Best Evansville, Indiana Auto Insurance in 2025

Indiana requires 25/50/25/50 for bodily injury and property coverage. Auto insurance in Indiana costs $55.52/mo. on average. Save now and compare quotes below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Evansville, IN fact table

| City Population | 118,930 |

|---|---|

| City Density | 2,922 people per square mile |

| Average Cost of Insurance in Evansville | $3,454.52 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor 16% Mediocre 25% Fair 22% Good 36% |

Shopping for insurance is tough. Doing a car insurance company research, researching types of insurance, and making sure you get the best rate can be confusing and very time-consuming.

If you are new to Evansville, you have a lot on your plate. Maybe you just moved to a new job or other situation, you are sure to have a lot more on your mind than trying to find insurance. So let us do the work for you.

We are going to break down the facts of who has the best rates and what factors can determine your rates. We are also going to take a look at certain city facts. What is the weather like in Evansville? How is parking in the city?

Let’s get started! Think you are ready to go ahead and get some quotes? Go ahead and enter your zip code here to use our free no-hassle quote comparison tool.

The Cost of Car Insurance in Evansville

Insurance can take a chunk out of your monthly paycheck. It is one of those necessary expenses you have, but you want to get the most bang for your buck.

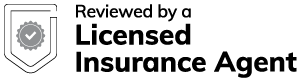

You might find yourself asking how does my Evansville, IN stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

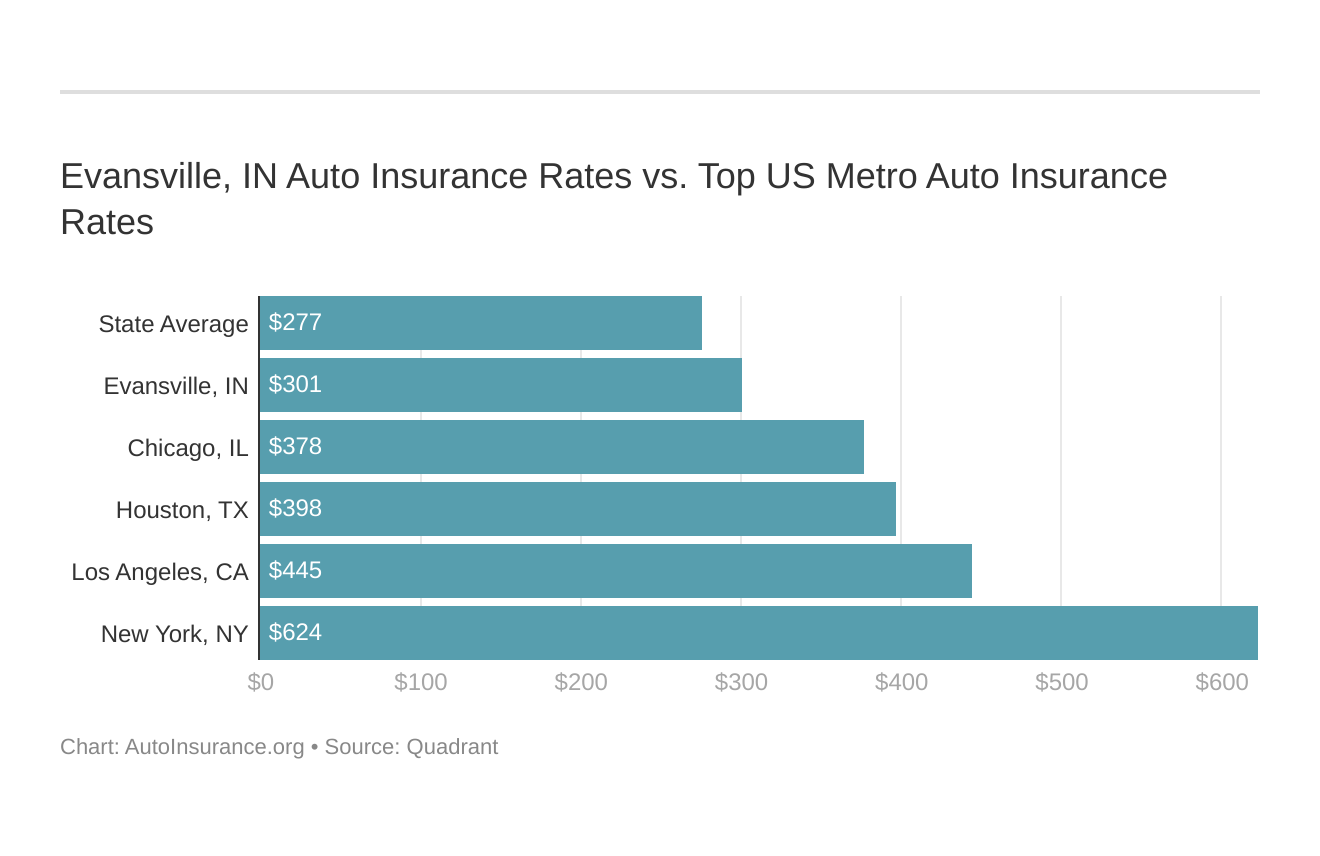

There are a few factors that determine your auto insurance rates and that you can’t really change. Your age and gender are two things that insurance companies look at when they are rating your insurance. Another factor is where your car is parked regularly.

So let’s jump in and take a look at these factors.

Male vs. Female vs Age

So who is a better driver, men or women? Ok, we won’t get into that debate, but we can show you the facts of who may pay more.

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Indiana does use gender, so check out the average monthly car insurance rates by age and gender in Evansville, IN.

Evansville, IN age rates

| Age & Gender | Rates |

|---|---|

| Age: 35 Female | $2,034 |

| Age: 35 Male | $2,029.98 |

| Age: 60 Female | $1,842 |

| Age: 60 Male | $1,900 |

| Age: 17 Female | $7,131 |

| Age: 17 Male | $9,124 |

| Age: 25 Female | $2,261 |

| Age: 25 Male | $2,567 |

Age is definitely the biggest factor in this category. Younger drivers have less experience and insurance companies rate them as such. Male young drivers have the highest rate, but as drivers get older the gap in price between men and women close.

