Best Maryland Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Geico offer the best Maryland auto insurance, starting at $57/month for minimum coverage. These companies are top-rated due to their competitive rates, comprehensive coverage, and excellent customer service, ensuring reliable and affordable insurance for Maryland drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated February 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Maryland

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Maryland

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Maryland

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top pick overall for the best Maryland auto insurance is State Farm, with USAA and Erie as close contenders for their exceptional full coverage auto insurance and customer satisfaction.

This information explores the best providers in Maryland, focusing on key factors like affordability, coverage options, and customer reviews.

Our Top 10 Company Picks: Best Maryland Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agents | State Farm | |

| #2 | 14% | A+ | Affordable Rates | Progressive | |

| #3 | 15% | A++ | Many Discounts | Geico | |

| #4 | 13% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 12% | A | Customizable Policies | Liberty Mutual |

| #6 | 11% | A+ | Extensive Coverage | Nationwide |

| #7 | 9% | A++ | Competitive Rates | Travelers | |

| #8 | 10% | A+ | Customer Service | Erie |

| #9 | 8% | A+ | Comprehensive Coverage | Farmers | |

| #10 | 16% | A++ | Military Benefits | USAA |

We highlight how these company leads the pack with a balanced mix of competitive rates and reliable service. Discover why these companies are the top choices for your MD auto insurance.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Best Maryland auto insurance with customized plans for various needs

- State Farm offers top coverage starting at $50/month

- Affordable Maryland auto insurance prioritizing local requirements

- Maryland Auto Insurance

- Cheapest SR-22 Insurance in Maryland for 2026 (Save With These 10 Providers)

- Cheap Gap Insurance in Maryland (Save Money With These 9 Companies for 2026)

- Best Auto Insurance After a DUI in Maryland (Top 10 Companies for 2026)

- Best Auto Insurance for Seniors in Maryland (Top 9 Companies Ranked for 2026)

- Cheap Auto Insurance for High-Risk Drivers in Maryland (10 Most Affordable Companies for 2026)

- Best Severna Park, Maryland Auto Insurance in 2026

- Best Salisbury, Maryland Auto Insurance in 2026

- Best Rockville, Maryland Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Hyattsville, Maryland Auto Insurance in 2026 (Compare the Top 10 Companies)

- Best Glen Burnie, Maryland Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Elkridge, Maryland Auto Insurance in 2026

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates for High-Risk Drivers: State Farm offers competitive rates for high-risk drivers in Maryland, making it a cost-effective option for those with accidents or traffic violations. For those looking for cheap auto insurance in Maryland, State Farm provides reliable coverage at affordable prices.

- Wide Network of Agents: According to our State Farm auto insurance review, the company’s extensive network of local agents provides personalized service and support.

- Comprehensive Coverage Options: State Farm provides a wide range of Maryland auto insurance coverage options, including full coverage and optional add-ons like roadside assistance.

Cons

- Limited Availability of Discounts: State Farm offers fewer discounts compared to some competitors, which can limit savings opportunities for Maryland auto insurance customers.

- Average Customer Satisfaction: Customer satisfaction ratings are average, with some Maryland auto insurance customers reporting delays in claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customizable Coverage

Pros

- Snapshot Program for Discounts: Progressive’s Snapshot program offers potential discounts for safe driving behaviors, helping Maryland drivers save on their auto insurance.

- Extensive Online Tools: Robust online tools, including a “name your price” tool, help Maryland auto insurance customers manage policies and match coverage to their budget.

- Broad Range of Coverages: Based on our Progressive auto insurance review, the company provides diverse coverage options including gap insurance and rideshare coverage.

Cons

- Higher Rates for High-Risk Drivers: Progressive often charges higher premiums for Maryland drivers with poor records or accidents.

- Mixed Customer Service Reviews: Customer service experiences are varied, with some Maryland auto insurance customers reporting slow claims processing.

#3 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico is known for offering some of the lowest rates in the Maryland auto insurance market, making it affordable for many drivers.

- User-Friendly App: The highly-rated mobile app allows Maryland auto insurance customers to file claims, access ID cards, and manage policies easily.

- Wide Availability: As per our Geico auto insurance review, the insurer is available in all 50 states, providing coverage to a broad range of drivers.

Cons

- Limited Coverage Options: Geico offers fewer specialized coverage options compared to competitors, potentially limiting customization for Maryland auto insurance customers.

