Best Rochester, New York Auto Insurance in 2026

The average annual auto insurance rates in Rochester, NY are around $3,424. The cheapest auto insurance company in Rochester, NY is Geico, although rates will vary for each person. Rochester, NY auto insurance must meet the state minimum requirements with coverage levels of 25/50/10 for liability and property damage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated September 2024

- The average annual auto insurance rate for Rochester, NY is $3,424

- The cheapest auto insurance company in Rochester, NY is Geico, and the second cheapest is USAA

- Rochester, NY rates are affected by the traffic that is shared with Syracuse as well as Buffalo

- The average commute time for Rochester is 17.7 minutes

Rochester, NY average annual auto insurance rates are well above the New York auto insurance average. They are about $100 lower than Syracuse rates and about $1,200 cheaper than Buffalo rates.

You can save on Rochester, New York auto insurance by shopping around, comparing rates, and looking for discounts, and we can help. Below you’ll find information on cheap auto insurance in Rochester, New York for every age, credit history, and driving record.

Ready to find affordable Rochester, NY auto insurance quotes? Enter your ZIP code above to get started.

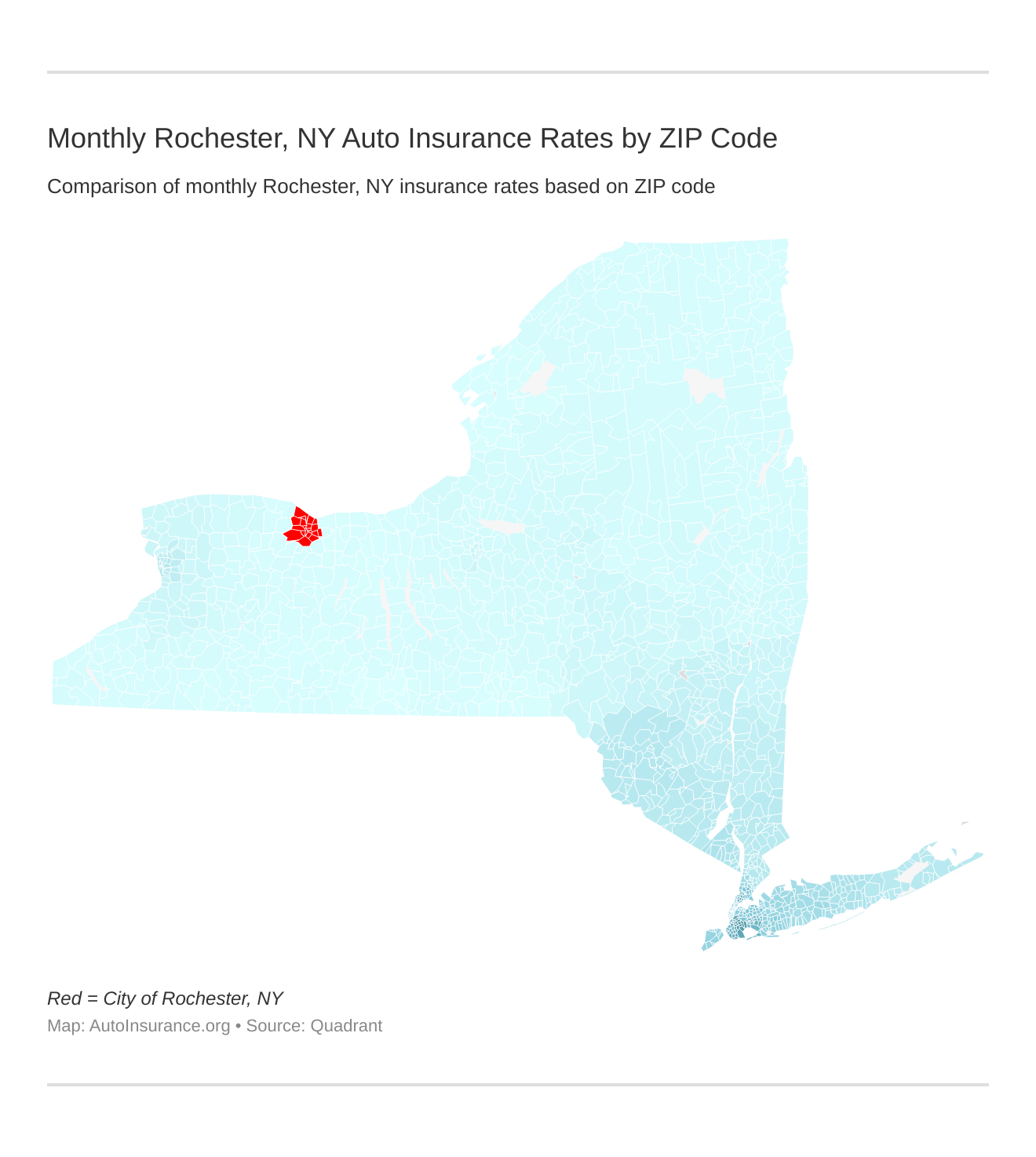

Monthly Rochester, NY Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Rochester, NY auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

