your car sunroof is leaking water.

How much does it cost to repair a sunroof leak? It can cost anywhere from $100 to $1,000 to repair sunroof leaks, depending on the extent of the damage.

However, luxury cars may see a higher sunroof repair cost. For instance, an Audi sunroof leak repair cost typically ranges from $300 to $1,500 due to higher costs associated with luxury vehicles.

Will car insurance cover water in an engine?

Can you claim on your car insurance for water damage to your engine? Comprehensive coverage will cover water in an engine due to natural disasters like flooding.

Are water leaks covered by car warranty?

Generally, water leaks won’t be covered by a vehicle warranty unless the leak resulted from a manufacturer’s defect.

Does full coverage insurance cover water damage?

Does my car insurance cover water damage? Yes, full coverage car insurance, through comprehensive coverage, will cover water damage caused by storms or floods.

Will insurance cover a leaking windshield?

Does insurance cover leaking windshield? Car insurance might pay for a leaky windshield if it’s caused by a covered event like vandalism or an accident. However, a leak caused by wear and tear or poor installation isn’t covered.

Who fixes sunroofs?

How can I avoid sunroof drain water damage?

Does Progressive cover water damage to car?

Does State Farm cover sunroofs leaking into car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.