Driving Without Auto Insurance in 2026 (Risks & Consequences)

Driving without auto insurance can lead to fines ranging from $100 to $1,500 for a first-time offense. You may also get points on your license, face suspension, and encounter other penalties. Liability insurance coverage protects other drivers and ensures you meet legal driving requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated November 2025

Driving without auto insurance is illegal in most states and may result in fines, license suspension, or other serious penalties. Even an insured driver driving an uninsured car can get into trouble.

If you don’t have insurance, you could have to pay a lot of money if there’s an accident. Also, you can go to jail for not having auto insurance in some places, so it’s really important to follow the rules.

- Driving without auto insurance can lead to fines, license loss, or jail

- No insurance can make it difficult to get future coverage

- Always keep an active policy to stay legal and avoid big financial risks

This guide will help you understand the laws, the dangers of being uninsured, and how to stay safe and legal when you drive. Find the cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Penalties for Driving Without Insurance by State

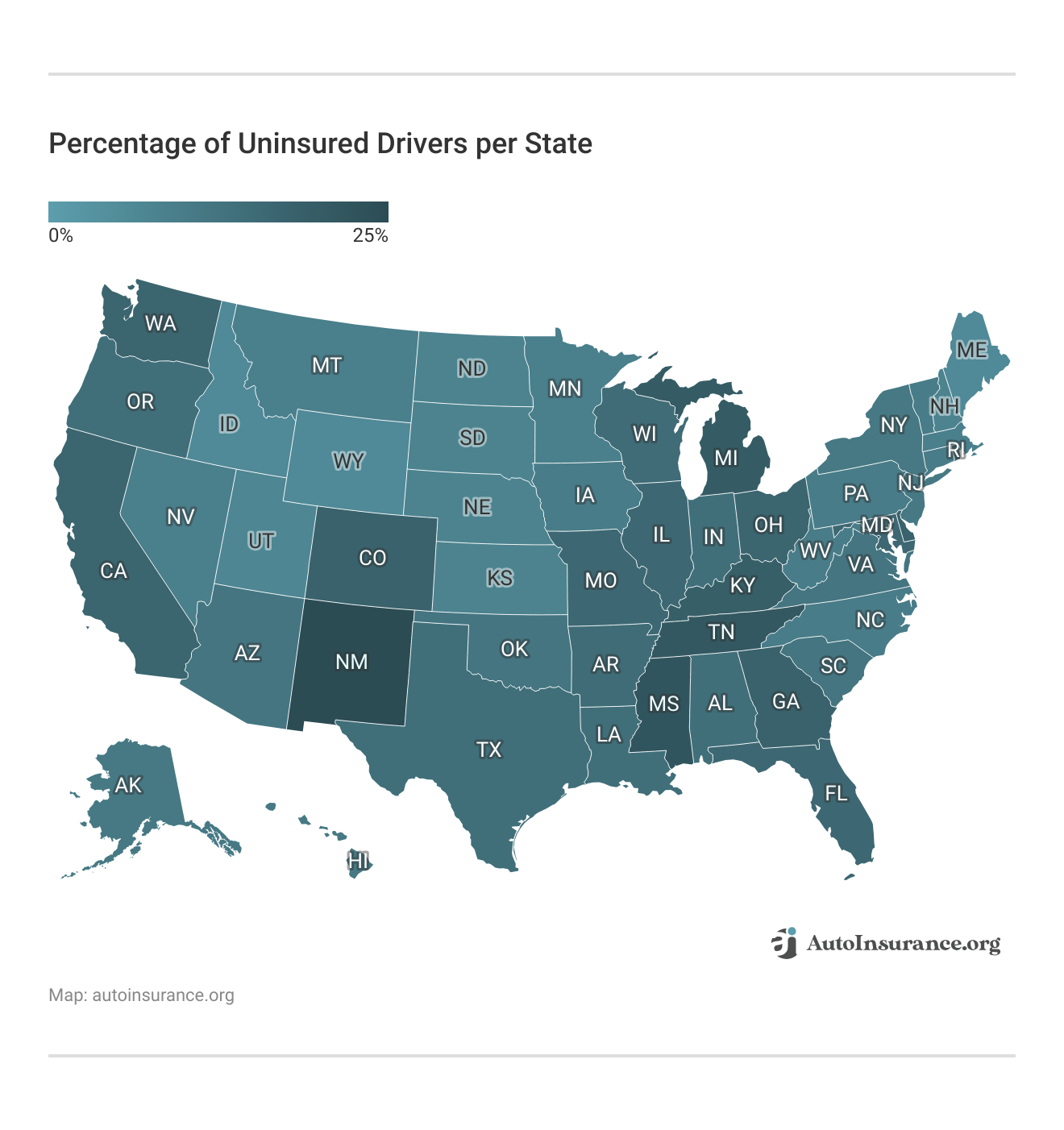

Driving without car insurance may not seem like a big issue, but it can result in severe consequences. The penalties for driving without insurance vary by state.

Driving without insurance risks hefty fines, license suspension, and even jail time. Always stay covered to protect yourself and those around you.Jeffrey Johnson Insurance Lawyer

You may face a substantial fine for driving without insurance, have your license revoked, be required to perform community service, or even face jail time. In some places, the maximum fine for driving without insurance can be very high. It’s also more expensive and harder to get auto insurance with a suspended license.

The penalty for driving without car insurance in Ohio includes a license suspension and a $100 reinstatement fee for first-time offenders. Repeat offenses can result in longer suspensions and fines of up to $600.

Penalties for Driving Without Insurance by State

| State | Penalty |

|---|---|

| Alabama | Fine $100–$1,000; suspension; SR‑22 |

| Alaska | Fine $100–$500; suspension; impoundment |

| Arizona | Fine $500+; suspension; SR‑22 |

| Arkansas | Fine $100–$250; suspension; possible jail |

| California | Fine $100–$500; suspension; SR‑22 |

