Best Indianapolis, Indiana Auto Insurance in 2025 (Compare the Top 10 Companies)

Finding the best Indianapolis, Indiana auto insurance can save you money and offer peace of mind. USAA excels in rates and customer service, Geico offers great pricing and discounts, and State Farm is known for personalized service. Check these top providers with rates from $90 monthly to find your best coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Indianapolis Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Indianapolis Indiana

A.M. Best Rating Score

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Indianapolis Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsFinding the best Indianapolis, Indiana auto insurance is essential for cost savings and quality coverage. USAA offers top rates and excellent service, while Geico provides competitive pricing and discounts. State Farm is also a strong option with reliable, personalized service.

This comprehensive guide will give you all the knowledge on factors impacting your auto insurance, including types of auto insurance, coverage, driving behavior, rate calculation, and more.

Our Top 10 Company Picks: Best Indianapolis, Indiana Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 15% | A++ | Affordable Rates | Geico | |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 12% | A+ | Customizable Plans | Progressive | |

| #5 | 10% | A+ | Full Coverage | Allstate | |

| #6 | 15% | A | Personal Attention | Farmers | |

| #7 | 10% | A+ | Policy Bundling | Nationwide |

| #8 | 10% | A | Family Benefits | American Family | |

| #9 | 12% | A | Custom Coverage | Liberty Mutual |

| #10 | 15% | A++ | Claims Service | Auto-Owners |

Use our free tool above with just your ZIP code to compare quotes from multiple insurance carriers. Read along to see how you can save money on your premiums.

- USAA excels in rates and customer service

- Geico offers competitive pricing and discounts

- State Farm provides reliable, personalized service

#1 – State Farm: Top Overall Pick

Pros

- Extensive Local Agent Network: State Farm offers personalized service through its large network of local agents, ensuring tailored coverage for Indianapolis drivers. Their customer service ratings are high, making them a strong choice for the best Indianapolis, Indiana auto insurance. Discover more details in our State Farm review.

- Discounts for Safe Driving: State Farm provides discounts for safe driving habits, which can lower premiums for cautious drivers. This includes savings for those with accident-free records and those who complete defensive driving courses. Their focus on safe driving makes them a top contender for the best Indianapolis, Indiana auto insurance.

- Versatile Coverage Selections: The provider offers a wide range of coverage options, including customizable policies that can be tailored to individual needs. This flexibility ensures comprehensive protection and is ideal for finding the best Indianapolis, Indiana auto insurance that fits diverse driving profiles.

Cons

- Higher Average Rates for Young Drivers: State Farm’s rates can be higher for younger drivers or those with less driving experience. This may impact affordability for younger Indianapolis drivers seeking the best Indianapolis, Indiana auto insurance. Their pricing structure may necessitate exploring additional discounts or options to manage costs effectively.

- Limited Coverage Options in Some Areas: In certain instances, State Farm may offer limited coverage options or exclusions based on specific regions within Indianapolis. This could be a drawback for drivers seeking specialized coverage. It’s important to review policy details to ensure comprehensive protection when considering the best Indianapolis, Indiana auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico is renowned for offering some of the most affordable auto insurance rates in Indianapolis, making it a top choice for cost-conscious drivers. Their pricing is competitive across various driver profiles, enhancing their appeal for the best Indianapolis, Indiana auto insurance.

- Numerous Discounts Available: Geico provides a variety of discounts, including those for bundling policies, maintaining a good driving record, and more. This variety helps drivers save on premiums, contributing to their status as a leading provider of the best Indianapolis, Indiana auto insurance. Find out more in our Geico auto insurance review.

- Easy Online Access: Geico’s user-friendly online platform allows for quick quote comparisons, policy management, and claims filing. This convenience is beneficial for busy Indianapolis drivers looking for efficient service. Their digital tools make managing the best Indianapolis, Indiana auto insurance straightforward.

Cons

- Less Personalized Customer Service: Geico’s focus on online and phone service may result in less personalized customer interactions compared to companies with local agents. This can be a disadvantage for Indianapolis drivers who prefer face-to-face consultations. It’s important to consider whether the convenience of online service meets your needs for the best Indianapolis, Indiana auto insurance.