- Customer Service Variability: Mixed reviews regarding customer service, with some Maryland auto insurance customers experiencing issues with claims resolution.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate offers a wide variety of Maryland auto insurance coverage options, including optional add-ons like new car replacement and accident forgiveness.

- Strong Financial Stability: Allstate’s high financial strength ratings ensure reliable claims payouts for Maryland auto insurance customers.

- Local Agents: In line with our Allstate auto insurance review, the company has a wide network of local agents available for personalized service and support.

Cons

- Higher Premiums: Generally, Allstate premiums are higher compared to other Maryland auto insurance providers.

- Average Digital Experience: The online and mobile experience is rated as average, lacking some advanced features found in competitor apps.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Policy Customization

Pros

- Customizable Policies: Liberty Mutual allows for extensive customization of Maryland auto insurance policies to meet individual needs, including options like better car replacement.

- Comprehensive Discounts: Offers a wide range of discounts for Maryland auto insurance customers, including for safe driving and bundling multiple policies.

- Strong Financial Ratings: Within our Liberty Mutual auto insurance review, we note the company’s high financial ratings, ensuring reliability in paying out claims.

Cons

- Higher Rates for Certain Drivers: Liberty Mutual tends to have higher rates for Maryland auto insurance customers with poor credit or driving records.

- Mixed Customer Reviews: Some Maryland auto insurance customers report dissatisfaction with claims handling and customer service responsiveness.

#6 – Nationwide: Best for Discount Programs

Pros

- Vanishing Deductible: In our Nationwide auto insurance review, the company rewards safe driving by reducing the deductible over time.

- On Your Side Review: Nationwide offers a free annual review to ensure Maryland auto insurance policyholders get the best coverage and discounts.

- Extensive Coverage Options: Provides a variety of Maryland auto insurance coverages, including accident forgiveness and total loss deductible waivers.

Cons

- Limited Availability of Local Agents: Fewer local agents in Maryland compared to some competitors, which can affect personalized service.

- Higher Premiums for Young Drivers: Nationwide often has higher premiums for younger, less experienced Maryland auto insurance customers.

#7 – Travelers: Best for Affordable Full Coverage

Pros

- Affordable Full Coverage: With our Travelers auto insurance review, we find that the company is known for offering some of the most affordable full coverage rates in Maryland.

- Comprehensive Policy Management: Provides robust online tools and a mobile app for managing Maryland auto insurance policies and filing claims.

- Diverse Coverage Options: Offers a wide range of Maryland auto insurance coverage options, including gap insurance and rental coverage.

Cons

- Higher Rates for High-Risk Drivers: Rates can be significantly higher for Maryland auto insurance customers with poor records.

- Average Customer Service: Customer service reviews are mixed, with some Maryland auto insurance customers reporting delays in claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Customer Satisfaction

Pros

- Excellent Customer Satisfaction: Along with our Erie auto insurance review, it’s highlighted that the company has high customer satisfaction ratings, particularly for claims handling and service.

- Low Rates for Young Drivers: Erie car insurance in Maryland offers some of the lowest rates for young and new drivers, making it a cost-effective choice.

- Comprehensive Coverage Options: Provides a variety of Maryland auto insurance coverage options, including new car replacement and personal injury protection.

Cons

- Limited Availability: Erie is only available in a few states, which limits access for some potential Maryland auto insurance customers.

- No Online Quotes: Requires contacting an agent for a quote, which can be less convenient for Maryland auto insurance customers who prefer online options.

#9 – Farmers: Best for Coverage Variety

Pros

- Strong Financial Stability: Following our Farmers auto insurance review, it is clear that the company has high financial strength ratings, indicating a robust ability to handle claims.

- Extensive Coverage Options: Farmers offers a wide range of optional coverages for Maryland auto insurance, including rideshare coverage and custom parts and equipment coverage.

- Bundling Discounts: Provides significant discounts for bundling multiple policies, such as home and Maryland auto insurance.

Cons

- Higher Rates for Some Drivers: Rates can be higher than average for Maryland auto insurance customers with poor credit or accident histories.

- Average Digital Experience: The digital and mobile experiences are rated as average, lacking advanced features.

#10 – USAA: Best for Military Members

Pros

- High Customer Satisfaction: For our USAA auto insurance review, we emphasize the company’s consistently high ratings for customer satisfaction and claims handling.

