Farmers Auto Insurance Review in 2026 (Rates & Customer Reviews)

Farmers Insurance shines in our in-depth Farmers auto insurance review, showcasing rates starting at $76 monthly. Dive into why choosing this provider means securing robust coverage paired with top-tier customer service, making it an excellent choice for those seeking reliable and comprehensive auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated November 2025

In our comprehensive Farmers auto insurance review, we explore the key factors that position Farmers auto insurance as a significant player in the auto insurance market, providing a clear understanding of comprehensive auto insurance defined.

Offering a broad spectrum of coverage options, Farmers tailors rates based on multiple personal factors. Explore the quality of customer service, the ease of filing claims, and the variety of discounts available, making it a valuable resource for anyone considering Farmers for their auto insurance needs.

Farmers Auto Insurance Rating

Rating Criteria ![]()

Overall Score 4.2

Business Reviews 4

Claim Processing 3.3

Company Reputation 4.5

Coverage Availability 5

Coverage Value 4.1

Customer Satisfaction 4

Digital Experience 4.5

Discounts Available 5

Insurance Cost 4.2

Plan Personalization 4.5

Policy Options 5

Savings Potential 4.5

Our analysis aims to equip you with all the necessary information to make an informed decision about your auto insurance.

Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

Farmers Auto Insurance Rate Factors

Understanding the monthly rates for Farmers auto insurance can help you make an informed decision about your car insurance needs. Rates vary based on several factors including coverage level, age, and gender. This guide breaks down the cost differences to give you a clear picture of what to expect when selecting your insurance plan.

Farmers Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

16-Year-Old Female $452 $1,156

16-Year-Old Male $452 $1,103

18-Year-Old Female $368 $853

18-Year-Old Male $387 $897

25-Year-Old Female $94 $246

25-Year-Old Male $98 $256

30-Year-Old Female $87 $228

30-Year-Old Male $91 $239

45-Year-Old Female $76 $199

45-Year-Old Male $76 $198

60-Year-Old Female $68 $171

60-Year-Old Male $72 $183

65-Year-Old Female $75 $194

65-Year-Old Male $75 $194

The analysis demonstrates that age and gender profoundly influence auto farmers insurance rates, with younger drivers encountering higher premiums. As drivers mature, their rates generally decline, mirroring their growing experience and reduced risk.

Farmers Insurance delivers trusted, comprehensive coverage backed by outstanding customer service, making it a top pick for discerning drivers.Laura Berry Former Licensed Insurance Producer