| Colorado | Fine $500; suspension; possible jail |

| Connecticut | Fine $200; suspension; possible jail |

| Delaware | Fine $500–$1,500; suspension |

| DC | Fine $100–$500; suspension |

| Florida | Fine $150–$500; suspension; SR‑22 |

| Georgia | Fine $200–$1,000; suspension; SR‑22 |

| Hawaii | Fine $500; suspension; possible jail |

| Idaho | Fine $75–$300; suspension; possible impoundment |

| Illinois | Fine $500; suspension; SR‑22 |

| Indiana | Fine $250; suspension; SR‑22 |

| Iowa | Fine $250; suspension; impoundment |

| Kansas | Fine $300; suspension; possible impoundment |

| Kentucky | Fine $500; suspension; impoundment |

| Louisiana | Fine $500; suspension |

| Maine | Fine $100; suspension; impoundment |

| Maryland | Fine $1,000; suspension; possible impoundment |

| Massachusetts | Fine $500; suspension; possible jail |

| Michigan | Fine $200; suspension; jail |

| Minnesota | Fine $200–$400; suspension; impoundment |

| Mississippi | Fine $500; suspension |

| Missouri | Fine $500; suspension; impoundment |

| Montana | Fine $250; suspension; possible jail |

| Nebraska | Fine $500; suspension; impoundment |

| Nevada | Fine $250; suspension; possible jail |

| New Hampshire | Fine $500–$1,500; suspension |

| New Jersey | Fine $300; suspension; impoundment |

| New Mexico | Fine $300; suspension; possible jail |

| New York | Fine $150; suspension; revocation |

| North Carolina | Fine $50; suspension |

| North Dakota | Fine $100; suspension; possible jail |

| Ohio | Fine $300; suspension; impoundment |

| Oklahoma | Fine $250; suspension; possible jail |

| Oregon | Fine $130; suspension; SR‑22 |

| Pennsylvania | Fine $300; suspension; impoundment |

| Rhode Island | Fine $100; suspension |

| South Carolina | Fine $200; suspension; possible jail |

| South Dakota | Fine $100; suspension; possible impoundment |

| Tennessee | Fine $300; suspension |

| Texas | Fine $175–$1,000; suspension; SR‑22 |

| Utah | Fine $400; suspension; SR‑22 |

| Vermont | Fine $250; suspension |

| Virginia | Fine $500; suspension; SR‑22 |

| Washington | Fine $550; suspension; possible jail |

| West Virginia | Fine $200; suspension; possible jail |

| Wisconsin | Fine $200; suspension |

| Wyoming | Fine $250; suspension; possible jail |

The maximum fine for driving without insurance in California ranges from $100 to $200, but added penalty costs can push the total over $400. Repeat offenders may face fines of up to $500, with total costs exceeding $1,800.