- Exclusive Low Rates for Military: USAA offers some of the lowest rates for military members and their families in Maryland.

- Comprehensive Coverage Options: USAA provides a range of Maryland auto insurance coverage options, including specific benefits for military personnel.

Cons

- Limited Eligibility: USAA is only available to military members, veterans, and their families, excluding the general public from Maryland auto insurance.

- Average Discount Variety: USAA offers fewer discounts compared to other Maryland auto insurance providers, which may limit savings opportunities.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maryland Auto Insurance Insights

When exploring auto insurance options in Maryland, it is crucial to understand the coverage requirements and factors that influence rates. To secure the best coverage, drivers should consider various policy options, evaluate their specific needs, and compare auto insurance quotes from different providers.

Factors such as driving history, vehicle type, and personal demographics play a significant role in determining insurance premiums. By carefully assessing these aspects and shopping around, you can find an insurance policy that offers the right balance of coverage and cost. For more tips on finding the best auto insurance, consider reviewing different policy features and discounts available.

Maryland Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $107 $201

Erie $22 $58

Farmers $74 $140

Geico $72 $135

Liberty Mutual $96 $181

Nationwide $56 $106

Progressive $64 $121

State Farm $57 $107

Travelers $55 $103

USAA $43 $80

This table provides an overview of the monthly rates for minimum and full coverage auto insurance offered by various companies in Maryland. For minimum coverage, Erie offers the most affordable rate at $22 per month, while Allstate has the highest rate at $107. For full coverage, Erie again offers the lowest rate at $58 per month, and Allstate charges the highest rate at $201.

The table includes rates from Allstate, Erie, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA, offering a comprehensive view of the cost differences among major providers for both coverage levels.

Navigating Maryland’s Car Insurance Landscape

In Maryland, all drivers must have at least the minimum required car insurance coverage, and failure to maintain proper insurance can result in significant fines and vehicle impoundment. Proof of insurance, which can be shown electronically, is mandatory. Car insurance rates are influenced by your driving record, with accidents, tickets, and DUIs leading to higher premiums.

State Farm provides the most reliable and affordable auto insurance in Maryland, making it the top choice for drivers seeking comprehensive coverage and excellent customer service.Laura Berry Former Licensed Insurance Producer

Post-accident, the cheapest rates vary, and while some companies may offer accident forgiveness for a first incident, repeated offenses usually result in increased costs. Speeding tickets also lead to higher rates, affecting premiums for up to three years. DUIs cause the most significant rate hikes and may result in denial of coverage for repeat offenses.

Age and credit score are crucial factors as well; younger drivers and those with lower credit scores typically face higher premiums. However, Maryland laws prevent insurers from denying coverage based solely on credit scores. Understanding these factors and comparing different options can help you secure the best rates.

Maryland DUI Insurance Laws

A DUI in Maryland significantly increases your car insurance rates and results in fines, license suspension, and possible jail time. Maryland law defines a DUI as having a BAC of 0.08% or higher for drivers 21 and over, under 0.02% for drivers under 21, and 0.04% or higher for commercial drivers.

A first DUI offense can lead to fines up to $1,000, a 45-day license suspension, and up to a year in jail, with subsequent offenses resulting in steeper penalties. Because DUIs indicate risky driving behavior, expect higher insurance rates and potential difficulty in obtaining coverage from some insurers if you have multiple DUIs.

