Best Classic Car Insurance Without a Garage in 2025 (Your Guide to the Top 10 Companies)

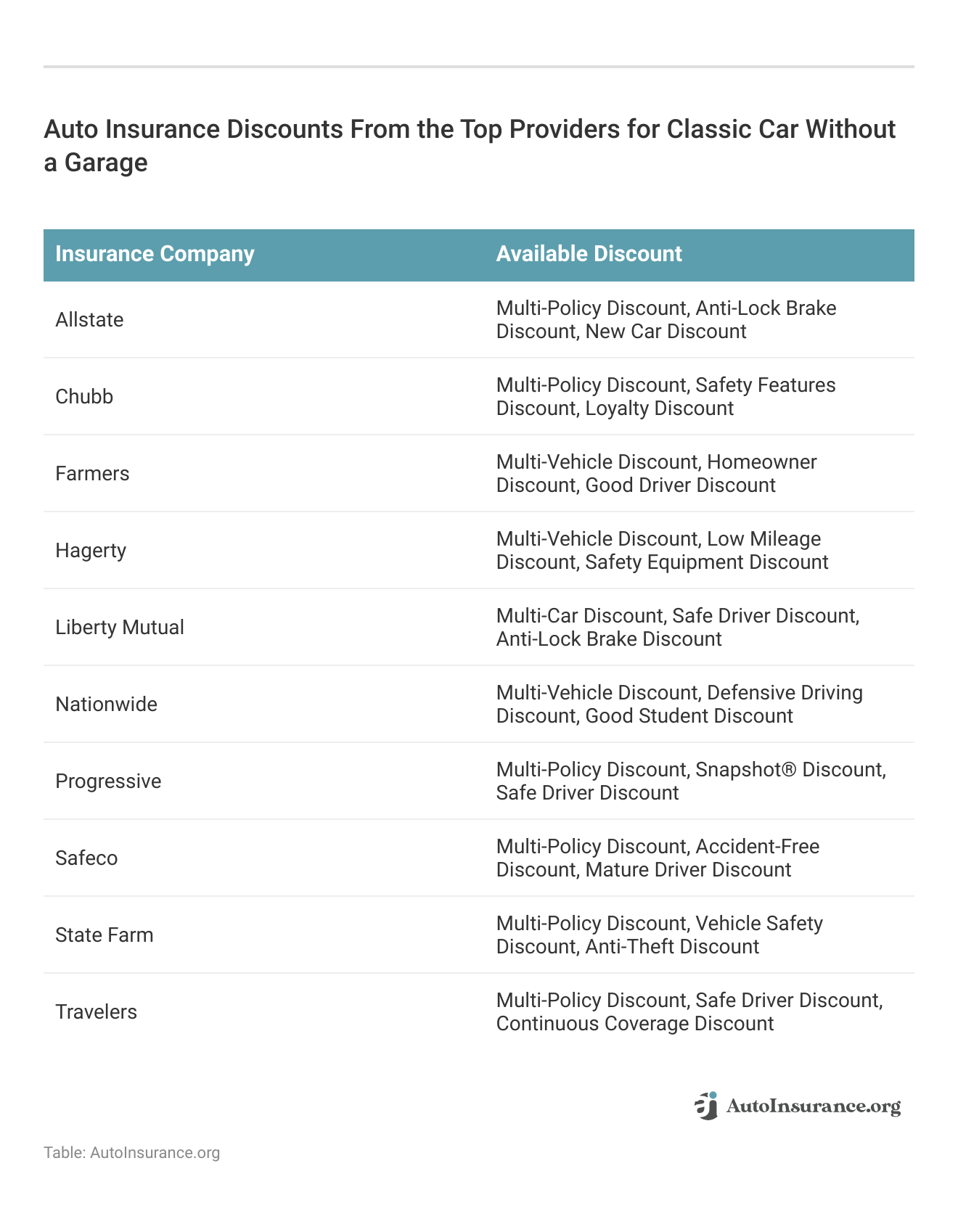

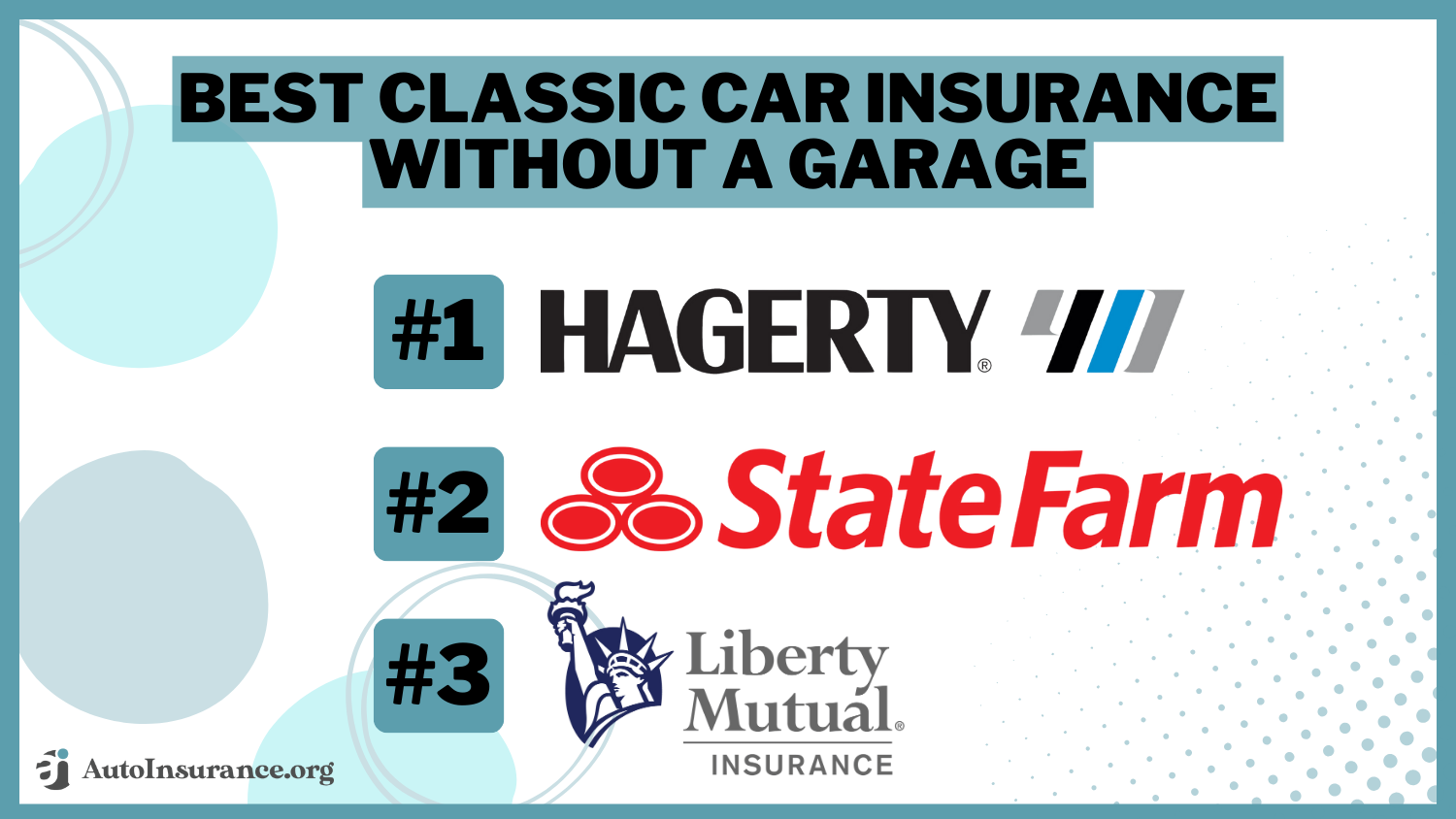

The best classic car insurance without a garage can be found with Hagerty, State Farm, and Liberty Mutual, which stand out with up to a 20% discount. These companies offer competitive rates, flexible policies, and tailored coverage for classic car owners. Compare quotes to find the best coverage for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17 reviews

17 reviewsCompany Facts

Full Coverage for Classic Car Without a Garage

A.M. Best Rating

Complaint Level

Pros & Cons

17 reviews

17 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Classic Car Without a Garage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Classic Car Without a Garage

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Classic cars are more than just vehicles. They often represent a beloved hobby as well. In many cases, classic car owners consider these vehicles to be among their most prized possessions. While many owners opt for securing their car in a garage, the reality is not everyone has access to this resource.

Classic car auto insurance is different from standard auto insurance and has different requirements. You may have heard that you cannot find classic car insurance with no garage requirement.