The penalties for driving without insurance in Florida are some of the toughest. If you cause an accident and don’t have insurance, especially if someone gets hurt, the punishment can be much worse.

Again, it depends on your state. Most states charge anywhere from $100 to $1,500 for the first offense. The fine usually increases if you get caught again within three to five years.

Every state has different rules, but here’s a list of other common penalties:

- Driver’s license suspension

- Registration suspension/revocation

- Points on your license

- Reinstatement fees

- Increased insurance premiums

- Towing and storage fees

In most U.S. states, fines for driving without auto insurance also include additional expenses, such as SR-22 auto insurance, which is costly and required for several years. If you’re in an accident without insurance, you may be fully liable for all damages.

The fine is just the beginning; future costs can be significantly higher.

Jail Time for Driving Without Auto Insurance Coverage

Most of the time, jail only happens in serious cases. In most states, you won’t go to jail for a first offense. Typically, you’ll receive a fine or warning, but in some states, you may face jail time for driving without insurance.

Some states allow judges to impose jail time, even for a first offense. In those places, going to jail for driving without insurance could mean spending 15 days to one year behind bars, especially if you hurt someone in an accident.

In other states, you won’t face jail for a first ticket, but you could still risk getting arrested for driving without insurance if you have other charges or repeat violations.

Many judges offer community service as an alternative to incarceration for first-time offenders, especially if no accident occurred. Still, sentencing guidelines for driving without insurance can change depending on where you live and what happened.

If you keep driving without insurance and registration, jail time could be possible. The penalties are serious, but you can avoid them by staying insured.

Read More: Types of Auto Insurance

License or Registration Suspension for Driving Without Auto Insurance

Losing your license or registration for driving without auto insurance depends on your state. For example, the penalty for driving without insurance in Indiana includes a 90-day license suspension for a first offense. Similarly, the first offense for driving without insurance in West Virginia can result in a 30-day suspension, a fine, and a requirement to file an SR-22 form.

A first-time offense for driving without insurance usually results in a suspension lasting from 30 days up to one year. Many states require proof of insurance, often with an SR-22, before they will reinstate your license or registration.

Each repeat violation increases the punishment for uninsured drivers, resulting in longer suspensions and higher fines. For example, the penalty for driving without insurance in California includes suspension of your license and costly reinstatement fees.

To get your license or registration back, you’ll likely have to pay a reinstatement fee and maintain SR-22 insurance for several years. Getting insurance while your license is suspended can be challenging, making the whole process harder.

Read more: Can I get my car out of impound without insurance?

Vehicle Impounded for Driving Without Auto Insurance

The trouble with driving a car with no insurance goes beyond just fines. If you get pulled over without insurance, you’ll usually have to pay an uninsured vehicle fine that can be hundreds of dollars. If you continue to get caught driving without insurance, the penalties can become more severe, such as having your car impounded.

While your vehicle can be impounded or your license plates taken for driving without insurance, this usually doesn’t happen the first time. Most of the time, cars get impounded for driving with a suspended registration.

If your vehicle is impounded because you were driving without insurance, most states will require you to prove you have insurance before you can get your car back. You’ll also have to pay a fee to release your car. The cost of tickets for driving without auto insurance can add up quickly with these extra fees, making the whole situation much more expensive.

Driving without auto insurance can result in fines, license suspension, or even jail time, depending on your state’s laws. Penalties include fees, car impoundment, and higher future insurance costs. Having insurance helps you avoid these problems and protects you from costly accident expenses.

Read more: How to Report a Driver Without Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance Coverage Required by State

All states except Virginia and New Hampshire require drivers to have at least the minimum auto insurance. Most states require liability auto insurance, which pays for damages and injuries you cause to others in an accident. This coverage doesn’t pay for your own repairs or medical bills, but protects you from being sued.