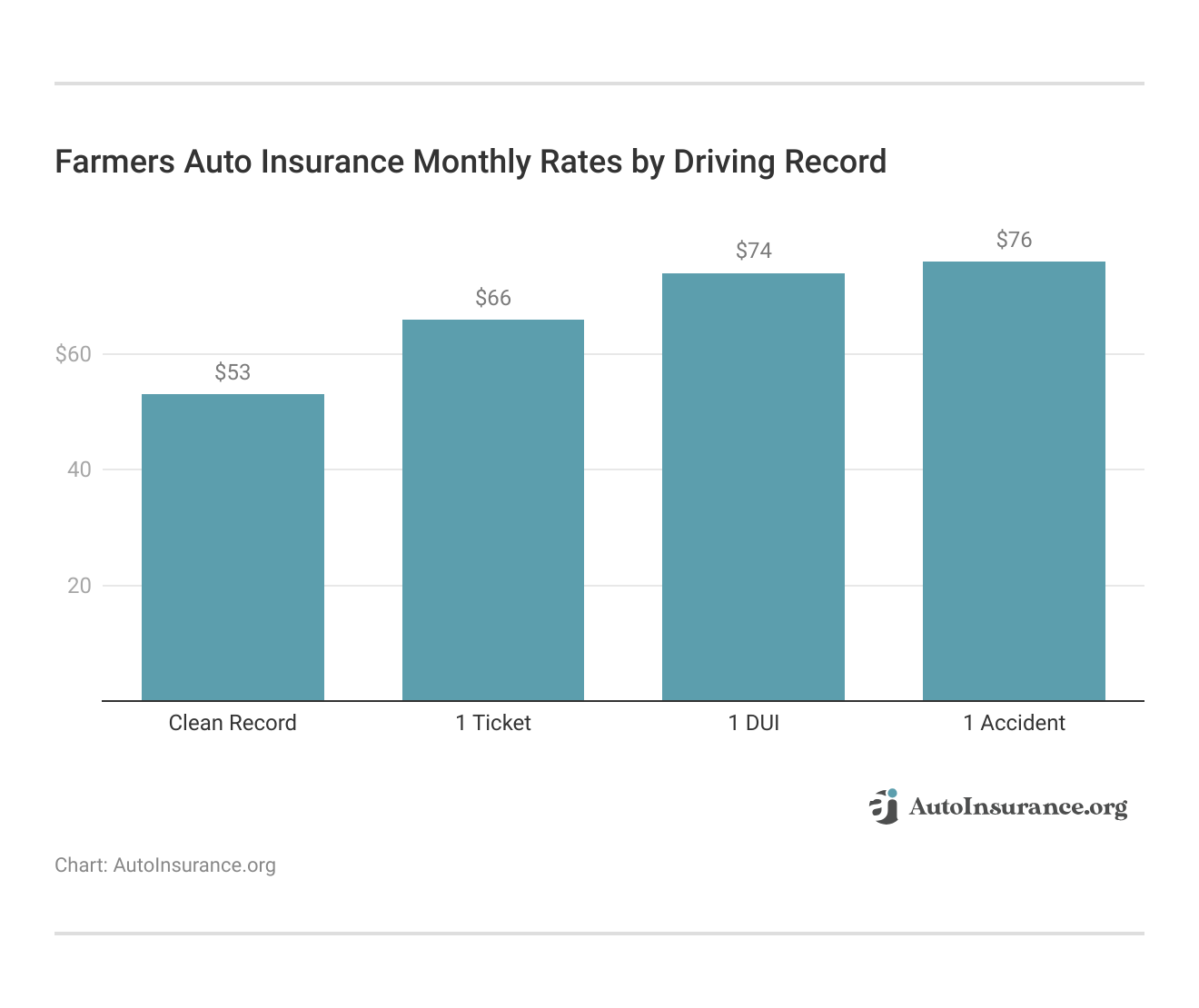

Your driving history is one of the key factors that affect auto insurance rates. This comprehensive overview examines how Farmers auto insurance adjusts monthly premiums according to your driving record.

We’ll look at costs associated with accidents, DUIs, speeding tickets, and maintaining a clean record. This comparison clearly shows the financial benefit of a clean driving record.

This highlights how farmers auto insurance increase rates for drivers with accidents, DUIs, or traffic violations on their records. Maintaining safe driving habits not only ensures safety on the roads but also helps in keeping your insurance premiums manageable.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Know About Farmers Auto Insurance Group

Farmers auto insurance is the seventh largest insurance company in America, and while it’s not as well known as other companies, it has solid customer reviews. Farmers offers an extensive list of insurance products to cover any need your car might have and several discounts to save money. While customers highly recommend Farmers, rates tend to be higher than other companies.

Farmers Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 706 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 82/100 High Customer Satisfaction |

|

| Score: 1.32 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Check out our comprehensive review of Farmers auto insurance and compare it with other providers using an auto insurance quote from Farmers to find the ideal policy for your requirements. Although not the biggest name in car insurance, Farmers is highly respected in the industry, providing traditional auto insurance and customization options like multi-policy discounts.

Although auto insurance quotes from Farmers are typically higher than those from competitors, many customers appreciate the company’s commitment to their interests. A key factor in Farmers’ high customer satisfaction is its wide range of insurance options and diverse discounts available.

Farmers receives strong customer service reviews, with many recommendations from customers. A.M. Best rates it A for financial strength, and the BBB gives it an A+ for handling complaints, despite several complaints listed on the BBB website. To learn how to file a complaint against your auto insurance company, reviewing these ratings can be helpful.

Farmers Auto Insurance Pros and Cons

Exploring Farmers Auto Insurance reveals a blend of tailored coverage options and customer-focused services.

- Farmers offers personalized coverage options

- Safe drivers enjoy discounts with the Signal program

- Exceptional 24/7 customer service and local agent network

Farmers stands out with its customizable policies and innovative discounts, but it’s important to consider the broader pricing context.

- Premiums are above industry average

- Accident forgiveness may not be available in all states

Meanwhile, Farmers offers excellent service and unique discounts, potential customers should weigh these benefits against the possibility of higher premiums.