Our Top 10 Company Picks: Best Classic Car Insurance Without a Garage

Company Rank Multi-Vehicle Discount Low-Mileage Discount Best For Jump to Pros/Cons

#1 10% 25% Specialized Coverage Hagerty

#2 17% 20% Customizable Plans State Farm

#3 10% 15% Coverage Options Liberty Mutual

#4 5% 10% Flexible Policies Travelers

#5 20% 15% Restoration Coverage Nationwide

#6 5% 30% Based Premiums Progressive

#7 20% 20% Value Vehicles Chubb

#8 5% 10% Vintage Car Farmers

#9 10% 35% Roadside Assistance Allstate

#10 15% 20% Policy Discounts Safeco

The truth is, most insurance companies will require you to safely store your classic car. Find cheap car insurance quotes by entering your ZIP code above.

- Many insurance companies require that a classic vehicle stay stored in a garage

- Investing in agreed value plans can help drivers protect their investment

- Understanding how classic cars are categorized for insurance is crucial

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Classic Car Insurance Without Garage Requirements

Finding good auto insurance companies for classic cars can have several difficulties. One of the most common difficulties you may face is the requirement for garaging. The value of these special vehicles is calculated very differently than that of average vehicles. Many insurance companies have policies in place requiring proof that the vehicle is stored in a garage before they provide coverage.

The problem with such a policy is that providing a garage for your vehicle is yet another expense you must shoulder. This can get even more difficult if you do not have the space on your property. You may then be required to rent space elsewhere.

To save money, you can shop around to find insurance coverage that does not insist on this requirement, but finding a company that doesn’t require you to provide a garage for your vehicle could be difficult.

Research to Find the Best Classic Car Coverage Without a Garage Requirement

Once drivers have invested money into rebuilding a classic car, they often opt for storing that vehicle in a proper garage facility. Taking this step helps to preserve the car and to protect the investment that has been made.

Read more: Can I park my car on the road with no insurance?

If you happen to own a classic vehicle that has not been fully restored yet, then you may be hesitant to fork over the extra money for proper garage space. For owners in this situation, the most affordable solution is to find classic car insurance coverage that does not have this requirement.

Classic car owners can find affordable insurance without a garage by openly discussing the realistic value of their vehicle with their insurance company.Jeffrey Manola LICENSED INSURANCE AGENT

The best way to go about finding an insurance policy without proof of a garage is to talk openly with your insurance company concerning the realistic value of the vehicle. Exceptions can be made when the vehicle has been properly valued.

Where to Find Classic Car Insurance

If you are looking for classic car insurance you may be wondering, “Where do I look? Who do I call? Who provides classic car insurance?” Most traditional car insurance companies such as SafeCo or State Farm do provide modified policies for classic car owners.

Choosing the right company requires a good deal of research on your part. First, make sure that your car qualifies for classic car insurance. Then you should invest time into this to ensure you are getting the best deal.

In addition to traditional car insurance companies, there are specialty companies as well. Grundy is a well-known name in classic car insurance. This company almost exclusively provides classic coverage or specialty coverage.

You may also be wondering if you can get full coverage on a classic vehicle. You can absolutely get full coverage and in fact, it is recommended that you do.

Auto Insurance Monthly Rates for Classic Car Without a Garage by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $110

Chubb $70 $120

Farmers $50 $100

Hagerty $40 $80

Liberty Mutual $50 $95

Nationwide $60 $110

Progressive $55 $105

Safeco $55 $105

State Farm $45 $90

Travelers $55 $100

The rates for these policies depend heavily on where you live. Review estimates of classic car insurance rates by state to see what you can expect to pay.

Not everyone plans to drive their classic car often. If this is the case, you may want to research auto insurance for parked cars. Auto insurance for parked cars can be a great option if your vehicle will not be moved at all. You can use this option even if you are just parking the car over the winter. It can really help you to save money on your classic car coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Classic Cars are Categorized and Valued

If you did not get into classic car ownership intentionally, you may not realize your need for proper coverage. Some people inherit classic cars or just happen to find a great deal and snatch it up. Either way, it is important for you to understand that classic cars do require special coverage.

The biggest difference between traditional insurance and classic car coverage is that traditional policies assume that a car’s value will depreciate over time. This does not apply to classic cars because they in fact appreciate in value over time, with the proper work and maintenance.

If you decide to get insurance through a company that specializes in classic car coverage, you can rest assured that they understand the special insurance needs of these vehicles. A good auto insurance company for classic cars looks for the following markers that good care has been taken with a car:

- Driven Infrequently

- Properly Protected From the Elements

- Special Care Given to Maintenance and Appearance

Make sure you understand these requirements so you can get the best value for your policy rates, even if you are not garaging your vehicle.

Read more: Does my car qualify for classic auto insurance?

Standard vs. Agreed Value Policies

A standard value for a vehicle is a value that is set by a recognized organization such as NADA. However, these values may not accurately reflect the worth of some older cars. In these cases, you may want to work with your insurance company to come to an agreed value.