Some states also require additional coverage, such as uninsured motorist coverage (UIM) and personal injury protection (PIP). Even if not required, these offer extra protection if you’re injured or hit by an uninsured driver.

Minimum Car Insurance Requirements by State

| State | Liability | UM/UIM | PIP/MedPay | Fault System |

|---|---|---|---|---|

| Alabama | 25/50/25 | Not required | Not required | At-Fault |

| Alaska | 50/100/25 | Not required | Not required | At-Fault |

| Arizona | 25/50/15 | Not required | Not required | At-Fault |

| Arkansas | 25/50/25 | Not required | PIP: $5,000 | At-Fault |

| California | 30/60/15 | Not required | Not required | At-Fault |

| Colorado | 25/50/15 | Not required | Not required | At-Fault |

| Connecticut | 25/50/25 | 25/50 | Not required | At-Fault |

| Delaware | 25/50/10 | Not required | PIP: $15,000/$30,000 | At-Fault |

| Florida | 10/20/10 | Not required | PIP: $10,000 | No-Fault |

| Georgia | 25/50/25 | Not required | Not required | At-Fault |

| Hawaii | 20/40/10 | Not required | PIP: $10,000 | No-Fault |

| Idaho | 25/50/15 | Not required | Not required | At-Fault |

| Illinois | 25/50/20 | 25/50 | Not required | At-Fault |

| Indiana | 25/50/25 | Not required | Not required | At-Fault |

| Iowa | 20/40/15 | Not required | Not required | At-Fault |

| Kansas | 25/50/25 | 25/50 | PIP: $4,500 | No-Fault |

| Kentucky | 25/50/25 | 25/50 | PIP: $10,000 | No-Fault |

| Louisiana | 15/30/25 | Not required | Not required | At-Fault |

| Maine | 50/100/25 | 50/100 | MedPay: $2,000 | At-Fault |

| Maryland | 30/60/15 | 30/60/15 | PIP: $2,500 | At-Fault |

| Massachusetts | 20/40/5 | 20/40 | PIP: $8,000 | No-Fault |

| Michigan | 50/100/10 | Not required | PIP: Tiered options | No-Fault |

| Minnesota | 30/60/10 | 25/50 | PIP: $40,000 | No-Fault |

| Mississippi | 25/50/25 | Not required | Not required | At-Fault |

| Missouri | 25/50/25 | 25/50 | Not required | At-Fault |

| Montana | 25/50/20 | Not required | Not required | At-Fault |

| Nebraska | 25/50/25 | 25/50 | Not required | At-Fault |

| Nevada | 25/50/20 | Not required | Not required | At-Fault |

| New Hampshire | 25/50/25 | 25/50 | Not required | At-Fault |

| New Jersey | 25/50/25 | 25/50 | PIP: $15,000 | No-Fault |

| New Mexico | 25/50/10 | Not required | Not required | At-Fault |

| New York | 25/50/10 | 25/50 | PIP: $50,000 | No-Fault |

| North Carolina | 30/60/25 | 30/60 | Not required | At-Fault |

| North Dakota | 25/50/25 | 25/50 | PIP: $30,000 | No-Fault |

| Ohio | 25/50/25 | Not required | Not required | At-Fault |

| Oklahoma | 25/50/25 | Not required | Not required | At-Fault |

| Oregon | 25/50/20 | 25/50 | PIP: $15,000 | At-Fault |

| Pennsylvania | 15/30/5 | Not required | PIP: $5,000 | No-Fault |

| Rhode Island | 25/50/25 | Not required | Not required | At-Fault |

| South Carolina | 25/50/25 | 25/50 | Not required | At-Fault |

| South Dakota | 25/50/25 | 25/50 | Not required | At-Fault |

| Tennessee | 25/50/15 | Not required | Not required | At-Fault |

| Texas | 30/60/25 | Not required | PIP: $2,500 (unless waived) | At-Fault |

| Utah | 25/65/15 | Not required | PIP: $3,000 | No-Fault |

| Vermont | 25/50/10 | 25/50 | Not required | At-Fault |

| Virginia | 25/50/20 | 25/50/20 | Not required | At-Fault |

| Washington | 25/50/10 | Not required | Not required | At-Fault |

| West Virginia | 25/50/25 | 25/50 | Not required | At-Fault |

| Wisconsin | 25/50/10 | 25/50 | Not required | At-Fault |

| Wyoming | 25/50/20 | Not required | Not required | At-Fault |

Driving without auto insurance is risky and illegal in most states. If caught, you could face steep fines, lose your license, or even go to jail for not having auto insurance. The fine for not having car insurance can be costly, and penalties worsen if you cause an accident or continue driving without coverage.

