At-Fault Accident Defined (2026)

At-fault accidents raise premiums by 43% and impact options for coverage. Insurers also use driving history, the severity of an accident, and where it took place to determine your rate. Discounts for defensive driving courses can help drivers manage higher premiums and get more affordable insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated July 2025

At-fault accidents significantly impact your insurance rates, raising them by as much as 43%. This information delves into how these incidents affect your premiums and what you can do to manage the increased costs.

We’ll delve into the factors the best auto insurance companies evaluate when modifying rates after an at-fault accident and provide tips on reducing financial stress.

Grasping these factors is key to making informed insurance decisions and saving money, especially when understanding the definition of an at-fault accident.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- At-fault accidents often lead to a significant 43% rate increase

- Essential strategies to manage costs after at-fault accidents

- Comprehensive guide on navigating at-fault accident impacts

Driving Violations and At-Fault Accident Rate Effects

An at-fault accident happens when a driver’s negligence leads to a collision, with accident examples including running a red light, not stopping at a stop sign, failing to yield, texting while driving, speeding, or driving under the influence. Any such traffic violation can lead to higher rates for at-fault car insurance.

The table compares monthly auto insurance rates from various providers based on driving records. It shows how rates increase for drivers with one ticket, one DUI, or when covered by comprehensive insurance compared to those with a clean record.

Social Worker Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 | |

| $32 | $36 | $42 | $58 |

State Farm typically provides the lowest rates, whereas Liberty Mutual and Allstate often charge higher premiums, particularly for DUIs. The U.S. average demonstrates how violations such as DUIs and understanding the at-fault accident meaning can lead to substantial rate increases.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Managing Insurance Rates After an At-Fault Accident

Being responsible for at-fault car accidents can significantly raise your auto insurance rates. Your rates will go up depending on how bad the accident was, your insurance company, location, and similar factors. However, you can expect your rates to go up at least a few hundred dollars a year.

To understand the accident definition and see how much insurance companies typically raise rates after a fault accident, examine the data below.

Full Coverage Auto Insurance Monthly Rates for Clean Record vs. One Accident

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| Allstate | $160 | $225 |

| American Family | $117 | $176 |

| Farmers | $139 | $198 |

| Geico | $80 | $132 |

| Liberty Mutual | $174 | $234 |

| Nationwide | $115 | $161 |

| Progressive | $105 | $186 |

| State Farm | $86 | $102 |

| Travelers | $99 | $139 |

| U.S Average | $119 | $173 |

In most cases, the at-fault accident will stay on your record for three to five years, which means you’ll have to pay the increased rate for quite some time. In some cases, however, your insurance company may offer accident forgiveness.

If you qualify for accident forgiveness, at-fault insurance will not increase your rates after your first at-fault accident.

Reducing Your Premiums After an At-Fault Accident

If your rates increase substantially after an accident, don’t panic. As the at-fault driver, there are still ways to reduce your coverage and make your rates more affordable.

Some of the things you can do to reduce your car insurance rates after an at-fault accident include:

- Drive Safely: Maintain a clean driving record to gradually lower your insurance rates over time.

- Drop Optional Coverages: Consider removing comprehensive or roadside assistance coverage if affordability is an issue.

- Raise Your Deductible: Opt for a higher deductible to significantly lower your insurance rates if you can cover the higher out-of-pocket costs.

- Shop Around: Compare quotes from other insurers, as some may offer better rates after an at-fault accident.

- Use Discounts: Take advantage of discounts, such as paperless billing or defensive driving courses, to help lower your premiums.

Just because you caused at-fault accidents doesn’t mean you’ll have high insurance quotes forever. Following the tips above will help you reduce your auto insurance rates to a more reasonable level.

Understanding Fault vs. No-Fault Auto Insurance

The assignment of fault and responsibility for damage costs hinges on at-fault vs no-fault states. Refer to the table below to determine if your state follows a no-fault or at-fault system for car insurance.