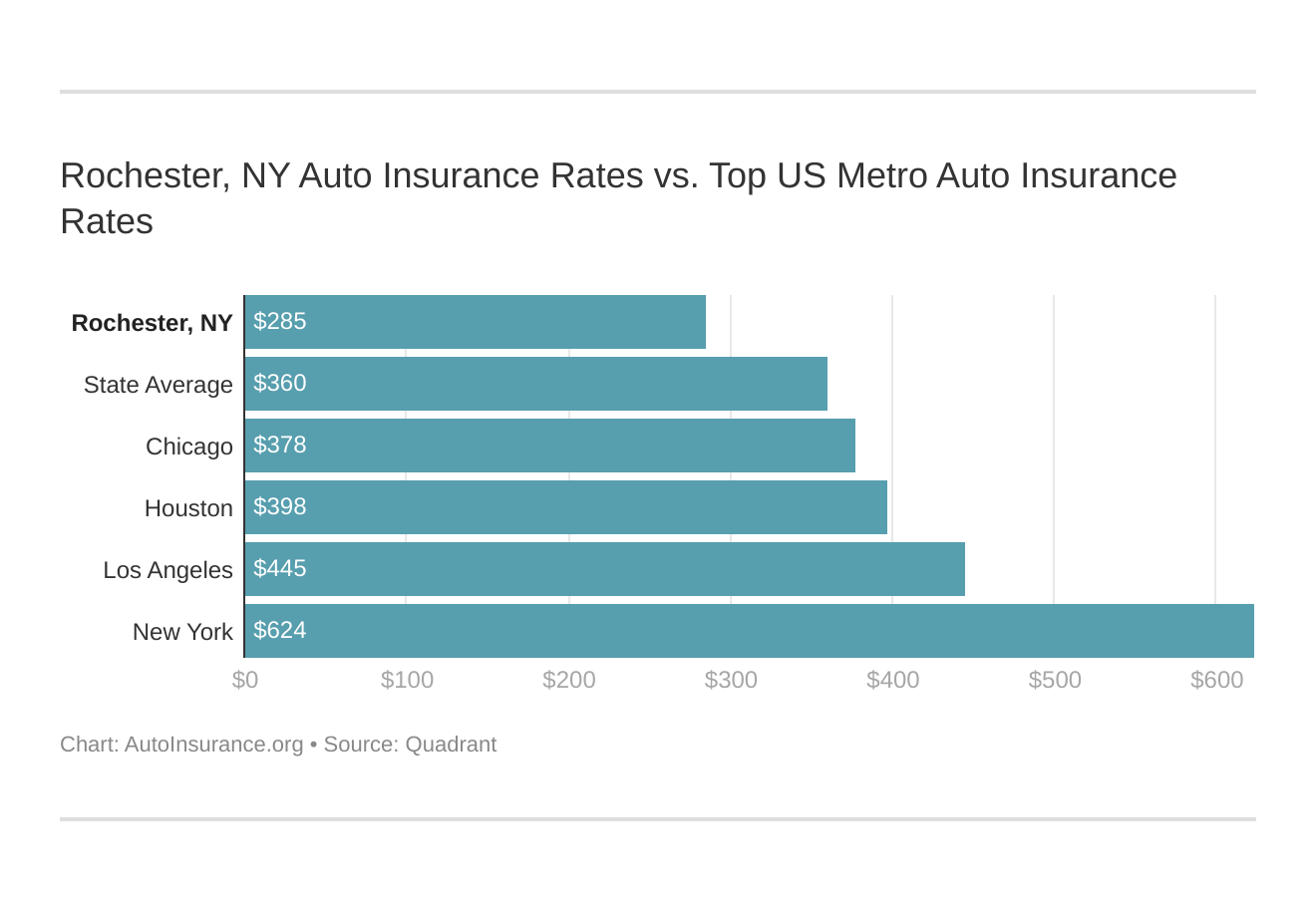

Rochester, NY Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Rochester, NY against other top US metro areas’ auto insurance costs.

What is the cheapest auto insurance company in Rochester, NY?