Farmers Claims Handling

Filing a claim with Farmers auto insurance is straightforward. To learn how to file an auto insurance claim, you can initiate the process online, through the app, or by calling the Farmers claims phone number. After starting your claim, you have the option to select a repair shop within the Farmers network.

Then, when all the details get settled, Farmers will pay your claim as your policy specifies. Most customers say they’re satisfied with how Farmers handles claims, including how easy the process was. More than half of surveyed Farmers’ customers say they were satisfied with how their claims got resolved.

Farmers App

The Farmers app is highly rated and allows you to manage your car insurance policy, among other services, easily. With the Farmers app, you can:

- Manage your payment options and make payments

- Get quotes

- Report claims

- Request roadside assistance

- Receive notifications about your policy

While you can manage your policy through the app, you can always speak to a representative. If you ever wonder, “Where is a Farmers auto insurance near me?” you can find a local agent using the app.

Farmers Auto Insurance Group Insurance Coverage Options

Farmers offers everything you need for a standard car insurance policy. Whether you want minimum coverage to keep your bill down or full coverage to maximize protection, you can find it with Farmers. The following options are Farmers’ standard choices for insurance:

- Liability: Liability auto insurance, which includes bodily injury and property damage coverage, pays for damages you cause in an accident but does not cover your own vehicle.

- Collision: You need collision auto insurance to protect your car from damage caused by an accident. Collision insurance, including Farmers collision repair, covers vehicle repairs after an accident, regardless of fault.

- Comprehensive: Comprehensive auto insurance protects your car from fire, weather, animal contact, theft, and vandalism.

- Personal Injury Protection (PIP): PIP auto insurance helps pay your medical bills after an accident. PIP insurance covers hospital bills, physical therapy, and lost wages.

- Uninsured/Underinsured Motorist: While most states require insurance coverage, not all drivers follow the law. Uninsured motorist coverage helps repair your car if a driver with inadequate insurance hits you or when you’re the victim of a hit-and-run.

These five insurance types offer fairly complete protection for your car. However, your coverage needs to depend on your unique situation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Auto Insurance Group Insurance Rates Breakdown

Farmers auto insurance receives positive reviews for coverage and customer service but is often more expensive than other providers. While many insurers offer competitive rates for specific demographics, Farmers’ pricing is generally higher. We provide a breakdown of average annual full-coverage auto insurance rates by state to help you understand these costs and make informed decisions based on location and coverage needs.