At-Fault vs. No-Fault Auto Insurance Laws by State

| State | System |

|---|---|

| Alabama | At-Fault |

| Alaska | At-Fault |

| Arizona | At-Fault |

| Arkansas | At-Fault |

| California | At-Fault |

| Colorado | At-Fault |

| Connecticut | At-Fault |

| Delaware | At-Fault |

| Florida | At-Fault |

| Georgia | No-Fault |

| Hawaii | At-Fault |

| Idaho | No-Fault |

| Illinois | At-Fault |

| Indiana | At-Fault |

| Iowa | At-Fault |

| Kansas | At-Fault |

| Kentucky | No-Fault |

| Louisiana | No-Fault |

| Maine | At-Fault |

| Maryland | At-Fault |

| Massachusetts | At-Fault |

| Michigan | No-Fault |

| Minnesota | No-Fault |

| Mississippi | No-Fault |

| Missouri | At-Fault |

| Montana | At-Fault |

| Nebraska | At-Fault |

| Nevada | At-Fault |

| New Hampshire | At-Fault |

| New Jersey | At-Fault |

| New Mexico | No-Fault |

| New York | At-Fault |

| North Carolina | No-Fault |

| North Dakota | At-Fault |

| Ohio | No-Fault |

| Oklahoma | At-Fault |

| Oregon | At-Fault |

| Pennsylvania | At-Fault |

| Rhode Island | No-Fault |

| South Carolina | At-Fault |

| South Dakota | At-Fault |

| Tennessee | At-Fault |

| Texas | At-Fault |

| Utah | At-Fault |

| Vermont | No-Fault |

| Virginia | At-Fault |

| Washington | At-Fault |

| Washington, D.C. | At-Fault |

| West Virginia | At-Fault |

| Wisconsin | At-Fault |

| Wyoming | At-Fault |

For example, your insurance pays for your medical costs in a no-fault state, meaning each driver must have medical insurance to protect themselves in an at-fault accident points scenario, regardless of fault. In an at-fault state, the driver who caused the accident is responsible for paying for damages to others’ vehicles and any medical bills.

Currently, 13 states and territories have no-fault insurance laws, including Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, Puerto Rico, and Utah. All other states and the District of Columbia are at-fault states.Laura D. Adams Insurance & Finance Analyst

Continue reading to gain insights into how claims for at-fault accidents are resolved under various state auto insurance laws, improving your understanding of the regulations that govern these policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Accidents in At-Fault States

In an at-fault state, the driver who caused the accident is responsible for the damages, meaning their insurance must pay for the other driver’s repair costs and medical bills. So, following insurance laws and carrying the correct liability amounts is vital.

The two coverages needed in at-fault states are property damage liability insurance and bodily injury liability insurance. Not carrying insurance in at-fault states is illegal and will result in the at-fault driver having to pay huge bills out of pocket. In addition, understanding the uninsured motorist definition is essential, as states charge uninsured drivers hefty fines.

Property damage liability will be paid up to your policy limit for the other driver’s damages from at-fault accidents. You’ll have to pay any overages out of pocket, so we recommend you carry a high liability limit. Bodily injury liability also pays up to the policy limit for injuries caused to other drivers, passengers, and pedestrians.

Does full coverage cover at-fault accidents? Yes, it does. Full coverage includes liability protection up to your policy limits for at-fault accidents.