This is a value that you set. You can then agree to pay rates for this coverage to ensure that you get a fair replacement that will take into consideration your investment and the cost of replacing or repairing the car.

Definitions

You want to talk in-depth with the insurance company you are considering to make sure you understand how they use definitions, such as classic and antique when valuing your car.

Registration

Classic cars need to be properly registered before they can be insured. Talk with your local DMV to find out how to get your classic vehicle properly registered.

When looking for classic car insurance, it is important that you do your own research. You can learn more through forums and events and by talking with other classic car enthusiasts.

The Bottom Line on Classic Car Insurance Without Garage Requirements

Finding classic car insurance with no garage requirement is not impossible but very difficult. You can avoid the extra expense of storing your vehicle in a garage if you use an Agreed Value insurance plan. (Read more: Best Garaging & Storing Auto Insurance Discounts)

To get the best insurance coverage and deals, it is important that you understand how classic vehicles are valued and categorized and use this information when talking with an insurance representative.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Frequently Asked Questions

What is garageless classic car insurance?

Garageless classic car insurance is a specialized type of insurance coverage designed for owners of classic cars who do not have access to a traditional garage or storage facility. It provides protection for classic cars that are stored in alternative locations such as driveways, carports, or rented storage units.

Why do I need garageless classic car insurance?

If you own a classic car but do not have a garage to store it in, you may be exposed to certain risks that could potentially damage or devalue your vehicle. Garageless classic car insurance offers coverage for risks like theft, vandalism, fire, and weather-related damage, providing financial protection and peace of mind.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

What does garageless classic car insurance typically cover?

Garageless classic car insurance typically provides coverage for a range of perils, including theft, vandalism, fire, lightning, hail, windstorm, falling objects, and other weather-related damages. Additionally, it may offer liability coverage in case your classic car causes damage to someone else’s property or injures someone.

Read more: Types of Auto Insurance

Are there any limitations or exclusions with garageless classic car insurance?

Yes, like any insurance policy, garageless classic car insurance may have certain limitations and exclusions. Common exclusions include mechanical breakdown, regular wear and tear, damage caused by improper maintenance or modifications, and racing-related incidents. It’s important to carefully review the policy details to understand what is covered and any specific exclusions that may apply.

How is the value of my classic car determined for insurance purposes?

The value of your classic car for insurance purposes can be determined through various methods, including agreed value and actual cash value (ACV). Agreed value coverage sets a pre-determined value for your vehicle, which is agreed upon by you and the insurance company. ACV coverage typically takes into account factors such as the car’s age, condition, market value, and any modifications.

Can I drive my classic car if I have garageless classic car insurance?

Yes, you can typically drive your classic car if you have garageless classic car insurance. However, the policy may have certain restrictions on usage, such as mileage limits or requirements for secure overnight parking. It’s important to review your policy or consult with your insurance provider to understand any specific limitations on driving your classic car.

Read more: Do you need auto insurance if you don’t drive your car?

How can I find garageless classic car insurance?

To find garageless classic car insurance, you can start by contacting insurance companies that specialize in classic car insurance. They will be familiar with the unique needs of classic car owners, including those without a garage. You can also consult with insurance agents or brokers who can help you find appropriate coverage based on your specific requirements.

Can I get classic car insurance if I don’t have a garage to store my vehicle?

Yes, it is possible to get classic car insurance even if you don’t have a garage. While many insurance companies prefer that classic cars be stored in a garage, there are specialized insurance providers that offer coverage for classic cars stored in driveways, carports, or rented storage units. Companies like Hagerty, State Farm, and Liberty Mutual are known for providing flexible policies that accommodate various storage situations.

How do I find classic car insurance that doesn’t require proof of garage storage?

To find classic car insurance without a garage requirement, you should look for insurance companies that offer specialized coverage for classic cars. It’s important to discuss your vehicle’s value openly with insurance providers to determine eligibility for coverage without a garage. Companies like Hagerty and Grundy are known for their understanding of classic car needs and may offer policies that suit your situation.

Read more: Can you get auto insurance without a title?

What are the advantages of choosing agreed value coverage for my classic car?

Agreed value coverage is beneficial for classic cars because it allows you to set a pre-determined value for your vehicle with the insurance company. This value is agreed upon by both parties and ensures that in the event of a covered total loss, you will receive the agreed-upon amount, taking into consideration your investment in the vehicle and any modifications. This is especially useful if your classic car doesn’t have a standard market value.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.