- Restricted Coverage Adjustments: Geico’s coverage options might be less customizable compared to some competitors. This can be a limitation for drivers who need more specialized coverage options. Ensuring that your specific needs are met is essential when choosing the best Indianapolis, Indiana auto insurance.

#3 – USAA: Best for Military Service

Pros

- Exclusive Military Discounts: USAA offers special discounts and benefits for military members and their families, making it a top choice for those eligible. Their military-focused services are a significant advantage for finding the best Indianapolis, Indiana auto insurance. Discover our USAA review for a full list.

- High Customer Satisfaction: USAA is highly rated for customer satisfaction and service, reflecting its commitment to quality and reliability. This high level of service is beneficial for Indianapolis drivers seeking the best Indianapolis, Indiana auto insurance.

- Full-Spectrum Coverage Choices: The provider offers extensive coverage options, including unique benefits tailored for military families. This comprehensive approach ensures that all needs are addressed, contributing to their status as a top choice for the best Indianapolis, Indiana auto insurance.

Cons

- Limited Eligibility: USAA insurance is only available to military members, veterans, and their families, limiting access for the general public. This exclusivity can be a drawback for those not eligible but still seeking competitive rates in Indianapolis. It’s important to check eligibility to determine if USAA is an option for the best Indianapolis, Indiana auto insurance.

- Fewer Local Agents: USAA primarily operates online and via phone, which may result in less personalized local service compared to companies with physical branches. This can be a limitation for those who prefer face-to-face interactions when managing the best Indianapolis, Indiana auto insurance.

#4 – Progressive: Best for Customizable Plans

Pros

- Variety of Coverage Options: Progressive offers a wide range of customizable insurance plans, allowing Indianapolis drivers to tailor coverage to their specific needs. This flexibility helps in finding the best Indianapolis, Indiana auto insurance for diverse driving profiles. Read more through our Progressive auto insurance review.

- Usage-Based Insurance Programs: Progressive’s Snapshot program provides discounts based on actual driving habits, offering potential savings for safe drivers. This innovative approach to pricing contributes to their reputation for the best Indianapolis, Indiana auto insurance.

- Competitive Rates for High-Risk Drivers: Progressive often provides competitive rates for drivers with higher risk profiles, including those with prior violations. This inclusivity makes them a viable option for a broad range of drivers seeking the best Indianapolis, Indiana auto insurance.

Cons

- Variable Customer Service: While Progressive offers many features, customer service experiences can vary, with some customers reporting less satisfactory interactions. This variability can impact the overall experience for those seeking the best Indianapolis, Indiana auto insurance.

- Complex Policy Options: The wide array of coverage options and add-ons can be overwhelming, potentially complicating the process of finding the best Indianapolis, Indiana auto insurance. It’s important to carefully review policy details to ensure they meet your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Full Coverage

Pros

- All-Inclusive Insurance Plans: Allstate offers extensive coverage options, including add-ons for full protection, making it a strong choice for drivers seeking thorough insurance. Their commitment to full coverage enhances their reputation for the best Indianapolis, Indiana auto insurance..

- Discounts for Bundling: Allstate provides significant discounts for bundling auto with other insurance products, such as home insurance. This can lead to substantial savings and is advantageous for finding the best Indianapolis, Indiana auto insurance, which you can learn about in our Allstate review.

- Unique Benefits for Safe Drivers: Allstate’s Safe Driving Bonus program rewards drivers for maintaining safe driving habits, offering additional savings. This program supports their position as a leading provider for the best Indianapolis, Indiana auto insurance.

Cons

- Higher Premiums for Certain Drivers: Allstate’s rates can be higher for certain driver profiles, including those with less favorable driving records. This can affect affordability for some Indianapolis drivers seeking the best Indianapolis, Indiana auto insurance.

- Complex Claims Process: Some customers have reported challenges with Allstate’s claims process, which can be more complicated compared to other providers. This complexity might be a consideration when choosing the best Indianapolis, Indiana auto insurance.