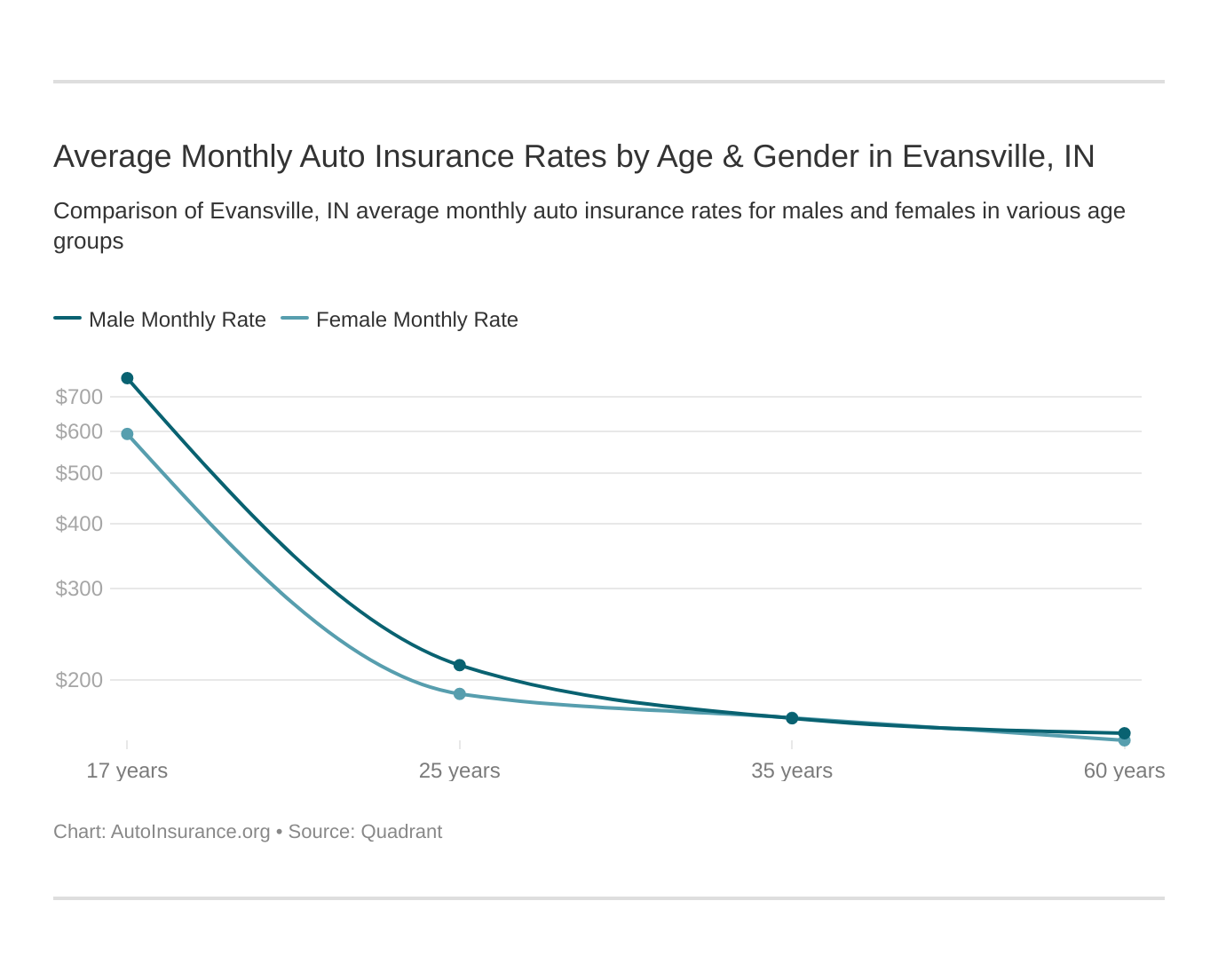

Evansville, IN car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

The median average in Evansville is 37.2 years of age. Therefore, more drivers are older and expereinced making the average rates lower.

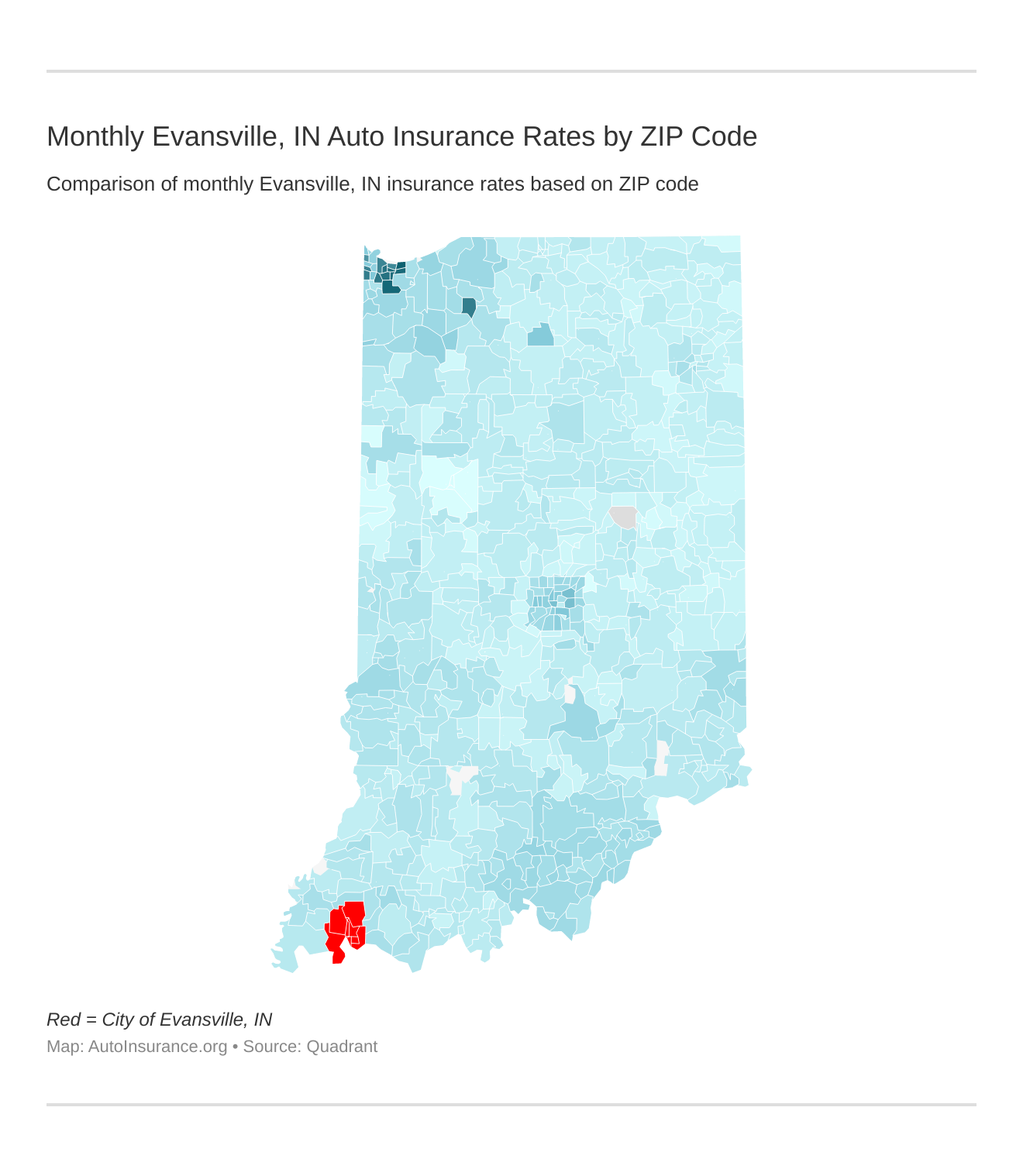

Cheapest Zip Codes in Evansville

Evansville, IN zip code rates

| ZIP CODE | AVERAGE ANNUAL RATE |

|---|---|

| 47725 | $3,454.52 |

| 47715 | $3,470.47 |

| 47710 | $3,497.48 |

| 47714 | $3,502.68 |

| 47712 | $3,502.88 |

| 47711 | $3,506.04 |

| 47720 | $3,511.22 |

| 47722 | $3,533.19 |

| 47713 | $3,593.25 |

| 47708 | $3,610.22 |

The difference between the cheapest and most expensive zip codes is under two hundred dollars.