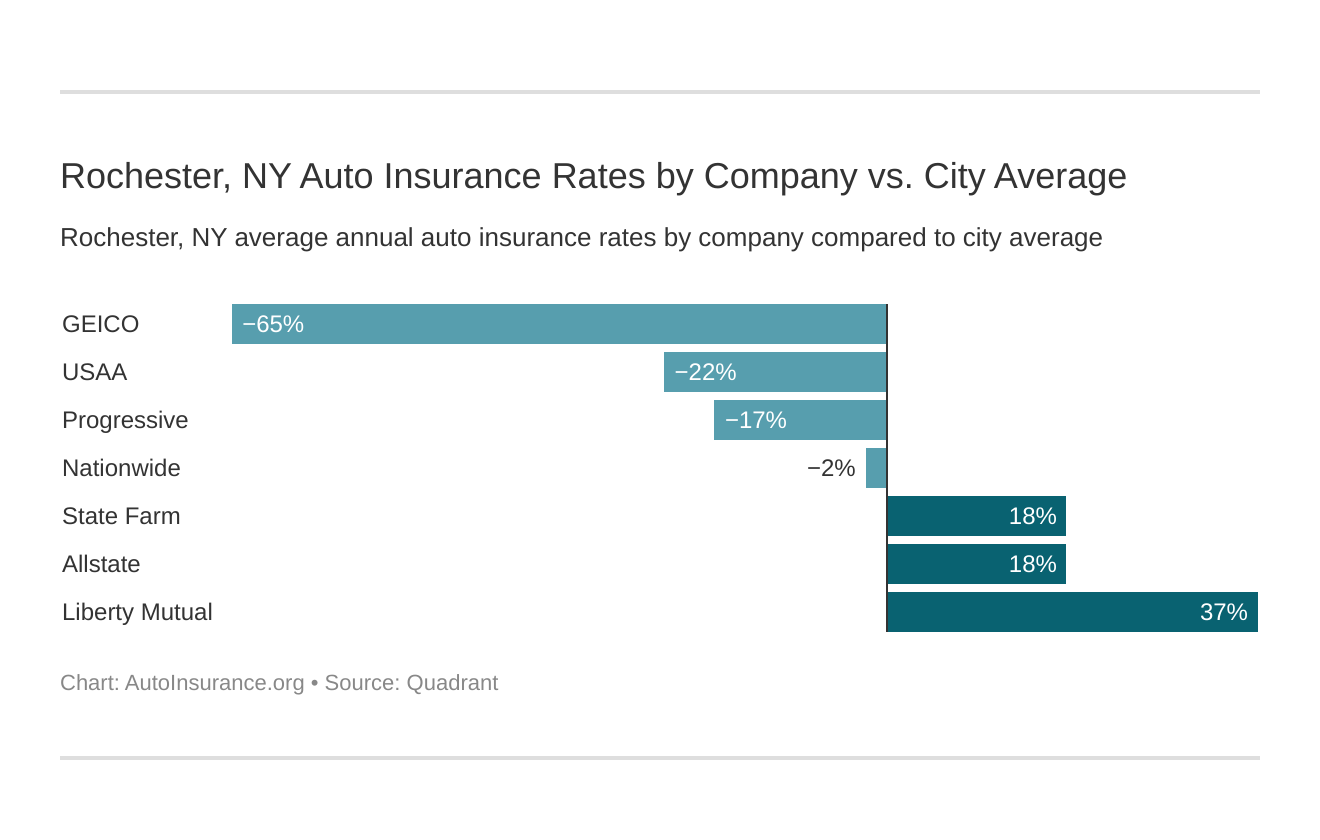

The cheapest auto insurance company in Rochester, based on average rates, is Geico. Check out our Geico auto insurance review for more information.

The cheapest Rochester, NY car insurance providers can be found below. You also might be wondering, “How do those Rochester, NY rates compare against the average New York car insurance company rates?” We uncover that too.