#6 – Farmers: Best for Personal Attention

Pros

- Customized Coverage Solutions: Farmers provides personalized insurance solutions tailored to individual needs, offering a high level of customization for Indianapolis drivers. Their focus on personal attention supports their reputation for the best Indianapolis, Indiana auto insurance.

- Range of Discounts: Farmers offers various discounts, including those for bundling policies and maintaining a clean driving record. These discounts can help reduce premiums and are beneficial for securing the best Indianapolis, Indiana auto insurance. Read more in our review of Farmers.

- Varied Coverage Alternatives: Farmers provides a wide range of coverage options, including specialized add-ons, to ensure comprehensive protection. This variety enhances their appeal as a top choice for the best Indianapolis, Indiana auto insurance.

Cons

- Augmented Rates for Risk-Prone Drivers: Farmers may offer higher premiums for drivers with higher risk profiles, including those with previous violations. This could affect affordability for some Indianapolis drivers seeking the best Indianapolis, Indiana auto insurance.

- Reduced Online Functionality: Farmers’ digital tools and online resources may not be as advanced as some competitors, potentially impacting the ease of managing policies online. This could be a drawback for those seeking a streamlined online experience for the best Indianapolis, Indiana auto insurance.

#7 – Nationwide: Best for Policy Bundling

Pros

- Excellent Bundling Discounts: Nationwide offers significant discounts for bundling multiple insurance policies, such as auto and home insurance. This bundling can lead to considerable savings and is beneficial for Indianapolis drivers seeking comprehensive coverage options. Their bundling benefits enhance their standing for the best Indianapolis, Indiana auto insurance.

- Extensive Policy Choices: Nationwide provides a wide array of coverage options, including unique add-ons and customization choices. This flexibility allows Indianapolis drivers to tailor their insurance to their specific needs, supporting their position as a top choice for the best Indianapolis, Indiana auto insurance.

- Reliable Claims Service: Nationwide is known for its reliable claims support, offering a straightforward and efficient process. This strong claims handling ensures that Indianapolis drivers can trust their coverage in the event of a claim, reinforcing their reputation for the best Indianapolis, Indiana auto insurance. Find out more in our Nationwide review.

Cons

- Premium Costs Can Be Higher: Nationwide’s premiums may be higher compared to some competitors, which could affect affordability for certain Indianapolis drivers. It’s important to compare rates to ensure the best Indianapolis, Indiana auto insurance aligns with your budget.

- Limited Local Presence: Some customers may find that Nationwide’s local agent presence is not as extensive as other providers, potentially impacting personalized service. This can be a consideration for those seeking local support for the best Indianapolis, Indiana auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Benefits

Pros

- Variety of Payment Plans: Travelers offers flexible payment options, including monthly and quarterly plans, making it easier for Indianapolis drivers to manage their insurance expenses. This flexibility in payment options supports their reputation for the best Indianapolis, Indiana auto insurance. Find out more in our American Family insurance review.

- Wide-Ranging Protection Plans: Travelers provides a range of coverage options and add-ons, allowing for customized protection tailored to individual needs. This extensive range ensures that drivers can find suitable coverage for their specific requirements, enhancing their appeal for the best Indianapolis, Indiana auto insurance.

- Robust Online Tools: Travelers’ online tools and resources provide a convenient way to manage policies, obtain quotes, and file claims. This digital efficiency supports their standing as a top choice for the best Indianapolis, Indiana auto insurance.

Cons

- Customer Service Variability: Some customers report variability in customer service experiences with Travelers, which could impact overall satisfaction. This variability is something to consider when selecting the best Indianapolis, Indiana auto insurance.

- Premium Surcharges for Riskier Drivers: Travelers may have higher rates for drivers with previous violations or higher risk profiles, which could affect affordability. It’s important to evaluate rates and coverage options to ensure the best Indianapolis, Indiana auto insurance meets your needs.