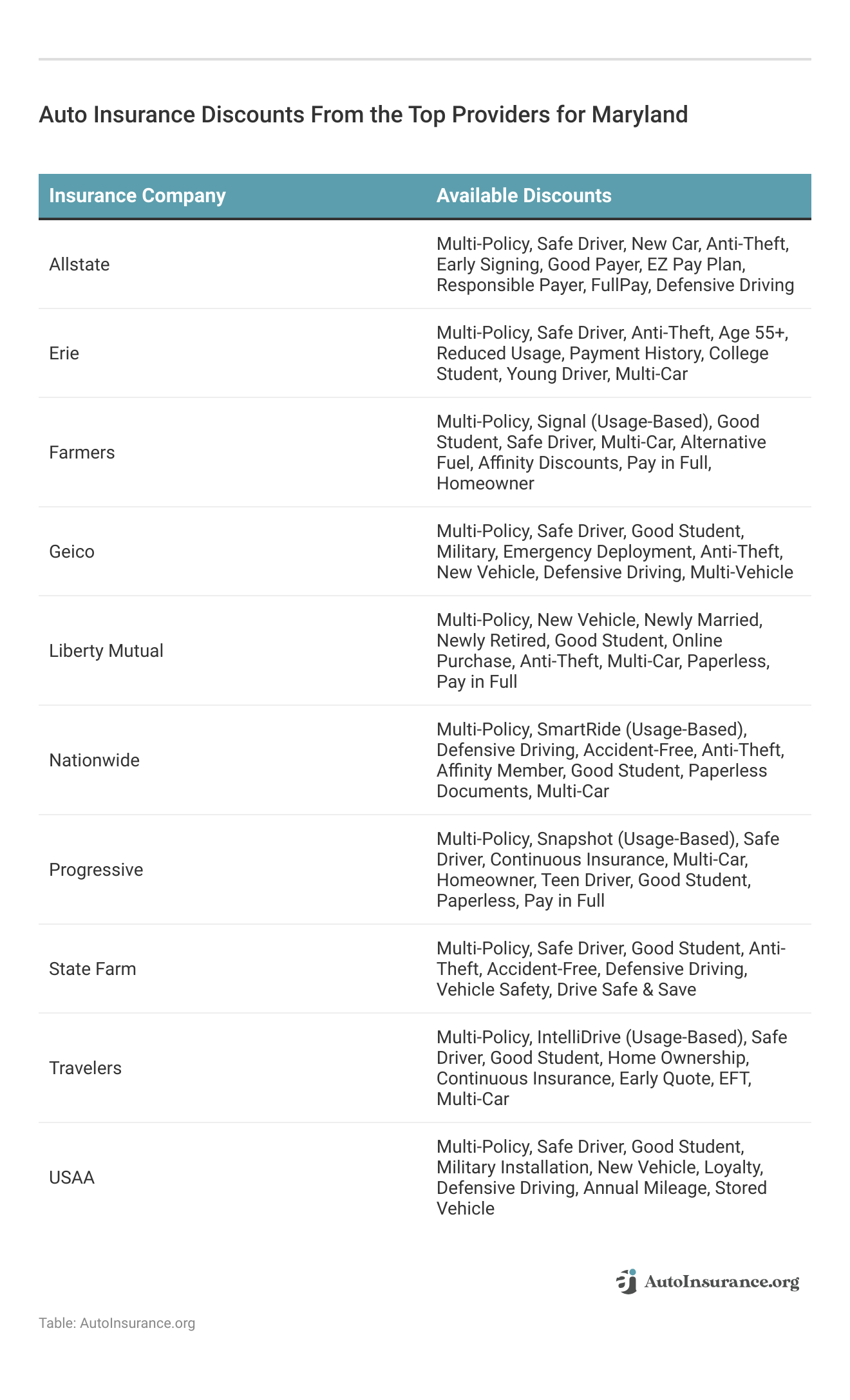

This table highlights auto insurance discounts from top Maryland providers. Allstate offers discounts for multi-policy, safe driving, and defensive driving. Erie provides anti-theft and college student discounts. Farmers offers good student and usage-based discounts. Geico includes military and multi-vehicle discounts.

Liberty Mutual has discounts for newly married and full pay. Nationwide offers usage-based and accident-free discounts. Progressive includes continuous insurance and usage-based discounts. State Farm offers safe driver and drive safe & save discounts. Travelers provides usage-based and early quote discounts. USAA offers military installation and loyalty discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of City Living on Maryland Auto Insurance Rates

Where you live significantly impacts car insurance rates, with higher costs in areas with heavy traffic and high crime rates due to the increased risk of damage or theft. Baltimore, for instance, has some of the highest car insurance rates in Maryland.

Maryland Auto Insurance Cost by City

Drivers in high-risk areas should consider adding collision auto insurance and comprehensive coverage to protect against damages from accidents, theft, vandalism, fire, and natural disasters like floods and hail. The cost of auto insurance varies across Maryland cities such as Elkridge, Hyattsville, Rockville, Salisbury, and Severna Park, reflecting the diverse landscape of insurance expenses in the state.