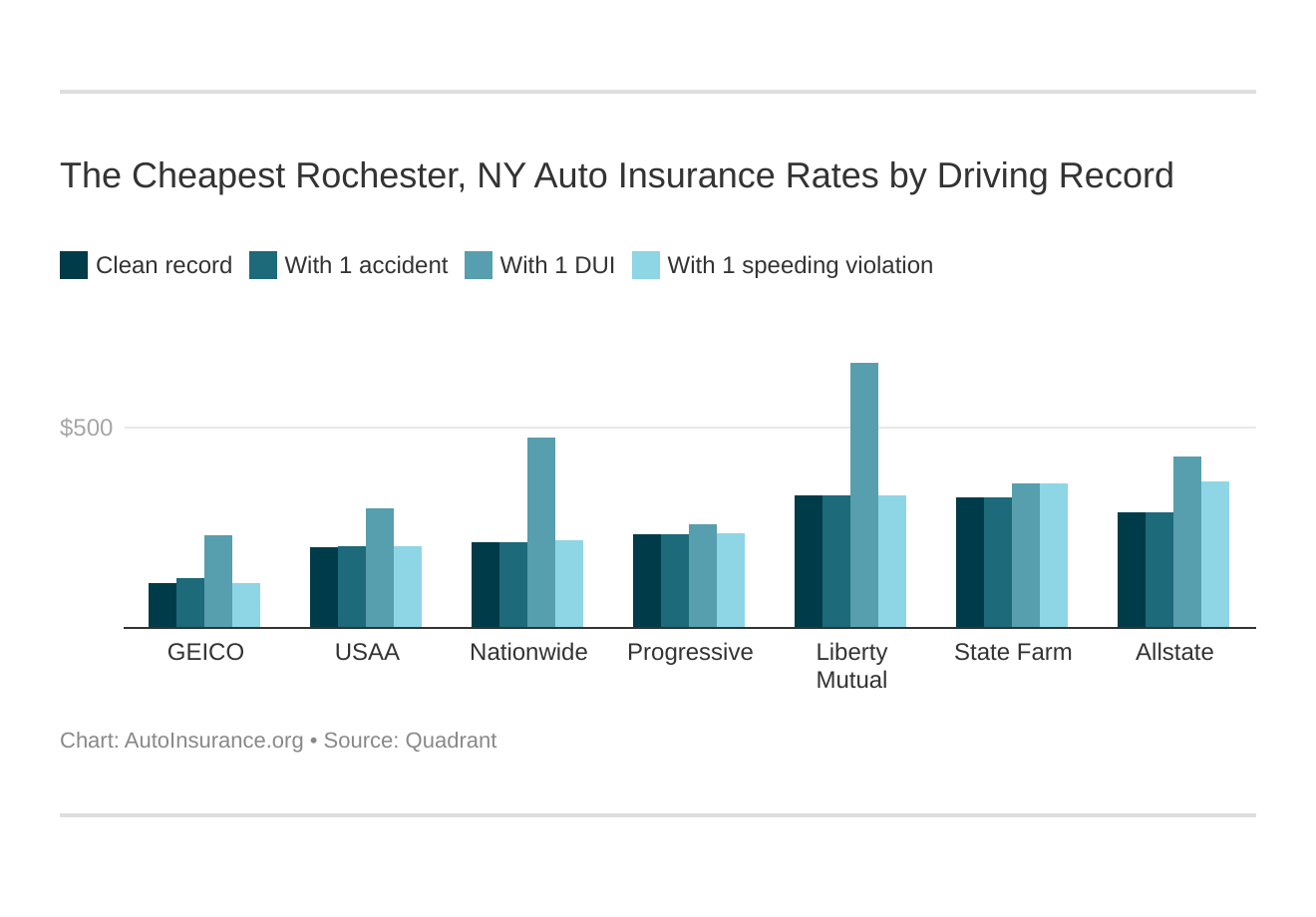

The top auto insurance companies in Rochester, NY, ranked from cheapest to most expensive are:

- Geico auto insurance—$1,746

- USAA auto insurance—$2,730

- Progressive auto insurance—$2,895

- Nationwide auto insurance—$3,366

- Travelers auto insurance—$3,469

- Allstate auto insurance—$4,114

- State Farm auto insurance—$4,120

- Liberty Mutual auto insurance—$4,955

There are a lot of factors that determine your auto insurance rates. The cheapest company for you will depend on your personal factors, including what part of the city you call home, your driving record, what kind of car you drive, and the coverage level you choose.