#9 – Liberty Mutual: Best for Custom Coverage

Pros

- Specialized Programs for New Drivers: Liberty Mutual offers programs tailored specifically for new drivers, including discounts and educational resources. These programs support new Indianapolis drivers in finding the best Indianapolis, Indiana auto insurance suited to their needs.

- Variety of Coverage Add-Ons: Liberty Mutual provides a wide range of coverage add-ons, allowing for extensive customization of policies. This variety ensures comprehensive protection for all types of drivers, contributing to their reputation for the best Indianapolis, Indiana auto insurance.

- Consolidated Policy Savings: Liberty Mutual offers significant savings for bundling auto insurance with other policies, such as home insurance. This can lead to substantial discounts, benefiting those seeking the best Indianapolis, Indiana auto insurance, which you can check out in our Liberty Mutual review.

Cons

- Increased Rates for Risky Drivers: Liberty Mutual may charge higher premiums for drivers with a history of violations or accidents. This could impact affordability for some Indianapolis drivers looking for the best Indianapolis, Indiana auto insurance.

- Sophisticated Coverage Plans: The extensive range of coverage options and add-ons might be overwhelming for some customers. Ensuring that the chosen policy aligns with specific needs is essential when selecting the best Indianapolis, Indiana auto insurance.

#10 – Auto-Owners: Best for Claims Service

Pros

- Exceptional Claims Service: Auto-Owners is renowned for its high-quality claims service, ensuring efficient and hassle-free processing. This strong performance in handling claims enhances their reputation as a provider of the best Indianapolis, Indiana auto insurance, as noted in our Auto-Owners auto insurance review.

- Diverse Insurance Offerings: The company offers a wide range of coverage options, including many customizable add-ons. This comprehensive approach allows Indianapolis drivers to tailor their insurance to meet their specific needs, contributing to their position as a top provider of the best Indianapolis, Indiana auto insurance.

- Reasonable Pricing: Auto-Owners provides competitive pricing that often results in lower premiums for policyholders. Their affordable rates, combined with excellent service, support their status as a leading option for the best Indianapolis, Indiana auto insurance.

Cons

- Constrained Digital Tools: Auto-Owners may offer fewer online tools and digital options compared to some competitors. This could be a drawback for tech-savvy Indianapolis drivers who prefer managing their insurance online for the best Indianapolis, Indiana auto insurance.

- Availability Issues: The company’s coverage and service areas might be limited in some regions, which could affect accessibility for certain Indianapolis drivers. Ensuring that Auto-Owners is available in your area is crucial when considering them for the best Indianapolis, Indiana auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Navigating Auto Insurance in Indianapolis: Your Guide to Coverage in the Racing Capital