Maryland Auto Insurance Coverage Requirements

Most states, including Maryland, require car insurance, but the specific coverage requirements vary. In Maryland, drivers must have at least $30,000 in bodily injury liability insurance per person, $60,000 per accident, $15,000 in property damage liability, $30,000 in uninsured motorist bodily injury per person, $60,000 per accident, and $15,000 in uninsured motorist property damage.

State Farm stands out in Maryland for its unbeatable combination of low rates and superior customer support, making it the ideal choice for auto insurance.Kristen Gryglik Licensed Insurance Agent

This mandatory liability coverage pays for injuries and damage you cause to others, while uninsured motorist coverage handles injuries and damage from uninsured drivers. However, these limits are low and do not cover your vehicle, so many drivers opt to increase their coverage limits and add additional protection to avoid out-of-pocket expenses in the event of an accident.

Maryland SR-22 Auto Insurance

SR-22 auto insurance isn’t actually insurance. Instead, it’s a certificate some states require high-risk drivers to file, showing they have at least the minimum amount of mandated car insurance. You may be required to file an SR-22 if you have multiple accidents or DUIs on your record or drive without insurance. However, Maryland is one of the few states that doesn’t require an SR-22 certificate.

But that doesn’t mean your car insurance rates will be lower. High-risk drivers still pay much higher car insurance rates than drivers with either a clean driving record or very few infractions. Keep in mind that you may have to file an SR-22 if you move to a state that requires one. Your driving record follows you when you move, so be prepared to get SR-22 insurance if needed.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Saving on Maryland Auto Insurance

Maryland car insurance rates are below the national average, but affordable coverage is still important.

For those seeking cheap car insurance in Maryland, insurers offer car insurance discounts for safe driving, good grades, multiple cars, policy bundling, paperless billing, and vehicles with safety features. Comparing offers is beneficial. Consider dropping collision and comprehensive coverage if your vehicle isn’t valuable or you can handle repairs.

Raising deductibles lowers premiums but increases out-of-pocket costs for claims. Skipping add-ons like roadside assistance can save money. A clean driving record, living in a low-crime area, and owning a cheaper vehicle lower rates. Compare rates from multiple companies to find the best deal, as location, driving record, and vehicle type impact premiums.

data-media-max-width=”560″>

I’m not just here for car insurance. I can help you look at car loan options through LightStream, too. With no fees, fast funding, and a simple online application, they offer a brighter approach to financing your next vehicle. Contact my office to learn more. pic.twitter.com/lZb9bW9J17

— JB Pitman – State Farm Agent (@state_jb) October 12, 2023

Average car insurance costs in Maryland vary widely by driver and location, with urban areas like Baltimore often seeing higher premiums due to increased risks. Maryland law mandates minimum liability and uninsured motorist coverage, but many drivers choose full coverage for better protection. Use a comparison tool to find the best rates and tailor your insurance to your needs.

Optional Auto Insurance Coverage in Maryland

Most drivers prefer to carry more than the mandatory coverage to ensure better protection, often opting for full coverage that includes the state’s required insurance along with collision and comprehensive coverage.

Additional coverages worth considering are collision auto insurance that pays for damages from accidents, comprehensive auto insurance that covers non-accident-related damages like theft and natural disasters, and gap insurance which covers the difference between your car’s value and what you owe if it’s totaled.

Rental car reimbursement coverage and roadside assistance provide further support, covering rental costs during repairs and services like towing or fuel delivery. While these extra coverages increase insurance costs, they can save you from significant out-of-pocket expenses in the event of a claim.

Case Studies: Maryland Auto Insurance Providers

These case studies demonstrate the benefits of choosing top auto insurance companies in Maryland for diverse needs. They highlight how different providers can meet specific requirements, from comprehensive family protection to affordable coverage options for individuals.

- Case Study #1 – Comprehensive Family Coverage: Jane, a teacher from Annapolis, needed coverage for her family’s three vehicles, including a teenage driver. She chose State Farm for their comprehensive family insurance and excellent customer service, providing reliable protection and peace of mind.

- Case Study #2 – Affordable Coverage for Young Professionals: Mike, an engineer in Baltimore, needed affordable full coverage for his new car. He chose Progressive for their competitive rates and easy online quotes, securing affordable comprehensive auto insurance coverage with discounts for safe driving and multiple policies.