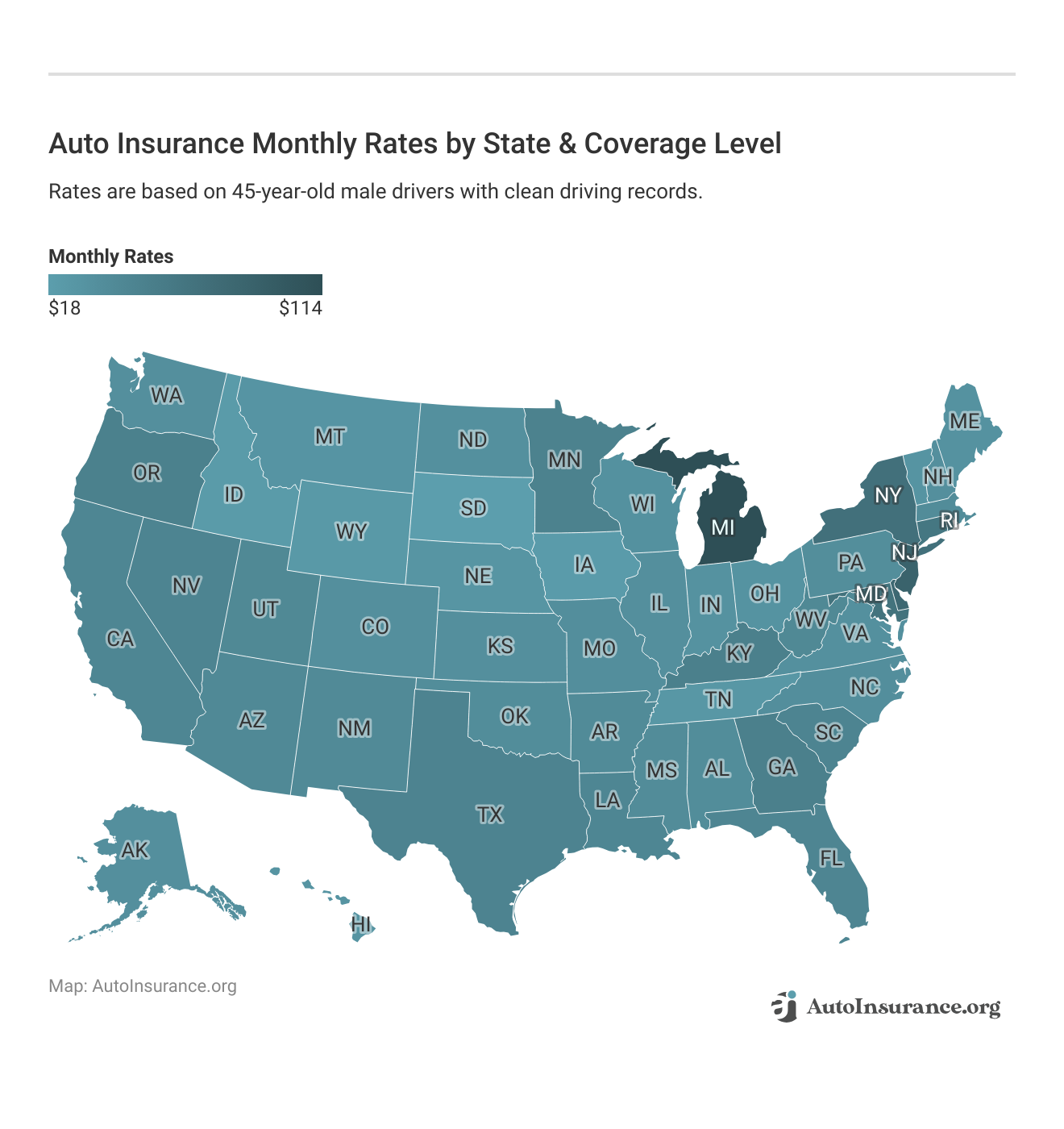

Here’s a look at the average best yearly premium auto insurance rates for full auto insurance coverage in each state.

However, remember that if you cause an at-fault collision and want your insurance company to pay for the damages, you must carry collision and comprehensive insurance, fitting the comprehensive auto insurance definition, known as a full coverage policy.

Accidents in the No-Fault States

In no-fault states, a degree of responsibility is still assigned to the drivers who caused the accident. Whoever caused the crash is responsible for any property damages, such as a smashed fender or broken fence.

However, every driver is responsible for carrying personal injury protection (PIP) or MedPay. Therefore, regardless of who caused the accident, each driver’s liability insurance will pay for their medical costs. Some states requiring drivers to have PIP to cover their medical expenses are Delaware, Florida, Hawaii, Kansas, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, and Utah.

Even though these states are labeled as no-fault, the driver who caused the accident is still on the hook for property damages and general damages, such as pain and suffering for injuries (where allowed by state law). They won’t have to pay for the other driver’s medical expenses.

Determining Fault After a Car Accident

Naturally, no one wants to be at fault for an accident and stuck with expensive bills and higher insurance rates. This can lead to multiple disputes over who caused the accident and is responsible for paying for repairs. Ultimately, it falls to the insurance companies to decide who is at fault for the accident.

Some of the things that the insurance company will look at to determine fault include:

- Accident Location and Details: Insurers assess where and how the accident occurred.

- Dashcam and Traffic Footage: Video evidence can clarify events leading to the crash.

- Vehicle Damage: The type and extent of damage help determine fault.

- Driver and Witness Statements: First-hand accounts provide valuable perspectives.

- Police Reports: Official reports offer crucial insights and documentation.

In some cases, the blame will be easy to assign. However, if both drivers are partly to blame for the accident, or there are more than two cars involved, it may take longer for insurance companies to figure out who is responsible for what costs.

If you’re at fault in an accident, your insurance covers the other driver’s damages and possibly their medical bills, depending on the state. In no-fault states, their insurance pays for medical costs, but they can sue if expenses exceed coverage. Understanding at-fault collision claims is crucial as you must file for damages and medical bills. Without collision coverage, you pay for property damage yourself.

Understanding the at-fault claim meaning and how to file an auto insurance claim and use an accident card is crucial due to the financial responsibility that at-fault drivers bear. Unfortunately, unless the reports incorrectly assign blame, contesting your fault is typically challenging.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to do After You Cause an Accident

What happens after a car accident that is your fault? If you caused the accident, keeping yourself safe and documenting the scene is essential.

Some of the basic steps you should take after an accident, no matter who caused it, are:

- Move Your Car if Possible: If the vehicle is driveable, you should move it out of the way of traffic. It would be best to put on your hazards to make the car more visible to other drivers.

- Check for Injuries: Check for injuries on both you and anyone else involved. If anyone is seriously injured, do not attempt to move them.

- Call the Authorities: To avoid being charged with a hit and run, call the police to come to handle the situation and remain until they arrive. If someone is injured, request an ambulance as well. Police may give you a ticket, but it’s essential to call them.