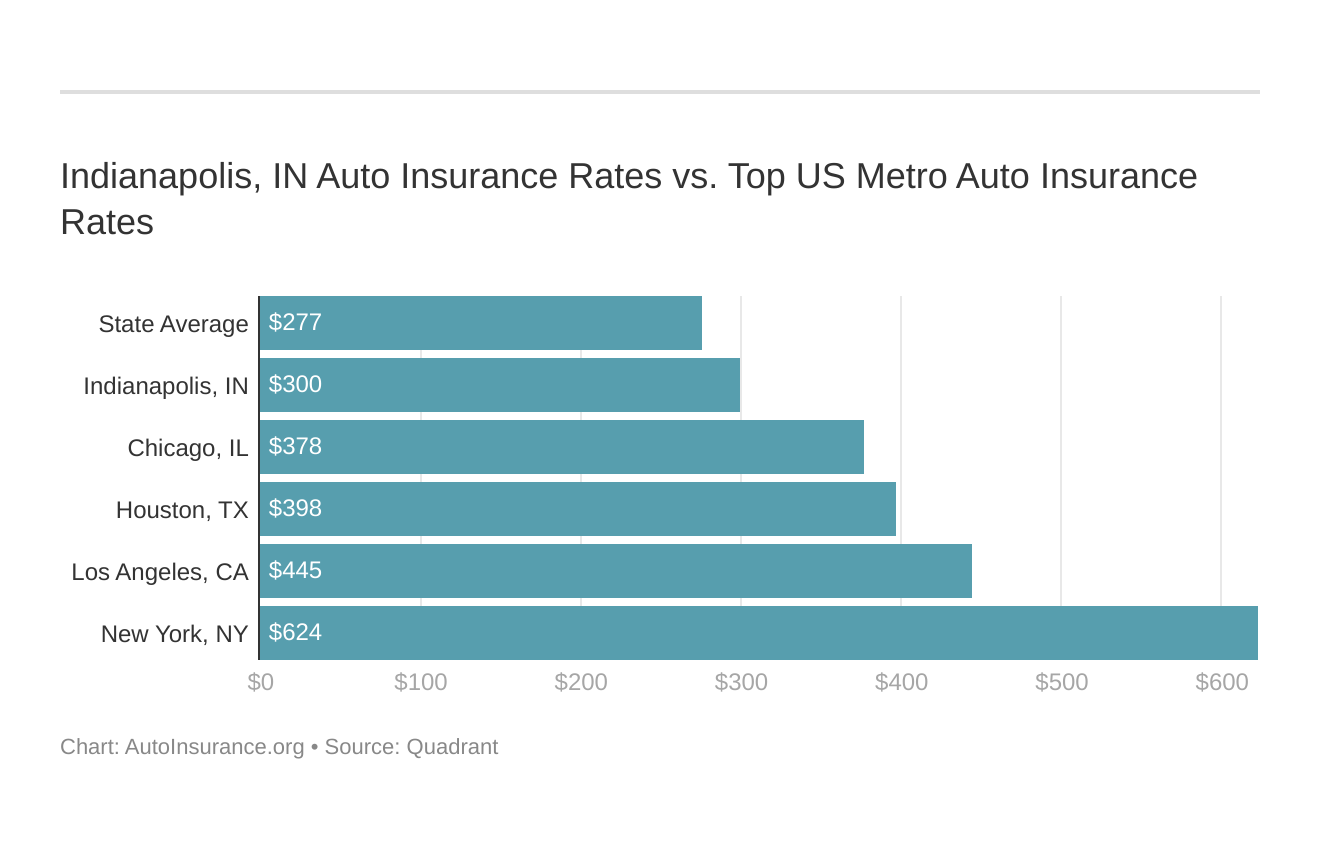

Indianapolis is the third-largest city in the Midwest, with a population of around 863,000. The Indianapolis Metropolitan Area has a population of around two million people.

Indianapolis, Indiana Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $45 | $110 |

| American Family | $40 | $104 |

| Auto-Owners | $37 | $97 |

| Farmers | $42 | $107 |

| Geico | $35 | $95 |

| Liberty Mutual | $42 | $108 |

| Nationwide | $39 | $102 |

| Progressive | $38 | $105 |

| State Farm | $40 | $100 |

| USAA | $30 | $90 |

Home to the Indiana Colts and the Indiana Pacers, the city of Indianapolis has had a strong influence on national culture. The city has a rich history since it was established as the capital of Indiana in 1825. Presidents such as Lincoln and Kennedy have delivered famous speeches in the city.

The capital city is also a global center of motorsports. Every year on Memorial Day weekend, the city’s Indianapolis Motor Speedway plays host to the Indy 500, which is considered part of the prestigious Triple Crown of Motorsports.

Around 500 motorsports companies and two racing bodies are headquartered in Indianapolis. Understanding what are the benefits of auto insurance is crucial in a city with such a deep automotive culture.

With such a strong pedigree, the love of cars in Indianapolis is well established. If you love to drive, auto insurance becomes inherently critical. It helps you not only protect yourself and your family but also your ride.

The Cost of Car Insurance in Indianapolis

Shopping for car insurance in Indianapolis, IN, requires understanding several critical factors impacting rates, including age, gender, and location. Younger drivers, particularly teens, face higher premiums due to the lack of driving history and perceived higher risk.

Insurance rates generally decrease with age and driving experience, with significant drops expected by age 25. Gender also plays a role, with males typically paying more than females.

Understanding how auto insurance companies check driving records is also crucial, as it affects your rates based on your driving history and risk profile.