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Evansville, Indiana auto insurance rates by ZIP Code below:

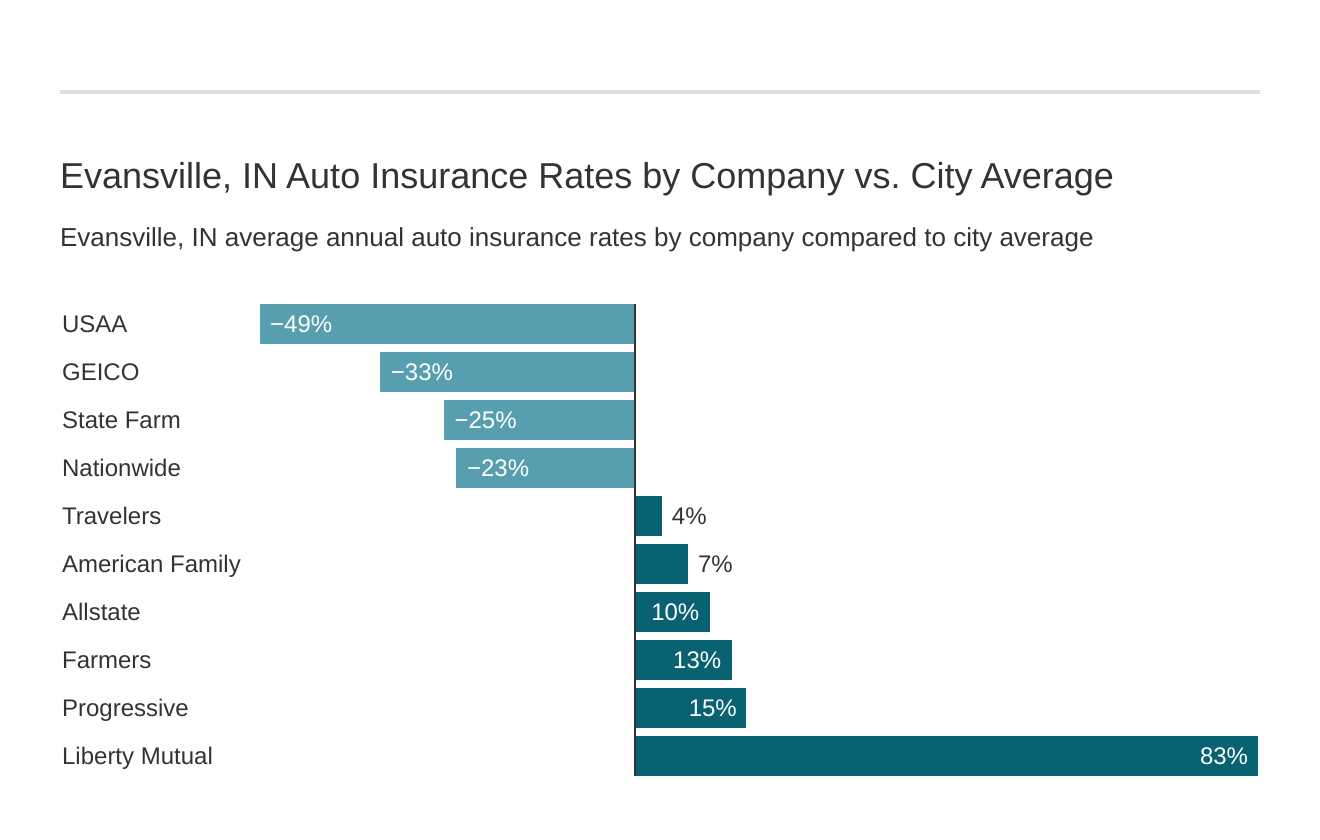

What’s the Best Car Insurance Company in Evansville

When shopping for car insurance, one of the first things you search for is the best company with the cheapest rates. When you hit the internet looking for companies, you find the task of finding the best and cheapest rather difficult.

Which Evansville, IN car insurance company has the best rates? And how do those rates compare against the average Indiana car insurance company rates? We’ve got the answers below.

This is where we come in. In this next section, we are going to visit various companies available in Evansville. We are going to look at a few different things that can change your car insurance rate.

Cheapest Car Insurance Rates by Company

First up, one of the most important questions gets an answer. Which company is the cheapest?

Evansville, IN demographic rates

| Insurance Company | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male |

|---|---|---|---|---|---|---|---|---|

| $2,425.16 | $2,478 | $2,138 | $2,340 | $7,632.33 | $9,657.25 | $2,446.95 | $2,658 | |

| $2,406.16 | $2,406.16 | $2,166.16 | $2,166.16 | $6,739.52 | $9,725.87 | $2,406.16 | $2,943 | |

| $1,825.76 | $1,802.26 | $1,560 | $1,761 | $9,972.40 | $10,670.99 | $2,418.71 | $2,602 | |

| $1,630.57 | $1,625.00 | $1,540 | $1,612 | $4,843.37 | $4,470.53 | $1,868.85 | $1,630 | |

| $4,529.29 | $4,529.29 | $4,169 | $4,169 | $9,833.99 | $14,812.49 | $4,529.29 | $6,184 |

| $1,690.20 | $1,723.93 | $1,483 | $1,580 | $5,004.78 | $6,481.54 | $1,991.90 | $2,175 |

| $1,747.33 | $1,646 | $1,588 | $1,597 | $10,462 | $11,751.52 | $2,191.28 | $2,225 | |

| $1,634.71 | $1,634.71 | $1,468 | $1,468 | $5,092.85 | $6,523 | $1,817 | $2,016 | |

| $1,294.77 | $1,315.74 | $1,222 | $1,221 | $8,459.19 | $13,508 | $1,376 | $1,568 | |

| $1,157.86 | $1,138.41 | $1,080.90 | $1,085.00 | $3,266.20 | $3,641.79 | $1,563.99 | $1,668.31 |

USAA auto insurance has the lowest rate in the top ten largest companies in Evansville. Keep in mind USAA insurance is only for veterans or currently enlisted military personnel. If you are not in the military or eligible person for USAA membership, you can look at companies like State Farm, Nationwide, and Geico.

Best Car Insurance for Commute Rates

Did you know how long your commute to work is can affect your insurance rate?

Evansville, IN - commute rates

| Insurance Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| $3,972 | $3,972 | |

| $3,823.00 | $3,917.06 | |

| $4,077 | $4,077 | |

| $2,361 | $2,444 | |

| $6,421 | $6,768 |

| $2,766 | $2,766 |

| $4,151 | $4,151 | |

| $2,629 | $2,784 | |

| $3,745 | $3,745 | |

| $1,801.23 | $1,849.46 |

Some companies rate your insurance on how much you use your vehicle. Which, would make sense since the longer the commute the more time you are on the road.

Indiana residents drive 17,806 miles a year.

Luckily for Evansville residents, most companies do not heavily surcharge for longer commutes. If you do have a heavier commute to work, see the above table showing companies that do not rate on commute. Travelers, Progressive, and Nationwide have the same rate for more miles driven in a year.