- Exchange Driver Information: Take down all the other driver’s information and provide them with your information, such as insurance information, names, and phone numbers. The police will assist in this process.

- Contact Your Insurer: After an accident, determine whose insurance you should call after an accident. Contact your insurer to report it and file an at-fault claim if needed for a payout.

Properly documenting the scene and getting help from the police will ensure that other parties involved in at-fault accidents cannot alter the story to gain more money.

Everything You Need to Know About At-Fault Accidents

Causing an accident raises your insurance rates. In at-fault states, the at-fault driver covers all medical and property bills. Explore discounts from top providers to lower rates after a claim. Vehicles with safety features may qualify for savings, like the anti-theft auto insurance discount.

In no-fault states, at-fault drivers cover property damage and, if allowed, pain and suffering compensation. PIP or MedPay is required to handle medical bills, regardless of fault. Rates increase after an at-fault accident, so search for cheap auto insurance rates after an accident to save. Use our free quote tool to find the best rates near you.

Managing At-Fault Accident Impacts

Grasping the impact of at-fault accidents is vital for drivers, as being at fault can raise insurance premiums by nearly 50%. Knowing how to compare auto insurance quotes is also essential since these incidents can affect your driving record and insurance costs for years.

However, drivers can mitigate these consequences by acquiring knowledge of state-specific laws—whether they pertain to no-fault or at-fault jurisdictions—and exploring options like accident forgiveness or defensive driving courses. Ultimately, being informed and proactive can help effectively manage the financial and legal aftermath of at-fault accidents.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

What does an at-fault accident mean?

An at-fault accident occurs when a driver is determined to be responsible for causing a collision. This driver is liable for covering the other party’s property damage and medical expenses, typically through their auto insurance policy. Fault is assigned based on evidence such as police reports, witness statements, and traffic laws.

How do insurance companies decide which driver is at fault?

Insurance companies use adjusters to gather and analyze evidence, such as police reports, witness reports, and photos of the damages. They assess this information to determine which driver was at fault, meaning they’re responsible for causing the accident based on traffic laws and circumstances.

Insurance companies will use adjusters to gather as much information as possible about the accident, such as pictures of the damages, police reports, witness reports, and more. The insurance adjuster will then determine who is at fault based on the evidence provided.

Will the insurance company fix my car if I’m at fault?

You can claim auto insurance if it’s your fault, provided you carry more than liability insurance. You would file an at-fault claim with comprehensive or collision insurance, depending on the accident type. For example, hitting a deer requires a comprehensive claim, while rear-ending another vehicle falls under the collision insurance definition. Without coverage beyond liability, you will pay for repairs out of pocket.

Does it matter which driver caused the accident?

Yes, it matters who caused the accident. The responsible party’s insurance will have to pay for repairs and injuries, so insurance companies are vested in who is at fault in an accident.

What should I do if the at-fault driver wants to pay out of pocket?

Obtain a written agreement from the driver detailing the terms and payment amount if they wish to pay for damages out of pocket. Then, notify your insurer to protect yourself if the driver doesn’t follow through.

What will happen if both drivers are at fault?

In cases where both drivers are at fault for an accident, the blame will be shared based on auto insurance laws. The state’s negligence laws determine how much damage each driver is responsible for. If one driver is more at fault, they will cover more of the costs.

Does fault matter in no-fault states?

Who caused the accident doesn’t matter regarding injury claims resulting in medical bills. Injured parties must file claims for medical bills under PIP or MedPay coverage in no-fault states. However, fault does matter when it comes to property damages. The responsible driver’s insurance must pay for the other driver’s vehicle repairs.

Enter your ZIP code into our free comparison tool below to get cheap no-fault auto insurance quotes from the top providers near you.

Can more than one driver be at fault in an accident?

Yes, more than one driver can be at fault in an accident. In such cases, both drivers will be responsible for the costs associated with the accident.

Will full coverage insurance cover at-fault accidents?

Yes, full coverage insurance includes liability protection that covers at-fault accidents up to your policy limits. However, to have your insurance company pay for damages, you would need collision and comprehensive insurance.

How much can my insurance rates increase after an at-fault accident?

Being responsible for a car accident can significantly raise your auto insurance rates. The increase will depend on factors such as the accident’s severity, your insurance company, location, and other similar factors. On average, you can expect your rates to go up at least a few hundred dollars per year.

Can I take a defensive driving course to offset the impact of an at-fault accident?

Does full coverage cover at-fault accidents?

Can I dispute the determination of fault made by my insurance company?

Is there a way to win an at-fault accident?

What happens if you are at fault in a car accident in California?

How does insurance work when it’s not your fault?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.