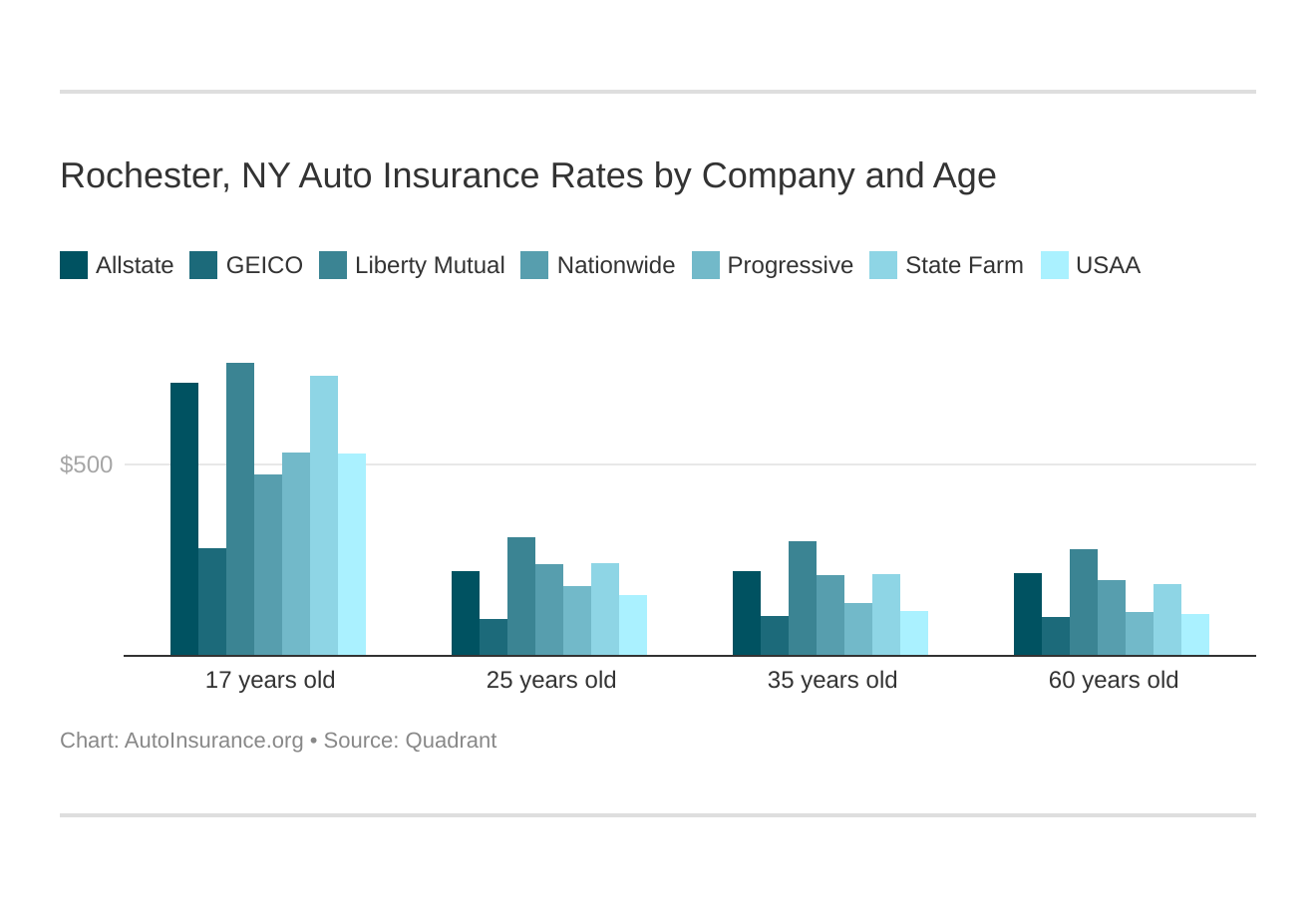

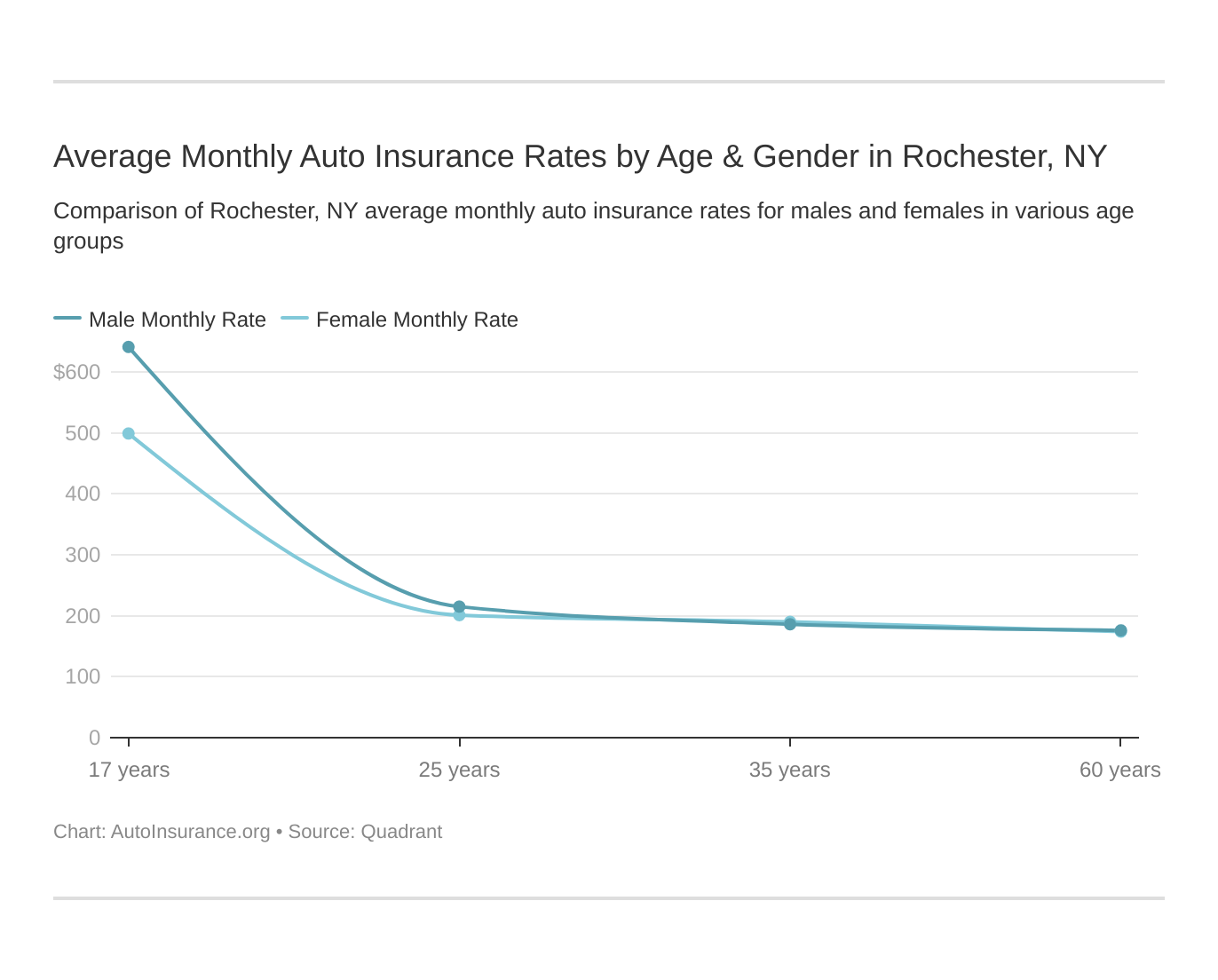

Rochester, NY car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group. Auto insurance for teens and young drivers is usually the most expensive.