Following your state’s insurance rules helps you avoid financial trouble and legal problems. It’s better to have proper coverage than face the serious consequences of driving without auto insurance.

What Happens if You Cause an Accident Without Insurance

While it’s always a bad idea, you should know what happens after an accident without auto insurance. The circumstances of the incident play a significant role. As mentioned above, the punishment for driving without insurance is usually more severe when an accident is involved.

You can find yourself in three types of accidents when driving an uninsured car: an at-fault accident, another driver is at fault, or you live in a no-fault state. Learn more about each below.

Getting in an At-Fault Accident Without Auto Insurance

Getting into an at-fault accident without auto insurance is a serious problem. It is illegal to drive without auto insurance, and if you cause a crash, you’ll be stuck paying for everything—repairs, medical bills, and other damages—out of pocket.

In some states, like Maine, driving without insurance is taken very seriously. Even if it’s your first offense, insurance companies may consider you a high-risk driver. This often leads to higher premiums and fewer coverage options in the future.

If you injure someone or damage their property, you could be sued, and without insurance, there’s nothing to protect you. The costs can quickly reach thousands of dollars, and the accident will stay on your record for years.

People often ask how long you can go without car insurance before being penalized. The answer is—usually not long. Many states act fast when coverage lapses. That’s why it’s important to always stay insured. Causing an accident without coverage can leave you in deep financial and legal trouble.

Someone Else Hits You and You Don’t Have Auto Insurance

According to auto insurance laws, if someone else crashes into you and you don’t have insurance, things can still go badly for you. Even though the accident wasn’t your fault, the risks of driving without insurance are still serious.

You might face license suspension, fines, or other legal trouble. In some states, like Louisiana, you may not be allowed to collect any money for injuries or damage if you’re uninsured. Many states also limit how much you can claim if you don’t have coverage.

Even a first-time offense for driving uninsured can lead to expensive penalties and make it harder to get affordable coverage in the future.Schimri Yoyo Licensed Agent & Financial Advisor

For example, driving without minimum insurance in California puts you at risk of losing your license and paying high costs, even if another driver caused the crash. Normally, your insurance company helps prove you weren’t at fault. But without insurance, you’ll need to gather your own evidence and might have to pay legal costs yourself.

People often ask how long you can drive without insurance before facing trouble. The truth is, it is not long—most states penalize you quickly if your coverage lapses.

Getting in an Accident in a No-Fault State Without Auto Insurance

No-fault states limit how much you can sue another driver for and require you to make claims with your insurance. While this system has advantages and disadvantages, it’s not a good situation to be in if you don’t have insurance.

In a no-fault state, you’ll be on your own to pay for car repairs, medical bills, and other expenses. Even if the other driver is responsible, you can’t file a claim against them.

The consequences of driving without auto insurance can be very serious, especially if you get into an accident. You may have to pay a substantial fine for not having car insurance and could also face license suspension. In some situations, you can go to jail for not having auto insurance, especially if someone is hurt. The best way to avoid these problems is to always keep your car insured.

Read more: Full Coverage Auto Insurance

6 Case Studies: Consequences of Driving Uninsured

As we’ve already discussed, driving without insurance can lead to severe financial, legal, and personal consequences. Here are some common scenarios demonstrating how driving uninsured can affect both the driver and others involved in an accident:

- Case Study #1 — Parking Lot Fender Bender: An uninsured driver backs into a car. They must pay out of pocket and may face fines, suspension, or impoundment.

- Case Study #2 — Rear-End Collision: An uninsured driver rear-ends another vehicle and must cover damages, facing citations, lawsuits, or court orders.

- Case Study #3 — T-Bone Crash: An uninsured driver causes a severe T-bone crash and may face lawsuits, wage garnishment, and asset seizure.