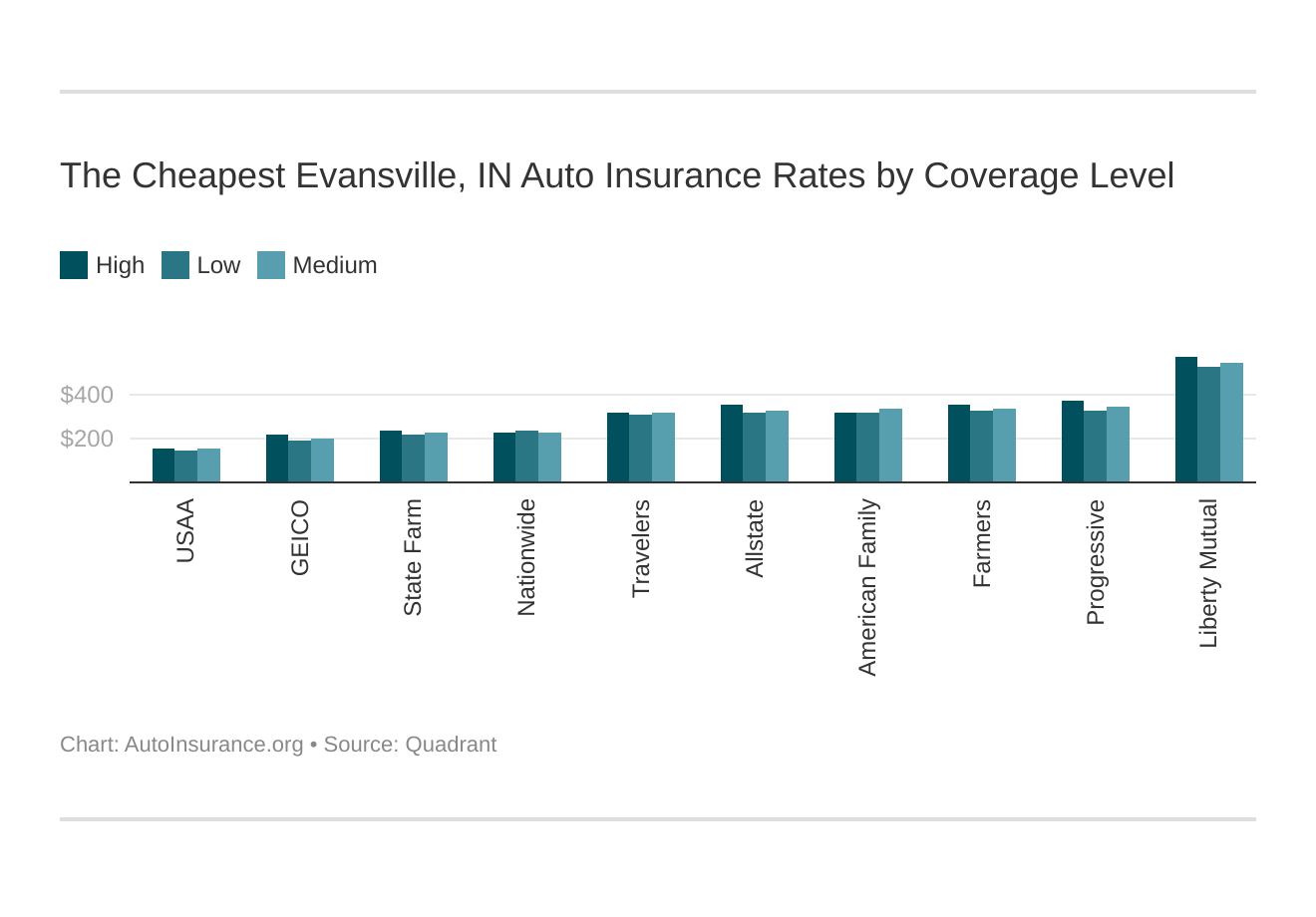

Best Car Insurance for Coverage Level Rates

More coverage equals more cost, right? Well, that is not necessarily true in all cases.

Your coverage level will play a major role in your Evansville car insurance rates. Find the cheapest Evansville, IN car insurance rates by coverage level below:

Evansville IN commute rates

| Insurance Company | High | Medium | Low |

|---|---|---|---|

| $4,192 | $3,957 | $3,767.25 | |

| $3,793.74 | $3,997.02 | $3,818.91 | |

| $4,236 | $4,068 | $3,925.98 | |

| $2,580 | $2,396 | $2,231.86 | |

| $6,865 | $6,574 | $6,344.00 |

| $2,757 | $2,747 | $2,795.11 |

| $4,473 | $4,081 | $3,900 | |

| $2,850 | $2,707 | $2,563.25 | |

| $3,814 | $3,781 | $3,641.27 | |

| $1,891.19 | $1,821.45 | $1,763.40 |

Take a look at American Family Car Insurance in the chart above. It is actually cheaper to have more coverage. Other companies have minimal increase in premium for a lot more coverage.

The biggest takeaway is to always quote various coverages when looking for insurance. In the event of a claim, a little premium increase for higher coverage can mean less stress when trying to get back on the road.

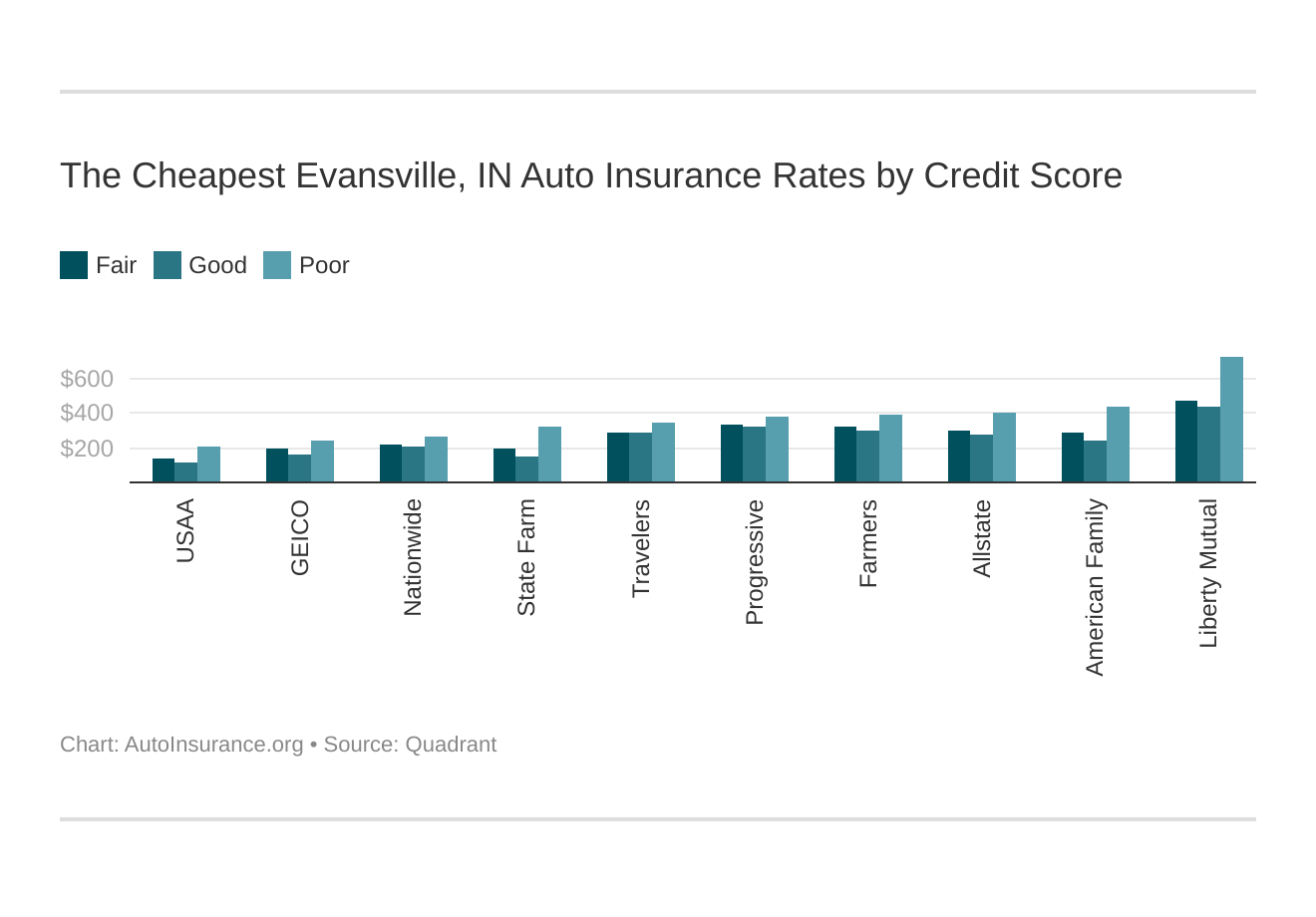

Best Car Insurance for Credit History Rates

Your credit history follows you for bigger purchases, like your home and auto, but are there other purchases where your credit history follows you?