Imported from Manual Input

| SUMMARY OVERVIEW OF INDIANAPOLIS, IN | DETAILS |

|---|---|

| Population | 863,002 |

| Density | 2,387 people per square mile |

| Average Cost of Insurance in Indianapolis | $3,512.78 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor: 22% Mediocre: 22% Fair: 15% Good: 42% |

Location, down to the ZIP code level, can further influence rates due to varying crime rates, accident frequency, and local traffic patterns. The best car insurance provider for you will depend on your specific needs, including commute distance, coverage level, credit score, and driving record.

Additionally, seeking the best low-mileage auto insurance discounts can significantly impact your premiums if you drive fewer miles than average. Companies like USAA, Geico, and State Farm often offer the cheapest rates, but it’s crucial to compare quotes based on your unique profile.

Economic factors like the median household income, which is lower in Indianapolis than the national average, and the homeownership rate, which can influence discounts, should be considered when budgeting for car insurance.

Driving in Indianapolis

We’ve already discussed factors like how you drive, but it’s also essential to consider what and where you drive when calculating your insurance risk. In this section, we’ll explore driving-related factors that may affect your insurance rates, including the impact of violations.

For instance, How long does a speeding ticket affect your auto insurance rates? Indianapolis, known as the Crossroads of America, has major interstates like I-70, I-65, and I-69, connected through I-465, with Meridian Street as a key thoroughfare.

The city’s roads, which are generally in good condition, require drivers to spend around $575 annually on maintenance.

Road condition in Indianapolis

| ROAD CONDITION | POOR | MEDIOCRE | FAIR | GOOD | VOC |

|---|---|---|---|---|---|

| Indianapolis, IN | 22% | 22% | 15% | 42% | $575 |

While Indiana doesn’t use red-light or speeding cameras, local enforcement relies on speed traps, especially in Indianapolis, where vehicle thefts and violent crime rates are concerning.

The city has three of the nation’s most congested highways, and traffic congestion costs drivers about $826 annually. Despite the lack of a robust public transportation network, most residents drive, with an average of two cars per household.

Violent crime in Indianapolis

| Geography | Violent Crimes (per 1,000 Residents) |

|---|---|

| Indianapolis | 13.52 |

| Indiana | 3.99 |

| United States (median) | 4 |

Popular vehicles like the Buick Encore, equipped with advanced safety features, may help lower insurance rates due to their modern safety tech. However, luxury vehicles often result in higher premiums due to costly repairs.

The city’s air quality is relatively clean compared to other large cities, though vehicular emissions still contribute to pollution. For those without a car, ridesharing options like Lyft, Uber, and e-scooters are available, and the new IndyGo Red Line offers additional public transit options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