- Case Study #4 — Pedestrian Hit While Jaywalking: Even if the jaywalker is partly at fault, the uninsured driver still faces fines and legal penalties.

- Case Study #5 — Lane Change Sideswipe: In disputed sideswipe cases, the uninsured driver risks license suspension and impoundment.

- Case Study #6 — Hit-and-Run Incident: A hit-and-run by an uninsured driver can lead to jail time and harsh criminal charges.

Having proper coverage not only protects you but also ensures that everyone involved in an accident gets fair compensation.

Learn more: How many drivers don’t have auto insurance?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Auto Insurance Now to Avoid a Coverage Lapse

Even if you think you won’t get caught, driving without auto insurance is risky and can cause big problems. If you get pulled over without auto insurance, you could have to pay the maximum fine for driving without auto insurance.

Having the right coverage before you drive helps you avoid penalties for not having car insurance, such as higher rates, fines, losing your license, or even going to jail (Learn more: Minimum Auto Insurance Requirements by State).

Car insurance might seem expensive, but finding affordable coverage doesn’t have to be hard, especially if you’ve never been caught driving without auto insurance.

A good way to find a competitive rate is to obtain quotes from multiple insurance companies. This way, you can compare prices and pick the best deal to stay protected and avoid the trouble that comes with driving without auto insurance.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code.

Frequently Asked Questions

Can you drive a car without insurance?

Most states require a minimum amount of insurance before you can drive on public roads, even during an emergency. In most cases, driving without insurance is a crime that comes with serious consequences. The most common being a penalty for not having car insurance.

What happens if you don’t have insurance on your car and cause an accident?

If you cause an accident without having liability insurance, you’ll face harsher punishments, including a possible jail sentence. At-fault accidents usually incur the maximum fine for driving without insurance. You’ll also be financially responsible for any damage or injuries you cause.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Can I have a car without insurance and not drive it?

You could pause your auto insurance policy if you don’t plan to drive your vehicle, and your state and insurance company allow it. As long as you are not driving, you shouldn’t receive a fine for not having car insurance.

However, it’s generally best to avoid car insurance coverage lapses because it could affect your rates when you reapply.

Read more: How long does an accident affect your auto insurance rate?

How long can you go without car insurance before being penalized?

To avoid a penalty for driving without insurance and registration, you should always have insurance. Receiving a penalty can occur if you are pulled over without insurance, and that is something that can not be predicted. It’s best to avoid the possibility of getting a fine for not having insurance by purchasing a policy.

What happens if you let your car insurance coverage lapse?

Letting your car insurance coverage lapse is never a good idea for a few reasons. First, you’ll face serious consequences for driving without insurance. There is also a future car insurance penalty of higher rates, since insurance rates since companies look at your insurance history.

What happens if you get pulled over without car insurance?

You might think you can drive under the radar and not get caught, but there are a few ways police can tell that you don’t have insurance. Some officers can access DMV records from their car, which will tell them you’re uninsured before they even pull you over.

Some states allow automated license plate readers to scan your vehicle for insurance information. States are increasingly adopting this method to reduce the number of uninsured motorists on the streets.

There’s also the traditional method. You’ll be asked to show proof of insurance when you are pulled over. Today, most states accept either physical or digital copies of your proof of insurance.

Read more: How to Settle a Car Accident Without Auto Insurance

Can I go to jail for driving without insurance?

Jail time is a potential consequence of driving without insurance if your state classifies it as a misdemeanor offense.

Can an uninsured driver drive my insured car?

Yes, an uninsured driver can drive your insured car if your car’s insurance policy allows it.

Can you get car insurance without a license?

Most national insurers require a driver’s license to get coverage. However, Geico auto insurance and The Hartford offer the best insurance for unlicensed drivers.

Can I drive an uninsured car?

This can be permissible under certain conditions, but it comes with potential risks and limitations, including receiving a penalty for not having insurance if you are pulled over.

Can you get in trouble for driving without insurance?

Can I drive a car without insurance on my insurance?

What happens if you get pulled over without auto insurance?

Can I go to jail for driving without insurance?

How much is the fine for driving without insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.