Your credit score will play a significant role in your Evansville, IN car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Evansville, IN car insurance rates by credit score below.

Your credit history will follow you when trying to get auto insurance as well since auto insurance companies check credit.

Evansville, IN credit history rates

| Insurance Company | Good | Fair | Poor |

|---|---|---|---|

| $3,333 | $3,667 | $4,915.58 | |

| $2,872.35 | $3,434.14 | $5,303.18 | |

| $3,597 | $3,881 | $4,752.66 | |

| $1,913 | $2,403 | $2,891.97 | |

| $5,285 | $5,715 | $8,782.73 |

| $2,492 | $2,658 | $3,148.67 |

| $3,830 | $4,057 | $4,566 | |

| $1,823 | $2,352 | $3,945.57 | |

| $3,537 | $3,536 | $4,163.35 | |

| $1,392.08 | $1,624.49 | $2,459.46 |

You can see a price jump over two thousand dollars with poor credit.

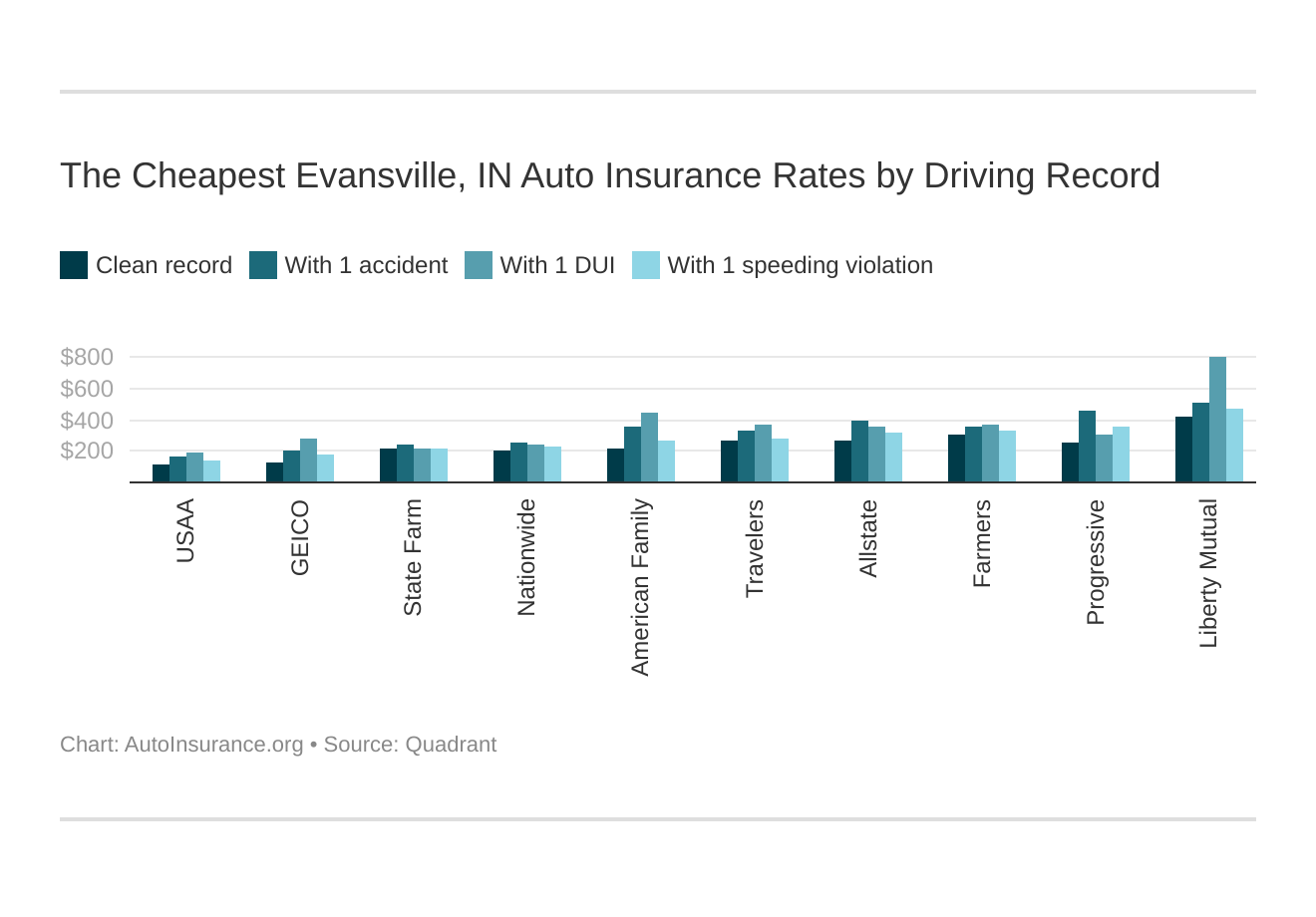

Best Car Insurance for Driving Record Rates

Most consumers know that speeding ticket will follow you when looking for insurance. Insurance companies will look at your past driving record and rate your insurance accordingly.

Your driving record will play a major role in your Evansville car insurance rates. For example, other factors aside, a Evansville, IN DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Evansville, IN car insurance rates by driving record.

Evansville IN rates by driving record

| Insurance Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| $3,159 | $4,664 | $4,299.84 | $3,764.94 | |

| $2,667.02 | $4,245.51 | $5,388.23 | $3,178.78 | |

| $3,645 | $4,253 | $4,384.43 | $4,024.39 | |

| $1,564 | $2,482 | $3,396.16 | $2,168.73 | |

| $5,083 | $6,039 | $9,632.95 | $5,623.68 |

| $2,381 | $3,065 | $2,939.75 | $2,679.43 |

| $3,098 | $5,487 | $3,701 | $4,318.45 | |

| $2,640 | $2,906 | $2,640.32 | $2,640 | |

| $3,184 | $3,929 | $4,452.65 | $3,416 | |

| $1,376.20 | $1,961.75 | $2,254.35 | $1,709.08 |

A clean record will secure you a lower premium rate, but you can see the table above how which companies rate more for tickets, accidents, and driving under the influence convictions.