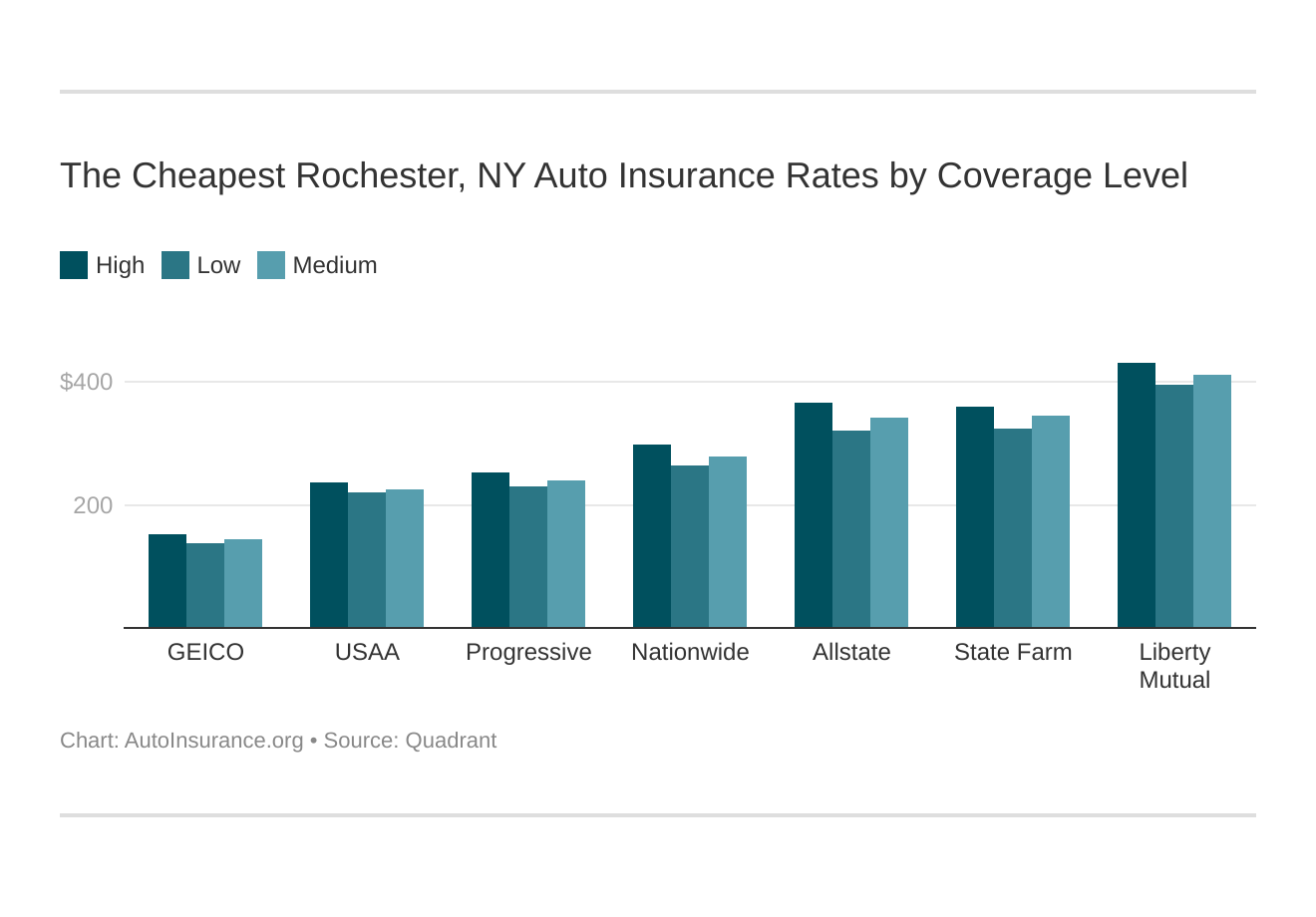

Your coverage level will play a major role in your Rochester, NY car insurance costs. The types of car insurance you choose will impact your rates. Find the cheapest Rochester, New York car insurance costs by coverage level below:

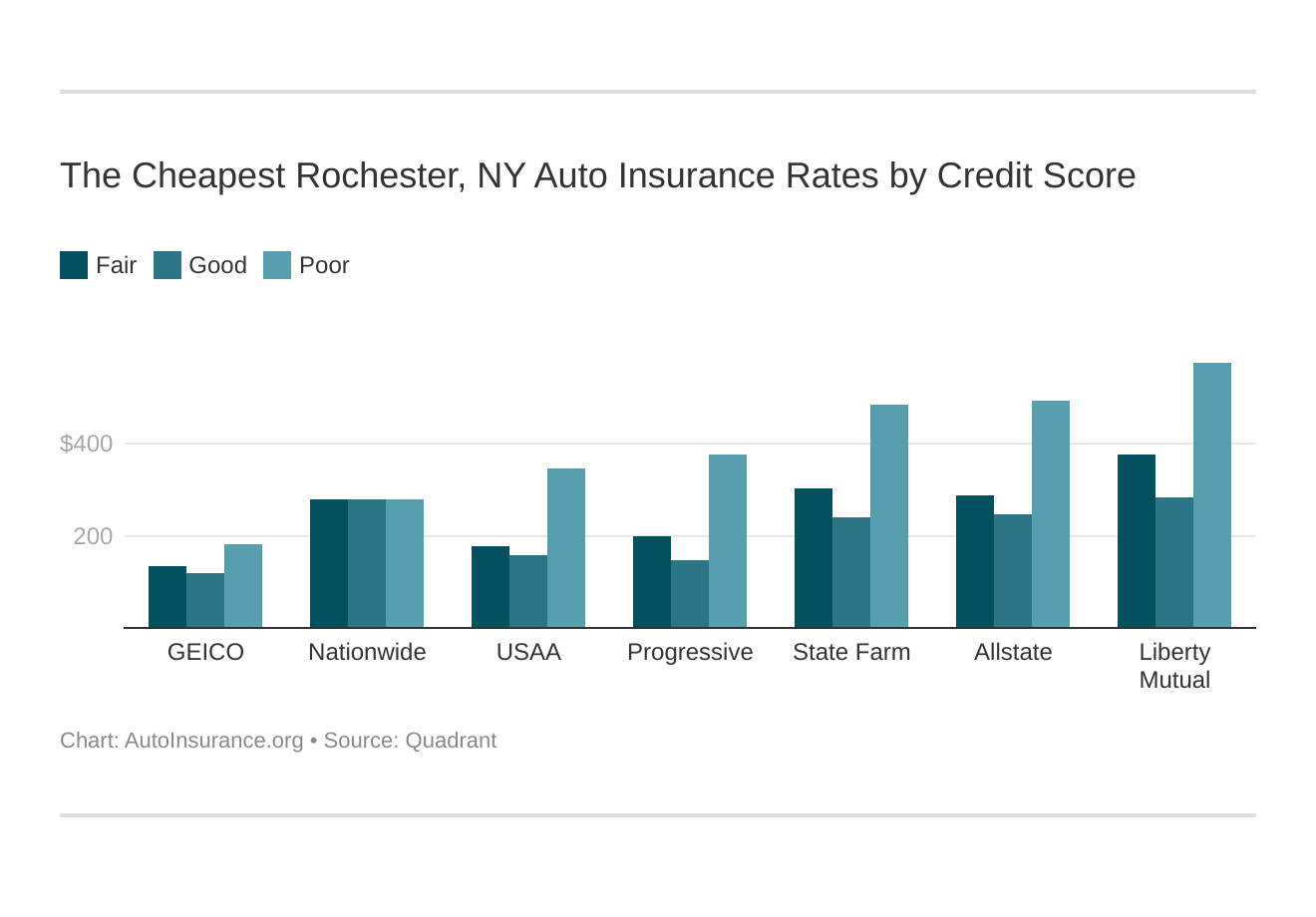

Your credit score will play a significant role in your Rochester insurance rates since auto insurance companies use credit scores to determine rates. Find the cheapest Rochester, New York car insurance rates by credit score below.

Your driving record will affect your Rochester, NY car insurance costs. For example, a Rochester, New York DUI may increase your car insurance costs 40 to 50%. Cheap auto insurance for drivers with a DUI is not easy to find. Find the cheapest Rochester, NY car insurance costs by driving record.