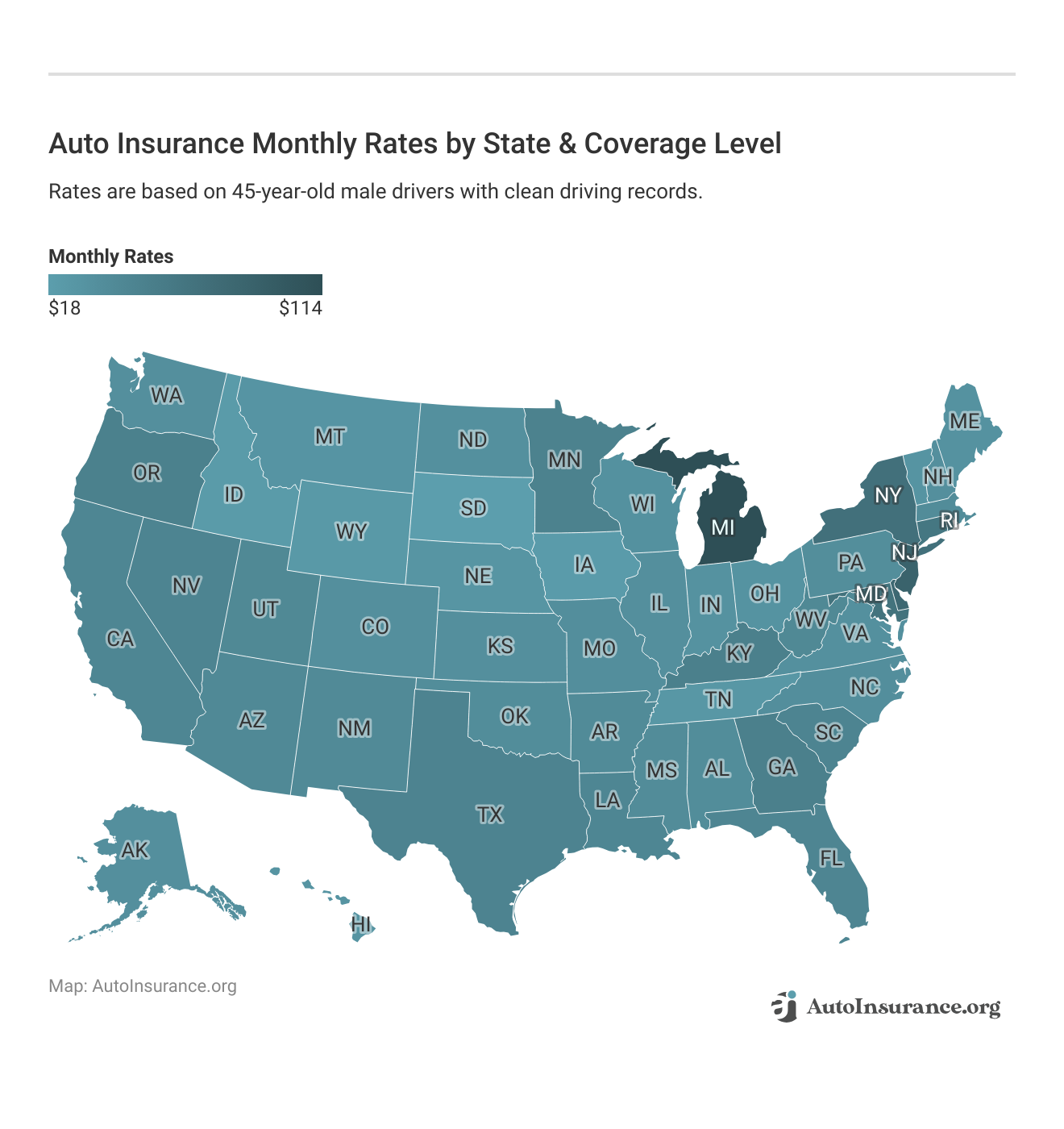

Farmers’ auto insurance rates vary by state and coverage type, especially for a 45-year-old male with a clean record. Reviewing these rates allows you to compare Farmers with other insurers, identify savings, and understand how location affects premiums. Knowing full coverage auto insurance defined can help determine if Farmers is the right choice for you.

How Age Impacts Farmers Auto Insurance Rates

Auto insurance rates by age vary, with younger drivers, especially teens, paying higher premiums. Farmers auto insurance tends to charge more for young drivers than other insurers. Although adding a teen to a parent’s policy can reduce costs, Farmers’ rates for young drivers remain above average.

Teen Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$318 $740

$253 $591

$387 $897

$153 $362

$398 $893

$239 $552

$400 $944

$178 $405

$443 $1,056

$125 $289

Older drivers benefit from lower premiums due to their experience and safer driving habits, which reduce risk. The rate difference between younger and older drivers decreases with age, but Farmers’ rates remain higher than those of other companies. This data helps assess how age affects auto insurance costs and whether Farmers auto insurance fits your budget and coverage needs.

Understanding Auto Insurance Rates for 65-Year-Old Drivers

Auto insurance premiums often increase for drivers at age 65 due to factors like age, which insurers use to assess risk. Full coverage rates for 65-year-old male drivers with clean records vary widely. Geico offers the lowest rate at $78 per month, while Liberty Mutual is the highest at $169. The U.S. average is $115, reflecting diverse options for senior drivers.

Farmers Senior Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $223 | |

| $163 | |

| $122 | |

| $194 | |

| $112 | |

| $243 |

| $160 |

| $147 | |

| $120 | |

| $138 |

When choosing an insurance provider, consider the monthly premium, customer service, claims handling, driving history, location, and coverage needs. Knowing how auto insurance companies check driving records helps you find a policy that fits your budget and provides adequate coverage.

Farmers Auto Insurance Rates & How Driving Record Affects Them

Your driving history plays a crucial role in determining your car insurance rates with Farmers. A clean record with no tickets, accidents, or serious violations like DUIs will result in lower premiums. However, any infractions can significantly increase your rates. For example, Farmers’ rates for drivers with a DUI or an accident are higher than those with a clean record, but they align closely with the national average for similar infractions.