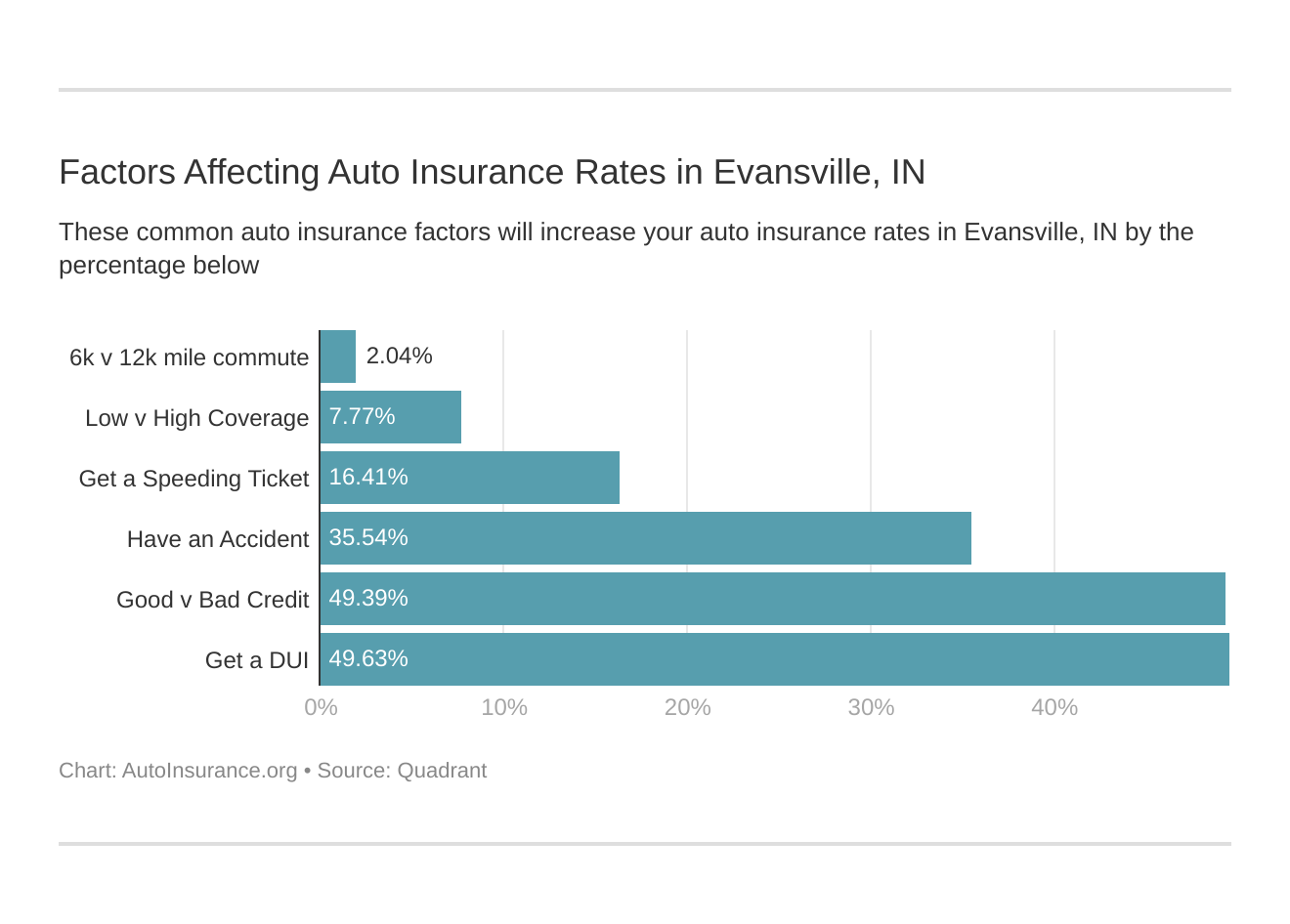

Car Insurance Factors in Evansville

In this next section, we are going to take a look at income, education, and housing in Evansville. These are all factors insurance companies take into consideration when rating your car insurance.

Factors affecting car insurance rates in Evansville, IN may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Evansville, Indiana car insurance.

Median Household Income

How much of your paycheck is going to your car insurance? In Evansville, the median income is $36,956 and the average auto policy is $3,611.05; therefore, the average Evansville resident loses a little under ten percent to car insurance.

Keep in mind, the auto policy average includes all ages. So if you are not a teen driver and have a clean record, your premium could be signicantly lower.

– Homeownership in Evansville

Believe it or not, owning your home can cut your insurance drastically. There are several non-driving factors that go into your car insurance quote and homeownership is definitely one of them.

This could be from the standpoint that is someone is making their monthly mortgage payment they are more inclined to make their monthly car insurance or maybe even be more cautious. Most companies also offer multi-policy discounts for insuring home and auto together,

Renting can cost you as much as 47 percent more than a homeonwer would pay for car insruance.

Median property values for Evansville are roughly $90,000, which is lower than its neighboring counties or the US average.

Education in Evansville

If you live in Evansville, you have a few choices when it comes to picking a college.

The University of Evansville is a private four-year college. It is on the smaller side with under three thousand students.

Ivy Tech Community College is also an option. This is a public two-year college. The most popular area of interest is in health professions.

The largest college in the area is the University of Southern Indiana.

Wage by Race & Ethnicity in Common Jobs

Job wages can vary due to race and ethnicity. Below is a chart showing common jobs in Evansville, such as nurses, managers, and administrative positions.

Wage by Gender in Common Jobs

Race and ethnicity is not the only factor in wages. Men and women can hold the same job, but they may get paid drastically different salaries.

This chart shows the entire state of Indiana. The biggest pay difference in gender is having a managerial role. Men earn as much as 1.39 more than females.

Poverty by Age and Gender

Just like wages, poverty also varies among age and gender.

Over twenty percent of Evansville residents live below the poverty line. Women, ages 18-24, have the highest amount in the twenty percent, As you can see, with the exception of two age groups, woman outnumber men in poverty.

Poverty by Race & Ethnicity

A higher amount of white residents live in poverty than any other ethnicity with almost twenty thousand living in poverty.

Employment by Occupations

Office and Administrative support occupations are the most common employment in Evansville. Production and sales-related occupations follow closely in the second and third place.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving in Evansville

If you are reading this, chances are you are looking for car insurance because you drive a car. This next section is all about driving.

We are going to take a look at roads and vehicles to weather and parking. Buckle up, we are going to be covering a lot of information in this next section.

Roads in Evansville

First up, let’s take a look at roads, popular destinations, and road conditions in Evansville.

Major Highways

Indiana has fourteen active routes covering 1306.52 miles. That is a lot of road to cover.

Here is a list of all active routes:

- I-64

- I-65

- I-69

- I-70

- I-74

- I-80

- I-90

- I-94

- I-164,

- I-469

- I-265

- I-465

- I-865

- I-275

Indiana East-West toll road is the only toll in Indiana. It is located on I-90 and 80. There is a maximum charge of $10 for the full length and minimum charge of $4.65.

Popular Road Trips/Sites

You may be new to the area and looking for some exciting things to do in your free time. We have compiled a list below of some great sites to see in Evansville.

- Evans Museum of Art, History, and Science

- Hartman Arboretum

- USS-LST 325

- Mesker Park Zoo and Botanic Garden

- Dream Car Museum

- Reitz Home Museum

Whether you are a history buff or love the outdoors, there are so many sites to see in Evansville.

Road Conditions

No driver likes to hit potholes or drive on rough roads. Let’s now take a look at road conditions in Evansville.

Evansville IN - roads

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 16% | 25% | 22% | 36% | $530.00 |

Evansville residents do not have the best roads with less than half being in good condition. Over 60 percent of the roads are poor to mediocre condition.

Speeding and Red Light Cameras in Evansville

Currently, Indiana doesn’t use speeding or redlight cameras with no sign of changing legislation.

If you are unfamiliar with red light and speeding cameras, here is a short video explaining how they work.

Vehicles in Evansville

You don’t buy car insurance without a vehicle. In this next section, we are going to dig into the subject of vehicles.

Vehicles Most Popular Vehicles Owned

While we do not have the specific data for Evansville, we do find the Chevrolet Impala is the most popular car of choice in the state of Indiana.