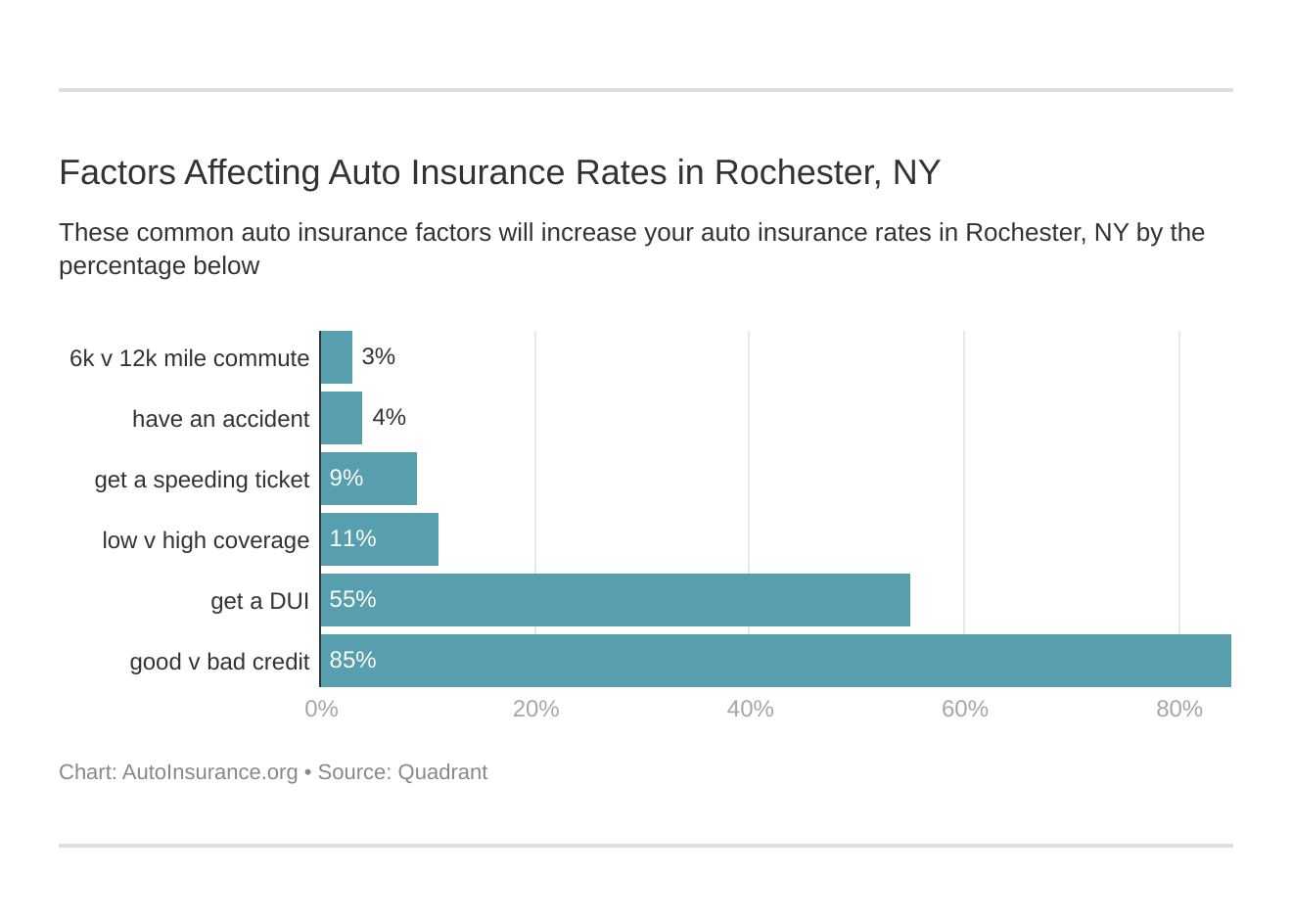

Controlling these risk factors will ensure you have the cheapest Rochester, New York car insurance. Factors affecting car insurance rates in Rochester, NY may include your commute, coverage level, tickets, DUIs, and credit.

Age is a significant factor for Rochester, NY car insurance rates. Young drivers are often considered high-risk. This Rochester, New York does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Rochester, NY. Car insurance rates are more for males on average.

What auto insurance coverage is required in Rochester, NY?

All Rochester drivers have to meet the New York state law minimum requirements to buy auto insurance.

In New York, you have to carry at least:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $10,000 per incident for property damage

It’s recommended that most drivers carry more than the state minimum.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Rochester, NY?

Rochester is the ninth-largest city in New York and a little over an hour drive from Syracuse and Buffalo. Let’s take a look at how Rochester auto insurance rates compare to other cities in New York.

Brooklyn, NY— $9,347 (most expensive)

Syracuse, NY— $3,519

Rochester, NY — $3,424

Buffalo, NY— $4,603

Corning, NY— $2,730 (cheapest)

INRIX ranks Buffalo as the 57th-most congested city in the U.S. Rochester is west of Syracuse and east Buffalo, so traffic heading to a larger city can affect auto insurance rates.

City-Data reports an average commute time for Rochester is 17.7 minutes.

Car theft in Rochester also affects rates. The FBI’s most recent annual statistics list Rochester with 616 auto thefts in a city population of 208,591. That’s a rate of 295 cars stolen per 100,000 population.

Rochester, NY Auto Insurance: The Bottom Line

Rochester has slightly above-average auto insurance rates compared to other cities of its size in New York, but you can still save by shopping around and comparing.

Before you buy auto insurance in Rochester, NY, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Rochester, NY auto insurance quotes.

Frequently Asked Questions

What is auto insurance and why is it important in Rochester, NY?

Auto insurance is a contract between a policyholder and an insurance company that provides financial protection in case of accidents, theft, or other damages to a vehicle. In Rochester, NY, auto insurance is mandatory and required by law to drive a vehicle on public roads. It is important because it helps cover the costs of repairs, medical expenses, and legal liabilities that may arise from accidents.

What are the minimum auto insurance requirements in Rochester, NY?

In Rochester, NY, the minimum auto insurance requirements are liability coverage of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident. These are the minimum limits required by law, but it’s advisable to consider higher coverage levels to provide better protection.

What factors can affect auto insurance premiums in Rochester, NY?

Several factors can impact auto insurance premiums in Rochester, NY. These factors include the driver’s age, driving history, type of vehicle, location, credit score, coverage limits, and deductible chosen. Other considerations may include the frequency of accidents and thefts in the area, as well as the average cost of repairs and medical care.

Are there any specific auto insurance requirements for teen drivers in Rochester, NY?

Yes, there are specific requirements for teen drivers in Rochester, NY. They are required to have the same minimum liability coverage as other drivers. Additionally, drivers under the age of 18 must have consent from a parent or guardian to obtain a driver’s license. It’s also common for insurance companies to charge higher premiums for teen drivers due to their lack of experience and higher risk profile.

What are the different types of auto insurance coverage available in Rochester, NY?

In Rochester, NY, there are various types of auto insurance coverage available. The most common ones include:

- Liability coverage: This covers the costs of bodily injury and property damage to others if you’re at fault in an accident.

- Collision coverage: This pays for damages to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive coverage: This covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Personal injury protection (PIP): This provides coverage for medical expenses, lost wages, and other related costs regardless of who caused the accident.

- Uninsured/underinsured motorist coverage: This protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage.

How can I find affordable auto insurance in Rochester, NY?

To find affordable auto insurance in Rochester, NY, consider the following steps:

- Shop around and obtain quotes from multiple insurance companies.

- Compare the coverage options, deductibles, and premiums offered by different insurers.

- Look for any discounts you may qualify for, such as safe driver discounts or multi-policy discounts.

- Consider increasing your deductibles, but ensure you can afford to pay the deductible amount if needed.

- Maintain a good driving record and credit score, as they can impact your premiums.

- Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, for potential discounts.

Can I get auto insurance if I have a poor driving record or previous accidents?

Yes, you can still get auto insurance in Rochester, NY, even if you have a poor driving record or previous accidents. However, insurance companies may consider you a higher-risk driver and charge higher premiums. It’s recommended to shop around and compare quotes from different insurers to find the best coverage options and rates available to you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.