Auto Insurance Monthly Rates by Driving Record

U.S. Average

Company Clean Record One Accident One DUI One Ticket

$87 $124 $152 $103

$62 $94 $104 $73

$76 $109 $105 $95

$43 $71 $117 $56

$96 $129 $178 $116

$63 $88 $129 $75

$56 $98 $75 $74

$47 $57 $65 $53

$53 $76 $112 $72

$32 $42 $58 $36

$65 $91 $112 $76

Understanding how auto insurance companies check driving records is crucial when evaluating insurance rates. The farmers car insurance company may not offer the lowest rates for drivers with minor violations, but it remains competitive for severe offenses such as DUIs. This information can assist you in determining if Farmers meets your insurance needs.

Comparing DUI Insurance Rates: Farmers vs. Competitors

Farmers auto insurance tends to have higher premiums across most categories, but its rates for drivers with a DUI align closely with the national average. For instance, Farmers charges $198 per month for a driver with a DUI, while the U.S. average is $173. This makes Farmers a relatively competitive choice for those with a DUI on their record, even though it may not offer the lowest rates overall.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

Insurance Company Clean Record One DUI Rate Increase

$87 $152 75%

$62 $104 68%

$76 $105 38%

$43 $117 172%

$96 $178 85%

$63 $129 105%

$56 $75 34%

$47 $65 38%

$53 $112 111%

$32 $58 81%

When reviewing DUI insurance rates, companies like Geico and AAA typically offer lower premiums for drivers with clean records. However, DUI defined as a significant risk factor, prompts substantial rate increases from Farmers and similar providers. This knowledge aids drivers in selecting the most suitable insurance based on their history and budget.

Farmers Auto Insurance Rates: Clean Record vs. Accident

Drivers with an accident on their record face higher insurance rates. Farmers auto insurance charges $282 per month for those with an accident, compared to $198 for a clean record. While Farmers’ rates are competitive with companies like Liberty Mutual at $234, they are higher than Geico’s $132.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

U.S. Average

Insurance Company Clean Record One Accident

$122 $189

$228 $321

$166 $251

$138 $196

$198 $282

$114 $189

$249 $335

$164 $230

$150 $265

$123 $146

$161 $235

$141 $199

$161 $244

An at-fault accident raises auto insurance premiums for most drivers. For instance, AAA’s rate escalates from $180 to $220, while The Hartford’s climbs from $175 to $230. Conversely, Geico and American Family have smaller increases, proving more affordable for drivers with an accident history. Comparing these rates assists in finding the most suitable insurance.

Speeding Tickets Spike Insurance Costs: How Farmers Compares

A speeding ticket raises auto insurance premiums. Farmers auto insurance increases rates from $139 per month for a clean record to $173 for one ticket. While Farmers is competitive compared to Liberty Mutual at $212, it’s higher than Geico’s $106. Keeping a clean driving record helps lower insurance costs.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

U.S. Average

Insurance Company One Ticket Clean Record

$154 $122

$268 $228

$194 $166

$150 $124

$170 $138

$100 $83

$247 $198

$151 $114

$302 $248

$196 $164

$199 $150

$137 $123

$396 $331

$194 $161

$192 $141

$148 $118

$203 $165

A single speeding ticket can elevate premiums with various providers. For example, Allstate’s rates escalate from $160 to $188, while The General’s climb from $232 to $277. Interestingly, Erie presents a smaller rate increase. By comparing these changes, drivers can explore how long a speeding ticket affects their auto insurance rates and find budget-friendly options tailored to their driving records.

Farmers vs. Top Auto Insurers: A Quick Comparison

Discover how Farmers auto insurance compares to other leading providers like Allstate, Geico, Nationwide, State Farm, and USAA. This analysis highlights key differences in rates, coverage options, and customer satisfaction, helping you choose the best insurance for your needs.

| Farmers vs. Other Top Auto Insurance Providers |

|---|

| Allstate vs. Farmers |

| Farmers vs. Geico |

| Farmers vs. Nationwide |

| Farmers vs. State Farm |

| Farmers vs. USAA |

Compare Farmers against each provider on platforms where to compare auto insurance rates to see where it stands in terms of value, service, and coverage. Use this comparison to make an informed decision about your auto insurance, whether you prioritize cost, comprehensive coverage, or customer service.