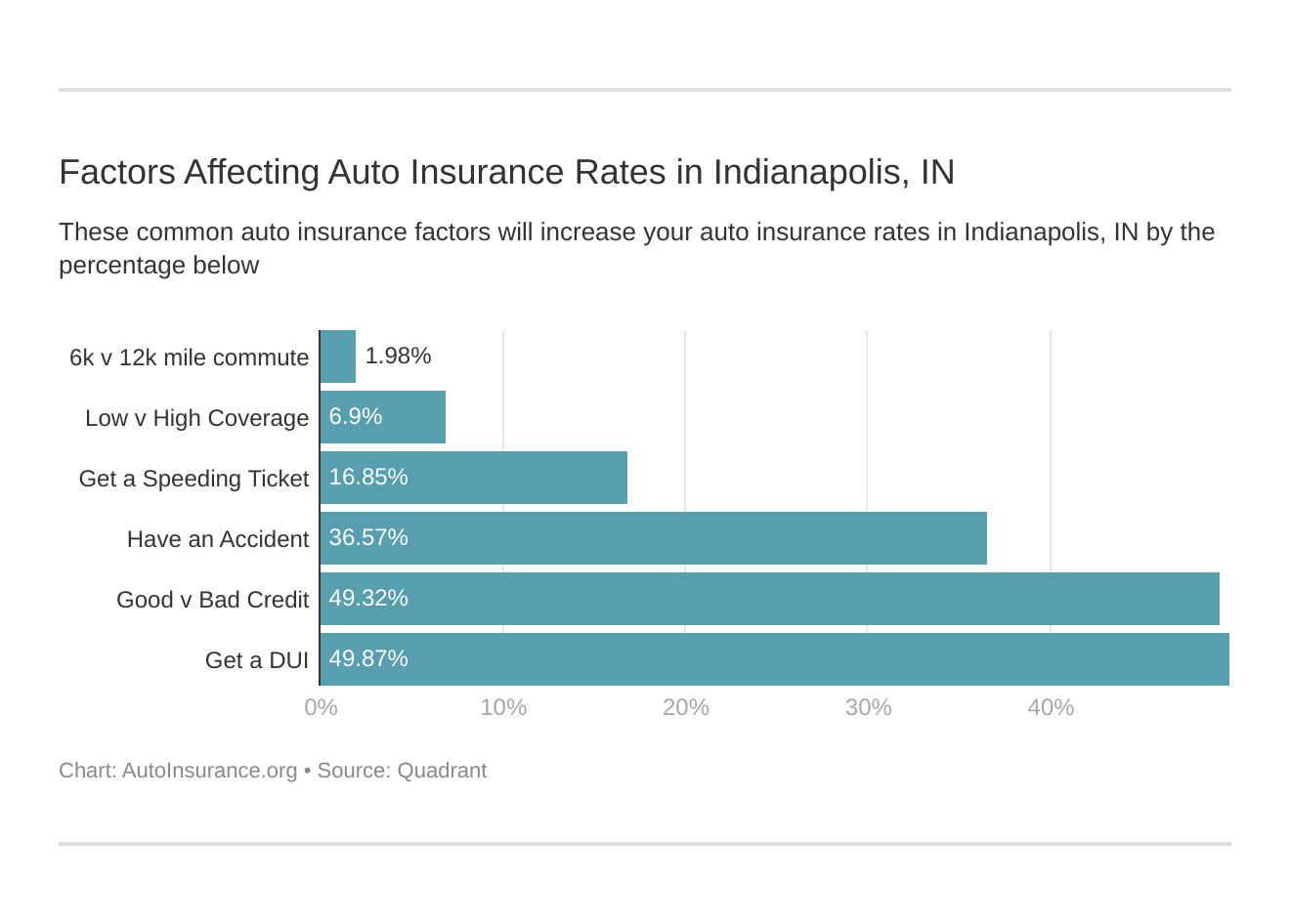

Indianapolis, IN Auto Insurance

Indianapolis, Indiana auto insurance requirements are 25/50/25 according to Indiana auto insurance laws. Finding cheap auto insurance companies in Indianapolis can seem like a difficult task, but all of the information you need is right here.

We’ll cover factors that affect auto insurance rates in Indianapolis, Indiana, including driving record, credit, commute time, and more.

Compare auto insurance in Indianapolis to other Indiana cities, including Carmel auto insurance rates, Indianapolis auto insurance rates, and Bloomington auto insurance rates to see how Indianapolis, Indiana auto insurance rates stack up.

Before you buy Indianapolis, Indiana auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Indianapolis, Indiana auto insurance quotes.

Best By Category: Cheapest Auto Insurance in Indianapolis, Indiana

Compare the cheapest auto insurance companies in Indianapolis, Indiana in each category to find the company with the best rates for your personal needs, considering the top factors that affect auto insurance rates.

Best Monthly Auto Insurance Rates by Company in Indianapolis, Indiana

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | USAA |

| With 1 Speeding Violation | USAA |

The Cheapest Indianapolis, Indiana Auto Insurance Companies

USAA, although only available to military members and their families, is often cited for its competitive rates and excellent customer service, making it a top choice for eligible drivers.

Geico is widely recognized for offering low rates and various discounts, such as for safe driving or bundling with other insurance products.

State Farm also provides competitive rates, particularly for drivers who maintain a clean driving record, and is known for its personalized service through a network of local agents.