While they probably don’t have Impalas at this event, Cars and Coffee is a great event to go to in Evansville if you have a love for cars.

How Many Cars Per Household

Most American families own two cars. Evansville is no different than the rest of the United States. The majority of families are two-car families.

Households Without a Car

While the majority of Evansville residents do have cars, there is a high percentage of households without a car.

Evansville IN - percent of homes with cars

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 11.70% | 11.50% | 1.54 | 1.48 |

For these families, public transit is a vital part of their transportation. We will look at public transportation and ride-sharing further down.

Speed Traps in Evansville

Thankfully for drivers, Evansville is not listed at the top ten worst cities in Indiana for speed traps. Just because they are not listed at the top does not mean you should speed. Remember, be safe and obey all posted speed limit signs.

Vehicle Theft in Evansville

We took a look at Neighborhood Scout for information on crimes in Evansville. Unfortunately, we found Evansville is not the safest place to live.

In 2017, there were 475 motor vehicle thefts.

Per 1,000 residents, this makes Evansville’s rate 3.99 which is well over the nationwide rate of 2.37. With such high rates of auto theft, prevention is key to making sure you are not a victim.

Safest Neighborhood in Evansville

Below is a list of the top ten safest neighborhoods to live in Evansville.

- Armstrong / Martin

- McCutchanville

- Belknap

- Saint Joseph / Kasson

- Cypress / U of Southern Indiana

- Melody Hill

- Highland

- E Lloyd Expy / Cross Pointe Blvd

- Stringtown

- Lakewood Hills

Violent Crime Comparison

Your chance to be involved in violent crime in Evansville is 1 in 144 people. In comparison, your chance in all of Indiana is one in 251 people.

Evansville IN violent crimes

| Murder | Rape | Robbery | Assualt | |

|---|---|---|---|---|

| Total Reported Crimes | 20 | 75 | 185 | 545 |

| Rate per 1,000 | 0.17 | 0.63 | 1.56 | 4.58 |

Sadly, on a rating of 100 being the safest, Evansville scores a three. This score means Evansville is safer than three percent of US cities.

Traffic

We all hate sitting in miles of traffic. You are stuck with no way out and everything is at a standstill. This section is going to cover traffic and transportation for the residents of Evansville.

Traffic Congestion in Indiana

The Lloyd Expressway is a heavily used road in Evansville, Indiana. The number of cars getting on and off this expressway causes extreme backup and congestion.

Two projects to try and help to reduce congestion in this area are The Lloyd Expressway Corridor project. This project is to start in 2024. Another project, the Epworth Road project, is set to start in 2021.

Transportation

The average Evansville employee as a slightly shorter commute time than the average nationwide worker. Evansville residents have an average commute time of 18.4 minutes.

Like most Americans, Evansville residents like a silent car ride to and from work. The average employee prefers to drive alone to work.

How Safe are Evansville Streets and Roads?

The National Highway Traffic Safety Administration keeps records of all fatalities in a state and then breaks down the data by county. Evansville is a city located in Vanderburgh County so we looked at fatalities in Vanderburgh to see just how safe Evansville roads are to drive.

We first took a look at the total number of fatalities in the county.

Evansville, IN - total fatalities

| Vanderburgh County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 21 | 20 | 15 | 16 | 21 |

This next chart shows fatalities due to drinking. Indiana’s blood alcohol content is 0.08 percent, so anything over this number could land you a DUI conviction.

Evansville, IN - Alcohol related fatalities

| Vanderburgh County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alcohol-Related Fatalities | 7 | 4 | 3 | 5 | 5 |

Next up, we took a look at crash type. We looked at single vehicles, speeding, roadway departure, and fatalities due to intersection crossing.

Evansville IN - Crash type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Car | 12 | 12 | 10 | 4 | 9 |

| Speeding | 3 | 5 | 3 | 3 | 6 |

| Roadway Departure | 9 | 12 | 7 | 3 | 11 |

| Intersection | 9 | 8 | 8 | 10 | 8 |

We also looked at data for who was the occupant killed. Passenger car fatalities were the highest in this grouping followed by pedestrians.

Evansville IN - fatalities by person type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Fatalities | 7 | 8 | 7 | 6 | 10 |

| Pedestrian Fatalities | 1 | 1 | 4 | 1 | 3 |

| Pedalcyclist Fatalities | 2 | 0 | 1 | 0 | 0 |

Lastly, we looked at the type of road fatalities most occurred.

Evansville, IN - fatalities by Road types

| Road Type | Rural | Urban | Freeway/Expressway | Other | Minor Arterial | Collector Arterial | Local | Unknown |

|---|---|---|---|---|---|---|---|---|

| Number of Fatalities | 1 | 0 | 0 | 5 | 3 | 4 | 6 | 0 |

Allstate America’s Best Drivers Report

Allstate America’s Best Drivers Report is an annual report showing driving habits and claims for the largest 200 cities. Evansville is not listed in this report, we did take a look at Indianapolis which is the largest city in Indiana.

Indianapolis is ranked 75th for safest driving city in 2019.

Most drivers in the city have claims ever nine and a half years. Their rate for hard breaking is 21 for every 1000 miles.

Ridesharing

Ridesharing is becoming a popular side hustle in most areas. In Evansville, it is very helpful for those without access to a vehicle.

Uber and Lyft are both available in Evansville.

EStar Repair Shops

If you have ever been in a car accident, you know you have the grueling task of finding a good, reputable repair company to help you get back on the road.

Esurance has a vendor list of EStar repair shops to help you find the right place for you. Here is a local shop in Evansville on the EStar list.

Evansville IN estar repair

| Shop Name | Address | Phone/Fax | |

|---|---|---|---|

| Dave Hicks Auto Collision | 5939 Old Boonville Hwy Evansville, IN 47715 | hicksauto@sigecom.net | 812-402-4400/4406 |

Weather

So, how is the weather in Vanderburgh County?

Evansville IN - weather

| Annual high temperature: | 66.9°F |

|---|---|

| Annual low temperature: | 45.7°F |

| Average temperature: | 56.3°F |

| Average annual precipitation - rainfall: | 45.39 inch |

| Average annual snowfall: | 11 inch |

It doesn’t get too warm along the Ohio River in Evansville. The average high is below 70 degrees.

Vanderburgh County has had 15 natural disasters. Listed below are the causes of natural disasters in Vanderburgh, keep in mind one natural disaster may be listed in multiple categories.

- Floods – 9

- Storms – 9

- Tornados – 5

- Winter Storms – 3

- Hurricane – 1

- Wind – 1

Public Transit

Like ridesharing, public transportation is a huge help to Evansville residents without access to a car. In 1971, the Metropolitan Evansville Transit System (METS) was created to help with the need for public transportation.

METS has twenty-four fixed bus routes across Evansville. You can buy rides or an unlimited monthly bus pass. Passes have special discounts for students and senior citizens. Children five and under ride for free.

- Adults are $0.75 per ride

- Students are $0.50 per ride

- Monthly Bus Pass can be purchased for $60

- Student Monthly Bus Pass (w/proper credentials) can be purchased for $45

- Elderly & Handicapped Monthly Bus Pass (w/proper credentials) can be purchased for $30

Alternate Transportation

Scooters and bikes are becoming a commonly used way of transportation. Companies like Lime and Bird are starting to move into Indiana, but have not entered into Evansville as of now.

Parking in Metro Areas

Parking can be a hassle in most major cities. We want you to be aware of the cost and areas you can park in Evansville.