Farmers Auto Insurance Group Discounts Available

Farmers has several discounts to help you save money. While discounts vary by state, you might find the following savings:

- Good Driver

- Homeowners

- Bundling Policies

- Anti-Theft Features

- Driver Education

You may also be eligible for auto insurance discounts if you’re part of certain professional groups, though you’ll have to check with an insurance representative to see if you qualify.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Signal Discount

Most of the largest insurance companies offer usage-based insurance for safe drivers who spend less time behind the wheel. For example, Farmers’ insurance program for safe drivers is called Signal. Signal is a mobile app that tracks your driving behavior. Drivers who sign up for Signal automatically receive a 5% discount.

data-media-max-width=”560″>

Accidents can be scary, but knowing what to do after a crash can help you be better prepared for the unexpected. Take these 5 steps after an accident: https://t.co/pjrDcz9I4L pic.twitter.com/Zxc45LwVx3

— Farmers Insurance (@WeAreFarmers) February 29, 2024

If you practice safe driving habits, you can earn an additional 15% discount on your next policy renewal. Signal tracks how far you drive when you drive, and driving behaviors like hard braking, sharp turns, and speeding. While it can help you save, you should only consider Signal if you’re comfortable with it monitoring your driving. For more information on Signal, read our Farmers signal review.

How Farmers Auto Insurance Group Ranks Among Providers

When selecting auto insurance, understanding how coverage levels impact your premiums is crucial. Farmers auto insurance offers a balanced rate of $53 for minimum coverage and $139 for full coverage, making it a competitive option between Geico’s low rates and Liberty Mutual’s higher prices. This balance allows you to tailor your choice based on your coverage needs and budget.

Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$43 $114

$63 $164

$56 $150

$47 $123

$53 $141

$32 $84

Comparing Farmers to other providers like Allstate, State Farm, and Progressive reveals the cost variations for different coverage levels. Whether you seek affordable minimum coverage or comprehensive protection, analyzing these rates, along with strategies on how to lower your auto insurance rates, helps you make an informed decision that fits your financial and insurance needs.

Farmers Auto Insurance Full Coverage Rates by State

Farmers auto insurance rates for full coverage vary by state. In Alabama, it’s $133 per month, while in California, it’s $167. Farmers offers competitive pricing compared to higher rates from Liberty Mutual but is more expensive than Geico in most states. Reviewing these rates helps determine if Farmers meets your coverage needs and budget.

Auto Insurance Monthly Rates by State & Coverage Level

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| Alabama | $50 | $139 |

| Alaska | $50 | $147 |

| Arizona | $59 | $156 |

| Arkansas | $56 | $162 |

| California | $72 | $219 |

| Colorado | $51 | $169 |

| Connecticut | $87 | $169 |

| Delaware | $96 | $183 |

| Florida | $64 | $190 |

| Georgia | $72 | $179 |

| Hawaii | $37 | $100 |

| Idaho | $30 | $106 |

| Illinois | $57 | $150 |

| Indiana | $49 | $143 |

| Iowa | $26 | $104 |

| Kansas | $43 | $135 |

| Kentucky | $64 | $176 |

| Louisiana | $54 | $201 |

| Maine | $51 | $115 |

| Maryland | $126 | $237 |

| Massachusetts | $56 | $144 |

| Michigan | $163 | $339 |

| Minnesota | $90 | $220 |

| Mississippi | $53 | $142 |

| Missouri | $55 | $156 |

| Montana | $42 | $153 |

| Nebraska | $39 | $148 |

| Nevada | $61 | $144 |

| New Hampshire | $50 | $122 |

| New Jersey | $126 | $197 |

| New Mexico | $56 | $142 |

| New York | $90 | $174 |

| North Carolina | $55 | $131 |

| North Dakota | $49 | $177 |

| Ohio | $44 | $114 |

| Oklahoma | $52 | $160 |

| Oregon | $75 | $147 |

| Pennsylvania | $60 | $179 |

| Rhode Island | $61 | $143 |

| South Carolina | $79 | $191 |

| South Dakota | $20 | $127 |

| Tennessee | $37 | $130 |

| Texas | $77 | $207 |

| Utah | $66 | $147 |

| Vermont | $43 | $133 |

| Virginia | $56 | $132 |

| Washington | $45 | $104 |

| Washington D.C. | $81 | $192 |

| West Virginia | $52 | $141 |

| Wisconsin | $47 | $133 |

| Wyoming | $24 | $105 |

Though not the cheapest, Farmers balances cost and coverage effectively. Knowing where to compare auto insurance rates and comparing rates across providers and states can help you find the right insurance plan that offers the protection you need at a reasonable price.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Auto Insurance Rate Insights

The Farmers car insurance company provides a wide range of coverage options and robust financial stability, though it contends with higher-than-average rates and mixed customer feedback. Enriched with Farmers car insurance reviews, it highlights this insurance provider’s strengths and weaknesses.