- Case Study #3 – Seamless Claims Process: Linda, a nurse in Silver Spring, sought a reliable insurer with a hassle-free claims process. She opted for Geico due to their efficient customer service and easy-to-use mobile app. After experiencing a minor accident, Linda filed a claim through Geico’s app and received prompt assistance, highlighting the convenience and speed of their claims handling.

These fictional case studies illustrate the benefits of choosing the right auto insurance provider in Maryland, from comprehensive family coverage and cost savings to streamlined claims processes.

State Farm excels in Maryland with a 90% customer satisfaction rating, offering the best balance of cost and coverage.Daniel Walker Licensed Auto Insurance Agent

By examining these scenarios, you can better understand how to select an insurance policy that fits your unique needs and offers the best value.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Maryland Auto Insurance

Maryland drivers have excellent auto insurance options with competitive rates, diverse coverage, and high customer satisfaction. These providers offer tailored solutions for comprehensive family coverage, affordable rates for young professionals, and seamless claims processes.

By comparing car insurance quotes in Maryland and understanding the various benefits each company offers, and exploring the types of auto insurance available, you can find the ideal policy that balances cost and coverage, ensuring peace of mind on the road.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

What is the best Maryland auto insurance for comprehensive coverage?

The best Maryland auto insurance for comprehensive coverage often includes companies like State Farm, Progressive, and Geico. These Maryland auto insurance companies are known for offering extensive policies that cover a wide range of scenarios, ensuring that you are protected no matter what happens.

For a detailed understanding, refer to our in-depth guide titled “Comprehensive Auto Insurance Explained” to get started.

Are there discounts available for Maryland auto insurance?

Yes, many Maryland auto insurance companies offer discounts. Discount Maryland auto insurance can include savings for safe driving, bundling policies, and installing anti-theft devices. Always ask about available discounts when requesting a Maryland auto insurance quote.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

What is the average Maryland auto insurance cost?

The average Maryland auto insurance cost is around $100 per month. This average cost for Maryland auto insurance can vary based on factors such as your driving history, the type of car you drive, and where you live in the state.

To learn more, delve into our detailed resource titled “What is the average auto insurance cost per month?” for further insights.

How do I get a Maryland auto insurance quote?

To get a Maryland auto insurance quote, you can visit the websites of major insurers or use comparison tools. These tools allow you to input your information and receive Maryland auto insurance quotes from multiple insurance companies, helping you find the best rate.

Is Maryland a no-fault state for auto insurance?

No, Maryland is not a no-fault state. This means that the driver who is found to be at fault in an accident is responsible for the damages. Understanding this is crucial when selecting your Maryland auto insurance policy.

What are the Maryland auto insurance laws?

Maryland auto insurance laws require all drivers to have a minimum of $30,000 per person and $60,000 per accident in bodily injury liability, plus $15,000 in property damage liability. It’s important to understand these requirements when shopping for Maryland auto insurance quotes.

For more details, refer to our in-depth report titled “What is the average auto insurance cost per month?” for further insights.

How can I find affordable Maryland auto insurance?

To find affordable Maryland auto insurance, compare Maryland auto insurance quotes from various providers. Using tools to get multiple Maryland auto insurance quotes can help you identify the best rates for your needs and budget.

For further information, check out our detailed guide titled “Where to Compare Auto Insurance Rates” for more insights.

How much is car insurance in Maryland per month?

The cost of car insurance in Maryland varies based on coverage and provider. On average, minimum coverage can start around $57 per month with companies like State Farm, Progressive, and Geico. For full coverage, prices will be higher. To find the cheapest car insurance in MD, compare quotes from these top providers and consider your specific coverage needs.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What options are available for high-risk drivers seeking Maryland auto insurance?

For high-risk drivers seeking Maryland auto insurance, companies like The General and Acceptance Insurance offer specialized policies. High-risk driver Maryland auto insurance can be more expensive, but these providers offer solutions that cater to drivers with a less-than-perfect record. The General car insurance in Maryland is specifically designed to accommodate the unique needs of high-risk drivers, ensuring they receive the necessary coverage.

For a thorough understanding, check out our detailed analysis titled “High-Risk Auto Insurance” for more information.

What is SR-22 Maryland auto insurance, and who needs it?

SR-22 Maryland auto insurance is a certificate of financial responsibility required for drivers who have committed certain violations, such as DUI. This type of Maryland auto insurance is often required for high-risk drivers and ensures that the driver carries the state-mandated coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.