On the other hand, Liberty Mutual is typically one of the more expensive options in Indianapolis, but it may still be worth considering for those who value its robust coverage options and customizable policies.

It’s important to note that while these companies may have competitive average rates, your actual premium will depend on several factors, including your age, driving record, credit history, and the specific coverage levels you choose.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Indianapolis, Indiana Auto Insurance Quotes

Before you buy Indianapolis, Indiana auto insurance, make sure you have compared rates from multiple companies.

Shop around and get quotes from multiple insurers to find the best rate for your needs.Scott W. Johnson Licensed Insurance Agent

Enter your ZIP code below to get free Indianapolis, Indiana auto insurance quotes.

Frequently Asked Questions

Can I change my auto insurance coverage or switch insurers in Indianapolis, IN?

Yes, you can change your auto insurance coverage or switch insurers in Indianapolis, IN. However, it’s important to review the terms and conditions of your current policy and consider any potential penalties or fees for canceling before making any changes.

When switching insurers, compare quotes and coverage options to ensure you’re getting the best value for your needs and consider what are the recommended auto insurance coverage levels.

Can I get discounts on my auto insurance in Indianapolis, IN?

How are auto insurance premiums determined in Indianapolis, IN?

Auto insurance premiums in Indianapolis, IN are influenced by various factors. Age and gender play a significant role, with premiums often varying based on these demographic details.

Driving records are crucial, as a history of accidents or violations can increase rates. Additionally, does a criminal record affect auto insurance rates? A criminal record can impact insurance costs, as insurers may view it as a sign of higher risk.

What are the minimum auto insurance requirements in Indianapolis, IN?

In Indianapolis, IN, drivers must carry minimum liability coverage as mandated by state law. This includes $25,000 for bodily injury or death per person in an accident, $50,000 for bodily injury or death for multiple people involved in a single accident, and $25,000 for property damage resulting from an accident.

Is auto insurance mandatory in Indianapolis, IN?

Yes, auto insurance is mandatory in Indianapolis, IN, as it is in most states. The state requires all drivers to carry a minimum amount of liability insurance to cover potential damages or injuries caused by an accident. Start comparing your quotes by entering your ZIP code.

Is Indiana a no-fault or at-fault state?

Indiana is an at-fault state. That means that in case of an accident, the driver at-fault is liable for any damages and injuries sustained by the other driver.

What is the minimum liability insurance required to drive legally in Indianapolis?

To drive legally in Indianapolis, you must meet specific insurance requirements. The minimum coverage includes Bodily Injury Liability, which is $25,000 per person and $50,000 per accident.

Additionally, Property Damage Liability must be at least $25,000 per accident. If you have a bad driving record, finding cheap auto insurance for a bad driving record that meets these minimum requirements is crucial for compliance.

What happens if you drive without insurance in Indiana?

In Indiana, the consequences for driving without valid insurance are severe. For a first offense, your driver’s license will be suspended for 90 days. A second offense results in a one-year license suspension and a $500 fine, along with the requirement to carry SR-22 insurance for three years.

Subsequent offenses lead to even harsher penalties, including a $1,000 fine and a one-year suspension of your driver’s license. Additionally, you will be required to maintain SR-22 insurance for at least five years. Enter your ZIP code to get free quotes.

Which carrier offers the cheapest car insurance in Indianapolis?

Insurance rates depend on various factors, such as your driving record, age, annual mileage, and more. Therefore, each insurance carrier may offer you varying rates based on your risk profile.

What is the average auto insurance cost per month? Based on average rates, the cheapest car insurance providers are USAA, Geico, and State Farm.

What if insurers deny me auto coverage because of high risk?

Based on your past driving record, auto insurers can deny you auto coverage in the voluntary market. You can apply for high-risk auto insurance under the Indiana Automobile Insurance Plan (IN AIP), which is designed to provide coverage to high-risk drivers.

If you are eligible, IN AIP will assign you to an insurer. The coverage you receive will be comparable to what is available in the voluntary market, but your premiums might be higher.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.