Weighing its coverage and costs, Farmers auto insurance could be a fit if you’re looking for reliability despite higher premiums. It’s also important to know how to check if an auto insurance company is legitimate before making a decision. Obtaining a farmers auto insurance quote online is crucial for comparing multiple quotes to secure the best deal.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Unpacking the Worth of Farmers Auto Insurance

Farmers auto insurance offers strong financial stability and a range of coverage options, appealing to those seeking reliability. Despite higher rates, discounts and the Signal program can help reduce costs, supported by high ratings from the Better Business Bureau and A.M. Best.

Farmers’ premiums are often higher, particularly for younger drivers or those with a history of traffic violations. It’s important to understand how to compare auto insurance quotes from different providers to see if Farmers’ coverage suits your needs and budget.

Frequently Asked Questions

Where does Farmers offer car insurance?

Farmers sells car insurance in most states except Alaska, Hawaii, Delaware, New Hampshire, Maine, Rhode Island, West Virginia, Vermont, and Washington D.C.

Does Farmers offer gap insurance coverage?

If you total a car you have a loan on, you might owe more than the vehicle is worth. gap coverage pays the difference between what you owe and your vehicle’s worth.

Unfortunately, Farmers doesn’t offer gap insurance coverage.

How do you get a car insurance quote from Farmers?

Getting a Farmers car insurance quote is simple. You can get a quote online or by speaking with a representative. You’ll need some personal information, but the process is generally quick.

For additional details, explore our comprehensive resource titled “How to Evaluate Auto Insurance Quotes,” which offers essential guidance in one concise sentence.

Can I manage my Farmers Auto Insurance policy online?

Yes, Farmers Insurance provides an online platform where policyholders can manage their auto insurance policies. Through their website or mobile app, you can view policy details, make payments, update personal information, request policy changes, and access important documents.

How do you cancel Farmers car insurance?

Unfortunately, you can’t cancel your Farmers insurance online. Instead, you’ll need to speak to a local representative or call the Farmers insurance customer service phone number.

How do you file a claim with Farmers?

You have three options for reporting a car insurance claim with Farmers. The easiest option is online, but you can also call the Farmers claims phone number or use the app. To make things quicker, make sure you have your policy number and the date of the incident ready.

To learn more, explore our comprehensive resource on insurance titled “How to File an Auto Insurance Claim,” providing quick, essential insights.

What should I do if I need roadside assistance?

Farmers offers optional roadside assistance coverage that can provide help if you experience a breakdown, flat tire, need a jump-start, or run out of fuel. If you have this coverage, you can call the dedicated roadside assistance number provided on your policy documents for immediate assistance.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Does Farmers cover rental cars?

Farmers auto insurance covers rental cars through its loss of use add-on if you need a temporary car while your vehicle is in the mechanic’s shop. While Farmers doesn’t cover rentals for other reasons, your personal policy will cover a rental car if you’re in the U.S., Canada, or Puerto Rico.

To delve deeper, refer to our in-depth report titled “Does my auto insurance cover rental cars?” for concise, detailed information.

What discounts does Farmers offer for auto insurance?

Farmers offers various discounts to help policyholders save on their auto insurance premiums. Some common discounts include safe driver discounts, good student discounts, multi-policy discounts, anti-theft device discounts, and discounts for completing driver training courses.

Is Farmers insurance good?

Farmers Insurance, like any other insurance provider, has its strengths and weaknesses. The quality of an insurance company can depend on various factors, including individual needs, preferences, and the region in which you live.

Ultimately, whether Farmers is a good fit for you depends on your specific needs and priorities. I recommend getting personalized quotes from Farmers and comparing them with quotes from other reputable insurance providers. Consider factors such as coverage options, customer service, and overall satisfaction when making your decision.

Does Farmers offer SR-22 insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.