There is one lot centrally located for cost-free and time free parking. This lot offers over a thousand spaces for people visiting downtown, Victory Theater, Old National Events Plaza, Civic Center, and Ford Center. This free lot is located at 9th Street and Walnut.

If you are using a metered spot, time parking is enforced Monday thru Friday from 8 am until 5 pm.

Parking Meter rates are below:

- $0.05 = 12 Minutes

- $0.10 = 24 Minutes

- $0.25 = 60 Minutes

Evansville has three public parking garages downtown.

- Corner of 3rd and Locust

- 5th and Locust

- 5th and Sycamore

If you drive a motorcycle, you have a designated parking lot at 9th Street and Walnut at the entrance of the city parking lot

The following areas are prohibited from parking:

- Sidewalks

- Yellow curbs

- Within fifteen feet of a fire hydrant

- Crosswalk

- Anywhere signs are located prohibiting parking

- Within four feet or directly in front of a public or private driveway

- Within 50 feet of a railroad crossing

- In the road or in an intersection

- On a bridge or other elevated structure

Be aware that you must know state statutes and municipal ordinances, this is not to be used as an excuse to get out of a parking citation.

https://www.evansvillegov.org/city/topic/index.php?topicid=1134&structureid=15#Where_are_free_spaces_downtown

Air Quality in Cities

Air quality should be a concern for everyone. It is especially concerning to people with sensitive breathing issues.

What is air pollution? It is foreign substances emitted into the air. Cars using gasoline emit pollutants in the air. We took a look at the United States Environmental Protection Agency quality index report for Evansville.

Evansville IN - air quality

| Air Quality | Partial 2019 | 2018 | 2017 |

|---|---|---|---|

| Good Days | 165 | 204 | 210 |

| Moderate Days | 43 | 146 | 154 |

| Unhealthy for Sensitive Groups | 0 | 15 | 0 |

So far in 2019, Evansville has had 165 good air quality days.

Military/Veterans

Are you active military personnel or a veteran living in Evansville? We want to thank you for your service to our country.

– Veterans by Service Period

Most veterans living in Evansville fought in the Vietnam Conflict followed by the Gulf War.

– Military Bases Within an Hour

Evansville does not have any military bases within an hour. The closest base is the Grissom Air Reserve Base a little over three hours away.

– Military Discounts

Car insurance can be a costly expense every month. Being in the military can get you discounts to lower the financial burden.

Evansville, IN - military discounts

| Insurance Company | Military | Military Garaging |

|---|---|---|

| ||

| ||

| x | ||

| ||

| x | ||

| x | ||

| x | ||

| x | |

| x | ||

| ||

| x | |

| x | ||

| x | ||

| x | ||

| ||

| x | x |

USAA is an insurance company tailored to veterans and active military personnel and eligible family members. USAA is often the lowest option for military families.

Indiana - State Averages (USAA comparison)

| Company | Rate | Compared to State Average | Percentage Difference |

|---|---|---|---|

| Allstate P&C | $3,980 | $662 | $17 |

| American Family Mutual | $3,679 | $361 | $10 |

| Illinois Farmers Ins 2.0 | $3,437 | $119 | $3 |

| Geico Cas | $2,261 | -$1,057 | -$47 |

| First Liberty Ins Corp | $5,782 | $2,464 | $43 |

| Nationwide Mutual | $2,712 | -$606 | -$22 |

| Progressive Paloverde | $3,898 | $580 | $15 |

| State Farm Mutual Auto | $2,409 | -$909 | -$38 |

| Travco Ins Co | $3,394 | $75 | $2 |

| USAA | $1,630 | -$1,688 | -$104 |

As you can see, USAA is well below the state average in their premiums.

Unique City Laws

Some cities have some very old laws on the books that may not make sense. Evansville has a strange law requiring no headlights to be turned on when driving down Main Street. They also have a law requiring no one can enter or exit a car while it is in motion. Hopefully, that law is not so much strange as common sense.

Hands-Free Laws

Distracted driving laws in Evansville follow the laws of the entire state of Indiana. Drivers can use cell phones to talk, but no use for texting or emails.

Drivers under the age of twenty-one can not use a cell phone for any reason other to dial 9-1-1 in the case of an emergency.

Food Trucks

If you are interested in operating a food truck in Evansville, you must obtain the proper food permits through the Vanderburgh County Health Department.

You will also need a business license and seller’s license to be a legal operator of a food truck.

Food trucks have become popular over the years. Evansville hosts a food truck festival to benefit a non-profit organization.

Tiny Homes

Tiny homes have become all the rage. Minimalistic living and tiny homes are appealing to many Americans. Do you have an interest in living in a tiny home?

Well, in Evansville it is actually against the law to live in a single-family one under 720 square feet.

Parking Laws

You can visit all parking laws here at the Evansville Municipal Code.

You must remember if you see parking facing the opposite way you are going, you must park facing the same direction as the flow of traffic.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Evansville Car Insurance FAQs

In this last section, we are going to finish up with a few common questions about living in Evansville.

What happens if I’m in a car accident in Evansville?

Indiana is considered an at-fault state. This means whoever is at fault is the one that must file the claim with their insurance. It gets a little more complicated in Indiana. Indiana has comparative fault laws. This means if you are under fifty percent at fault, you can claim the percentage of which you are not at fault and receive funds.

What car insurance coverage do I need?

If you are new to the area, you need to know Indiana has required minimum limits for insurance. This means you must carry at least the following coverages on your auto policy:

- $25,000 for property damage liability insurance

- $25,000 for bodily injury per person and $50,000 per accident

- Uninsured coverage that matches the limits of your liability insurance

Please note, this is the minimum required amount and we suggest you get more coverage.

– If I’m moving to Evansville, can I keep my current driver’s license?

If you are moving from outside of Indiana, no you can not keep your current license. You must visit a local DMV and turn in your old license and get a new Indiana license.

What do students do for fun in the city of Evansville?

As we mentioned earlier, there are a few colleges in the area. We also talked about some fun things residents and visitors can do in the area. Evansville may be located in Indiana, but is also very close to Kentucky and Illinois. The possibilities are endless of fun things to do.

We have covered a lot of information about Evansville, Indiana. If you are ready to get started, you can enter your zip code here for a free no-hassle quote.

Frequently Asked Questions

Is auto insurance mandatory in Evansville, IN?

Yes, auto insurance is mandatory in Evansville, IN, as it is in most states. The minimum required coverage typically includes liability insurance, which covers the costs if you cause an accident that results in property damage or injuries to others.

What are the different types of auto insurance coverage?

There are several types of auto insurance coverage available, including:

- Liability coverage: This covers the costs of injuries and property damage you cause to others in an accident.

- Collision coverage: This covers the cost of repairing or replacing your vehicle if it’s damaged in a collision.

- Comprehensive coverage: This covers the cost of repairing or replacing your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP): This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/underinsured motorist coverage: This covers the costs if you’re in an accident with a driver who doesn’t have insurance or has insufficient coverage.

How is auto insurance premium calculated?

Auto insurance premiums are calculated based on several factors, including your age, driving record, the type of vehicle you own, where you live, and the coverage options you choose. Insurance companies use statistical models to assess the risk of insuring you and determine the premium accordingly.

Are there any discounts available for auto insurance in Evansville, IN?

Yes, many insurance companies offer various discounts that can help you save money on your auto insurance premium. Some common discounts include multi-vehicle discounts, good student discounts, safe driving discounts, and discounts for bundling multiple policies (such as auto and home insurance) with the same company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.